Global Juice Concentrate Market Size, Share, And Business Benefits By Type (Fruit Concentrates(Orange, Lemon, Grapefruit, Berries, Strawberry, Mango, Pineapple, Banana, Passion Fruit, Others), Vegetable Concentrates (Carrot, Tomato, Beetroot, Cucumber, Others)), By Form (Liquid, Powder, Granular), By End Use (Food and Beverages (Bakery and Confectionery, Jams and Spreads, Dairy and Frozen Desserts, Alcoholic Beverages, Dietary Supplements, Others), Retail/Household, Cosmetics and Personal Care, Others), By Distribution Channel (B2B, B2C (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online Retail, Others)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145622

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

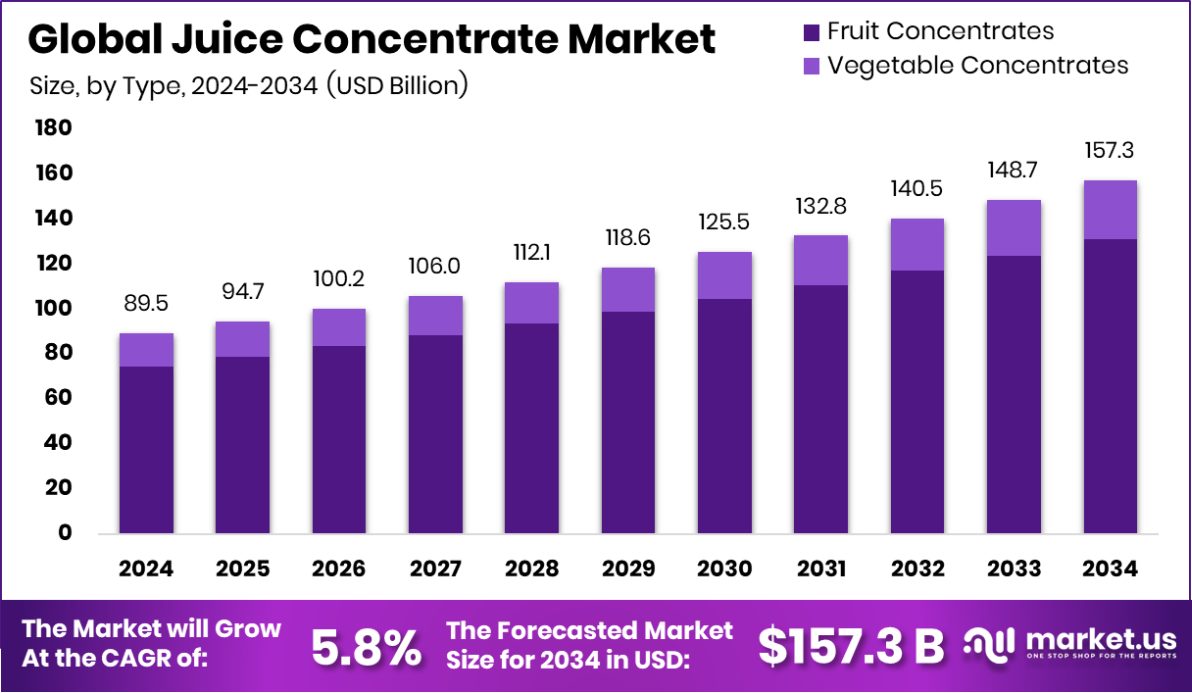

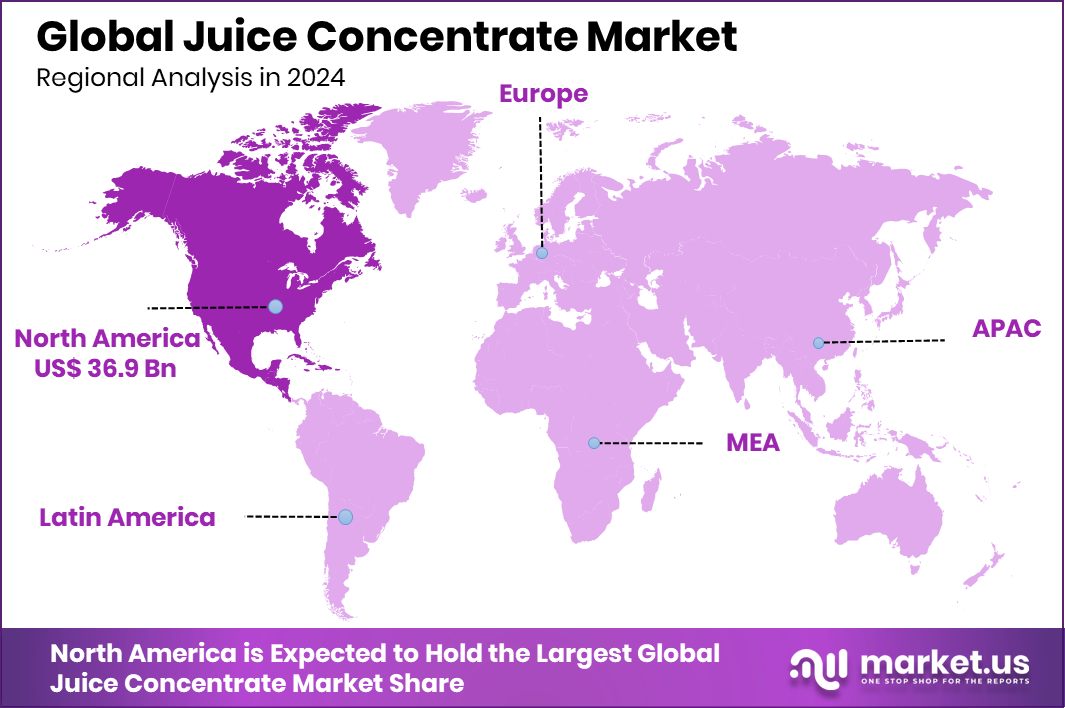

The Global Juice Concentrate Market is expected to be worth around USD 157.3 billion by 2034, up from USD 89.5 billion in 2024, and grow at a CAGR of 5.8% from 2025 to 2034. With 41.30% market share, North America’s Juice Concentrate Market is USD 36.9 Bn strong.

Juice concentrate is a product derived from fruits and vegetables that have been processed to remove most of their water content. This leaves a thick, rich extract that can be stored and transported more efficiently than fresh juice. Juice concentrates are often reconstituted by adding water before consumption, and they serve as a key ingredient in beverages, foods, and various culinary preparations.

The Juice Concentrate Market refers to the commercial industry focused on the production, distribution, and sale of these concentrated products. This market caters to a diverse range of sectors, including food and beverage manufacturing, hospitality, healthcare, and retail, providing a versatile ingredient that enhances flavor and nutritional content in a wide array of products.

One significant growth factor for the juice concentrate market is the rising demand for convenient and long-lasting food products. Juice concentrates offer an extended shelf life and reduced shipping costs, making them a cost-effective solution for manufacturers and consumers alike.

Demand for juice concentrates is also driven by their widespread use in the health and wellness industry. As consumers become more health-conscious, the demand for natural and nutrient-rich ingredients has risen. Juice concentrates are rich in vitamins and minerals and are often used in supplements, functional foods, and health drinks.

Key Takeaways

- The Global Juice Concentrate Market is expected to be worth around USD 157.3 billion by 2034, up from USD 89.5 billion in 2024, and grow at a CAGR of 5.8% from 2025 to 2034.

- In the Juice Concentrate Market, fruit concentrates dominate with a substantial 83.40% share.

- Liquid form juice concentrates lead, accounting for 67.40% of the market’s preference.

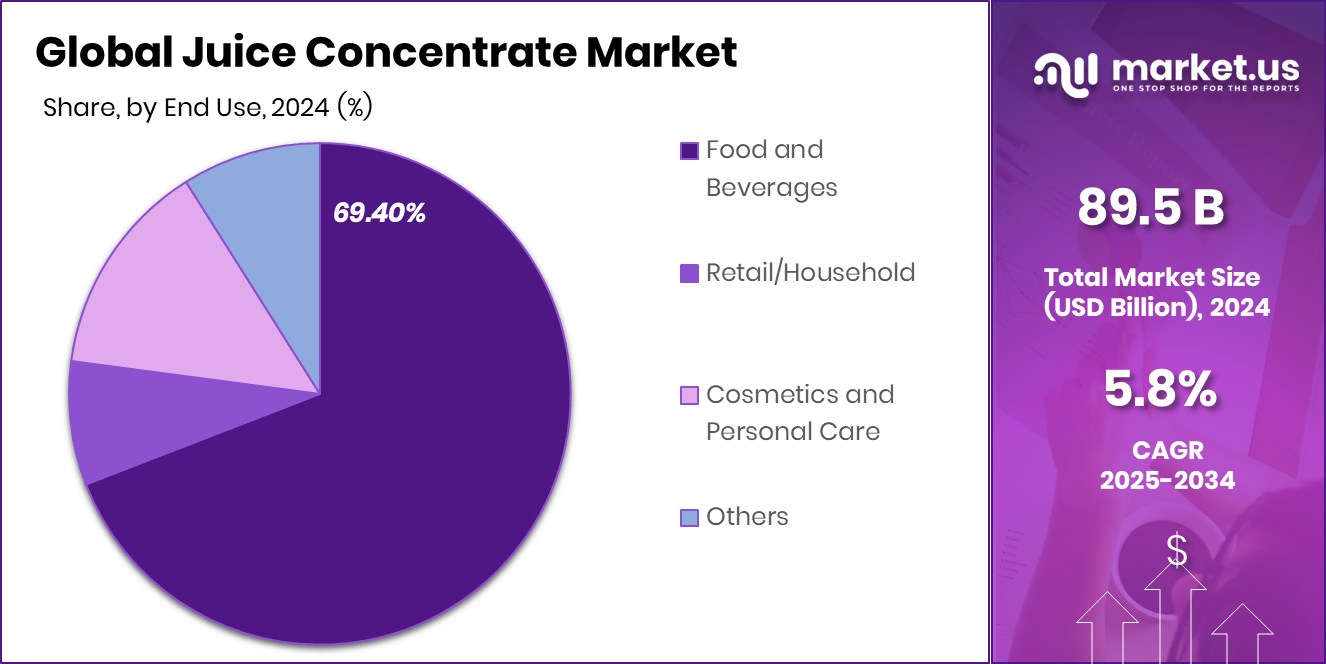

- The food and beverages sector is the major end-user, holding 69.40% of the market.

- Business-to-business transactions represent the largest distribution channel at 73.50% in this market.

- In North America, the Juice Concentrate Market reaches USD 36.9 Bn, a 41.30% share.

By Type Analysis

Fruit Concentrates dominate the Juice Concentrate Market by 83.40% in Type.

In 2024, Fruit Concentrates held a dominant market position in the By Type segment of the Juice Concentrate Market, capturing an 83.40% share. This substantial market share underscores the robust demand for fruit concentrates among consumers seeking natural and flavorful ingredients for beverages, culinary applications, and dietary supplements.

The preference for fruit concentrates can be attributed to their convenience, extended shelf life, and ability to retain most of the fruit’s flavor and nutritional benefits. As consumers increasingly lean toward healthier dietary choices and clean-label products, fruit concentrates have emerged as a preferred option over artificial flavorings and additives.

This trend is reflective of a broader shift in consumer behavior, where there is a growing inclination toward products that offer nutritional benefits without compromising on taste. The market dynamics suggest a stable growth trajectory for fruit concentrates, driven by their versatile applications across various industries, including food and beverage, pharmaceuticals, and nutraceuticals.

By Form Analysis

Liquid form leads in the Juice Concentrate Market with a 67.40% share.

In 2024, Liquid held a dominant market position in the By Form segment of the Juice Concentrate Market, with a 67.40% share. This significant market share highlights the strong preference for liquid juice concentrates over other forms, such as powder. The liquid form’s popularity is primarily due to its ease of use, efficient storage, and transportation capabilities, making it a preferred choice for both industrial manufacturers and retail consumers.

The preference for liquid juice concentrates is also driven by their application versatility in a range of products including soft drinks, cocktails, and culinary recipes, where they serve as a crucial ingredient for enhancing flavor and richness. The market’s inclination towards the liquid form is expected to be sustained, given its practical benefits in commercial settings, where quick and effective solutions are paramount.

This dominance in the market underscores the strategic importance for companies operating in the Juice Concentrate Market to focus on innovation in liquid concentrate production techniques to enhance quality and expand application areas, thereby catering to the evolving consumer preferences and boosting market growth.

By End-Use Analysis

The food and Beverages sector leads End Use with 69.40% market share.

In 2024, Food and Beverages held a dominant market position in the By End Use segment of the Juice Concentrate Market, capturing a 69.40% share. This prominent position reflects the extensive use of juice concentrates within the food and beverage industry, where they are a key ingredient in products ranging from soft drinks and cocktails to sauces and baked goods.

Juice concentrates are favored in food and beverage applications not only for their flavor enhancement but also for their contribution to the color and texture of the final products, making them integral to creating appealing and delicious items. Additionally, the shift toward more natural and less processed foods has bolstered the adoption of juice concentrates as a preferred alternative to artificial flavors and sweeteners.

The dominance of food and beverages in the juice concentrate market underscores the ongoing need for innovation in flavor profiles and applications, suggesting that companies should continue to invest in R&D to meet evolving consumer tastes and preferences while maintaining the high standards of quality and sustainability demanded by the market.

By Distribution Channel Analysis

B2B channel holds a dominant 73.50% share in distribution channels.

In 2024, B2B held a dominant market position in the By Distribution Channel segment of the Juice Concentrate Market, with a 73.50% share. This dominance underscores the significant reliance of businesses on bulk purchases of juice concentrates for manufacturing processes.

The B2B channel’s prominence is largely attributed to the extensive use of juice concentrates by food and beverage manufacturers who incorporate these products into various items ranging from beverages to culinary dishes and confectioneries.

The strong position of the B2B channel is driven by the cost-efficiencies and logistical advantages it offers to businesses. Bulk purchasing allows companies to benefit from lower prices and economies of scale, which is crucial in managing production costs and enhancing profitability.

Additionally, the direct relationships established through B2B transactions ensure a stable supply chain and allow for more customized product formulations tailored to specific business needs.

Key Market Segments

By Type

- Fruit Concentrates

- Orange

- Lemon

- Grapefruit

- Berries

- Strawberry

- Mango

- Pineapple

- Banana

- Passion Fruit

- Others

- Vegetable Concentrates

- Carrot

- Tomato

- Beetroot

- Cucumber

- Others

By Form

- Liquid

- Powder

- Granular

By End Use

- Food and Beverages

- Bakery and Confectionery

- Jams and Spreads

- Dairy and Frozen Desserts

- Alcoholic Beverages

- Dietary Supplements

- Others

- Retail/Household

- Cosmetics and Personal Care

- Others

By Distribution Channel

- B2B

- B2C

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retail

- Others

Driving Factors

Growing Demand for Natural Beverage Ingredients

The Juice Concentrate Market is primarily driven by the increasing consumer demand for natural and healthier beverage options. As awareness of health benefits associated with natural ingredients grows, more consumers are shifting away from artificial flavors and sweeteners.

Juice concentrates offer a convenient and natural way to enhance flavor without compromising on health, making them highly popular in the production of juices, smoothies, and other beverages.

This trend is further supported by the clean label movement, where consumers seek products with easily understandable ingredients. The versatility of juice concentrates in flavoring and their extended shelf life also make them appealing to both manufacturers and consumers, fueling the market’s growth.

Restraining Factors

High Cost of Production and Storage

One of the main restraining factors in the Juice Concentrate Market is the high cost associated with the production and storage of juice concentrates. Producing juice concentrates involves removing a significant amount of water from fresh fruits, which requires extensive energy and advanced technology.

This process not only increases production costs but also impacts the pricing of the final product, making it less competitive against fresh juices or other beverage alternatives. Additionally, juice concentrates need to be stored in specific conditions to maintain their quality and prevent spoilage, further adding to the operational costs.

These factors can deter manufacturers from entering the market or expanding their range, ultimately restraining market growth.

Growth Opportunity

Expanding into Emerging Markets Boosts Potential

A significant growth opportunity for the Juice Concentrate Market lies in expanding into emerging markets. As economies in regions like Asia, Africa, and South America continue to grow, so does the middle-class population with disposable income to spend on premium food and beverage products.

This demographic shift presents a ripe opportunity for juice concentrate manufacturers to introduce their products to new consumers who are increasingly health-conscious and interested in convenient, natural food options.

Furthermore, the growing urbanization and busy lifestyles in these regions drive demand for quick and easy meal solutions, where juice concentrates can play a key role. Capitalizing on these trends by entering emerging markets could significantly expand the customer base and boost market growth.

Latest Trends

Rise of Functional Beverages Shapes Market Trends

A prominent trend in the Juice Concentrate Market is the rise of functional beverages, which are drinks enhanced with vitamins, minerals, and other beneficial ingredients to offer health benefits beyond basic nutrition. Juice concentrates are increasingly being used as a key component in these beverages to provide natural flavors and added health benefits without artificial additives.

This trend is driven by growing consumer awareness about health and wellness and the desire for beverages that not only taste good but also contribute to personal health objectives like improved immunity, energy, and overall well-being.

As a result, manufacturers are innovating their product offerings to include juice concentrates in a variety of functional beverages, tapping into consumer demands for health-oriented products.

Regional Analysis

North America holds 41.30% of the Juice Concentrate Market, valued at USD 36.9 Bn.

The Juice Concentrate Market is segmented into several key regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Dominating the market, North America holds a substantial share of 41.30%, valued at USD 36.9 billion, driven by a high demand for health-conscious beverage options and a robust food and beverage industry.

Europe follows, where the market benefits from strong consumer preferences for natural and organic products, enhancing the demand for juice concentrates in both retail and commercial sectors. Asia Pacific presents significant growth opportunities attributed to rising disposable incomes and urbanization, which increases demand for convenient and healthier food choices.

The market in the Middle East & Africa is gradually expanding, with an increasing awareness of health and wellness influencing consumer choices towards juice concentrates. Latin America, though smaller in comparison, is seeing a shift as consumers increasingly opt for nutritious beverage alternatives.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Juice Concentrate Market sees significant contributions from key players like Tropicana Products, Sunkist Growers, and Ceres Fruit Juices, each bringing unique strengths to the industry.

Tropicana Products continues to be a leader in the market, leveraging its long-standing brand reputation and extensive distribution network. The company’s focus on innovation, particularly in low-sugar and fortified products, aligns well with the global trend toward healthier lifestyle choices. Tropicana’s ability to maintain high-quality standards and consumer trust plays a crucial role in its dominance, especially in North America and Europe, where the demand for premium juice products is high.

Sunkist Growers, traditionally known for their citrus-based products, capitalizes on their cooperative business model to ensure freshness and quality, directly sourcing from growers. This approach not only enhances product quality but also allows Sunkist to effectively control supply chain costs. Their strong focus on sustainability and traceability appeals to environmentally conscious consumers, further strengthening their market position.

Ceres Fruit Juices stands out in the international market, especially in regions like Europe and Asia Pacific, with its wide range of exotic fruit concentrates. The company’s commitment to using no preservatives or artificial colors resonates with the growing consumer demand for clean-label products. Ceres’s strategic marketing and diverse product offerings enable it to capture a niche market that prefers unique and natural juice flavors.

Top Key Players in the Market

- Suntory Beverage and Food

- Langers Juice Company

- CocaCola

- Doehler

- Tropicana Products

- Sunkist Growers

- Ceres Fruit Juices

- Blue Diamond Growers

- Tree Top

- Dole Food Company

- Kraft Heinz

- PepsiCo

- Rich Products Corporation

Recent Developments

- In August 2024, Langers released a new line of Agua Fresca drinks in three flavors: Strawberry Hibiscus, Mango Lime, and Cucumber Lime. These beverages aim to deliver refreshing and vibrant taste profiles inspired by traditional Latin American beverages.

- In April 2024, Suntory Beverage & Food Hong Kong introduced Suntory Oolong Tea and Suntory Jasmine Oolong Tea to the Hong Kong market. These products quickly gained popularity among consumers and earned the company the Consumer Good of the Year (Tea) award at the FMCG Asia Awards 2024.

Report Scope

Report Features Description Market Value (2024) USD 89.5 Billion Forecast Revenue (2034) USD 157.3 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Fruit Concentrates(Orange, Lemon, Grapefruit, Berries, Strawberry, Mango, Pineapple, Banana, Passion Fruit, Others), Vegetable Concentrates (Carrot, Tomato, Beetroot, Cucumber, Others)), By Form (Liquid, Powder, Granular), By End Use (Food and Beverages (Bakery and Confectionery, Jams and Spreads, Dairy and Frozen Desserts, Alcoholic Beverages, Dietary Supplements, Others), Retail/Household, Cosmetics and Personal Care, Others), By Distribution Channel (B2B, B2C (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online Retail, Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Suntory Beverage and Food, Langers Juice Company, CocaCola, Doehler, Tropicana Products, Sunkist Growers, Ceres Fruit Juices, Blue Diamond Growers, Tree Top, Dole Food Company, Kraft Heinz, PepsiCo, Rich Products Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Suntory Beverage and Food

- Langers Juice Company

- CocaCola

- Doehler

- Tropicana Products

- Sunkist Growers

- Ceres Fruit Juices

- Blue Diamond Growers

- Tree Top

- Dole Food Company

- Kraft Heinz

- PepsiCo

- Rich Products Corporation