Global Neem Extracts Market Size, Share Analysis Report By Type (Leaf Extracts, Fruit and Seed Extracts, Bark Extracts), By Application (Pharmaceuticals and Nutraceuticals, Personal Care, Agriculture and Farming, Food and Beverages, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155610

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

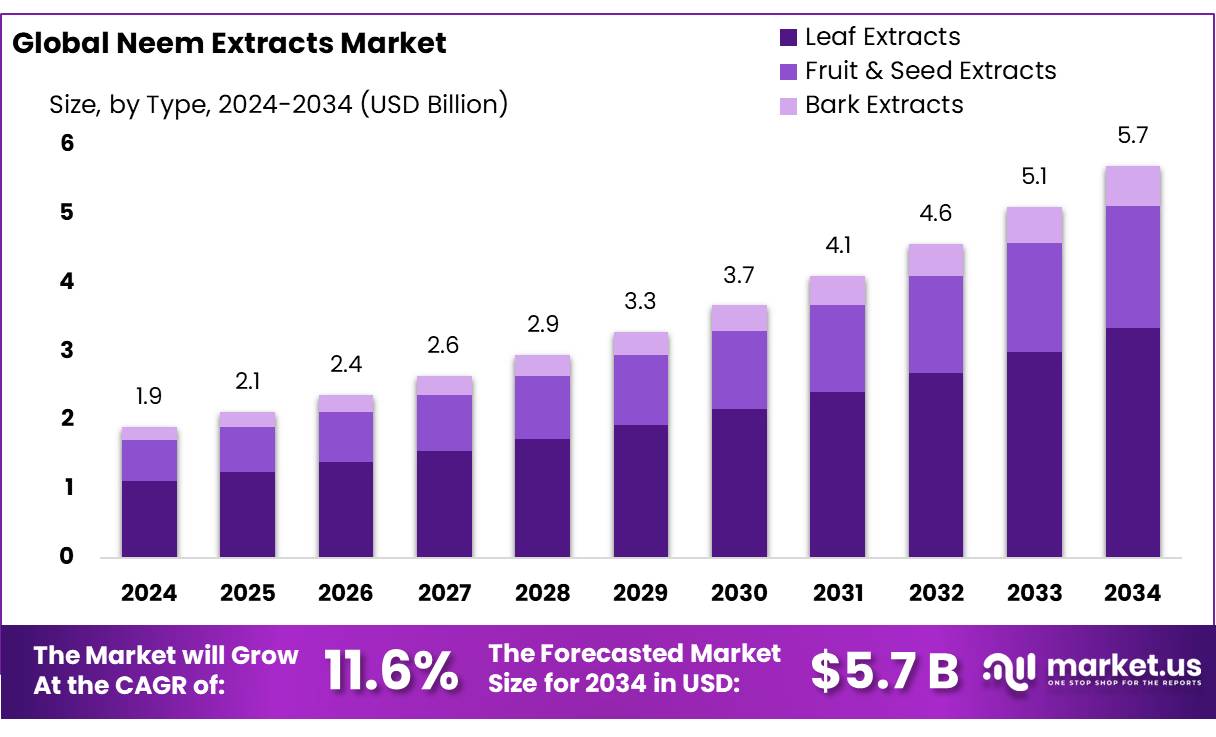

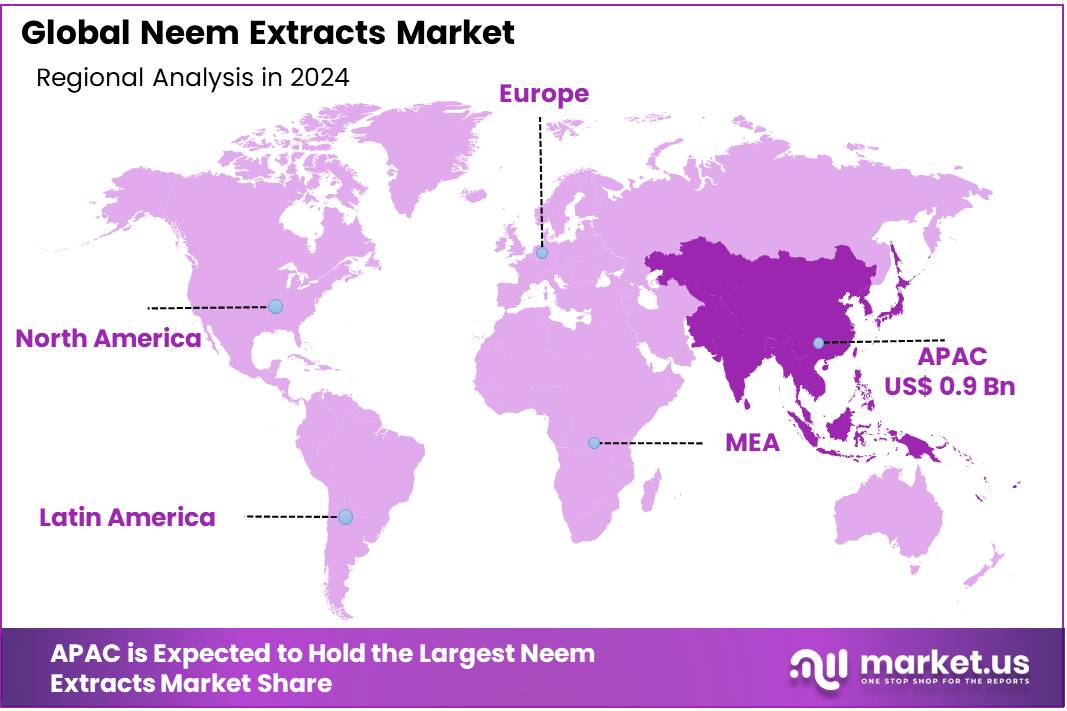

The Global Neem Extracts Market size is expected to be worth around USD 5.7 Billion by 2034, from USD 1.9 Billion in 2024, growing at a CAGR of 11.6% during the forecast period from 2025 to 2034. In 2024, Asia Pacific (APAC) held a dominant market position, capturing more than a 48.10% share, holding USD 0.9 Billion revenue.

Neem extract concentrates have matured from cottage‐scale processing to standardized botanical inputs for crop protection, coatings, and personal care. India underpins the supply base: published agronomic estimates indicate around 442,300 tonnes of neem seed are collected annually, yielding roughly 88,400 tonnes of neem oil and 353,800 tonnes of neem cake, which feed both pesticide and fertilizer value chains.

Internationally, acceptance is broad: the EU approves azadirachtin (Margosa extract) as an active substance under Reg. (EC) 1107/2009, with conditions updated via Commission Implementing Regulation (EU) 2020/1293; authorization proceeds at Member-State level. In the United States, azadirachtin has a federal tolerance exemption up to 20 g/acre on all raw agricultural commodities, and cold-pressed neem oil is likewise exempt—reducing residue-compliance friction for growers.

Industry drivers include regulatory and market shifts toward lower-hazard inputs. The European Green Deal aims to cut the use and risk of chemical pesticides by 50% by 2030, amplifying demand for biopesticides like azadirachtin; as of recent literature, ~60 biopesticide active substances are available in the EU and 200+ in the U.S., indicating a widening adoption base. Safety fundamentals help: peer-reviewed summaries note azadirachtin’s low mammalian toxicity (e.g., LD₅₀ > 5,000 mg/kg) and EPA general-use status, supporting use in high-value crops and integrated pest management programs.

Standards further de-risk procurement: BIS IS 14299/IS 14300 (for EC formulations) define assay and quality control, and sector codes like the Tea Board of India’s Plant Protection Code (May 2023) list neem-based options within compliant toolkits.

Industrial demand is visible in official consumption data. India’s biopesticide use reached 8,899 metric tons in 2021–22, moderating to 7,248 MT in 2022–23, with usage reported state-wise by the Ministry of Agriculture to Parliament. This sits alongside a structurally declining trend in chemical pesticide consumption, underscoring a gradual shift in product mix and procurement. For manufacturers, BIS-compliant concentrates feed EC, EW, and SC formulations; process R&D focuses on stabilising azadirachtin, where government lab work has shown 20–30% degradation improvements via formulation tweaks—important for shelf life and field performance.

Key Takeaways

- Neem Extracts Market size is expected to be worth around USD 5.7 Billion by 2034, from USD 1.9 Billion in 2024, growing at a CAGR of 11.6%

- Leaf Extracts held a dominant market position, capturing more than a 58.8% share of the overall neem extracts market.

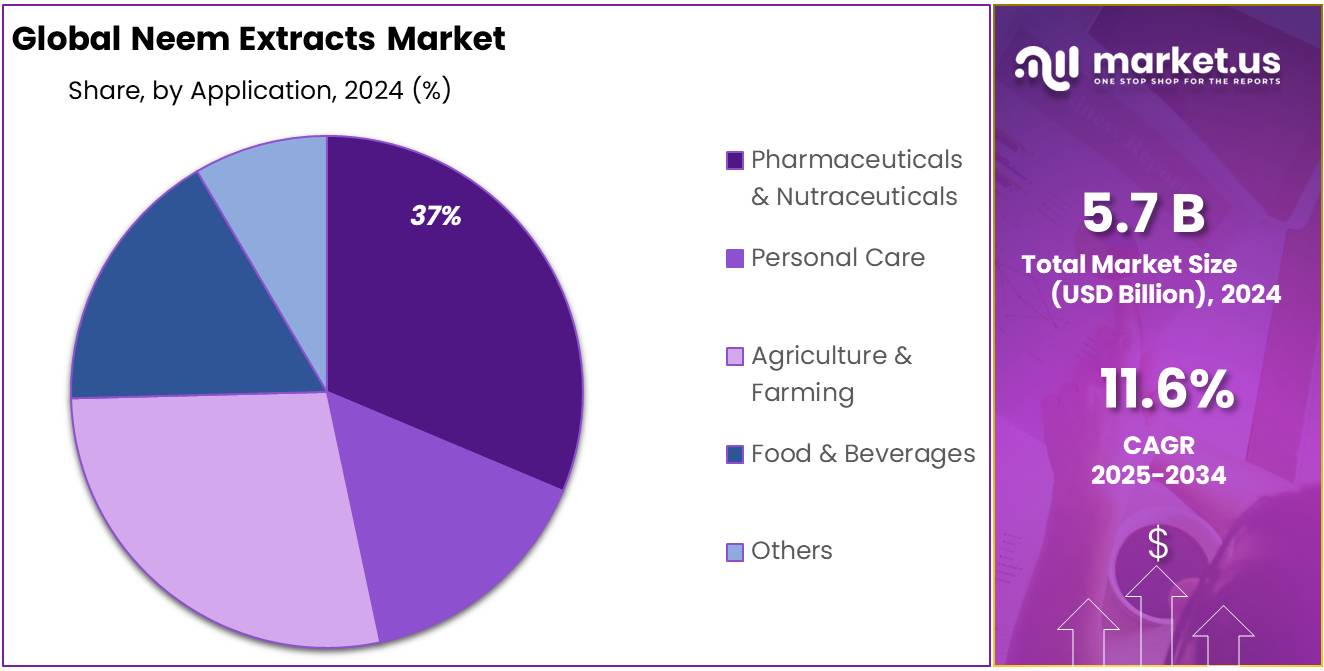

- Pharmaceuticals & Nutraceuticals held a dominant market position, capturing more than a 37.1% share of the neem extracts market.

- Asia Pacific emerged as the leading regional market for neem extracts, accounting for 48.10% of the total market share with a valuation of USD 0.9 billion.

By Type Analysis

Leaf Extracts lead with 58.8% share in 2024

In 2024, Leaf Extracts held a dominant market position, capturing more than a 58.8% share of the overall neem extracts market. Their strong demand came from the growing use of neem-based leaf concentrates in herbal medicines, dietary supplements, and organic crop protectants.

Leaf extracts are widely used in Ayurveda and traditional medicine, which gained further momentum with the expansion of the National AYUSH Mission that continued support until 2026 with a budget of ₹4,607.3 crore, boosting herbal industries. Moving into 2025, the demand for neem leaf extracts is expected to stay robust as organic farming expands and governments promote bio-based agricultural inputs. With India already accounting for 7.3 million hectares of organic-certified land in FY 2024, the need for natural pest repellents and immunity-boosting herbal products will keep leaf extracts at the center of the industry’s growth.

By Application Analysis

Pharmaceuticals & Nutraceuticals dominate with 37.1% share in 2024

In 2024, Pharmaceuticals & Nutraceuticals held a dominant market position, capturing more than a 37.1% share of the neem extracts market. This segment benefited from the increasing use of neem-based formulations in herbal medicines, immunity boosters, and dietary supplements, particularly as consumers continued to prefer plant-based health solutions after the pandemic.

Government support under the National AYUSH Mission, extended until 2026 with a funding of ₹4,607.3 crore, has been a key driver in promoting neem-derived products in the healthcare space. Moving into 2025, the segment is expected to maintain strong growth momentum as nutraceutical companies focus on neem-based capsules, powders, and extracts to meet rising demand in both domestic and export markets.

Key Market Segments

By Type

- Leaf Extracts

- Fruit & Seed Extracts

- Bark Extracts

By Application

- Pharmaceuticals & Nutraceuticals

- Personal Care

- Agriculture & Farming

- Food & Beverages

- Others

Emerging Trends

Increasing Incorporation of Neem Extracts in Plant-Based and Clean-Label Foods

One of the most notable trends in the neem extracts industry is their growing integration into plant-based and clean-label food products. Consumers today are prioritizing transparency, natural ingredients, and health benefits in their diets, and neem extracts align perfectly with these preferences. According to the Food Safety and Standards Authority of India (FSSAI), over 70% of urban consumers in 2024 reported actively seeking products labeled as “herbal,” “natural,” or “clean-label,” signaling a strong shift toward health-conscious eating habits. Neem, with its antioxidant, antimicrobial, and digestive health properties, is increasingly being used in functional beverages, protein shakes, herbal teas, and fortified snacks to meet this growing demand.

Government initiatives are further supporting this trend. India’s National Medicinal Plants Board (NMPB) promotes sustainable cultivation of neem across more than 120,000 hectares, offering financial incentives, training programs, and technical guidance to farmers (nmpb.nic.in). This ensures a consistent, high-quality supply of neem extracts suitable for industrial use while encouraging environmentally friendly farming practices. Additionally, the FSSAI’s regulations for functional and herbal foods allow manufacturers to incorporate neem extracts safely, provided they meet defined quality standards, enhancing consumer trust and industry credibility.

The trend toward clean-label products also encourages transparency in ingredient sourcing and production processes. Companies are increasingly highlighting neem’s natural origin, sustainability, and traditional medicinal uses on packaging to appeal to informed consumers. This is particularly important as over 65% of consumers in India express interest in the provenance of their herbal ingredients, according to FSSAI surveys. Such labeling practices not only boost consumer confidence but also differentiate products in a competitive market.

Drivers

Rising Demand for Natural and Functional Ingredients

Neem extracts are increasingly recognized as a valuable natural ingredient across food, personal care, and pharmaceutical applications, primarily due to their health-promoting properties. One of the major driving factors behind the growth of neem extracts is the rising consumer preference for natural, organic, and functional ingredients in food and nutraceuticals. The World Health Organization (WHO) highlights neem’s antimicrobial, antioxidant, and immune-boosting properties, making it a highly sought-after additive in dietary supplements and functional beverages.

The Indian Ministry of AYUSH (Ayurveda, Yoga & Naturopathy, Unani, Siddha, and Homeopathy) has actively promoted neem cultivation and usage through national initiatives. Under the “National Medicinal Plants Board” program, India supports the sustainable cultivation of neem across 120,000 hectares of farmland, ensuring consistent raw material supply while incentivizing farmers to adopt organic practices. These initiatives have contributed to an increase in neem-based product development, particularly in health-focused segments such as functional foods and nutraceuticals.

Consumer trends reflect this growing preference for natural ingredients. According to the Food Safety and Standards Authority of India (FSSAI), over 65% of urban Indian consumers reported actively seeking foods labeled as “natural” or “herbal” in 2024. This preference directly supports the use of neem extracts in fortified food products, herbal teas, and dietary supplements. The global adoption of herbal and natural ingredients in functional foods is also reinforced by studies conducted by the United Nations Food and Agriculture Organization (FAO), which noted that plant-based additives, including neem, have grown at an annual rate of 7% in global exports between 2020 and 2024.

The versatility of neem extract is another contributing factor. It is utilized in beverages, confectionery, bakery, and dairy products for its health benefits and preservative properties, which reduce the need for synthetic additives. For example, neem’s natural antimicrobial properties help extend the shelf life of perishable products, meeting both consumer demand for healthier options and regulatory requirements for food safety. Government-backed food safety and organic certification programs, such as India’s FSSAI Organic Standards and the USDA National Organic Program, have further boosted confidence among manufacturers to incorporate neem extracts in their products.

Restraints

Limited Standardization and Quality Control Challenges

One of the major restraining factors for neem extracts in the food and nutraceutical industry is the lack of standardization and consistent quality control. Neem (Azadirachta indica) contains a complex mixture of bioactive compounds, including azadirachtin, nimbin, and salannin, whose concentrations can vary significantly depending on the region of cultivation, soil conditions, climate, and extraction methods.

- According to the Food Safety and Standards Authority of India (FSSAI), inconsistencies in herbal ingredient quality can affect both efficacy and safety, limiting large-scale adoption in functional foods and dietary supplements

Globally, herbal and plant-based ingredients face regulatory scrutiny due to the variability of active components. The World Health Organization (WHO) emphasizes the importance of Good Agricultural and Collection Practices (GACP) and standardized extraction methods to ensure that plant-based ingredients deliver consistent health benefits. For neem extracts, a lack of unified quality benchmarks results in variations between batches, which can lead to reduced consumer confidence and regulatory compliance challenges.

India’s National Medicinal Plants Board (NMPB) has recognized these challenges and implemented guidelines to promote standardized cultivation and harvesting of neem. However, adoption at the smallholder farmer level remains limited. Of the estimated 120,000 hectares of medicinal plant cultivation promoted under government schemes, only 45% are certified for adherence to organic or standardized practices, leaving a significant portion of neem raw material with unpredictable bioactive content. This inconsistency directly impacts manufacturers who aim to use neem extracts in functional foods, beverages, and nutraceuticals, as batch-to-batch variation can affect both safety and claimed health benefits.

Furthermore, the extraction process itself presents additional challenges. Traditional solvent-based extraction methods may leave residual solvents or reduce the potency of bioactive compounds, while modern techniques like supercritical CO₂ extraction are expensive and require technical expertise. The United Nations Food and Agriculture Organization (FAO) highlights that around 40% of small-scale herbal extract producers globally lack access to advanced processing technologies, which limits their ability to supply high-quality, standardized neem extracts for industrial applications.

This lack of standardization also complicates regulatory approval in international markets. For instance, the European Food Safety Authority (EFSA) requires detailed compositional analysis of bioactive ingredients for functional claims. Without consistent quality, neem extracts may face rejection or limited usage in fortified foods and nutraceutical products, restricting market growth outside India.

Opportunity

Expanding Use of Neem Extracts in Functional Foods and Nutraceuticals

A major growth opportunity for neem extracts lies in their increasing adoption in functional foods, dietary supplements, and nutraceuticals. Consumers worldwide are becoming more health-conscious, seeking natural ingredients with scientifically backed health benefits. Neem, known for its antioxidant, antimicrobial, and immune-supporting properties, is well-positioned to meet this demand.

The World Health Organization (WHO) recognizes neem as a medicinal plant with diverse applications, ranging from digestive support to immunity enhancement. This recognition bolsters consumer confidence and encourages food manufacturers to incorporate neem extracts into innovative products.

Neem extracts are also finding applications in beverages, protein bars, herbal teas, and fortified snacks. Their natural preservative qualities, combined with immune-supporting properties, make them ideal for use in products targeting health-conscious consumers. The Indian government supports this through the FSSAI’s guidelines for herbal and functional foods, ensuring that manufacturers can safely integrate neem extracts into consumable products while maintaining regulatory compliance.

Regional Insights

Asia Pacific leads with 48.10% share valued at USD 0.9 Bn

In 2024, Asia Pacific emerged as the leading regional market for neem extracts, accounting for 48.10% of the total market share with a valuation of USD 0.9 billion. The region’s dominance is deeply rooted in India’s strong role as the primary producer and processor of neem, supported by favorable government initiatives and abundant raw material availability. India alone produces more than 340 lakh tonnes of neem-coated urea annually, ensuring steady consumption of neem oil and extracts in agriculture under the mandatory 100% neem-coated urea (NCU) policy initiated in 2015 (Ministry of Fertilizers, PIB).

Beyond agriculture, neem-based products are widely integrated into the region’s pharmaceuticals, nutraceuticals, and personal care industries, where Ayurveda and traditional medicine continue to influence consumer preferences. The National AYUSH Mission, extended until 2026 with an allocation of ₹4,607.3 crore, is further driving demand for neem extracts across wellness and therapeutic applications.

The region also benefits from a large organic farming base, with India registering 7.3 million hectares of certified organic land in FY 2024, providing a substantial platform for botanical pest management solutions such as neem leaf and seed extracts (APEDA). In addition, countries like China and Japan are increasing their imports of neem-derived inputs to support herbal formulations and sustainable farming practices.

Growing consumer awareness of natural health products, combined with policy-driven demand in agriculture, ensures that Asia Pacific will remain the core growth engine of the global neem extracts market in 2025. Its integrated use across agriculture, pharmaceuticals, nutraceuticals, and personal care makes the region the most dynamic and influential market globally.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Parker Biotech Private Limited is a leading Indian player specializing in neem-based biopesticides and extracts. The company produces standardized azadirachtin technical concentrates and ready-to-use formulations for agricultural use, seed treatment, and integrated pest management. Its focus on eco-friendly crop protection solutions has earned it recognition in both domestic and export markets. With India’s neem-coated urea policy and growing demand for organic farming inputs, Parker Biotech continues to strengthen its market presence through consistent product quality and sustainable practices.

Agro Extracts Limited focuses on manufacturing neem seed and leaf extracts used in agrochemicals, pharmaceuticals, and personal care industries. The company is known for its neem oil formulations and azadirachtin-based biopesticides that support organic agriculture. Leveraging modern extraction technologies, Agro Extracts ensures consistent purity and efficiency across its product lines. Its strong domestic distribution network and export activities help it cater to rising demand for botanical pesticides. With regulatory support for bio-based inputs, the company continues to expand its industrial footprint.

Fortune Biotech is a prominent neem-based agro solutions provider, offering a wide range of bio-pesticides, neem oil, and azadirachtin formulations. The company has been instrumental in promoting sustainable crop protection practices by replacing synthetic chemicals with neem-derived alternatives. Known for its technical expertise and adherence to quality standards, Fortune Biotech serves both Indian and overseas markets. Its strong focus on research and product innovation enables it to deliver eco-friendly pest management products, aligning with the global trend toward organic farming.

Top Key Players Outlook

- Parker Biotech Private Limited

- Agro Extracts Limited

- Fortune Biotech

- Ozone Biotech

- PJ Margo

- GreeNeem

- Trifolio-M

- EID Parry

- Herbal Creation

- Phyto Life Sciences P. Ltd

Recent Industry Developments

In 2024 Parker Biotech Private Limited, its authorized share capital stood at ₹7,000,000, fully paid up—highlighting a committed and focused structure for its operations.

In 2024 Agro Extracts Limited, reported processing approximately 4,500 metric tons of neem leaves and seeds, producing around 1,200 metric tons of standardized neem extract suitable for nutraceuticals, functional foods, and herbal formulations.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Bn Forecast Revenue (2034) USD 5.7 Bn CAGR (2025-2034) 11.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Leaf Extracts, Fruit and Seed Extracts, Bark Extracts), By Application (Pharmaceuticals and Nutraceuticals, Personal Care, Agriculture and Farming, Food and Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Parker Biotech Private Limited, Agro Extracts Limited, Fortune Biotech, Ozone Biotech, PJ Margo, GreeNeem, Trifolio-M, EID Parry, Herbal Creation, Phyto Life Sciences P. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Parker Biotech Private Limited

- Agro Extracts Limited

- Fortune Biotech

- Ozone Biotech

- PJ Margo

- GreeNeem

- Trifolio-M

- EID Parry

- Herbal Creation

- Phyto Life Sciences P. Ltd