Global Magnesium Metal Market By Type (Primary Magnesium, Secondary Magnesium), By Process (Pidgeon, Electrolytic, Recycling), By Application (Aluminum Alloys, Die Casting, Iron And Steel Making, Metal Reduction, Others), By End-use (Automotive, Aerospace And Defense, Building And Construction, Packaging, Medical And Healthcare, Electronics, Heavy Industry, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151502

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

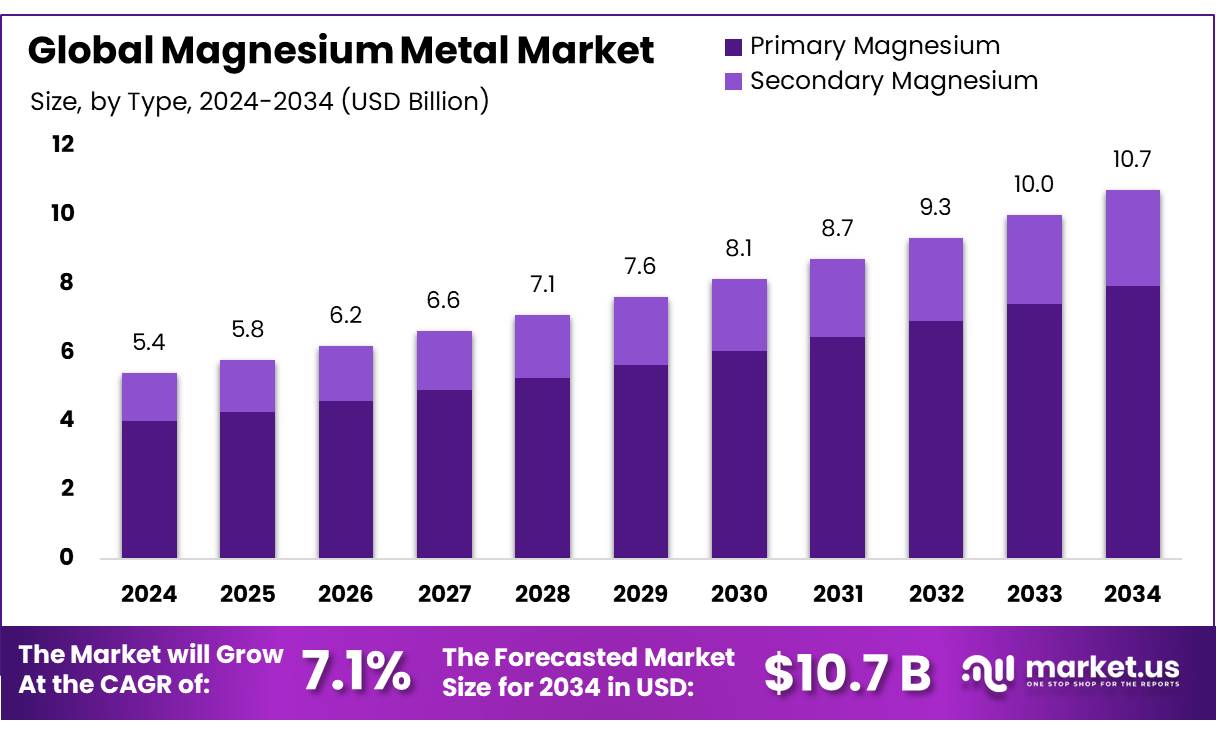

The Global Magnesium Metal Market size is expected to be worth around USD 10.7 Billion by 2034, from USD 5.4 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034.

Magnesium metal concentrates are refined metallic magnesium substances, primarily used as lightweight, structural materials across automotive, aerospace, and energy industries. Compared to heavier metals such as steel and aluminum, magnesium offers a density advantage—about two-thirds that of aluminum—making it highly valuable in weight sensitive applications. Its primary industrial use is as an alloying addition in aluminum billets for automobile parts and beverage cans.

Global magnesium metal production reached approximately 1 million tonnes in 2024, with an estimated 85% derived from seawater sources, while existing smelting capacity remains double that output. Production is highly concentrated: over 90% of supply is currently controlled by China and Russia, whereas the U.S. has virtually no domestic primary producers. The U.S. Geological Survey reports magnesium is the eighth most abundant element in the Earth’s crust; nevertheless, production is restricted by costly extraction and limited downstream capacity.

Energy intensity remains a defining characteristic of this sector. The Pidgeon process—commonly employed in China—consumes up to 20 kWh per kg of magnesium and emits approximately 37 kg of CO2 per kg of metal, significantly higher than steel production. Die casting of magnesium requires 1.8–2 kWh per kg of final product

A key driver of magnesium metal concentrates is automotive and aerospace lightweighting needs. Demand for magnesium alloys in these sectors is expected to grow significantly, with global magnesium metal demand projected to increase from 1.25 million t in 2023 to over 1.60 million t by 2034, according to government verified supply chain data. Lightweight components improve overall fuel efficiency and reduce emissions.

Government initiatives are accelerating the shift toward sustainable magnesium production. In Europe, the EU’s Critical Raw Materials Act mandates domestic processing of 40% and recycling of 15% of critical metals by 2030. As part of this, Romania granted a concession to Verde Magnesium for a mine targeting 90,000 tonnes annually by 2027, representing roughly half of the EU’s current needs.

Key Takeaways

- Magnesium Metal Market size is expected to be worth around USD 10.7 Billion by 2034, from USD 5.4 Billion in 2024, growing at a CAGR of 7.1%.

- Primary Magnesium held a dominant market position, capturing more than a 73.30% share of the global magnesium metal market.

- Pidgeon held a dominant market position, capturing more than a 76.40% share of the global magnesium metal market.

- Aluminum Alloys held a dominant market position, capturing more than a 48.20% share of the global magnesium metal market.

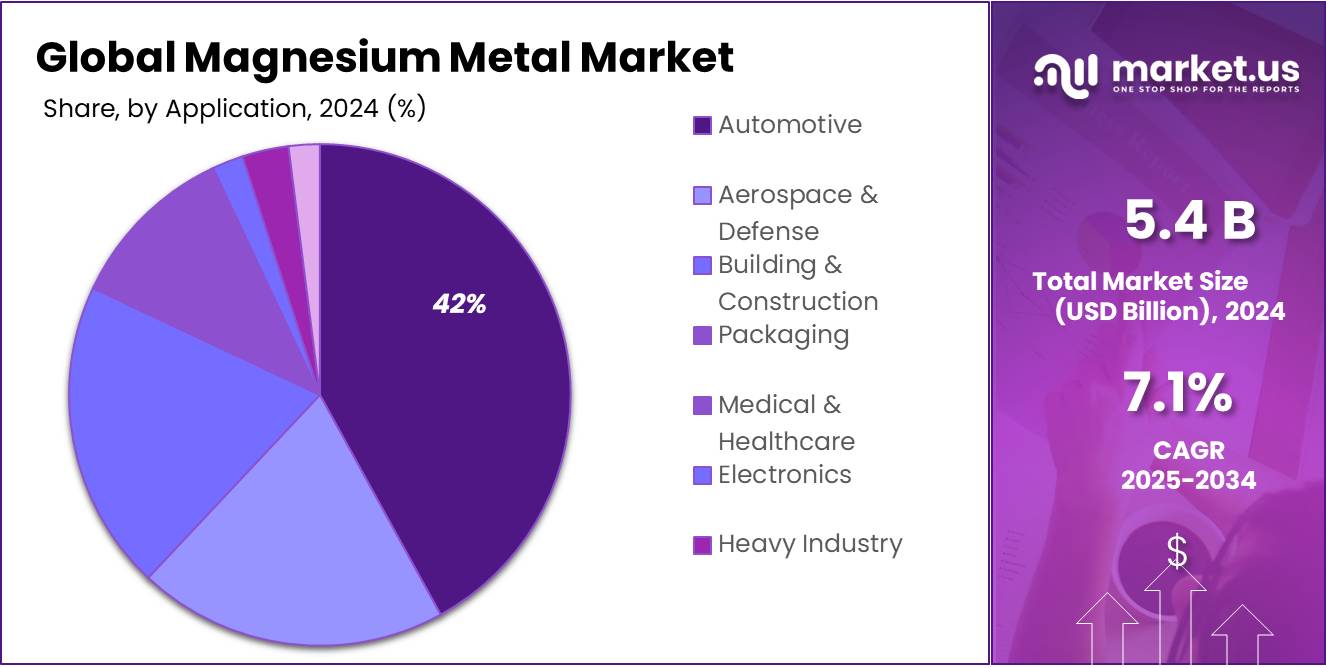

- Automotive held a dominant market position, capturing more than a 42.20% share of the global magnesium metal market.

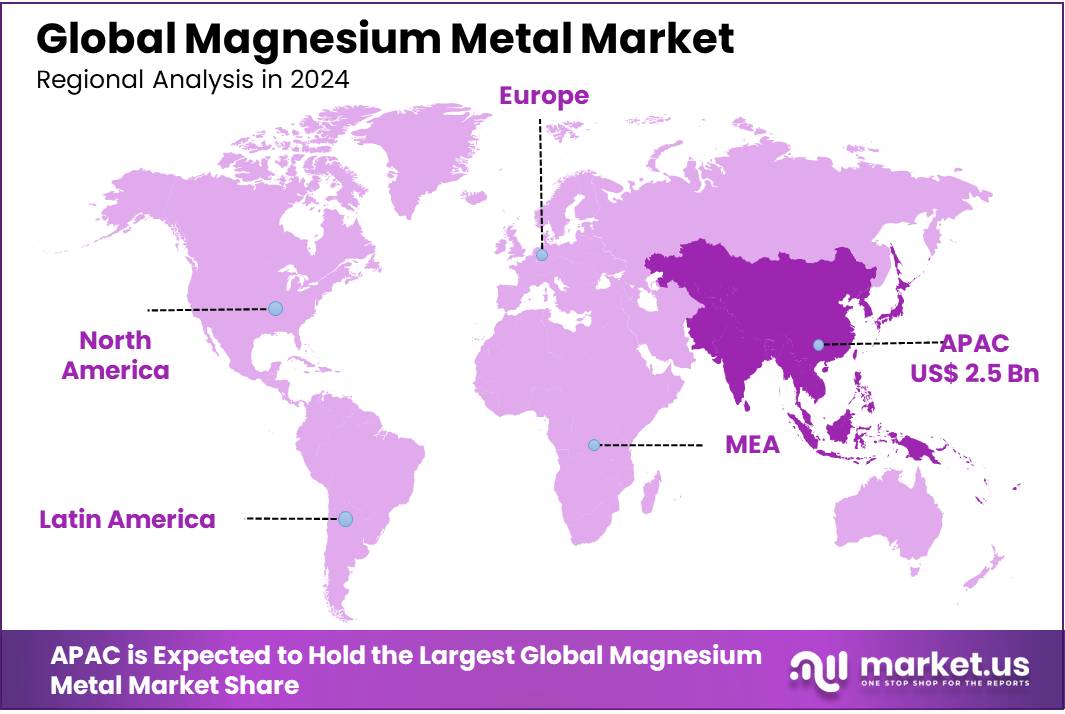

- Asia-Pacific (APAC) region held a dominant position in the global magnesium metal market, accounting for 47.20% of total market share, which translated to a valuation of approximately USD 2.5 billion.

By Type

Primary Magnesium leads with 73.30% share in 2024, supported by high-volume demand in casting and alloy production

In 2024, Primary Magnesium held a dominant market position, capturing more than a 73.30% share of the global magnesium metal market. This dominance is largely due to its extensive use in structural alloys, die casting applications, and aluminum alloying—sectors that demand large-scale, high-purity inputs. Primary magnesium is produced directly from raw materials like dolomite or magnesite through energy-intensive processes such as the Pidgeon method or electrolytic reduction. Countries like China, which control the majority of global primary magnesium production, supply these industries at scale.

Automotive manufacturers especially rely on primary magnesium for making lightweight components, which helps reduce vehicle weight and improve fuel efficiency. The aerospace industry also uses primary magnesium due to its excellent strength-to-weight ratio. With rising global interest in lightweight materials and increasing regulatory focus on fuel efficiency and carbon emission reduction, demand for primary magnesium remained strong in 2024 and is expected to stay on an upward trend into 2025.

By Process

Pidgeon Process dominates with 76.40% share in 2024 due to low setup costs and large-scale use in China

In 2024, Pidgeon held a dominant market position, capturing more than a 76.40% share of the global magnesium metal market by process. The Pidgeon process, which relies on the thermal reduction of dolomite using ferrosilicon in a vacuum, remains the most widely adopted method, especially in China, where over 85% of global magnesium production originates. Its dominance is rooted in relatively low capital investment, straightforward technology, and abundant availability of raw materials like dolomite and coal.

Although the method is energy-intensive and carbon-heavy—releasing around 37 kg of CO₂ per kg of magnesium produced—it continues to be favored in regions where environmental regulations are less strict or where emission control measures are still developing. Despite increasing global focus on green manufacturing, the Pidgeon process remains the backbone of current production due to its established infrastructure and cost efficiency. This allowed it to retain its leading share through 2024, although future years may see a gradual shift toward cleaner processes as sustainability pressure and regulatory policies intensify globally.

By Application

Aluminum Alloys lead with 48.20% share in 2024, driven by demand for lightweight and high-strength materials

In 2024, Aluminum Alloys held a dominant market position, capturing more than a 48.20% share of the global magnesium metal market by application. Magnesium is widely used as an alloying element in aluminum to enhance its strength, corrosion resistance, and machinability—qualities essential in transportation, construction, and packaging industries. This application is especially critical in the automotive and aerospace sectors, where aluminum-magnesium alloys help reduce overall weight while maintaining structural performance.

The continued shift toward electric vehicles and lightweight mobility solutions has further boosted demand for these alloys. In the construction industry, aluminum-magnesium alloys are used in cladding, roofing, and structural frames due to their strength and weather resistance. With growing global infrastructure development and rising fuel efficiency standards, the need for durable and lightweight materials kept the aluminum alloy segment in a leading position throughout 2024. This trend is expected to continue into 2025, as magnesium’s role in enhancing aluminum’s mechanical properties remains vital to multiple fast-growing industrial sectors.

By End-use

Automotive sector leads with 42.20% share in 2024, fueled by the push for lightweight and fuel-efficient vehicle components

In 2024, Automotive held a dominant market position, capturing more than a 42.20% share of the global magnesium metal market by end-use. This strong position is mainly due to the growing use of magnesium in manufacturing lightweight car components such as gearboxes, steering wheels, seat frames, engine blocks, and transmission cases. Magnesium’s low density—about 33% lighter than aluminum—makes it a valuable material for automakers aiming to reduce vehicle weight and improve fuel economy or extend battery range in electric vehicles.

As governments across the world enforce stricter emission and efficiency regulations, automotive manufacturers are increasingly turning to magnesium-based materials to meet these targets. The global rise in electric vehicle adoption has also played a key role, as EV producers prioritize lightweight designs to optimize energy use. In 2024, both legacy carmakers and EV startups expanded their magnesium usage in structural parts, keeping the automotive segment in the lead. This trend is expected to continue into 2025 as demand for cleaner, lighter, and more efficient mobility solutions remains high.

Key Market Segments

By Type

- Primary Magnesium

- Secondary Magnesium

By Process

- Pidgeon

- Electrolytic

- Recycling

By Application

- Aluminum Alloys

- Die Casting

- Iron & Steel Making

- Metal Reduction

- Others

By End-use

- Automotive

- Aerospace & Defense

- Building & Construction

- Packaging

- Medical & Healthcare

- Electronics

- Heavy Industry

- Others

Drivers

Government Initiatives and Strategic Policies

A significant driving factor for the global magnesium metal market is the increasing emphasis on government initiatives and strategic policies aimed at ensuring a stable and sustainable supply of critical raw materials. Magnesium, recognized for its lightweight properties and essential role in various industries, has garnered attention from governments worldwide seeking to bolster domestic production and reduce reliance on imports.

In Europe, the European Union’s Critical Raw Materials Act, effective from May 2024, designates magnesium as a strategic material. This legislation sets ambitious goals for the EU to mine 10% of its critical mineral consumption, process 40%, and recycle 15% by 2030. As part of this initiative, Romania granted a mining concession to Verde Magnesium, a Bucharest-based company backed by U.S. investor Amerocap, aiming to invest $1 billion in a disused magnesium mine near Oradea. The project plans to produce 90,000 tonnes annually, covering half of the EU’s magnesium needs, thereby enhancing supply chain resilience and supporting the green transition.

In the United States, magnesium is included in the 2023 Final Critical Materials List, highlighting its importance for energy and manufacturing sectors. The U.S. Department of Energy’s focus on critical materials underscores the need for domestic production capabilities to mitigate supply chain vulnerabilities.

Restraints

High Production Costs and Energy Consumption

A significant challenge facing the global magnesium metal market is the high production costs, primarily due to the energy-intensive nature of its extraction and refining processes. Traditional methods, such as the Pidgeon process, require substantial energy inputs, making magnesium production costly and less environmentally friendly. This issue is compounded by the limited availability of raw materials and the environmental impact of mining operations, further escalating costs.

In 2024, the global primary magnesium output was approximately 940,000 tonnes, a decrease of about 15% from 2022. However, the market experienced a rebound in 2024 to 1 million tonnes, an increase of 11%, and is projected to grow at a compound annual growth rate (CAGR) of 4.5% until 2034.

Despite this growth, high production costs remain a major concern, as the extraction and refining processes are energy-intensive and expensive. The limited availability of raw materials and the environmental impact of mining operations further add to the costs. Additionally, there are concerns about supply chain disruptions and geopolitical tensions that may affect the availability of magnesium. The volatility in raw material prices and the need for substantial investments in production infrastructure also pose challenges to market expansion.

Opportunity

Increasing Demand for Magnesium in the Food Industry

In recent years, the demand for magnesium in the food industry has been on the rise, driven by its essential role in human health and nutrition. Magnesium is a vital mineral that supports various bodily functions, including nerve and muscle function, heart health, and bone strength. As awareness of these health benefits grows, consumers are seeking magnesium-rich food products, creating a robust opportunity for the magnesium metal market. In 2024, the U.S. Food and Drug Administration (FDA) reported that nearly 50% of the U.S. population fails to meet the recommended daily intake of magnesium. This statistic highlights the growing need for fortified food products containing magnesium.

Government initiatives aimed at addressing nutritional deficiencies also contribute to this growth. For instance, in 2023, the U.S. Department of Agriculture (USDA) included magnesium as one of the critical minerals in its updated dietary guidelines, encouraging food manufacturers to enhance product fortification. These efforts align with a broader focus on improving public health and preventing chronic diseases related to nutrient deficiencies.

The food industry’s adoption of magnesium supplementation is expanding as manufacturers incorporate magnesium into various food products like cereals, energy bars, and beverages. In 2024, major food producers like Kellogg’s and General Mills reported increasing their investments in magnesium-fortified products. For example, Kellogg’s new magnesium-enriched cereals are seeing rising demand, with the company projecting a 25% increase in sales over the next three years.

Trends

Surge in Magnesium Fortification in Food Products

In recent years, the food industry has witnessed a notable shift towards incorporating magnesium into various products, driven by increasing consumer awareness of its health benefits. Magnesium, an essential mineral, plays a crucial role in numerous bodily functions, including muscle and nerve function, blood glucose control, and bone health. Despite its importance, studies indicate that a significant portion of the population fails to meet the recommended daily intake of magnesium. For instance, data from the National Institutes of Health (NIH) suggests that many individuals do not consume adequate amounts of magnesium through their diet alone.

This nutritional gap has prompted food manufacturers to enhance their product offerings by fortifying them with magnesium. The global market for food-grade magnesium derivatives, such as magnesium oxide and magnesium citrate, has been expanding in response to this demand.

Government initiatives have further supported this trend. For example, the U.S. Food and Drug Administration (FDA) has recognized the importance of magnesium in public health, leading to updated dietary guidelines that encourage the fortification of foods with essential nutrients, including magnesium. Such policies aim to address widespread deficiencies and promote better health outcomes among the population.

Regional Analysis

Asia-Pacific dominates the global magnesium metal market with 47.20% share, valued at USD 2.5 billion in 2024

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global magnesium metal market, accounting for 47.20% of total market share, which translated to a valuation of approximately USD 2.5 billion. This leadership is primarily driven by China, which remains the world’s largest producer and exporter of primary magnesium, contributing more than 85% of global supply. The region benefits from an abundant availability of raw materials like dolomite and ferrosilicon, as well as cost-effective labor and extensive smelting infrastructure. China’s widespread use of the Pidgeon process, despite its high carbon footprint, continues to supply massive volumes for both domestic consumption and export markets.

In addition to China, countries like India, Japan, and South Korea are contributing to market growth through increased magnesium usage in automotive manufacturing, aerospace, electronics, and construction. Japan and South Korea, in particular, are leveraging magnesium for die casting in the production of lightweight vehicle and electronic components. The rising demand for electric vehicles and energy-efficient transport across APAC economies has further accelerated the use of magnesium alloys. Moreover, government support for industrial decarbonization in the region is beginning to influence investment in cleaner production technologies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Latrobe Magnesium Limited is advancing a pioneering hydrometallurgical/thermal process that extracts magnesium metal from industrial fly ash. The company’s demonstration plant is designed to produce 1,000 tonnes per annum (tpa), with a target of scaling up to a 10,000 tpa commercial facility by mid-2025 in Victoria, Australia. A future “mega” plant in Sarawak, Malaysia, is expected to reach 100,000 tpa, signaling a bold expansion of its sustainable magnesium production strategy

RIMA Industrial, headquartered in Brazil, is the only primary magnesium producer in the Southern Hemisphere and uniquely manufactures automotive parts directly from ore. Utilising vertically integrated silicon-thermic reduction, RIMA extracts metal from its own dolomite reserves. Its production process is valued for generating only 10.1 kg CO eq per kg of magnesium—the lowest carbon footprint among existing global technologies

Shanxi Bada Magnesium, located in Shanxi province, China, specializes in high-purity magnesium ingots and alloys with a monthly output of approximately 2,500 tonnes of ingots and 1,500 tonnes of alloys. The company maintains continuous ingot production while alloy manufacturing fluctuates with downstream demand, reflecting market-sensitive production strategies.

Top Key Players in the Market

- Shanxi Yinguang Huasheng Magnesium Industry Co., LTD

- US Magnesium LLC

- Tongxiang Magnesium (Shanghai) Co., Ltd.

- Dead Sea Magnesium [DSM] Ltd

- Latrobe Magnesium Limited

- VSMPO-AVISMA

- RIMA Industrial

- Shanxi Bada Magnesium Co., Ltd.

- Esan

- Western Magnesium Corporation

- Southern Magnesium & Chemicals Limited (SMCL)

- OJSC SMZ

- Baowu Magnesium

- West High Yield Resources

- Other Key Players

Recent Developments

VSMPO-AVISMA, based in Verkhnyaya Salda, Russia, is recognized primarily as the world’s largest titanium producer, but it also produces magnesium and aluminum alloys. In 2024, the company employed approximately 19,353 personnel across its facilities.

In 2024 Shanxi Bada Magnesium Co., Ltd., operates with significant production capacity: 50,000 t/year of primary magnesium, 40,000t/year of alloyed magnesium, and over 25,000t/year of break billets, alongside extensive downstream extrusion and die-casting outputs.

Report Scope

Report Features Description Market Value (2024) USD 5.4 Bn Forecast Revenue (2034) USD 10.7 Bn CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Primary Magnesium, Secondary Magnesium), By Process (Pidgeon, Electrolytic, Recycling), By Application (Aluminum Alloys, Die Casting, Iron And Steel Making, Metal Reduction, Others), By End-use (Automotive, Aerospace And Defense, Building And Construction, Packaging, Medical And Healthcare, Electronics, Heavy Industry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Shanxi Yinguang Huasheng Magnesium Industry, US Magnesium LLC, Tongxiang Magnesium (Shanghai), Dead Sea Magnesium [DSM], Latrobe Magnesium Limited, VSMPO-AVISMA, RIMA Industrial, Shanxi Bada Magnesium, Esan, Western Magnesium Corporation, Southern Magnesium & Chemicals Limited (SMCL), OJSC SMZ, Baowu Magnesium, West High Yield Resources, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Shanxi Yinguang Huasheng Magnesium Industry Co., LTD

- US Magnesium LLC

- Tongxiang Magnesium (Shanghai) Co., Ltd.

- Dead Sea Magnesium [DSM] Ltd

- Latrobe Magnesium Limited

- VSMPO-AVISMA

- RIMA Industrial

- Shanxi Bada Magnesium Co., Ltd.

- Esan

- Western Magnesium Corporation

- Southern Magnesium & Chemicals Limited (SMCL)

- OJSC SMZ

- Baowu Magnesium

- West High Yield Resources

- Other Key Players