Global Wood Plastic Composite Market Size, Share, And Business Benefits By Material Type (Polythene, Polypropylene, Polyvinyl Chloride, Polylactic Acid), By End-Use (Building and Construction, Automotive Components, Consumer Goods, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146848

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

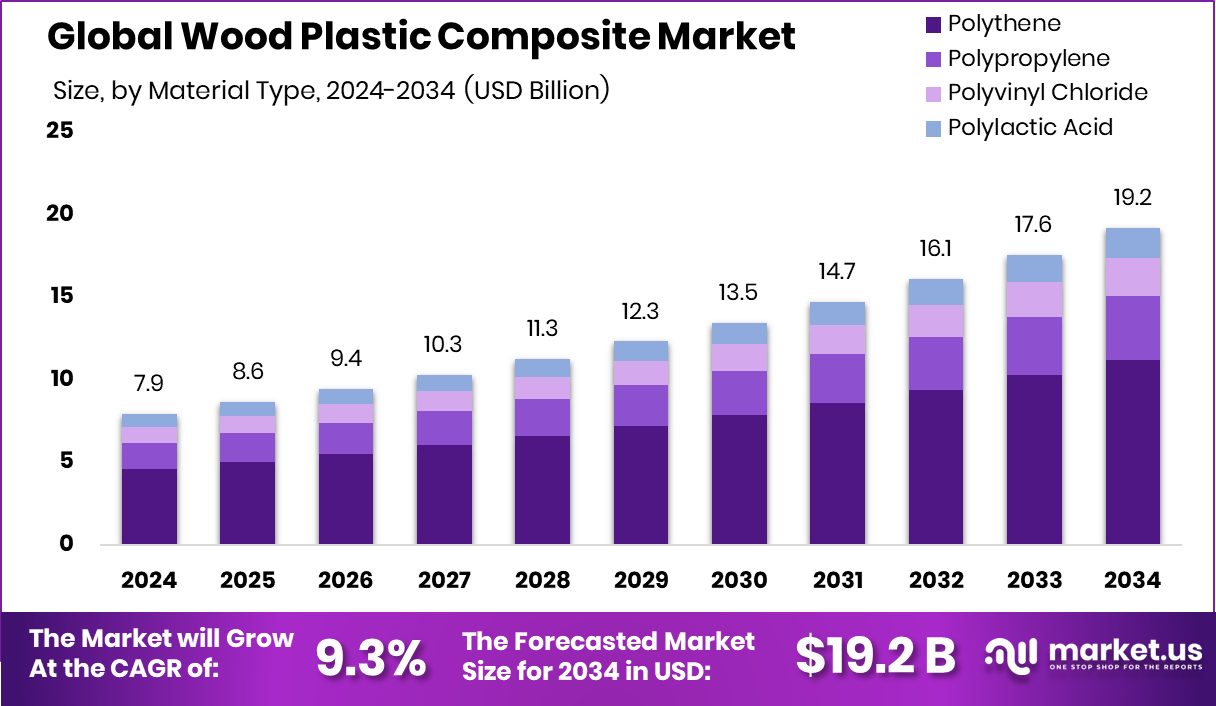

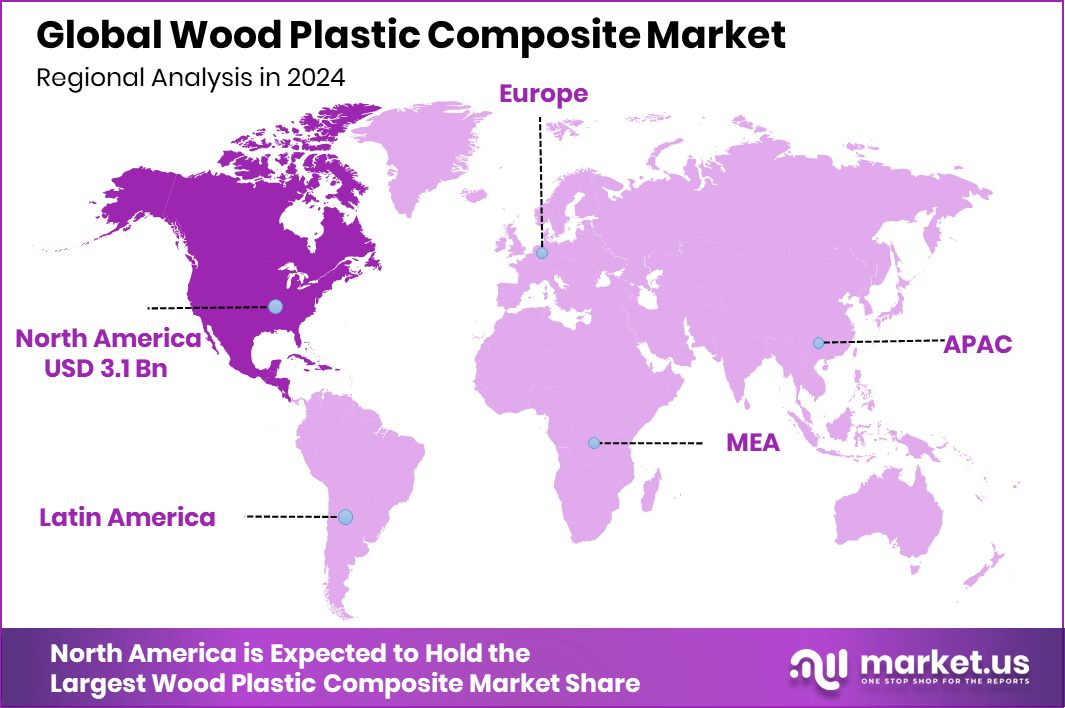

Global Wood Plastic Composite Market is expected to be worth around USD 19.2 billion by 2034, up from USD 7.9 billion in 2024, and grow at a CAGR of 9.3% from 2025 to 2034. The North American region held a 39.3% share, generating USD 3.1 Bn revenue.

Wood Plastic Composite (WPC) is an innovative material that combines wood fibers or agricultural residues with thermoplastics, offering a sustainable alternative to traditional wood and plastic products. In India, WPC is gaining traction due to its durability, resistance to moisture and pests, and versatility in applications such as construction, furniture, and automotive components.

The Indian WPC industry is witnessing growth, supported by government initiatives aimed at promoting sustainable materials and waste management. For instance, the CSIR-Advanced Materials and Processes Research Institute (CSIR-AMPRI) in Bhopal has developed ‘Evergreen Hybrid Ply and Composite Wood’ using agro-industrial wastes like paddy straw and fly ash. This innovation not only provides a wood substitute but also offers a solution to stubble burning, a significant environmental issue in northern India.

Government policies are further propelling the WPC sector. The Ministry of Science and Technology supports technologies that convert plastic waste into valuable products, such as plastic-bonded plywood, enhancing the economic value of single-use plastics. Additionally, the Draft National Capital Goods Policy highlights the development of machinery for extruding WPC sections, indicating a focus on domestic manufacturing capabilities.

The demand for WPC is also influenced by the construction and infrastructure sectors. The National Infrastructure Pipeline, with an investment of $1.4 trillion, emphasizes the use of sustainable materials, providing opportunities for WPC applications in various projects. Furthermore, the National Technical Textiles Mission aims to promote technical textiles, including composites like WPC, through research, innovation, and market development.

Key Takeaways

- Global Wood Plastic Composite Market is expected to be worth around USD 19.2 billion by 2034, up from USD 7.9 billion in 2024, and grow at a CAGR of 9.3% from 2025 to 2034.

- In 2024, Polythene dominated Wood Plastic Composite production, securing a 58.4% market share.

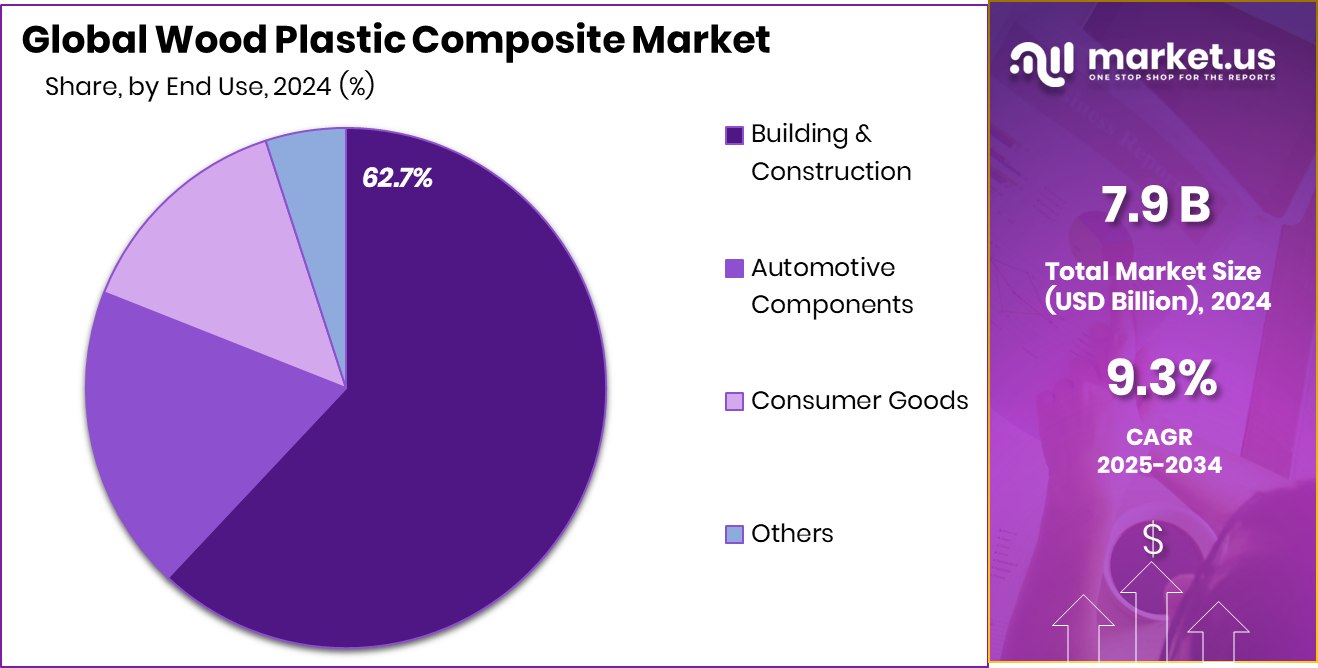

- In 2024, Building and Construction led with 62.7% of total Wood Plastic Composite usage.

- With USD 3.1 Bn, North America dominated the market at 39.3% share.

By Material Type Analysis

Polythene dominates material usage with 58.4%, ensuring enhanced product flexibility.

In 2024, Polythene held a dominant market position in the By Material Type segment of the Wood Plastic Composite Market, with a 58.4% share. This significant market share highlights the material’s widespread preference owing to its versatility, cost-effectiveness, and compatibility with wood fiber.

Polythene-based wood plastic composites are especially favored for their moisture resistance, enhanced durability, and improved mechanical properties, making them ideal for outdoor applications such as decking, fencing, and landscaping.

The material’s lightweight nature and recyclability further strengthen its industrial appeal, aligning with growing sustainability mandates across construction and manufacturing sectors. The ease of processing polythene with various additives also allows manufacturers to tailor composite properties based on application-specific needs. Its dominance reflects the construction industry’s strong reliance on high-performance, low-maintenance alternatives to traditional timber and plastic.

This 58.4% market share also signals the material’s compatibility with existing extrusion and injection molding technologies, which has accelerated its adoption in both developed and emerging economies. In addition, government initiatives supporting green building materials and infrastructure expansion in regions like Asia-Pacific have reinforced the use of polythene composites in structural and aesthetic applications.

By End-Use Analysis

Building and construction lead WPC demand, capturing 62.7% market share.

In 2024, Building and Construction held a dominant market position in the By End-Use segment of the Wood Plastic Composite Market, with a 62.7% share. This substantial share underscores the material’s growing role in modern construction practices, particularly in outdoor infrastructure such as decking, railings, wall panels, cladding, and fencing.

Wood plastic composites (WPCs) are being increasingly adopted in this sector due to their excellent weather resistance, low maintenance, and enhanced lifecycle over traditional wood.

The shift toward sustainable and durable construction materials has positioned WPCs as a reliable substitute for conventional timber, particularly in regions experiencing urban expansion and real estate growth. The 62.7% share reflects widespread deployment in both residential and commercial building projects, driven by demand for aesthetic appeal coupled with structural performance.

Furthermore, the increasing incorporation of recycled plastics and wood waste in WPC production aligns with global sustainability goals and circular economy frameworks. Builders and developers are favoring WPCs for their termite resistance, water resistance, and ease of installation—attributes that lower long-term maintenance costs.

Key Market Segments

By Material Type

- Polythene

- Polypropylene

- Polyvinyl Chloride

- Polylactic Acid

By End-Use

- Building and Construction

- Automotive Components

- Consumer Goods

- Others

Driving Factors

Eco-Friendly Demand Boosting Wood Plastic Composite Market

One big reason behind the growth of the Wood Plastic Composite (WPC) market is the rising global demand for eco-friendly and sustainable materials. Consumers and industries are actively looking for alternatives to traditional wood and plastic, and WPC offers the best of both worlds. It uses recycled plastic and wood fibers, reducing environmental waste and promoting resource conservation.

Governments worldwide are also encouraging green construction practices and sustainable product usage, which is pushing more companies to adopt WPC for decking, fencing, and other applications. As construction and furniture sectors seek durable yet sustainable options, WPC continues to gain popularity. Its low maintenance and weather resistance further add to its appeal, making it a top choice across regions.

Restraining Factors

High Initial Cost Limits Market Growth Potential

One key challenge for the Wood Plastic Composite (WPC) market is its high initial cost compared to traditional wood or plastic materials. Although WPC offers long-term benefits like durability and low maintenance, many buyers, especially in developing countries, are hesitant to invest due to higher upfront expenses. Small construction firms and budget-conscious consumers often prefer cheaper alternatives even if they require more maintenance.

Additionally, WPC manufacturing involves specialized machinery and processing techniques, which increase production costs. This cost factor makes it harder for WPC to compete in price-sensitive markets. Unless awareness about its long-term value improves or prices drop through better technologies, the adoption of WPC might remain limited in certain regions or applications.

Growth Opportunity

Automotive Industry Drives Wood Plastic Composite Growth

The automotive industry presents a significant opportunity for the Wood Plastic Composite (WPC) market. As car manufacturers strive to produce lighter vehicles for better fuel efficiency, WPCs are increasingly used in car interiors like door panels, dashboards, and seat backs. These materials are not only lightweight but also durable and resistant to moisture, making them ideal for automotive applications.

Additionally, WPCs contribute to sustainability goals by utilizing recycled materials, aligning with the industry’s push for eco-friendly solutions. The growing demand for electric vehicles further amplifies this trend, as manufacturers seek materials that support energy efficiency. With the automotive sector’s continuous growth and emphasis on sustainability, the use of WPCs is expected to rise, offering a promising avenue for market expansion.

Latest Trends

Composite Decking Gains Popularity in Outdoor Spaces

A notable trend in the Wood Plastic Composite (WPC) market is the increasing use of composite decking in outdoor living areas. Homeowners are seeking durable, low-maintenance materials that can withstand various weather conditions while providing aesthetic appeal.

Composite decking, made from a blend of wood fibers and plastic, offers resistance to rot, splintering, and insect damage, making it an attractive alternative to traditional wood decking. Additionally, the variety of colors and textures available allows for customization to match different design preferences.

The demand for eco-friendly building materials also contributes to this trend, as many composite decking products utilize recycled materials, aligning with sustainable construction practices. As outdoor spaces become extensions of indoor living areas, the preference for composite decking is expected to continue growing.

Regional Analysis

In North America, the Wood Plastic Composite market reached 39.3%, valued at USD 3.1 Bn.

In 2024, North America emerged as the leading region in the Wood Plastic Composite (WPC) market, capturing a significant 39.3% share and generating a total revenue of USD 3.1 billion. The region’s dominance is attributed to the high demand for sustainable construction materials, coupled with growing applications of WPCs in decking, fencing, and automotive interiors.

Additionally, consumers in North America show a strong preference for low-maintenance and durable building alternatives, further boosting market uptake. Europe followed closely, driven by strict environmental regulations and the rising adoption of recycled composite materials in construction projects. In the Asia Pacific region, rapid urbanization and infrastructure development are encouraging the adoption of WPC, especially in countries like China and India.

Meanwhile, the Middle East & Africa and Latin America represent emerging markets, with gradual growth seen in residential and commercial construction activities. Although these regions hold smaller market shares, they exhibit increasing awareness regarding eco-friendly materials.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, CertainTeed LLC, Beologic, and Fiberon have emerged as influential players in the global Wood Plastic Composite (WPC) market, each contributing uniquely to the industry’s growth and innovation.

CertainTeed LLC has solidified its position as a leading North American manufacturer of sustainable building materials. The company’s extensive product portfolio includes low-maintenance siding solutions that combine aesthetic appeal with durability. CertainTeed’s commitment to sustainability is evident through its achievement of Gold level verification from the +Vantage Vinyl™ initiative, highlighting its dedication to environmentally responsible practices.

Beologic, a Belgian company with over two decades of experience, specializes in manufacturing sustainable compounds for WPC applications. Operating under the Sustainable Development Group, Beologic offers a range of products, including Beobase, Beograde, Beocycle, and Beosmart, all designed to conserve natural resources and promote environmental protection. Their expertise in creating biobased composites positions them as a key player in advancing sustainable materials within the WPC industry.

Fiberon has distinguished itself through its innovative approach to composite cladding and decking solutions. The company’s Wildwood™ composite cladding, made from 94% mixed recycled wood-fiber and plastic content, has garnered recognition for its sustainability, winning the 2024 Sustainable Product of the Year award

Top Key Players in the Market

- CertainTeed, LLC.

- Beologic

- Fiberon

- Trex Company, Inc.

- MoistureShield

- UFP Industries Inc.

- Timbertech LLC

- Beologic

- FKuR Kunststoff GmbH

- Oldcastle APG

- Green Dot Bioplastics, Inc.

- Goldstab Organics

- Others

Recent Developments

- In February 2025, Fiberon introduced the Astir Collection under its Concordia line, featuring three nature-inspired colors: Prairie Wheat, Mountain Ash, and Seaside Mist. These boards have a rustic cathedral grain and are designed for durability and low maintenance.

- In October 2024, CertainTeed introduced the Decoustics Impressions line, featuring ceiling and wall panels with 10 unique wood-like finishes. These panels utilize digital printing technology to replicate natural wood aesthetics. They are designed for easy installation and maintenance, with sizes up to 48″×96″, making them suitable for various interior applications.

Report Scope

Report Features Description Market Value (2024) USD 7.9 Billion Forecast Revenue (2034) USD 19.2 Billion CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Polythene, Polypropylene, Polyvinyl Chloride, Polylactic Acid), By End-Use (Building and Construction, Automotive Components, Consumer Goods, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape CertainTeed, LLC., Beologic, Fiberon, Trex Company, Inc., MoistureShield, UFP Industries Inc., Timbertech LLC, Beologic, FKuR Kunststoff GmbH, Oldcastle APG, Green Dot Bioplastics, Inc., Goldstab Organics, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wood Plastic Composite MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Wood Plastic Composite MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- CertainTeed, LLC.

- Beologic

- Fiberon

- Trex Company, Inc.

- MoistureShield

- UFP Industries Inc.

- Timbertech LLC

- Beologic

- FKuR Kunststoff GmbH

- Oldcastle APG

- Green Dot Bioplastics, Inc.

- Goldstab Organics

- Others