Global Chemical Warehousing and Storage Market Size, Share, And Business Benefits By Type (General Warehouse, Speciality Chemical Warehouse), By Chemical Type (Petrochemical, General Chemicals, Agriculture Chemicals, Construction Chemicals, Textile Chemicals, Others), By Storage Type (Bulk Storage, Racked Storage, Drum Storage, Tote Storage, Containerized Storage), By Services (Storage Services, Distribution Services, Inventory Management Services, Packaging Services), By Warehouse Type (Public Warehouses, Private Warehouses, Automated Warehouses, Dedicated Warehouses, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146417

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

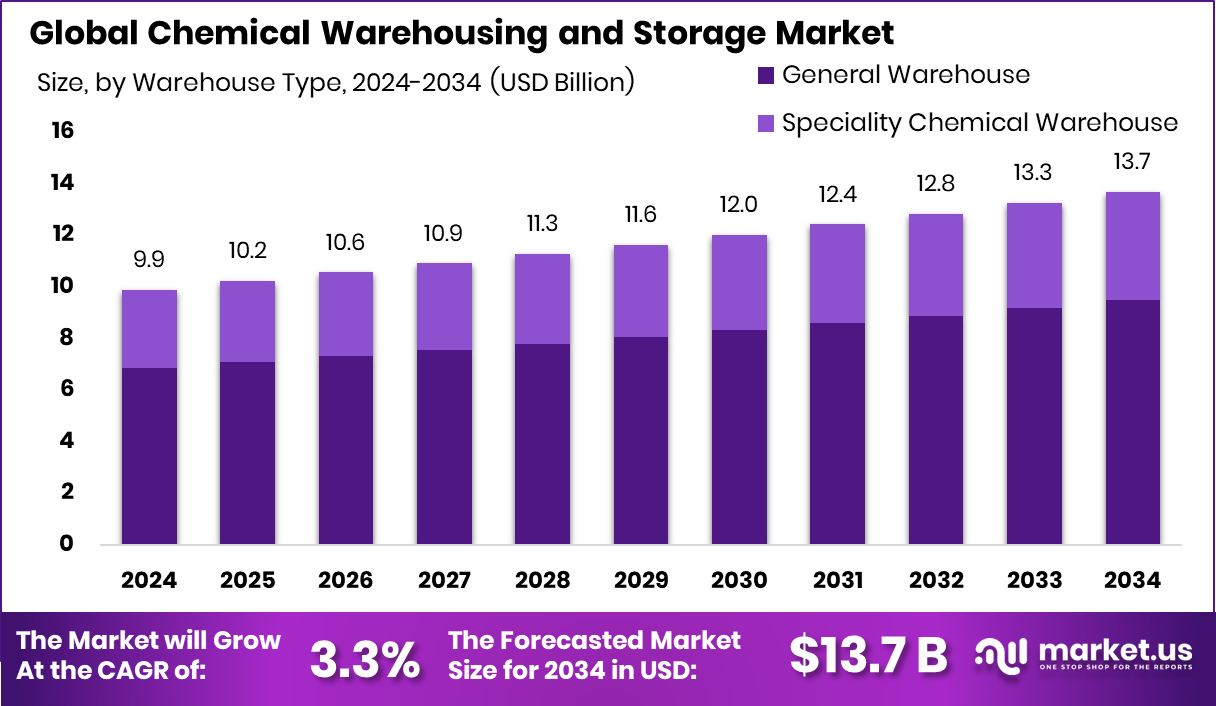

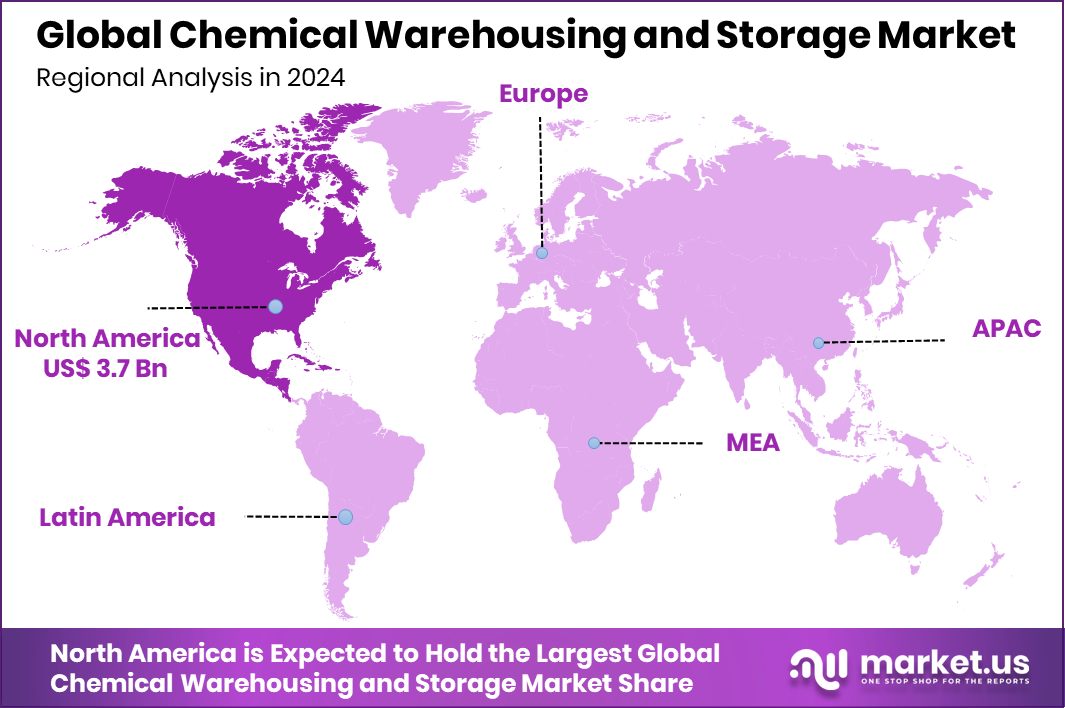

Global Chemical Warehousing and Storage Market is expected to be worth around USD 13.7 billion by 2034, up from USD 9.9 billion in 2024, and grow at a CAGR of 3.3% from 2025 to 2034. With a 37.7% share, North America’s market value stood strong at USD 3.7 Bn.

Chemical warehousing and storage involve managing and containing chemicals in a controlled environment. This specialized form of storage ensures the safekeeping of hazardous and non-hazardous chemicals, preventing spills, leaks, and contamination that could pose risks to the environment, public health, and safety.

The market for chemical warehousing and storage has grown due to the stringent regulations for handling hazardous materials, the expansion of chemical manufacturing, and the increasing importance of supply chain efficiency in the chemical industry.

Growth Factors One major growth factor is the increasing global demand for chemicals across various industries, including pharmaceuticals, agriculture, and manufacturing. As the production and consumption of chemicals rise, so does the need for specialized storage facilities that comply with stringent regulatory standards.

India is targeting a massive $87 billion investment in its petrochemicals sector over the next decade. In the agrochemical space, IFC has invested Rs 300 crore in Crystal Crop Protection. Meanwhile, JK Cement has signed a binding agreement to acquire a 60% stake in Acro Paints for Rs 153 crore, strengthening its presence in the paints segment.

Key Takeaways

- Global Chemical Warehousing and Storage Market is expected to be worth around USD 13.7 billion by 2034, up from USD 9.9 billion in 2024, and grow at a CAGR of 3.3% from 2025 to 2034.

- General warehouses hold a dominant market share in chemical warehousing, accounting for 69.2% of facilities.

- Petrochemicals are a major segment in chemical warehousing, comprising 31.3% of stored chemical types.

- Bulk storage is a preferred method in chemical warehousing, representing 34.6% of storage types.

- Storage services are essential, making up 42.9% of services offered in the chemical warehousing market.

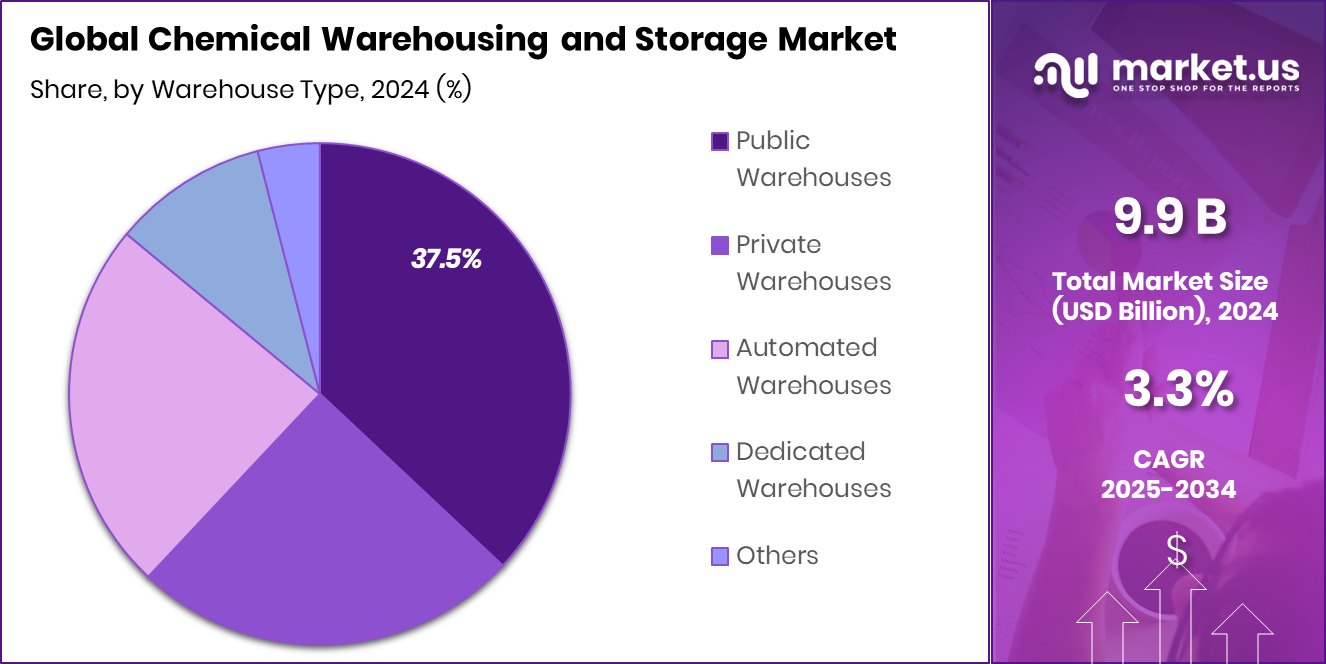

- Public warehouses play a significant role, accounting for 37.5% of the chemical warehousing market.

- North America’s chemical warehousing sector reached USD 3.7 Bn, holding 37.7% market dominance.

By Type Analysis

General Warehouse dominates, holding 69.2% of the Chemical Warehousing Market.

In 2024, General Warehouse held a dominant market position in the By Warehouse Type segment of the Chemical Warehousing and Storage Market, capturing a substantial 69.2% share. This prominence is attributed to the versatile nature of general warehouses, which are equipped to handle a wide range of chemicals under standard storage conditions.

These facilities are favored by companies for their ability to store large volumes of products efficiently while adhering to safety and regulatory requirements. The significant market share of general warehouses also reflects their critical role in the supply chain, providing foundational support for the distribution and management of chemical products across various industries.

The reliance on these warehouses is expected to persist as they continue to offer cost-effective solutions for bulk storage, coupled with increasing demand from sectors such as agriculture, pharmaceuticals, and manufacturing that require extensive and secure storage capabilities.

By Chemical Type Analysis

Petrochemicals account for 31.3% of chemicals stored in these facilities.

In 2024, Petrochemicals held a dominant market position in the By Chemical Type segment of the Chemical Warehousing and Storage Market, with a 31.3% share. This significant portion of the market can be attributed to the vast array of applications and the essential role that petrochemicals play in the global economy. These substances are crucial components in the manufacture of products ranging from plastics and fertilizers to pharmaceuticals and cosmetics, driving the demand for secure and specialized storage solutions.

The robust position of petrochemicals in the market is further bolstered by the ongoing expansion of industries that depend heavily on these chemicals. As these sectors continue to grow, particularly in emerging economies, the need for effective warehousing and storage solutions that meet strict regulatory standards for safety and environmental impact also increases.

Moreover, the strategic storage of petrochemicals enables companies to manage supply chain volatility and price fluctuations effectively, thus maintaining stability in their operations. This aspect is critical given the global nature of the petrochemical market and its susceptibility to geopolitical and economic shifts.

By Storage Type Analysis

Bulk Storage is preferred by 34.6% for chemical warehousing needs.

In 2024, Bulk Storage held a dominant market position in the By Storage Type segment of the Chemical Warehousing and Storage Market, with a 34.6% share. This leading position underscores the critical role bulk storage facilities play in the chemical industry, particularly for the handling of large quantities of liquid and granulated materials. These facilities are integral to the operations of major industries, including agriculture, where fertilizers and pesticides are stored, and the petrochemical sector, which requires the safekeeping of vast volumes of oils and solvents.

The preference for bulk storage solutions is driven by their efficiency in accommodating large-scale chemical inventories, reducing handling costs, and optimizing supply chain operations. Additionally, the adoption of advanced technologies for monitoring and managing stored chemicals enhances safety and regulatory compliance, further solidifying the market share of this segment.

As global production scales and the demand for chemicals increases, the reliance on bulk storage solutions is expected to continue. This trend is also supported by ongoing investments in infrastructure improvements and technological upgrades, ensuring that bulk storage remains a vital component of the chemical warehousing and storage ecosystem.

By Services Analysis

Storage Services constitute 42.9% of the services offered in this market.

In 2024, Storage Services held a dominant market position in the By Services segment of the Chemical Warehousing and Storage Market, with a 42.9% share. This substantial market share highlights the critical demand for specialized storage services within the chemical industry. These services are essential for managing the safe and compliant storage of a diverse range of chemical products, from hazardous chemicals requiring stringent safety protocols to general chemicals that need standard storage solutions.

The prominence of storage services in the market is reinforced by the increasing complexity of chemical manufacturing and the corresponding regulatory requirements. Companies rely on professional storage providers to ensure that their chemicals are handled according to the latest safety standards, which include proper containment, temperature control, and fire protection measures.

Moreover, the strategic role of storage services extends beyond mere containment. They facilitate efficient inventory management, help in reducing operational costs through economies of scale, and enhance the supply chain’s responsiveness to market changes. This segment’s strong position is expected to be sustained as industries such as pharmaceuticals, agriculture, and manufacturing continue to expand and increasingly outsource their storage needs to specialized service providers.

By Warehouse Type Analysis

Public Warehouses make up 37.5% of the warehousing types utilized.

In 2024, Public Warehouses held a dominant market position in the By Warehouse Type segment of the Chemical Warehousing and Storage Market, with a 37.5% share. This significant market share reflects the essential role that public warehouses play in the chemical logistics sector. Public warehouses are preferred by many companies for their flexibility and cost-effectiveness, particularly for businesses that require temporary or fluctuating storage needs without the commitment of owning and maintaining private storage facilities.

The strength of public warehouses in the market is largely due to their ability to offer scalable solutions that can adjust to varying inventory levels, a feature particularly valuable in industries like chemicals, where production and demand can be unpredictable. Moreover, these warehouses typically provide a range of additional services, including handling, transportation, and inventory management, which are crucial for maintaining the integrity and timely distribution of chemical products.

Key Market Segments

By Type

- General Warehouse

- Speciality Chemical Warehouse

By Chemical Type

- Petrochemical

- General Chemicals

- Agriculture Chemicals

- Construction Chemicals

- Textile Chemicals

- Others

By Storage Type

- Bulk Storage

- Racked Storage

- Drum Storage

- Tote Storage

- Containerized Storage

By Services

- Storage Services

- Distribution Services

- Inventory Management Services

- Packaging Services

By Warehouse Type

- Public Warehouses

- Private Warehouses

- Automated Warehouses

- Dedicated Warehouses

- Others

Driving Factors

Increasing Regulatory Requirements Drive Chemical Storage Solutions

One of the primary driving factors for the Chemical Warehousing and Storage Market is the escalating regulatory requirements governing the safe handling and storage of chemicals. Governments worldwide are intensifying safety standards to prevent accidents and environmental damage, prompting chemical producers and users to seek specialized warehousing solutions that comply with these stringent regulations.

This trend not only ensures the safety of the workforce and surrounding communities but also helps in maintaining the integrity of the stored chemicals, reducing the risk of costly spills and contamination. As regulations become more rigorous, the demand for certified and technologically equipped chemical warehouses continues to surge, reinforcing the growth of this market segment.

Restraining Factors

High Costs and Complexities Limit Market Growth

A significant restraining factor for the Chemical Warehousing and Storage Market is the high operational costs and complexities associated with managing chemical warehouses. These facilities require specialized equipment, advanced technology, and rigorous safety protocols to ensure the safe handling and storage of hazardous materials.

Additionally, the need for compliance with various environmental and safety regulations adds further layers of complexity and cost, including regular audits, employee training, and the implementation of emergency response strategies.

These requirements make setting up and operating chemical warehouses an expensive endeavor, which can deter smaller companies or new entrants from investing in this market. Consequently, the high cost and complexity of operations restrict the growth and scalability of the chemical warehousing and storage industry.

Growth Opportunity

Technological Advancements Propel Market Efficiency and Safety

A key growth opportunity within the Chemical Warehousing and Storage Market lies in the integration of technological advancements. Modern technologies such as automation, real-time inventory management systems, and advanced safety sensors significantly enhance the efficiency and safety of chemical storage facilities.

These technologies enable precise monitoring and control of environmental conditions, ensuring that chemicals are stored under optimal conditions to prevent degradation or hazardous reactions.

Automation reduces human error and improves operational efficiency by streamlining processes like inventory tracking, loading, and unloading. As companies increasingly adopt these technologies, the market for chemical warehousing and storage is expected to see substantial growth, driven by the demand for safer, more efficient, and compliant storage solutions.

Latest Trends

Sustainability Trends Shape Chemical Storage Practices

A prominent trend in the Chemical Warehousing and Storage Market is the growing emphasis on sustainability within storage practices. This shift is driven by increasing environmental regulations and the chemical industry’s commitment to reducing its carbon footprint.

Modern chemical warehouses are now incorporating green technologies such as solar power, energy-efficient lighting, and advanced insulation materials to minimize energy consumption. Additionally, sustainable water management systems and waste reduction protocols are becoming standard practices.

These initiatives not only comply with stringent environmental standards but also appeal to stakeholders who prioritize ecological responsibility. As sustainability continues to gain traction, it is reshaping how companies approach the design and operation of chemical storage facilities, making green practices a key trend in the market.

Regional Analysis

North America led the chemical storage market with a 37.7% share, worth USD 3.7 Bn.

In 2024, North America emerged as the dominant region in the Chemical Warehousing and Storage Market, accounting for 37.7% of the global share, which translates to a market value of USD 3.7 billion. This dominance is attributed to the region’s well-established chemical manufacturing base, supported by robust logistics infrastructure and advanced safety compliance systems.

The U.S. and Canada play a central role in driving regional demand due to increased chemical exports and consistent demand from the pharmaceutical and petrochemical sectors.

Europe followed as a significant contributor, benefiting from strict regulatory frameworks that mandate secure chemical storage and handling across major countries such as Germany and France. In the Asia Pacific region, rapid industrialization and growing chemical consumption, especially in China and India, supported market growth, though the region did not surpass North America in market share.

Meanwhile, the Middle East & Africa region witnessed steady growth fueled by the expansion of oil-based chemical storage requirements, while Latin America saw moderate market participation driven by Brazil and Argentina’s industrial activity.

Although these regions contributed to global expansion, North America led the market in terms of both value and share, highlighting its stronghold in the global chemical warehousing and storage landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Affiliated Warehouse Companies continued to expand its network across the U.S., offering customized chemical storage solutions with a strong focus on regulatory compliance and hazardous material handling. The company leveraged its third-party warehousing model to support both short-term and long-term chemical storage, attracting clients from the manufacturing and pharmaceutical industries.

ALFRED TALKE GmbH & Co. KG, a leading logistics partner for the chemical and petrochemical industries, maintained its strong presence in Europe and the Middle East. The company’s investments in specialized storage tanks, container terminals, and safety-certified infrastructure positioned it as a trusted partner for bulk chemical logistics. Its tailored approach to handling flammable and temperature-sensitive chemicals enhanced client retention and operational efficiency.

Anchor 3PL focused on temperature-controlled warehousing and handling of regulated chemical products across select U.S. locations. In 2024, the company emphasized end-to-end transparency through digital inventory tracking systems, which boosted its value proposition for specialty chemical manufacturers. Its scale remains niche, but its precision-driven services gained traction among small and mid-sized chemical producers.

Aramex, although traditionally known for parcel logistics, has increasingly invested in chemical warehousing services, particularly across the Middle East and North Africa. In 2024, the company expanded its secure storage zones compliant with hazardous goods protocols, targeting regional industrial hubs. With its deep logistics network and tech-enabled systems, Aramex is bridging the gap between chemical producers and industrial customers, reinforcing its role as a rising player in chemical logistics.

Top Key Players in the Market

- Affiliated Warehouse Companies

- ALFRED TALKE GmbH & Co. KG

- Anchor 3PL

- Aramex

- BRENNTAG

- Broekman Logistics

- Capital Resin Corporation

- Commonwealth Inc.

- Deutsche Post DHL Group.

- DSV A/S

- Goodrich Maritime Private Limited

- KEMITO

- Odyssey Logistics & Technology Corporation

- Rhenus SE & Co. KG

- Rinchem Company, Inc.

- RSA TALKE

- SolvChem Custom Packaging Division

- Univar Solutions LLC

- Warehouse Specialists Inc.

Recent Developments

- In March 2025, Kemira and IFF formed a joint venture named Alpha Bio, investing €130 million to produce sustainable biobased materials. The facility in Kotka, Finland, will convert up to 44,000 metric tons of plant sugars into high-performance biopolymers, with production starting in late 2027.

- In July 2024, Brenntag acquired ICC in Denver, Colorado, boosting its last-mile delivery operations. The facility features large-scale storage and direct rail connectivity. ICC generated $40 million in revenue in 2023, strengthening Brenntag’s regional chemical warehousing footprint.

Report Scope

Report Features Description Market Value (2024) USD 9.9 Billion Forecast Revenue (2034) USD 13.7 Billion CAGR (2025-2034) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Chemical Warehousing and Storage MarketChemical Warehousing and Storage MarketType (General Warehouse, Speciality Chemical Warehouse), By Chemical Type (Petrochemical, General Chemicals, Agriculture Chemicals, Construction Chemicals, Textile Chemicals, Others), By Storage Type (Bulk Storage, Racked Storage, Drum Storage, Tote Storage, Containerized Storage), By Services (Storage Services, Distribution Services, Inventory Management Services, Packaging Services), By Warehouse Type (Public Warehouses, Private Warehouses, Automated Warehouses, Dedicated Warehouses, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Affiliated Warehouse Companies, ALFRED TALKE GmbH & Co. KG, Anchor 3PL, Aramex, BRENNTAG, Broekman Logistics, Capital Resin Corporation, Commonwealth Inc., Deutsche Post DHL Group., DSV A/S, Goodrich Maritime Private Limited, KEMITO, Odyssey Logistics & Technology Corporation, Rhenus SE & Co. KG, Rinchem Company, Inc., RSA TALKE, SolvChem Custom Packaging Division, Univar Solutions LLC, Warehouse Specialists Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Chemical Warehousing and Storage MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Chemical Warehousing and Storage MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Affiliated Warehouse Companies

- ALFRED TALKE GmbH & Co. KG

- Anchor 3PL

- Aramex

- BRENNTAG

- Broekman Logistics

- Capital Resin Corporation

- Commonwealth Inc.

- Deutsche Post DHL Group.

- DSV A/S

- Goodrich Maritime Private Limited

- KEMITO

- Odyssey Logistics & Technology Corporation

- Rhenus SE & Co. KG

- Rinchem Company, Inc.

- RSA TALKE

- SolvChem Custom Packaging Division

- Univar Solutions LLC

- Warehouse Specialists Inc.