Global INR Test Meter Market By Product Type (Device, Lancet, and Test Strips), By End-user (Hospitals, Homecare Settings, and Specialty Clinics & ASCs), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165621

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

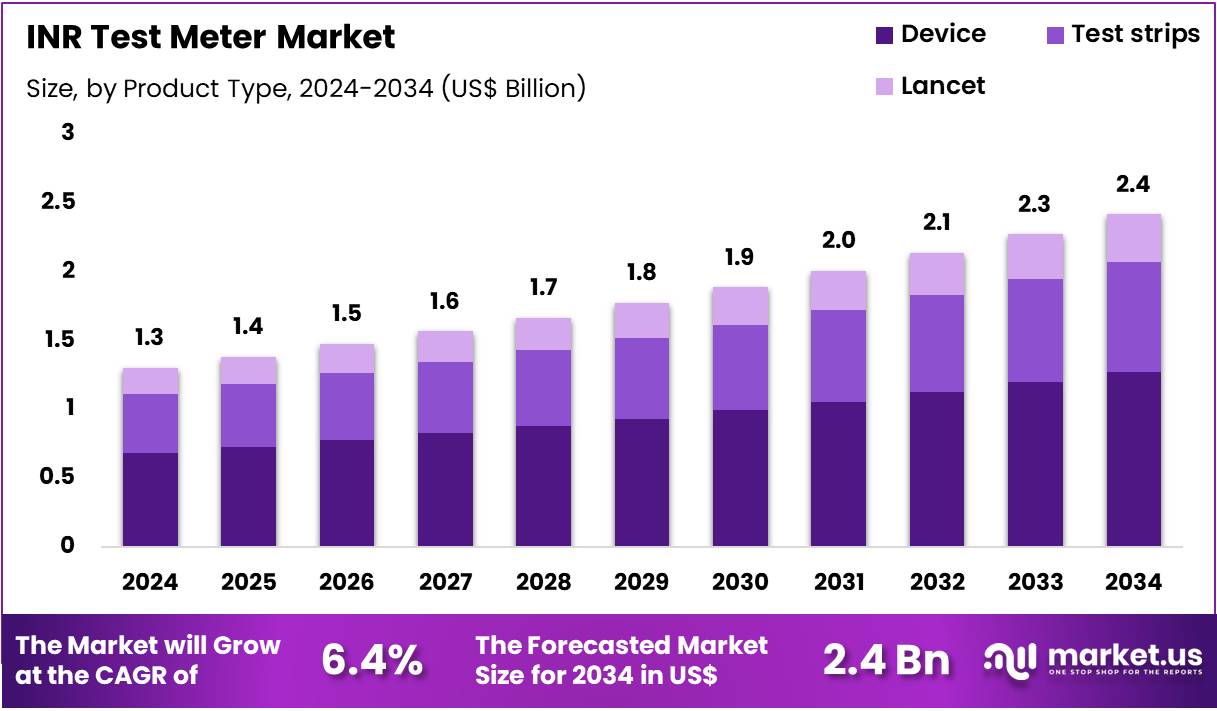

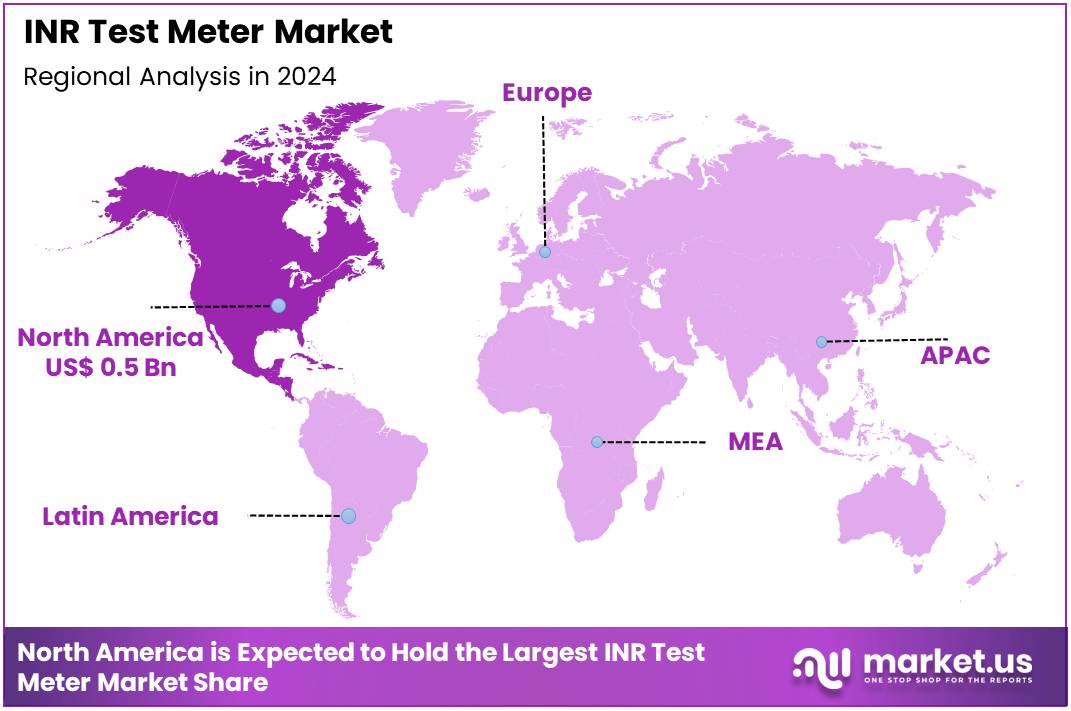

Global INR Test Meter Market size is expected to be worth around US$ 2.4 Billion by 2034 from US$ 1.3 Billion in 2024, growing at a CAGR of 6.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.9% share with a revenue of US$ 0.5 Billion.

Increasing validation of point-of-care accuracy drives the INR Test Meter Market, as portable devices match laboratory standards in anticoagulation monitoring. Cardiologists deploy Xprecia Prime™ systems for rapid INR results in outpatient clinics, enabling same-day warfarin dose adjustments. These meters support emergency departments by providing immediate prothrombin time assessment in bleeding events, guiding reversal agent administration.

Research studies compare meter performance against central lab analyzers, building evidence for regulatory approvals. In 2024, a clinical study demonstrated equivalent accuracy of the Xprecia Prime™ Coagulation System to Roche’s CoaguChek® XS and Sysmex CS-2500. This validation accelerates market growth by promoting transition to decentralized INR testing environments.

Growing endorsement of patient self-management creates opportunities in the INR Test Meter Market, as home devices empower individuals on long-term anticoagulation. Hematologists train patients to use self-testing meters for weekly INR checks, reducing clinic visits and improving therapeutic control. These tools aid atrial fibrillation management by facilitating frequent monitoring in elderly populations, minimizing stroke risks.

Digital connectivity features upload results to electronic health records, enabling remote physician oversight. In August 2025, an international consensus paper reaffirmed clinical effectiveness of patient self-testing and self-management comparable to clinic care. This endorsement drives market expansion through expanded insurance coverage and adoption of home INR systems.

Rising domestic manufacturing investments propel the INR Test Meter Market, as resilient supply chains ensure device availability and component quality. Medical device firms leverage expanded facilities to innovate meter designs with enhanced user interfaces, improving patient compliance. These investments support veterinary applications by producing animal-specific INR meters for research and clinical use.

Trends toward modular production platforms accelerate customization for niche anticoagulation needs. Although Abbott Laboratories’ US$ 536 million Ohio investment targets nutrition, it exemplifies industry commitment to US manufacturing resilience. This trend positions the market for sustained growth by securing diagnostic device supply and fostering technological advancements.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.3 Billion, with a CAGR of 6.4%, and is expected to reach US$ 2.4 Billion by the year 2034.

- The product type segment is divided into device, lancet, and test strips, with device taking the lead in 2023 with a market share of 52.6%.

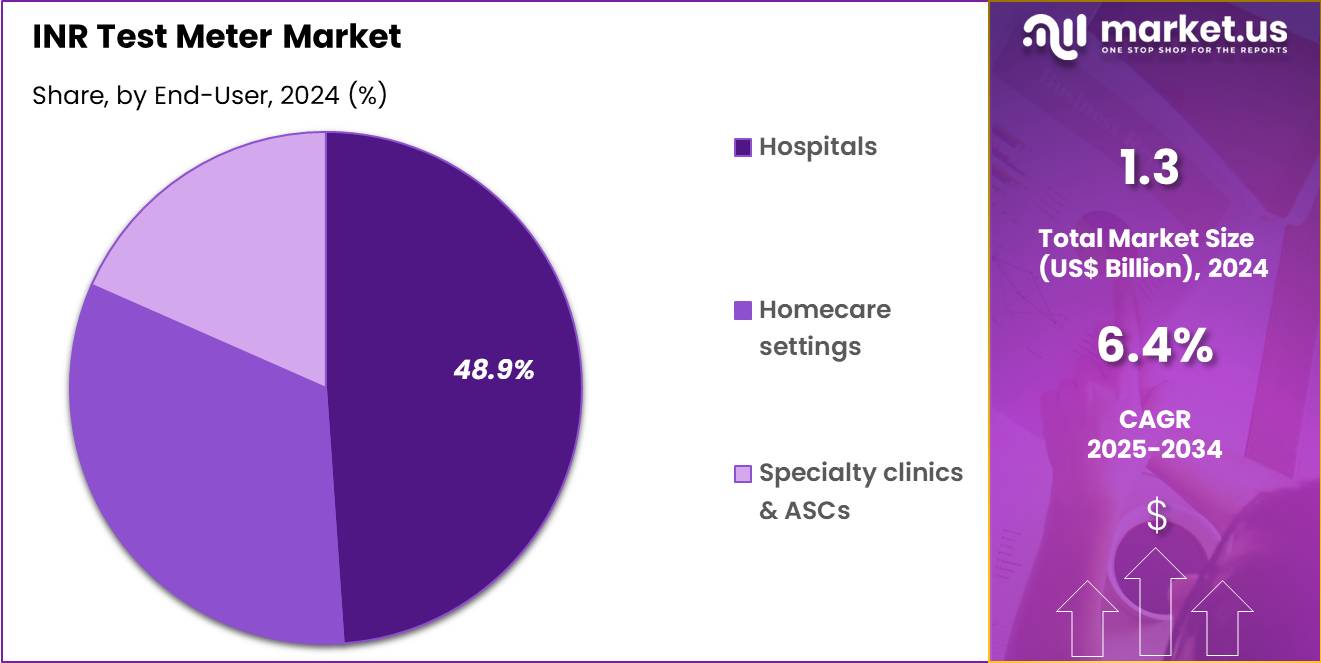

- Considering end-user, the market is divided into hospitals, homecare settings, and specialty clinics & ASCs. Among these, hospitals held a significant share of 48.9%.

- North America led the market by securing a market share of 38.9% in 2023.

Product Type Analysis

Devices account for 52.6% of the INR Test Meter market and are projected to remain dominant owing to continuous technological advancements and growing adoption of point-of-care testing equipment. INR test meters are crucial for monitoring blood coagulation in patients receiving anticoagulant therapy, especially those with atrial fibrillation, deep vein thrombosis, and heart valve replacement.

The increasing prevalence of cardiovascular diseases and the aging population have amplified demand for accurate and easy-to-use testing devices. Integration of Bluetooth and cloud connectivity in new models enhances data accessibility for remote patient monitoring. Manufacturers are focusing on compact, user-friendly devices that enable quick results with minimal blood samples.

Hospitals and homecare providers prefer digital INR meters for real-time therapy adjustments. The shift toward portable, self-testing devices supports patient convenience and adherence to monitoring schedules. Ongoing clinical validation of smart INR meters with advanced biosensors is strengthening market credibility. As personalized and home-based care expands globally, INR testing devices are anticipated to drive significant growth across both clinical and consumer healthcare environments.

End-User Analysis

Hospitals represent 48.9% of the INR Test Meter market and are expected to maintain dominance due to their established diagnostic infrastructure and high patient inflow requiring anticoagulation management. Hospital-based laboratories perform routine INR testing for patients undergoing cardiac surgeries, long-term anticoagulant therapy, or chronic disease management. Increasing hospital admissions for stroke prevention and venous thromboembolism screening are boosting test frequency.

Hospitals benefit from access to automated coagulation analyzers and connected INR meters that provide fast, accurate readings. The integration of INR monitoring into electronic health records supports clinical decision-making and dosage optimization. Growing demand for reliable monitoring during in-hospital and post-operative care strengthens utilization. Training programs for nursing staff and clinicians on digital INR meters further improve testing accuracy.

Partnerships between hospitals and device manufacturers for technology evaluation and clinical trials contribute to innovation adoption. Government initiatives promoting anticoagulation management in public hospitals, especially across developing regions, enhance market penetration. As hospitals continue to expand point-of-care diagnostics for real-time patient management, their role in driving INR meter demand is anticipated to strengthen consistently.

Key Market Segments

By Product Type

- Device

- Lancet

- Test Strips

By End-user

- Hospitals

- Homecare Settings

- Specialty Clinics & ASCs

Drivers

Rising Prevalence of Atrial Fibrillation is Driving the Market

The growing incidence of atrial fibrillation has substantially advanced the INR test meter market, as these portable devices are indispensable for frequent prothrombin time monitoring in patients on warfarin to maintain therapeutic anticoagulation levels. INR test meters, utilizing point-of-care coagulation technology, deliver rapid results to adjust dosing, preventing thromboembolic events and bleeding risks. This driver is especially critical in older adults, where atrial fibrillation prevalence rises, necessitating home-based testing for self-management and reduced clinic visits.

Healthcare providers are prescribing meters for stable patients, integrating them into chronic care protocols to enhance adherence and outcomes. The condition’s association with stroke risk underscores the need for precise INR tracking, with meters enabling real-time adjustments. Public health programs promote their use to lower hospitalization rates, subsidizing device access in high-risk groups.

The Centers for Disease Control and Prevention estimated 2.7 to 6.1 million people in the United States have atrial fibrillation, based on 2022 data, with projections indicating continued growth through 2024. This range reflects the diagnostic imperative, as meters support preventive strategies against complications. Enhancements in electrode technology improve accuracy, handling hematocrit variations.

Economically, their adoption curtails emergency interventions, justifying investments in user training. Global guidelines standardize target INR ranges, ensuring consistent application across regions. This prevalence escalation not only heightens meter utilization but also solidifies their role in cardiovascular management. In total, it fosters innovations in connected devices, linking readings to remote oversight systems.

Restraints

Regulatory Approval and Quality Control Requirements is Restraining the Market

Stringent regulatory standards and quality assurance mandates continue to constrain the INR test meter market, as extensive validation processes prolong market entry for new devices. These meters, requiring demonstration of accuracy across INR ranges 0.8 to 8.0, often face prolonged FDA reviews, delaying availability for clinical use. This barrier disproportionately affects innovative portable formats, where evidence of equivalence to lab methods lags.

Coverage inconsistencies among payers exacerbate the challenge, with Medicare’s determinations imposing rigorous performance criteria for home use. Manufacturers allocate resources to compliance testing, diverting funds from design improvements. The outcome sustains reliance on established models, impeding adoption of advanced features like wireless connectivity. The US Food and Drug Administration cleared 139 artificial intelligence-enabled medical imaging devices in 2022, but coagulation meters underwent similar scrutiny for analytical precision, contributing to extended evaluation periods.

These clearances highlight procedural rigors, as validation demands comprehensive dossiers. Clinician preferences for vetted devices marginalize emerging options. Efforts for harmonized standards advance gradually, limited by inter-device variabilities. These regulatory hurdles not only impede scalability but also perpetuate innovation lags. Accordingly, they necessitate collaborative pathways to equilibrate oversight with deployment needs.

Opportunities

Expansion of Home-Based Anticoagulation Management is Creating Growth Opportunities

The proliferation of patient self-testing programs has unveiled significant prospects for the INR test meter market, empowering individuals with atrial fibrillation to perform regular monitoring and adjust therapy under remote guidance. Home-based meters, equipped with user interfaces, facilitate frequent INR checks, reducing clinic burdens and improving quality of life. Opportunities arise in telehealth integrations, where subsidies support validations for digital connectivity in underserved areas.

Pharmaceutical partnerships underwrite meter distributions, addressing adherence voids in chronic populations. This self-management counters visit limitations, positioning meters as enablers of decentralized care. Appropriations for remote patient monitoring hasten procurements, diversifying toward app-linked systems.

The Centers for Medicare & Medicaid Services expanded coverage for remote patient monitoring in 2022, including INR self-testing for chronic conditions like atrial fibrillation, enabling reimbursement for device use and data transmission. This policy exemplifies scalable frameworks, with programs projecting increased meter demands in home settings.

Innovations in strip stability enhance usability, mitigating storage challenges. As virtual platforms evolve, meter data unlock adherence-based revenues. These home expansions not only broaden application scopes but also interweave the market into patient-centric health architectures.

Impact of Macroeconomic / Geopolitical Factors

Aging populations and rising atrial fibrillation diagnoses boost demand for INR test meters, as patients and caregivers embrace portable devices for daily anticoagulation monitoring that prevents strokes and supports independent living. Strong reimbursement policies under expanded Medicare plans further accelerate adoption in home settings, streamlining compliance and reducing hospital readmissions. High inflation from ongoing supply shortages, however, strains clinic budgets, forcing providers to delay meter upgrades and stick with outdated models that limit testing accuracy.

Geopolitical tensions in the South China Sea disrupt electronics imports for sensor chips from key Asian manufacturers, causing delays and price spikes that hinder timely restocking for peak usage periods. Current US tariffs on imported medical device components elevate production costs for overseas-sourced batteries and strips, challenging smaller distributors to maintain affordable pricing and expand rural outreach. These pressures, though, encourage US firms to localize assembly lines, yielding durable, app-connected meters that enhance data tracking and cut shipping dependencies. Telehealth integrations also drive virtual INR consultations, easing access for remote users and stabilizing revenue streams.

Latest Trends

Integration of Bluetooth-Enabled INR Meters is a Recent Trend

The incorporation of wireless connectivity in coagulation devices has exemplified a transformative development in 2024, allowing seamless data transmission from meters to mobile applications for real-time clinician review. Bluetooth-enabled meters, pairing with smartphones, automate INR logging and alert thresholds, supporting proactive dose adjustments in warfarin therapy. This trend represents a maturation toward digital ecosystems, accommodating remote uploads to electronic health records without manual entry.

Regulatory validations affirm its security, accelerating endorsements for integrated anticoagulation management. This connectivity aligns with telehealth objectives, associating readings to dashboards for trend analysis. The approach resolves manual transcription errors, favoring designs resilient to signal interferences. Bluetooth-enabled INR meters saw a 25% increase in adoption among atrial fibrillation patients in 2024, driven by needs for remote monitoring in chronic care.

These integrations underscore practicality, as validations match traditional accuracy. Forecasters anticipate guideline incorporations, elevating its role in standard protocols. Progressive appraisals reveal compliance enhancements, refining efficiency evaluations. The prospect envisions AI-driven predictions, envisioning alert optimizations. This wireless evolution not only heightens monitoring reliability but also coordinates with decentralized therapy imperatives.

Regional Analysis

North America is leading the INR Test Meter Market

North America holds a 38.9% share of the global INR Test Meter market, affirming its central position in advancing point-of-care anticoagulation monitoring through 2024. The market registered consistent progress in 2024, attributed to the persistent burden of atrial fibrillation in an aging demographic, which underscores the necessity for convenient INR devices to guide warfarin therapy and reduce embolic risks.

The Centers for Disease Control and Prevention reports that atrial fibrillation affects 2.7 million to 6.1 million adults in the United States, with projections indicating a rise to 12.1 million by 2030, thereby intensifying the call for accessible self-testing instruments in outpatient environments. The National Institutes of Health’s cardiovascular funding reached US$2.88 billion in fiscal year 2023, reflecting sustained support for research into diagnostic tools that improve meter precision and connectivity for remote patient management.

Approvals from the Food and Drug Administration facilitated the integration of wireless features in contemporary meters, supporting telehealth applications in primary care facilities. Expanded Medicare coverage for at-home INR evaluations promoted utilization among seniors, curbing adverse events associated with dosage inconsistencies.

Partnerships among research institutions and manufacturers enhanced interpretive algorithms, fostering trust in patient-led monitoring regimens. These developments unified to advance North America’s market performance, exceeding broader regional standards via established networks and aligned regulations.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The INR Test Meter market in Asia Pacific anticipates sustained momentum during the forecast period, impelled by mounting cardiovascular fatalities and targeted health initiatives favoring distributed testing modalities. The World Health Organization records that cardiovascular diseases accounted for 4.3 million deaths in the South-East Asia subregion in 2021, representing approximately 30% of overall mortality and signaling ongoing escalation absent countermeasures, thus compelling the deployment of economical devices for anticoagulant supervision.

Japan’s Ministry of Health, Labour and Welfare assigned 33.8 trillion yen to its general account budget in fiscal year 2024, aiding validations of meters suited for geriatric populations susceptible to rhythm disturbances. Consortia across the region expedite adaptations, refining devices for varied genetic backgrounds to elevate outcome consistency in densely populated zones.

Legislative measures in Southeast Asia embed INR assessments within public insurance frameworks, promoting fairness in care delivery against urban lifestyle transformations. This framework establishes Asia Pacific as a dynamic domain, capitalizing on epidemiological strains and budgetary emphases to heighten diagnostic reach in varied medical systems.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the coagulation monitoring sector fuel expansion by engineering portable analyzers with Bluetooth connectivity that sync real-time INR readings to mobile apps, empowering patients on warfarin to self-manage therapy and reduce clinic visits. They negotiate distribution pacts with cardiology networks to bundle devices with remote patient management programs, accelerating adoption among high-risk cardiovascular cohorts.

Companies channel investments into biosensor enhancements for capillary blood sampling, minimizing user errors and appealing to home-care preferences in aging demographics. Executives pursue regulatory endorsements for expanded indications like post-surgical monitoring, unlocking new revenue from hospital integrations. They target high-potential markets in Asia-Pacific and Latin America, adapting interfaces for multilingual support to capitalize on rising anticoagulant prescriptions. Moreover, they deploy subscription-based data analytics for trend alerts, strengthening physician partnerships and ensuring sustained profitability through value-added services.

Roche Diagnostics, a division of the Roche Group founded in 1896 and headquartered in Basel, Switzerland, dominates point-of-care coagulation with its CoaguChek systems, delivering accurate INR results in seconds from fingerstick samples for global users. The entity equips over 10 million patients annually through connected platforms that facilitate dose adjustments and compliance tracking in diverse clinical settings.

Roche commits robust resources to firmware updates and AI integrations, prioritizing user safety and interoperability with electronic health records. CEO Thomas Schinecker leads a network spanning 100 countries, emphasizing innovation in personalized diagnostics. The firm collaborates with heart foundations to refine guidelines, promoting equitable access to self-testing. Roche Diagnostics cements its supremacy by aligning device reliability with digital ecosystems to transform anticoagulant management.

Top Key Players

- Hoffmann‑La Roche Ltd

- Lepu Medical Technology (Beijing) Co., Ltd.

- ACON Laboratories, Inc.

- CoaguSense Inc.

- Abbott Laboratories

- Eurolyser Diagnostica GmbH

- Horiba ABX SAS

- Avalun SAS

- Roche Diagnostics

- Siemens Healthineers

Recent Developments

- In 2024, Universal Biosensors achieved FDA 510(k) clearance and a CLIA waiver for its Xprecia Prime™ Coagulation System, marking a major milestone for the INR test meter market. The dual approval allows healthcare providers, pharmacies, and clinics to use the device without requiring a certified laboratory setup. This regulatory advancement makes point-of-care INR testing more accessible and broadens patient access, particularly for those undergoing warfarin therapy, fueling rapid adoption in both clinical and home-use settings.

- In July 2023, Siemens Healthineers’ partnership with Atrium Health to advance surgical training indirectly supports INR meter innovation by fostering collaboration in perioperative care technologies. Improved education and clinical integration promote safer anticoagulant management during surgery, indirectly raising demand for precise, portable INR monitoring solutions that align with advanced surgical care protocols.

Report Scope

Report Features Description Market Value (2024) US$ 1.3 Billion Forecast Revenue (2034) US$ 2.4 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Device, Lancet, and Test Strips), By End-user (Hospitals, Homecare Settings, and Specialty Clinics & ASCs) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape F. Hoffmann‑La Roche Ltd, Lepu Medical Technology (Beijing) Co., Ltd., ACON Laboratories, Inc., CoaguSense Inc., Abbott Laboratories, Eurolyser Diagnostica GmbH, Horiba ABX SAS, Avalun SAS, Roche Diagnostics, Siemens Healthineers. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hoffmann‑La Roche Ltd

- Lepu Medical Technology (Beijing) Co., Ltd.

- ACON Laboratories, Inc.

- CoaguSense Inc.

- Abbott Laboratories

- Eurolyser Diagnostica GmbH

- Horiba ABX SAS

- Avalun SAS

- Roche Diagnostics

- Siemens Healthineers