Global Juicers Market By Product (Centrifugal Juicer, Masticating Juicer, Triturating Juicer), By Technology (Electric Juicer, Manual Juicer), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137790

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

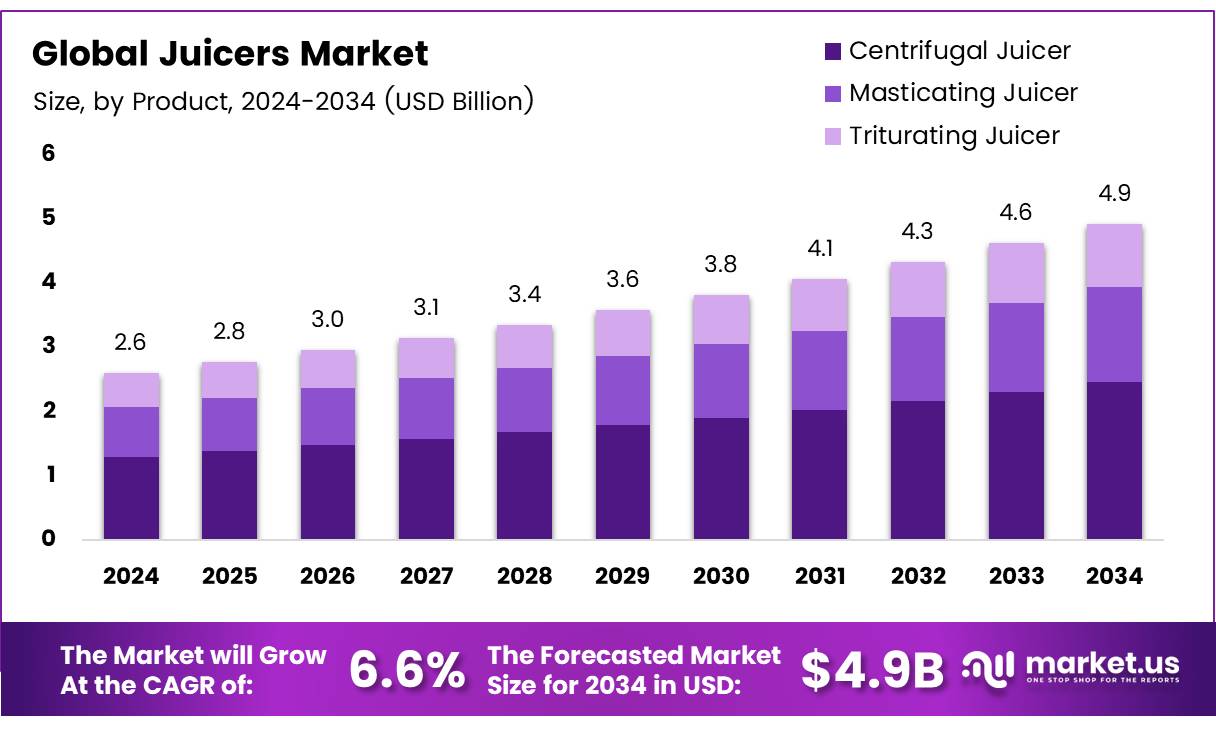

The Global Juicers Market size is expected to be worth around USD 4.9 Billion by 2034, from USD 2.6 Billion in 2024, growing at a CAGR of 6.6% during the forecast period from 2025 to 2034.

Juicers are appliances designed to extract juice from fruits, vegetables, and other organic materials. They operate through various mechanisms, including centrifugal force, masticating action, and triturating processes, each tailored to maximize yield and nutrient retention.

The Juicers Market refers to the commercial landscape encompassing the manufacture, distribution, and sale of these devices. This market responds dynamically to consumer health trends and technological advancements, influencing product development and marketing strategies.

From an analytical perspective, the Juicers market is poised for significant growth, driven by a rising global focus on health and wellness. Technological innovations such as cold-press and slow-masticating juicers are enhancing juice quality and nutritional value, thereby attracting health-conscious consumers.

Additionally, the integration of smart technology in juicers, including IoT connectivity and AI-driven functionality, is reshaping consumer interactions with kitchen appliances, making them more intuitive and efficient.

The global juicers market is benefiting from several growth opportunities. Government investments in health and wellness campaigns are indirectly boosting the demand for juicers as part of a broader push towards nutritious diets.

Regulations focusing on energy efficiency and safety standards in kitchen appliances are also influencing product development, leading to more eco-friendly and user-safe models. These factors, coupled with an increasing inclination towards fitness and healthy living, are propelling the market forward.

According to Study, during the marketing year 2023/2024, Brazil led as the global orange juice producer, achieving a production volume of approximately 1.12 million metric tons. This substantial output underscores the scale of demand for juicers in commercial juice production settings.

Moreover, as per Volza’s data, the leading importers of centrifugal juicers globally include India, Ukraine, and the United States. India topped this list with 305 shipments, followed by Ukraine with 148 shipments, and the United States with 98 shipments, reflecting robust market activity and consumer demand in these regions.

Additionally, global imports of centrifugal juicers tallied at 176 shipments from March 2023 to February 2024 (TTM), indicating a sustained international trade interest in these appliances. This import activity highlights not only the global reach of the juicers market but also the potential for growth in both established and emerging markets.

Key Takeaways

- The global juicers market is projected to reach USD 4.9 billion by 2034, growing at a CAGR of 6.6% from 2025 to 2034.

- Centrifugal juicers accounted for 48.8% of the market share in the product analysis segment in 2024.

- Electric juicers dominated the technology segment in 2024, holding a 75.6% market share.

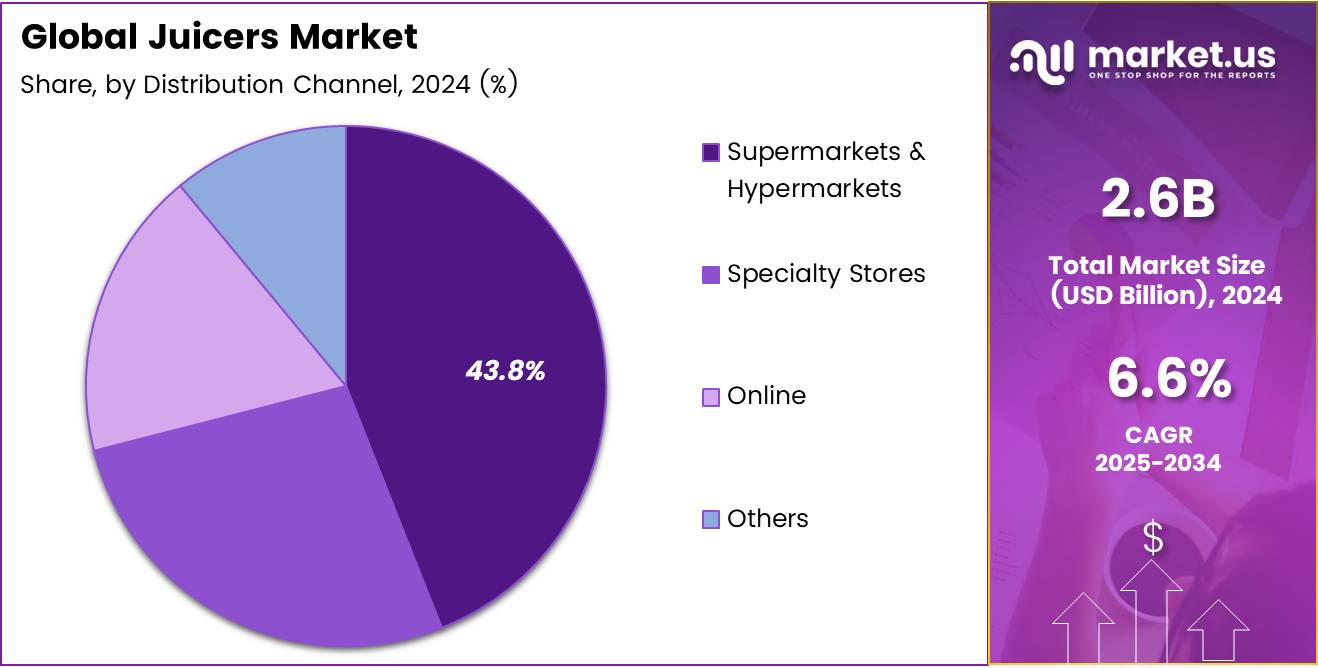

- Supermarkets & hypermarkets led the distribution channel segment in 2024, with a 43.8% share.

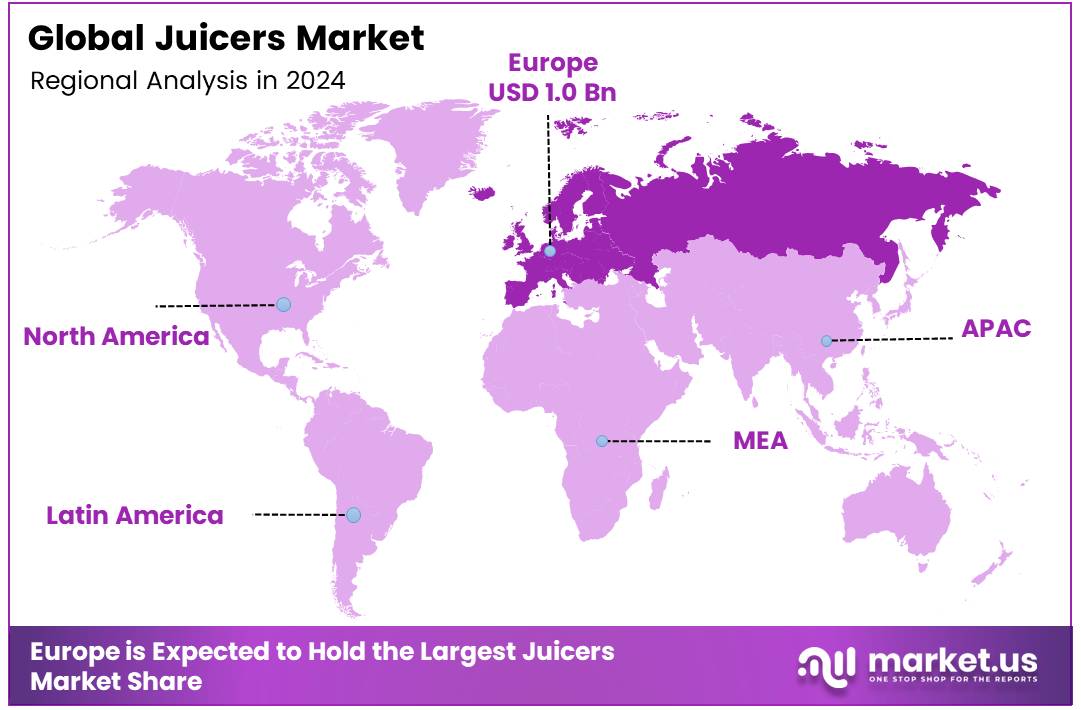

- Europe holds the largest share of the global juicers market, with 37.5% valued at USD 1.0 billion in 2024.

Product Analysis

Centrifugal Juicer Holds 48.8% Share in 2024, Leading the By Product Analysis Segment of the Juicers Market

In 2024, Centrifugal Juicer commanded a dominant position in the By Product Analysis segment of the juicers market, accounting for 48.8% of the total market share.

The growth of this segment can be attributed to the centrifugal juicer’s speed, affordability, and ease of use, which have made it a popular choice for both households and commercial establishments. Centrifugal juicers are especially favored for their ability to produce juice quickly, which aligns with consumer demands for convenience in fast-paced lifestyles.

Masticating Juicers, while accounting for a smaller portion of the market, have gained traction due to their superior juice extraction efficiency. These juicers are known for producing higher juice yields and retaining more nutrients, making them increasingly preferred by health-conscious consumers. Their market share, however, remains at a lower level compared to centrifugal models, due to their higher price point and slower juicing process.

Triturating Juicers, or twin-gear juicers, represent the niche segment of the market, providing the highest juice quality and nutritional value. These juicers, typically utilized in commercial or professional settings, account for the smallest share, primarily due to their higher cost and complex operation. Despite this, they continue to grow among those seeking premium juicing performance.

Technology Analysis

Electric Juicer Leads with 75.6% Market Share, Driven by Convenience and Efficiency

In 2024, Electric Juicer held a dominant market position in the By Technology Analysis segment of the Juicers Market, with a 75.6% share. The substantial share of electric juicers can be attributed to their convenience, efficiency, and ability to process larger volumes of fruits and vegetables with minimal effort.

Their popularity has been further enhanced by advancements in motor technology, which have improved both speed and energy efficiency. As consumers increasingly seek time-saving kitchen appliances, electric juicers continue to outperform manual alternatives in terms of usage convenience and overall performance.

manual juicers appeal to a specific demographic, primarily those interested in portable, cost-effective, and eco-friendly alternatives, they are often seen as less efficient than their electric counterparts.

Despite this, manual juicers retain a niche market, particularly among health-conscious consumers and individuals who prefer low-maintenance appliances. However, the growth potential for manual juicers remains limited, given the overall market shift toward electric models driven by the rising demand for modern and automated kitchen tools.

Distribution Channel Analysis

Supermarkets & Hypermarkets Lead Distribution Channels with 43.8% Share in 2024

In 2024, Supermarkets & Hypermarkets held a dominant market position in the By Distribution Channel segment of the Juicers Market, with a 43.8% share. This significant market share can be attributed to the widespread availability and convenience of these retail outlets, offering a broad selection of juicer brands and models.

The presence of large retail chains and their extensive distribution networks enables consumers to easily access products across various geographic regions. Additionally, promotional campaigns and seasonal discounts are frequently offered, further enhancing consumer appeal and driving sales.

Specialty Stores accounted for a notable portion of the market, catering to a niche consumer base seeking high-end, premium juicer models. The focus on expert knowledge, customer service, and product specialization makes specialty stores attractive for discerning buyers, although their market share remains smaller compared to larger retail chains.

The online segment also displayed steady growth, contributing to the evolving preference for e-commerce platforms. Consumers are increasingly drawn to the convenience of shopping from home, along with the ability to compare prices and access reviews.

Other distribution channels, though contributing to the market, represent a minor share in comparison to the dominant players such as supermarkets, hypermarkets, and online platforms.

Key Market Segments

By Product

- Centrifugal Juicer

- Masticating Juicer

- Triturating Juicer

By Technology

- Electric Juicer

- Manual Juicer

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online

- Others

Drivers

Health and Wellness Trend Drives Demand for Juicers

The increasing consumer focus on health and wellness is a significant driver for the growth of the juicers market. As more individuals embrace healthier lifestyles, there is a growing preference for fresh, nutrient-rich juices. This shift is largely attributed to the perceived health benefits of fresh juice, which is often seen as a natural source of vitamins and minerals.

The rising trend of incorporating nutritious beverages into daily diets has led to an increased demand for juicers that allow consumers to prepare these juices at home. Moreover, the growing popularity of cold-pressed juices, which are considered to preserve more nutrients compared to traditional juicing methods, has further fueled demand for masticating and triturating juicers.

These juicers, known for their ability to extract juice at low temperatures, cater to consumers seeking high-quality, nutritious products. Additionally, the expanding retail distribution channels, including online platforms, have made it easier for consumers to access a wide range of juicing equipment. Online shopping provides convenience, allowing consumers to research and purchase juicers from the comfort of their homes.

The increased availability of juicers across various retail platforms ensures a broader consumer reach, further accelerating the market’s growth. Overall, the combination of health-conscious trends, the preference for nutrient-dense beverages, and improved accessibility to juicing products is driving the demand for juicers globally.

Restraints

High Cost of Premium Juicers Limits Consumer Adoption

The high cost associated with premium juicer models can act as a significant constraint in the market. Advanced juicers, especially those with specialized features such as slow juicing, multi-functionality, and durability, often come with a hefty price tag. This can deter a large portion of budget-conscious consumers who are hesitant to invest in expensive appliances, particularly when more affordable options are available.

While these premium products promise superior performance and long-term value, the initial investment can be seen as prohibitive for many households.

Additionally, the growing availability of cheaper, ready-to-drink packaged juices further diminishes the attractiveness of high-end juicers. Packaged juices, which are convenient and require no investment in appliances, offer consumers a more accessible solution for obtaining similar health benefits without the upfront cost.

As a result, even though there is demand for fresh juices, the pricing of premium juicers remains a key challenge in expanding the market. The cost barrier may limit the adoption of juicers, especially in emerging markets where affordability is a primary concern. Hence, manufacturers may need to consider introducing more cost-effective models or innovative financing options to appeal to a broader consumer base, ensuring market growth remains strong despite these challenges.

Growth Factors

Expanding into Emerging Markets Presents Significant Growth Potential for Juicer Manufacturers

The global juicers market is expected to experience considerable growth driven by several key opportunities. Emerging markets, particularly in regions such as Asia-Pacific, Africa, and Latin America, are witnessing an increase in awareness and adoption of juicing appliances, creating a fertile ground for expansion.

As disposable income rises and health-consciousness becomes more prevalent, these markets represent a significant opportunity for manufacturers to introduce their products. Furthermore, the incorporation of innovative features such as IoT connectivity, enhanced energy efficiency, and multifunctional capabilities into juicers presents a competitive advantage.

By catering to consumer demand for smarter, more efficient appliances, manufacturers can differentiate themselves in a crowded market. The growth of health-focused establishments such as cafes, restaurants, and gyms also offers lucrative prospects for expansion into commercial spaces, where fresh juice offerings are in high demand.

Moreover, leveraging digital and social media marketing strategies can help reach a broader audience and engage directly with health-conscious consumers, building brand loyalty. These avenues allow manufacturers to tap into new customer bases while also enhancing their visibility in established markets. The combination of these strategies is expected to drive sustained growth, positioning companies for long-term success in the juicers market.

Emerging Trends

Smart Juicers and Health Trends Fuel Market Expansion

The juicers market is witnessing notable growth due to several key factors driving consumer demand. One significant trend is the integration of smart juicers with home automation systems, allowing users to control their appliances remotely through smartphones or voice assistants.

This convenience appeals to tech-savvy consumers seeking enhanced functionality and a seamless kitchen experience. Another important driver is the increasing popularity of juice cleanses and detox diets.

Consumers are increasingly turning to juicers as part of health and wellness routines, with specific models tailored to meet the demand for nutrient-dense beverages that support weight loss and detoxification. This trend has led to the rise of specialized juicers designed for maximum juice extraction from fruits and vegetables, fueling demand in the market.

Additionally, seasonal promotions and discounts, particularly during the new year and summer months, play a significant role in boosting sales. As health and fitness resolutions peak, retailers implement targeted offers to attract customers, driving sales during high-demand periods.

These factors, combined with the ongoing shift toward healthier lifestyles, are expected to contribute to the sustained growth of the juicers market in the coming years, offering opportunities for both established brands and new entrants.

Regional Analysis

Europe leads the juicers market with 37.5% share and USD 1.0 billion in value

The global juicers market is experiencing significant growth across various regions, with notable differences in market dynamics and consumer preferences. Europe is the dominant region, holding a 37.5% share of the market, valued at USD 1.0 billion.

This market leadership is driven by the increasing consumer focus on health and wellness, where countries like Germany, France, and the United Kingdom exhibit strong demand for juicing appliances. The rising popularity of healthy eating habits and sustainable lifestyles among European consumers has further reinforced the demand for both traditional and cold-press juicers.

Regional Mentions:

North America, led by the United States and Canada, is another key market, contributing substantially to the global juicer industry. This region benefits from high consumer spending on premium products, coupled with a growing preference for organic juices and health-focused living. The presence of well-established retail and online platforms has also facilitated widespread access to juicing products, making them a common household item for health-conscious consumers.

In Asia Pacific, the market is expanding rapidly, driven by urbanization, rising disposable income, and evolving dietary habits. Countries such as China and India are experiencing an increased uptake of juicers as consumers look for healthier beverage alternatives. This region is expected to continue growing at a significant rate, contributing notably to the overall market expansion.

The Latin American and Middle East & Africa regions represent emerging markets, collectively accounting for a smaller portion of the global share. However, as disposable incomes rise and health trends become more pervasive, both regions are anticipated to see incremental growth. The adoption of modern kitchen appliances and an increasing interest in nutrition-oriented lifestyles are factors contributing to this positive trend in these regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global juicers market in 2024 is characterized by a competitive landscape dominated by several established players, each contributing distinct strengths in product innovation, market penetration, and consumer appeal.

Breville Group Ltd. is expected to continue leading the premium segment with its high-performance juicers, known for advanced features such as cold press technology and integrated cleaning systems. The brand’s strong market presence in North America, Europe, and Asia positions it for sustained growth.

Midea Retail (PTY) Ltd. and Bajaj Electricals Ltd. are anticipated to leverage their extensive distribution networks in emerging markets, capitalizing on the rising demand for affordable, high-quality appliances in regions like Asia-Pacific and Africa. Midea’s broad product portfolio and Bajaj’s established reputation within India are key drivers.

Cuisinart Inc. and Hamilton Beach Brands Holding Co. remain prominent in the North American market, benefitting from their strong retail presence and wide product offerings that cater to both entry-level and mid-range consumers.

Omega Juicers is expected to maintain its dominance in the high-end segment, appealing to health-conscious consumers with its masticating juicers, known for their superior nutrient retention and juice yield.

Philips N.V. and Panasonic Corporation continue to lead in technological innovation, offering multifunctional juicers that align with consumer trends favoring convenience and multifunctionality.

Hurom America Inc. and Kuvings are expected to retain significant shares in the premium slow juicer segment, capitalizing on the growing trend of health-focused, nutrient-rich juices.

Overall, the competitive environment in 2024 will be defined by ongoing innovation, market diversification, and an emphasis on both functionality and design, with key players aligning their strategies with global consumer trends toward health and wellness.

Top Key Players in the Market

- Breville Group Ltd

- Midea Retail (PTY) Ltd.

- Bajaj Electricals Ltd.

- Cuisinart Inc.

- Electrolux AB

- Omega Juicers

- Borosil Ltd.

- DeLonghi Spa

- Joyoung Co. Ltd.

- Kuvings

- Hamilton Beach Brands Holding Co.

- Koninklijke Philips N.V.

- Panasonic Corporation

- Hurom America Inc.

- SEB SA Co.

Recent Developments

- In April 2024, JUICER secured $5.3 million in seed funding to accelerate the development of its innovative energy solutions, aiming to revolutionize renewable power storage and distribution. This new capital will help expand their technology and bring it to market faster.

- In October 2024, Molg raised $5.5 million in seed funding to tackle the growing issue of electronic waste by pioneering circular manufacturing techniques. The funds will be used to scale up their platform for recycling and repurposing electronics in a sustainable way.

- In December 2024, Cadstrom raised $6.8 million in seed funding to enhance the efficiency of validation processes for electronic hardware design. This funding will enable the company to refine its AI-driven platform, helping designers reduce errors and speed up time-to-market.

Report Scope

Report Features Description Market Value (2024) USD 2.6 Billion Forecast Revenue (2034) USD 4.9 Billion CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Centrifugal Juicer, Masticating Juicer, Triturating Juicer), By Technology (Electric Juicer, Manual Juicer), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Breville Group Ltd, Midea Retail (PTY) Ltd., Bajaj Electricals Ltd., Cuisinart Inc., Electrolux AB, Omega Juicers, Borosil Ltd., DeLonghi Spa, Joyoung Co. Ltd., Kuvings, Hamilton Beach Brands Holding Co., Koninklijke Philips N.V., Panasonic Corporation, Hurom America Inc., SEB SA Co. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Breville Group Ltd

- Midea Retail (PTY) Ltd.

- Bajaj Electricals Ltd.

- Cuisinart Inc.

- Electrolux AB

- Omega Juicers

- Borosil Ltd.

- DeLonghi Spa

- Joyoung Co. Ltd.

- Kuvings

- Hamilton Beach Brands Holding Co.

- Koninklijke Philips N.V.

- Panasonic Corporation

- Hurom America Inc.

- SEB SA Co.