Global Monoclonal Antibodies Market By Product Type (Human, Murine, and Chimeric), By Technology (In Vitro, and In Vivo), By Application (Oncology, Neurological Diseases, Infectious Diseases, Autoimmune Diseases, and Others), By End-user (Hospitals, Specialty Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 16123

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

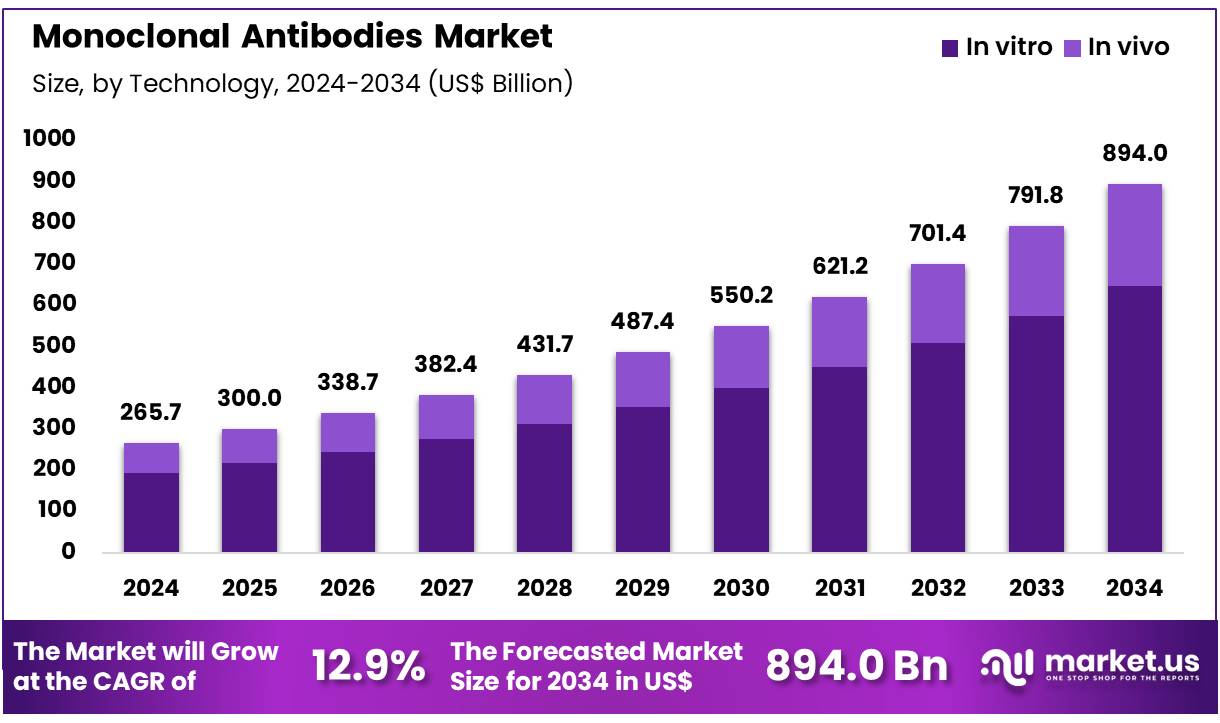

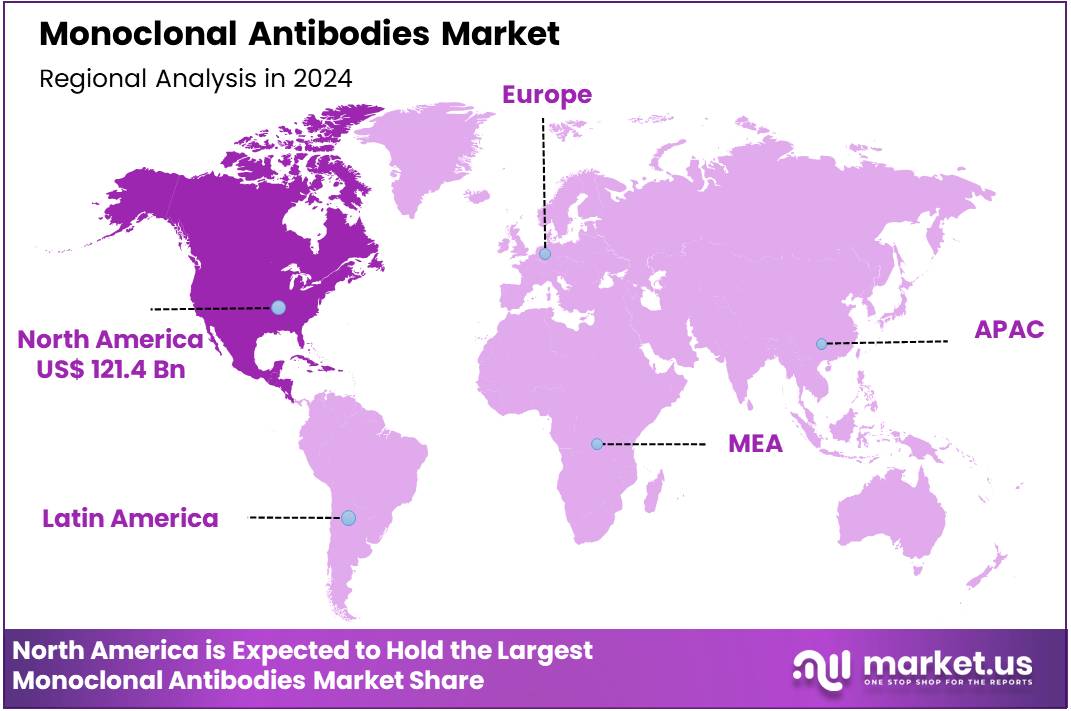

Global Monoclonal Antibodies Market size is expected to be worth around US$ 894.0 Billion by 2034 from US$ 265.7 Billion in 2024, growing at a CAGR of 12.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 45.7% share with a revenue of US$ 121.4 Billion.

Rising prevalence of chronic and autoimmune diseases drives the monoclonal antibodies market as clinicians seek targeted therapies for precise patient outcomes. Oncologists increasingly deploy monoclonal antibodies (mAbs) in cancer treatment, utilizing agents like trastuzumab to inhibit tumor growth in HER2-positive breast cancer. This driver intensifies with the demand for immunotherapy, where mAbs modulate immune checkpoints to combat melanoma.

Rheumatologists apply these biologics in autoimmune disorders, administering adalimumab to reduce joint inflammation in rheumatoid arthritis. In February 2025, Novartis acquired Anthos Therapeutics for US$ 925 million, bolstering its mAb portfolio with abelacimab for cardiovascular indications. According to the American Cancer Society, 2,001,140 new cancer cases were projected for 2024, underscoring the urgent need for advanced mAb therapies across oncology and beyond.

Growing investment in biologics research creates substantial opportunities in the monoclonal antibodies market. Biopharmaceutical firms develop mAbs for neurology, targeting amyloid plaques in Alzheimer’s disease to slow cognitive decline. Infectious disease specialists explore these therapies for antiviral applications, designing antibodies to neutralize pathogens like respiratory syncytial virus.

Opportunities also arise in ophthalmology, where mAbs treat macular degeneration by inhibiting vascular endothelial growth factor. In October 2024, REGiMMUNE and Kiji Therapeutics merged to form REGiMMUNE/Kiji TX, advancing mAb platforms for autoimmune and inflammatory conditions. The NIH allocated $ 3.2 billion to biologic drug development in 2023, highlighting the potential for mAbs to address unmet needs in diverse therapeutic areas.

Recent trends in the monoclonal antibodies market emphasize strategic mergers and next-generation engineering to enhance therapeutic efficacy. Developers focus on bispecific mAbs for hematology, combining binding sites to target multiple leukemia cell antigens simultaneously. Trends also include antibody-drug conjugates for precision oncology, delivering cytotoxic payloads to cancer cells with minimal systemic toxicity.

In October 2024, Aerovate Therapeutics and Jade Biosciences merged to advance mAb therapies for autoimmune disorders, redefining treatment standards. The FDA approved 12 new mAb therapies in 2023, reflecting robust innovation in biologics. These advancements signal a dynamic shift toward versatile, high-impact monoclonal antibody solutions for complex diseases.

Key Takeaways

- In 2024, the market generated a revenue of US$ 265.7 Billion, with a CAGR of 12.9%, and is expected to reach US$ 894.0 Billion by the year 2034.

- The product type segment is divided into human, murine, and chimeric, with human taking the lead in 2023 with a market share of 59.7%.

- Considering technology, the market is divided into in vitro and in vivo. Among these, in vitro held a significant share of 72.4%.

- Furthermore, concerning the application segment, the market is segregated into oncology, neurological diseases, infectious diseases, autoimmune diseases, and others. The oncology sector stands out as the dominant player, holding the largest revenue share of 48.6% in the market.

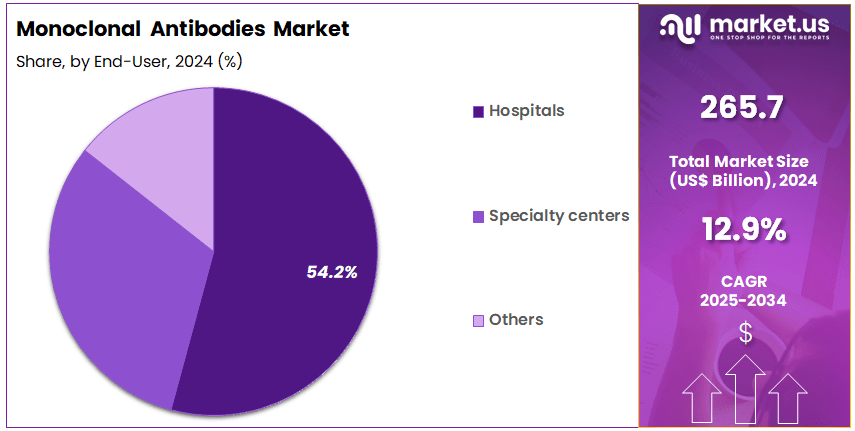

- The end-user segment is segregated into hospitals, specialty centers, and others, with the hospitals segment leading the market, holding a revenue share of 54.2%.

- North America led the market by securing a market share of 45.7% in 2023.

Product Type Analysis

Human monoclonal antibodies account for 59.7% of the market share and are expected to continue growing due to their superior specificity, lower immunogenicity, and broader application in targeted therapies. These antibodies are derived from human sources, making them less likely to be recognized as foreign by the immune system, reducing the risk of immune reactions.

The increasing adoption of human monoclonal antibodies in oncology, autoimmune diseases, and neurological conditions is projected to drive the market’s growth. Advancements in recombinant DNA technology have enhanced the production of human monoclonal antibodies, improving their efficacy and safety profiles. The growing trend toward personalized medicine, where treatment is tailored to the individual, is expected to accelerate the demand for human monoclonal antibodies.

Furthermore, the expanding pipeline of human monoclonal antibody-based therapeutics, including several promising cancer treatments, is anticipated to support continued market growth in this segment. As healthcare systems focus more on precision medicine, human monoclonal antibodies are expected to dominate the therapeutic landscape.

Technology Analysis

In vitro technology holds 72.4% of the market share and is anticipated to remain the leading technology in monoclonal antibody development due to its ability to provide detailed insights into antibody-antigen interactions, offering more accurate and reliable results for drug discovery and diagnostics. In vitro techniques enable the screening and identification of potential monoclonal antibodies, allowing for the rapid generation of high-quality antibodies suitable for therapeutic applications.

This approach offers significant advantages in terms of speed, control, and reproducibility when compared to in vivo methods. The increasing use of in vitro technologies in research and clinical trials for the development of monoclonal antibody-based treatments, particularly in oncology, is expected to fuel growth in this segment.

Additionally, the ability of in vitro assays to facilitate the discovery of monoclonal antibodies that can target specific disease markers and tumor antigens is projected to drive market expansion. The focus on developing safer and more effective drugs with fewer side effects, along with the increasing demand for in vitro diagnostics, ensures the continued dominance of this technology in the monoclonal antibodies market.

Application Analysis

Oncology represents 48.6% of the application segment and is expected to remain the dominant area for monoclonal antibody treatments, driven by the rising global incidence of cancer and the growing preference for targeted therapies. Monoclonal antibodies have proven to be effective in targeting specific cancer cells, delivering therapeutic agents directly to tumors, and minimizing damage to surrounding healthy tissues.

The increasing use of monoclonal antibodies in various cancer types, including breast, lung, and colorectal cancers, is likely to accelerate the growth of this segment. Innovations in monoclonal antibody-based therapies, such as combination therapies with other immuno-oncology agents, are expected to expand the scope of their application in cancer treatment.

As the understanding of cancer biology improves, monoclonal antibodies are projected to play an even more significant role in the treatment of both solid and hematological cancers. The growing number of approvals for monoclonal antibody-based cancer treatments by regulatory authorities worldwide will likely further boost the demand for these therapies in oncology, ensuring the continued growth of this application segment.

End-User Analysis

Hospitals account for 54.2% of the end-user segment and are projected to remain the primary consumers of monoclonal antibody treatments due to their central role in patient care and complex treatments, including chemotherapy and immunotherapy. The high demand for monoclonal antibody-based drugs in hospitals is driven by their effectiveness in treating a wide range of conditions, including cancer, autoimmune diseases, and infectious diseases.

Hospitals are adopting monoclonal antibodies for both therapeutic and diagnostic purposes, benefiting from their precision and safety profile. The increasing number of hospitals integrating monoclonal antibody treatments into their treatment protocols, particularly for high-risk patients with chronic or life-threatening conditions, is likely to drive further market growth.

Additionally, the expansion of oncology and immunology departments in hospitals, along with growing government and healthcare sector investments in biopharmaceuticals, is expected to sustain demand. Hospitals also play a key role in conducting clinical trials and research on monoclonal antibodies, further contributing to the segment’s expansion.

As healthcare providers continue to emphasize the use of cutting-edge biologics in treatment regimens, hospitals are expected to remain the largest end-users of monoclonal antibody therapies.

Key Market Segments

By Product Type

- Human

- Murine

- Chimeric

By Technology

- In Vitro

- In Vivo

By Application

- Oncology

- Neurological Diseases

- Infectious Diseases

- Autoimmune Diseases

- Others

By End-user

- Hospitals

- Specialty Centers

- Others

Drivers

Rising Cancer Incidence Rates is Driving the Market

The escalating global burden of cancer has emerged as a primary catalyst for the expansion of the monoclonal antibodies market, as these biologics offer targeted therapies that significantly improve survival outcomes in various malignancies.

Monoclonal antibodies function by specifically binding to tumor-associated antigens, thereby inhibiting cell proliferation, inducing apoptosis, or enhancing immune-mediated cytotoxicity against cancer cells. This precision approach reduces off-target effects compared to traditional chemotherapy, making them a cornerstone of modern oncology protocols.

The demand is particularly intense for antibodies targeting HER2 in breast cancer, PD-1/PD-L1 in immunotherapy, and CD20 in hematologic cancers, where they have demonstrated substantial clinical benefits.

As cancer becomes a leading cause of mortality worldwide, healthcare systems are prioritizing investments in these advanced therapeutics to address unmet needs in both early-stage and metastatic settings. Regulatory bodies have accelerated approvals for novel antibodies, facilitating quicker market entry and broader adoption.

The National Cancer Institute reports that the age-adjusted rate of new cancer cases reached 445.8 per 100,000 men and women per year based on 2018–2022 data, reflecting a persistent upward trajectory that underscores the urgent requirement for effective interventions. This statistic highlights the sheer volume of patients necessitating innovative treatments, thereby fueling research and development expenditures by pharmaceutical entities.

Furthermore, the integration of monoclonal antibodies with other modalities, such as chemotherapy or radiation, has expanded their therapeutic utility, driving sales volumes in hospital and outpatient settings. Economic analyses indicate that early adoption of these therapies can lower long-term healthcare costs by averting disease progression and reducing hospitalization frequencies.

Key players continue to innovate, with pipeline candidates focusing on combination regimens to overcome resistance mechanisms. Overall, this driver not only propels market valuation but also encourages global collaborations to enhance accessibility in low-resource regions.

Restraints

High Development and Treatment Costs is Restraining the Market

The substantial financial hurdles associated with the development and administration of monoclonal antibodies continue to impede their full market penetration, particularly in resource-constrained environments. These biologics require intricate manufacturing processes involving cell cultures, purification, and stringent quality controls, which escalate production expenses to levels far exceeding small-molecule drugs.

Consequently, treatment courses often burden patients and payers with high out-of-pocket costs, leading to disparities in access and utilization. In oncology, where monoclonal antibodies are most prevalent, the average annual cost per patient can surpass $ 100,000, prompting payers to impose stringent reimbursement criteria and formulary restrictions. This restraint is compounded by the need for cold-chain logistics and specialized infusion centers, further inflating operational overheads for healthcare providers.

Patent protections extend these monopolies, delaying generic or biosimilar competition and maintaining elevated price points. Such premiums deter widespread adoption, especially in emerging markets where public health budgets are limited. Moreover, the risk of adverse events necessitates ongoing pharmacovigilance, adding to post-marketing surveillance costs.

Stakeholders face challenges in balancing innovation incentives with affordability, often resulting in delayed launches or scaled-back distribution strategies. Efforts to mitigate this include value-based pricing models, yet implementation remains inconsistent across jurisdictions. Ultimately, these cost barriers not only constrain market growth but also exacerbate inequities in therapeutic equity.

Opportunities

Increasing FDA Approvals of Biosimilars is Creating Growth Opportunities

The surge in regulatory approvals for biosimilar monoclonal antibodies has unlocked significant growth prospects within the market by enhancing affordability and expanding treatment options for chronic conditions. Biosimilars, as highly similar versions of reference biologics, undergo abbreviated pathways that reduce development timelines and costs, enabling faster market entry while maintaining comparable efficacy and safety profiles.

This democratization of access is crucial for diseases like rheumatoid arthritis, psoriasis, and certain cancers, where originator products have historically been prohibitively expensive. By fostering competition, biosimilars can lower prices by 20-30%, making therapies viable for larger patient cohorts and alleviating budgetary pressures on healthcare systems. Opportunities extend to emerging markets, where biosimilars can bridge gaps in biologic availability through local manufacturing partnerships.

The U.S. Food and Drug Administration’s approval of Bkemv as the first interchangeable biosimilar to Soliris (eculizumab) in 2024 exemplifies this trend, targeting paroxysmal nocturnal hemoglobinuria and atypical hemolytic uremic syndrome. This milestone not only validates the pathway’s robustness but also paves the way for pharmacy-level substitutions, akin to generics. Pharmaceutical firms are capitalizing on this by investing in biosimilar portfolios, anticipating revenue streams from both new entrants and originator patent cliffs.

Collaborative ventures between innovators and biosimilar developers further accelerate this shift, promoting knowledge transfer in analytics and clinical comparability. As more patents expire, the influx of biosimilars could capture substantial market share, driving volume-based growth. This dynamic encourages innovation in next-generation formats, ensuring sustained pipeline vitality.

Impact of Macroeconomic / Geopolitical Factors

Ongoing inflation and supply chain disruptions are forcing developers in the targeted biologic therapeutics sector to delay bioreactor scaling efforts, shifting resources toward raw material stockpiling to manage volatile global commodity prices.

Increasing U.S.-India trade negotiations and disruptions in Indian Ocean shipping lanes are also impacting the flow of cell culture media from Southeast Asia, leading to longer upstream process validation times and higher compliance costs for multinational fill-finish operations.

In response, some developers are partnering with Quebec-based media fermenters, creating quality redundancies that streamline FDA inspections and attract precision oncology investors. Meanwhile, rising incidences of autoimmune disorders are driving NIH extramural grants into bispecific conjugate pipelines, boosting clinical throughput in adaptive trial frameworks.

The U.S. imposition of tariffs on imported pharmaceutical components, effective February 18, 2025, is increasing procurement costs for Asian-sourced excipients and filtration kits, squeezing profit margins for contract manufacturers and leading to delays in biosimilar product launches. This move has created hesitation in supply chain rerouting, occasionally disrupting affinity chromatography timelines, particularly in high-demand therapeutic areas.

To mitigate these challenges, resilient developers are leveraging IRA bio-innovation credits to develop perfusion suites in Colorado, enhancing perfusion-based yields and strengthening capabilities in downstream purification. Despite the added costs, these challenges are driving a shift toward self-sufficiency and fostering a more innovation-driven ecosystem, positioning the sector for future growth.

Latest Trends

Surge in Approvals of Bispecific Monoclonal Antibodies is a Recent Trend

The proliferation of bispecific monoclonal antibodies has marked a pivotal trend in the monoclonal antibodies landscape, revolutionizing treatment paradigms through dual-target engagement in 2024. These engineered molecules simultaneously bind two distinct epitopes, enabling novel mechanisms such as T-cell redirection for tumor lysis or blockade of complementary pathways to thwart resistance. This bispecificity enhances potency and specificity, particularly in refractory solid tumors and hematologic malignancies, where monospecific antibodies may fall short.

Clinical advancements have demonstrated superior response rates, with reduced dosing frequencies due to extended half-lives via Fc modifications. The trend aligns with a broader push toward multifunctional biologics, integrating effector functions like antibody-dependent cellular cytotoxicity.

In 2024, the U.S. Food and Drug Administration granted approvals to 13 monoclonal antibodies, including several bispecific formats that accounted for over 25% of all novel drug authorizations that year. This record underscores the maturing ecosystem for complex antibody designs, supported by refined manufacturing scales. Bispecifics like tarlatamab and zanidatamab exemplify breakthroughs in small cell lung cancer and biliary tract cancers, respectively.

Their adoption is bolstered by real-world evidence of durable remissions, influencing guideline updates from oncology societies. Looking ahead, pipeline candidates emphasize combinations with immunotherapies, forecasting deeper market integration. This evolution not only refines precision medicine but also stimulates cross-disciplinary research in protein engineering.

Regional Analysis

North America is leading the Monoclonal Antibodies Market

In 2024, North America held a 45.7% share of the global monoclonal antibodies market, underpinned by a record number of regulatory endorsements for novel biologics targeting unmet needs in oncology and autoimmune disorders, which expedited therapeutic availability for complex patient populations. Pharmaceutical developers accelerated bispecific antibody pipelines, leveraging accelerated pathways to address resistance mechanisms in relapsed multiple myeloma and solid tumors through enhanced effector functions.

The surge in demand for precision immunotherapies aligned with expanded Medicare coverage for innovative biologics, facilitating broader access in community oncology practices. Collaborative consortia between federal research entities and industry refined manufacturing scalability, mitigating supply vulnerabilities exposed by prior global disruptions.

Demographic pressures from rising incidences of inflammatory conditions further propelled investments in subcutaneous formulations, optimizing patient convenience in ambulatory settings. These dynamics affirmed the region’s stature as a hub for advanced biologic innovation. The FDA approved 15 antibody-based biologics in 2024, establishing a new annual record since the first recombinant monoclonal antibody in 1994.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Health authorities in Asia Pacific anticipate the monoclonal antibodies sector to flourish during the forecast period, as regulatory harmonization accelerates domestic production to meet surging oncology demands in populous urban centers. National agencies in China and Japan allocate substantial grants to expedite biosimilar validations, enabling cost-effective alternatives for rheumatoid arthritis management in aging cohorts.

Biopharma consortia engage local facilities to engineer PD-1 inhibitors, projecting enhanced efficacy in esophageal squamous cell carcinoma through ethnicity-specific dosing optimizations. Oversight bodies in South Korea and Australia pioneer adaptive trial frameworks, positioning research networks to evaluate bispecific constructs for hematologic malignancies with reduced immunogenicity risks.

Governments project integrating these agents into universal reimbursement schemes, alleviating treatment barriers in remote provinces via centralized distribution hubs. Regional innovators refine glycoengineered variants, coordinating with pharmacovigilance databases to monitor long-term safety in hepatitis B-endemic areas.

These strategies cultivate a vibrant ecosystem for localized biologic advancements. China’s NMPA approved 46 Class 1 or 1.1 innovative drugs in 2024, including nine biological products such as lutetium monoclonal antibodies for targeted radionuclide therapy.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the biotherapeutics sector fuel growth by engineering novel antibody-drug conjugates that enhance precision in targeting complex diseases like lymphomas and autoimmune disorders. They forge strategic alliances with clinical research organizations to streamline trial phases, accelerating regulatory approvals and market entry. Enterprises invest heavily in scalable bioreactor technologies, optimizing production yields to meet escalating global demand.

Executives pursue targeted acquisitions of gene-editing innovators, integrating CRISPR-based platforms to develop next-generation therapies. They expand aggressively into Africa and South Asia, tailoring pricing strategies to align with regional healthcare budgets and procurement systems. Additionally, they deploy real-time analytics dashboards for payer negotiations, strengthening reimbursement frameworks and ensuring consistent revenue streams.

Amgen Inc., founded in 1980 and headquartered in Thousand Oaks, California, pioneers biologics that address critical illnesses, including cancer, osteoporosis, and inflammatory conditions. The company develops therapies like Blincyto for leukemia, leveraging its proprietary XenoMouse platform for antibody discovery.

Amgen commits substantial resources to advancing bispecific T-cell engagers, enhancing treatment efficacy through precision immunology. CEO Robert A. Bradway leads a global workforce operating in over 100 countries, fostering innovation through biotech partnerships.

The firm collaborates with academic institutions to refine therapeutic pipelines, ensuring robust clinical outcomes. Amgen solidifies its industry leadership by blending scientific rigor with strategic market expansion to transform patient care.

Top Key Players

- Pfizer Inc

- Novartis AG

- Merck & Co., Inc.

- Johnson & Johnson Services, Inc.

- GlaxoSmithKline plc

- Eli Lilly And Company

- Daiichi Sankyo Company, Limited

- Bristol Myers Squibb

- Bayer AG

- AstraZeneca plc

- Amgen Inc.

- Abbott Laboratories

Recent Developments

- In February 2025, Novartis announced its agreement to acquire Anthos Therapeutics, a clinical-stage biopharmaceutical company developing abelacimab for stroke and systemic embolism prevention in atrial fibrillation patients. This acquisition strengthens Novartis’ cardiovascular portfolio, expanding its pipeline of innovative monoclonal antibody therapies, and accelerates market penetration by adding a late-stage mAb candidate with high clinical relevance.

- In March 2025, Sun Pharmaceutical Industries revealed its acquisition of Checkpoint Therapeutics, a US-based firm focused on immunotherapy and targeted oncology. By integrating Checkpoint’s mAb-based oncology pipeline, Sun Pharmaceutical enhances its specialty generics and biopharmaceutical offerings, driving growth in the monoclonal antibody market through expanded therapeutic applications.

- In September 2023, KBI Biopharma, under its SUREtechnology Platform, introduced SUREmAb, a solution for safe, efficient, and cost-effective monoclonal antibody research and manufacturing. By streamlining production and enhancing mAb quality, this technology drives the market by lowering barriers to entry for mAb developers and increasing overall production capacity.

Report Scope

Report Features Description Market Value (2024) US$ 265.7 Billion Forecast Revenue (2034) US$ 894.0 Billion CAGR (2025-2034) 12.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Human, Murine, and Chimeric), By Technology (In Vitro, and In Vivo), By Application (Oncology, Neurological Diseases, Infectious Diseases, Autoimmune Diseases, and Others), By End-user (Hospitals, Specialty Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Pfizer Inc, Novartis AG, Merck & Co., Inc., Johnson & Johnson Services, Inc., GlaxoSmithKline plc, Eli Lilly And Company, Daiichi Sankyo Company, Limited, Bristol Myers Squibb, Bayer AG, AstraZeneca plc, Amgen Inc., Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Monoclonal Antibodies MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Monoclonal Antibodies MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Pfizer Inc

- Novartis AG

- Merck & Co., Inc.

- Johnson & Johnson Services, Inc.

- GlaxoSmithKline plc

- Eli Lilly And Company

- Daiichi Sankyo Company, Limited

- Bristol Myers Squibb

- Bayer AG

- AstraZeneca plc

- Amgen Inc.

- Abbott Laboratories