Global Lupin Milk Market Size, Share Analysis Report By Product Type (Plain, Flavored), By Source (Organic, Conventional), By End-Use (Food and Beverages, Bakery and Confectionery, Personal Care, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Wholesale Stores, Specialty Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170333

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

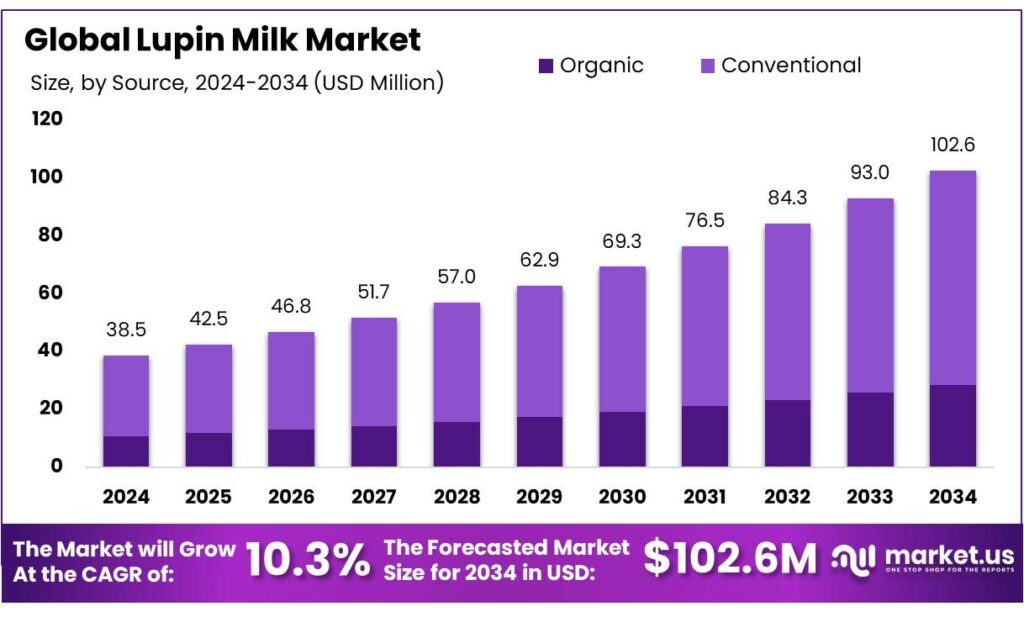

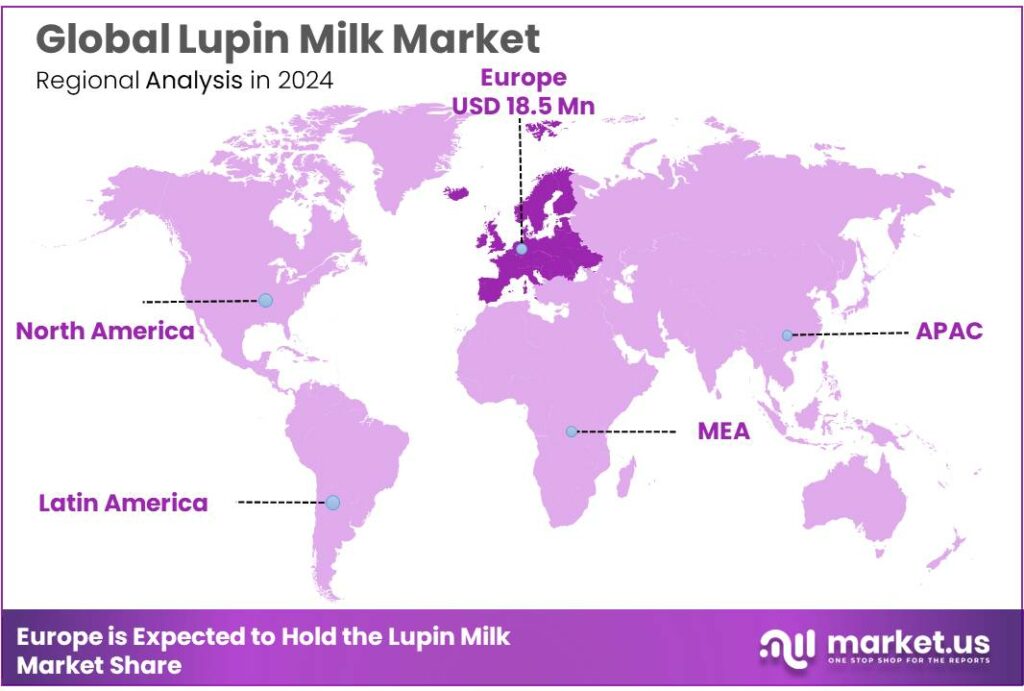

The Global Lupin Milk Market size is expected to be worth around USD 102.6 Million by 2034, from USD 38.5 Million in 2024, growing at a CAGR of 10.3% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 48.20% share, holding USD 18.5 Million revenue.

Lupin milk is a plant-based “milk alternative” made by extracting and emulsifying proteins, fibers, and oils from lupin (Lupinus) seeds, a legume crop already used in food and feed value chains. Its industrial appeal comes from the seed’s naturally high protein potential (often cited in the ~30–40% range for seeds used as protein sources) and the ability to formulate a creamy beverage without relying on soy or nuts—useful for brands targeting allergen-aware and “high-protein” shoppers.

From an industrial scenario viewpoint, lupin milk sits inside the broader plant-based milk category, where scale, retail distribution, and foodservice adoption are already established. In the U.S., plant-based milk sales were reported at $2.8 billion in 2024, but it still represented a large share of total plant-based food dollar sales—meaning manufacturers keep investing in product renovation rather than exiting the category. In foodservice, plant-based milk dollars were up 9% and pound sales up 6% in 2024, showing that cafés and quick-service channels can remain a growth engine even when retail softens.

Driving factors are a mix of consumer and supply-side shifts. Demand is being pulled by interest in protein-forward beverages and dairy diversification, while supply is supported by ongoing investment in legume and plant-protein R&D. For example, the European Commission has reported €644 million invested since 2015 across 125 Horizon projects related to legumes/protein systems—supporting innovation that can spill over into ingredients, processing, and crop improvement for applications like lupin milk. On the crop side, Australia reports average production around 800 kilotonnes over 2015–16 to 2024–25, indicating meaningful upstream availability when contracts and specifications are in place.

Regulation and trust are equally central to scaling. In the EU, lupin is one of the allergens that must be declared under food information rules (Regulation (EU) No 1169/2011), and EFSA’s consumer guidance also lists lupin among major allergens—so manufacturers must invest in allergen controls, labeling discipline, and cross-contact risk management.

Government and public programs are also shaping the industrial scenario and future capacity. Under the EU’s CAP 2023–2027 framework, support for protein crops and legumes is stated to increase by 25% versus 2022, with supported area estimated to reach 7 million hectares in 2027—a tailwind for European-grown protein-crop supply, including lupins. At a country level, Ireland’s Protein Aid Scheme explicitly includes lupins and set aside €10 million in 2024, with a payment rate of €493 per hectare, directly incentivizing acreage and domestic availability.

Key Takeaways

- Lupin Milk Market size is expected to be worth around USD 102.6 Million by 2034, from USD 38.5 Million in 2024, growing at a CAGR of 10.3%.

- Plain held a dominant market position, capturing more than a 68.2% share in the global lupin milk market.

- Conventional held a dominant market position, capturing more than a 72.4% share in the global lupin milk market.

- Food & Beverages held a dominant market position, capturing more than a 49.1% share in the lupin milk market.

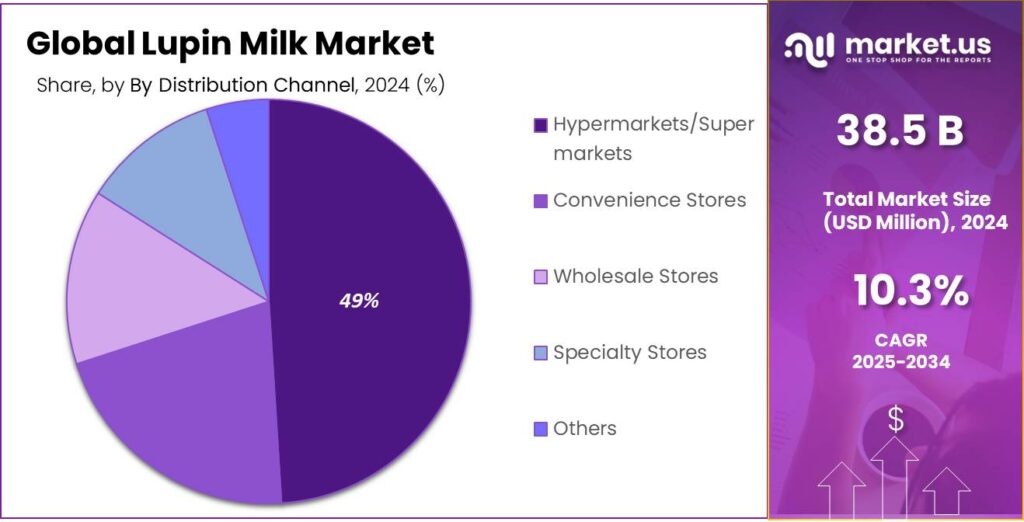

- Hypermarkets/Supermarkets held a dominant market position, capturing more than a 48.9% share in the lupin milk market.

- Europe accounted for a leading position in the lupin milk market, registering a 48.20% share which corresponded to a volume of 18.5 million.

By Product Type Analysis

Plain Lupin Milk dominates with 68.2% due to its clean label appeal and everyday usability

In 2024, Plain held a dominant market position, capturing more than a 68.2% share in the global lupin milk market, supported by rising demand for simple, unsweetened plant-based beverages. The strong preference for plain variants was driven by health-conscious consumers seeking low-sugar, allergen-friendly, and minimally processed milk alternatives. Plain lupin milk was widely adopted for direct consumption as well as for use in coffee, cooking, and cereal applications, which supported its broad household penetration.

In 2024, its positioning as a neutral base for both sweet and savory uses strengthened repeat purchases across retail and foodservice channels. Moving into 2025, demand for plain lupin milk is expected to remain stable, supported by continued growth in vegan diets, lactose-free preferences, and clean-label food choices, with plain formats maintaining their role as the core product within the category.

By Source Analysis

Conventional lupin milk leads with 72.4% driven by cost efficiency and wide raw material access

In 2024, Conventional held a dominant market position, capturing more than a 72.4% share in the global lupin milk market, supported by its lower production cost and stable supply of conventionally grown lupin beans. The segment benefited from established farming practices and higher crop yields, which helped manufacturers maintain consistent pricing across retail shelves.

In 2024, conventional lupin milk remained the preferred choice for mass-market consumers, particularly in price-sensitive regions, due to its comparable nutrition profile and wider availability. Moving into 2025, the segment is expected to retain its strong position as demand continues from mainstream buyers and foodservice users seeking scalable and affordable plant-based milk options, reinforcing conventional sources as the backbone of overall market volume.

By End-Use Analysis

Food & Beverages leads with 49.1% supported by strong use in daily consumption products

In 2024, Food & Beverages held a dominant market position, capturing more than a 49.1% share in the lupin milk market, driven by its wide application across everyday food and drink products. Lupin milk was increasingly used in beverages, dairy-free yogurts, desserts, baked goods, and ready-to-drink formulations, where its high protein content and neutral taste offered functional advantages.

In 2024, large-scale food and beverage producers favored lupin milk for its stable texture and compatibility with existing recipes, supporting higher volume consumption. Looking ahead to 2025, this segment is expected to maintain its leading position as manufacturers continue to expand plant-based product lines and respond to steady consumer demand for lactose-free and allergen-friendly food options.

By Distribution Channel Analysis

Hypermarkets and supermarkets dominate with 48.9% due to strong shelf visibility and bulk buying habits

In 2024, Hypermarkets/Supermarkets held a dominant market position, capturing more than a 48.9% share in the lupin milk market, supported by their wide product assortment and strong consumer trust. These stores offered better brand comparison, frequent promotions, and competitive pricing, which encouraged first-time trials and repeat purchases.

In 2024, shoppers preferred buying lupin milk from large retail formats due to easy access, in-store discounts, and the ability to purchase in larger quantities. Moving into 2025, this channel is expected to remain the leading sales route as organized retail continues to expand and plant-based dairy alternatives gain more shelf space within mainstream grocery outlets.

Key Market Segments

By Product Type

- Plain

- Flavored

By Source

- Organic

- Conventional

By End-Use

- Food & Beverages

- Bakery & Confectionery

- Personal Care

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Wholesale Stores

- Specialty Stores

- Others

Emerging Trends

Shift Toward Clean-Label, High-Protein Plant Milks Made from Legumes

One clear latest trend shaping lupin milk is the move toward clean-label, legume-based plant milks that deliver higher protein with fewer ingredients. Consumers are no longer satisfied with plant drinks that are mostly water and starch. Instead, they are actively looking for products that are simple, nutritious, and close to whole-food sources. Lupin milk fits this trend well because it is made from a legume that is naturally rich in protein and fiber, without needing heavy fortification.

- According to the FAO, global protein demand is rising as diets change and populations grow, with plant proteins increasingly promoted to balance nutrition and sustainability. FAO data show that pulses and legumes already contribute roughly 22% of global plant protein intake, and this share is expected to rise as countries encourage diversification away from animal proteins.

Lupin stands out within legumes. Food science literature supported by public research institutions consistently reports lupin seeds containing 30–45% protein, higher than many commonly used plant-milk bases such as rice or oats. This allows lupin milk to deliver meaningful protein levels without long ingredient lists. For clean-label brands, this is a major advantage at a time when consumers read labels closely and avoid products with stabilizers or synthetic additives.

Government-linked nutrition and sustainability strategies are reinforcing this trend. In the European Union, the Farm to Fork Strategy explicitly promotes increased consumption of plant-based foods and sustainable protein sources as part of healthier diets. The European Commission highlights legumes as key crops for meeting nutrition goals while reducing environmental pressure. As part of CAP 2023–2027, support for protein crops and legumes is expected to rise by 25% compared with 2022, encouraging more food-grade legume production.

- According to the Government of Western Australia (DPIRD), Western Australia produces around 560,000 tonnes of lupins annually and accounts for about 85% of global supply. Yet DPIRD notes that roughly 96% of Australian sweet lupins are still used for animal feed. This imbalance is pushing innovation toward human food applications, including beverages like lupin milk, as processors look to capture higher value.

Drivers

Nutritional and Protein-Driven Demand for Lupin Milk

One of the most important reasons lupin milk is gaining interest across food industries and among consumers is its high nutritional and protein value compared with other plant-based milks, which taps directly into growing global demand for healthier, nutrient-rich foods. Unlike many plant milks made from cereals, nuts, or seeds that are often low in protein, lupin milk offers a protein profile closer to traditional dairy, appealing to people who want plant-based alternatives that still support daily protein needs. This factor is especially compelling in markets where consumers care deeply about both health benefits and sustainable diets.

Lupin seeds naturally contain about 30–45% protein by weight, a level comparable to soy and significantly higher than many other legumes and plant sources. This is noted in scientific research showing that Lupinus angustifolius seeds can contain protein levels between ~30–45%, making them a strong protein source for food products such as lupin milk. Because of this rich protein content, lupin milk can deliver nutrient density that is attractive to health-conscious consumers—particularly those who choose plant-based diets for wellness or environmental reasons.

From a practical nutrition perspective, research also highlights that lupin-based beverages like lupin milk can have a protein content similar to cow’s milk, which typically has ~3.3–3.5% protein by weight. One comparative study noted lupin beverages delivering ~4.05% protein (w/v), slightly higher than typical cow’s milk and higher than many other plant milks. This points to an important advantage: lupin milk isn’t just an alternative, it’s a nutritional peer to established dairy and higher-protein plant milks, which users who want protein without dairy find especially appealing.

This nutritional advantage feeds directly into larger consumer trends and food guidelines. Across many countries, national dietary recommendations increasingly emphasize protein quality and plant-based nutrition, responding to health concerns like cardiovascular disease, type 2 diabetes, and obesity. While specific nutrients recommended vary by country, the general push toward balanced diets incorporating plant proteins supports lupin milk’s relevance in evolving food basket choices.

Restraints

Allergen Labelling and Cross-Reactivity Risks Restrain Lupin Milk Adoption

A major restraint for lupin milk is that lupin is a regulated food allergen, which creates real barriers in product development, manufacturing, and consumer acceptance. In the European Union, lupin is one of the 14 allergens that must be indicated to consumers when used as an ingredient, under the EU food information rules (Regulation (EU) No 1169/2011, Annex II). In the UK, the Food Standards Agency also lists lupin within the regulated 14 allergens that food businesses must communicate to consumers.

The operational impact is biggest in factories that also handle common allergens like milk, soy, nuts, or gluten cereals. Because lupin is part of the regulated allergen set, producers must invest in stronger allergen controls: dedicated lines or validated cleaning, stricter supplier assurance, clear label governance, and robust traceability. If a plant makes multiple beverages, lupin introduces another allergen risk to manage, and that can slow down innovation cycles. For smaller brands, it can also limit which co-packers they can use, because many co-packers already run at capacity with allergen segregation plans built around higher-volume ingredients.

- The consumer-side restraint is even more specific: cross-reactivity with peanut allergy has been repeatedly flagged as a concern. EFSA’s scientific opinion notes that one controlled study in peanut-allergic patients suggested a clinically relevant cross-reactivity rate of about 30%, while higher rates (up to 68%) have been reported in other contexts. Separate clinical research also reports that around 19–25% of peanut-allergic individuals may be sensitized to lupin, with 6–8% showing clinically relevant symptoms.

Regulatory momentum reinforces this restraint. Australia and New Zealand have also moved to treat lupin as a label-declared allergen in their food standards context. More recently, Food Standards Australia New Zealand has continued tightening allergen labelling rules, which increases compliance expectations for any lupin-containing product marketed in that region.

Opportunity

Protein-Crop Incentives and New Processing Capacity Create a Big Growth Runway

One of the strongest growth opportunities for lupin milk is the policy-backed expansion of protein crops and the build-out of plant-protein processing, which together can make lupin ingredients cheaper, more available, and easier for brands to scale. In simple terms: when more farmers grow lupins and more plants can clean, fractionate, and process them into food-grade protein and fiber, it becomes much easier to put lupin milk on shelves—not just as a niche product, but as a reliable everyday option.

Across Europe, public policy is actively pushing protein crops and legumes. Under the EU’s CAP Strategic Plans (2023–2027), support for protein crops and legumes is expected to be 25% higher than 2022, and the supported area is estimated to reach about 7 million hectares by 2027. This matters for lupin milk because a larger supported area improves supply stability and encourages long-term contracting, which is exactly what food manufacturers want before they invest in product launches, packaging lines, and distribution.

- National programs inside Europe make the opportunity even more concrete. Ireland’s Department of Agriculture announced that in 2024, €10 million was set aside for the Protein Aid Scheme, with a payment rate of €493 per hectare for eligible crops including lupins. In 2025, Ireland again set aside €10 million, and the rate was set at €600 per hectare for lupins. For lupin milk producers, these incentives can translate into more consistent local sourcing, stronger farmer participation, and better year-to-year availability of raw material—especially important for brands that want to advertise “EU-grown” or “locally sourced” plant protein.

Australia adds a second growth engine: scale and export-ready infrastructure. Western Australia is described by DPIRD as the world’s largest producer and exporter of lupins, delivering about $200.1 million in export earnings in 2021–22. DPIRD also outlines a clear processing opportunity: WA has about 1,600 growers on 610,000 hectares producing around 560,000 tonnes of lupins annually, and it notes that about 85% of global supply is produced in WA—yet about 96% of Australian sweet lupin volume is still consumed by livestock. Finally, EU policy signals that modernization investments are expected to reach almost 400,000 EU farms, including technologies tied to efficiency and resource use.

Regional Insights

Europe — 48.20% share; 18.5 Mn (2024)

In 2024, Europe accounted for a leading position in the lupin milk market, registering a 48.20% share which corresponded to a volume of 18.5 million units; this performance was supported by established dairy-alternative demand, mature retail networks, and active product reformulation by manufacturers. Consumption patterns across key Western European markets were characterized by steady household adoption of plant-based milks for everyday use, and lupin milk was increasingly selected for its high protein content and neutral flavour profile.

Distribution advantages were provided by well-developed hypermarket and supermarket channels, where placement, pricing strategies, and promotional activity were used to stimulate trial and repeat purchase. In addition, foodservice uptake in urban centres contributed to volume, as cafés and quick-service operators adopted lupin milk for beverages to meet lactose-free and vegan consumer segments. Regulatory alignment on novel food approvals and labelling standards within the region was instrumental in reducing time-to-market for new product launches, and this facilitated broader shelf availability.

Sustainability messaging and local sourcing claims were leveraged by several brands to strengthen consumer trust, while private-label ranges helped to expand penetration among price-sensitive buyers. Looking ahead to 2025, the regional market dynamics are expected to remain supportive of lupin milk, with innovation in format and fortification anticipated to sustain interest among health-conscious and flexitarian consumers. Dominance by Europe was therefore evident in 2024, with the region serving as both a volume engine and an innovation test bed for lupin milk products.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Fraunhofer IVV contributes to the lupin milk market primarily through applied research and process innovation rather than commercial branding. In 2024, the institute supported product development by improving extraction, stability, and sensory profiles of lupin-based beverages. Its research-backed solutions enabled manufacturers to reduce off-flavors and improve shelf life. Moving into 2025, Fraunhofer IVV’s role remained important in accelerating commercialization and improving production efficiency across the lupin milk value chain.

Emsland Group leverages its expertise in plant-based ingredients to support lupin milk production, particularly in Europe. In 2024, the company focused on functional starches and proteins that enhance mouthfeel and consistency in dairy alternatives. Its strong processing infrastructure and relationships with food manufacturers supported reliable ingredient supply. As plant-based beverage volumes expanded, Emsland Group remained well positioned in 2025 to support larger-scale lupin milk formulations for mainstream food applications.

ADM holds a strategic position in the lupin milk market through its global ingredient processing capabilities and extensive distribution network. In 2024, the company supported lupin milk development by supplying plant proteins and formulation support to beverage manufacturers. Its scale enabled cost-efficient production and consistent quality, which appealed to large food and beverage producers. Entering 2025, ADM’s focus on plant-based nutrition and sustainable sourcing continued to reinforce its relevance in the lupin milk ecosystem.

Top Key Players Outlook

- Lupin Foods Australia

- PURIS

- Fraunhofer IVV

- Emsland Group

- ADM

- GOODMILLS Innovation

- Others

Recent Industry Developments

In 2024, Archer Daniels Midland (ADM) remained an important ingredient partner for companies developing lupin milk and other plant-based beverages, building on its 122-year history in food and agricultural processing and 44,043 employees globally.

Emsland Group, a Germany-based ingredient company that has processed more than 2.2 million tons of potatoes and 160,000 tons of peas into food ingredients, is increasingly relevant for plant-based milks like lupin milk because it supplies plant proteins, starches, and fibres used to improve texture and nutrition in dairy alternatives.

Report Scope

Report Features Description Market Value (2024) USD 38.5 Mn Forecast Revenue (2034) USD 102.6 Mn CAGR (2025-2034) 10.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Plain, Flavored), By Source (Organic, Conventional), By End-Use (Food and Beverages, Bakery and Confectionery, Personal Care, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Wholesale Stores, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Lupin Foods Australia, PURIS, Fraunhofer IVV, Emsland Group, ADM, GOODMILLS Innovation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Lupin Foods Australia

- PURIS

- Fraunhofer IVV

- Emsland Group

- ADM

- GOODMILLS Innovation

- Others