Global Juices Market Size, Share, And Enhanced Productivity By Product Type (100% Juice, Juice Drinks (up to 24% Juice), Juice Concentrates, Nectars), By Packaging Type (Aseptic Packages, Glass Bottles, Metal Can, PET Bottles, Disposable Cups and Pouches), By Category (Conventional, Organic), By Distribution Channel (Off-Trade (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others), On-Trade), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174052

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

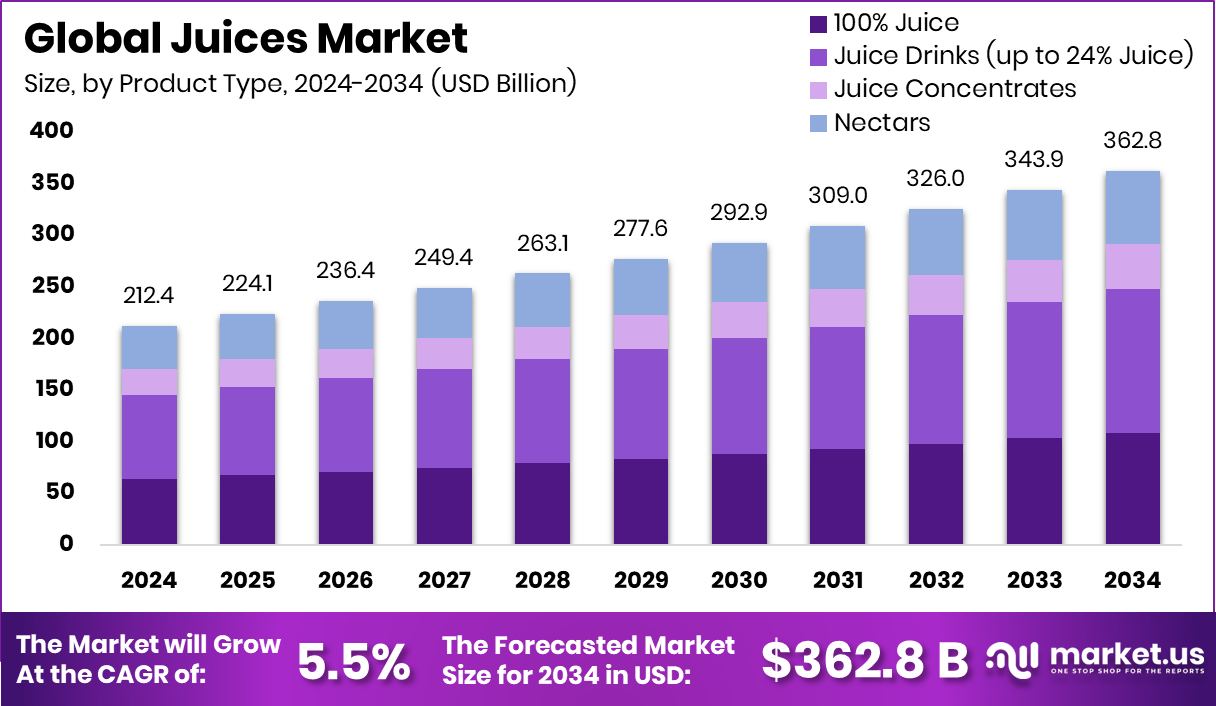

The Global Juices Market is expected to be worth around USD 362.8 billion by 2034, up from USD 212.4 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034. Strong consumption makes Asia Pacific lead Juices Market at 38.9%, USD 82.6 Bn.

Juices are beverages made by extracting liquid from fruits or vegetables, offering natural taste, hydration, and basic nutrition. They are consumed fresh or in packaged forms and are widely used at home, workplaces, and foodservice outlets. Juices can be pure, blended, or lightly diluted, depending on consumer preference and price sensitivity. Their appeal lies in convenience, flavor variety, and everyday consumption across age groups.

The Juices Market refers to the production, packaging, distribution, and sale of fruit- and vegetable-based drinks across retail and foodservice channels. It includes fresh juices, packaged juices, and ready-to-drink formats sold through off-trade and on-trade outlets. Market growth is shaped by lifestyle changes, urbanization, and rising demand for convenient beverages. In many regions, government support has strengthened infrastructure, such as the NSW government granting Grove Juice USD 2.5 million to install a new bottling line, improving supply capacity.

Growth factors for the juices market include rising health awareness, improved cold-chain logistics, and brand innovation. Investment activity reflects this momentum, with Alienkind raising USD 1.2 million in seed funding, Nomva closing a USD 3 million round, and Raw Pressery securing USD 4.5 million to scale operations. These funds support processing, packaging upgrades, and wider market reach.

Demand continues to rise due to busy lifestyles and preference for ready-to-drink beverages. In Southeast Asia, Being Juice secured USD 1 million in seed funding for rapid expansion, while another founder-led juice brand also raised USD 1 million, showing strong regional consumption trends and repeat purchase behavior.

Opportunities are emerging through innovation, technology, and financing ecosystems. While not beverage producers, funding platforms such as Juice raising €29.4 million, Juice securing £25 million, and Creative Juice launching a USD 50 million fund alongside a USD 15 million Series A indirectly support juice brands and creators through capital access. These financial flows enable scaling, digital marketing, and new product development across the juice ecosystem.

Key Takeaways

- The Global Juices Market is expected to be worth around USD 362.8 billion by 2034, up from USD 212.4 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

- In the Juices Market, juice drinks up to 24% juice lead types with 38.4% share.

- Aseptic packages dominate packaging preferences in the Juices Market, accounting for a strong 37.10% share.

- Conventional offerings remain dominant in the Juices Market, representing 83.5% of total category consumption globally.

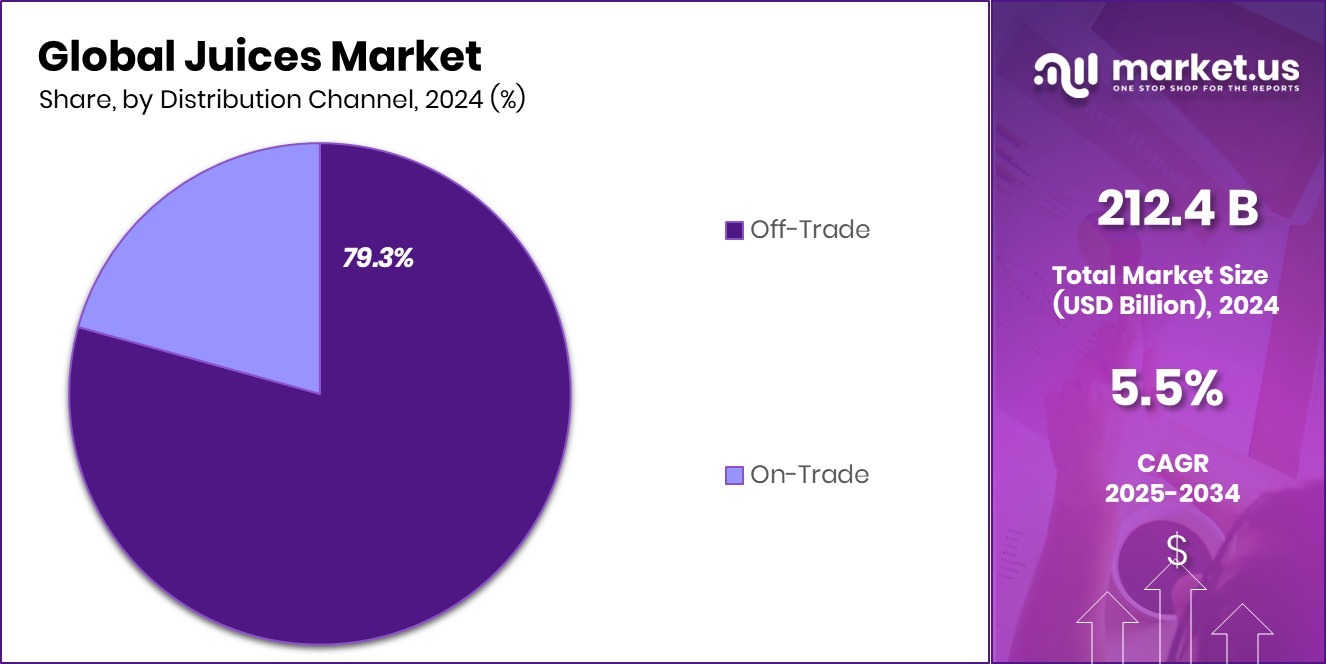

- Off-trade channels lead Juices Market distribution, capturing 79.3% share through retail-led consumer purchasing behavior trends.

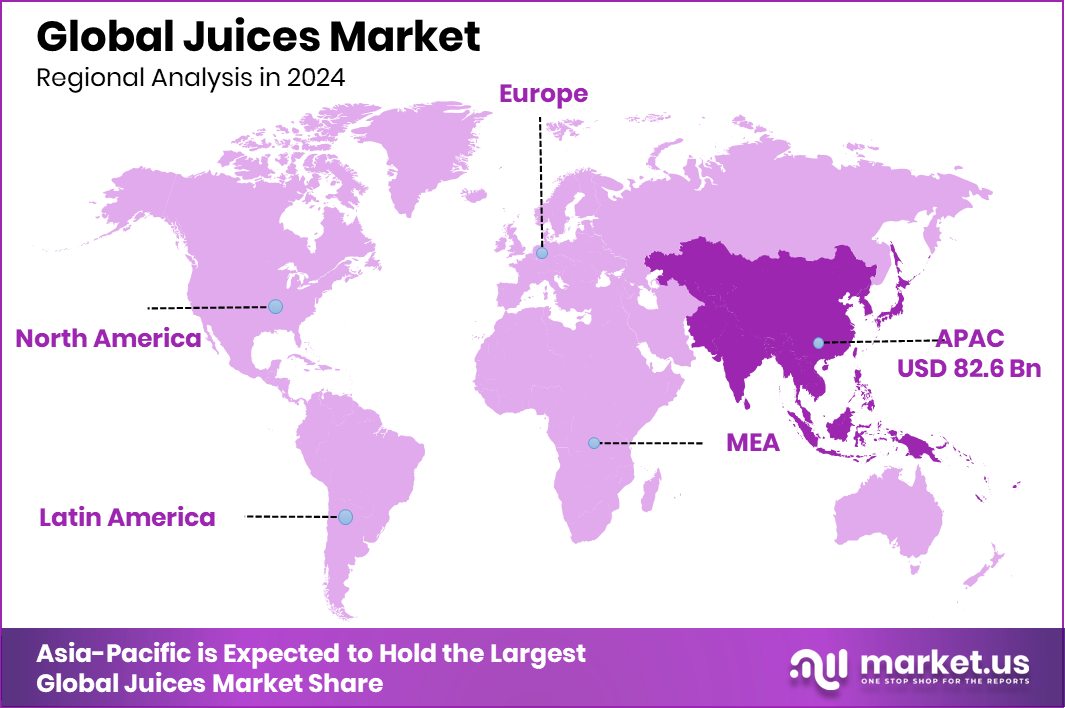

- In Asia Pacific, Juices Market reached USD 82.6 Bn, accounting for 38.9% globally.

By Product Type Analysis

In Juices Market, juice drinks up to 24% juice hold 38.4% share.

In 2024, the Juices Market saw Juice Drinks (up to 24% juice) hold a strong 38.4% share by product type, reflecting rising consumer demand for affordable, flavored, and lightly fruit-based beverages that balance taste, convenience, and cost. These products appeal especially to urban households and younger consumers who prefer ready-to-drink options with longer shelf life and consistent flavor.

Manufacturers continued to focus on fortification, flavor innovation, and attractive pricing to expand volume sales, while retailers promoted multipacks and value offerings. The segment also benefited from rising on-the-go consumption, school and workplace demand, and growing acceptance of blended juice beverages across both developed and emerging economies.

By Packaging Type Analysis

In Juices Market, aseptic packages dominate packaging type with 37.10% share globally.

In 2024, the Juices Market was strongly influenced by aseptic packages, which accounted for 37.10% of total packaging share, driven by their ability to preserve product quality without refrigeration or preservatives. Aseptic packaging supports longer shelf life, reduced food waste, and efficient transportation, making it highly attractive for manufacturers and distributors. Its lightweight structure lowers logistics costs and carbon footprint, aligning with sustainability goals.

Consumers increasingly prefer aseptic packs due to their convenience, portability, and safety perception. Brand owners also used advanced printing on aseptic cartons to improve shelf visibility and communication of health claims, further strengthening adoption across retail formats.

By Category Analysis

In Juices Market, conventional category leads consumption patterns with overwhelming 83.5% share.

In 2024, the Juices Market remained largely dominated by the conventional category, which captured a substantial 83.5% share, highlighting the continued reliance on mainstream production methods and wide consumer acceptance. Conventional juices benefit from established supply chains, consistent raw material availability, and lower production costs compared to organic alternatives.

Price sensitivity in many regions supported higher volumes of conventional products, especially in mass retail channels. Manufacturers focused on incremental improvements such as reduced sugar variants and vitamin enrichment rather than full organic conversion. This dominance reflects the balance between affordability and familiarity, particularly in high-population and price-conscious markets.

By Distribution Channel Analysis

In Juices Market, off-trade channels remain primary distribution route holding 79.3% share.

In 2024, the Juices Market was heavily driven by off-trade distribution channels, which accounted for 79.3% of total sales, underscoring the importance of supermarkets, hypermarkets, convenience stores, and online retail. Consumers preferred off-trade purchases due to wider product variety, promotional pricing, and bulk buying options.

Retail chains invested in private-label juice offerings, further strengthening off-trade volumes. Growth in e-commerce grocery platforms also supported this channel by offering doorstep delivery and subscription models. The strong off-trade dominance reflects changing shopping habits, increased at-home consumption, and the convenience of organized retail formats.

Key Market Segments

By Product Type

- 100% Juice

- Juice Drinks (up to 24% Juice)

- Juice Concentrates

- Nectars

By Packaging Type

- Aseptic Packages

- Glass Bottles

- Metal Can

- PET Bottles

- Disposable Cups and Pouches

By Category

- Conventional

- Organic

By Distribution Channel

- Off-Trade

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

- On-Trade

Driving Factors

Rising Investment And Health Innovation Drive Demand

The Juices Market is strongly driven by growing investment interest and product innovation focused on healthier consumption. Brands are attracting capital to expand retail presence and modernize operations, which directly supports market growth. For example, Joe & the Juice targeting a USD 2.4 billion IPO backed by General Atlantic highlights strong investor confidence in juice-led beverage models.

At the same time, product-side innovation is reshaping demand, as seen with MinusSugar raising USD 2.5 million to remove sugar without losing taste. This supports consumer demand for better-for-you juices without compromising flavor. Together, large-scale capital inflow and technical breakthroughs are making juices more accessible, scalable, and aligned with modern health expectations, pushing steady demand across urban and premium consumption segments.

Restraining Factors

High Innovation Costs And Sustainability Pressures Restrain Growth

One key restraint in the Juices Market is the rising cost of technology, data, and sustainability-driven innovation. Companies increasingly rely on advanced tools such as AI, digital engagement platforms, and alternative ingredient research, which require heavy upfront spending. This is reflected in Nectar Social raising USD 10.6 million to build consumer engagement technology, showing how marketing and data costs are rising.

In parallel, sustainability pressures add complexity, as seen with the Bezos Earth Fund investing USD 2 million into AI-based projects for better-tasting sustainable proteins. While these efforts support long-term goals, they increase operational costs and slow profitability for juice producers, especially smaller players managing tight margins.

Growth Opportunity

Technology And Sustainable Nutrition Create New Opportunities

A major growth opportunity in the Juices Market lies in combining technology with sustainable nutrition development. Juice brands increasingly explore AI, data science, and ingredient optimization to improve taste, nutrition, and sourcing efficiency. This trend is supported by Food System Innovations receiving USD 2 million from the Bezos Earth Fund to improve sustainable proteins using AI, opening pathways for juice fortification and alternative ingredients.

At the same time, Nectar Social emerging from stealth with USD 10.6 million in funding enables brands to better understand consumers and personalize juice offerings. These developments create opportunities for smarter product design, cleaner labels, and stronger consumer loyalty across health-focused markets.

Latest Trends

Nutrition Focus And Climate-Ready Supply Shape Trends

The latest trend in the Juices Market is the growing link between nutrition outcomes and resilient supply chains. Governments and health systems increasingly recognize nutrition’s role in public health, with studies showing that stronger nutrition focus could save 3.7 million lives by 2025, driving demand for nutrient-rich juices.

On the supply side, Sahyadri Farms securing USD 47.8 million supports climate-resilient crops and processing capacity, ensuring stable fruit availability. While not directly juice-related, large-scale infrastructure funding like Mazoon Mining’s USD 270 million financing reflects broader investment momentum supporting industrial ecosystems. Together, nutrition-driven demand and resilient sourcing define the market’s current direction.

Regional Analysis

Asia Pacific dominates Juices Market with 38.9% share valued at USD 82.6 Bn.

The Juices Market shows clear regional variation across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, shaped by consumption habits, retail maturity, and product accessibility.

Asia Pacific dominates the global landscape, accounting for 38.9% of total market share and reaching a value of USD 82.6 Bn, supported by large population bases, rising urbanization, and strong demand for affordable packaged juice products. High household penetration and frequent off-trade purchases sustain volume growth across both developed and emerging economies in the region.

North America represents a mature juices market, characterized by stable consumption patterns and a strong preference for packaged and ready-to-drink formats distributed through organized retail channels. Europe reflects consistent demand driven by established juice consumption culture and widespread retail availability, with steady replacement purchases supporting market continuity.

The Middle East & Africa market is influenced by growing urban populations and increasing availability of packaged beverages through expanding retail networks. Latin America shows steady market presence, supported by fruit availability and traditional juice consumption habits, particularly in household settings.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Coca-Cola Company plays a central role in the global Juices Market in 2024 through its broad beverage portfolio, global bottling system, and strong retail penetration. From an analyst perspective, the company benefits from deep distribution reach across off-trade channels, allowing juice products to achieve high visibility and consistent availability. Its scale supports efficient sourcing, packaging optimization, and pricing flexibility, which helps maintain volumes across both mature and developing markets. Brand trust and long-standing consumer relationships further strengthen its competitive position in everyday juice consumption.

PepsiCo Inc. remains a key player in the Juices Market by leveraging its integrated food and beverage ecosystem. Analysts note that PepsiCo’s strength lies in combining beverage sales with strong retail partnerships, enabling effective shelf placement and promotional execution. Its operational scale supports steady supply, while its experience in packaged beverages helps maintain quality consistency. The company’s ability to align juice offerings with evolving consumer preferences supports stable performance within its broader non-carbonated beverage portfolio.

Tropicana Brands Group stands out as a focused juice specialist, giving it a distinct position in the global market. From an analyst viewpoint, its category specialization allows strong brand identity and deep consumer association with fruit juice products. The company emphasizes product familiarity and everyday consumption, supporting loyalty in household purchases. This focused approach enables Tropicana Brands Group to remain a relevant and influential player in the global Juices Market during 2024.

Top Key Players in the Market

- The Coca-Cola Company

- PepsiCo Inc.

- Tropicana Brands Group

- Keurig Dr Pepper Inc.

- Suntory Holdings Ltd.

- Nongfu Spring Co. Ltd.

- Britvic plc

- Eckes-Granini Group GmbH

- Thai Beverage PCL

- Uni-President Enterprises Corp.

- Rauch Fruchtsäfte GmbH & Co OG

Recent Developments

- In February 2025, Keurig Dr Pepper unveiled a 2025 flavor lineup across its cold beverage portfolio that includes fruit-oriented and juice-related innovations under brands such as Snapple (a ready-to-drink juice and tea brand) and Bai (hydration drinks with fruit flavors). This lineup adds new fruit and juice-inspired choices, reflecting a focus on expanding juice and fruit flavors in its portfolio.

- In June 2024, Suntory Holdings and its subsidiary Suntory Beverage & Food Europe signed a partnership with agricultural research group CIRAD to fight orange tree disease affecting citrus fruit supply. This work aims to support healthy orange crops, which are essential for orange juices and orange-based beverages sold in markets like France, Belgium, and Spain.

Report Scope

Report Features Description Market Value (2024) USD 212.4 Billion Forecast Revenue (2034) USD 362.8 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (100% Juice, Juice Drinks (up to 24% Juice), Juice Concentrates, Nectars), By Packaging Type (Aseptic Packages, Glass Bottles, Metal Can, PET Bottles, Disposable Cups and Pouches), By Category (Conventional, Organic), By Distribution Channel (Off-Trade (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others), On-Trade) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape The Coca-Cola Company, PepsiCo Inc., Tropicana Brands Group, Keurig Dr Pepper Inc., Suntory Holdings Ltd., Nongfu Spring Co. Ltd., Britvic plc, Eckes-Granini Group GmbH, Thai Beverage PCL, Uni-President Enterprises Corp., Rauch Fruchtsäfte GmbH & Co OG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The Coca-Cola Company

- PepsiCo Inc.

- Tropicana Brands Group

- Keurig Dr Pepper Inc.

- Suntory Holdings Ltd.

- Nongfu Spring Co. Ltd.

- Britvic plc

- Eckes-Granini Group GmbH

- Thai Beverage PCL

- Uni-President Enterprises Corp.

- Rauch Fruchtsäfte GmbH & Co OG