Global Medical Rehabilitation Services Market Analysis By Therapy (Physical Therapy, Occupational Therapy, Cognitive Therapy, Speech and Language Therapy, Others), By Setting (Outpatient, Inpatient), By Application (Orthopedic, Cardiologic, Neurological, Pulmonary, Sports Related Injuries, Others), By End-use (Hospital and Clinics, Rehab Centers, Homecare Settings, Physiotherapy Centers) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147094

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

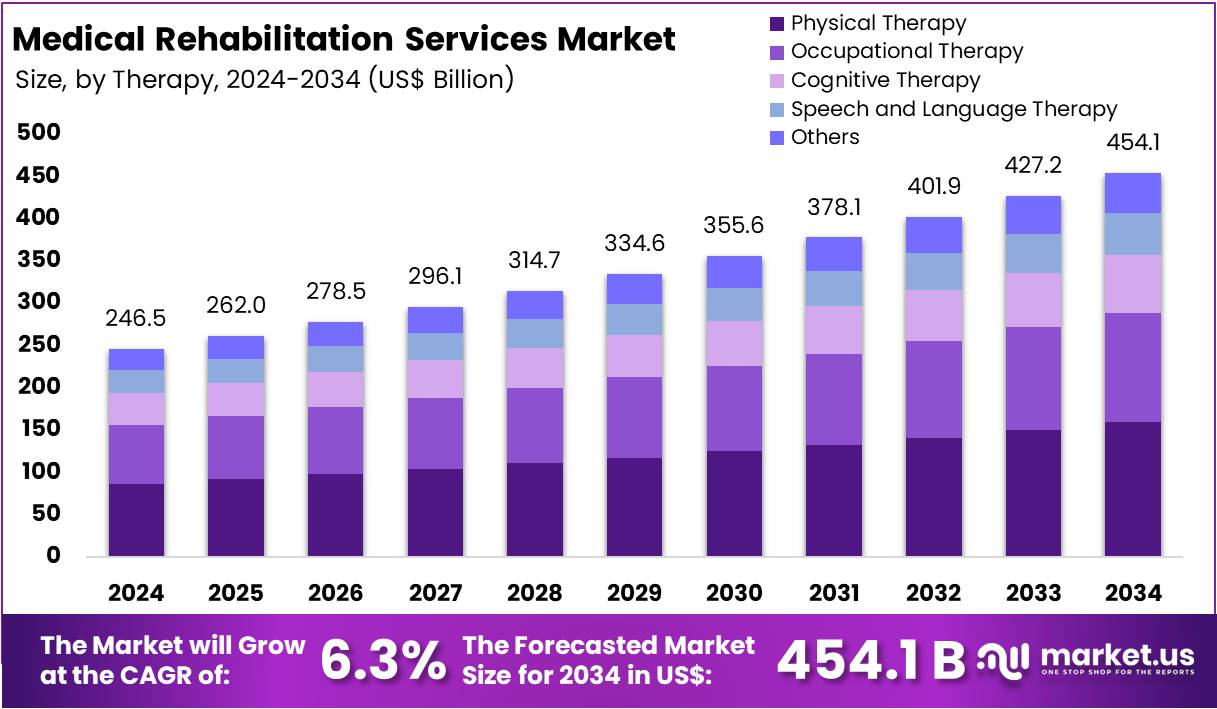

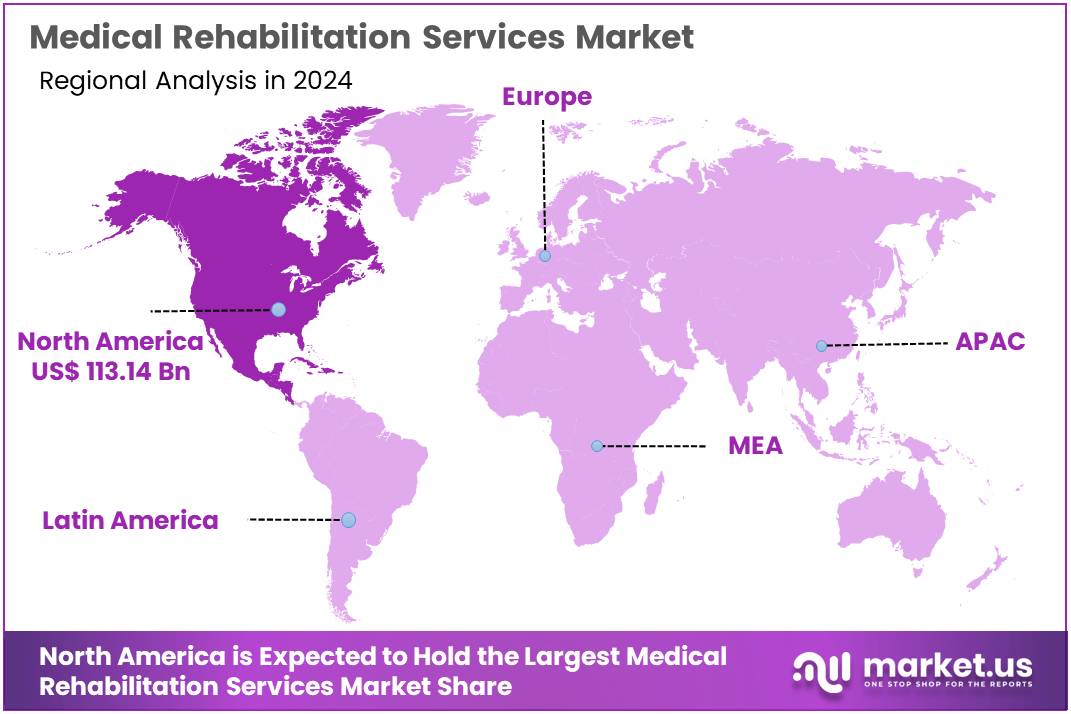

The Global Medical Rehabilitation Services Market Size is expected to be worth around US$ 454.1 Billion by 2034, from US$ 246.5 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 45.9% share and holds US$ 113.14 Billion market value for the year.

The medical rehabilitation services sector is experiencing robust growth, driven by demographic shifts, the rising prevalence of chronic diseases, and global policy initiatives. According to the World Health Organization (WHO), approximately 2.41 billion individuals worldwide were living with health conditions requiring rehabilitation in 2019, marking a 63% increase from 1990. This statistic highlights that nearly one-third of the global population benefits from rehabilitation services, reflecting the sector’s critical importance in modern healthcare systems.

Demographic changes, especially the aging population, play a significant role in boosting demand. For instance, the number of people over 60 years of age is expected to double by 2050. Older individuals are more susceptible to health conditions that impair physical function and quality of life. This shift, combined with the rising incidence of noncommunicable diseases (NCDs) such as diabetes, cancer, and heart disease, further intensifies the need for comprehensive rehabilitation services globally.

The World Health Organization has initiated key policies to address these rising demands. A major milestone includes the adoption of a resolution by the World Health Assembly in May 2023, aiming to integrate rehabilitation into all levels of healthcare. Similarly, the WHO’s “Rehabilitation 2030” initiative emphasizes strengthening leadership, enhancing service delivery, and improving data systems to support effective rehabilitation planning and financing.

Noncommunicable diseases and injuries significantly contribute to rehabilitation needs. For example, while NCDs like heart disease and diabetes are major disability drivers, injuries from road traffic accidents and falls also play a critical role. According to a study by the National Center for Biotechnology Information (NCBI), for every person who dies from an injury, many more survive but require long-term rehabilitation. This dynamic stresses the urgent need to expand rehabilitation services across both high- and low-income regions.

Despite rising demand, access to rehabilitation remains a challenge, particularly in low- and middle-income countries. According to WHO data, in some areas, there are fewer than 10 skilled rehabilitation practitioners per 1 million people. Factors such as a shortage of trained professionals, inadequate infrastructure, and limited funding contribute to this gap. Advancements like telerehabilitation are being promoted to overcome these barriers by delivering therapy remotely, especially in underserved regions.

The medical rehabilitation services sector is poised for sustained expansion, supported by global demographic trends and increasing recognition of its value within healthcare systems. Addressing access barriers and workforce shortages will be essential for meeting the growing demand. Strengthened global initiatives and technological innovations are expected to shape a more inclusive rehabilitation landscape, ensuring improved functional outcomes and enhancing the quality of life worldwide.

Key Takeaways

- The Global Medical Rehabilitation Services Market is projected to reach approximately US$ 454.1 Billion by 2034, growing from US$ 246.5 Billion in 2024 at a 6.3% CAGR.

- In 2024, Physical Therapy secured a leading position in the Therapy Segment, accounting for more than 36.2% of the overall market share.

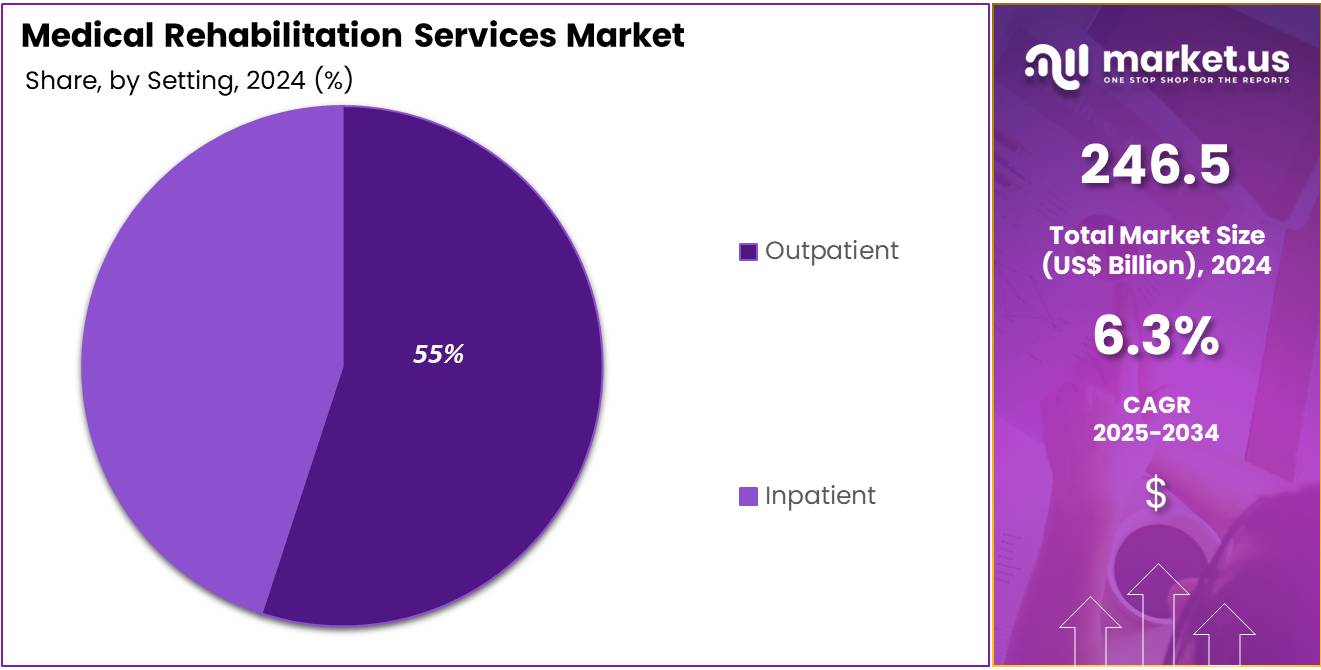

- The Outpatient Section dominated the Setting Segment of the Medical Rehabilitation Services Market in 2024, capturing over 57.9% of the market share.

- In the Application Segment, the Orthopedic Section maintained leadership in 2024, contributing to more than 30.5% of the Medical Rehabilitation Services Market.

- Hospitals and Clinics segment maintained a dominant position within the End-Use Segment of the Medical Rehabilitation Services Market, accounting for over 45.2% of the total share.

- North America held a dominant position in 2024, representing over 45.9% of the global market and reaching a value of US$ 113.14 Billion.

U.S. Tariff Impact

The imposition of U.S. tariffs has notably impacted the medical rehabilitation services sector, mainly through increased equipment costs and supply chain disruptions. Specialized equipment such as wheelchairs, prosthetics, orthotics, and diagnostic devices has become more expensive due to tariffs on imported medical supplies. For example, tariffs on Chinese-manufactured medical devices have raised prices by up to 25%, covering a broad range of products from syringes to diagnostic equipment. This rise in costs is directly affecting procurement practices across rehabilitation centers and healthcare providers.

Supply chain disruptions have also intensified due to tariffs. Established delivery networks for medical equipment and supplies have been destabilized, causing delays that hinder timely rehabilitation services. Similar to the supply shortages experienced during 2023, these disruptions can negatively affect patient outcomes by delaying access to essential rehabilitation devices. Medical centers are struggling to maintain consistent supply levels, which directly impacts their ability to deliver effective and continuous patient care services.

Financial strain on healthcare providers is another critical consequence. Increased procurement costs are frequently passed onto rehabilitation centers, limiting their capacity to invest in new technologies or expand services. As prices on imported equipment, pharmaceuticals, and consumable supplies rise, healthcare organizations face additional financial pressures. These challenges compound the existing economic strains in the healthcare sector, making it harder for providers to maintain quality care standards and operational sustainability.

Higher costs and supply shortages are also impacting patient access to rehabilitation services. Vulnerable populations, who rely heavily on affordable rehabilitation care, are particularly affected. Out-of-pocket expenses for patients are rising, and certain rehabilitation services are becoming less available. In response, there is a gradual shift toward domestic manufacturing of medical supplies. However, as seen with examples like Dr. Mark Epstein’s practice, this transition involves substantial investment, time, and logistical hurdles before supply chains can stabilize and costs can be effectively controlled.

Therapy Analysis

In 2024, the Physical Therapy section held a dominant market position in the Therapy Segment of the Medical Rehabilitation Services Market and captured more than a 36.2% share. This dominance can be attributed to the high demand for musculoskeletal rehabilitation and post-surgical recovery programs. The increase in orthopedic surgeries and sports injuries has further fueled the need for physical therapy services. Additionally, greater awareness among patients about physical rehabilitation benefits has strengthened the growth of this therapy segment globally.

Occupational Therapy emerged as the second-largest contributor in the therapy segment. It plays a vital role in helping individuals regain essential daily living and working skills. Rising cases of neurological conditions, including stroke and spinal injuries, have increased the demand for occupational therapy. Cognitive Therapy also witnessed steady growth. It is mainly driven by the growing incidence of cognitive disorders such as dementia and traumatic brain injuries. Rehabilitation centers are actively integrating cognitive therapies into comprehensive care plans.

Speech and Language Therapy experienced notable growth in 2024, primarily due to the rising prevalence of speech impairments caused by stroke, Parkinson’s disease, and pediatric conditions. The availability of early intervention programs and specialized therapies supported segment expansion. Other therapies, such as recreational and respiratory therapy, held a smaller but promising share. The focus on improving the overall quality of life through supportive therapies is expected to drive future growth across these smaller therapy categories within the market.

Setting Analysis

In 2024, the Outpatient Section held a dominant market position in the Setting Segment of the Medical Rehabilitation Services Market, and captured more than a 57.9% share. This dominance can be attributed to the rising preference for flexible treatment schedules and cost-effective care options. Outpatient rehabilitation services allow patients to continue their daily routines while receiving necessary therapies. The growing burden of chronic diseases and musculoskeletal disorders has further increased the demand for outpatient rehabilitation facilities worldwide.

Inpatient rehabilitation services, however, continue to play a critical role for patients requiring intensive care. These services are often essential for individuals recovering from major surgeries, strokes, or severe injuries. Inpatient settings offer comprehensive care under constant medical supervision, helping patients achieve faster recovery. Despite the higher costs associated with inpatient programs, they remain vital for patients needing structured and multidisciplinary support.

The expansion of outpatient centers and advancements in rehabilitation technologies have strengthened the outpatient segment’s growth. Additionally, supportive government initiatives aimed at reducing healthcare costs have promoted outpatient rehabilitation models. As healthcare systems increasingly prioritize value-based care, the outpatient segment is expected to maintain its dominant position, offering convenient, effective, and affordable rehabilitation solutions.

Application Analysis

In 2024, the Orthopedic Section held a dominant market position in the Application Segment of Medical Rehabilitation Services Market, and captured more than a 30.5% share. This dominance can be attributed to the rising prevalence of orthopedic disorders, including fractures, arthritis, and joint replacements. An aging population and the increasing number of accident-related injuries further accelerated the demand for orthopedic rehabilitation services. Additionally, advancements in rehabilitation techniques and assistive technologies have enhanced recovery outcomes for orthopedic patients.

The Cardiologic Section also accounted for a significant share in 2024. The increasing burden of cardiovascular diseases, particularly in aging demographics, has been a major driver. Rehabilitation services are essential for improving patient outcomes after cardiac events such as heart attacks and surgeries. Structured rehabilitation programs focusing on physical activity, nutrition, and mental health have been promoted by global health organizations, thereby boosting segment growth. Early intervention through rehabilitation has been proven to lower hospital readmission rates and mortality.

The Neurological Section witnessed steady growth, supported by the rising incidence of strokes, traumatic brain injuries, and neurodegenerative conditions like Parkinson’s and Alzheimer’s diseases. Specialized rehabilitation therapies help patients regain cognitive and motor functions, improving their quality of life. Pulmonary rehabilitation services, catering to chronic respiratory conditions such as COPD, and sports injury rehabilitation programs, targeting both amateur and professional athletes, also contributed meaningfully to the overall market expansion. Other applications, including pediatric and geriatric rehabilitation, continue to emerge as important focus areas.

End-use Analysis

In 2024, the Hospitals and Clinics Section held a dominant market position in the End-Use Segment of the Medical Rehabilitation Services Market, and captured more than a 45.2% share. The significant share can be attributed to the extensive availability of specialized rehabilitation programs within hospital settings. Hospitals and clinics offer multidisciplinary rehabilitation services that cater to various conditions such as orthopedic injuries, neurological disorders, and post-surgical recovery. Their access to advanced medical equipment and skilled healthcare professionals further strengthens their role in driving market demand.

Rehabilitation Centers accounted for a substantial portion of the market. These facilities provide focused therapy programs, often customized for chronic conditions and long-term disabilities. The increasing need for specialized and prolonged rehabilitation interventions has accelerated the preference for dedicated rehab centers. A rising number of patients suffering from conditions like stroke, spinal cord injuries, and complex musculoskeletal disorders has supported the expansion of this segment across several regions.

Homecare Settings are gaining considerable traction in the Medical Rehabilitation Services Market. The shift toward home-based rehabilitation is driven by a growing elderly population, rising healthcare costs, and patient preference for comfortable recovery environments. Technological advancements, such as remote monitoring tools and tele-rehabilitation, have enabled healthcare providers to deliver effective rehabilitation services at home, thereby supporting this segment’s growth.

Physiotherapy Centers also play a vital role in the market’s expansion. These centers offer specialized therapies focused on improving mobility, strength, and function. Patients recovering from sports injuries, fractures, or surgical procedures increasingly seek targeted therapies available at physiotherapy clinics. The growing awareness about the benefits of physical therapy and the emphasis on early intervention for musculoskeletal conditions continue to fuel demand for services offered by physiotherapy centers.

Key Market Segments

By Therapy

- Physical Therapy

- Occupational Therapy

- Cognitive Therapy

- Speech and Language Therapy

- Others

By Setting

- Outpatient

- Inpatient

By Application

- Orthopedic

- Cardiologic

- Neurological

- Pulmonary

- Sports Related Injuries

- Others

By End-use

- Hospital and Clinics

- Rehab Centers

- Homecare Settings

- Physiotherapy Centers

Drivers

Growing Prevalence Of Chronic Diseases

The growing prevalence of chronic diseases is a major driver for the Medical Rehabilitation Services Market. Noncommunicable diseases (NCDs), including heart disease, stroke, cancer, diabetes, and chronic lung disease, are responsible for 74% of all deaths globally. A significant burden is observed in low- and middle-income countries, accounting for over three-quarters of these deaths. The increasing incidence of chronic illnesses is expected to fuel the demand for long-term rehabilitation services, thus supporting market growth over the forecast period.

Cardiovascular diseases, particularly ischemic heart disease and stroke, have a profound impact on rehabilitation needs. In developing nations, these conditions account for 85% of cardiovascular-related deaths and 28% of all-cause mortality. Stroke survivors form a large segment requiring continuous rehabilitation. In institutional settings, physical therapists treat around 157 stroke patients per 1,000 individuals, while occupational therapists manage 358 stroke patients per 1,000. Such statistics underline the critical role rehabilitation services play in patient recovery and quality of life improvements.

Musculoskeletal disorders also contribute significantly to the demand for medical rehabilitation services. Among patients undergoing cardiac rehabilitation, about 45% are diagnosed with arthritis, while 52% experience muscle or joint pain limiting moderate exercise. These conditions increase the need for customized rehabilitation programs that address mobility, pain management, and functional independence. As arthritis and musculoskeletal complications continue to rise alongside other chronic illnesses, the rehabilitation services sector is poised to expand substantially.

Moreover, rehabilitation has been linked to better health outcomes in chronic disease management. Studies indicate that patients with moderate rheumatoid arthritis who attend more than 40 rehabilitation sessions annually experience a notable reduction in stroke risk. This emphasizes the therapeutic value of regular, structured rehabilitation interventions. As clinical evidence supporting rehabilitation effectiveness strengthens, healthcare providers and policymakers are likely to prioritize these services, driving further growth in the Medical Rehabilitation Services Market.

Restraints

Financial Barriers and Insurance Limitations

Financial barriers and insurance limitations have been identified as critical restraints affecting the growth of the Medical Rehabilitation Services Market. Despite the rising demand for rehabilitation services, insurance coverage remains limited in many regions. Patients often face high out-of-pocket expenses, which deter them from continuing essential treatments. In the United States, co-payments for therapy services can reach up to $75 per visit, making continuous rehabilitation financially burdensome. Arbitrary limits on the number of visits covered per year further exacerbate the issue, pushing patients to bear additional costs.

The financial burden is not confined to high-income countries. Evidence from a study conducted in a Chinese city between 2015 and 2019 indicates a rising trend in inpatient rehabilitation costs. During this period, the average cost per capita rose from $6,248.56 to $7,930.86. Moreover, the proportion of expenditures from the total medical insurance fund increased from 4% to 8.69%. This data demonstrates that financial pressures are increasing globally, placing significant stress on both patients and healthcare systems.

Insurance status directly impacts access to rehabilitation services. Uninsured or underinsured patients are substantially less likely to receive the rehabilitation care they require. This disparity negatively influences patient outcomes and leads to prolonged disabilities. For example, in the WHO European Region, less than 20% of patients with heart failure received cardiac rehabilitation, despite clinical indications. Such statistics highlight the unequal provision of services and show that insurance inadequacies critically restrict the potential of rehabilitation programs to improve population health.

The presence of financial barriers also discourages early intervention, which is crucial for effective rehabilitation outcomes. Delays in accessing services due to cost considerations often result in more severe health complications. As a consequence, the demand for more intensive, and therefore more expensive, care increases over time. These systemic financial limitations significantly restrain market expansion, despite the growing awareness and proven benefits of rehabilitation services.

Opportunities

Expansion Of Tele-Rehabilitation And Digital Health Platforms

The expansion of tele-rehabilitation and digital health platforms is creating a significant opportunity for the Medical Rehabilitation Services Market. These platforms enable the remote delivery of rehabilitation services, overcoming traditional barriers such as geographic isolation and limited access to specialized care. Patients in rural and underserved areas benefit most, as they can receive continuous monitoring and treatment adjustments without the burden of travel. Tele-rehabilitation has been associated with improved patient outcomes, higher satisfaction rates, and a reduction in hospital readmissions, making it a transformative solution.

Furthermore, tele-rehabilitation addresses critical challenges in rural regions. Limited internet connectivity, digital illiteracy, and infrastructure deficits have historically restricted access to healthcare. For example, approximately 35% of rural populations lack high-speed internet, while only 11% of older adults in rural India possess digital literacy skills. Despite these challenges, the scalability of digital platforms offers a strong opportunity to bridge the healthcare divide. Real-time communication technologies are becoming increasingly viable solutions to support remote rehabilitation efforts across underserved communities.

Global and national initiatives are playing a vital role in supporting this expansion. The World Health Organization (WHO) has developed a global strategy to accelerate digital health adoption with a focus on scalability and sustainability. In India, the National Digital Health Mission aims to build an integrated digital health infrastructure, enhancing healthcare access nationwide. These efforts are expected to drive the widespread adoption of tele-rehabilitation services and create new opportunities for growth within the Medical Rehabilitation Services Market.

To maximize the benefits, key strategies must be implemented. Investments in broadband connectivity, training programs for digital literacy, and supportive policies are crucial. Community engagement should also be prioritized to ensure the cultural relevance of digital health initiatives. By addressing infrastructural and educational barriers, the Medical Rehabilitation Services Market can unlock the full potential of tele-rehabilitation, leading to improved patient outcomes, higher system efficiency, and broader access to quality care across diverse regions.

Trends

Increasing Integration of AI, Robotics, and Wearable Technologies in Rehabilitation Therapies

The integration of artificial intelligence (AI), robotics, and wearable technologies is emerging as a transformative trend in the Medical Rehabilitation Services Market. These advancements are significantly improving personalized recovery solutions, particularly for patients recovering from strokes, spinal cord injuries, and musculoskeletal disorders. The use of AI algorithms to tailor rehabilitation plans is enhancing the precision and effectiveness of therapies. This trend is addressing the growing need for individualized care approaches, making rehabilitation more accessible and outcome-driven across different patient demographics.

AI technologies are playing a crucial role by optimizing therapy outcomes through machine learning and natural language processing. A recent survey found that 80.9% of physical therapy professionals anticipate AI integration in their practice, while 78.6% recognize its substantial impact. AI is enabling the development of highly adaptive rehabilitation programs that respond to real-time patient progress. Such personalized interventions are reducing recovery time and enhancing therapy success rates. The increasing adoption of AI-driven systems is expected to continue reshaping rehabilitation services in the coming years.

Robotic technologies are further supporting the modernization of rehabilitation practices. The Global Rehabilitation Equipment Market is projected to grow from US$ 15.5 Billion in 2023 to US$ 24.8 Billion by 2033, at a CAGR of 4.8%. Robotic devices assist in repetitive and accurate movement exercises, crucial for neuromuscular re-education. Their role is particularly vital as the healthcare industry faces a shortage of physiotherapists. Robotic rehabilitation equipment is enabling the extension of therapy services to more patients without compromising the quality of care.

Wearable technologies are also enhancing rehabilitation outcomes by providing real-time monitoring and feedback. Devices such as smart gloves and exoskeletons are allowing patients to continue therapy outside traditional clinical settings. These innovations are enabling remote tracking of patient activity levels, movement patterns, and vital signs. By facilitating home-based rehabilitation, wearable devices are expanding access to therapy, improving patient compliance, and addressing the demand for convenient and efficient rehabilitation solutions.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 45.9% share and holds US$ 113.14 Billion market value for the year. This strong position can be linked to the region’s highly developed healthcare infrastructure. A growing number of chronic diseases, such as strokes and musculoskeletal disorders, has led to increased demand for rehabilitation services. Greater public awareness regarding early intervention and recovery programs has also helped drive the growth of the rehabilitation market across North America.

The United States remains the leading contributor within North America. Several factors are responsible for this trend. These include a rising elderly population, high healthcare spending, and the presence of advanced rehabilitation centers. Government support through Medicare and Medicaid coverage has further boosted therapy adoption rates. A shift toward patient-centered rehabilitation approaches has also encouraged the growth of both inpatient and outpatient rehabilitation services, thereby supporting consistent market expansion across the region.

Technological innovations have played a major role in strengthening the medical rehabilitation services market. Robotic-assisted rehabilitation systems, tele-rehabilitation platforms, and virtual therapy programs have made treatments more accessible. Investments in such technologies are increasing in the United States and Canada. The focus is also growing on personalized rehabilitation plans, aimed at faster patient recovery. These advances are enabling healthcare providers to improve outcomes and meet the diverse needs of rehabilitation patients more efficiently.

North America further benefits from a large pool of skilled healthcare professionals. Physiotherapists, occupational therapists, and speech-language pathologists are widely available, ensuring high-quality patient care. A growing preference for home-based rehabilitation services and outpatient recovery programs is reshaping the market landscape. Continuous innovation, combined with strong regulatory support and patient demand for advanced therapies, is expected to help North America maintain its dominant position in the global medical rehabilitation services market over the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Medical Rehabilitation Services market is highly competitive, with key players continuously enhancing their capabilities. Shirley Ryan AbilityLab is recognized for its integration of research with patient care, especially in neurorehabilitation and orthopedic therapy. Its focus on evidence-based practices ensures high clinical outcomes and operational excellence. Prism Medical is another significant player, specializing in mobility and patient handling solutions. Its safe handling technologies support rehabilitation facilities in improving patient mobility outcomes and caregiver safety, strengthening its presence across the United States and Canada.

Academic institutions also contribute significantly to the medical rehabilitation landscape. The Icahn School of Medicine at Mount Sinai leads in multidisciplinary rehabilitation care through advanced techniques in musculoskeletal and neurological therapy. Paradigm Healthcare plays a key role by offering personalized rehabilitation programs for complex and catastrophic injuries. Its evidence-based approach and predictive analytics optimize patient recovery and cost-efficiency. The University of Chicago Medical Center delivers comprehensive rehabilitation services, focusing on neurological, orthopedic, and cardiopulmonary rehabilitation supported by research-backed therapeutic interventions.

Beyond these institutions, various other players drive growth in the Medical Rehabilitation Services market. Regional hospitals, outpatient centers, and home healthcare agencies play crucial roles. Emerging trends include virtual rehabilitation and AI-driven therapy solutions. These developments aim to enhance service quality and patient engagement. Investments in tele-rehabilitation and wearable technologies are further expanding service accessibility. The collective efforts of both established and emerging players are shaping a dynamic and evolving rehabilitation services market.

Market Key Players

- Shirley Ryan AbilityLab

- Prism Medical

- Icahn School of Medicine at Mount Sinai

- Paradigm Healthcare

- The University of Chicago Medical Center

- MindMaze Healthcare

- Lifespan Physical Therapy Services

- SuVitas

- nMotion Physical Therapy

- Therapy Solutions for Kids

- Athletico Physical Therapy

Recent Developments

- In October 2024: Prism Healthcare Group acquired Joerns Healthcare’s UK operations, including the renowned ‘Oxford’ range of patient handling equipment. This strategic acquisition expanded Prism’s portfolio with clinical hoisting systems, slings, and bathing solutions, thereby strengthening its position in the UK healthcare market. The integration aimed to enhance Prism’s offerings in homecare, long-term care, and acute care settings. Chris Morgan, former Managing Director of Joerns UK, assumed leadership of Prism’s UK Homecare and Acute Care divisions following the acquisition.

- In June 2023: Shirley Ryan AbilityLab secured a five-year clinical research grant totaling $8.7 million from the National Institutes of Health (NIH). This funding supports the first clinical program globally that combines osseointegration, targeted muscle reinnervation, and pattern-recognition control using implanted sensors. The study utilizes Integrum’s e-OPRA™ Implant System, aiming to advance prosthetic limb functionality and integration for amputees.

Report Scope

Report Features Description Market Value (2024) US$ 246.5 Billion Forecast Revenue (2034) US$ 454.1 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Therapy (Physical Therapy, Occupational Therapy, Cognitive Therapy, Speech and Language Therapy, Others), By Setting (Outpatient, Inpatient), By Application (Orthopedic, Cardiologic, Neurological, Pulmonary, Sports Related Injuries, Others), By End-use (Hospital and Clinics, Rehab Centers, Homecare Settings, Physiotherapy Centers) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Shirley Ryan AbilityLab, Prism Medical, Icahn School of Medicine at Mount Sinai, Paradigm Healthcare, The University of Chicago Medical Center, MindMaze Healthcare, Lifespan Physical Therapy Services, SuVitas, nMotion Physical Therapy, Therapy Solutions for Kids, Athletico Physical Therapy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Medical Rehabilitation Services MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Medical Rehabilitation Services MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Shirley Ryan AbilityLab

- Prism Medical

- Icahn School of Medicine at Mount Sinai

- Paradigm Healthcare

- The University of Chicago Medical Center

- MindMaze Healthcare

- Lifespan Physical Therapy Services

- SuVitas

- nMotion Physical Therapy

- Therapy Solutions for Kids

- Athletico Physical Therapy