Internet of Medical Things (IoMT) Market By Component (Hardware, Software and Services), By Deployment Model (Cloud-Based and On-Premise), By Connectivity (Wired and Wireless), By Type (Wearable Devices, Stationary Devices, Implantable Devices and Other Device Types), By Application (Patient Monitoring, Telemedicine, Medication Management and Other Applications), By End-User (Hospitals and Clinics, Home Healthcare, Pharmaceutical Companies, and Research Organizations), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 73450

- Number of Pages: 284

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Component Analysis

- Deployment Model Analysis

- Connectivity Analysis

- Type Analysis

- Application Analysis

- End User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Key Opinion Leaders

- Recent Developments

- Report Scope

Report Overview

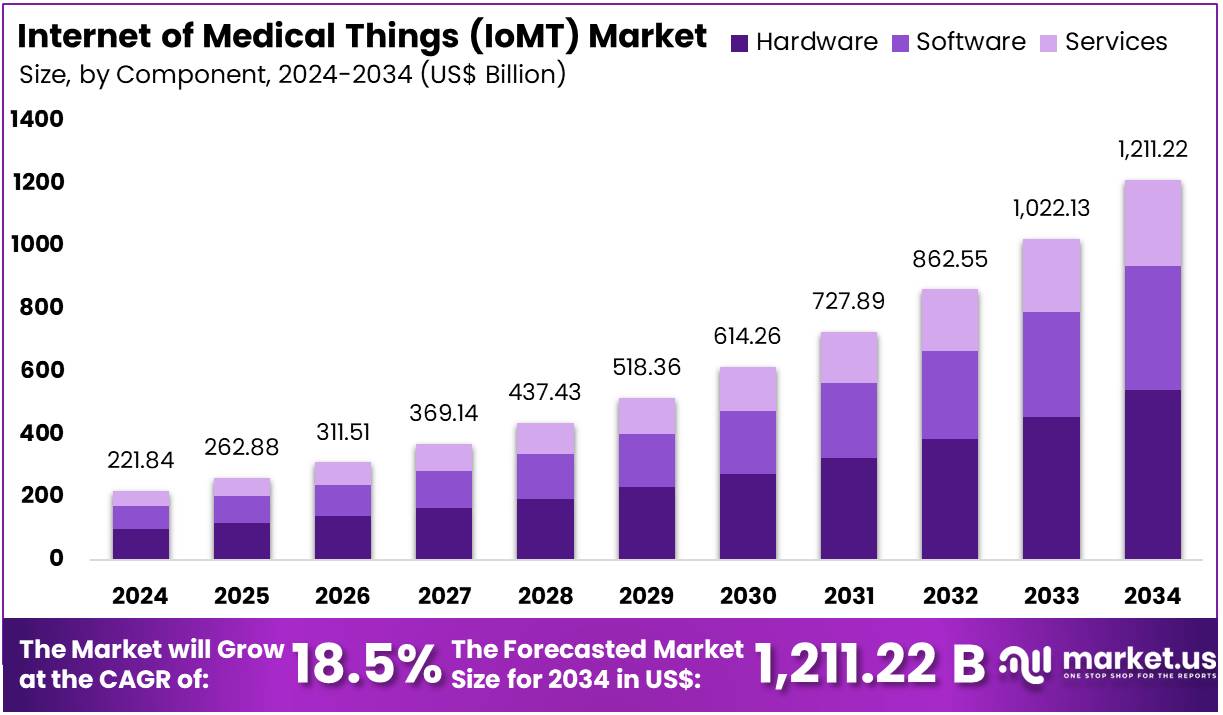

The Internet of Medical Things (IoMT) Market size is expected to be worth around US$ 1,211.22 billion by 2034 from US$ 221.84 billion in 2024, growing at a CAGR of 18.5% during the forecast period 2025 to 2034.

The Internet of Medical Things (IoMT) refers to the network of internet-enabled medical devices, hardware infrastructure, and software applications that connect healthcare information systems. Also known as IoT in healthcare, IoMT enables wireless and remote devices to securely exchange medical data over the internet, facilitating fast and flexible analysis. While the broader Internet of Things (IoT) encompasses various internet-connected devices, such as factory machinery, biometric cybersecurity scanners, and autonomous agricultural equipment, IoMT is specifically dedicated to healthcare applications. Due to the sensitive nature of healthcare data and stringent regulations, IoMT demands a more robust security framework compared to other IoT systems.

The Internet of Medical Things (IoMT) market is experiencing significant growth, driven by advancements in connected healthcare devices and telemedicine. IoMT integrates medical devices, sensors, and wearables with cloud platforms to enable real-time patient monitoring, data collection, and analysis. This technology enhances chronic disease management, improves patient outcomes, and reduces healthcare costs. Increasing demand for remote monitoring, government initiatives promoting digital health, and the rising adoption of wearable medical devices are key factors fueling the market’s expansion. Despite challenges related to data privacy and security, IoMT’s potential to transform healthcare delivery remains immense.

In March 2024, the U.S. Food and Drug Administration approved the first over-the-counter (OTC) continuous glucose monitor (CGM) for marketing. The Dexcom Stelo Glucose Biosensor System is an integrated CGM (iCGM) designed for individuals aged 18 and older who do not use insulin, including those with diabetes managing their condition with oral medications or people without diabetes seeking to understand how diet and exercise affect their blood sugar levels. Notably, the system is not intended for individuals with problematic hypoglycemia, as it does not provide alerts for low blood sugar.

Key Takeaways

- In 2024, the market for Internet of Medical Things (IoMT) generated a revenue of US$ 221.84 billion, with a CAGR of 18.5%, and is expected to reach US$ 1,211.22 billion by the year 2034.

- The Component segment is divided into Hardware, Software, and Services with Hardwaretaking the lead in 2024 with a market share of 44.7%.

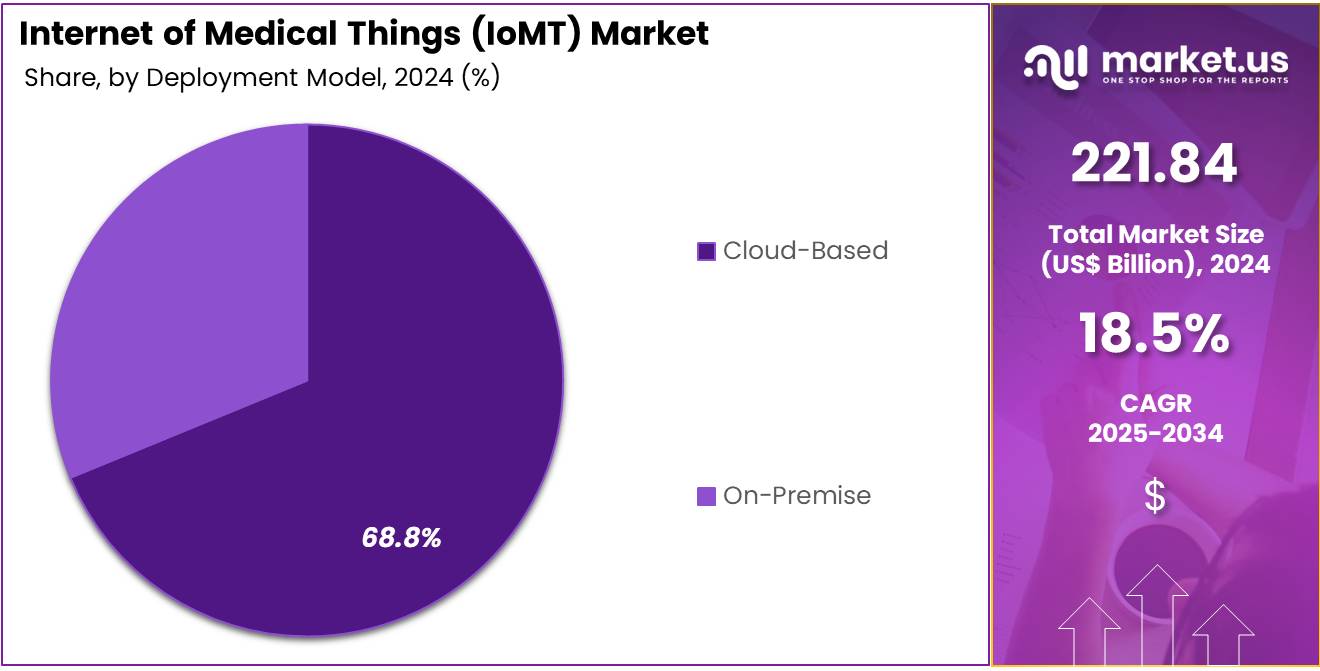

- By Deployment Model, the market is bifurcated into Cloud-Based, and On-Premise, with Cloud-Based leading the market with 68.8% of market share in 2024.

- Considering the Connectivity segment, the market is bifurcated into Wired, and Wireless with Wireless taking the lead in 2024 with 52.1% market share.

- By Type, the market is classified into Wearable Devices, Stationary Devices, Implantable Devices, and Other Device Types with Wearable Devices taking the lead in 2024 with 45.7% market share.

- With respect to Application segment, the market is bifurcated into Patient Monitoring, Telemedicine, Medication Management, and Other Applications with Patient Monitoring dominating the market with 37.8% market share.

- Concerning the End User segment, the market is bifurcated into Hospitals and Clinics, Home Healthcare, Pharmaceutical Companies, and Research Organizations with Hospitals and Clinics dominating the market with 41.8% market share.

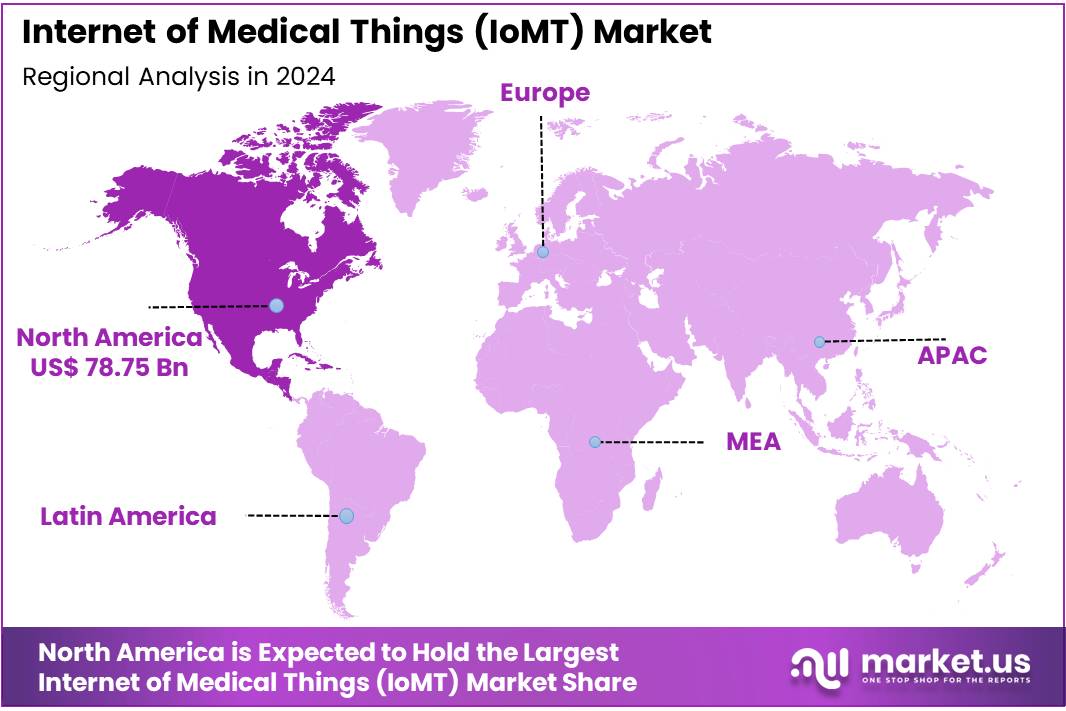

- North America led the market by securing a market share of 35.5% in 2024.

Component Analysis

In the Internet of Medical Things (IoMT) market, the hardware segment is currently the dominating segment with 44.7% market share, driven by the widespread adoption of connected medical devices, wearables, and sensors. Hardware components are essential for collecting and transmitting health data, making them foundational to IoMT ecosystems. Wearables like smartwatches (e.g., Apple Watch) and continuous glucose monitors (e.g., Dexcom G6) are prime examples of IoMT devices that enable continuous health monitoring. These devices use sensors to track vital signs such as heart rate, blood glucose levels, and physical activity. Additionally, diagnostic equipment like connected ECG monitors and smart thermometers provide real-time health data, helping clinicians make informed decisions remotely.

The growth of this segment is further supported by the increasing demand for chronic disease management tools, where IoMT hardware plays a critical role in enhancing patient care. In April 2025, Forescout, a global leader in cybersecurity, released its fifth annual “Riskiest Connected Devices of 2025” report. The report analyzes millions of devices within Forescout’s Device Cloud, using a multifactor risk scoring methodology to assess the most vulnerable devices in enterprise networks. The analysis considers each device’s configuration (vulnerabilities and open ports), its criticality to the business, and its exposure to the internet.

Deployment Model Analysis

In 2024, the Cloud-based Section held a dominant market position in the Deployment Model Segment of Internet of Medical Things (IoMT) Market, and captured more than a 68.8% share. Largely due to its scalability, cost-effectiveness, and remote accessibility. Cloud-based IoMT solutions allow healthcare providers to store, manage, and analyze vast amounts of patient data collected from connected medical devices without the need for extensive on-site infrastructure. This enables real-time data sharing across different healthcare systems and geographical locations, improving collaboration and facilitating better patient care.

Examples of cloud-based IoMT applications include platforms like Cerner’s cloud-based electronic health records (EHR) and Philips HealthSuite, which connect medical devices, integrate patient data, and provide actionable insights for healthcare providers. These platforms allow healthcare professionals to monitor patients remotely, access data from anywhere, and even use AI-powered analytics to predict health outcomes.

In June 2025, Polar, a global leader in wearable sports and fitness technology for nearly five decades, announced the launch of a new product and category. The new wearable, set to release in September 2025, marks the company’s first screen-free wrist device. This product is designed as a subscription-free alternative to existing health bands and fitness trackers in the market.

The introduction of this innovation reflects Polar’s strategy to differentiate its offerings by addressing consumer demand for simplicity, affordability, and long-term value. The launch is expected to strengthen Polar’s position in the competitive wearable technology market and expand its reach among health-conscious users seeking practical and cost-effective solutions.

Connectivity Analysis

In the Internet of Medical Things (IoMT) market, the wireless connectivity segment is the dominant category with 52.1% market share, driven by its flexibility, scalability, and ease of integration. Wireless technologies such as Wi-Fi, Bluetooth, Zigbee, and cellular networks enable seamless communication between medical devices, wearables, and healthcare systems, facilitating remote monitoring, data sharing, and real-time patient management.

Wireless IoMT devices, including wearable fitness trackers, smart thermometers, and blood pressure monitors, offer convenience and mobility, allowing patients to be monitored outside of traditional healthcare settings. This wireless connectivity supports telemedicine, home healthcare, and chronic disease management by enabling healthcare providers to access patient data remotely and make timely interventions.

Type Analysis

In the Internet of Medical Things (IoMT) market, the wearable devices segment is the dominant category which accounted for 45.7% market share, driven by the increasing adoption of consumer health technologies and the growing demand for continuous monitoring. Wearables, such as smartwatches (e.g., Apple Watch, Fitbit), wearable ECG monitors (e.g., KardiaMobile), and continuous glucose monitors (e.g., Dexcom), are gaining traction due to their ability to provide real-time health data. These devices offer features like heart rate tracking, sleep monitoring, physical activity tracking, and even ECG readings, which allow for proactive health management.

The wearable devices segment is especially popular in managing chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders. The convenience, portability, and ease of use of wearable devices make them highly accessible to patients and healthcare professionals alike. In July 2024, Samsung Electronics Co., Ltd. introduced the new Galaxy Ring, Galaxy Watch7, and Galaxy Watch Ultra1, further extending the capabilities of Galaxy AI2. These new wearables are designed to offer comprehensive wellness experiences, making advanced health and fitness features accessible to a wider audience.

Application Analysis

In the Internet of Medical Things (IoMT) market, the patient monitoring segment is the dominant application, driven by the increasing need for continuous and remote healthcare monitoring. IoMT-enabled patient monitoring systems allow healthcare providers to track vital signs like heart rate, blood pressure, glucose levels, and oxygen saturation in real-time. Devices such as remote ECG monitors, blood pressure cuffs, and wearable health trackers (e.g., Fitbit, Apple Watch) are widely used in this segment.

In October 2023, InfoBionic announced that it had received FDA 510(k) clearance for its next-generation remote ECG monitoring device. The device features a Bluetooth-enabled diagnostic six-lead sensor, specifically designed for patients needing cardiac monitoring.

End User Analysis

In the Internet of Medical Things (IoMT) market, the hospitals and clinics segment is the dominant end-user category. Healthcare facilities rely heavily on IoMT technologies to improve patient care, streamline operations, and enhance clinical decision-making. Connected devices such as patient monitoring systems, smart infusion pumps, and wearable health devices are commonly used to track real-time patient data, reducing the need for frequent hospital visits and enabling more effective management of chronic conditions.

Hospitals and clinics benefit from IoMT by providing continuous, remote monitoring for patients, reducing the burden on healthcare staff and improving operational efficiency. In January 2022, a study by Juniper Research revealed that smart hospitals worldwide are projected to deploy 7.4 million connected IoMT devices by 2026, averaging over 3,850 devices per hospital. This marks a 131% increase from 2021, when 3.2 million devices were in use. The IoMT concept centers on healthcare providers utilizing connected devices, including remote monitoring sensors and surgical robotics, to enhance patient care, staff productivity, and operational efficiency.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Deployment Model

- Cloud-Based

- On-Premise

By Connectivity

- Wired

- Wireless

By Type

- Wearable Devices

- Stationary Devices

- Implantable Devices

- Other Device Types

By Application

- Patient Monitoring

- Telemedicine

- Medication Management

- Other Applications

By End User

- Hospitals and Clinics

- Home Healthcare

- Pharmaceutical Companies

- Research Organizations

Drivers

Growing Adoption of Remote Patient Monitoring

The increasing demand for remote patient monitoring (RPM) is a major driver in the IoMT market. With advancements in wearable technologies and sensor devices, healthcare providers can remotely monitor patients’ vital signs and conditions in real-time. This adoption is largely driven by the need for continuous care, especially in managing chronic diseases like diabetes, heart disease, and respiratory disorders.

RPM offers significant benefits such as reduced hospital readmissions, increased patient engagement, and more efficient use of healthcare resources. Moreover, the global shift towards telemedicine, driven by the COVID-19 pandemic, has also accelerated the adoption of IoMT for remote care delivery. RPM reduces the burden on healthcare facilities while providing patients with the convenience of being monitored from the comfort of their homes, leading to better outcomes and cost-effective care delivery.

In October 2022, GE Healthcare and AMC Health announced a collaboration to provide Remote Patient Monitoring (RPM) as a virtual care solution, extending patient care from the hospital to the home. This partnership combines GE Healthcare’s acute patient monitoring expertise with AMC Health’s RPM solutions, leveraging an FDA Class II 510(k)-cleared platform and advanced analytics. The collaboration aims to enhance the continuum of care for patients following hospital discharge.

Restraints

Data Privacy and Security Concerns

Despite the immense potential of IoMT, data privacy and security concerns remain a significant restraint in its growth. The integration of IoMT devices with cloud platforms and other networks increases the vulnerability to cyberattacks and data breaches. Healthcare data is particularly sensitive, and unauthorized access to patient health information can lead to severe consequences, including identity theft and legal implications.

The lack of uniform standards for securing IoMT devices and data exacerbates this issue. While there are regulatory frameworks like HIPAA (Health Insurance Portability and Accountability Act) in the U.S. and GDPR (General Data Protection Regulation) in Europe, many regions still struggle with adequate enforcement. To mitigate these concerns, healthcare organizations must invest in robust cybersecurity measures and ensure that IoMT devices meet stringent data protection standards.

Opportunities

Expansion of Healthcare in Emerging Markets

One of the major opportunities for the IoMT market lies in the expansion of healthcare infrastructure in emerging markets. As countries in Asia, Africa, and Latin America experience economic growth, there is a rising demand for improved healthcare systems, including more efficient patient monitoring and management solutions. IoMT can significantly contribute by offering affordable, scalable, and remote healthcare solutions to underserved populations.

The adoption of IoMT devices such as wearable sensors and mobile health applications allows for better chronic disease management and maternal care, reducing healthcare costs while improving accessibility and outcomes. Additionally, with growing government initiatives to digitize healthcare, such as India’s National Digital Health Mission, IoMT has the potential to reshape healthcare delivery in these regions, driving future market growth.

Impact of Macroeconomic / Geopolitical Factors

On the macroeconomic front, economic conditions such as GDP growth, healthcare spending, and government budgets for digital health initiatives directly affect the adoption of IoMT solutions. In regions with strong economies, there is often greater investment in healthcare technology, facilitating widespread IoMT adoption. Conversely, economic downturns or budget cuts in healthcare systems may hinder investment in advanced medical technologies, slowing IoMT market growth. Additionally, inflation and currency fluctuations can impact the cost of IoMT devices and services, making them less accessible in emerging markets.

Geopolitical factors also play a crucial role. Trade restrictions and tariffs between countries may affect the supply chain for medical devices, impacting their cost and availability. Regulatory variations across countries—such as the EU’s GDPR or the U.S.’s HIPAA—can create challenges for companies looking to expand globally. Political instability in certain regions may further delay healthcare reforms or the implementation of IoMT technologies.

Latest Trends

Direct-to-Consumer Internet of Medical Things (IoMT)

A major trend in the IoMT market is the integration of artificial intelligence (AI) and machine learning (ML) technologies. AI and ML algorithms are being increasingly used to enhance the capabilities of IoMT devices, improving data analysis and decision-making processes. These technologies enable IoMT devices to detect anomalies, predict potential health issues, and provide personalized care recommendations in real-time. For example, AI algorithms in wearable devices can track vital signs and predict the onset of a heart attack or stroke, alerting both patients and healthcare providers to take preventive action.

Furthermore, AI-powered diagnostics, such as imaging analysis and predictive modeling, are making healthcare more proactive. This trend not only enhances the effectiveness of IoMT solutions but also opens up new avenues for precision medicine, making healthcare smarter and more efficient.

Regional Analysis

North America is leading the Internet of Medical Things (IoMT) Market

North America is the leading region in the Internet of Medical Things (IoMT) market with 35.5% market share, primarily driven by advanced healthcare infrastructure, high adoption rates of digital health technologies, and significant investments in IoMT innovations. The U.S. and Canada are at the forefront of IoMT adoption, with healthcare systems increasingly integrating connected devices to enhance patient care, optimize operations, and reduce costs.

For example, the U.S. healthcare system has widely adopted wearable devices like Fitbit and Apple Watch, which help patients track vital signs and enable healthcare providers to monitor chronic conditions remotely. Additionally, hospitals and clinics in North America utilize connected medical devices such as smart infusion pumps and ECG monitors to provide real-time patient data, improving decision-making and patient outcomes.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Internet of Medical Things (IoMT) market includes Medtronic plc, GE Healthcare, Siemens Healthineers, Philips Healthcare, Johnson & Johnson MedTech, Boston Scientific Corporation, Dexcom Inc., ResMed Inc., Abbott Laboratories, Biotronik SE & Co. KG, Apple Inc., Google LLC (Fitbit), Qualcomm Life, Cisco Systems Inc., and Other key players.

Medtronic is a global leader in medical technology, offering IoMT-enabled devices that enhance patient care. Their portfolio includes connected diagnostic and therapeutic devices, such as remote monitoring systems for chronic disease management, integrating real-time data to optimize treatment and improve patient outcomes across diverse healthcare settings.

GE Healthcare leverages IoMT solutions to provide advanced medical imaging, patient monitoring, and data analytics. With its cloud-connected platforms, GE enables remote patient monitoring, offering healthcare professionals real-time access to critical data, which improves clinical decision-making and streamlines healthcare operations, enhancing efficiency and care quality.

Siemens Healthineers integrates IoMT technologies in their diagnostic imaging and patient monitoring systems. Through connected medical devices, they enable real-time health data monitoring, which enhances diagnostic accuracy and allows for remote patient management, particularly in critical care, fostering efficient, personalized treatment in healthcare facilities worldwide.

Key Opinion Leaders

Leaders Opinion Dr. Lisa Reynolds, Cardiologist & Medical Technology Expert, Philips Healthcare “Philips Healthcare continues to lead the charge in the Internet of Medical Things (IoMT) space by integrating cutting-edge technologies into their medical devices. Their ability to seamlessly connect diagnostic tools and patient monitoring systems provides a comprehensive view of patient health in real-time. With the HealthSuite platform, Philips is setting new standards for remote patient care, making healthcare more personalized and accessible. Their commitment to AI and machine learning, paired with their vast network of connected devices, is transforming how we approach diagnostics and treatment, particularly in cardiology and oncology.” Dr. Michael Harris, Orthopedic Surgeon & Medical Device Specialist, Johnson & Johnson MedTech “Johnson & Johnson MedTech has consistently delivered innovative IoMT solutions that are advancing surgical and clinical care. Their connected surgical instruments and monitoring solutions are revolutionizing operating room efficiency. By integrating real-time data, they provide surgeons with valuable insights that enhance precision during procedures. J&J’s focus on IoMT is key in reducing complications and improving patient outcomes, particularly in orthopedic surgeries. They are positioning themselves as a trusted partner in the IoMT ecosystem, helping healthcare providers achieve better care coordination and patient management.” Dr. Sarah Thompson, Cardiologist & Medical Device Innovator, Boston Scientific Corporation “Boston Scientific is making significant strides in the IoMT market, particularly with their connected devices in cardiology. Their remote patient monitoring systems, including connected pacemakers and defibrillators, are game-changers in the management of heart disease. By providing continuous data to physicians, they can adjust treatment protocols promptly, ensuring better patient care. Boston Scientific’s integration of IoMT not only enhances patient safety but also optimizes long-term care plans, reducing hospital visits and improving patient quality of life.” Recent Developments

- In May 2025: Trixeo Aerosphere was approved in the UK as the first inhaled respiratory medicine using a next-generation propellant with near-zero Global Warming Potential (GWP). This marks the first approval of a pressurized metered-dose inhaler (pMDI) delivering a medicine with a propellant that has 99.9% lower GWP compared to those used in currently available pMDIs.

- In March 2025, Circadian Health, the first and only virtual-first provider specializing in cardiometabolic care across all 50 states, announced a strategic partnership with Tenovi. Tenovi is a leading provider of over 40 next-generation cellular-connected remote patient monitoring (RPM) and remote therapeutic monitoring (RTM) devices.

- In May 2024, Sony Group Corporation (Sony) announced the development of a microsurgery assistance robot capable of automatically exchanging surgical instruments and providing precision control. The prototype will be showcased at the Sony booth during the 2024 Institute of Electrical and Electronics Engineers (IEEE) International Conference on Robotics and Automation (ICRA2024), set to open in Yokohama on May 13.

Top Key Players in the Internet of Medical Things (IoMT) Market

- Medtronic plc

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Johnson & Johnson MedTech

- Boston Scientific Corporation

- Dexcom Inc.

- ResMed Inc.

- Abbott Laboratories

- Biotronik SE & Co. KG

- Apple Inc.

- Google LLC (Fitbit)

- Qualcomm Life

- Cisco Systems Inc.

- Other key players

Report Scope

Report Features Description Market Value (2024) US$ 221.84 billion Forecast Revenue (2034) US$ 1,211.22 billion CAGR (2025-2034) 18.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software and Services), By Deployment Model (Cloud-Based and On-Premise), By Connectivity (Wired and Wireless), By Type (Wearable Devices, Stationary Devices, Implantable Devices and Other Device Types), By Application (Patient Monitoring, Telemedicine, Medication Management and Other Applications), By End-User (Hospitals and Clinics, Home Healthcare, Pharmaceutical Companies, and Research Organizations) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Medtronic plc, GE Healthcare, Siemens Healthineers, Philips Healthcare, Johnson & Johnson MedTech, Boston Scientific Corporation, Dexcom Inc., ResMed Inc., Abbott Laboratories, Biotronik SE & Co. KG, Apple Inc., Google LLC (Fitbit), Qualcomm Life, Cisco Systems Inc., and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Internet of Medical Things (IoMT) MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Internet of Medical Things (IoMT) MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic plc

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Johnson & Johnson MedTech

- Boston Scientific Corporation

- Dexcom Inc.

- ResMed Inc.

- Abbott Laboratories

- Biotronik SE & Co. KG

- Apple Inc.

- Google LLC (Fitbit)

- Qualcomm Life

- Cisco Systems Inc.

- Other key players