Global Lactic Starter Culture Market Size, Share, And Business Benefits By Type (Mesophilic Starter Cultures, Thermophilic Starter Cultures, Probiotic Starter Cultures, Others), By Form (Freeze-Dried, Frozen Concentrates, Liquid Cultures), By Application (Dairy Products, Bakery Products, Fermented Beverages, Meat Products, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153705

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

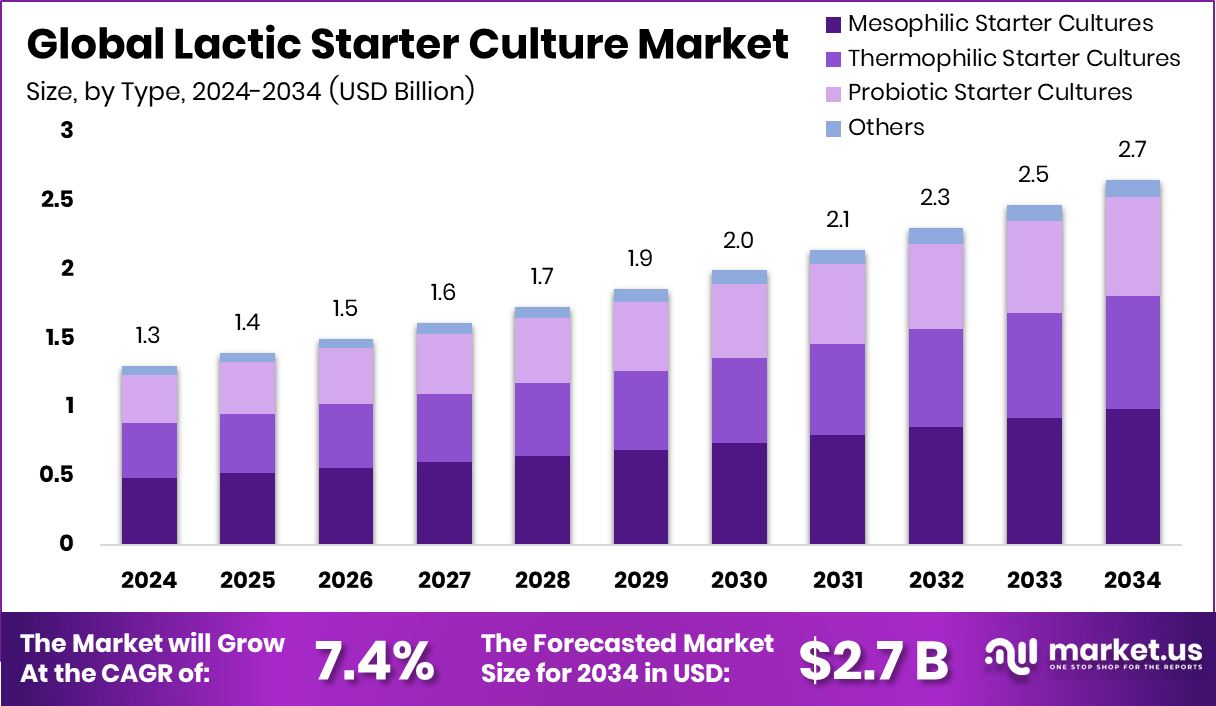

The Global Lactic Starter Culture Market is expected to be worth around USD 2.7 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 7.4% from 2025 to 2034. Demand in North America 48.2% rose steadily due to preference for natural fermentation methods.

Lactic Starter Culture refers to a group of beneficial bacteria primarily used in the fermentation of dairy and food products. These cultures, mainly consisting of Lactobacillus, Lactococcus, and Streptococcus species, convert lactose and other sugars into lactic acid. This acidification process not only helps in preserving food but also enhances its flavor, texture, and digestibility. Commonly used in products like yogurt, cheese, sour cream, and fermented beverages, lactic starter cultures play a critical role in food safety and shelf-life extension by inhibiting the growth of harmful bacteria.

The Lactic Starter Culture Market comprises the global trade and utilization of these microbial cultures across various sectors such as dairy, bakery, meat processing, and beverages. This market includes both freeze-dried and frozen cultures offered in different formats to meet industrial and artisanal food production needs. It spans various end-user industries, including food processing units, commercial kitchens, and even probiotics-based nutritional product manufacturers.

One of the major growth factors driving this market is the rising consumer preference for fermented and functional foods. Growing awareness regarding gut health, natural preservation methods, and demand for clean-label food products is steadily increasing the adoption of lactic starter cultures in daily diets.

Demand is further strengthened by the expanding dairy and non-dairy alternatives market. As plant-based yogurts, cheeses, and probiotic drinks grow in popularity, the need for tailored microbial cultures suited for non-dairy fermentation is also rising, thereby widening application areas. According to an industry report, Doodhvale Farms, a dairy startup based in Delhi, has secured $3 million in funding. Stellapps, a dairy-tech company, has raised $26 million through its Series C funding round.

Key Takeaways

- The Global Lactic Starter Culture Market is expected to be worth around USD 2.7 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 7.4% from 2025 to 2034.

- Mesophilic starter cultures hold a 37.2% share in the Lactic Starter Culture Market due to versatility.

- Freeze-dried form dominates the Lactic Starter Culture Market with a 49.1% share due to long shelf life.

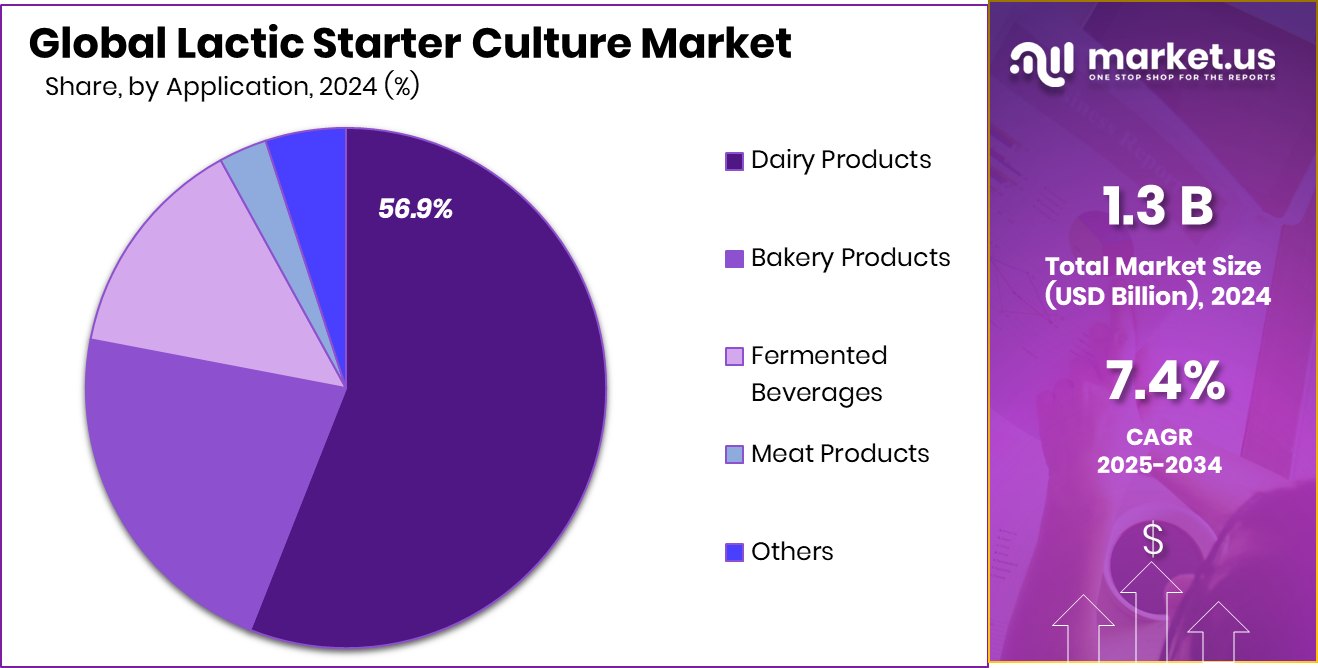

- Dairy products account for 56.9% of the Lactic Starter Culture Market applications owing to high global demand.

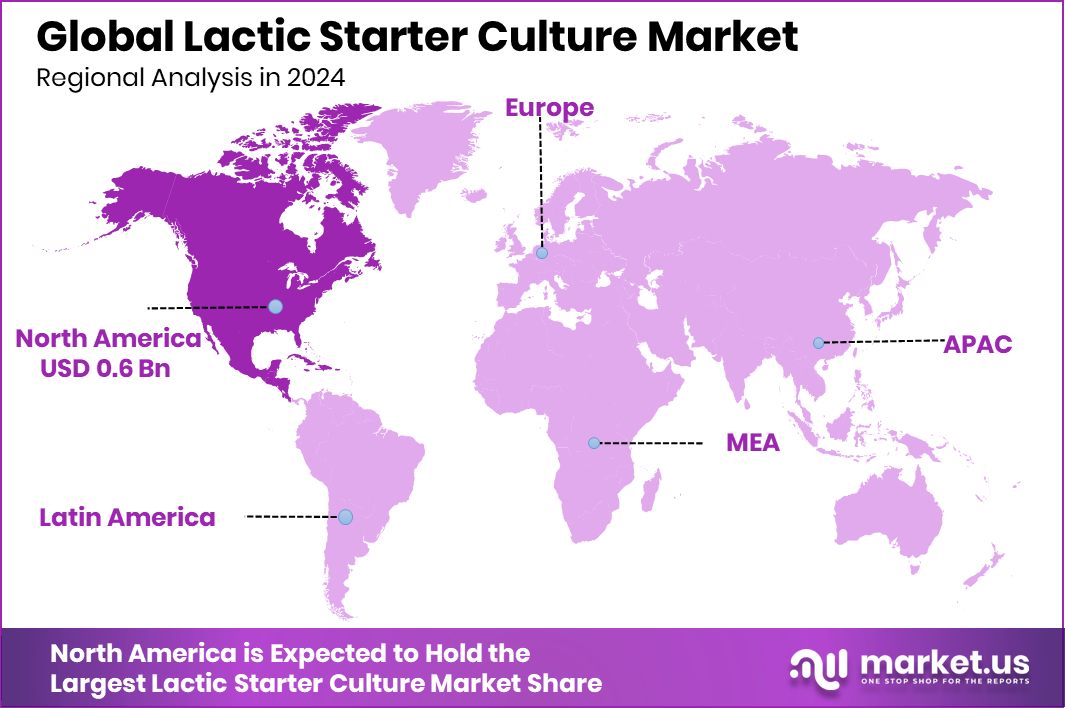

- The North America market was valued at USD 0.6 Bn, driven by dairy consumption.

By Type Analysis

Mesophilic cultures lead the Lactic Starter Culture Market with a 37.2% share.

In 2024, Mesophilic Starter Cultures held a dominant market position in the By Type segment of the Lactic Starter Culture Market, with a 37.2% share. This dominance is attributed to their widespread application in traditional dairy fermentation processes such as cheese, sour cream, and cultured butter.

Mesophilic cultures, which operate optimally at moderate temperatures, are favored for their reliability, consistent acidification, and contribution to desirable flavor profiles. Their adaptability in both artisanal and industrial production environments has supported steady demand, especially across regions with established dairy consumption habits.

The preference for mesophilic strains is also supported by their compatibility with common milk types and their proven role in ensuring product safety through natural pH reduction. Their ease of use and compatibility with a variety of fermentation equipment further strengthen their appeal to small and medium-sized food manufacturers. As consumer interest in traditional and clean-label fermented foods continues to grow, mesophilic cultures remain central to maintaining authenticity in product formulation.

By Form Analysis

Freeze-dried form dominates with 49.1% in the Lactic Starter Culture Market.

In 2024, Freeze-Dried held a dominant market position in the By Form segment of the Lactic Starter Culture Market, with a 49.1% share. This leading position can be attributed to the superior shelf life, stability, and ease of transportation offered by freeze-dried cultures. These cultures do not require refrigeration during shipping and storage, which reduces logistical challenges and costs, making them a preferred choice among manufacturers, particularly in regions with limited cold chain infrastructure.

The freeze-drying process preserves the viability and functionality of the bacteria, allowing for rapid activation upon rehydration. This feature ensures consistency in fermentation performance, a critical factor for maintaining quality standards in large-scale production. Food processors favor freeze-dried forms due to their convenience in dosing and extended usability, which supports operational efficiency and reduces waste.

With the increasing adoption of automated systems and precision fermentation in the food industry, freeze-dried lactic starter cultures align well with current production demands. Their ability to retain microbial potency even under fluctuating environmental conditions further solidifies their dominance in the market.

By Application Analysis

Dairy products hold a 56.9% share in the Lactic Starter Culture Market.

In 2024, Dairy Products held a dominant market position in the By Application segment of the Lactic Starter Culture Market, with a 56.9% share. This leadership is primarily driven by the widespread use of lactic starter cultures in traditional dairy processing, particularly in the production of cheese, yogurt, buttermilk, and sour cream. These products rely heavily on specific bacterial strains to achieve desired taste, texture, and shelf stability, making starter cultures an essential input in dairy manufacturing.

The 56.9% share also reflects the growing consumer demand for fermented dairy items, which are increasingly valued for their probiotic content and digestive benefits. Lactic starter cultures play a central role in developing these health-oriented characteristics while ensuring product safety through natural preservation. Their consistent performance and established efficacy in dairy fermentation processes make them the preferred choice for both small-scale producers and large commercial dairies.

The dominance of dairy applications also points to the continued strength of the global dairy industry, where traditional eating habits and expanding product lines have kept demand stable. As production technologies evolve, dairy manufacturers continue to depend on high-quality, well-characterized starter cultures to meet strict regulatory and quality standards, thereby reinforcing their position as the leading application area in this market.

Key Market Segments

By Type

- Mesophilic Starter Cultures

- Thermophilic Starter Cultures

- Probiotic Starter Cultures

- Others

By Form

- Freeze-Dried

- Frozen Concentrates

- Liquid Cultures

By Application

- Dairy Products

- Bakery Products

- Fermented Beverages

- Meat Products

- Others

Driving Factors

Rising Demand for Natural Food Preservation Methods

One of the main driving factors for the growth of the lactic starter culture market is the increasing demand for natural ways to preserve food. Consumers today are more cautious about what they eat and prefer products without artificial additives or chemical preservatives. Lactic starter cultures offer a clean-label solution by naturally producing lactic acid, which helps prevent spoilage and improves shelf life.

This not only enhances food safety but also supports the global trend toward healthier and minimally processed foods. Food manufacturers are using these cultures more often in dairy, bakery, and fermented products to meet this demand. As health-conscious eating becomes more common, natural preservation through starter cultures is gaining strong momentum in the food industry.

Restraining Factors

High Production and Storage Cost Limits Adoption

A key restraining factor in the lactic starter culture market is the high cost associated with the production, storage, and transportation of these microbial cultures. Maintaining the viability and effectiveness of the bacteria requires controlled conditions such as refrigeration or freeze-drying, which adds to operational expenses.

Small and medium-sized food producers often find it difficult to invest in such infrastructure, especially in developing regions. Additionally, the need for specialized packaging, quality control, and shelf-life maintenance further increases the overall cost. These factors make it challenging for new or cost-sensitive players to adopt lactic starter cultures at scale.

Growth Opportunity

Expansion into the Plant‑Based Fermented Foods Market

A major growth opportunity in the lactic starter culture market lies in its expansion into the plant‑based fermented foods segment. As more consumers adopt vegetarian, vegan, and flexitarian diets, demand is rising for dairy alternatives such as plant‑based yogurts, cheeses, kefirs, and beverages made from soy, almond, oat, coconut, and pea.

These products require carefully selected lactic starter cultures that are compatible with non‑dairy substrates and capable of delivering optimal texture, flavor, and targeted probiotic benefits. Development of specialized strains tailored for the fermentation of plant milks presents a significant avenue for culture suppliers to innovate and capture new demand

Latest Trends

Exopolysaccharide‑Producing Starter Cultures Drive Innovation

A notable emerging trend in the lactic starter culture market is the growing utilization of strains capable of producing exopolysaccharides (EPS). These naturally occurring compounds, synthesized by certain lactic acid bacteria, provide both sensory and health-related enhancements—such as improved texture, mouthfeel, and potential probiotic effects.

Producers of fermented foods are increasingly adopting EPS‑producing cultures to create smoother, creamier products without adding artificial stabilizers or emulsifiers. This aligns with consumer demand for clean‑label, minimally processed foods that offer functional benefits. Additionally, EPS presence can improve product stability and shelf life, supporting manufacturers in meeting quality expectations while maintaining natural formulations.

The trend supports novel applications across dairy and plant‑based fermentations where texture and mouthfeel are critical. By selecting and fostering starter cultures with optimized EPS output, formulators can distinguish products in a competitive market. As the food industry advances toward solutions that pair sensory excellence with health value, this innovation in microbial functionality represents a forward‑looking opportunity for culture suppliers and processors alike.

Regional Analysis

North America led the lactic starter culture market with a 48.2% share in 2024.

In 2024, North America held a dominant position in the lactic starter culture market, accounting for 48.2% of the global share, valued at USD 0.6 billion. This leading position is supported by high dairy consumption, strong presence of commercial dairy processors, and rising preference for natural fermentation processes across the region. The adoption of clean-label food products and increased awareness of gut health have further fueled the use of lactic starter cultures in North American food industries.

In Europe, the market continues to show steady growth, driven by traditional fermented food practices and a well-established dairy processing infrastructure. Countries in Western Europe, in particular, maintain a consistent demand for starter cultures in both artisanal and industrial applications.

The Asia Pacific region is witnessing growing interest in fermented foods, supported by urbanization and expanding consumer awareness, while Latin America shows gradual growth as food safety and shelf-life concerns drive interest in natural preservation. In the Middle East & Africa, market uptake remains emerging, with cultural dairy consumption and climatic preservation needs contributing to niche demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Danone S.A. continues to be a leading force in the fermentation-based dairy sector, leveraging its expertise in fermented milk products and yogurt. Its sustained investment in probiotic strain development has allowed it to reinforce its portfolio of health-oriented dairy products and support growing consumer demand for gut health.

Lallemand Inc., known for its specialization in microbiological fermentation, has strengthened its presence by offering a wide range of lactic acid bacteria strains for dairy, meat, and vegetable fermentation. In 2024, the company emphasized the diversification of its bacterial portfolio and expanded its reach into emerging markets, addressing the growing demand for natural preservation and flavor enhancement.

Sacco System S.R.L., a family-owned enterprise, has continued to gain prominence through its comprehensive range of freeze-dried lactic cultures and customized fermentation solutions. In 2024, its efforts were particularly focused on expanding R&D collaborations and supporting artisan cheese and yogurt producers with tailored culture blends, enhancing its foothold in premium and niche dairy segments.

Top Key Players in the Market

- Danone S.A.

- Novonesis Group

- Lallemand Inc.

- Sacco System S.R.L.

- Kerry Group plc

- Lesaffre International

- Meiji Holdings Co., Ltd.

Recent Developments

- In October 2024, Danone introduced “Actimel+ Triple Actions” across 20 European countries. This yogurt shot is fortified with vitamins B6, C, and D, plus magnesium, and contains L. casei probiotic cultures to support gut health and immunity. It represents a fusion of traditional fermentation cultures with functional nutrition.

- In September 2024, Lallemand inaugurated new research and development labs in Blagnac (Toulouse region), expanding its capacity by over 800 m². The investment of approximately €1.7 million supports integrated research across business units, including Specialty Cultures, which covers lactic starter cultures for fermented foods. These upgraded facilities are intended to accelerate the development of next‑generation microbial strains, including novel lactic acid bacteria.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.7 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Mesophilic Starter Cultures, Thermophilic Starter Cultures, Probiotic Starter Cultures, Others), By Form (Freeze-Dried, Frozen Concentrates, Liquid Cultures), By Application (Dairy Products, Bakery Products, Fermented Beverages, Meat Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Danone S.A., Novonesis Group, Lallemand Inc., Sacco System S.R.L., Kerry Group plc, Lesaffre International, Meiji Holdings Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lactic Starter Culture MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Lactic Starter Culture MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Danone S.A.

- Novonesis Group

- Lallemand Inc.

- Sacco System S.R.L.

- Kerry Group plc

- Lesaffre International

- Meiji Holdings Co., Ltd.