Global Intravenous Pegloticase Market By Age Group (Adult, Pediatric and Geriatric), By Application (Chronic and Refractory), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173717

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

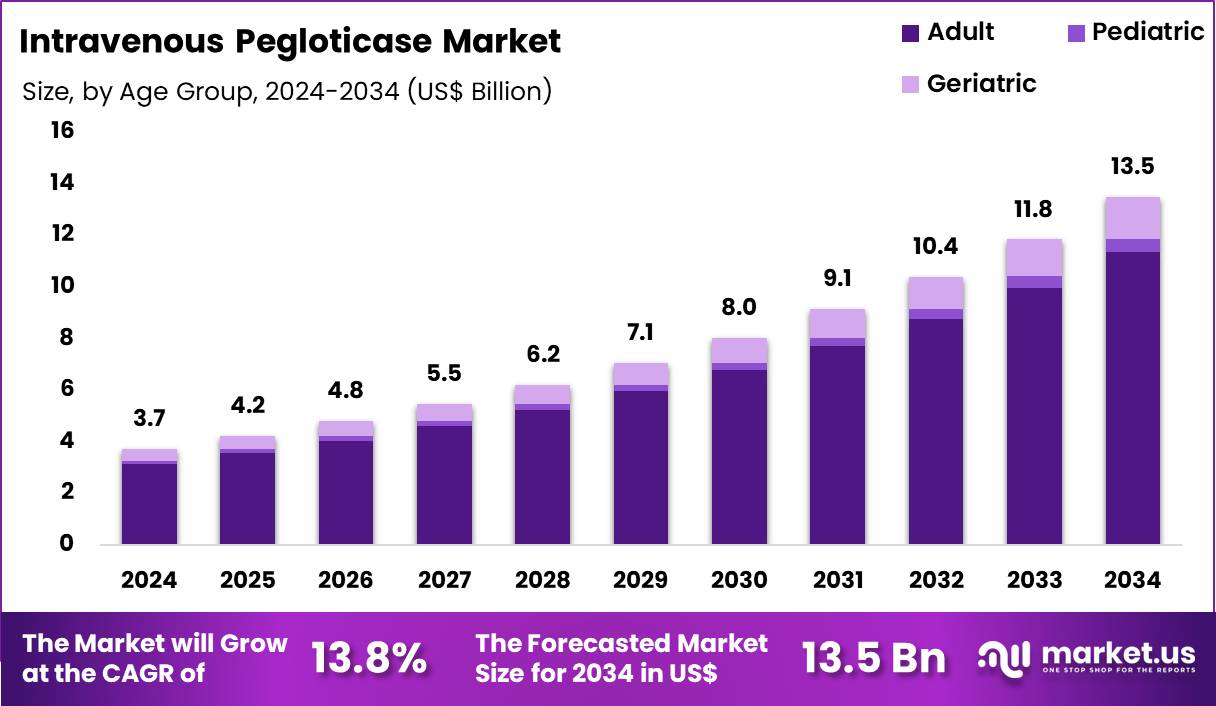

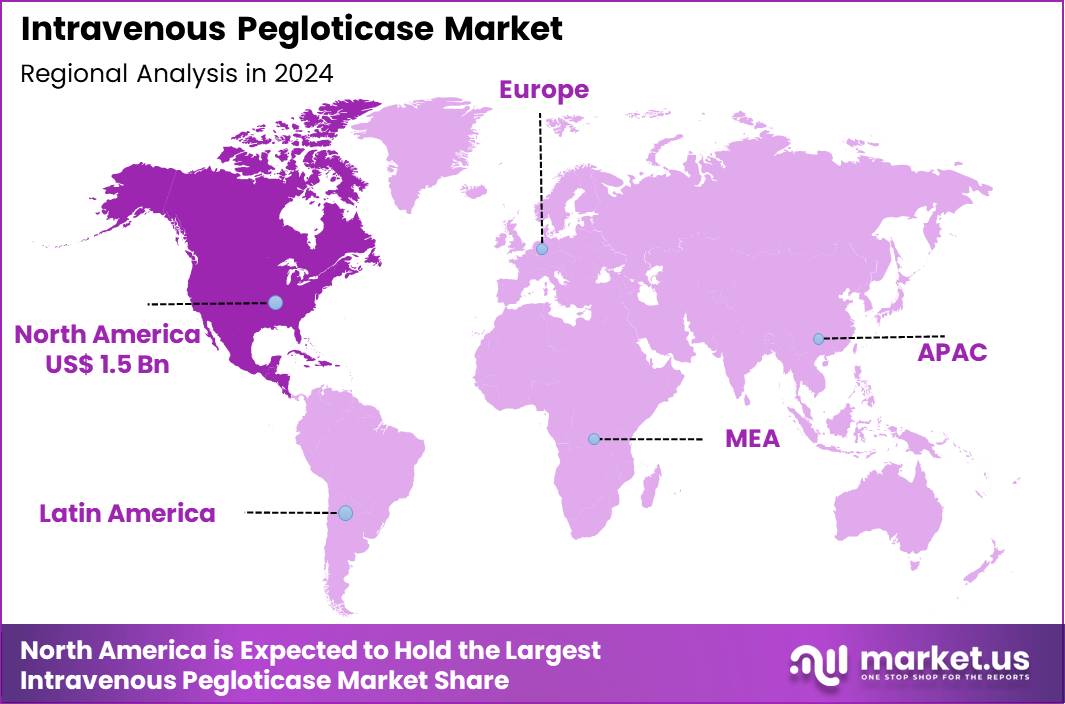

The Global Intravenous Pegloticase Market size is expected to be worth around US$ 13.5 Billion by 2034 from US$ 3.7 Billion in 2024, growing at a CAGR of 13.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.9% share with a revenue of US$ 1.5 Billion.

Growing recognition of refractory chronic gout as a disabling condition is accelerating the use of intravenous pegloticase as an advanced urate-lowering therapy for patients who do not respond adequately to xanthine oxidase inhibitors. This recombinant uricase enzyme is administered biweekly by rheumatologists to rapidly lower serum uric acid levels below therapeutic targets, promoting dissolution of urate crystal deposits in joints and soft tissues.

Pegloticase is primarily used in severe tophaceous gout and chronic gouty arthritis, where persistent hyperuricemia leads to functional limitation, recurrent flares, and joint damage despite optimized oral therapy. Clinical use has been associated with meaningful tophus reduction, pain relief, improved mobility, and restoration of joint function in advanced disease.

Updated guidance issued in 2024 and 2025 reinforced combination therapy to reduce anti-drug antibody formation during pegloticase treatment. Data from the MIRROR trial demonstrated a sustained six-month response in 71% of patients receiving pegloticase with methotrexate, compared with 39% with monotherapy. Follow-up results in 2025 further showed complete resolution of at least one tophus in 54% of combination-treated patients, markedly exceeding monotherapy outcomes.

Pharmaceutical developers are focusing on optimized co-therapy regimens, improved infusion protocols, and biomarker-driven patient selection to expand pegloticase use. Ongoing efforts emphasize real-world evidence generation, long-term safety monitoring, and integrated care models to position pegloticase as a disease-modifying option for refractory gout.

Key Takeaways

- In 2024, the market generated a revenue of US$ 13.7 Billion, with a CAGR of 13.8%, and is expected to reach US$ 13.5 Billion by the year 2034.

- The age group segment is divided into adult, pediatric and geriatric, with adult taking the lead in 2024 with a market share of 84.2%.

- Considering application, the market is divided into chronic and refractory. Among these, chronic held a significant share of 71.6%.

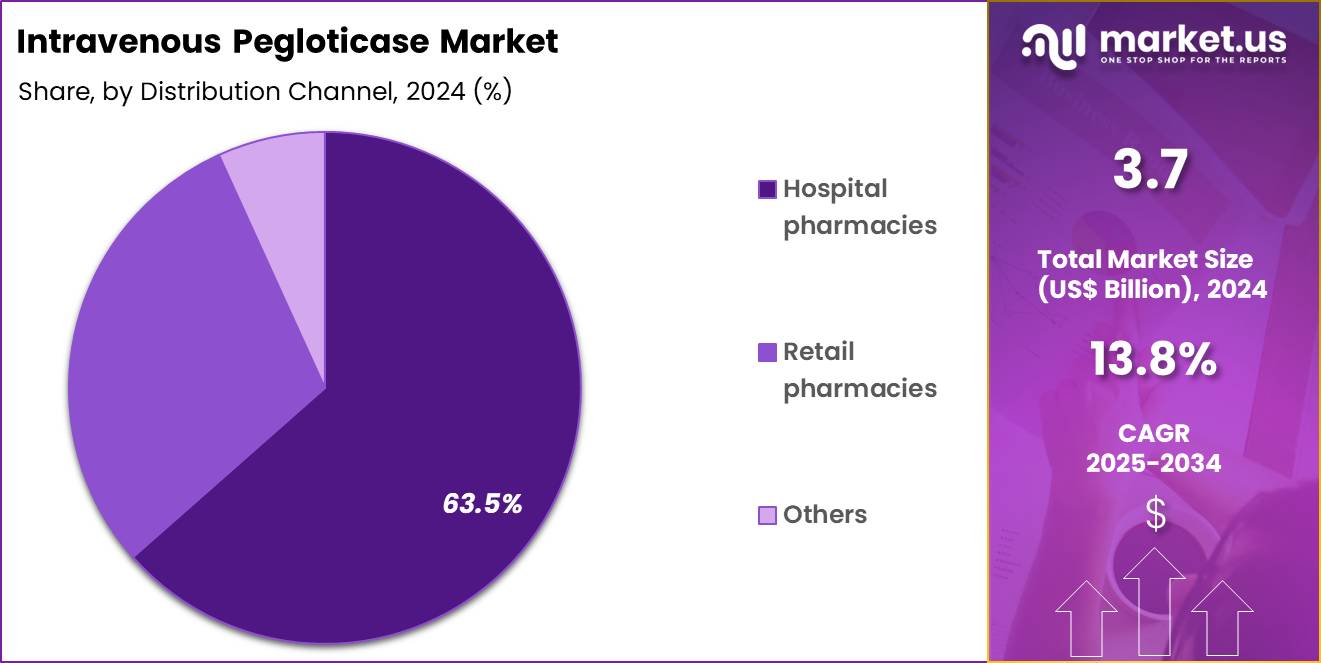

- Furthermore, concerning the distribution channel segment, the market is segregated into hospital pharmacies, retail pharmacies and others. The hospital pharmacies sector stands out as the dominant player, holding the largest revenue share of 63.5% in the market.

- North America led the market by securing a market share of 39.9% in 2024.

Age Group Analysis

Adult accounted for 84.2% of growth within the age group category and represents the core demand base of the Intravenous Pegloticase market. Adult patients form the largest population affected by chronic gout refractory to conventional urate-lowering therapies. Rising prevalence of hyperuricemia linked to obesity, diabetes, cardiovascular disease, and renal impairment increases adult treatment volumes.

Rheumatologists increasingly escalate adults with uncontrolled serum urate levels to biologic uricase therapy. Adults exhibit higher rates of tophaceous gout, driving demand for rapid urate debulking therapies. Treatment guidelines emphasize aggressive management in adults with recurrent flares and joint damage. Improved diagnostic rates in adult populations support earlier identification of refractory disease.

Adults tolerate structured infusion schedules supported by monitoring protocols. Insurance coverage frameworks primarily target adult refractory gout populations. Work productivity concerns motivate timely escalation in adult patients. Growing awareness among clinicians improves referral rates to infusion-based therapies. Adult patients frequently present with long disease duration, reinforcing advanced treatment need. Hospital-based rheumatology practices prioritize adult case management.

Increased life expectancy expands the adult chronic gout population. Adherence improves with specialist-led infusion care. Adult-focused patient assistance programs support access continuity. The segment is projected to remain dominant due to disease epidemiology. Market growth reflects adult-centric indications and prescribing patterns. Clinical outcomes data reinforce confidence in adult use. Overall dominance aligns with population size and disease burden.

Application Analysis

Chronic represented 71.6% of growth within the application category and stands as the primary driver of the Intravenous Pegloticase market. Chronic gout patients experience persistent hyperuricemia despite standard oral therapies. Long-term disease progression leads to joint damage and tophi formation. Clinicians prioritize sustained serum urate control in chronic cases. Pegloticase aligns with treatment goals for severe chronic disease. Recurrent flares and continuous pain increase escalation rates.

Chronic patients generate higher healthcare utilization, supporting advanced therapy adoption. Guidelines emphasize treat-to-target strategies in chronic gout management. Monitoring of serum urate identifies non-responsive chronic patients earlier. Chronic disease management increasingly shifts to specialty care settings. Comorbid renal dysfunction limits oral therapy effectiveness in chronic cases.

Infusion-based therapy supports rapid and sustained urate reduction. Chronic patients demonstrate higher persistence when clinical response is achieved. Hospital systems design care pathways for chronic uncontrolled gout. Increased education on immunomodulation improves long-term outcomes.

Payer policies emphasize chronic refractory status for reimbursement. Patient quality-of-life considerations accelerate treatment initiation. Aging populations expand the chronic gout pool. The segment is anticipated to maintain leadership across indications. Growth reflects long-duration disease and unmet therapeutic needs.

Distribution Channel Analysis

Hospital pharmacies captured 63.5% of growth within distribution channels and dominate the Intravenous Pegloticase market. Administration requires controlled infusion settings and emergency readiness. Hospitals provide infrastructure for monitoring infusion-related reactions. Pharmacy teams manage cold-chain storage and biologic handling requirements. Hospital outpatient infusion centers support scheduled dosing protocols. Multidisciplinary coordination improves safety and treatment continuity.

Complex patient profiles concentrate care within hospital systems. Prior authorization processes operate efficiently in hospital settings. Hospital pharmacies integrate laboratory monitoring for serum urate assessment. Clinical pharmacists support dosing, premedication, and follow-up care. Referral pathways funnel refractory cases to hospital-based services. Hospitals manage patients with multiple comorbidities effectively. Infusion documentation standards improve regulatory compliance.

Hospital purchasing frameworks streamline biologic acquisition. Specialty pharmacy services embedded in hospitals support access programs. Patient education and adherence improve through hospital oversight. Acute flare admissions create initiation opportunities within hospitals. Expansion of ambulatory infusion units increases capacity. Hospital-based governance reinforces clinician confidence. The segment is projected to retain dominance due to safety and complexity requirements.

Key Market Segments

By Age Group

- Adult

- Pediatric

- Geriatric

By Application

- Chronic

- Refractory

By Distribution Channel

- Hospital pharmacies

- Retail Pharmacies

- Others

Drivers

Increasing prevalence of gout is driving the market

The intravenous pegloticase market experiences significant growth due to the rising prevalence of gout, which necessitates effective treatments for patients with uncontrolled symptoms resistant to conventional therapies. Healthcare providers increasingly prescribe pegloticase for its ability to rapidly lower serum uric acid levels in severe cases, improving patient outcomes and reducing joint damage. Regulatory approvals support its use as a targeted enzyme therapy, encouraging adoption in rheumatology practices.

Pharmaceutical companies invest in production to meet the demands of a growing patient population affected by hyperuricemia. Clinical guidelines recommend pegloticase for refractory gout, driving its integration into standard care protocols. Global health surveillance tracks gout trends, informing strategies for treatment accessibility in high-burden regions. Academic research validates pegloticase efficacy in diverse demographics, sustaining market momentum.

Patient education on gout management promotes earlier intervention with advanced therapies like pegloticase. Economic burdens from gout-related disabilities further justify expanded use of intravenous options. According to a 2024 study, the prevalence of gout among U.S. adults is 3.9%, with higher rates in men at 5.2% and women at 2.7%.

Restraints

Infusion reactions and high treatment costs are restraining the market

The intravenous pegloticase market faces constraints from frequent infusion reactions, which can lead to treatment discontinuation and require premedication protocols to mitigate risks. Healthcare professionals must monitor patients closely during administration, adding to procedural complexities and resource demands. Regulatory labeling highlights anaphylaxis risks, deterring use in sensitive populations and limiting market penetration.

Pharmaceutical distribution challenges arise from the need for specialized infusion centers, restricting accessibility in rural areas. Clinical trials report higher incidence of reactions in patients with anti-pegloticase antibodies, complicating dosing regimens. Global variations in healthcare infrastructure exacerbate administration barriers for intravenous therapies.

Academic analyses underscore the need for risk stratification to address tolerability issues. Patient adherence suffers from fear of adverse events, reducing overall utilization. Economic factors, including high costs per infusion cycle, impose burdens on payers and patients. According to product labeling, infusion reactions occurred in 53% of patients with high anti-pegloticase antibody titers in clinical studies.

Opportunities

Expansion of labeling for co-administration with methotrexate is creating growth opportunities

The intravenous pegloticase market benefits from the expansion of labeling for co-administration with methotrexate, which enhances treatment persistence by reducing immunogenicity and infusion reactions. Healthcare providers gain flexibility in managing refractory gout patients, improving therapeutic outcomes through immunomodulation. Regulatory approvals for this combination open avenues for broader patient eligibility, including those previously intolerant to monotherapy.

Pharmaceutical companies can market pegloticase with supportive data on extended use, attracting investment in combination strategies. Clinical research explores similar adjunctive therapies to further optimize pegloticase efficacy. Global adoption in rheumatology aligns with labeling updates promoting safer administration protocols.

Academic partnerships refine dosing regimens to maximize benefits from co-administration. Patient populations with severe gout access sustained urate-lowering therapy, reducing disease flares. Economic models project cost savings from fewer discontinuations and hospitalizations. The U.S. Food and Drug Administration approved expanded labeling for co-administration with methotrexate in 2022, based on clinical trial results.

Impact of Macroeconomic / Geopolitical Factors

Thriving global economies allocate significant budgets to chronic disease management, invigorating the intravenous pegloticase market with amplified prescriptions for gout treatments. Corporations harness population health trends in developed countries to introduce tailored dosing regimens and expand distribution networks. Notwithstanding these gains, rampant worldwide inflation surges utility and research expenditures, impeding affordability for patients in developing nations.

Mounting geopolitical disputes in biotech production centers curtail enzyme sourcing, disrupting formulation processes for key stakeholders. Directors alleviate such interruptions through robust contingency sourcing from allied nations, which refines efficiency and broadens collaborative ventures. Contemporary US tariffs, instituting 100% levies on imported branded and patented drugs as of October 2025, escalate overheads for entities dependent on overseas biologics.

U.S.-based manufacturers exploit this framework to heighten internal capabilities, catalyzing research investments and supply autonomy. Revolutionary integrations of precision medicine techniques persistently elevate the market’s potential, assuring dynamic advancement and superior therapeutic efficacy moving forward.

Latest Trends

Presentation of new data on rare inflammatory diseases at ACR 2024 is a recent trend

In 2024, the intravenous pegloticase market has observed a prominent trend toward the presentation of new data on its role in treating rare inflammatory diseases at major conferences, highlighting its efficacy in uncontrolled gout. Healthcare researchers are sharing real-world evidence on long-term outcomes, informing updated clinical practices. Regulatory discussions incorporate these findings to guide future labeling expansions for broader indications.

Pharmaceutical entities leverage conference data to strengthen marketing strategies for pegloticase in specialized settings. Clinical hotspots focus on patient subgroups benefiting from targeted enzyme therapy. Academic publications from these presentations emphasize safety profiles in diverse populations. Global rheumatology networks adopt insights to standardize pegloticase use in refractory cases.

Patient therapies advance with evidence-based adjustments to dosing intervals. Ethical considerations ensure data transparency in conference disclosures. Amgen presented new data on pegloticase across rare inflammatory diseases at the American College of Rheumatology conference in 2024.

Regional Analysis

North America is leading the Intravenous Pegloticase Market

In 2024, North America secured a 39.9% share of the global intravenous pegloticase market, advanced by escalating demands for effective uric acid-lowering therapies amid rising gout diagnoses and complications from hyperuricemia in patients unresponsive to oral treatments. Rheumatologists expanded prescriptions for this enzyme replacement therapy to manage refractory chronic gout, supported by clinical evidence demonstrating sustained urate reduction and tophus resolution in high-risk groups with comorbidities like cardiovascular disease.

Regulatory endorsements facilitated broader reimbursement under Medicare, enabling access in outpatient infusion centers where personalized dosing regimens addressed tolerability concerns. Aging demographics and lifestyle factors amplified case volumes for erosive joint damage, prompting integrated care models that incorporate pegloticase with anti-inflammatory adjuncts. Pharmaceutical innovations refined administration protocols to minimize infusion reactions, aligning with patient-centered approaches in managed care networks.

Collaborative guidelines from professional societies promoted its use in tophaceous gout, bridging gaps in underserved populations. Supply optimizations ensured consistent biologic availability, supporting scalability in specialty clinics. The prevalence of gout is estimated at 3.9% of U.S. adults, affecting 8.3 million individuals.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts project considerable momentum in intravenous pegloticase adoption across Asia Pacific over the forecast period, as healthcare expansions confront surging hyperuricemia burdens from dietary shifts and metabolic syndromes. Specialists integrate the biologic into gout management protocols, optimizing infusion schedules for patients with renal impairments in densely populated urban hospitals.

National authorities subsidize access through public formularies, equipping facilities to handle refractory cases amid aging workforces facing joint erosions. Biotech entities customize administration kits with enhanced stability, tailoring them to tropical storage conditions for broader distribution. Regional consortia validate long-term efficacy through multicenter studies, fostering confidence in urate-lowering outcomes for comorbid diabetes cohorts.

Pharmaceutical leaders license production technologies, enabling local manufacturers to scale outputs compliant with harmonized safety norms. Community health drives educate practitioners on reaction mitigation, extending utility to peripheral clinics grappling with diagnostic delays. Data from multicenter surveys in China indicate that the prevalence of gout stands at 1.1%.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Intravenous Pegloticase market drive growth by deepening physician education around refractory gout management and by positioning infusion-based therapy as a definitive option for patients who fail oral urate-lowering drugs. Companies expand adoption through treatment-pathway optimization, infusion-center partnerships, and patient-support programs that improve persistence and clinical outcomes.

Commercial strategies emphasize real-world evidence generation and guideline engagement to reinforce appropriate use in specialist-driven settings. Innovation priorities include combination approaches and immunomodulation strategies that enhance durability of response and reduce discontinuation risk.

Market expansion targets regions with rising gout prevalence, improved biologic reimbursement, and expanding specialty infusion infrastructure. Horizon Therapeutics, now part of Amgen, anchors this space with its pegloticase franchise, strong rheumatology relationships, and focused execution across specialty care, patient access, and lifecycle management.

Top Key Players

- Horizon Therapeutics plc

- Teijin Pharma Ltd.

- Selecta Biosciences, Inc.

- Krystal Biotech, Inc.

- BioMarin Pharmaceutical Inc.

- Sarepta Therapeutics, Inc.

- Benitec Biopharma Inc.

- Bioblast Pharma

- PTC Therapeutics

- NS Pharma

Recent Developments

- In 2025, Amgen’s financial disclosures highlighted the continued commercial strength of Krystexxa, with full-year revenue reaching US$1.2 billion in 2024. By the third quarter of 2025, quarterly sales climbed to US$320 million, marking a 3% year-over-year increase driven by a 9% rise in treated patient volumes. Earlier in the second quarter of 2025, revenue growth accelerated to 19%, reaching US$349 million, supported by expanded adoption among nephrologists managing gout patients with concurrent chronic kidney disease.

- In late 2024, with continued evaluation through 2025, data from the AGILE clinical trial demonstrated that a reduced 60-minute infusion protocol, when pegloticase is co-administered with methotrexate, maintains both safety and efficacy. The study showed that 67.2% of patients sustained serum urate levels below 6 mg/dL over six months. This shortened infusion duration improves operational efficiency at infusion centers and reduces patient burden while preserving a favorable safety profile.

Report Scope

Report Features Description Market Value (2024) US$ 3.7 Billion Forecast Revenue (2034) US$ 13.5 Billion CAGR (2025-2034) 13.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Age Group (Adult, Pediatric and Geriatric), By Application (Chronic and Refractory), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Horizon Therapeutics plc, Teijin Pharma Ltd., Selecta Biosciences, Inc., Krystal Biotech, Inc., BioMarin Pharmaceutical Inc., Sarepta Therapeutics, Inc., Benitec Biopharma Inc., Bioblast Pharma, PTC Therapeutics, NS Pharma Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Intravenous Pegloticase MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Intravenous Pegloticase MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Horizon Therapeutics plc

- Teijin Pharma Ltd.

- Selecta Biosciences, Inc.

- Krystal Biotech, Inc.

- BioMarin Pharmaceutical Inc.

- Sarepta Therapeutics, Inc.

- Benitec Biopharma Inc.

- Bioblast Pharma

- PTC Therapeutics

- NS Pharma