Italy Hot-Dip Galvanizing Market By Process (Batch , and Continuous), By Metal Type (Steel, and Iron), By End-Use (Construction, Automotive, Street and Outdoor Furniture, Agriculture, Renewable Energy, Power and Utilities, Industrial Machinery, Transport Infrastructure, Consumer Goods, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150003

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

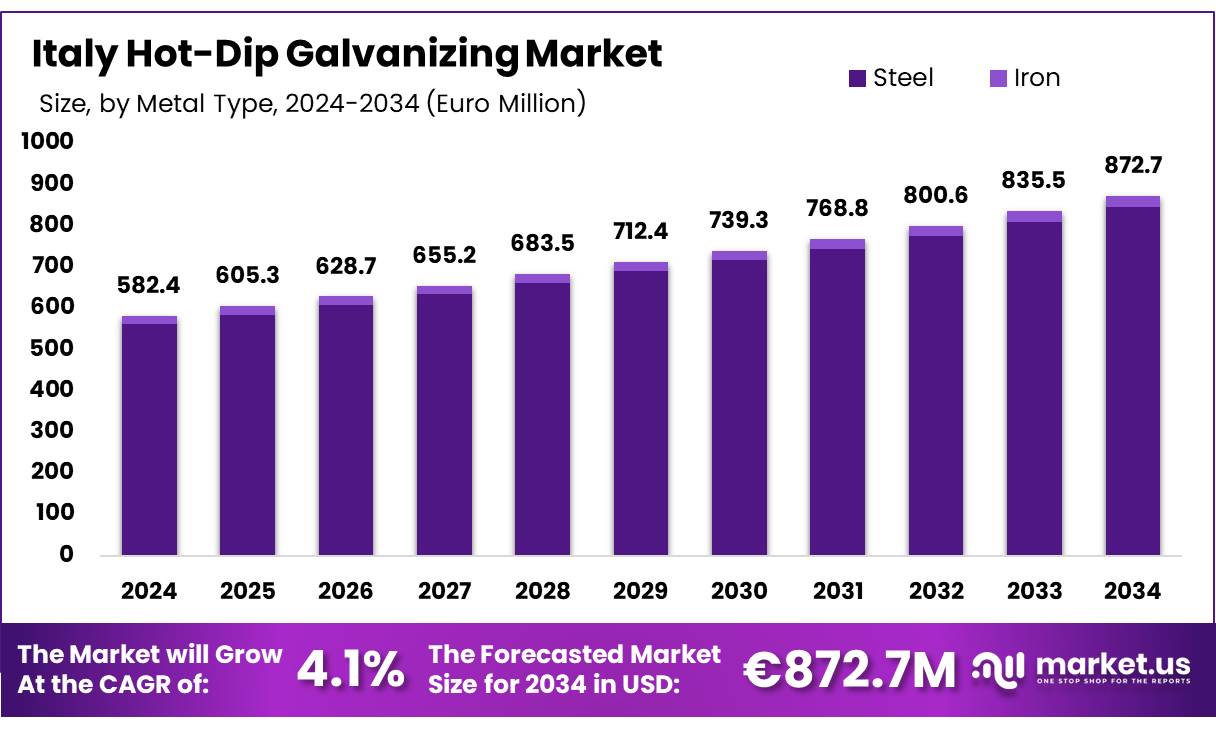

The Italy Hot-Dip Galvanizing Market size is expected to be worth around Euro 872.7 Million by 2034, from Euro 582.4 Million in 2024, growing at a CAGR of 4.1% during the forecast period from 2025 to 2034.

Hot-dip galvanizing is an industrial process in which iron or steel components are coated with a protective zinc layer by immersing them in a bath of molten zinc, typically maintained at approximately 450 °C (842 °F). This results in a metallurgically bonded coating that provides long-term resistance to corrosion by shielding the base metal from both internal and external environmental exposure. The technique ensures structural durability and is widely adopted across sectors demanding high material resilience.

Italy’s hot-dip galvanizing industry is integral to the country’s infrastructure and manufacturing sectors. According to the Italian National Institute of Statistics (ISTAT), the steel industry, which includes galvanizing services, contributes significantly to Italy’s industrial output. The demand for galvanized steel is driven by its extensive use in construction, transportation, energy, and agriculture.

In the construction sector, galvanized steel is favored for its durability and low maintenance, making it ideal for building frameworks, bridges, and other structural applications. The transportation industry utilizes galvanized components in vehicles and railway systems, benefiting from the material’s resistance to environmental factors. Energy infrastructure, including power transmission and renewable energy installations, also relies on galvanized steel for its longevity and reliability.

Key Takeaways

- Italy Hot-Dip Galvanizing Market size is expected to be worth around Euro 872.7 Million by 2034, from Euro 582.4 Million in 2024, growing at a CAGR of 4.1%

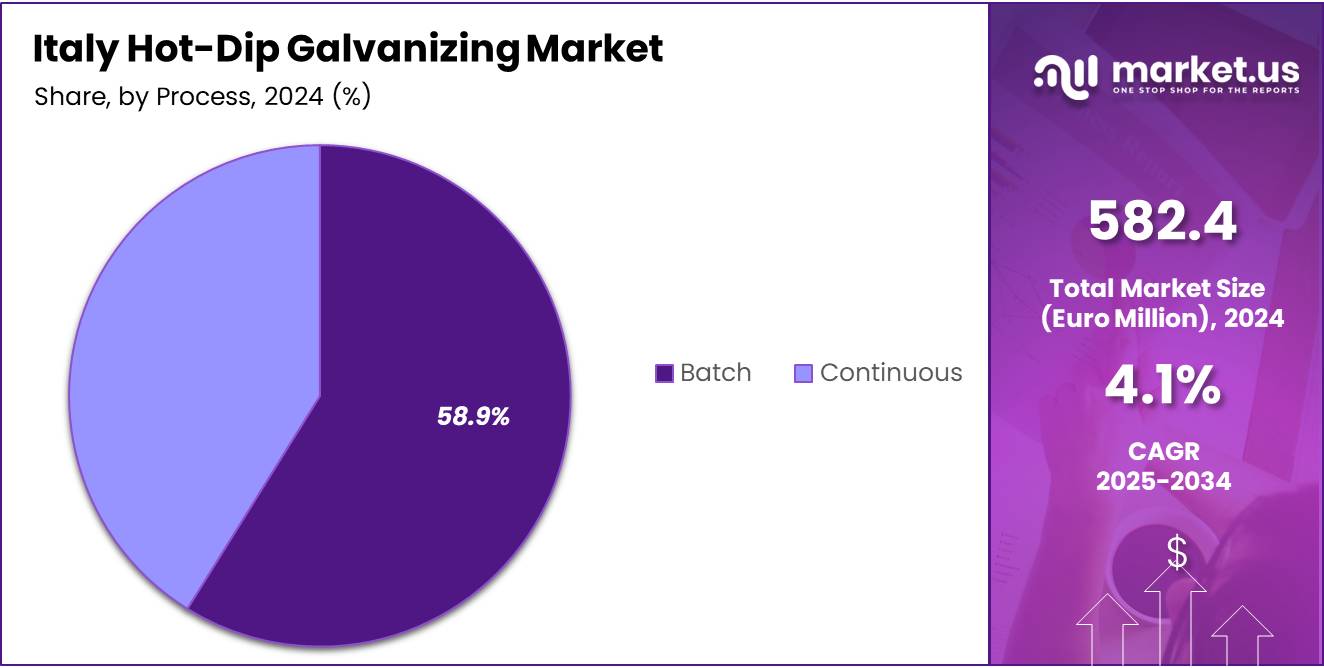

- Among hot-dipped galvanizing process, the batch type held the majority of the revenue share at 58.9%.

- Based on metal type, steel accounted for the largest market share with 96.6%.

- Among end-uses, construction sector is the major end-user accounted for the majority of the hot dipped galvanizing market share with 36.1%.

Process Analysis

Batch Held The Major Share Owing To Its Wide Applications

Italy hot dipped galvanizing market is segmented based on process into batch & continuous. Among these, batch type held the majority of revenue share in 2024, with a market share of 58.9% driven largely by its flexibility, adaptability to varying component sizes, and suitability for customized applications. Unlike continuous galvanizing, which is optimized for high-speed coating of steel strips and coils, the batch process is more compatible with irregularly shaped, heavy, or fabricated steel structures such as beams, railings, and structural frameworks. This makes it the preferred method for construction, infrastructure renovation, and public works projects across Italy, especially in historical urban zones whe re diverse shapes and restoration components are common.

Additionally, batch galvanizing allows for full immersion of fabricated items, ensuring uniform coating even on internal surfaces, edges, and welds critical for long-term corrosion resistance in Italy’s coastal and industrial areas. Moreover, batch galvanizing is favored for smaller production volumes, making it economically feasible for medium-scale manufacturers and contractors involved in bespoke steelwork.

The ability to process items on demand rather than in high-volume runs gives batch operations a logistical advantage in Italy’s fragmented construction and industrial landscape. As environmental regulations tighten and the demand for durable, corrosion-resistant steel grows, the batch process remains a stronghold in applications requiring quality, versatility, and adherence to project-specific standards.

Italy Hot-Dip Galvanizing Market, By Process, 2020-2024 (Mn EUR)

Process 2020 2021 2022 2023 2024 Batch 294.7 307.2 319.1 330.2 342.8 Continuous 214.1 219.1 225.0 231.5 239.6 Metal Type Analysis

Steel Dominated the Italy Hot-Dip Galvanizing Market

Based on metal type, the market is segmented steel & iron. Among these metal type, steel accounted for the majority of the market share with 96.6% primarily due to its widespread use, superior mechanical properties, and compatibility with the galvanizing process. Steel is the backbone material for various industries in Italy, including construction, automotive, transportation, and manufacturing. Its strength-to-weight ratio, versatility, and cost-effectiveness make it an ideal candidate for galvanizing, especially when long-term corrosion protection is required. The hot-dip galvanizing process forms a robust metallurgical bond between zinc and steel, offering excellent resistance against rust and environmental degradation a critical need in Italy’s coastal and industrial regions.

Additionally, galvanized steel is heavily used in infrastructure projects such as bridges, guardrails, power transmission structures, and building frameworks, all of which demand durability and low maintenance. Compared to iron, which is more brittle and less adaptable to modern engineering applications, steel offers better weldability, formability, and surface finish. Furthermore, the availability of various steel grades tailored for specific end-uses ranging from structural beams to thin sheets—contributes to its near-total dominance in galvanizing applications. Italy’s established steel fabrication and construction ecosystems further reinforce the dominance of galvanized steel, making it the material of choice across nearly all downstream sectors.

Italy Hot-Dip Galvanizing Market, By Metal Type, 2020-2024 (Mn EUR)

Metal Type 2020 2021 2022 2023 2024 Steel 491.2 508.2 525.5 542.5 562.6 Iron 17.6 18.1 18.6 19.2 19.8 End-Use Analysis

Construction Has Dominated The Italy’s Safety Testing Market

The hot dipped galvanizing market in Italy was further categorized based on end-uses such as construction, automotive, street & outdoor furniture, agriculture, renewable energy, power & utilities, industrial machinery, transport infrastructure, consumer goods, others. In 2024, the construction sector emerged as the largest end-use segment in Italy’s hot-dipped galvanizing market, accounting for 36.1% of the total share.

This dominance is closely tied to the country’s continuous investments in residential, commercial, and infrastructure development, where durability, corrosion resistance, and structural integrity are top priorities. Galvanized steel is widely used in beams, columns, roofing, frameworks, staircases, and balconies, providing a cost-effective solution with extended service life and minimal maintenance.

Italy’s geographic diversity, with coastal zones prone to high humidity and urban areas exposed to pollution, makes galvanized components essential for withstanding environmental stress. Moreover, renovations of heritage buildings and the expansion of modern architectural projects both demand materials that can meet strict safety and aesthetic standards needs that galvanized steel fulfills.

Additionally, government initiatives promoting energy-efficient buildings and resilient infrastructure, particularly under Italy’s National Recovery and Resilience Plan (NRRP), have further accelerated demand. The batch galvanizing process, commonly used in construction, ensures thorough coating even on complex fabricated structures, enhancing long-term performance. The sector’s extensive consumption of fabricated steel components, combined with evolving design needs and stringent regulations, has positioned construction as the top consumer of hot-dipped galvanized materials in the Italian market landscape.

Italy Hot-Dip Galvanizing Market, By End-Use, 2020-2024 (Mn EUR)

End-Use 2020 2021 2022 2023 2024 Construction 181.2 189.1 196.5 203.1 210.5 Automotive 29.3 30.0 30.8 31.6 32.7 Street & Outdoor Furniture 67.3 69.6 71.9 74.2 77.0 Agriculture 56.6 58.1 59.8 61.6 64.0 Renewable Energy 44.4 45.6 47.0 48.6 50.5 Power & Utilities 22.0 22.7 23.5 24.3 25.2 Industrial Machinery 18.4 18.7 >19.0 19.4 19.8 Transport Infrastructure 50.8 52.5 54.3 56.3 58.7 Consumer Goods 13.0 13.3 13.6 13.8 14.2 Others 25.7 26.7 27.8 28.8 29.9 Key Market Segments

By Process

- Batch

- Continuous

By Metal Type

- Steel

- Iron

By End-Use

- Construction

- Automotive

- Street & Outdoor Furniture

- Agriculture

- Renewable Energy

- Solar

- Wind

- Others

- Power & Utilities

- Industrial Machinery

- Transport Infrastructure

- Consumer Goods

- Others

Drivers

Italy’s Infrastructure and Construction Growth Shaping The Market

The ongoing expansion and modernization of Italy’s infrastructure and construction sectors are significantly boosting the demand for hot-dip galvanizing (HDG). Hot-dip galvanizing, the process of coating steel with a protective zinc layer through immersion in molten zinc, is integral to ensuring the durability and corrosion resistance essential for Italy’s diverse structural applications. This growing preference for galvanized steel directly corresponds to Italy’s ambitious infrastructure initiatives, backed by substantial governmental investments and policies.

One of the most influential factors is Italy’s National Recovery and Resilience Plan (PNRR), implemented as part of the European Union’s broader NextGenerationEU recovery package. Italy has allocated roughly €191.5 billion to infrastructure and green transition initiatives, including extensive improvements to roads, railways, ports, and public utilities. Specifically, about €62 billion is directed explicitly toward sustainable infrastructure and mobility, such as the expansion of the high-speed railway network and the rehabilitation of bridges and tunnels.

- The construction sector in Italy currently contributes about 4.23% to the country’s GDP in 2024, with projections indicating a gradual decline to 3.98% by 2028.

- After strong post-pandemic growth (+8.3% in 2021, +4.0% in 2022), the sector continued to support economic expansion in 2023, with GDP up 0.9% and construction investments rising 4.7% in 2022.

- The National Resilience and Recovery Plan (NRRP), funded by the EU, allocates €108 billion to construction and related spending by 2026, with 45% managed by local governments.

Restraints

Volatility in Zinc Prices and Energy Costs May Hinder Market Growth to A Certain Extent

Volatility in zinc prices and energy costs poses a significant challenge to Italy’s hot-dip galvanizing (HDG) market, affecting both the cost structure and operational stability of galvanizing companies. Zinc is the primary raw material in the galvanizing process, forming the protective coating that gives galvanized steel its corrosion resistance. When zinc prices fluctuate unpredictably, it directly impacts the per-ton cost of galvanizing, making budgeting and pricing strategies difficult for galvanizers.

According to data from the London Metal Exchange (LME), zinc prices have seen considerable swings in recent years—rising from around $2,300 per metric ton in 2020 to peaks of over $4,500 per metric ton in 2022, driven by supply chain disruptions, increased demand from infrastructure sectors, and geopolitical tensions such as the Russia-Ukraine war. Although prices moderated in 2023 and early 2024, they remain well above pre-pandemic levels, creating sustained pressure on manufacturers. As of early May 2025, LME zinc cash-settlement prices are around $2,580–$2,830 per metric ton, reflecting a decline from the 2022 peak but continued volatility.

Italian galvanizing companies, many of which are small to mid-sized enterprises, find it difficult to absorb or pass on these price increases, especially in competitive bidding situations for infrastructure or construction projects. As zinc accounts for up to 30–40% of total galvanizing costs, even small fluctuations can significantly erode profit margins.

- Italy’s steel and HDG sectors are heavily reliant on electricity, especially since 85% of Italian steel is produced via electric arc furnaces (EAF).

- Italian industrial electricity prices are among the highest in Europe, exceeding €110/MWh in 2023, compared to about €65/MWh in Germany.

- Zinc prices have been highly volatile, with 2024 seeing prices above $2,800/t and projections for 2025 ranging between $2,600/t and $3,200/t depending on supply-demand dynamics and market forecasts.

Opportunity

The Expansion of Renewable Energy Projects Will Create Lucrative O pportunities in the Market

The expansion of renewable energy projects presents a significant and timely opportunity for Italy’s hot-dip galvanizing (HDG) market, as the country intensifies its transition toward cleaner energy systems and sustainable infrastructure. Italy, being one of the leading European nations in renewable energy deployment, has made strong policy commitments under the European Green Deal and its National Energy and Climate Plan (NECP), which aims to achieve 30% of total energy consumption from renewable sources by 2030. This transition necessitates the large-scale development of solar farms, wind turbines, biomass facilities, and hydroelectric structures—each of which demands durable, corrosion-resistant steel components.

Hot-dip galvanizing, known for providing long-term protection against rust and weathering, is critical in safeguarding steel foundations, support towers, framing systems, and structural frameworks in these renewable installations. In 2023, Italy’s installed solar photovoltaic (PV) capacity surpassed 26.1 GW, with over 4.7 GW of new capacity added in that year alone, according to GSE (Gestore dei Servizi Energetici), Italy’s national energy agency.

Trends

Advanced Inspection and Smart Coatings Influencing the Market

Italian galvanizing plants are increasingly integrating sophisticated inspection systems to ensure the integrity and consistency of zinc coatings. These systems employ non-destructive testing (NDT) methods, such as ultrasonic thickness measurements and magnetic flux leakage detection, to identify coating defects and ensure compliance with international standards such as UNI EN ISO 1461.

The implementation of such technologies minimizes human error, reduces rework, and ensures that galvanized products meet the stringent requirements of sectors such as construction and automotive manufacturing. Moreover, the use of automated inspection equipment allows for real-time monitoring of the galvanizing process. Sensors and imaging systems can detect anomalies in coating thickness, adhesion, and surface finish, enabling immediate corrective actions. This proactive approach not only enhances product quality but also optimizes resource utilization by reducing zinc consumption and energy usage.

The development and application of smart coatings represent another significant trend in Italy’s HDG market. These coatings possess self-healing properties and can respond to environmental stimuli, such as changes in temperature or pH levels. For instance, encapsulated corrosion inhibitors within the coating matrix can be released upon mechanical damage, providing localized protection and extending the service life of the galvanized component.

Geopolitical Impact Analysis

Geopolitical Trade Wars Have Significantly Affected The Growth Of The Hot Dipped Galvanizing Market In Italy

The imposition of U.S. Section 232 tariffs—initially introduced under US President—placed a 25% duty on all steel imports, including hot-dip galvanized steel products from Italy. This decision, framed as a measure to protect U.S. national security by shielding domestic steel producers from global overcapacity, severely affected Italy’s high-value steel exports.

Italian galvanizing companies, many of which produce advanced, corrosion-resistant steel products used in automotive and infrastructure applications, found themselves suddenly priced out of the U.S. market due to the tariff premium. Prior to the tariffs, the United States was a key export destination for Italian steel, particularly for precision galvanized sheets and pre-coated components used in industrial machinery and high-speed rail projects. According to data by ISTAT, Italy’s steel exports to the U.S. sharply declined following 2018.

For instance, galvanized steel exports dropped by over 30% within the first full year of tariffs being implemented. This decline had a two-fold impact. First, Italian galvanizing firms—especially mid-sized ones—faced revenue contraction as they lost a premium market. U.S. buyers, often reliant on Italian quality and custom galvanizing techniques, had to shift to either more expensive domestic alternatives or lower-quality imports from exempt nations.

Second, the loss of volume meant that Italian galvanizers had to absorb excess capacity, which led to lower utilization rates across plants. This caused ripple effects down the value chain, impacting zinc suppliers, energy providers, and logistics operators tied to the galvanizing business. With the U.S. accounting for a significant share of external demand for high-end galvanized products, the sudden market cut-off forced Italian companies to re-orient towards Europe, North Africa, and the Middle East—markets with thinner margins and different regulatory standards.

Key Countries Covered

- Italy

- North

- Central

- South

Key Players Analysis

Market Players In The Italyan Hot Dipped Galvanizing Industry Are Adopting Several Key Strategies To Stay Competitive

To remain competitive in the rapidly evolving Italyan Hot Dipped Galvanizing industry, market players are employing several key strategies. A major focus is on investing in advanced technologies such as AI, machine learning, and automation to improve testing efficiency, accuracy, and speed. These innovations enable faster, more reliable results, meeting the growing demand for real-time testing and ensuring compliance with increasingly stringent food safety regulations. Additionally, companies are expanding their service offerings by providing multi-contaminant testing, traceability solutions, and comprehensive safety protocols to cater to a broader range of food products, ensuring thorough quality checks at every stage of the food supply chain.

Major Players in The Industry

- Bordignon Giuseppe S.P.A.

- Del Carlo Group

- AMMA S.p.a.

- Giambarini Group

- Sati Italia SpA

- Zincogam S.p.a

- Irpinia Zinco s.r.l.

- BISOL S.p.A.

- GM Zincatura

- Zimetal S.r.l.

- Nuova Elettromeccanica Sud SpA

- Other Key Players

Report Scope

Report Features Description Market Value (2024) Euro 582.4 Mn Market Volume (2024) XX Tons Forecast Revenue (2034) Euro 872.7 Mn CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Italy Hot-Dip Galvanizing Market By Process (Batch , and Continuous), By Metal Type (Steel, and Iron), By End-Use (Construction, Automotive, Street & Outdoor Furniture, Agriculture, Renewable Energy, Power & Utilities, Industrial Machinery, Transport Infrastructure, Consumer Goods, and Others) Country Analysis Italy – North, Central & South Competitive Landscape Bordignon Giuseppe S.P.A., Del Carlo Group, AMMA S.p.a., Giambarini Group, Sati Italia SpA, Zincogam S.p.a, Irpinia Zinco s.r.l., BISOL S.p.A., GM Zincatura, Zimetal S.r.l., Nuova Elettromeccanica Sud Sp, & Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate User License (Unlimited User and Printable PDF)  Italy Hot-Dip Galvanizing MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Italy Hot-Dip Galvanizing MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bordignon Giuseppe S.P.A.

- Del Carlo Group

- AMMA S.p.a.

- Giambarini Group

- Sati Italia SpA

- Zincogam S.p.a

- Irpinia Zinco s.r.l.

- BISOL S.p.A.

- GM Zincatura

- Zimetal S.r.l.

- Nuova Elettromeccanica Sud SpA

- Other Key Players