Global Animal Antibiotics Market By Animal Type (Pigs, Cattle, Sheep & Goats, Poultry, and Others), By Drug Class (Tetracyclines, Penicillins, Sulfonamides, Macrolides, and Others), By Dosage (Oral Powders, Oral Solutions, Injections, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146245

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

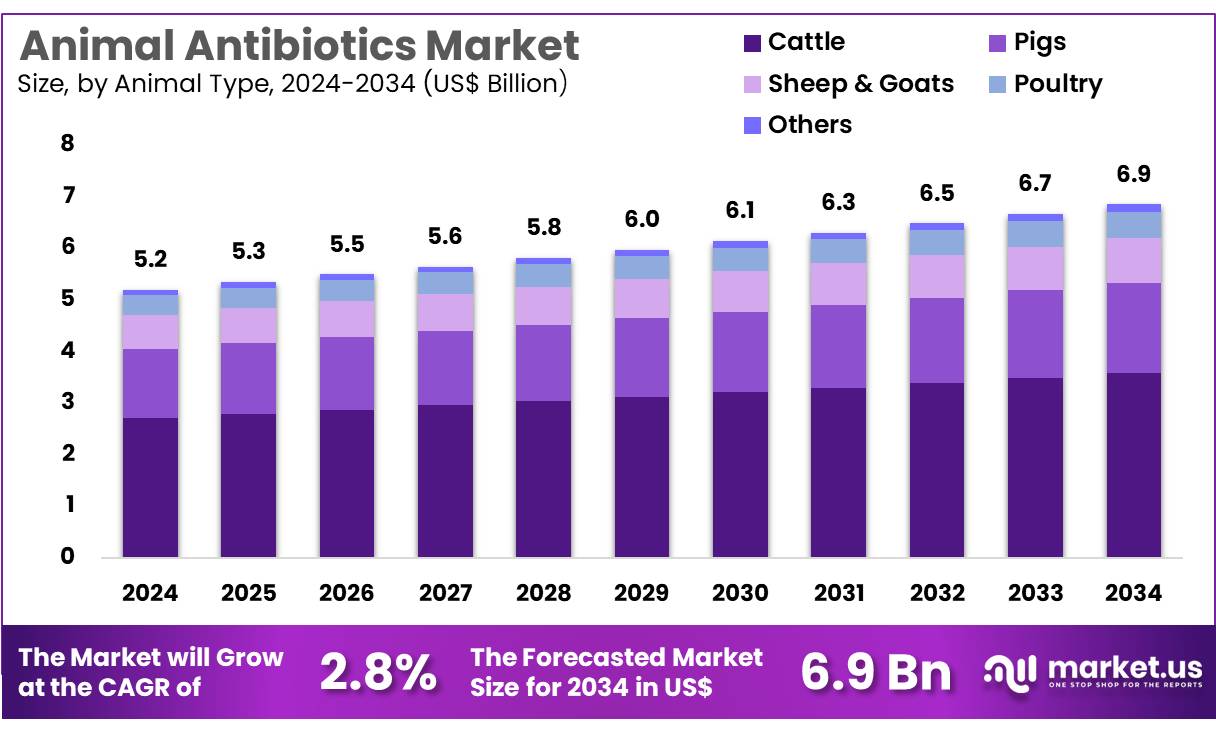

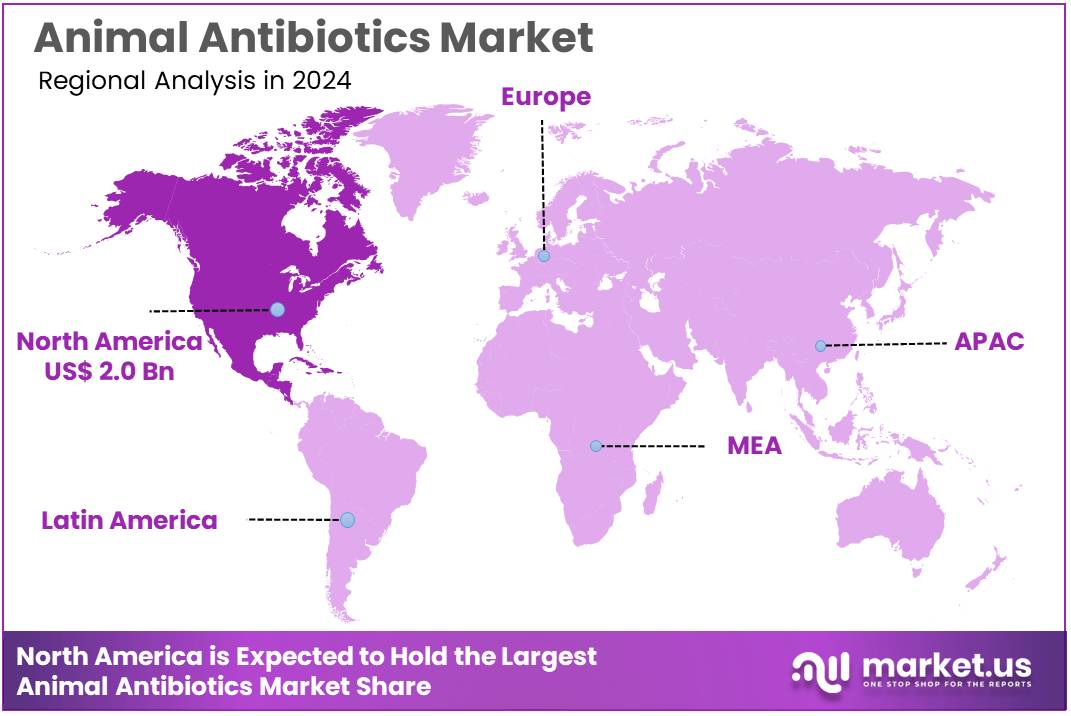

Global Animal Antibiotics Market size is expected to be worth around US$ 6.9 Billion by 2034 from US$ 5.2 Billion in 2024, growing at a CAGR of 2.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.6% share with a revenue of US$ 2.0 Billion.

Increasing concerns over animal health and the rise of zoonotic diseases are driving the growth of the animal antibiotics market. Farmers and veterinarians use antibiotics to prevent and treat infections in livestock, poultry, and other animals, ensuring animal welfare and improving productivity. The growing demand for animal protein and the expansion of animal farming activities have led to an increase in the use of antibiotics to maintain herd health and optimize production efficiency.

Recent trends in the market indicate a shift towards more sustainable practices, such as reducing the use of antibiotics in favor of alternatives like probiotics, vaccines, and enhanced biosecurity measures. In 2022, the European Medicines Agency (EMA) revealed that oral antimicrobial solutions made up approximately 63.4% of veterinary treatment sales across 31 European Union countries, underscoring their essential role in veterinary care on farms.

Despite increasing regulatory scrutiny regarding antibiotic use in animals, the market continues to see innovations in antibiotic formulations and administration methods, presenting significant opportunities for growth and advancements in veterinary care.

Key Takeaways

- In 2024, the market for animal antibiotics generated a revenue of US$ 5.2 billion, with a CAGR of 2.8%, and is expected to reach US$ 6.9 billion by the year 2033.

- The animal type segment is divided into pigs, cattle, sheep & goats, poultry, and others, with cattle taking the lead in 2024 with a market share of 52.3%.

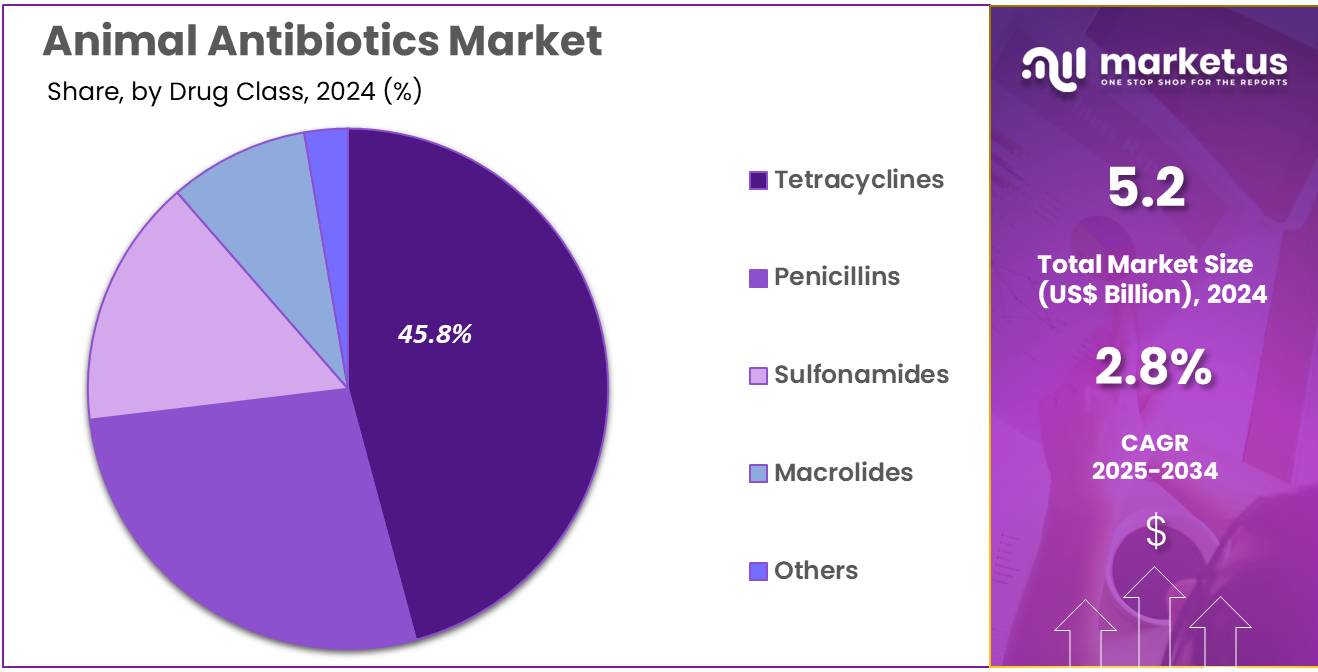

- Considering drug class, the market is divided into tetracyclines, penicillins, sulfonamides, macrolides, and others. Among these, tetracyclines held a significant share of 45.8%.

- Furthermore, concerning the dosage segment, the market is segregated into oral powders, oral solutions, injections, and others. The oral solutions sector stands out as the dominant player, holding the largest revenue share of 51.2% in the animal antibiotics market.

- North America led the market by securing a market share of 38.6% in 2024.

Animal Type Analysis

The cattle segment led in 2024, claiming a market share of 52.3% as the demand for meat and dairy products increases globally. The rising population and improving living standards in developing economies are likely to drive the demand for cattle products, leading to higher consumption of antibiotics to maintain animal health and prevent disease outbreaks in livestock.

Additionally, the growing focus on improving productivity in cattle farming and ensuring the quality of meat and dairy products is expected to further fuel the market for animal antibiotics. The need for antibiotics to control infections, enhance growth, and promote general well-being in cattle is projected to contribute to the expansion of this segment.

Drug Class Analysis

The tetracyclines held a significant share of 45.8% due to their broad-spectrum activity and effectiveness in treating a wide range of bacterial infections in animals. Tetracyclines are commonly used in both livestock and companion animals to combat respiratory infections, gastrointestinal diseases, and other bacterial infections.

The growing resistance to antibiotics in animals and the continued need for effective treatment options in livestock are expected to drive the demand for tetracyclines. Furthermore, ongoing advancements in tetracycline formulations and their continued use in veterinary practices are likely to contribute to the market expansion of this drug class.

Dosage Analysis

The oral solutions segment had a tremendous growth rate, with a revenue share of 51.2% as oral administration remains a preferred method of delivering antibiotics to animals due to its ease of use and cost-effectiveness. Oral solutions are commonly used for treating livestock, particularly cattle and poultry, as they can be mixed with feed or water, ensuring efficient delivery.

The growing trend towards preventive healthcare in livestock, along with the increasing focus on improving animal health and reducing treatment costs, is anticipated to drive the demand for oral solutions. As veterinary care continues to evolve, the convenience and efficacy of oral antibiotics in maintaining animal health are likely to promote the growth of this segment.

Key Market Segments

By Animal Type

- Pigs

- Cattle

- Sheep & Goats

- Poultry

- Others

By Drug Class

- Tetracyclines

- Penicillins

- Sulfonamides

- Macrolides

- Others

By Dosage

- Oral Powders

- Oral Solutions

- Injections

- Others

Drivers

Rising Demand for Livestock Products is Driving the Market

The growing global population and increasing meat consumption are driving the demand for animal antibiotics to ensure livestock health and productivity. Global meat production reached 360 million metric tons in 2023, leading to higher antibiotic use in livestock. The US Department of Agriculture (USDA) reported that over 70% of medically important antibiotics in the US were sold for food-producing animals.

Companies like Zoetis and Elanco have seen increased sales, with Zoetis generating US$ 8.1 billion in revenue in 2023, partly due to strong demand for livestock health products. Emerging economies, particularly in Asia and Latin America, are adopting intensive farming practices, further boosting antibiotic usage. This trend underscores the direct link between meat production growth and the need for veterinary antimicrobials, supporting the continued expansion of the market.

Restraints

Stringent Regulations on Antibiotic Use are Restraining the Market

Governments worldwide are imposing strict regulations to curb antibiotic resistance, limiting market growth. The European Union banned the routine use of antibiotics in livestock in 2022, and the US FDA introduced tighter restrictions on medically important antimicrobials in 2023. The World Health Organization (WHO) reported a 15% decline in antibiotic use in animals across Europe between 2022 and 2023 due to regulatory pressures. Companies like Merck Animal Health saw a 5% drop in antibiotic sales in regulated markets during the same period.

These policies are encouraging alternatives such as vaccines and probiotics, reducing reliance on traditional antimicrobials. While these measures are essential for public health, they present a challenge for manufacturers and farmers who rely on antibiotics for disease prevention and control. These restrictions may limit market growth, particularly in regions where antibiotics have been a central part of livestock health management.

Opportunities

Increasing Focus on Precision Livestock Farming is Creating Growth Opportunities

Advancements in digital farming technologies, particularly AI-driven health monitoring systems, are opening new opportunities for more targeted antibiotic use. Companies like DeLaval and Allflex are developing smart sensors that detect early signs of infection, allowing for precise treatment and reducing blanket antibiotic use. Precision livestock farming adoption grew by 25% in 2023 compared to 2022, particularly in the dairy and poultry sectors.

Zoetis invested over US$ 200 million in digital diagnostics in 2023 to support this shift. This trend not only aligns with regulatory demands for responsible antibiotic use but also helps maintain animal health, creating a lucrative niche for tech-integrated veterinary solutions. By optimizing antibiotic use through precision farming techniques, the industry can meet both health and regulatory needs, fostering the long-term growth of the market.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly affect the veterinary antibiotics market, influencing production costs and global trade dynamics. Inflation and rising raw material costs have led to higher production expenses for veterinary antibiotics, which in turn raises prices for end-users. The Russia-Ukraine conflict disrupted global grain supplies in 2022 and 2023, raising feed costs and indirectly impacting livestock health budgets.

However, government subsidies in countries like India and Brazil are supporting farmers in accessing essential veterinary drugs, reducing the financial burden. The World Organisation for Animal Health (WOAH) reported a 7% increase in global animal health spending in 2023, reflecting the resilience of the market.

Trade tensions, particularly between China and Western nations, have delayed shipments of active pharmaceutical ingredients (APIs), but local production expansions in Southeast Asia are helping to mitigate shortages. Despite short-term disruptions, innovation in alternatives and the sustained demand for protein-rich diets ensure continued long-term growth in the sector.

Latest Trends

Rising Adoption of Phytogenic Alternatives is a Recent Trend

Farmers and veterinarians are increasingly turning to plant-based antimicrobials as sustainable substitutes for traditional antibiotics. A USDA report from 2023 noted a 30% increase in phytogenic feed additive usage in the US poultry industry compared to 2022. Companies like Cargill and Kemin have expanded their natural product lines, with Cargill’s animal nutrition segment growing by 10% in 2023.

Consumer demand for antibiotic-free meat, particularly in North America and Europe, is accelerating this shift toward phytogenics. While phytogenics currently complement rather than replace antibiotics, their growing acceptance signals a long-term transformation in livestock health management. As consumers demand cleaner, antibiotic-free products, the adoption of phytogenic alternatives is expected to continue, reshaping the industry over time.

Regional Analysis

North America is leading the Animal Antibiotics Market

North America dominated the market with the highest revenue share of 38.6% owing to rising livestock production, increasing zoonotic disease risks, and stricter regulatory oversight. The US Department of Agriculture (USDA) reported a 7% increase in cattle and poultry populations since 2022, leading to higher demand for veterinary antimicrobials. The US Food and Drug Administration (FDA) approved 10 new antibiotic formulations for livestock in 2023, enhancing treatment options for bacterial infections.

Outbreaks of diseases such as bovine respiratory disease, which affected over 2 million cattle in 2023, further accelerated antibiotic usage. The Canadian Food Inspection Agency (CFIA) noted a rise in antibiotic prescriptions for swine herds due to rising cases of porcine epidemic diarrhea. Zoetis, a leading animal health company, recorded a US$500 million revenue increase from antibiotic products in North America between 2022 and 2024. Government initiatives, such as the USDA’s Antimicrobial Resistance Action Plan, also encouraged responsible antibiotic use, sustaining market growth.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to expanding livestock farming, rising meat consumption, and improving animal healthcare infrastructure. The Food and Agriculture Organization (FAO) reported an increase in poultry production across China and India between 2022 and 2024, driving antibiotic adoption. Vietnam’s Ministry of Agriculture and Rural Development documented a surge in swine antibiotic usage following disease outbreaks in 2023.

Japan’s Ministry of Health, Labour and Welfare approved five new veterinary antimicrobials in 2024 to address rising bacterial infections in dairy cattle. The Indian government’s National Action Plan on Antimicrobial Resistance allocated US$200 million to improve livestock disease management, including antibiotic stewardship programs. Leading companies such as Boehringer Ingelheim and Elanco reported a combined revenue growth of US$300 million in the region during this period.

Australia’s Department of Agriculture noted a rise in antibiotic prescriptions for sheep and cattle due to increasing cases of foot rot. With growing awareness of antimicrobial resistance, governments are expected to implement stricter regulations while maintaining access to essential veterinary treatments.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the animal antibiotics market drive growth through technological innovation, strategic acquisitions, and expanding global distribution networks. They invest in developing advanced antibiotic formulations and delivery systems to enhance efficacy and safety in veterinary applications. Collaborations with research institutions and healthcare providers facilitate the integration of new technologies and broaden market reach. Additionally, targeting emerging markets with increasing livestock production and a rising demand for animal-derived food products presents significant growth opportunities.

Zoetis Inc., headquartered in Parsippany, New Jersey, is the world’s leading animal health company, specializing in the discovery, development, manufacture, and commercialization of animal health medicines and vaccines. In 2024, the company reported revenues of approximately US$9.3 billion. Zoetis offers a comprehensive portfolio of products, including antibiotics, vaccines, diagnostics, and other technologies for both livestock and companion animals. The company operates globally, serving customers in over 100 countries, and is committed to advancing care for animals through continuous innovation and a focus on sustainability.

Top Key Players

- Zoetis Services LLC

- Virbac

- Vetoquinol

- Prodivet pharmaceuticals SA/NV

- Norbrook Laboratories

- Elanco Animal Health Incorporated

- Calier

- Blacksmith Medicines

Recent Developments

- In February 2024, Blacksmith Medicines partnered with Zoetis to develop next-generation antibiotics targeting metalloenzymes to combat antibiotic resistance. Utilizing Blacksmith’s advanced platform and Zoetis’ deep expertise in veterinary science, the collaboration aims to create sustainable solutions for animal health while reducing the dependency on antibiotics critical to human medicine.

- In May 2023, Virbac bolstered its presence in Central Europe by acquiring GS Partners, its longstanding distributor in the Czech Republic and Slovakia. This strategic acquisition supports Virbac’s expansion, enhancing its ability to meet the growing demand for animal health products in the region, particularly in the pet and ruminant sectors

Report Scope

Report Features Description Market Value (2024) US$ 5.2 Billion Forecast Revenue (2034) US$ 6.9 Billion CAGR (2025-2034) 2.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Animal Type (Pigs, Cattle, Sheep & Goats, Poultry, and Others), By Drug Class (Tetracyclines, Penicillins, Sulfonamides, Macrolides, and Others), By Dosage (Oral Powders, Oral Solutions, Injections, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zoetis Services LLC, Virbac, Vetoquinol, Prodivet pharmaceuticals SA/NV, Norbrook Laboratories, Elanco Animal Health Incorporated, Calier, and Blacksmith Medicines. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Animal Antibiotics MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Animal Antibiotics MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zoetis Services LLC

- Virbac

- Vetoquinol

- Prodivet pharmaceuticals SA/NV

- Norbrook Laboratories

- Elanco Animal Health Incorporated

- Calier

- Blacksmith Medicines