Global Androgenetic Alopecia Market By Gender (Male and Female), By Treatment (Pharmaceuticals and Devices), By End-use (Dermatology Clinics and Homecare Settings), By Sales Channel (Prescriptions and OTC), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146218

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

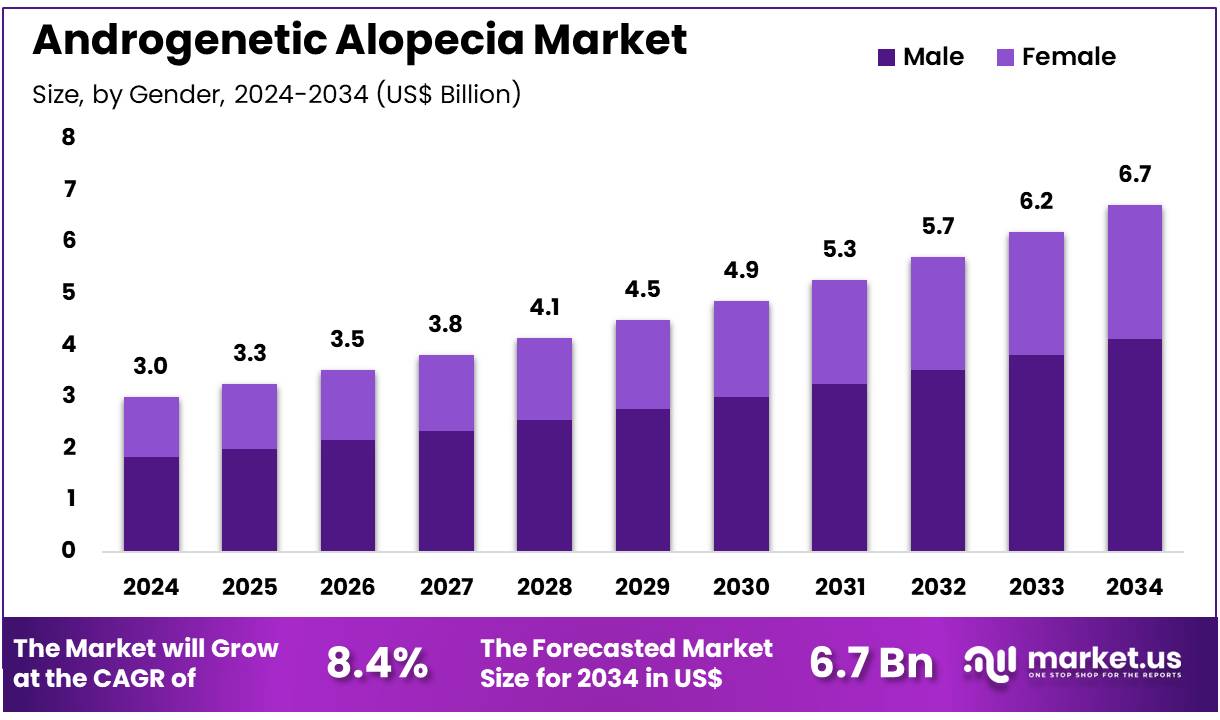

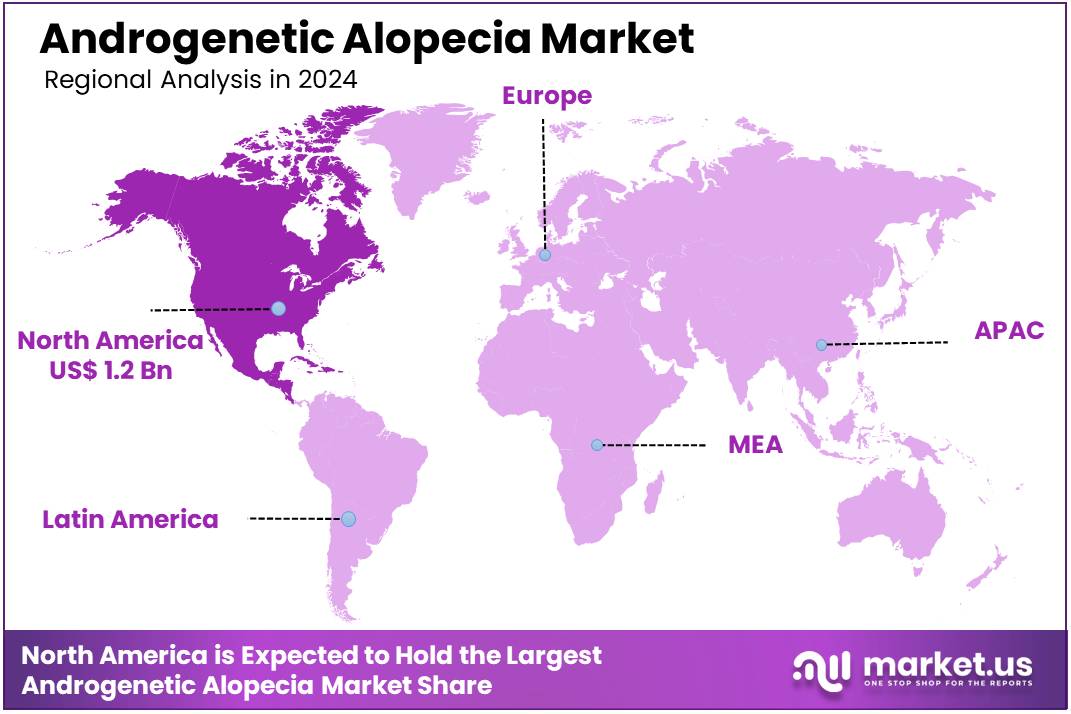

Global Androgenetic Alopecia Market size is expected to be worth around US$ 6.7 billion by 2034 from US$ 3.0 billion in 2024, growing at a CAGR of 8.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.4% share with a revenue of US$ 1.2 Billion.

Increasing awareness about hair loss treatments and the growing desire for aesthetic improvement are driving the rapid expansion of the androgenetic alopecia market. This market encompasses a variety of treatment options, including topical solutions, oral medications, hair transplants, and innovative therapies aimed at regrowing hair and preventing further loss.

Rising incidences of androgenetic alopecia, combined with the increasing willingness of individuals to seek aesthetic solutions, further contribute to market growth. Recent advances in pharmaceutical formulations, such as finasteride and minoxidil, have proven effective in addressing hair loss, with further research focusing on stem cell and regenerative treatments.

In June 2023, Dr. Reddy’s Laboratories Ltd. launched RgenX, a dedicated division within its generics business in India, aimed at providing a broader range of affordable medicines. This initiative reflects the growing demand for accessible and cost-effective treatments for various conditions, including androgenetic alopecia. As the market for hair loss treatments continues to evolve, opportunities for innovative and personalized solutions expand, driving growth and competition in the sector.

Key Takeaways

- In 2023, the market for Androgenetic Alopecia generated a revenue of US$ 3.0 billion, with a CAGR of 8.4%, and is expected to reach US$ 6.7 billion by the year 2033.

- The gender segment is divided into male and female, with male taking the lead in 2023 with a market share of 61.5%.

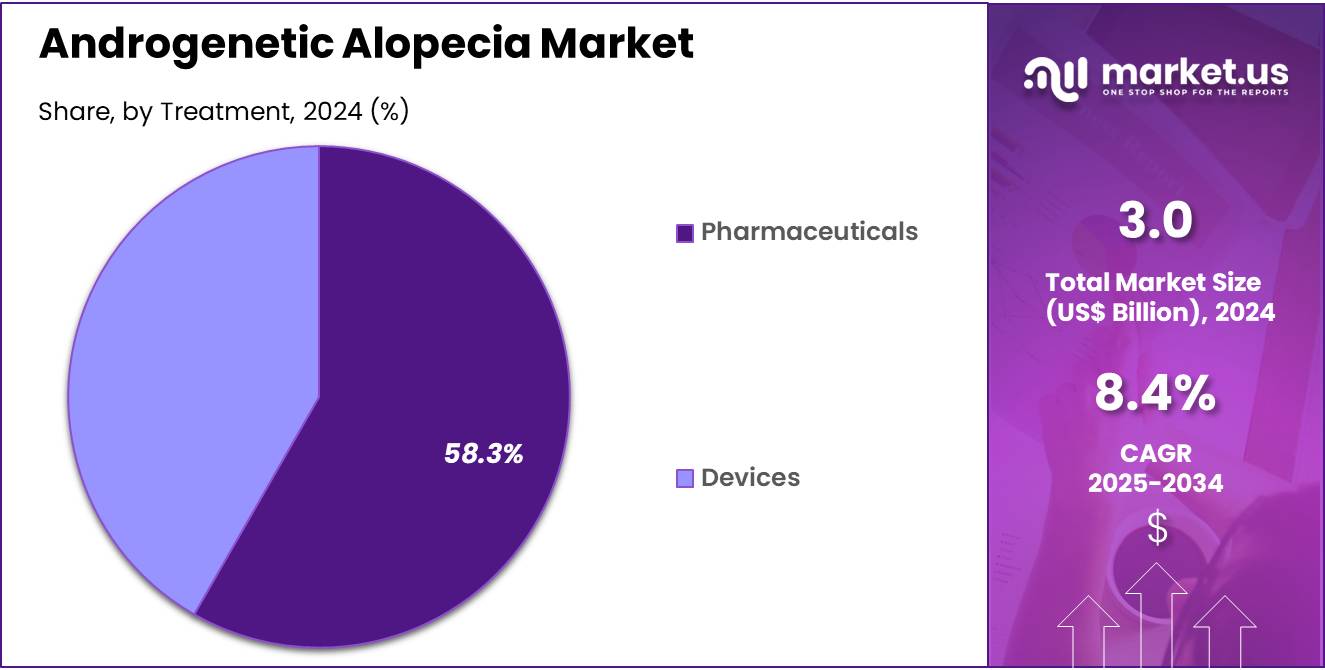

- Considering treatment, the market is divided into pharmaceuticals and devices. Among these, pharmaceuticals held a significant share of 58.3%.

- Furthermore, concerning the end-use segment, the market is segregated into dermatology clinics and homecare settings. The dermatology clinics sector stands out as the dominant player’s holding the largest revenue share of 62.0% in the Androgenetic Alopecia market.

- The sales channel segment is segregated into prescriptions and OTC, with the prescriptions segment leading the market, holding a revenue share of 55.2%.

- North America led the market by securing a market share of 38.4% in 2023

Gender Analysis

The male segment led in 2023, claiming a market share of 61.5% owing to the increasing prevalence of hair loss among men. Factors such as rising stress levels, poor lifestyle habits, and genetics contribute to the growing demand for effective treatments targeting male pattern baldness.

As awareness of available treatments increases and more men seek solutions to combat hair loss, the market for male-targeted hair loss treatments is anticipated to expand. Additionally, the growing trend of self-care and the increasing number of grooming and wellness products designed for men are likely to fuel the growth of this segment in the coming years.

Treatment Analysis

The pharmaceuticals held a significant share of 58.3% due to the continuous advancements in pharmaceutical treatments for hair loss. Oral medications, such as finasteride and dutasteride, have gained popularity for their effectiveness in treating androgenetic alopecia by inhibiting the hormone dihydrotestosterone (DHT), which is responsible for hair thinning.

As research progresses and new pharmaceutical options are introduced, the demand for oral treatments is expected to increase. Furthermore, the convenience and efficacy of pharmaceutical solutions over topical treatments are anticipated to contribute to the segment’s expansion.

End-Use Analysis

The dermatology clinics segment had a tremendous growth rate, with a revenue share of 62.0% as more individuals seek professional treatments for hair loss. Dermatologists offer specialized services, including hair transplants, platelet-rich plasma (PRP) therapy, and laser treatments, which are becoming increasingly popular due to their effectiveness.

The rising number of dermatology clinics specializing in hair restoration treatments and the growing number of patients seeking medical-grade solutions are expected to drive growth in this segment. Additionally, as awareness of advanced treatments continues to spread, more individuals are likely to visit clinics for personalized care.

Sales Channel Analysis

The prescriptions segment grew at a substantial rate, generating a revenue portion of 55.2% as prescribed treatments for hair loss gain more recognition for their effectiveness. Prescription treatments, such as finasteride and topical minoxidil, have long been proven to help reduce hair loss and promote hair regrowth.

As healthcare professionals recommend these treatments more frequently, the prescriptions segment is expected to experience significant growth. The increasing number of individuals seeking professional consultations and prescriptions for hair loss is likely to further fuel the demand for prescription-based solutions, contributing to the market’s expansion.

Key Market Segments

By Gender

- Male

- Female

By Treatment

- Pharmaceuticals

- Devices

By End-use

- Dermatology Clinics

- Homecare Settings

By Sales Channel

- Prescriptions

- OTC

Drivers

Increasing Prevalence of Hair Loss Disorders is Driving the Market

The rising incidence of androgenetic alopecia, particularly among younger populations, is a major market driver. Studies indicate that 50% of men and 25% of women experience noticeable hair loss by age 50, according to the American Academy of Dermatology (2023). The National Institutes of Health (NIH) reported a 15% increase in hair loss consultations from 2022 to 2023, reflecting growing awareness.

Pharmaceutical companies like Pfizer (HairMax) and Johnson & Johnson (Rogaine) have seen 7-9% revenue growth in their hair loss treatment divisions in 2023. Social media and celebrity endorsements are further normalizing treatments, accelerating adoption. Emerging markets in Asia and Latin America are also contributing to growth due to increasing disposable incomes and medical tourism for hair restoration.

Restraints

High Treatment Costs and Side Effects are Restraining the Market

The expense and potential adverse effects of hair loss therapies limit widespread adoption. The average annual cost of FDA-approved treatments like finasteride and minoxidil ranges from US$500 to US$1,200, making them unaffordable for many. Additionally, 10-15% of users report side effects such as sexual dysfunction or scalp irritation.

Surgical options like hair transplants can cost US$4,000 to US$15,000 per procedure, further restricting accessibility. Insurance coverage for these treatments remains limited, with only 5% of US health plans offering reimbursement. These factors discourage long-term adherence, particularly in low- and middle-income regions, hindering market expansion.

Opportunities

Advancements in Stem Cell and Gene Therapy are Creating Growth Opportunities

Breakthroughs in regenerative medicine and personalized treatments present significant opportunities for the market. Companies like Stemson Therapeutics and HairClone are pioneering stem cell-based hair regeneration, with clinical trials showing 30-40% follicle reactivation rates. Gene-editing technologies like CRISPR are also being explored, with NIH grants funding research on genetic predictors of hair loss.

These innovations could revolutionize treatment efficacy and reduce reliance on lifelong medications, unlocking premium pricing potential. Emerging biotech startups are partnering with dermatology clinics to accelerate commercialization, particularly in the US and Europe.

Impact of Macroeconomic / Geopolitical Factors

Economic stability and healthcare spending directly influence the hair loss treatment market, with North America and Europe dominating due to high disposable incomes and insurance coverage. Inflation, however, has raised production costs, with price hikes for topical treatments. Geopolitical tensions, like US-China trade disputes, disrupted supply chains for raw materials like minoxidil, delaying manufacturing.

Conversely, medical tourism in Turkey and India is thriving, offering affordable hair transplants and boosting local economies. Governments in Japan and South Korea are subsidizing regenerative medicine research, fostering innovation.

Telehealth expansions post-pandemic have also improved access to prescriptions, with significant growth in online dermatology consultations. Despite short-term challenges, the convergence of biotech advancements and consumer demand for holistic solutions ensures robust long-term growth.

Latest Trends

Rising Demand for Non-Invasive and Natural Solutions is a Recent Trend

Consumers are increasingly opting for minimally invasive and plant-based hair loss treatments, reshaping the market. At-home devices like laser caps and microneedling rollers saw a notable sales surge, with Capillus and iRestore leading the segment.

Social media influencers and telehealth platforms are amplifying this shift, with a significant percentage of dermatologists noting increased patient inquiries about natural alternatives. Pharmaceutical companies are responding by integrating botanicals like saw palmetto and caffeine into their formulations, blending science with wellness trends.

Regional Analysis

North America is leading the Androgenetic Alopecia Market

North America dominated the market with the highest revenue share of 38.4% owing to rising prevalence, increased treatment adoption, and advancements in therapeutic options. According to the National Institutes of Health (NIH), approximately 50 million men and 30 million women in the US were affected by pattern hair loss in 2023, up from 48 million and 28 million respectively in 2022.

The US Food and Drug Administration (FDA) approved two new topical formulations for hair regrowth in early 2024, expanding treatment accessibility. Pharmaceutical companies like Pfizer and Eli Lilly reported an increase in sales of finasteride and minoxidil products in 2023, as disclosed in their annual financial statements. The American Academy of Dermatology (AAD) noted a rise in patient consultations for hair loss treatments between 2022 and 2023, reflecting growing awareness.

Additionally, the Canadian Dermatology Association reported a surge in demand for platelet-rich plasma (PRP) therapies for hair restoration in 2023. Insurance coverage expansions for FDA-approved treatments, highlighted by the Centers for Medicare & Medicaid Services (CMS) in late 2023, further accelerated market growth.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing disposable income, rising aesthetic consciousness, and improving healthcare infrastructure. The Indian Journal of Dermatology reported an increase in clinical visits for hair loss in 2023 compared to 2022, driven by greater awareness. China’s National Health Commission (NHC) approved three new topical treatments in early 2024, likely boosting adoption rates.

Japan’s Ministry of Health, Labour and Welfare (MHLW) recorded a rise in prescriptions for 5-alpha reductase inhibitors since 2022, reflecting growing treatment demand. South Korea’s Dermatological Society noted a surge in hair transplant procedures between 2022 and 2023, indicating strong market potential.

The Australian Therapeutic Goods Administration (TGA) fast-tracked approvals for two novel therapies in 2023, expected to drive future growth. Governments across Southeast Asia are anticipated to invest more in dermatological care, with Thailand’s Ministry of Public Health allocating US$10 million for hair loss research in 2024. Key players like Merck and Johnson & Johnson are likely to expand their regional presence, further stimulating market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the androgenetic alopecia market focus on product innovation, expanding their treatment options, and increasing market accessibility to drive growth. They invest in developing new therapies, such as topical treatments, oral medications, and hair restoration devices, to address varying patient needs. Companies also collaborate with healthcare providers, dermatologists, and research institutions to enhance product development and improve clinical outcomes.

Strategic partnerships and digital marketing help these companies reach wider audiences, particularly in emerging markets where awareness of hair loss treatments is growing. Additionally, improving patient access to treatments through cost-effective solutions helps boost adoption rates.

Johnson & Johnson, headquartered in New Brunswick, New Jersey, is a global leader in healthcare and pharmaceutical products. The company offers minoxidil, marketed under the Rogaine brand, as one of the most well-known treatments for hair loss. Johnson & Johnson focuses on research and development, continuously working to improve the effectiveness of its products. With a broad global presence and a strong focus on dermatology, the company remains a significant player in the hair loss treatment market, aiming to provide innovative solutions to meet patient needs worldwide.

Top Key Players

- Sun Pharmaceutical Industries Ltd

- Merck & Co., Inc

- Lexington Intl., LLC

- Reddy’s Laboratories Ltd

- Curallux, LLC

- Cosmo Pharmaceuticals

- Aurobindo Pharma

- Apira Science, Inc

Recent Developments

- In December 2023, Sun Pharmaceutical Industries Ltd. formed a strategic partnership with Aclaris to gain exclusive rights to the use of deuruxolitinib JAK inhibitor, or other isotopic forms of ruxolitinib. This collaboration focuses on developing treatments for alopecia areata and androgenetic alopecia, expanding Sun Pharma’s portfolio in dermatology.

- In July 2023, Cosmo Pharmaceuticals began phase 3 clinical trials for Clascoterone Solution, a topical androgen receptor-blocking drug aimed at treating hair loss conditions. This marks a significant step in the company’s efforts to introduce new treatment options for dermatological disorders.

Report Scope

Report Features Description Market Value (2024) US$ 3.0 Billion Forecast Revenue (2034) US$ 6.7 Billion CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Gender (Male and Female), By Treatment (Pharmaceuticals and Devices), By End-use (Dermatology Clinics and Homecare Settings), By Sales Channel (Prescriptions and OTC) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sun Pharmaceutical Industries Ltd, Merck & Co., Inc, Lexington Intl., LLC, Dr. Reddy’s Laboratories Ltd, Curallux, LLC, Cosmo Pharmaceuticals, Aurobindo Pharma, and Apira Science, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Androgenetic Alopecia MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Androgenetic Alopecia MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sun Pharmaceutical Industries Ltd

- Merck & Co., Inc

- Lexington Intl., LLC

- Reddy’s Laboratories Ltd

- Curallux, LLC

- Cosmo Pharmaceuticals

- Aurobindo Pharma

- Apira Science, Inc