Global 2, 5-Dibromopyrazine Market By Purity (Up to 98% and above 98%), By Application (Pharmaceutical, Dyes and Pigments, Agrochemicals, Material Science and Chemical Synthesis), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141083

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

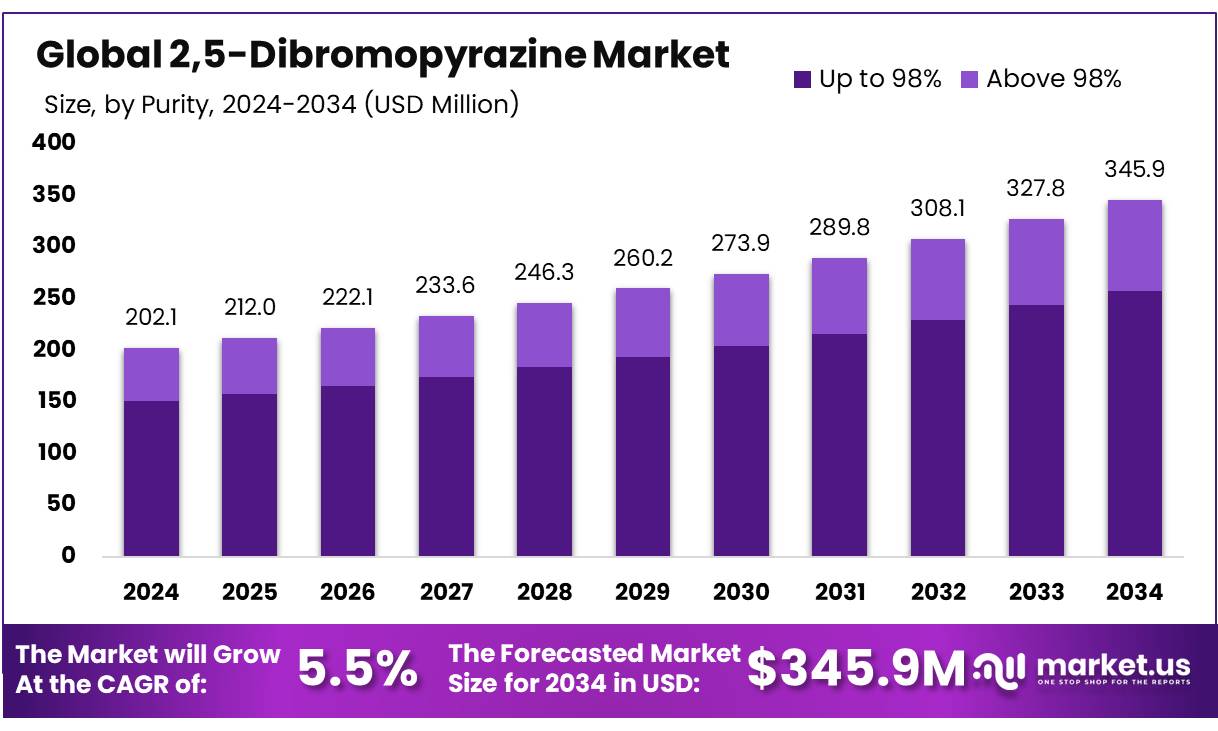

The Global 2, 5-Dibromopyrazine Market size is expected to be worth around USD 345.9 Million by 2034, from USD 202.1 Million in 2024, growing at a CAGR of 5.5% from 2025 to 2034. 2, 5-Dibromopyrazine (CAS 23229-26-7) is an organic chemical compound with the chemical formula C4H2Br2N2. It has a molecular weight of 237.88 and melts between 45 to 49 degrees Celsius. At room temperature, it appears as a white or light yellow solid powder with a density of 2.2.

In organic synthesis, these compounds are commonly used as reaction intermediates in various product synthesis. It is soluble in polar solvents, but not soluble in water. 2, 5-Dibromopyrazine is part of a group of compounds called heterocyclic aromatic compounds and is primarily used in the production of other chemicals.

The market for 2, 5-Dibromopyrazine is expanding due to its adoption in several industries. Its role as a key intermediate in the pharmaceutical industry, particularly in synthesizing biologically active molecules, highlights its importance in drug discovery and development. Similarly, in the agrochemical sector, it is used to create pesticides and herbicides with improved environmental profiles. The dye and pigment industry utilizes this compound for developing high-performance colorants, while its application in material science for advanced materials such as luminescent and conductive substances adds further value.

Key Takeaways

- The global 2, 5-Dibromopyrazine market was valued at USD 202.1 million in 2024.

- The global 2, 5-Dibromopyrazine market is projected to grow at a CAGR of 5.5% and is estimated to reach USD 345.9 million by 2034.

- Among purities, up to 98% accounted for the largest market share at 74.6%.

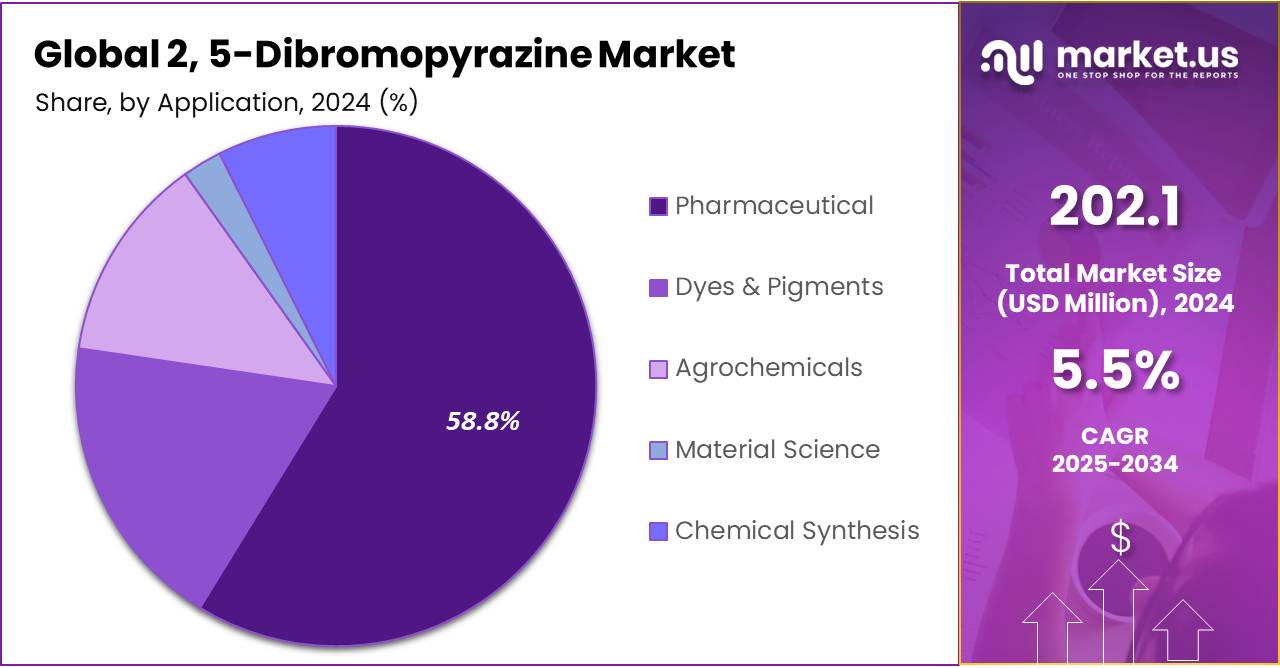

- Among applications, pharmaceuticals accounted for the majority of the market share at 58.8%.

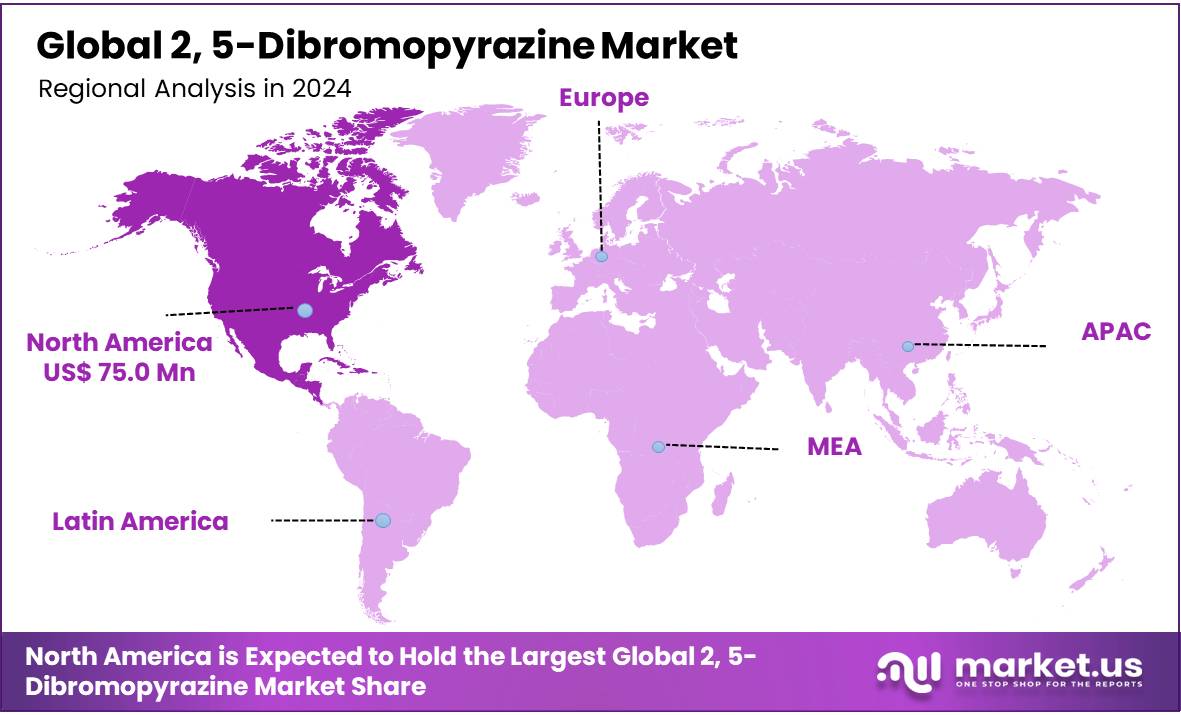

- North America is estimated as the largest market for 2, 5-Dibromopyrazine with a share of 37.1% of the market share.

- Asia-Pacific is anticipated to register the highest CAGR of 6.2%.

- Europe with a revenue share of 30.7% in 2024 and expected to register a CAGR of 5.2%.

Regulatory Framework

Region/Country Regulatory Body/ Regulation Description The US 2012 OSHA Hazard Communication Standard (29 CFR 1910.1200) 2,5-Dibromopyrazine is classified as a hazardous chemical under the 2012 OSHA Hazard Communication Standard (29 CFR 1910.1200). This classification mandates that the chemical must be properly labeled and that safety data sheets (SDS) must be provided to convey the associated hazards. Toxic Substances Control Act (TSCA) 2,5-Dibromopyrazine is listed under TSCA, which requires manufacturers to notify the EPA about the production and use of certain chemicals. The current status indicates that it is an active substance in the TSCA inventory. European Union REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) Manufacturers and importers in the EU must register 2,5-Dibromopyrazine with the European Chemicals Agency (ECHA) if annual production/import exceeds 1 ton. Purity Analysis

Up to 97% Pure 2, 5-Dibromopyrazines Dominated the Market, Owing to Their Widespread Industrial Applications

The 2, 5-Dibromopyrazine market is segmented based on up to 98% & above 98% In 2024, the 2, 5-Dibromopyrazine market segment with up to 98% purity held a significant revenue share of 74.6%. In 2024, the 2,5-Dibromopyrazine market segment with up to 98% purity commanded a significant revenue share of 74.6% due to its extensive utility across various applications where ultra-high purity is not a critical requirement. This segment includes 2,5-Dibromopyrazine used in the synthesis of intermediate products in industries such as pharmaceuticals, agrochemicals, and specialty chemicals. The demand in these sectors is driven by the need for cost-effective intermediates that balance performance and production economics.

Products with up to 98% purity meet the requisite standards for a wide range of industrial applications, making them a popular choice for companies looking to optimize costs without compromising significantly on quality. For many chemical syntheses, especially where the final product undergoes further purification steps or where slight impurities do not affect the overall quality of the end product, using 2,5-Dibromopyrazine of this purity level proves to be efficient and economically viable.

Global 2, 5-Dibromopyrazine Market, By Purity, 2020-2024 (USD Million)

Purity 2020 2021 2022 2023 2024 Up to 98% 129.22 133.61 138.64 144.10 150.71 Above 98% 42.92 44.77 46.78 48.90 51.37 Application Analysis

The 2, 5-Dibromopyrazine Market Was Dominated By the Pharmaceutical Industry.

Based on application, the market is further divided into pharmaceutical, dyes & pigments, agrochemicals, material science & chemical synthesis. The 2, 5-Dibromopyrazines market, particularly within the pharmaceutical sector, exhibited a commanding 58.8% market share in 2024. This dominance is primarily due to the compound’s effectiveness as a key intermediate in synthesizing a variety of pharmacologically active molecules. Pharmaceuticals require specific chemical intermediates that can facilitate the development of new treatments for diseases with complex pathologies, such as cancer and neurological disorders.

The ongoing push within the pharmaceutical industry for innovative drug solutions accelerates the demand for reliable and efficient chemical intermediates such as 2,5-Dibromopyrazine. Furthermore, the increased focus on targeted therapies and personalized medicine has heightened the need for specialized compounds that can be used in precise drug formulations, where 2,5-Dibromopyrazine’s versatility and reactivity make it particularly valuable.

Its ability to bind with various organic compounds enhances its utility in creating complex drug molecules, which is critical for developing new medications that meet stringent regulatory standards for safety and efficacy. As a result, its significant utility and indispensability in drug synthesis solidify 2,5-Dibromopyrazine’s leading position in the pharmaceutical sector, accounting for its predominant market share in 2024.

Global 2, 5-Dibromopyrazine Market, By Application, 2020-2024 (USD Million)

Application 2020 2021 2022 2023 2024 Pharmaceutical 100.45 104.38 108.74 113.33 118.76 Dyes & Pigments 31.85 33.01 34.34 35.78 37.51 Agrochemicals 22.39 23.11 23.93 24.83 25.92 Material Science 4.21 4.35 4.52 4.72 4.97 Chemical Synthesis 13.25 13.54 13.90 14.34 14.93 Key Market Segments

By Purity

- Up to 98%

- Above 98%

By Application

- Pharmaceutical

- Dyes & Pigments

- Agrochemicals

- Material Science

- Chemical Synthesis

Drivers

Growing Industrial Applications Drive the 2, 5-Dibromopyrazine Markets Estimated to Boost The 2, 5-Dibromopyrazine Market.

The market for 2,5-Dibromopyrazine, a vital chemical intermediate known for its applications across various industries, is poised for growth driven by expanding industrial uses. This compound is integral in the synthesis of pharmaceuticals, agrochemicals, and advanced materials, where it is used as a building block for more complex chemical formulations. The growing pharmaceutical industry, particularly, leverages 2,5-dibromopyrazine for the production of innovative drugs aimed at treating complex diseases, which fuels demand for this chemical.

Similarly, in the agrochemical industry, the push for more effective pesticides and herbicides to enhance crop yields and reduce losses also drives the demand. Additionally, its role in the manufacture of high-performance polymers and electronics, where these compounds are used in the production of photo resistors and light-emitting diodes, further broadens its industrial applications. As these sectors continue to advance technologically and expand in scope, the demand for 2,5-dibromopyrazine is expected to rise, significantly boosting the market. The trend toward more specialized and high-performance materials in these applications ensures that the demand for 2,5-dibromopyrazine will remain robust and growing.

Restraints

Availability of Other Alternative Chemicals May Hinder The Growth Of The Market to a Certain Extent

The availability of alternative chemicals can pose a challenge to the growth of the 2,5-dibromopyrazine market, particularly as industries look for more cost-effective or efficient substitutes. In both the pharmaceutical and agrochemical sectors, companies often seek alternatives that offer similar or superior performance at a lower cost, or that align better with evolving regulatory standards. For example, there are other brominated pyrazine derivatives or different heterocyclic compounds that can serve as intermediates in drug synthesis or pesticide formulation, potentially reducing the reliance on 2,5-dibromopyrazine.

Moreover, advancements in green chemistry and sustainable production methods have led to the development of more eco-friendly chemicals, which may reduce the demand for certain traditional intermediates like 2,5-dibromopyrazine. As environmental concerns and regulations around toxic chemical usage become stricter, companies may shift towards using chemicals with a lower environmental impact, thereby limiting the growth of markets for certain chemicals.

Opportunity

Rapid Growth in the Global Agrochemicals Industry Is Anticipated To Create Lucrative Opportunities

The global agrochemicals industry is experiencing rapid growth, driven by the escalating demand for food due to the increasing global population and shrinking arable land. This surge is anticipated to create lucrative opportunities for various stakeholders in the agrochemicals market, from manufacturers to distributors. As farmers strive to enhance crop yields and quality to meet food supply needs, the reliance on agrochemicals such as fertilizers, pesticides, herbicides, and insecticides intensifies. This increased consumption is particularly evident in developing regions where agriculture forms a significant part of economic growth and food security.

The push towards more sustainable farming practices also fuels innovation in the agrochemicals sector, with a growing focus on developing eco-friendly and highly effective products. These innovations include biopesticides and precision farming technologies that require advanced chemical solutions, opening new avenues for revenue. Moreover, regulatory support for environmentally safer products in developed countries encourages companies to invest in research and development, leading to the creation of novel agrochemicals that comply with stringent environmental standards.

Trends

Focus on High Application Products

The growing demand for high-application products is a notable trend that is significantly influencing the 2,5-dibromopyrazine market. 2,5-Dibromopyrazine is a crucial compound used in various industries, including pharmaceuticals, agrochemicals, and specialty chemicals, owing to its versatile chemical properties. In the pharmaceutical industry, it serves as an important intermediate for the synthesis of biologically active compounds, including potential drugs for cancer and other diseases. Additionally, its role in the agrochemical sector, particularly in the formulation of pesticides and herbicides, is gaining prominence as global agricultural practices demand more efficient and sustainable chemical solutions.

As industries focus on producing higher-performing and more specific end-products, the demand for high-application intermediates like 2,5-dibromopyrazine is on the rise. This trend is further fueled by the growing emphasis on innovation and specialized chemicals that can enhance the efficacy and efficiency of final products across different applications. As a result, manufacturers are ramping up production of 2,5-dibromopyrazine to cater to these diverse needs, driving growth in the market. The increased focus on high-performance products that meet the specific demands of industries is expected to continue propelling the market for 2,5-dibromopyrazine in the coming years.

Geopolitical Impact Analysis

Geopolitical Tensions And Disruptions In The Global Supply Chain Have A Negative Impact On The Growth Of The 2, 5-Dibromopyrazine Market.

The global market for Active Pharmaceutical Ingredients (APIs) such as 2,5-Dibromopyrazine is increasingly influenced by geopolitical events, which have profound implications for supply chains, production costs, and overall market stability.

The Israel-Hamas war has severely impacted global shipping routes and operations in Israel, particularly at major ports similar Ashkelon. This has led to significant increases in shipping costs and delays, with ocean shipping premiums reportedly multiplying tenfold due to strained operations. Such disruptions can lead to shortages of APIs, as many multinational companies involved in pharmaceutical manufacturing operate in Israel. The prolonged conflict between Russia and Ukraine has resulted in sanctions that affect critical commodities, including those necessary for API production.

The sanctions have disrupted the supply of raw materials essential for pharmaceuticals, thereby increasing costs and complicating logistics. This situation has been exacerbated by rising energy prices and transportation costs due to the conflict. Ongoing trade disputes have introduced additional complexities into the API market. Export restrictions imposed by the US on certain technologies have led to retaliatory measures from China, affecting the availability of key materials used in API production. For instance, China’s export controls on graphite and other essential minerals have caused significant price surges.

Shipping delays lead to interruptions in the supply chain, causing pharmaceutical companies to experience production halts. For instance, companies have reported that prolonged shipping times have resulted in product shortages and potential revenue losses due to disrupted production schedules. The average lead time for shipments has significantly increased, with some deliveries taking over twice as long as pre-pandemic times. For instance, delivery times from Chinese contract manufacturing organizations (CMOs) to the U.S. West Coast rose from less than 50 days to a record high of 113 days. Such delays can hinder timely access to essential APIs.

Regional Analysis

North America Held the Largest Share of the Global 2, 5-Dibromopyrazine Market

In 2024, North America dominated the global 2,5-dibromopyrazine market, accounting for 37.1% of the share, driven by a combination of factors, primarily the region’s robust pharmaceutical, agrochemical, and specialty chemical sectors. 2,5-dibromopyrazine, a key intermediate in the synthesis of various active ingredients, plays a crucial role in the production of pharmaceuticals, including those targeting neurological and infectious diseases, as well as in agrochemicals for crop protection.

The United States, in particular, hosts numerous global pharmaceutical and agrochemical giants, which creates a consistent and growing demand for specialized chemical intermediates similar 2,5-dibromopyrazine.

Furthermore, North America benefits from advanced manufacturing capabilities, including high-tech chemical synthesis facilities and a well-established regulatory environment that ensures the production of high-quality, compliant products. These facilities are equipped to meet the stringent standards required for complex chemical production, giving companies in the region a competitive advantage in producing high-purity intermediates.

Additionally, the region’s strong R&D ecosystem fosters continuous innovation in drug development and agricultural solutions, fueling demand for specialized chemicals like 2,5-dibromopyrazine. With ongoing investments in healthcare and agricultural biotechnology, coupled with a well-established supply chain infrastructure, North America remains at the forefront of this market. The combination of innovation, infrastructure, and demand from key industries ensures that North America maintains its dominant position in the global 2,5-dibromopyrazine market.

Global 2, 5-Dibromopyrazine Market, By Region, 2020-2024 (USD Million)

Region 2020 2021 2022 2023 2024 North America 63.99 66.29 68.90 71.69 75.04 Europe 53.37 55.15 57.17 59.34 61.95 Asia Pacific 40.34 42.07 44.01 46.10 48.57 Middle East & Africa 7.93 8.17 8.45 8.75 9.11 Latin America 6.52 6.70 6.90 7.12 7.40 Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Major Companies Are Employing Various Strategic Initiatives That Focusing On Innovation, Expansion, Partnerships, And Operational Efficiency.

To maintain a competitive edge in the 2,5-dibromopyrazine market, major companies focus on several strategic initiatives that enhance their market positioning and operational efficiency. One key approach is investment in research and development (R&D) to improve the synthesis and efficiency of 2,5-dibromopyrazine production.

This focus on innovation not only boosts product quality but also drives the discovery of new applications, particularly in pharmaceuticals and agrochemicals, where the compound is used as a critical intermediate. By advancing manufacturing technologies, companies can achieve higher yields, reduce production costs, and meet the growing demand for high-purity intermediates. Strategic partnerships and collaborations are another vital avenue for maintaining a competitive edge.

By partnering with pharmaceutical and agrochemical firms, companies can secure long-term contracts, gain access to new markets, and develop customized solutions that meet specific industry needs. Finally, regulatory compliance and sustainability are prioritized, with companies investing in eco-friendly production processes that align with international standards. This helps maintain a positive brand reputation and ensures long-term viability in an increasingly competitive and environmentally conscious market.

The following are some of the major players in the industry

- Vesino Industrial Co., Ltd.

- Win-Win Chemical CO., Limited

- SAGECHEM

- Shanghai Ruifu Chemical Co., Ltd.

- ENAO Chemical Co., Ltd

- Hunan Jiahang

- Pharmaceutical Technology Co., Ltd.

- Amitychem Corporation

- Puyer Group

- Zhengzhou Alfa Chemical Co., Ltd.

- Hangzhou Keying Chem Co., Ltd.

- abcr GmbH

- Chemneo Chemicals

- Other Key Players

Report Scope

Report Features Description Market Value (2024) US$ 202.1 Mn Market Volume (2024) XX Ton Forecast Revenue (2034) US$ 345.9 Mn CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Up to 98% and above 98%), By Application (Pharmaceutical, Dyes & Pigments, Agrochemicals, Material Science & Chemical Synthesis) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Vesino Industrial Co., Ltd., Win-Win Chemical CO., Limited, SAGECHEM, Shanghai Ruifu Chemical Co., Ltd., ENAO Chemical Co., Ltd, Hunan Jiahang, Pharmaceutical Technology Co., Ltd., Amitychem Corporation, Puyer Group, Zhengzhou Alfa Chemical Co., Ltd., Hangzhou Keying Chem Co., Ltd., abcr GmbH, Chemneo Chemicals & Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  2, 5-Dibromopyrazine MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

2, 5-Dibromopyrazine MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Vesino Industrial Co., Ltd.

- Win-Win Chemical CO., Limited

- SAGECHEM

- Shanghai Ruifu Chemical Co., Ltd.

- ENAO Chemical Co., Ltd

- Hunan Jiahang

- Pharmaceutical Technology Co., Ltd.

- Amitychem Corporation

- Puyer Group

- Zhengzhou Alfa Chemical Co., Ltd.

- Hangzhou Keying Chem Co., Ltd.

- abcr GmbH

- Chemneo Chemicals

- Other Key Players