Global Mycelium Market By Form (Solid Mycelium, Liquid Mycelium, Pre-Formed Mycelium), By End-Use (Consumer Goods, Food and Beverage, Construction, Healthcare and Pharmaceuticals, Agriculture, Others), By Distribution Channel (Online Retail, Offline Retail) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151108

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

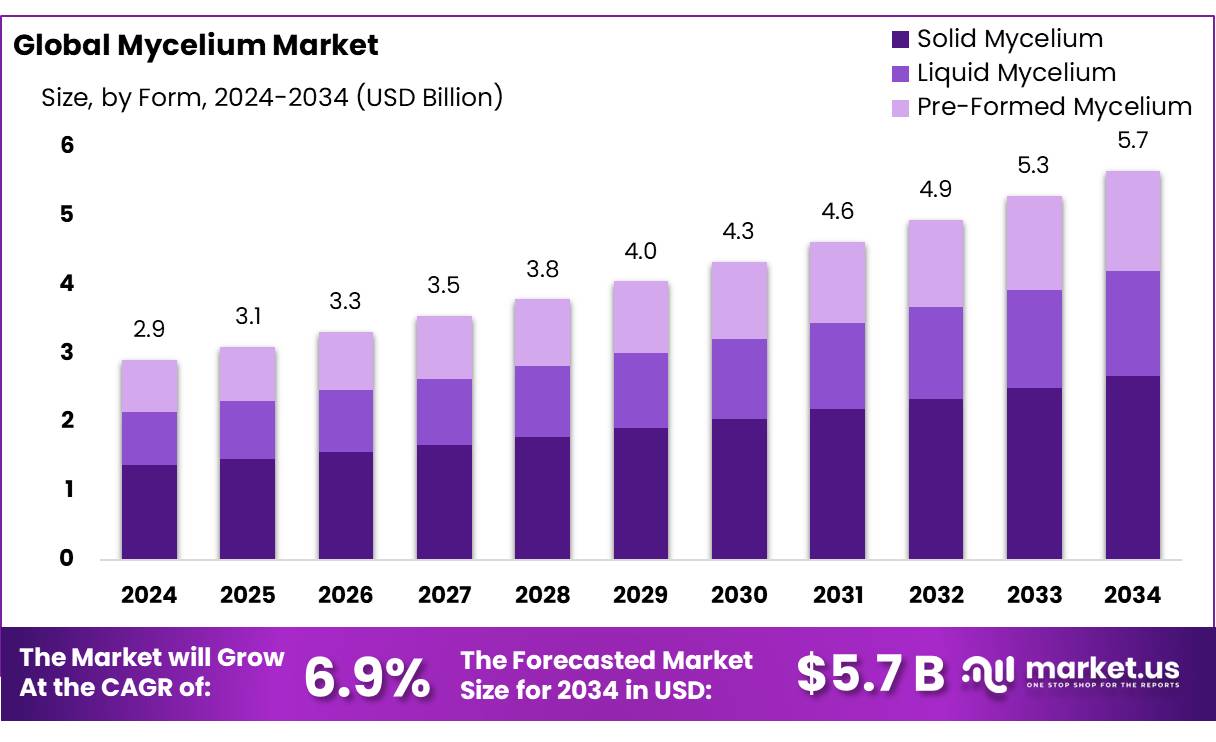

The Global Mycelium Market size is expected to be worth around USD 5.7 Billion by 2034, from USD 2.9 Billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

Mycelium concentrates refer to refined extracts derived from the vegetative network (mycelium) of fungi. These concentrates are rich in bioactive compounds such as polysaccharides, proteins, and phenolics, which render them valuable across food and beverage, nutraceutical, cosmetic, and industrial applications. Their inherent biodegradability, renewable sourcing, and capacity to sequester carbon have positioned them as versatile sustainable alternatives to conventional petrochemical based materials.

The current industrial scenario underscores increasing production capacity and adoption. According to the U.S. Energy Information Administration, U.S. mycelium production capacity reached approximately 2 million metric tons in 2023. In Germany, production for food and beverages was recorded at around 180,000 tons in 2023.

Driving factors for the sector include its environmental credentials, versatile functional properties, and reduced reliance on petrochemicals. Mycelium-based composites show density values between 199 and 340kg/m³, comparable to polystyrene and polyurethane foams, making them suitable for packaging and insulation. Government policy frameworks support this shift: for instance, the European Industrial Strategy explicitly identifies bio-based materials as key to meeting 2050 climate objectives.

Additionally, the U.S. FDA has granted “Generally Recognized as Safe” (GRAS) status to Aspergillus oryzae, facilitating its use in processing enzymes used in bio-based manufacturing; fungal-derived enzymes represent around 85% of the global fungal enzyme market, valued at USD 7.42 billion in 2023.

Future growth opportunities lie in further diversification into high-performance applications, such as automotive-grade composites, acoustic insulation, bio-leather for fashion, and active nutraceutical products. Mycelium-based leather currently costs between USD 0.18–0.28 per m², compared to USD 5.81–6.24 per m² for animal hide, making it commercially compelling.

Key Takeaways

- Mycelium Market size is expected to be worth around USD 5.7 Billion by 2034, from USD 2.9 Billion in 2024, growing at a CAGR of 6.9%.

- Solid Mycelium held a dominant market position, capturing more than a 47.3% share of the global mycelium market.

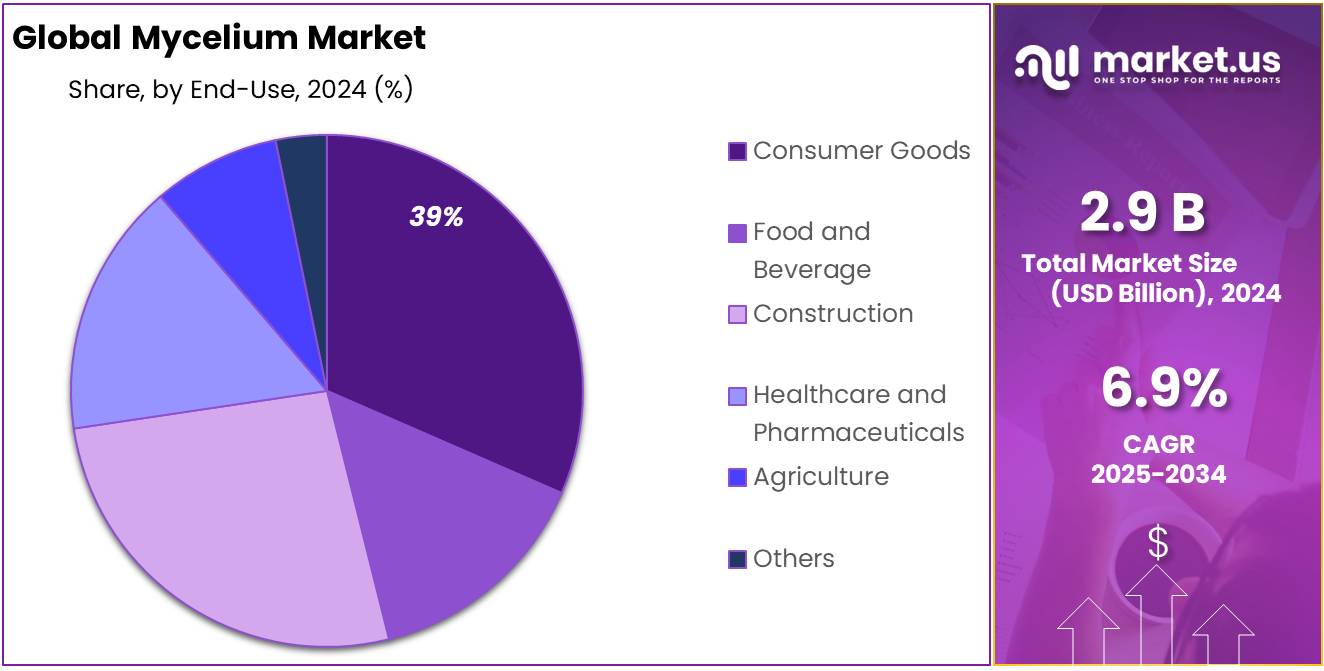

- Consumer Goods held a dominant market position, capturing more than a 39.2% share of the global mycelium market.

- Online Retail held a dominant market position, capturing more than a 59.1% share of the global mycelium market.

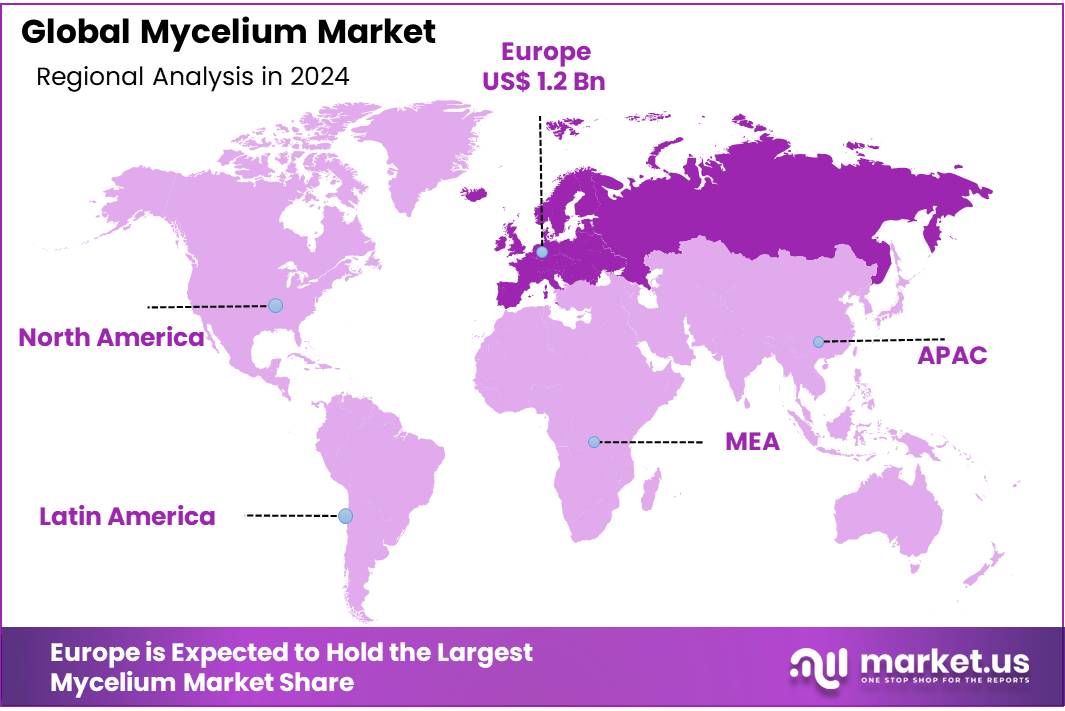

- Europe accounted for a commanding 43.2% share of the global mycelium market, translating to approximately USD 1.2 billion.

By Form

Solid Mycelium dominates with 47.3% due to its superior structural strength and versatility in applications.

In 2024, Solid Mycelium held a dominant market position, capturing more than a 47.3% share of the global mycelium market by form. This significant share can be attributed to its extensive usage across packaging, construction, textile alternatives, and insulation materials. Solid mycelium, known for its fibrous density and moldability, has been increasingly preferred in industries seeking biodegradable and compostable solutions with mechanical durability.

Its ability to replace plastic-based foams and wood-derived composites has gained traction especially in Europe and North America, where regulations are encouraging the adoption of bio-based alternatives. By 2025, this form is expected to sustain its lead, driven by expanding production capacities and new partnerships between biotech startups and packaging giants, aiming to replace conventional petrochemical packaging. As demand grows for eco-friendly materials with performance characteristics similar to traditional options, solid mycelium continues to stand out for its sustainability, affordability, and adaptability across multiple industrial uses.

By End-Use

Consumer Goods lead with 39.2% due to rising demand for sustainable materials in daily-use products.

In 2024, Consumer Goods held a dominant market position, capturing more than a 39.2% share of the global mycelium market by end-use. This dominance was largely driven by the growing interest in eco-friendly alternatives for items like packaging, footwear, accessories, and home decor. Mycelium’s biodegradable nature and customizable texture make it ideal for replacing plastics, leather, and synthetic foams in consumer-facing products.

Brands focused on circular economy principles increasingly turned to mycelium to reduce environmental impact while maintaining product quality and design flexibility. By 2025, this segment is expected to expand further as major retail and lifestyle companies commit to using mycelium-based materials in product lines, encouraged by stricter environmental regulations and growing consumer preference for plant-based innovations. The consumer goods sector continues to be the largest and most dynamic outlet for industrial mycelium applications.

By Distribution Channel

Online Retail dominates with 59.1% as direct-to-consumer demand for eco-friendly products surges.

In 2024, Online Retail held a dominant market position, capturing more than a 59.1% share of the global mycelium market by distribution channel. This strong performance was mainly due to the rising popularity of sustainable products among eco-conscious consumers who prefer the convenience of digital platforms. Mycelium-based goods—ranging from biodegradable packaging to fashion items and homeware—have found a growing audience through online marketplaces and brand-owned e-commerce stores.

The ability to reach niche markets and promote the environmental benefits of mycelium directly to end-users has helped fuel sales. Additionally, social media and influencer marketing played a key role in increasing awareness and driving online purchases. By 2025, online retail is expected to maintain its lead as more producers expand their digital footprint and align with global sustainability trends, offering consumers easy access to innovative, plant-based alternatives.

Key Market Segments

By Form

- Solid Mycelium

- Liquid Mycelium

- Pre-Formed Mycelium

By End-Use

- Consumer Goods

- Food and Beverage

- Construction

- Healthcare and Pharmaceuticals

- Agriculture

- Others

By Distribution Channel

- Online Retail

- Offline Retail

Drivers

Government Support and Policy Initiatives

The Indian government has recognized the potential of the mushroom industry and has implemented various schemes to promote its growth. The Ministry of Agriculture and Farmers Welfare, through the Directorate of Mushroom Research, provides training, technical support, and quality spawn to farmers. Additionally, the Mission for Integrated Development of Horticulture (MIDH) offers financial assistance for infrastructure development and capacity building in mushroom cultivation. These initiatives aim to enhance productivity, improve quality standards, and increase the income of mushroom farmers.

For instance, the “Mushroom Production in Huts” scheme launched by the Horticulture Directorate covers 50% of the initial setup costs for mushroom cultivation units. This scheme operates on a first-come, first-served basis, with each applicant eligible for support for only one unit. Such government interventions are instrumental in making mushroom farming accessible and profitable for small-scale farmers.

These combined efforts from the government and the private sector are driving the growth of the mushroom industry in India, positioning it as a significant contributor to the country’s agricultural and economic landscape.

Restraints

Limited Awareness and Technical Expertise

One of the significant challenges hindering the growth of the mycelium market in India is the limited awareness and technical expertise among farmers and entrepreneurs. While mushrooms, including mycelium-based products, offer substantial economic and nutritional benefits, many potential cultivators lack the necessary knowledge and skills to engage in successful cultivation.

A study conducted in Haryana’s Sonipat district revealed that 70.83% of respondents cited inadequate support from government agencies and NGOs as a major constraint, while 68% reported difficulties in accessing loans. Additionally, 60% of farmers faced challenges related to the high cost of raw materials, and 54% lacked knowledge about available credit facilities. These financial and informational barriers significantly impact the adoption and expansion of mushroom farming.

To address these challenges, the Indian government and various agricultural institutions are working towards enhancing awareness and technical capabilities. For instance, Krishi Vigyan Kendras (KVKs) provide training programs in mushroom cultivation, and institutions like the Indian Council of Agricultural Research (ICAR) offer research and development support. Additionally, financial schemes such as the MUDRA loans and subsidies under the National Horticulture Board (NHB) aim to alleviate financial constraints for aspiring mushroom farmers.

Opportunity

Expanding Export Potential of Mycelium-Based Products

India’s mycelium industry is poised for significant growth, particularly in the export sector. The global demand for sustainable and biodegradable products is on the rise, and India, with its diverse agricultural landscape and supportive government policies, is well-positioned to meet this demand.

The Indian government has recognized the potential of the mycelium industry and has implemented various schemes to promote its growth. The Mission for Integrated Development of Horticulture (MIDH) offers subsidies ranging from 35% to 50% for mushroom cultivation, depending on the area and type of cultivation . Additionally, the National Horticulture Board (NHB) provides up to 40% financial assistance for setting up mushroom production units . These initiatives aim to enhance productivity, improve quality standards, and increase the income of mushroom farmers.

Furthermore, the Indian government has launched the “Mushroom Kit Vitaran” scheme to encourage farmers and individuals to engage in mushroom cultivation. This scheme provides free distribution of mushroom kits to promote sustainable agriculture practices and create employment opportunities in rural areas.

To capitalize on the growing global demand, India can focus on enhancing the quality and consistency of mycelium-based products, meeting international standards and certifications. Establishing dedicated export promotion cells, participating in international trade fairs, and forming strategic partnerships with global distributors can further bolster India’s position in the global mycelium market.

Trends

Surge in Gourmet and Medicinal Mushroom Consumption

In recent years, India has witnessed a notable shift in consumer preferences towards gourmet and medicinal mushrooms, such as shiitake, oyster, and truffles. This trend is driven by increasing health consciousness, the rise of plant-based diets, and the growing popularity of functional foods. These mushrooms are not only valued for their unique flavors but also for their potential health benefits, including immune-boosting properties and high antioxidant content.

To support this growing demand, the Indian government has implemented various initiatives. The Mission for Integrated Development of Horticulture (MIDH) provides subsidies ranging from 35% to 50% for mushroom cultivation, depending on the area and type of cultivation. Additionally, the National Horticulture Board (NHB) offers up to 40% financial assistance for setting up mushroom production units. These schemes aim to enhance productivity, improve quality standards, and increase the income of mushroom farmers.

Furthermore, research institutions like the Indian Institute of Horticultural Research (IIHR) are focusing on developing high-yielding and disease-resistant mushroom varieties. IIHR has developed a sporeless mutant of oyster mushroom, which is expected to have better shelf life and marketability . Such innovations are expected to further boost the production and consumption of gourmet and medicinal mushrooms in India.

Regional Analysis

Europe leads with 43.2%, equivalent to USD 1.2 billion in 2024.

In 2024, Europe accounted for a commanding 43.2% share of the global mycelium market, translating to approximately USD 1.2 billion in revenue. This strong performance reflects the region’s proactive stance on sustainability, circular economy principles, and stringent environmental regulations that encourage adoption of bio-based materials. The European Union’s policy framework supports the transition away from fossil-based plastics through initiatives like the EU Plastic Strategy and the Circular Economy Action Plan, which directly benefit alternative materials such as mycelium-based packaging and building products.

Over recent years, a surge in eco-conscious consumer demand across Germany, France, the UK, Italy, and the Netherlands has driven investment in local production facilities and R&D centers. Europe’s footprint is further enlarged by advancing collaborations between innovative biotech startups and established manufacturing firms seeking greener supply chains. For instance, Italy has emerged as a hub for mycelium-based composites, blending agricultural waste with fungal biomass to create insulating panels and leather-like materials—products that align with governmental funding schemes supporting circular bioeconomy projects.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ecovative Design LLC is a leader in the mycelium-based product market, known for creating sustainable materials and packaging solutions. The company specializes in growing mycelium to replace conventional plastics and other materials in packaging, insulation, and construction. Ecovative’s flagship product, MycoComposite™, is used in various industries, including automotive and consumer goods. With a strong focus on sustainability and innovation, Ecovative continues to lead the development of environmentally-friendly alternatives in the global market.

MycoWorks is a biotechnology company that specializes in developing and manufacturing mycelium-based materials for use in fashion, furniture, and other applications. Their flagship product, Reishi™, is a premium mycelium-based leather alternative. By harnessing the unique properties of mycelium, MycoWorks aims to disrupt traditional leather and synthetic materials markets. The company partners with major brands in luxury goods and sustainable fashion to offer eco-friendly solutions, contributing to the growing demand for biodegradable materials in the industry.

Atlast Food Co. focuses on creating mycelium-based meat alternatives, particularly mycelium-driven products like “Fable.” Their innovative technology uses the mycelium network to create plant-based meat products that mimic the texture and taste of traditional meats. Atlast is part of the growing trend towards sustainable, plant-based diets and is addressing the global demand for more sustainable protein sources. Their products are gaining traction in the food industry as more consumers opt for healthier and eco-conscious food choices.

Top Key Players in the Market

- Ecovative Design LLC

- MycoWorks

- Atlast Food Co.

- Meati Foods

- Bolt Threads Inc.

- Mogu

- Mycelia

- Biomyc

- Prime Roots

- Four Sigmatic

- Radical Mycology

Recent Developments

In 2024 Ecovative Design LLC, has raised over $145 million in funding to advance its sustainable material technologies.

In 2024 Meati Foods, experienced significant growth, doubling its revenue compared to 2023 and expanding its retail presence to over 7,000 stores nationwide.

Report Scope

Report Features Description Market Value (2024) USD 2.9 Bn Forecast Revenue (2034) USD 5.7 Bn CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Solid Mycelium, Liquid Mycelium, Pre-Formed Mycelium), By End-Use (Consumer Goods, Food and Beverage, Construction, Healthcare and Pharmaceuticals, Agriculture, Others), By Distribution Channel (Online Retail, Offline Retail) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ecovative Design LLC, MycoWorks, Atlast Food Co., Meati Foods, Bolt Threads Inc., Mogu, Mycelia, Biomyc, Prime Roots, Four Sigmatic, Radical Mycology Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ecovative Design LLC

- MycoWorks

- Atlast Food Co.

- Meati Foods

- Bolt Threads Inc.

- Mogu

- Mycelia

- Biomyc

- Prime Roots

- Four Sigmatic

- Radical Mycology