Global Insect Cell Culture Market By Product Type (Sf9, Sf21, and High Five), By Application (Biopharmaceutical Manufacturing, Gene Therapy, Tissue Culture & Engineering, and Cytogenetic), By End-user (Pharmaceutical industry, Pathology labs, Research laboratories, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 131807

- Number of Pages: 353

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

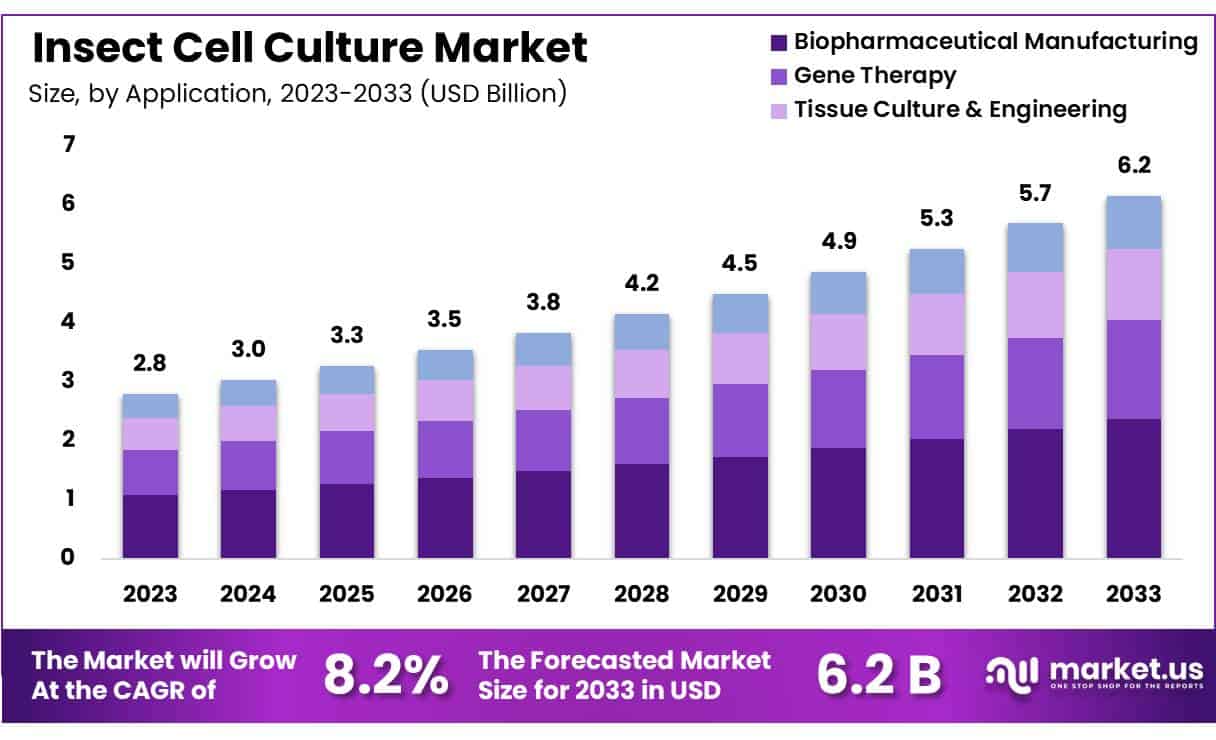

Global Insect Cell Culture Market size is expected to be worth around US$ 6.2 billion by 2033 from US$ 2.8 billion in 2023, growing at a CAGR of 8.2% during the forecast period 2024 to 2033.

Increasing utilization of insect cell cultures in pharmaceutical research and development drives growth in this market, given their efficiency in producing biologics and vaccines. Insect cell lines have become indispensable in synthesizing drugs for chronic conditions, especially with the pressing need for innovative treatments for noncommunicable diseases.

The World Health Organization reports that noncommunicable diseases account for approximately 74% of global fatalities, underscoring the urgent demand for advanced therapeutic solutions. Insect cell cultures provide a reliable and scalable system for protein expression, gene therapy development, and vaccine production, as they demonstrate high productivity and adaptability compared to other cell culture systems.

Recent trends reveal a rising preference for insect cell lines in gene editing and recombinant protein synthesis, fueled by the need for efficient, cost-effective bioproduction methods. Companies continue to explore partnerships and technological advancements in cell culture systems, aiming to enhance yield, reduce costs, and maintain regulatory compliance. Given these factors, the insect cell culture market presents robust opportunities in advancing both therapeutic and preventive healthcare.

Key Takeaways

- In 2023, the market for insect cell culture generated a revenue of US$ 8 billion, with a CAGR of 8.2%, and is expected to reach US$ 6.2 billion by the year 2033.

- The product type segment is divided into Sf9, Sf21, and high five, with high five taking the lead in 2023 with a market share of 42.5%.

- Considering application, the market is divided into biopharmaceutical manufacturing, gene therapy, tissue culture & engineering, and cytogenetic. Among these, biopharmaceutical manufacturing held a significant share of 38.6%.

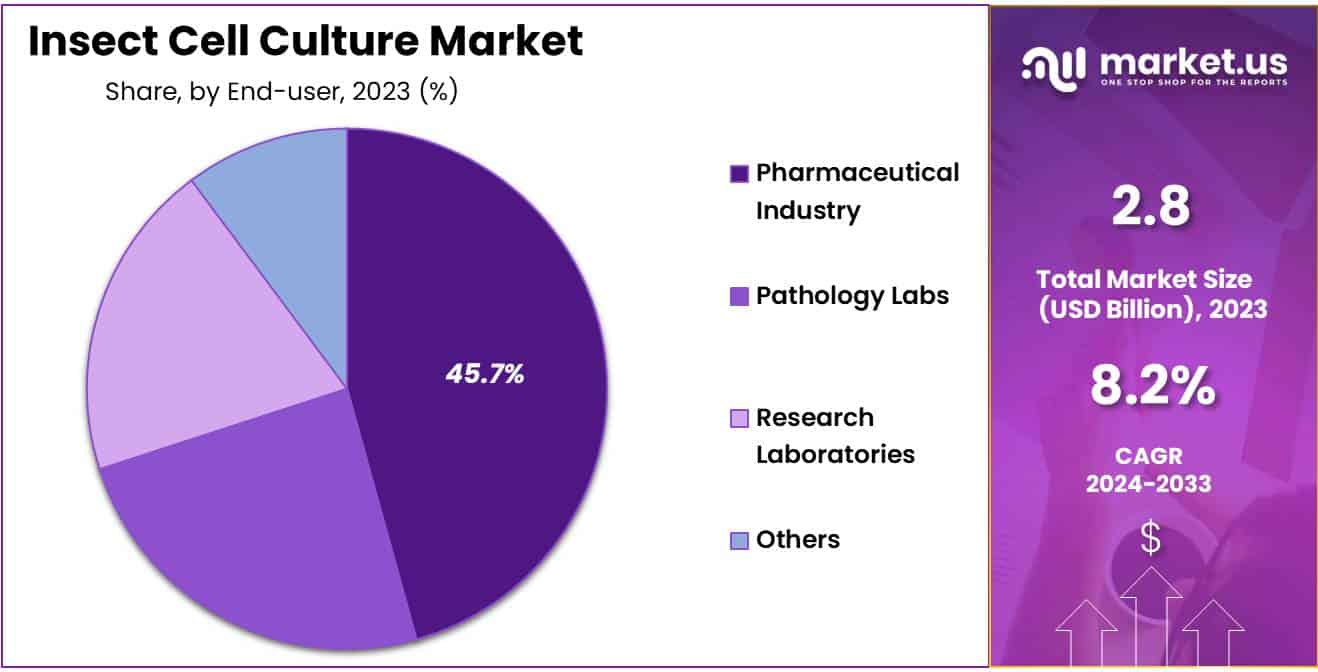

- Furthermore, concerning the end-user segment, the market is segregated into pharmaceutical industry, pathology labs, research laboratories, and others. The pharmaceutical industry sector stands out as the dominant player, holding the largest revenue share of 45.7% in the insect cell culture market.

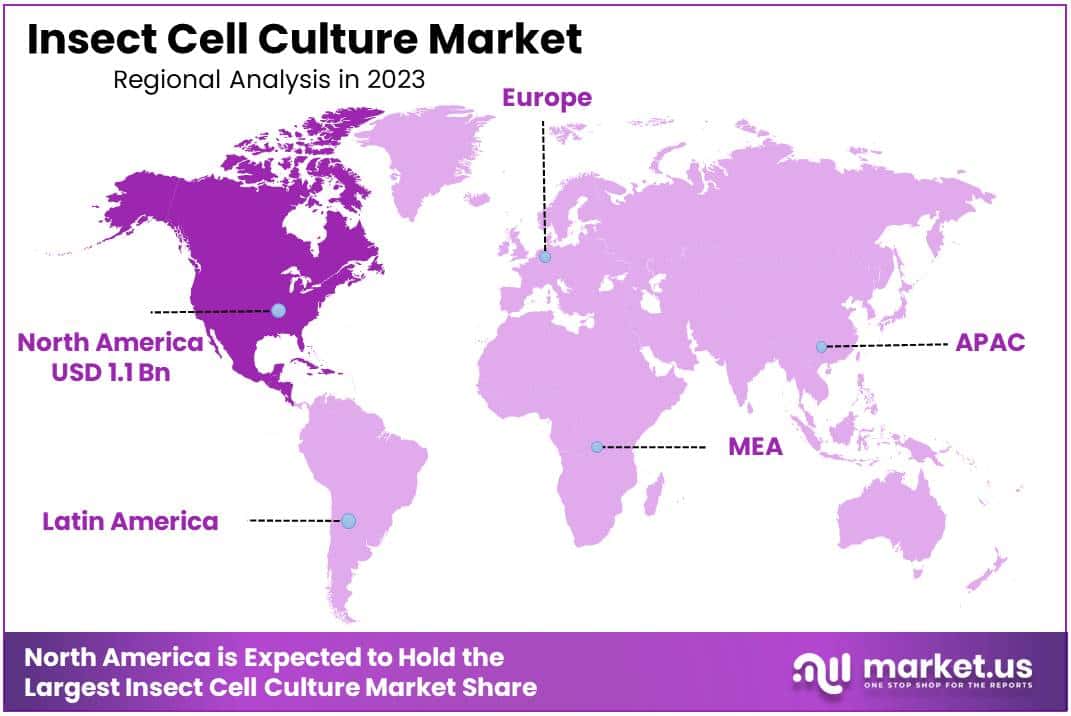

- North America led the market by securing a market share of 40.5% in 2023.

By Product Type Analysis

The high five segment led in 2023, claiming a market share of 42.5% owing to its higher protein expression levels and versatility in producing complex proteins. Researchers favor high five cells for recombinant protein production, especially in gene therapy and vaccine development, as they provide higher yields than other insect cell lines like Sf9 and Sf21.

Increased demand for biologics and protein-based treatments enhances the adoption of high five cells in various biotechnological applications. Moreover, the rising prevalence of infectious diseases has led to a surge in vaccine research, further supporting growth in this segment.

As pharmaceutical companies and research institutions pursue innovative therapies, high five cells, known for their scalability and suitability for large-scale production, are likely to attract further investments. Expanded funding in biotech and advancements in cell culture technologies are anticipated to drive the high five segment, aligning with the growing need for efficient and high-yield protein expression systems.

By Application Analysis

The biopharmaceutical manufacturing held a significant share of 38.6% due to increasing demand for biologics, including vaccines, antibodies, and gene therapies. Insect cell cultures offer several advantages in biopharmaceutical production, such as faster growth cycles and higher productivity, particularly beneficial in large-scale vaccine production.

As biopharmaceutical firms invest more heavily in developing complex protein-based treatments, the versatility of insect cell cultures, especially in expressing recombinant proteins, supports this segment’s growth. Additionally, advancements in gene editing and synthetic biology have expanded the use of insect cells in producing customized biopharmaceuticals, a factor likely to accelerate segment expansion.

Growing investments in R&D, coupled with the need for scalable, cost-effective manufacturing processes, contribute to the adoption of insect cell culture in biopharmaceutical manufacturing. This trend aligns with the increasing focus on precision medicine and targeted treatments, reinforcing the growth trajectory of this segment.

By End-user Analysis

The pharmaceutical industry segment had a tremendous growth rate, with a revenue share of 45.7% owing to expanding applications in drug discovery, vaccine production, and therapeutic protein development. As pharmaceutical companies increasingly rely on insect cells for reliable and cost-effective protein expression systems, the demand in this segment is expected to rise.

The high adaptability of insect cells to large-scale production environments makes them suitable for commercial applications, meeting the needs of the pharmaceutical industry for efficient bioproduction processes.

Additionally, rising investment in personalized medicine and regenerative therapies spurs interest in insect cell culture techniques, particularly for complex biologics. Expanding R&D activities, coupled with the urgency for rapid vaccine development, reinforce the pharmaceutical industry’s reliance on insect cell culture. This growth trajectory aligns with an increasing focus on innovative drug manufacturing techniques, making the segment likely to experience sustained expansion.

Key Market Segments

By Product Type

- Sf9

- Sf21

- High Five

By Application

- Biopharmaceutical Manufacturing

- Gene Therapy

- Tissue Culture & Engineering

- Cytogenetic

By End-user

- Pharmaceutical Industry

- Pathology Labs

- Research Laboratories

- Others

Drivers

Growing Demand for Cell-Based Therapies Drives the Insect Cell Culture Market

The insect cell culture market is experiencing robust growth, driven by the increasing demand for cell-based therapies in biotechnology and biopharmaceutical industries. Cell-based therapies, including gene therapy, immunotherapy, and cancer treatment, frequently utilize insect cell lines due to their high protein yield and capacity for complex post-translational modifications.

From 2022 to 2024, these therapies saw an uptick in demand, prompting companies to employ insect cells as a cost-effective and efficient method for producing necessary proteins and viral vectors. Companies focusing on producing high-quality insect cell lines for biopharmaceutical applications are well-positioned to benefit from this trend. In particular, North America and Europe have contributed substantially to this growth due to government investments in cell-based research infrastructure and advancements in gene therapy development.

Restraints

Rising Environmental Sustainability Concerns Hamper the Insect Cell Culture Market

Growing concerns about environmental sustainability pose a notable restraint for the insect cell culture market. The production and disposal processes associated with cell cultures, which often involve non-biodegradable plastic and substantial energy consumption, contribute to environmental challenges. Many biotechnology firms now face pressure to adopt greener practices to reduce the carbon footprint of their operations.

Regulatory agencies in the European Union and the United States have begun implementing guidelines to encourage more sustainable lab practices. The lack of efficient recycling programs for single-use lab materials further exacerbates the challenge, with firms facing higher operational costs if they switch to sustainable alternatives. As awareness of these environmental issues increases, the insect cell culture market may experience slowed growth unless companies make significant strides toward sustainability.

Opportunities

Increasing Production Capacities by Key Market Players Create Opportunities in the Insect Cell Culture Market

The rapid expansion in production capacities by prominent market players presents significant opportunities in the insect cell culture market. Major companies have recently invested in scaling up facilities to meet the growing global demand for insect cell lines, particularly in the areas of vaccine development and therapeutic protein production. For example, Lonza introduced a new insect cell line medium in 2023 to increase production efficiency for viral vectors like Adeno-Associated Virus (AAV), crucial in gene therapies. These expansions not only increase supply but also drive innovations that can reduce costs and improve production timelines. With a steady rise in research funding and therapeutic demand, companies expanding their insect cell culture capabilities are poised to capture significant market share.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors have significantly influenced the insect cell culture market, presenting both opportunities and challenges. Rising costs of raw materials and inflation have heightened production expenses, creating financial pressures on manufacturers and impacting pricing strategies. Trade tensions and regulatory variations between regions have complicated global supply chains, limiting access to critical resources and delaying product development timelines.

However, increased investment in biotechnology and life sciences, particularly in emerging economies, has driven demand for insect cell cultures in vaccine production and drug development. Governments in several countries have also prioritized biopharmaceutical research, providing funding and tax incentives to stimulate advancements in cell culture technology. Despite certain obstacles, robust interest in biotechnology and the expanding application of insect cells in innovative therapies position the market for sustained growth in the coming years.

Latest Trends

Focus on High-Throughput Systems as a Recent Trend in the Insect Cell Culture Market

A significant trend in the insect cell culture market from 2022 to 2024 has been the focus on high-throughput systems, which allow for faster and more efficient production of insect cell lines. These systems enable biopharmaceutical companies to meet the rising demand for insect cell-based products used in vaccines and therapeutic proteins.

By automating cell culture processes, high-throughput systems reduce human error and improve scalability, an advantage critical for companies facing rising global demand. Firms developing these advanced production systems can provide large-scale solutions to meet the needs of industries such as gene therapy and biopharmaceutical production, especially in North America and Europe, where demand for innovative therapies remains high.

Regional Analysis

North America is leading the Insect Cell Culture Market

North America dominated the market with the highest revenue share of 40.5% owing to an increasing demand for advanced cell lines in biopharmaceuticals, vaccine development, and gene therapy. Driven by technological advancements and higher investment in research and development, the market gained momentum as biotechnology companies expanded their use of insect cell cultures for efficient protein expression and recombinant protein production.

Notably, the U.S. market, with its strong research infrastructure and high healthcare expenditure, represented the majority share in this regional growth. Furthermore, advancements in media formulations and improved bioreactor designs have optimized production processes, enhancing the appeal of insect cell cultures in North America. Government funding and collaboration with academic research institutions have further fueled this sector’s expansion, positioning it as a critical area of growth in biotechnology applications.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

In the Asia Pacific region, the insect cell culture market is projected to experience robust growth throughout the forecast period. Countries such as China and Japan are anticipated to drive this expansion due to increasing investments in biotechnology and the rising prevalence of chronic diseases, which bolster the demand for innovative therapeutic solutions.

The market’s growth aligns with a regional focus on sustainable production, as seen with Covestro’s launch of a dedicated mechanical recycling line for polycarbonates in Shanghai in 2023. This facility is set to produce over 25,000 tons of premium polycarbonates annually, highlighting Asia’s shift toward environmentally friendly materials for medical and healthcare applications. Increasing adoption of recombinant DNA technology for vaccine production and therapeutic proteins further supports the insect cell culture market’s anticipated growth in the Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the insect cell culture market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the insect cell culture market focus on optimizing cell lines for high-yield protein production to support vaccine development and biopharmaceutical applications.

Companies invest in research to improve scalability and cost-efficiency, making cell culture processes more accessible for large-scale manufacturing. They collaborate with academic institutions and biotech firms to accelerate innovation and refine production methods. Expansion into emerging regions enhances their market presence and enables access to new research ecosystems. Additionally, firms prioritize automation and advanced bioreactor technologies to increase productivity and meet the growing demand for biologics.

Top Key Players

- Thermo Fisher

- Sigma Aldrich

- Merck Millipore

- Lonza

- Life Technologies

- GE Healthcare

- Corning (Cellgro)

- BD

Recent Developments

- In March 2023, Thermo Fisher Scientific announced an expansion of its bioproduction capabilities, specifically targeting the development of high-efficiency media formulations for insect cell culture. This move enhances the company’s ability to meet increasing demand for efficient insect cell media in biopharmaceutical manufacturing, driven by growth in gene therapy and vaccine production needs.

- In January 2023, Expression Systems, a leader in cell culture media, partnered with leading biopharmaceutical firms to improve chemically defined, serum-free media for insect cell culture applications. This collaboration aims to advance insect cell systems for viral vector production and gene therapy, thereby strengthening the use of insect cells in scalable, reproducible processes critical to the pharmaceutical industry.

Report Scope

Report Features Description Market Value (2023) USD 2.8 billion Forecast Revenue (2033) USD 6.2 billion CAGR (2024-2033) 8.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Sf9, Sf21, and High Five), By Application (Biopharmaceutical Manufacturing, Gene Therapy, Tissue Culture & Engineering, and Cytogenetic), By End-user (Pharmaceutical industry, Pathology labs, Research laboratories, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher, Sigma Aldrich, Merck Millipore, Lonza, Life Technologies, GE Healthcare, Corning (Cellgro), and BD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher

- Sigma Aldrich

- Merck Millipore

- Lonza

- Life Technologies

- GE Healthcare

- Corning (Cellgro)

- BD