Global Potassium 2-Ethylhexanoate Market Size, Share, And Business Benefits By Purity (Less Than 80%, 80% to 85%, 90% to 95%, Above 95%), By Form (Powder, Solution), By Application (Paints and Coatings, Adhesives and Sealants, Plastics, Rubber, Metalworking Fluids, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146515

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

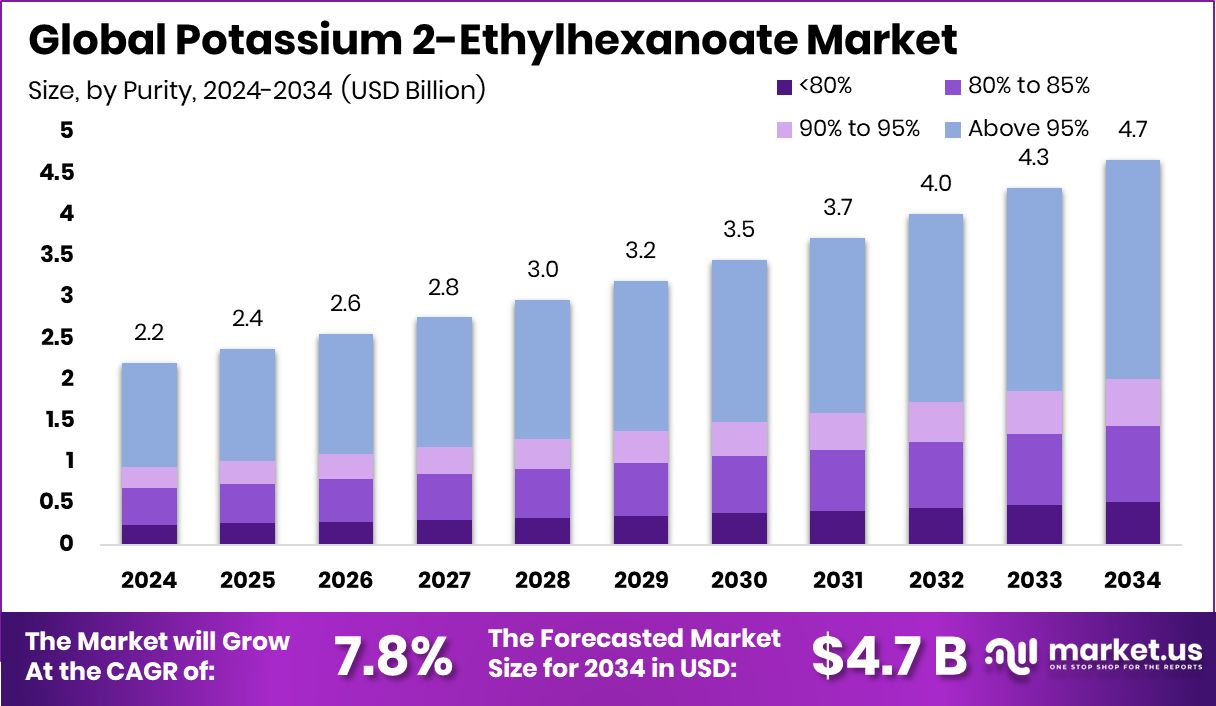

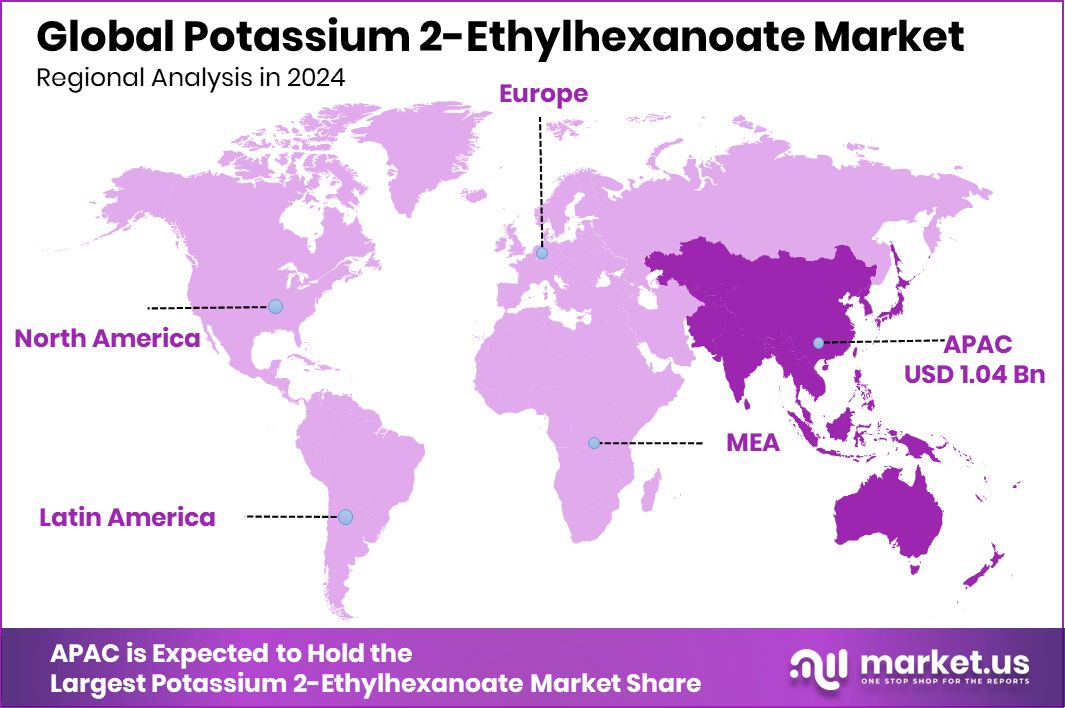

Global Potassium 2-Ethylhexanoate Market is expected to be worth around USD 4.7 billion by 2034, up from USD 2.2 billion in 2024, and grow at a CAGR of 7.8% from 2025 to 2034. Asia-Pacific leads globally in Potassium 2-Ethylhexanoate, reaching USD 1.04 Bn, 47.4% share.

Potassium 2-Ethylhexanoate is a chemical compound used primarily as a catalyst and stabilizer in various industrial processes, including the production of synthetic rubbers and plastics. It is known for its effectiveness in promoting polymerization reactions and enhancing the durability and stability of materials.

The Potassium 2-Ethylhexanoate market is experiencing growth due to its increasing demand in the polymer and coatings industries. As manufacturers seek more efficient and cost-effective catalysts, the adoption of Potassium 2-Ethylhexanoate has increased, particularly in applications requiring high thermal stability and chemical resistance.

The market is driven by the expanding plastics and rubber industries, especially in regions with booming construction and automotive sectors. Its role in improving the properties of polymers, such as flexibility and resistance to degradation, makes it a valuable component in numerous industrial applications.

Demand for Potassium 2-Ethylhexanoate is also bolstered by the rising need for lightweight and durable materials in automotive manufacturing. As the industry shifts towards more fuel-efficient and environmentally friendly vehicles, the need for advanced materials, where Potassium 2-Ethylhexanoate plays a crucial role, is also increasing.

Key Takeaways

- Global Potassium 2-Ethylhexanoate Market is expected to be worth around USD 4.7 billion by 2034, up from USD 2.2 billion in 2024, and grow at a CAGR of 7.8% from 2025 to 2034.

- Potassium 2-Ethylhexanoate with above 95% purity dominates, holding 57.5% of its market segment.

- In solution form, Potassium 2-Ethylhexanoate constitutes 67.4% of the market, preferred for easier application.

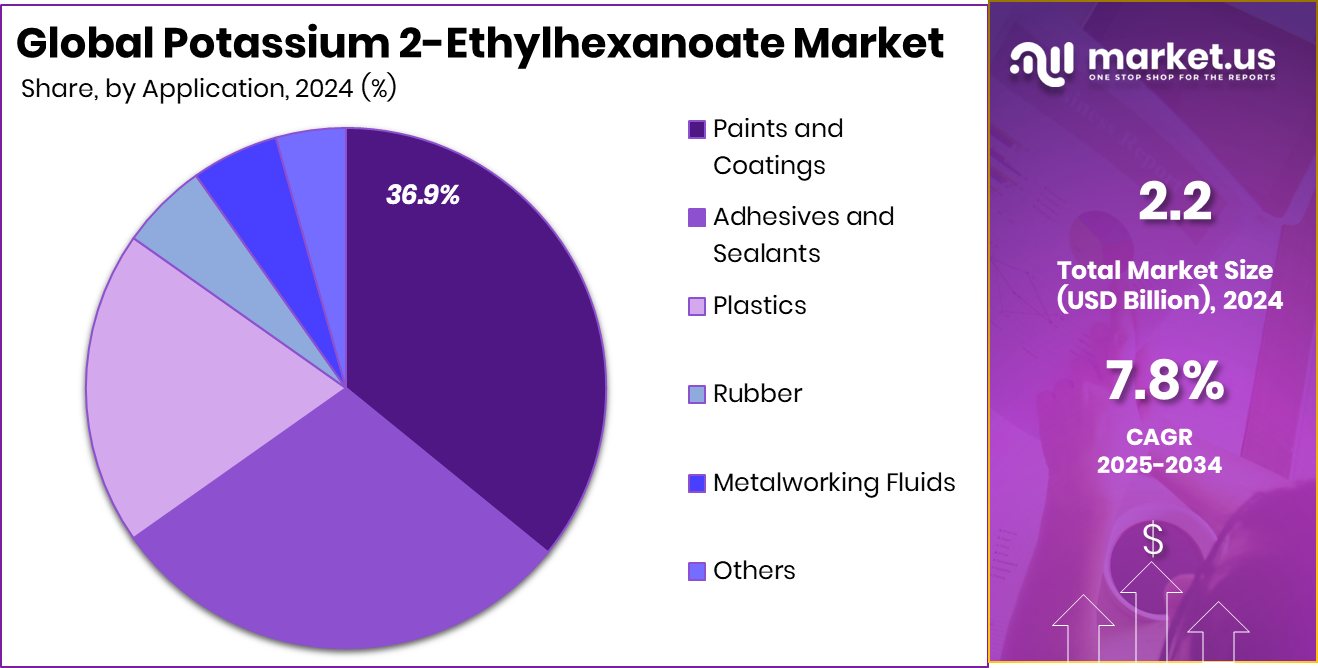

- Paints and coatings utilize Potassium 2-Ethylhexanoate extensively, making up 36.9% of its applications.

- Strong demand in Asia-Pacific boosts Potassium 2-Ethylhexanoate Market to 47.4% share.

By Purity Analysis

Above 95% purity holds 57.5% market share, highly preferred.

In 2024, Above 95% held a dominant market position in the By Purity segment of the Potassium 2-Ethylhexanoate Market, with a 57.5% share. This substantial market dominance reflects the growing demand for high-purity potassium 2-ethylhexanoate, a key chemical compound used in a wide range of industrial applications, particularly in coatings, adhesives, and lubricants.

The increased adoption of high-purity grades of this compound can be attributed to their enhanced performance characteristics, such as better stability, efficiency, and compatibility with advanced production processes.

The market share of above 95% purity grade is indicative of its superior quality and demand in sectors that require strict adherence to regulatory standards and high-performance specifications. The preference for this purity level has been particularly strong in the automotive, electronics, and consumer goods industries, where product quality and consistency are critical.

By Form Analysis

Solution form dominates, comprising 67.4% of the market.

In 2024, Solution held a dominant market position in the By Form segment of the Potassium 2-Ethylhexanoate Market, with a 67.4% share. This strong market presence reflects the widespread adoption of potassium 2-ethylhexanoate in solution form across various industries. The solution form of the compound is preferred due to its versatility, ease of use, and effective application in several manufacturing processes.

The significant share of the solution form can be attributed to its convenience in formulation and transportation. The liquid state allows for more precise mixing and application, particularly in industries such as coatings, adhesives, and pharmaceuticals, where consistent quality and ease of integration are paramount. Additionally, the solution form facilitates better dispersion and reaction rates in manufacturing, which makes it an ideal choice for high-performance industrial processes.

As industries continue to prioritize efficiency and precision, the demand for potassium 2-ethylhexanoate in solution form is expected to remain dominant. Its widespread acceptance in both large-scale industrial operations and specialized applications highlights the importance of this form in the overall market.

By Application Analysis

Paints and coatings lead, with 36.9% application share.

In 2024, Paints and Coatings held a dominant market position in the By Application segment of the Potassium 2-Ethylhexanoate Market, with a 36.9% share. This leading market share highlights the critical role potassium 2-ethylhexanoate plays in the paints and coatings industry, where it is primarily used as a stabilizing agent, ensuring better dispersion and enhanced performance of the coatings.

The demand for potassium 2-ethylhexanoate in paints and coatings can be attributed to its excellent compatibility with various resins and its ability to improve the stability and longevity of the final product. As the global construction and automotive industries continue to grow, the need for high-performance, durable coatings has fueled the demand for this compound.

Moreover, the increasing focus on environmentally friendly and high-quality paints, along with stricter regulations on VOC emissions, has further driven the adoption of potassium 2-ethylhexanoate in this application.

Key Market Segments

By Purity

- <80%

- 80% to 85%

- 90% to 95%

- Above 95%

By Form

- Powder

- Solution

By Application

- Paints and Coatings

- Adhesives and Sealants

- Plastics

- Rubber

- Metalworking Fluids

- Others

Driving Factors

Growing Demand for Potassium-Based Additives

Potassium 2-Ethylhexanoate has gained popularity due to its significant role in various industrial applications. One of the key driving factors for its market growth is the increasing demand for potassium-based additives in multiple sectors, such as paints, coatings, and lubricants. These additives are highly effective in improving the stability and performance of products, especially in high-temperature environments.

With the rise in demand for high-performance coatings and the growing need for safer and more efficient additives, manufacturers are increasingly turning to Potassium 2-Ethylhexanoate. Its ability to act as a stabilizer and catalyst enhances product durability, making it an essential component across diverse industries, thereby fueling its market growth.

Restraining Factors

High Production Costs of Potassium Additives

One of the primary factors restraining the growth of the Potassium 2-Ethylhexanoate market is the high production costs associated with its manufacturing. The process of synthesizing Potassium 2-Ethylhexanoate requires expensive raw materials and specialized equipment, which increases overall production expenses.

These high costs are often passed on to consumers, making the product less attractive for industries looking to cut costs. As a result, manufacturers may seek alternative, more cost-effective chemicals or additives, limiting the demand for Potassium 2-Ethylhexanoate.

This price factor can also affect the competitiveness of Potassium 2-Ethylhexanoate in industries where budget constraints are significant, hindering its widespread adoption despite its performance benefits.

Growth Opportunity

Expanding Use in Sustainable Coatings

A significant growth opportunity for the Potassium 2-Ethylhexanoate market lies in its expanding use in sustainable and eco-friendly coatings. As industries increasingly focus on reducing their environmental footprint, there is a rising demand for coatings that are both high-performing and environmentally safe. Potassium 2-Ethylhexanoate can play a crucial role in these applications due to its ability to act as an efficient catalyst and stabilizer in eco-friendly formulations.

With the global push for green chemistry and sustainable solutions, the adoption of Potassium 2-Ethylhexanoate in low-VOC (volatile organic compound) and water-based coatings is expected to grow, presenting a valuable opportunity for market expansion. This trend is expected to fuel demand, opening doors for more innovative, eco-conscious products.

Latest Trends

Surge in Demand Across Industries

The Potassium 2-Ethylhexanoate market is witnessing a significant surge in demand across various industries, including automotive, construction, and electronics. This growth is primarily driven by its versatile applications as a catalyst, stabilizer, and corrosion inhibitor.

In the automotive sector, it enhances the performance of coatings and adhesives, while in construction, it improves the durability of materials. The electronics industry benefits from its use in stabilizing components, ensuring longevity and reliability.

This trend reflects a broader shift towards high-performance materials that meet the evolving demands of modern manufacturing processes. As industries continue to innovate, the role of Potassium 2-Ethylhexanoate is becoming increasingly pivotal in achieving advanced material properties and performance standards.

Regional Analysis

Asia-Pacific dominates the Potassium 2-Ethylhexanoate Market with 47.4% share, valued at USD 1.04 Bn.

The Potassium 2-Ethylhexanoate market demonstrates strong regional diversity, with Asia-Pacific emerging as the dominant region, holding a substantial 47.4% market share, equivalent to USD 1.04 billion. This leadership reflects robust industrial demand and large-scale consumption across key end-use sectors in countries such as China, India, and Japan.

North America follows with stable growth, driven by the adoption of eco-friendly additives and steady infrastructure activities across the United States and Canada. Europe exhibits moderate market performance supported by stringent environmental regulations and continued application in paints, coatings, and catalysts.

The Middle East & Africa market shows gradual uptake of Potassium 2-Ethylhexanoate, particularly in construction and chemical manufacturing hubs like the UAE and South Africa.

Latin America maintains a developing outlook, with Brazil and Mexico witnessing increased industrial activities and rising adoption across automotive and architectural applications. While Asia-Pacific leads in both value and volume, the market across other regions reflects potential growth opportunities due to expanding industrialization, regulatory shifts, and evolving consumer preferences.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Potassium 2-Ethylhexanoate market is witnessing significant growth, driven by its versatile applications across various industries. Key players such as Milliken & Company, Glindia Chemicals, and American Elements are strategically positioning themselves to capitalize on this trend.

Milliken & Company is leveraging its extensive experience in specialty chemicals to enhance the performance and sustainability of Potassium 2-Ethylhexanoate. The company focuses on integrating this compound into applications like coatings and adhesives, aligning with the industry’s shift towards eco-friendly solutions. Milliken’s commitment to innovation and environmental responsibility positions it as a leader in meeting the evolving demands of the market.

Glindia Chemicals offers high-purity Potassium 2-Ethylhexanoate, catering to specialized sectors such as pharmaceuticals and electronics. With a focus on quality and consistency, Glindia ensures that its products meet stringent industry standards. The company’s emphasis on research and development enables it to provide customized solutions, addressing specific client requirements and reinforcing its competitive edge.

American Elements brings a robust global distribution network and a diverse product portfolio to the table. By supplying Potassium 2-Ethylhexanoate to various industries, including automotive and construction, the company supports large-scale manufacturing needs. American Elements’ ability to deliver high-quality materials efficiently makes it a reliable partner for clients seeking scalability and dependability.

Top Key Players in the Market

- Milliken & Company

- Glindia Chemicals

- American Elements

- Haihang Industry Co.,Ltd.

- Shandong Lanhai Industry Co., Ltd

- ADEG S.R.L.

- Ferguson Chemicals

- Ningbo Inno Pharmchem Co.,Ltd.

- Mofan Polyurethane Co., Ltd.

- SincereChemical

- Ivy Fine Chemicals

- Ronak Chemicals

- Actylis

- Nihon Kagaku Sangyo Co., Ltd.

- Other Key Players

Recent Developments

- In January 2025, Milliken & Company, through its Borchers brand, introduced “15% Potassium Hex-Cem®,” a catalyst containing potassium 2-ethylhexanoate. This product enhances rigid urethane foam production and stabilizes two-component polyurethane systems. It also reduces discoloration in unsaturated polyester systems by minimizing cobalt usage.

- In May 2024, Haihang Industry Co., Ltd. rebranded as GetChem Co., Ltd. This change reflects their commitment to providing better service and expanding their global presence. Their product line includes Potassium 2-Ethylhexanoate (CAS 3164-85-0).

Report Scope

Report Features Description Market Value (2024) USD 2.2 Billion Forecast Revenue (2034) USD 4.7 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (<80%, 80% to 85%, 90% to 95%, Above 95%), By Form (Powder, Solution), By Application (Paints and Coatings, Adhesives and Sealants, Plastics, Rubber, Metalworking Fluids, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Milliken & Company, Glindia Chemicals, American Elements, Haihang Industry Co.,Ltd., Shandong Lanhai Industry Co., Ltd, ADEG S.R.L., Ferguson Chemicals, Ningbo Inno Pharmchem Co.,Ltd., Mofan Polyurethane Co., Ltd., SincereChemical, Ivy Fine Chemicals, Ronak Chemicals, Actylis, Nihon Kagaku Sangyo Co., Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Potassium 2-Ethylhexanoate MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Potassium 2-Ethylhexanoate MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Milliken & Company

- Glindia Chemicals

- American Elements

- Haihang Industry Co.,Ltd.

- Shandong Lanhai Industry Co., Ltd

- ADEG S.R.L.

- Ferguson Chemicals

- Ningbo Inno Pharmchem Co.,Ltd.

- Mofan Polyurethane Co., Ltd.

- SincereChemical

- Ivy Fine Chemicals

- Ronak Chemicals

- Actylis

- Nihon Kagaku Sangyo Co., Ltd.

- Other Key Players