Global Migraine Market By Therapeutic Use (Acute, Preventive) By Therapeutic Class (CGRP monoclonal antibodies, CGRP small molecule antagonists, Acetylcholine inhibitors/ neurotoxins, Triptans, Ditans, Ergot alkaloids, NSAIDs, Others) By Route of Administration (Oral, Injectable, Others) By Age Group (Pediatric, Adult, Geriatric) By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) and by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2025

- Report ID: 160977

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Therapeutic Use Analysis

- Therapeutic Class Analysis

- Route of Administration Analysis

- Age Group Analysis

- Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Trending Factors

- Restraining Factors

- Opportunity

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

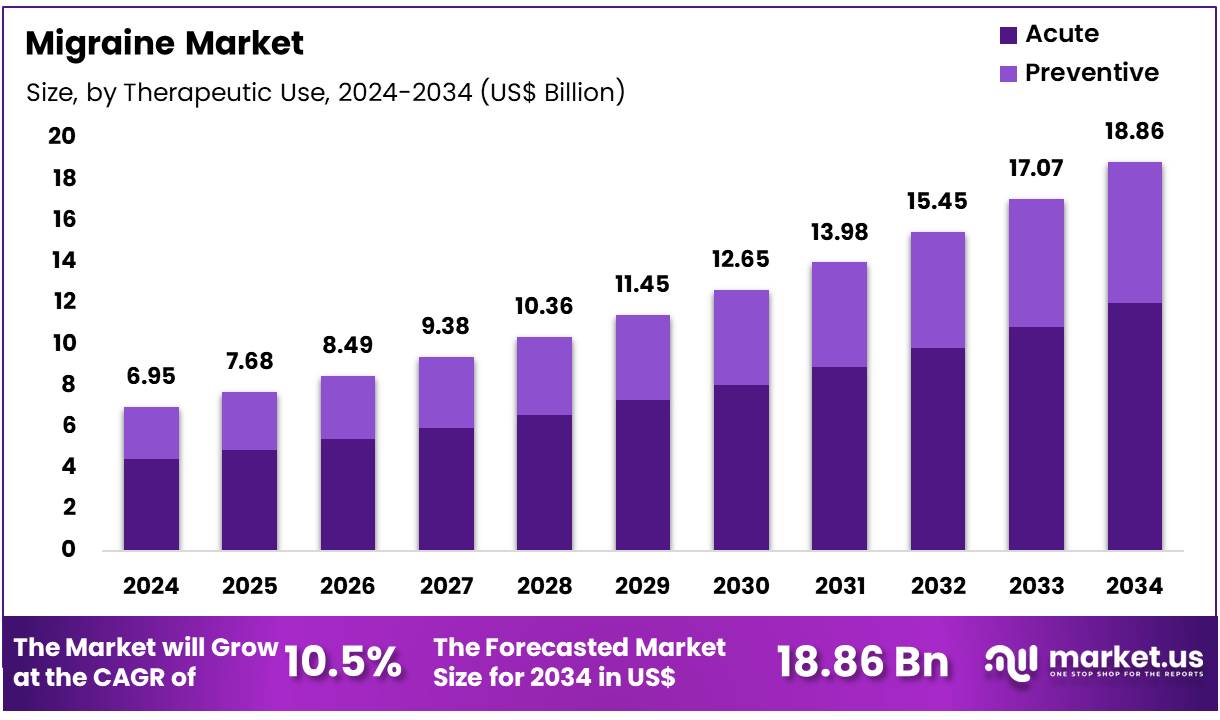

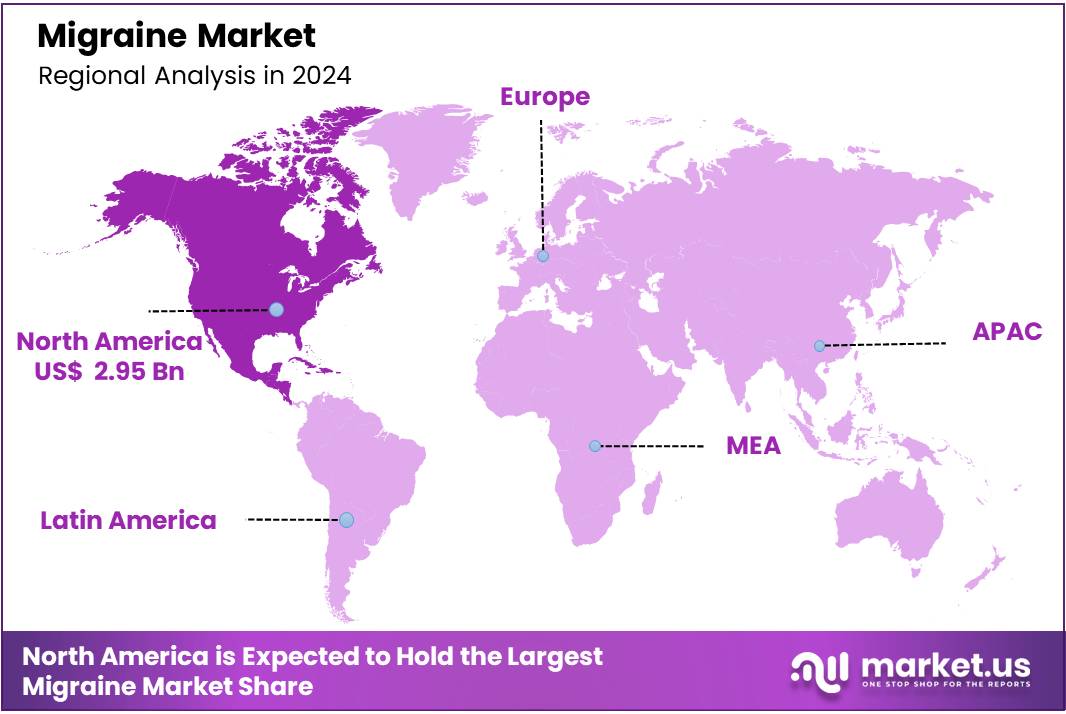

Global Migraine Market size is expected to be worth around US$ 18.86 Billion by 2034 from US$ 6.95 Billion in 2024, growing at a CAGR of 10.5% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 42.5% share with a revenue of US$ 2.95 Billion.

The migraine market is witnessing sustained growth due to the high and persistent global disease burden. The World Health Organization reported in 2021 that headache disorders affected nearly 40% of the global population, with migraine being a leading cause of disability, especially among working-age women.

Despite this, underdiagnosis and undertreatment remain widespread, leaving a significant care gap. As healthcare systems strengthen neurology and primary care services, more patients are expected to enter diagnosis and treatment pathways, boosting demand for both acute and preventive therapies.

Prevalence trends further contribute to expansion. Global Burden of Disease studies show migraine cases have risen sharply over three decades, reaching about 1.16 billion in 2021, with incidence and disability-adjusted life years (DALYs) increasing. This growth reflects population aging, rising recognition, and better health survey coverage, expanding addressable markets for both prescription and over-the-counter options.

High-income markets demonstrate stable yet substantial prevalence. U.S. data show that in 2021, 4.3% of adults reported severe headache or migraine in the past three months, with higher rates among women. Such persistent needs support ongoing prescriptions, therapy switching, and long-term use of acute and preventive treatments.

Innovation is accelerating adoption and enhancing revenue opportunities. Calcitonin gene-related peptide (CGRP)-targeting drugs, including monoclonal antibodies and small-molecule antagonists (“gepants”), offer alternatives for patients who cannot use or do not respond to triptans. Recent approvals, such as intranasal zavegepant in the U.S. and atogepant in Europe, improve convenience and tolerability, raising initiation and persistence.

Guideline integration and reimbursement are expanding access, with bodies such as NICE in the U.K. including gepants in preventive care pathways. Public-health initiatives, supported by the WHO’s Global Action Plan (2022–2031), emphasize early diagnosis and medicine access, further enlarging treated populations. Demographic trends, particularly higher prevalence in working-age women, combined with education campaigns and digital tools, are expected to improve adherence and sustain long-term growth.

Key Takeaways

- Market Size: Global Migraine Market size is expected to be worth around US$ 18.86 Billion by 2034 from US$ 6.95 Billion in 2024.

- Market Growth: The market growing at a CAGR of 10.5% during the forecast period from 2025 to 2034.

- Therapeutic Use Analysis: In 2024, the acute segment is estimated to dominate the market with a 63.7% share

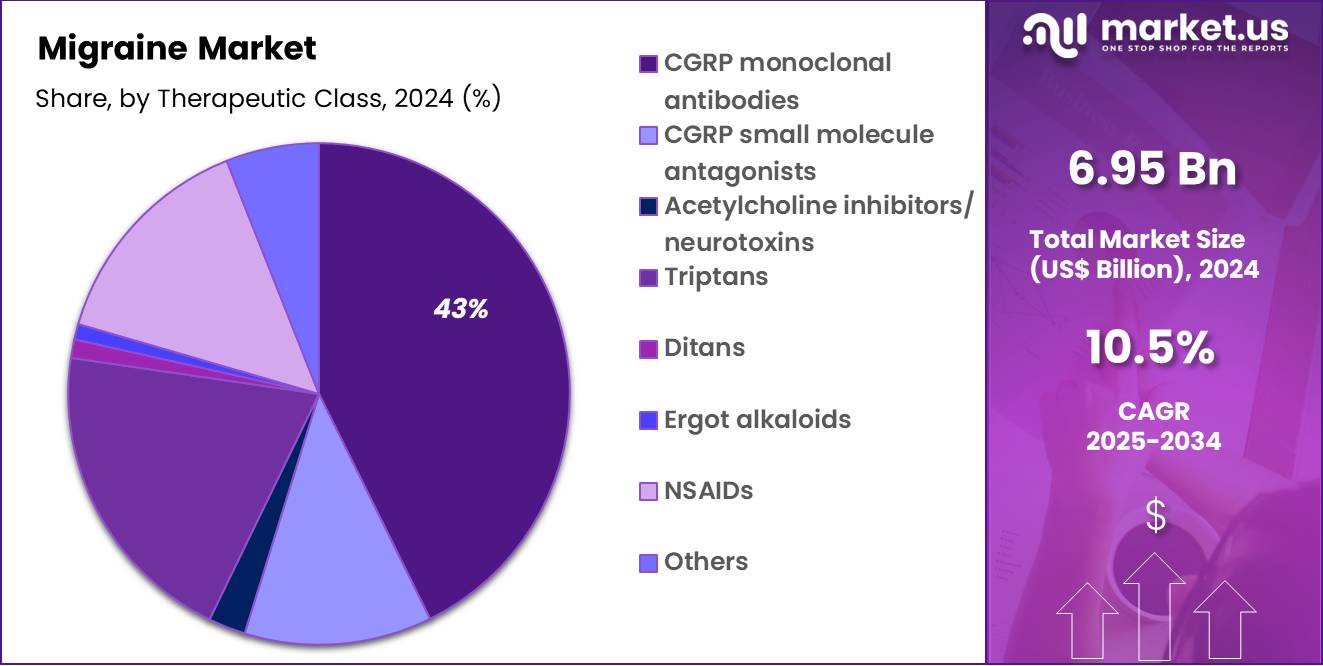

- Therapeutic Class Analysis: CGRP monoclonal antibodies are projected to dominate with a 42.7% market share in 2024.

- Route of Administration Analysis: In 2024, the oral segment is estimated to dominate the market with a 49.8% share.

- Age Group Analysis: In 2024, the adult segment is projected to dominate with a 69.7% market share.

- Distribution Channel Analysis: The retail pharmacy segment is projected to dominate with a 51.2% market share.

- Regional Analysis: In 2024, North America led the market, achieving over 42.5% share with a revenue of US$ 2.95 Billion.

Therapeutic Use Analysis

The migraine treatment market is segmented into acute and preventive therapies. Acute therapies are utilized to alleviate migraine symptoms during an active episode, while preventive therapies are prescribed to reduce the frequency, severity, and duration of attacks.

In 2024, the acute segment is estimated to dominate the market with a 63.7% share. The dominance of this segment can be attributed to the high prevalence of patients seeking immediate relief from migraine pain and associated symptoms such as nausea, photophobia, and phonophobia. Widespread use of nonsteroidal anti-inflammatory drugs (NSAIDs), triptans, and ergot derivatives has supported the sustained demand in this segment. Furthermore, the growing availability of novel acute treatments, including gepants and ditans, has enhanced adoption rates, reinforcing the segment’s leading position.

The preventive segment is projected to register significant growth during the forecast period. Rising awareness of chronic migraine management, coupled with the introduction of calcitonin gene-related peptide (CGRP) monoclonal antibodies and oral preventive agents, has accelerated adoption. Preventive therapies are gaining preference among patients with high migraine frequency, thereby reducing disability and improving quality of life. Increasing physician recommendations and long-term cost-effectiveness are further expected to drive uptake in this segment.

Therapeutic Class Analysis

The Therapeutic class segmented into CGRP monoclonal antibodies, CGRP small molecule antagonists, acetylcholine inhibitors/neurotoxins, triptans, ditans, ergot alkaloids, NSAIDs, and others. Among these, CGRP monoclonal antibodies are projected to dominate with a 42.7% market share in 2024. This strong position can be attributed to their high efficacy, long-lasting preventive effect, and favorable safety profile compared to conventional treatments. The introduction of agents such as erenumab, galcanezumab, fremanezumab, and eptinezumab has significantly enhanced preventive therapy adoption, driving this segment’s leadership.

The CGRP small molecule antagonists segment is expected to register rapid growth, supported by the rising use of oral gepants for both acute and preventive treatment. Their convenience of administration and tolerability has accelerated patient uptake. Triptans continue to be widely prescribed for acute migraine attacks, though their growth is limited by side effects and contraindications in cardiovascular patients.

Ditans and ergot alkaloids occupy niche positions, primarily for patients unresponsive to other therapies. NSAIDs maintain relevance for mild to moderate episodes due to accessibility and affordability, but face competition from advanced options. Acetylcholine inhibitors/neurotoxins, such as botulinum toxin, remain significant for chronic migraine management.

Route of Administration Analysis

Route of administration segmented into oral, injectable, and others. In 2024, the oral segment is estimated to dominate the market with a 49.8% share. This dominance is driven by the high patient preference for orally administered drugs due to convenience, ease of use, and non-invasive delivery.

The growing availability of novel oral treatments, including CGRP small molecule antagonists (gepants) and ditans, has strengthened the adoption of oral therapies. Furthermore, the widespread use of oral NSAIDs and triptans for acute migraine management continues to support this segment’s leading position.

The injectable segment is expected to exhibit significant growth over the forecast period, primarily due to the increasing adoption of CGRP monoclonal antibodies and botulinum toxin injections for preventive treatment. These therapies are preferred for patients with frequent or chronic migraine, offering long-term efficacy and reduced recurrence. Advances in self-injection devices and improved patient compliance further enhance their utilization.

The others segment, which includes nasal sprays, transdermal patches, and inhaled formulations, represents a smaller share but continues to gain attention for patients requiring rapid symptom relief or those unable to tolerate oral medications.

Age Group Analysis

The migraine market is segmented into adult, pediatric, and geriatric populations. In 2024, the adult segment is projected to dominate with a 69.7% market share. The dominance of this segment is primarily driven by the high prevalence of migraine among adults, particularly in the age group of 18 to 50 years, which represents the most economically active population.

Increased stress levels, lifestyle changes, and rising work-related pressures contribute significantly to migraine incidence in this group. Moreover, adults demonstrate higher treatment-seeking behavior and adherence to both acute and preventive therapies, further supporting the segment’s leading position.

The pediatric segment represents a smaller share but is expected to witness gradual growth. Early diagnosis rates are increasing due to improved awareness among parents and healthcare providers. However, treatment options for children remain limited due to safety and tolerability concerns, which continues to restrict wider adoption of therapies in this group.

The geriatric segment is anticipated to expand steadily, supported by the growing aging population and the rising burden of chronic migraine in older adults. Nonetheless, comorbidities and drug interaction risks pose challenges for therapy adoption.

Distribution Channel Analysis

In 2024, the retail pharmacy segment is projected to dominate with a 51.2% market share. This dominance is supported by the easy accessibility, strong penetration, and wide availability of both prescription and over-the-counter (OTC) migraine therapies through retail outlets.

Retail pharmacies serve as the most common point of purchase for acute medications such as NSAIDs and triptans, as well as preventive therapies, thereby maintaining their leading position. Additionally, patient preference for physical consultation with pharmacists and the established trust in retail networks further reinforce this segment’s share.

The hospital pharmacy segment holds a significant portion of the market, primarily driven by the growing administration of advanced therapies such as injectable CGRP monoclonal antibodies and botulinum toxin, which require physician supervision. Hospital pharmacies also play a critical role in the management of severe and chronic migraine cases, ensuring specialist-driven treatment adherence.

The online pharmacy segment is anticipated to witness the fastest growth, supported by increasing digital adoption, home delivery convenience, and rising preference for contactless purchasing. Attractive pricing models, subscription services, and growing availability of prescription refills are further propelling online adoption.

Key Market Segments

By Therapeutic Use

- Acute

- Preventive

By Therapeutic Class

- CGRP monoclonal antibodies

- CGRP small molecule antagonists

- Acetylcholine inhibitors/ neurotoxins

- Triptans

- Ditans

- Ergot alkaloids

- NSAIDs

- Others

By Route of Administration

- Oral

- Injectable

- Others

By Age Group

- Pediatric

- Adult

- Geriatric

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Driving Factors

One of the principal drivers in the migraine market is the rising prevalence and burden of migraine globally. Over the period 1990–2021, migraine prevalence increased by 58 %, with active headache disorders affecting ~52 % of the population, and migraine accounting for ~15.2 % prevalence globally.

In the United States, 4.3 % of adults reported being “bothered a lot” by headache or migraine in the past three months in 2021, with higher incidence in women (6.2 %) than men (2.2 %). This growing disease burden creates escalating demand for better therapies, diagnostics, and care, thereby fueling market expansion.

Trending Factors

A major trend in the migraine market is the shift toward targeted biologic and CGRP-based therapies (monoclonal antibodies, small molecule CGRP antagonists) for both acute and preventive treatment. Pharma R&D investment is prioritizing novel mechanisms over older generic agents, leading to a rising share of the preventive segment (notably CGRP therapies).

Simultaneously, patient and physician awareness is improving globally, aided by advocacy and digital health platforms. The trend also includes personalized medicine (tailoring therapy by patient phenotype) and digital tools & telemedicine to support migraine monitoring, adherence, and remote care.

Restraining Factors

A key restraint is the high cost and reimbursement uncertainty associated with newer therapies. Many advanced migraine medications (e.g. biologics) have premium pricing and may not be fully reimbursed in many markets, thereby limiting access in lower-income regions or constrained health systems. In addition, safety concerns and side effects (e.g., cardiovascular issues, long-term unknown effects) impose caution among clinicians and regulatory bodies.

Moreover, lack of awareness or underdiagnosis, especially in developing markets, constrains market penetration. In many countries, patients may not seek migraine care or may rely on over-the-counter analgesics rather than prescription therapies.

Opportunity

An important opportunity lies in expanding access in emerging markets (e.g. India, Southeast Asia, Latin America) where awareness, diagnosis, and therapeutic adoption are still low. With rising healthcare spending and infrastructure improvement, these regions represent untapped patient pools. Another opportunity is development of non-pharmacologic and adjunctive therapies, such as neuromodulation devices, digital therapeutics, and wearable monitors, which can complement drug therapy.

Additionally, biomarker discovery and precision diagnostics (to stratify patients for optimal therapy) could drive differentiated products. Finally, collaborative public health initiatives and inclusion of migraine in national health programs might stimulate demand and reimbursement, especially if migraine is recognized as a high-burden neurological disorder by government agencies or WHO frameworks.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 42.5% share and holding US$ 2.95 billion market value for the year. The region’s leadership is supported by a high prevalence of migraine among adults. According to the Centers for Disease Control and Prevention (CDC), migraine and severe headache affect around 15% of U.S. adults, with higher rates among women. This large patient pool drives strong demand for effective therapies.

Advanced healthcare infrastructure in the United States and Canada enables early diagnosis and wider adoption of novel treatments, including CGRP inhibitors. Favorable reimbursement policies and strong clinical research capacity also strengthen the regional position. Rising awareness campaigns and patient education initiatives further enhance treatment uptake. Together, these factors establish North America as the leading market for migraine management.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The migraine market is characterized by the presence of established pharmaceutical manufacturers, emerging biotech innovators, and medical device developers. These players are actively engaged in the development of advanced therapeutics aimed at addressing both acute and preventive treatment needs.

A significant focus has been placed on targeting calcitonin gene-related peptide (CGRP) pathways, leading to the introduction of monoclonal antibodies and oral antagonists. These products are shaping the competitive landscape by offering improved efficacy, reduced relapse rates, and better patient adherence compared to traditional therapies.

Key players are also expanding through strategic collaborations with research institutions to strengthen innovation pipelines. Clinical trials remain central, with investments directed toward next-generation molecules, neuromodulation devices, and digital health platforms. Competitive differentiation is increasingly driven by pricing strategies, safety profiles, and accessibility across high- and low-income regions. Additionally, market participants are concentrating on geographic expansion, ensuring availability in both mature and emerging markets.

The landscape is further influenced by patent expirations, which open opportunities for biosimilars and generics, thereby intensifying competition. Overall, the migraine market reflects a dynamic interplay of innovation, regulatory approvals, and access strategies, ensuring sustained growth potential despite pricing pressures and regional disparities.

Market Key Players

- Eli Lilly

- Teva Pharmaceutical Industries

- GlaxoSmithKline (GSK)

- Pfizer

- AbbVie

- Allergan

- Merck & Co.

- Sanofi

- Bausch Health

- Biohaven

- Axsome Therapeutics

- Theranica

- Medtronic

- eNeura

- Cefaly Technology

- Other key players

Recent Developments

- Teva Pharmaceutical Industries (Aug 2025): The U.S. Food and Drug Administration approved an expanded pediatric indication for Ajovy (fremanezumab-vfrm), making it the first anti-CGRP therapy approved for preventive treatment of episodic migraine in children aged 6–17 (≥ 45 kg).

- Pfizer (April 2025): Pfizer launched a clinical trial assessing rimegepant in adolescents with frequent migraine attacks — expanding its indications beyond adults.

- AbbVie (June 2025): AbbVie announced that atogepant (Qulipta/Aquipta) achieved superiority over topiramate in a head-to-head Phase 3 trial (TEMPLE), demonstrating better tolerability and efficacy across endpoints.

- Sanofi (2025): In late 2024, Sanofi was collaborating with Teva on non–migraine therapeutics (IBD), but no major migraine acquisition, launch or merger was publicly recorded for 2025.

Report Scope

Report Features Description Market Value (2024) US$ 18.86 Billion Forecast Revenue (2034) US$ 6.95 Billion CAGR (2025-2034) 10.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Therapeutic Use (Acute, Preventive) By Therapeutic Class (CGRP monoclonal antibodies, CGRP small molecule antagonists, Acetylcholine inhibitors/ neurotoxins, Triptans, Ditans, Ergot alkaloids, NSAIDs, Others) By Route of Administration (Oral, Injectable, Others) By Age Group (Pediatric, Adult, Geriatric) By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Eli Lilly, Teva Pharmaceutical Industries, GlaxoSmithKline (GSK), Pfizer, AbbVie, Allergan, Merck & Co., Sanofi, Bausch Health, Biohaven, Axsome Therapeutics, Theranica, Medtronic, eNeura, Cefaly Technology, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Eli Lilly

- Teva Pharmaceutical Industries

- GlaxoSmithKline (GSK)

- Pfizer

- AbbVie

- Allergan

- Merck & Co.

- Sanofi

- Bausch Health

- Biohaven

- Axsome Therapeutics

- Theranica

- Medtronic

- eNeura

- Cefaly Technology

- Other key players