Global Animal Drugs Market By Product Type (Biologics (Vaccines (Modified/Attenuated Live, Inactivated (Killed), and Other Vaccines), Other Biologics), Pharmaceuticals (Parasiticides, Anti-inflammatory, Anti-infectives, Analgesics, and Others), Medicated Feed Additives), By Route of Administration (Oral, Injectable, Topical, and Other), By Animal Type (Production Animals (Poultry, Sheep & Goats, Pigs, Cattle, and Others), Companion Animals (Dogs, Horses, Cats, and Others)), By Distribution Channel (Veterinary Hospitals & Clinics, E-commerce, Offline Retail Stores, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146190

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Route of Administration Analysis

- Animal Type Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

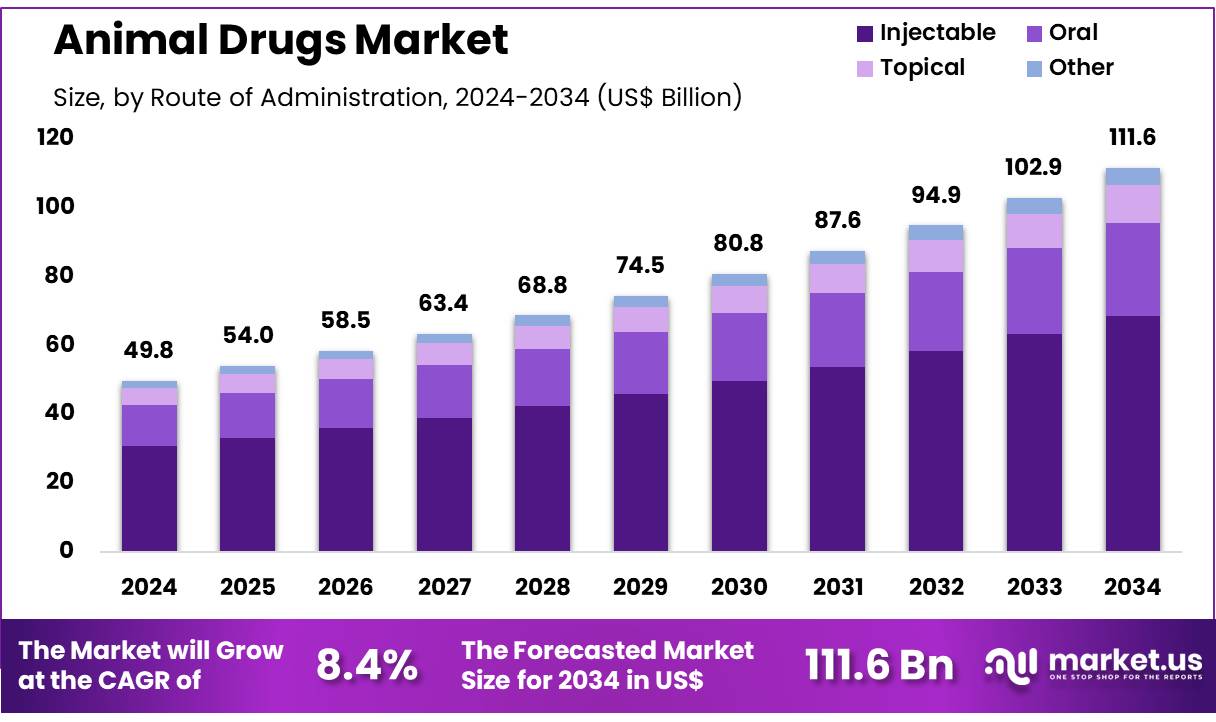

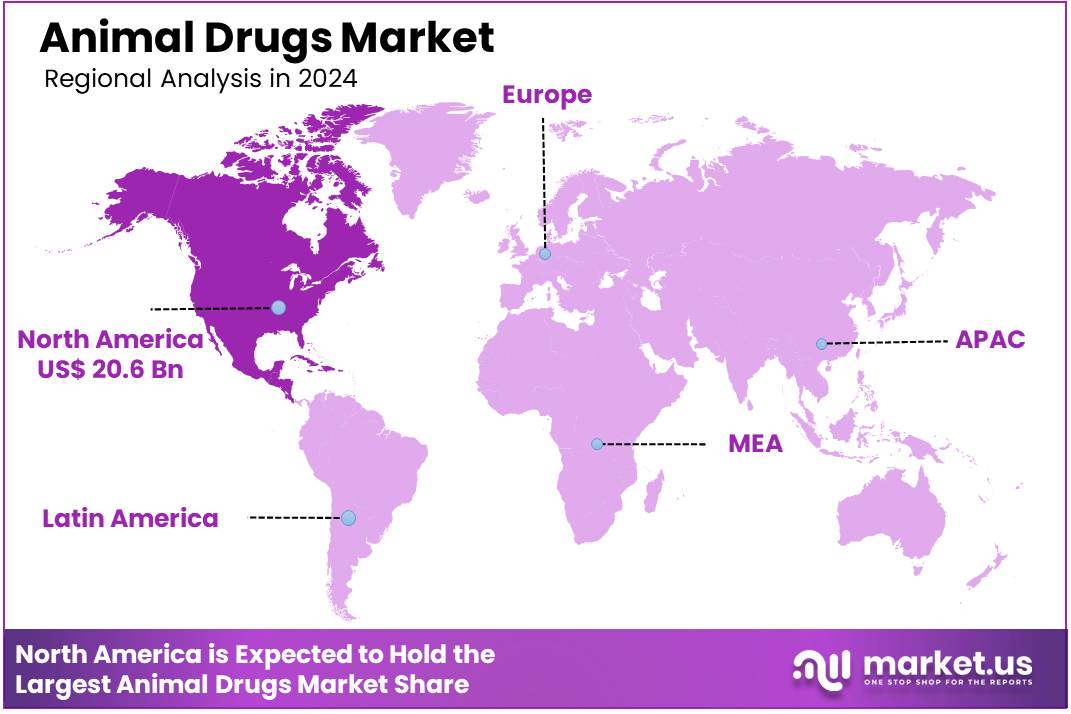

Global Animal Drugs Market size is expected to be worth around US$ 111.6 Billion by 2034 from US$ 49.8 Billion in 2024, growing at a CAGR of 8.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.3% share with a revenue of US$ 20.6 Billion.

Increasing demand for animal health products, driven by rising pet ownership, livestock farming, and the growing focus on food safety, is propelling the animal drugs market. As veterinary care evolves, there is a growing need for effective treatments to manage diseases in both companion animals and livestock. The market benefits from advancements in drug development, including vaccines, antibiotics, anti-inflammatory agents, and parasitic treatments, all essential to improving animal health and productivity.

Increasing awareness of zoonotic diseases and their potential impact on human health has also contributed to the growth of the market. In September 2024, Zoetis and Danone formed a strategic alliance to drive sustainable dairy farming through advanced genetic technologies. This partnership will focus on improving cow health and reducing environmental impacts by using genetic testing to breed more resilient animals, supporting both farm productivity and consumer demand for sustainable dairy products.

Such collaborations reflect the growing trend of integrating innovation and sustainability in the animal drugs market. These developments present numerous opportunities to improve animal welfare while meeting consumer demand for more sustainable food sources.

Key Takeaways

- In 2024, the market for animal drugs generated a revenue of US$ 49.8 billion, with a CAGR of 8.4%, and is expected to reach US$ 111.6 billion by the year 2033.

- The product type segment is divided into biologics, pharmaceuticals, and medicated feed additives, with pharmaceuticals taking the lead in 2024 with a market share of 55.2%.

- Considering route of administration, the market is divided into oral, injectable, topical, and other. Among these, injectable held a significant share of 61.5%.

- Furthermore, concerning the animal type segment, the market is segregated into production animals and companion animals. The production animals sector stands out as the dominant player, holding the largest revenue share of 62.8% in the animal drugs market.

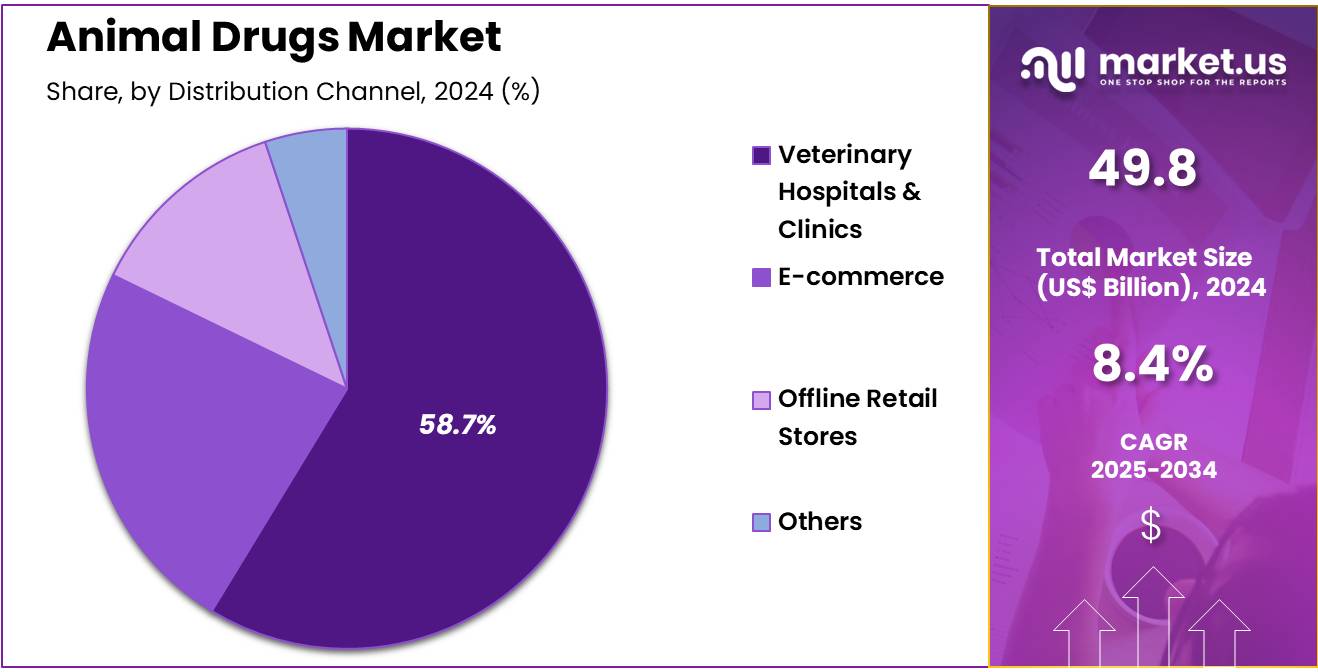

- The distribution channel segment is segregated into veterinary hospitals & clinics, e-commerce, offline retail stores, and others, with the veterinary hospitals & clinics segment leading the market, holding a revenue share of 58.7%.

- North America led the market by securing a market share of 41.3% in 2024.

Product Type Analysis

The pharmaceuticals segment led in 2024, claiming a market share of 55.2% owing to the increasing demand for effective treatments for both companion and production animals. Pharmaceuticals, including antibiotics, anti-inflammatory drugs, and pain management medications, are anticipated to see rising demand due to the growing awareness of animal health and the increasing incidence of diseases among animals.

The expansion of animal farming, coupled with the need for preventive and therapeutic treatments, will likely contribute to the growth of this segment. Additionally, the development of new pharmaceutical products aimed at improving animal welfare and reducing production losses in livestock is projected to fuel market expansion.

Route of Administration Analysis

The injectable held a significant share of 61.5% as veterinarians and animal care providers increasingly turn to injectable medications for their rapid efficacy and precision in delivering treatments. Injectable drugs offer significant advantages in terms of bioavailability and are often preferred for administering vaccines, pain relief, and other therapeutics.

The increasing prevalence of chronic diseases in animals and the need for quick and effective treatments are expected to drive demand for injectable drugs. Furthermore, the convenience and efficiency of injectable products are expected to contribute to the segment’s growth in veterinary practices and farming environments.

Animal Type Analysis

The production animals segment had a tremendous growth rate, with a revenue share of 62.8% owing to the increasing demand for livestock products, such as meat, milk, and eggs. Production animals, including cattle, pigs, and poultry, are expected to drive the growth of the market as the demand for animal drugs increases to ensure the health, productivity, and disease prevention of livestock.

The rising global population and the growing need for animal protein are anticipated to fuel demand for production animal drugs. Additionally, advancements in veterinary care and the need for more effective treatments for livestock diseases are likely to propel growth in this segment.

Distribution Channel Analysis

The veterinary hospitals & clinics segment grew at a substantial rate, generating a revenue portion of 58.7% due to the increasing number of veterinary clinics and hospitals worldwide. As pet ownership increases and animal healthcare becomes a higher priority for owners, veterinary hospitals and clinics are expected to see growing demand for animal drugs.

These establishments are key players in dispensing medications and providing health care for companion animals and livestock. The increasing awareness about animal health, coupled with advancements in veterinary medicine, is projected to support the expansion of the veterinary hospitals & clinics segment in the animal drugs market.

Key Market Segments

By Product Type

- Biologics

- Vaccines

-

-

- Modified/ Attenuated Live

- Inactivated (Killed)

- Other Vaccines

- Other Biologics

-

- Pharmaceuticals

- Parasiticides

- Anti-inflammatory

- Anti-infectives

- Analgesics

- Others

- Medicated Feed Additives

By Route of Administration

- Oral

- Injectable

- Topical

- Other

By Animal Type

- Production Animals

- Poultry

- Sheep & Goats

- Pigs

- Cattle

- Others

- Companion Animals

- Dogs

- Horses

- Cats

- Others

By Distribution Channel

- Veterinary Hospitals & Clinics

- E-commerce

- Offline Retail Stores

- Others

Drivers

Rising Prevalence of Chronic Diseases in Animals is Driving the Market

The increasing incidence of chronic conditions such as diabetes, arthritis, and cancer in pets and livestock is significantly driving demand for specialized pharmaceuticals. As more pet owners seek advanced treatments for their animals, veterinary drug expenditures continue to rise. Zoetis, a leading company in animal health, reported a 14% revenue growth in its companion animal segment in 2023, mainly due to the demand for chronic disease therapies.Similarly, livestock producers are investing in long-term treatments that improve animal health and productivity. In response, pharmaceutical firms are focusing on developing innovative biologics and extended-release formulations, which are expected to drive further market expansion. The increasing recognition of these chronic conditions and the need for long-term care will likely continue to influence the growth of this market segment.

Restraints

Stringent Regulatory Approvals are Restraining the Market

The animal drugs market faces challenges due to lengthy and complex regulatory approval processes, which delay product launches and increase the overall development costs. Regulatory agencies such as the FDA’s Center for Veterinary Medicine (CVM) require extensive clinical trials to ensure product safety and efficacy, and this can significantly prolong time-to-market.Smaller companies often struggle with meeting these regulatory demands, which limits competition and slows the introduction of new treatments. Additionally, the European Medicines Agency (EMA) has imposed tighter regulations on antibiotic use in livestock, further restricting the availability of certain drugs. While these regulations are necessary to ensure safety and reduce resistance, they do slow down innovation and limit accessibility, particularly in regions where regulatory frameworks are still developing.

Opportunities

Expansion of Telemedicine for Pets is Creating Growth Opportunities

Telemedicine has become a crucial factor in the growth of the animal drugs market, as it increases access to veterinary consultations and prescriptions for at-home and over-the-counter medications. Platforms like Vetster and Chewy’s Connect With a Vet service saw a 60% surge in consultations in 2023, indicating growing demand for telehealth services. This shift to virtual care encourages veterinarians to recommend more diagnostic tests and treatments, which in turn boosts pharmaceutical sales.Companies like Elanco and Merck Animal Health are capitalizing on this trend by partnering with telemedicine providers to streamline the distribution of veterinary medications. Rural areas, where access to in-person veterinary care is limited, are particularly benefitting from this trend. With improvements in digital infrastructure, telemedicine is expected to continue growing and drive the expansion of the pharmaceuticals market.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors, such as inflation, and geopolitical tensions are significantly impacting the animal drugs market by raising production costs and creating supply chain challenges. As the cost of raw materials and active pharmaceutical ingredients (APIs) rises, companies are forced to increase the prices of veterinary medications, which can reduce affordability for some consumers. Supply chain disruptions, worsened by trade restrictions and geopolitical issues, particularly with key manufacturing hubs in China and India, have delayed shipments of necessary components.

Despite these challenges, government initiatives aimed at improving livestock health, such as the European Union’s 2023 policies on antibiotic reduction, are driving investments in alternative treatments like vaccines and probiotics. Additionally, trade agreements like the USMCA are improving cross-border drug distribution, benefiting manufacturers. While economic volatility and geopolitical instability present short-term challenges, the growing demand for veterinary care, along with innovations in pharmaceuticals and technology, ensures a strong long-term outlook for the market.

Latest Trends

Growing Demand for Parasiticides is a Recent Market Trend

As the need for effective parasite control increases, demand for parasiticides is growing rapidly in both the companion animal and livestock sectors. Zoetis reported an 18% increase in revenue from parasiticides in 2023, reflecting the high demand for flea, tick, and worm treatments. The rise in cases of vector-borne diseases like Lyme disease further contributes to the growing need for preventative treatments. Livestock producers are also increasing their use of antiparasitic medications, particularly for deworming cattle, to ensure the health and productivity of their herds.Additionally, new formulations, such as chewables and spot-on treatments, are gaining popularity due to their ease of administration and higher compliance rates. With climate change expanding parasite habitats, this trend is expected to continue, making parasite control a key area for market growth.

Regional Analysis

North America is leading the Animal Drugs Market

North America dominated the market with the highest revenue share of 41.3% owing to increasing pet healthcare expenditure, rising livestock production, and regulatory approvals for novel therapeutics. The American Pet Products Association (APPA) reported that US pet owners spent over US$38 billion on veterinary care in 2024, up from US$34 billion in 2022, reflecting higher demand for pharmaceuticals. The USDA noted a 5% increase in cattle and poultry production in 2024 compared to 2022, boosting the need for antibiotics and vaccines.

The US Food and Drug Administration’s Center for Veterinary Medicine approved 15% more new animal drug applications in 2023 than in 2022, accelerating treatment accessibility. Zoetis, a leading animal health company, recorded an 8% revenue increase in 2023, driven by strong sales of parasiticides and biologics.

Additionally, the Canadian Animal Health Institute (CAHI) reported a rise in antimicrobial sales for livestock in 2024, linked to disease prevention measures. These factors, combined with growing awareness of veterinary medicine, contributed to the market’s expansion across North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to expanding livestock industries, rising pet adoption, and government-led animal health initiatives. India’s Department of Animal Husbandry and Dairying vaccinated over 300 million livestock in 2023 under its National Animal Disease Control Programme, supporting drug sales.

China’s Ministry of Agriculture and Rural Affairs approved more veterinary drugs in 2024 than in 2022, streamlining market entry for new treatments. Japan’s pet population grew in 2023, increasing the need for companion animal medications. Australia’s government allocated US$50 million in 2024 to improve livestock biosecurity, further boosting pharmaceutical demand. These trends indicate a robust outlook for the market, with innovation and policy support playing key roles in regional expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the animal drugs market focus on product innovation, strategic partnerships, and expanding market reach to drive growth. They invest in developing novel therapeutics and vaccines to address various animal diseases and improve animal health outcomes. Companies also prioritize increasing their presence in emerging markets where demand for veterinary care and livestock production is rising. Collaborations with research institutions and veterinary clinics help enhance product offerings and accelerate adoption. Additionally, improving access to affordable treatments and focusing on sustainability initiatives further supports their market expansion.

Zoetis Inc., headquartered in Parsippany, New Jersey, is a global leader in animal health, specializing in medicines, vaccines, and diagnostics for both livestock and companion animals. The company’s portfolio includes a broad range of animal health products designed to improve animal well-being and productivity. Zoetis invests heavily in research and development, ensuring its products meet evolving industry needs. With operations in over 100 countries, Zoetis continues to expand its presence and influence in the global animal health market.

Top Key Players

- Virbac

- Trupanion

- Phibro Animal Health Corporation

- Elanco

- Dechra Pharmaceuticals PLC

- Boehringer Ingelheim

- Biogenesis Bago

- Bimeda Corporate

Recent Developments

- In August 2024, Boehringer Ingelheim entered into a collaboration with Vvaan Lifesciences Pvt Ltd to expand its presence in the Indian pet healthcare market. This collaboration is aimed at increasing accessibility to essential pet parasiticide treatments, particularly in underserved regions, helping raise standards in pet healthcare across the country.

- In June 2024, Trupanion and Boehringer Ingelheim formed a collaboration to enhance the quality of pet healthcare. By combining Trupanion’s insurance coverage with Boehringer Ingelheim’s expertise, this partnership focuses on improving treatment accessibility, promoting early health risk detection, and integrating innovative insurance solutions for more efficient veterinary care.

Report Scope

Report Features Description Market Value (2024) US$ 49.8 billion Forecast Revenue (2034) US$ 111.6 billion CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Biologics (Vaccines (Modified/Attenuated Live, Inactivated (Killed), and Other Vaccines), Other Biologics), Pharmaceuticals (Parasiticides, Anti-inflammatory, Anti-infectives, Analgesics, and Others), Medicated Feed Additives), By Route of Administration (Oral, Injectable, Topical, and Other), By Animal Type (Production Animals (Poultry, Sheep & Goats, Pigs, Cattle, and Others), Companion Animals (Dogs, Horses, Cats, and Others)), By Distribution Channel (Veterinary Hospitals & Clinics, E-commerce, Offline Retail Stores, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Virbac, Trupanion, Phibro Animal Health Corporation, Elanco, Dechra Pharmaceuticals PLC, Boehringer Ingelheim, Biogenesis Bago, and Bimeda Corporate. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Virbac

- Trupanion

- Phibro Animal Health Corporation

- Elanco

- Dechra Pharmaceuticals PLC

- Boehringer Ingelheim

- Biogenesis Bago

- Bimeda Corporate