Global Hot Dipped Galvanizing Market Size, Share, And Growth Analysis Report By Metal Type (Steel, Iron), By Process (Batch, Continuous), By End-Use (Construction, Automotive, Consumer Goods, Utilities and Energy, Industrial Machinery, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146205

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

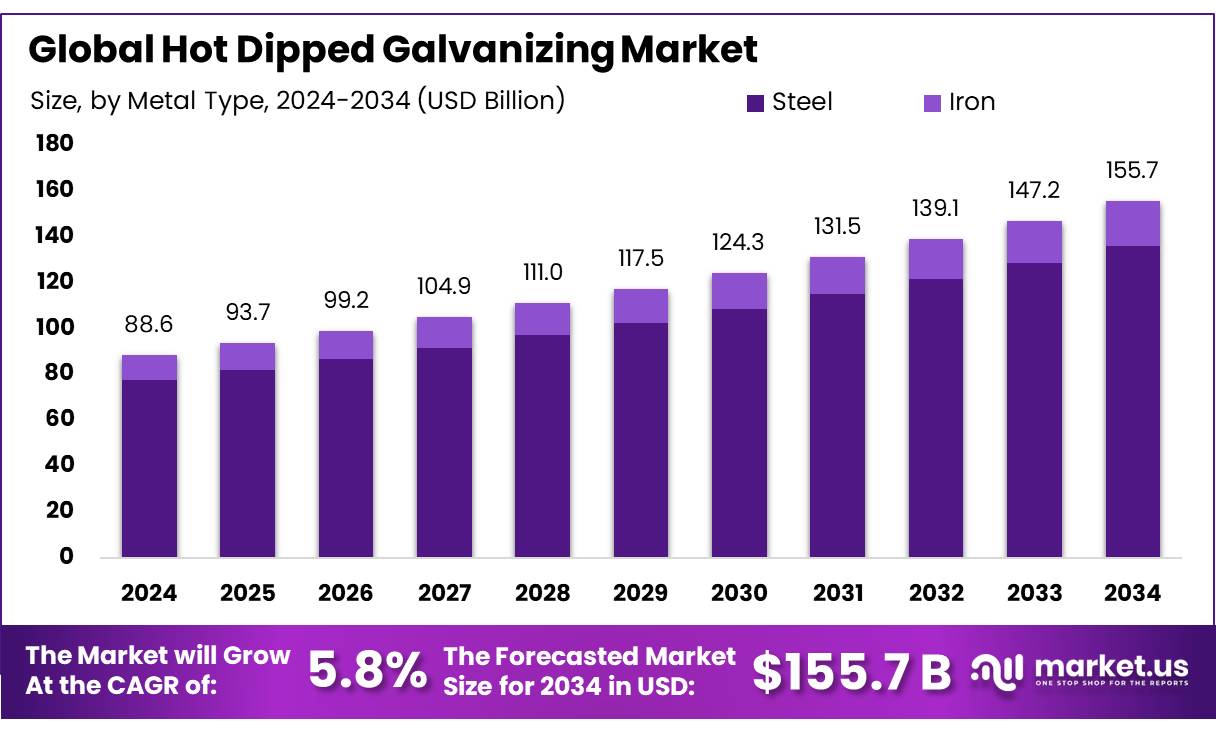

The Global Hot Dipped Galvanizing Market size is expected to be worth around USD 155.7 billion by 2034, from USD 88.6 billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

The Hot-Dip Galvanizing Market plays a pivotal role in enhancing the durability and corrosion resistance of steel and iron products, serving industries such as construction, automotive, infrastructure, and energy. Hot-dip galvanizing involves submerging steel components in molten zinc to apply a protective coating, ensuring longevity in harsh environments. This process is widely adopted due to its cost-effectiveness, sustainability, and ability to provide robust protection against rust, making it integral to industrial applications worldwide.

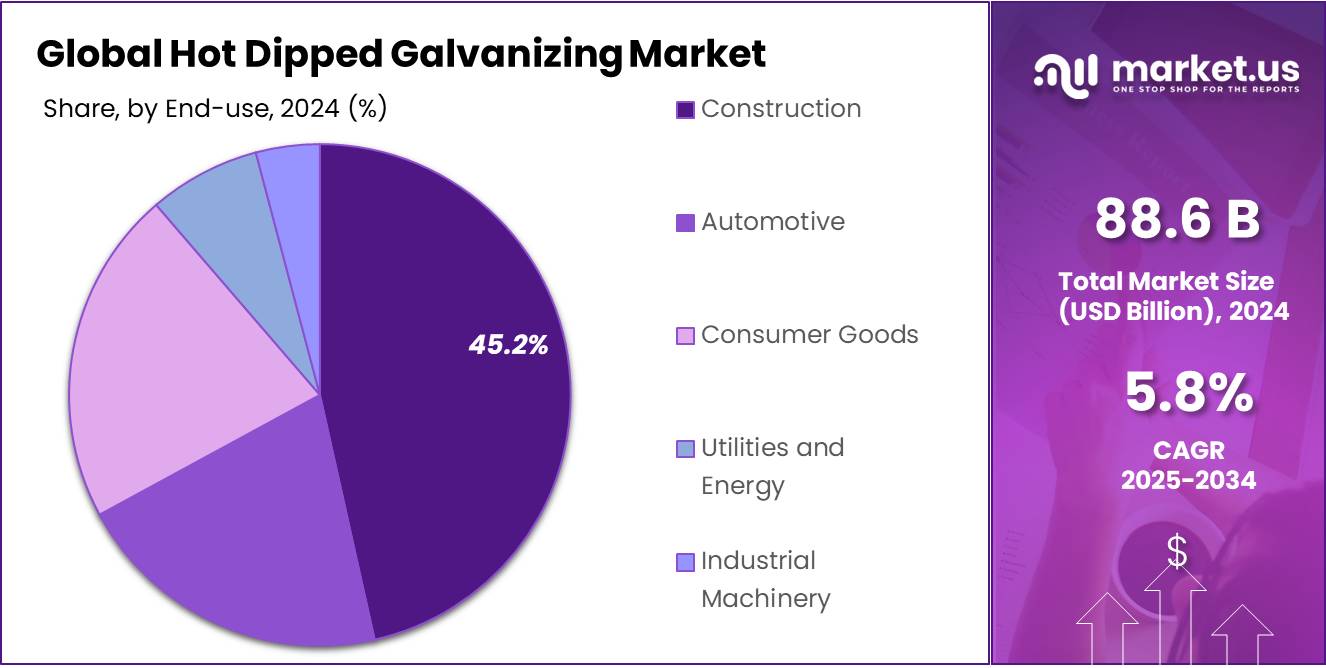

The construction sector dominates, accounting for over 45% of market share, as galvanized steel is extensively used in structural frameworks, roofing, and bridges. The automotive industry also contributes significantly, utilizing galvanized components for vehicle chassis and body panels. Technological advancements, such as eco-friendly galvanizing processes and alloy-enhanced coatings, further bolster market expansion.

Future growth opportunities lie in expanding applications in renewable energy, particularly wind and solar infrastructure, where galvanized steel ensures durability. Innovations in low-emission galvanizing and waste recycling present avenues to meet regulatory demands and reduce costs. Additionally, advancements in coating technologies, like aluminum-zinc alloys, could enhance performance, driving demand across diverse industrial applications.

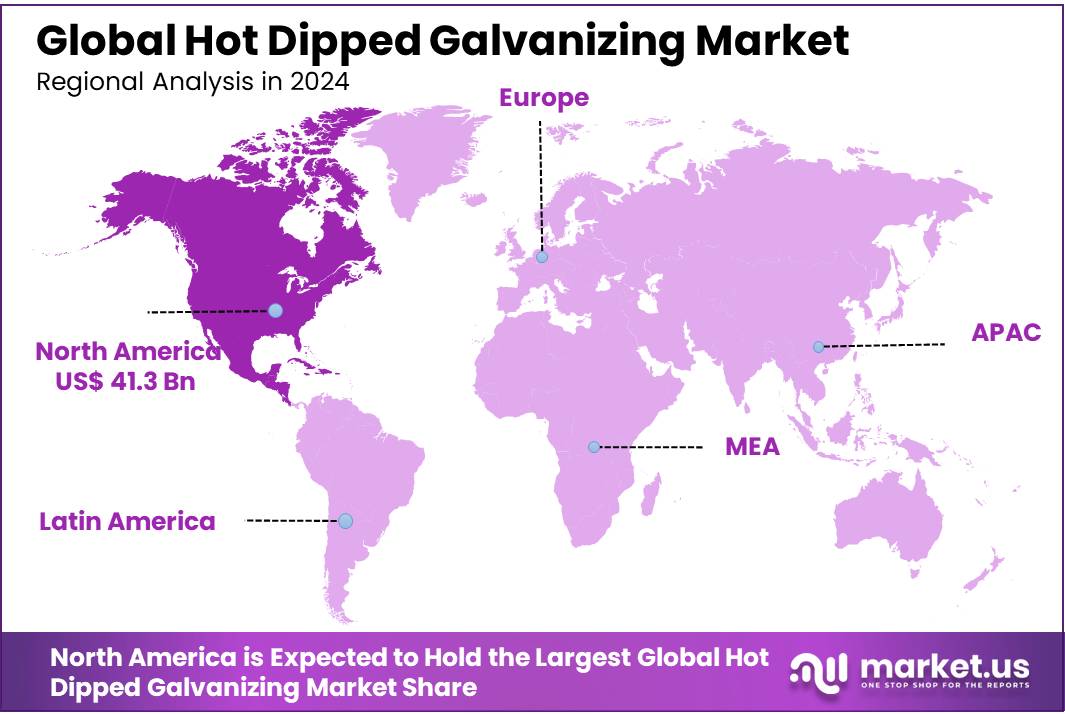

The HDG market is highly fragmented, with key players operating across North America, Europe, and Asia-Pacific. North America dominates, holding over 46% of the market share in 2024. Asia-Pacific and Europe follow, supported by stringent environmental regulations promoting sustainable corrosion protection. The construction sector accounts for nearly 45% of HDG demand, while the automotive and energy sectors contribute.

Key Takeaways

- The Hot-Dipped Galvanizing Market is projected to grow from USD 88.6 billion in 2024 to USD 155.7 billion by 2034, at a 5.8% CAGR.

- Steel holds 87.4% market share due to its durability, cost-effectiveness, and corrosion resistance in construction, automotive, and infrastructure.

- The Batch galvanizing process captures 66.8% market share, favored for coating large, complex structures in construction and heavy machinery.

- Construction accounts for 45.2% of demand, driven by corrosion-resistant steel needs in bridges, highways, and buildings.

- North America holds 46.7% market share, USD 41.3 billion, fueled by a strong construction industry.

Analyst Viewpoint

The Hot-Dip Galvanizing Market offers compelling opportunities, driven by its critical role in protecting steel across booming sectors like construction, automotive, and renewable energy. The demand for corrosion-resistant materials is surging, particularly in emerging markets like India and Southeast Asia, where urbanization is accelerating.

Regulatory pressures are tightening, with stricter environmental rules in regions like the EU mandating lower emissions and better waste management, potentially raising costs for non-compliant firms. Consumer insights reveal a growing preference for sustainable materials, but some industries hesitate due to perceived high initial costs, favoring cheaper alternatives despite long-term savings.

Technological advancements, like AI-driven quality control, are game-changers, boosting efficiency and reducing defects, yet they demand significant upfront investment. The regulatory environment, while pushing innovation, can stifle smaller operators unable to afford compliance upgrades. Investors must weigh these challenges against the market’s promise, focusing on firms that balance innovation with cost discipline to thrive in this dynamic landscape.

By Metal Type

In 2024, Steel dominated the hot-dipped galvanizing market, holding more than an 87.4% share. Its widespread use in construction, automotive, and infrastructure projects drove this strong position. The demand for steel in galvanizing stayed high due to its durability, cost-effectiveness, and resistance to corrosion. Compared to other metals, steel remained the top choice for industries needing long-lasting protection against rust and wear.

Steel is expected to maintain its lead, though growth may slow slightly as alternative metals gain traction in niche applications. Even so, steel’s established role in major industries ensures it will keep the largest market share. The steady demand from emerging economies, where infrastructure development is booming, will further support its dominance.

By Process

In 2024, the Batch process dominated the hot-dipped galvanizing market, capturing more than a 66.8% share. Its popularity comes from its ability to handle large, irregularly shaped components, making it a top choice for industries like construction, automotive, and heavy machinery. The batch method’s flexibility in coating complex structures ensures strong corrosion protection, which keeps demand high.

The batch process is expected to hold its leading position, though continuous galvanizing methods may see slight growth in high-volume production sectors. The batch technique’s reliability and cost-effectiveness for bulk processing will keep it in demand, especially in developing regions where infrastructure projects are expanding.

By End-Use

In 2024, the Construction sector held a dominant position in the hot-dipped galvanizing market, accounting for more than 45.2% of total demand. The need for corrosion-resistant steel in infrastructure projects—such as bridges, highways, and commercial buildings kept this segment at the forefront.

Governments and private developers continue to prioritize long-lasting materials, making galvanized steel a preferred choice due to its durability and low maintenance costs. The construction industry is expected to maintain its lead, though growth may stabilize as some markets face economic fluctuations.

Key Market Segments

By Metal Type

- Steel

- Iron

By Process

- Batch

- Continuous

By End-Use

- Construction

- Automotive

- Consumer Goods

- Utilities and Energy

- Industrial Machinery

- Others

Drivers

Durability and Hygiene: A Key Driver for Hot-Dip Galvanizing in the Food Industry

In the food processing industry, maintaining hygiene and ensuring the longevity of equipment are paramount. Hot-dip galvanizing (HDG) addresses these concerns effectively by providing a robust, corrosion-resistant coating to steel structures. This process involves immersing steel in molten zinc, forming a protective layer that shields against rust and wear.

According to the American Galvanizers Association, HDG can keep steel corrosion-free for decades, even under the demanding conditions of food and beverage facilities. Food processing environments are notoriously harsh. They are characterized by constant exposure to moisture, chemical cleaners, and physical wear from machinery and human activity.

The economic benefits are substantial. By reducing the need for regular maintenance and replacements, HDG helps food processing companies lower operational costs. This is particularly crucial in an industry where profit margins can be tight, and any cost-saving measure can have a significant impact. Moreover, the durability of HDG contributes to uninterrupted production processes, minimizing downtime and ensuring consistent product quality.

Restraints

High Initial Costs: A Barrier to Hot-Dip Galvanizing in the Food Industry

In the food processing sector, ensuring equipment durability and hygiene is vital. Hot-dip galvanizing (HDG) offers corrosion resistance, but its high initial costs can be a significant restraint, especially for small and medium-sized enterprises (SMEs). The HDG process involves immersing steel in molten zinc, leading to a protective coating.

For food processing businesses, which often operate on tight margins, these costs can be prohibitive. While HDG offers long-term savings by reducing maintenance, the upfront investment can deter companies from adopting this method. This is particularly true for SMEs that may lack the capital to invest in more durable infrastructure.

Government initiatives, such as India’s Pradhan Mantri Kisan SAMPADA Yojana, aim to modernize food processing infrastructure. However, without specific subsidies or support for corrosion-resistant technologies like HDG, adoption remains limited. Targeted financial assistance could encourage more businesses to invest in HDG, leading to longer-lasting and more hygienic equipment.

Opportunity

Sustainability and Longevity: Driving the Adoption of Hot-Dip Galvanizing in the Food Industry

In the food processing sector, ensuring equipment durability and hygiene is paramount. Hot-dip galvanizing (HDG) addresses these concerns effectively by providing a robust, corrosion-resistant coating to steel structures. This process involves immersing steel in molten zinc, forming a protective layer that shields against rust and wear.

Food processing environments are notoriously harsh, characterized by constant exposure to moisture, chemical cleaners, and physical wear from machinery and human activity. Such conditions can rapidly degrade unprotected steel, leading to frequent maintenance and potential contamination risks. HDG offers a solution by significantly extending the lifespan of steel components.

The economic benefits are substantial. By reducing the need for regular maintenance and replacements, HDG helps food processing companies lower operational costs. This is particularly crucial in an industry where profit margins can be tight, and any cost-saving measure can have a significant impact. Moreover, the durability of HDG contributes to uninterrupted production processes, minimizing downtime and ensuring consistent product quality.

Trends

Sustainability: A Growing Driver for Hot-Dip Galvanizing in the Food Industry

In today’s food processing industry, sustainability is becoming increasingly important. Hot-dip galvanizing (HDG) is emerging as a key solution, offering both environmental and economic benefits. HDG involves coating steel with a layer of zinc, providing long-lasting protection against corrosion.

This durability means that equipment and structures require less frequent replacement, reducing resource consumption and waste. According to the American Galvanizers Association, HDG can protect steel for decades, even in harsh environments. The sustainability of HDG is further enhanced by the recyclability of its primary materials.

Both zinc and steel are 100% recyclable, making HDG a circular solution that aligns with eco-friendly practices. This is particularly relevant in the food industry, where maintaining a hygienic and durable infrastructure is crucial. In India, government initiatives are supporting sustainable practices in food processing.

Regional Analysis

North America: A Dominant Force in the Hot-Dip Galvanizing Market

The North America hot dipped galvanizing market holds a dominant position globally, commanding a substantial 46.7% share of the global market, valued at approximately USD 41.3 billion in 2024.

The U.S. government’s substantial investments in infrastructure, including the Bipartisan Infrastructure Law and the Inflation Reduction Act, modernize the nation’s infrastructure. These initiatives have spurred demand for durable materials like hot-dip galvanized steel, known for its corrosion resistance and longevity.

North America’s automotive sector plays a crucial role in the market’s expansion. The increasing production of vehicles, coupled with a focus on enhancing vehicle durability and safety, has led to a higher adoption of hot-dip galvanized components. This trend is further supported by technological advancements in galvanizing processes, which have improved coating quality and efficiency.

Environmental considerations also influence market dynamics. The recyclability of galvanized steel aligns with the region’s growing emphasis on sustainable construction practices. Moreover, the adoption of advanced galvanizing technologies has reduced energy consumption and emissions, making hot-dip galvanizing an environmentally favorable option.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- AZZ Inc., headquartered in Fort Worth, Texas, is a leading independent provider of hot-dip galvanizing and coil coating solutions across North America. In the fiscal year 2025, the company’s Metal Coatings segment reflected strong demand from the construction, industrial, and transportation sectors. AZZ’s extensive network and commitment to quality position it as a dominant player in the industry.

- Ganges Internationale specializes in manufacturing and galvanizing steel structures, including telecom towers, solar module mounting structures, and scaffolding systems. The company employs hot-dip galvanizing techniques to ensure durability and corrosion resistance, catering to both domestic and international markets.

- Valmont Industries, headquartered in Omaha, Nebraska, operates a global network of over 30 coating facilities across seven countries. The company’s Coatings division offers hot-dip galvanizing services for various industries, including infrastructure, agriculture, and energy. Valmont’s commitment to sustainability and technological advancement has earned it multiple Excellence in Hot-Dip Galvanizing awards, reinforcing its position as a global leader in corrosion protection solutions.

Top Key Players in the Market

- AZZ Inc.

- Ganges Internationale

- Valmont Industries, Inc

- LTL Galvanizers (Pvt) Limited

- Frontier Galvanizing Inc.

- International Galvanizing, Inc.

- ZINKPOWER Group

- Galserv

- Nucor Corporation

- Joseph Ash Ltd

- Hylite Group

- Pocinkovalnica doo

- Crossroads Galvanizing

- Bordignon Giuseppe S.P.A.

Recent Developments

- In 2024, AZZ Inc. announced an expansion of its galvanizing facility in Fort Worth, Texas, to meet rising demand from the energy and infrastructure sectors. The upgrade includes a new automated galvanizing line expected to increase production capacity.

- In 2024, Ganges Internationale, a key player in India’s galvanizing industry, secured a USD 12 million contract from Indian Railways for supplying galvanized steel components for railway electrification projects. This aligns with the Indian government’s National Rail Plan.

Report Scope

Report Features Description Market Value (2024) USD 88.6 Billion Forecast Revenue (2034) USD 155.7 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Metal Type (Steel, Iron), By Process (Batch, Continuous), By End-Use (Construction, Automotive, Consumer Goods, Utilities and Energy, Industrial Machinery, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AZZ Inc., Ganges Internationale, Valmont Industries, Inc, LTL Galvanizers (Pvt) Limited, Frontier Galvanizing Inc., International Galvanizing, Inc., ZINKPOWER Group, Galserv, Nucor Corporation, Joseph Ash Ltd, Hylite Group, Pocinkovalnica doo, Crossroads Galvanizing, Bordignon Giuseppe S.P.A. Customization Scope Customization for segments at, region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited Users and Printable PDF)  Hot Dipped Galvanizing MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Hot Dipped Galvanizing MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AZZ Inc.

- Ganges Internationale

- Valmont Industries, Inc

- LTL Galvanizers (Pvt) Limited

- Frontier Galvanizing Inc.

- International Galvanizing, Inc.

- ZINKPOWER Group

- Galserv

- Nucor Corporation

- Joseph Ash Ltd

- Hylite Group

- Pocinkovalnica doo

- Crossroads Galvanizing

- Bordignon Giuseppe S.P.A.