Electrosurgical Devices Market By Method (Monopolar and Bipolar), By Product (Electrosurgical Generators, Active Electrodes, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142429

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

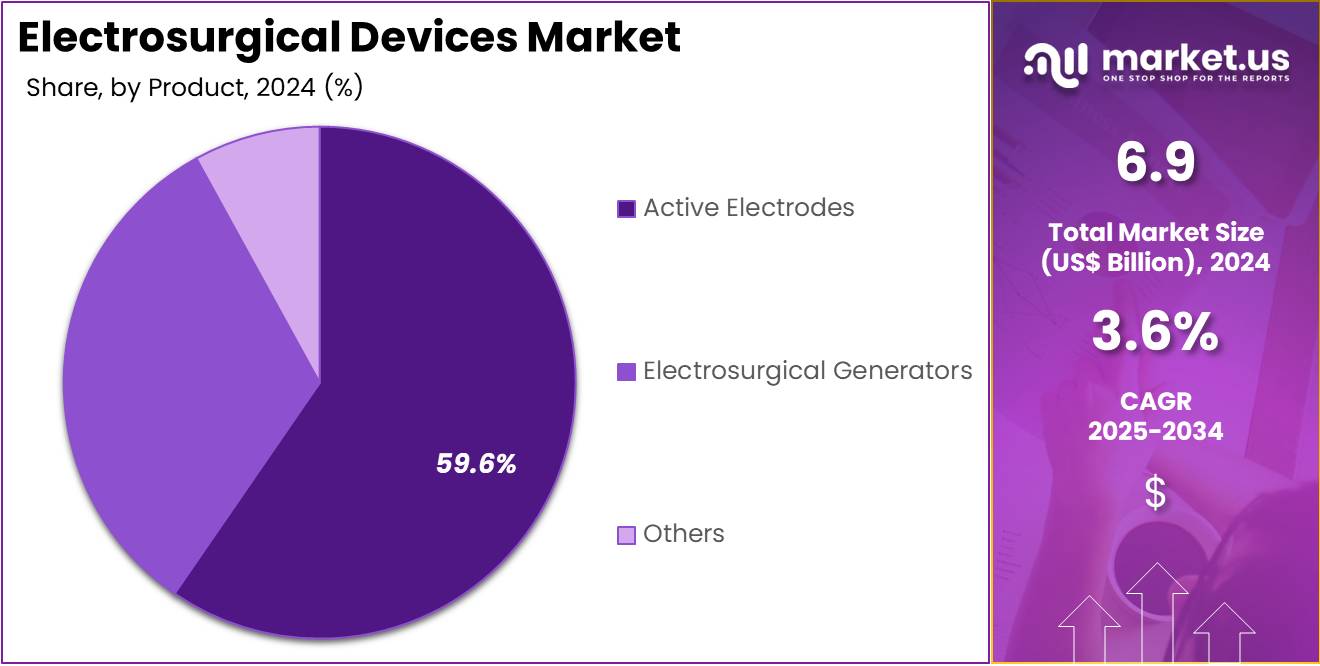

The Global Electrosurgical Devices Market size is expected to be worth around US$ 9.8 Billion by 2034, from US$ 6.9 Billion in 2024, growing at a CAGR of 3.6% during the forecast period from 2025 to 2034.

Increasing adoption of minimally invasive surgeries is driving the growth of the electrosurgical market. Electrosurgery, which utilizes high-frequency electrical currents for cutting, coagulation, and tissue destruction, is gaining prominence in various medical fields, including general surgery, orthopedics, gynecology, and dermatology. The shift toward minimally invasive procedures is fueled by the desire for shorter recovery times, reduced risk of infections, and enhanced precision in surgical procedures.

Electrosurgical devices, such as electrosurgical pencils, generators, and electrodes, have seen significant advancements, offering better control, higher efficiency, and improved patient safety. These innovations are opening up opportunities for the market to expand, especially with the growing demand for advanced treatments in both hospitals and outpatient settings.

According to a World Health Organization (WHO) report, North America maintains a relatively high hospital bed density, with an average of 5.9 beds available per 1,000 individuals, reflecting the strong healthcare infrastructure that supports the adoption of electrosurgical technologies. These developments and the continued emphasis on surgical precision and patient outcomes position the electrosurgical market for sustained growth.

Key Takeaways

- In 2023, the market for electrosurgical devices generated a revenue of US$ 6.9 billion, with a CAGR of 3.6%, and is expected to reach US$ 9.8 billion by the year 2033.

- The method segment is divided into monopolar and bipolar, with bipolar taking the lead in 2023 with a market share of 64.5%.

- Considering product, the market is divided into electrosurgical generators, active electrodes, and others. Among these, active electrodes held a significant share of 59.6%.

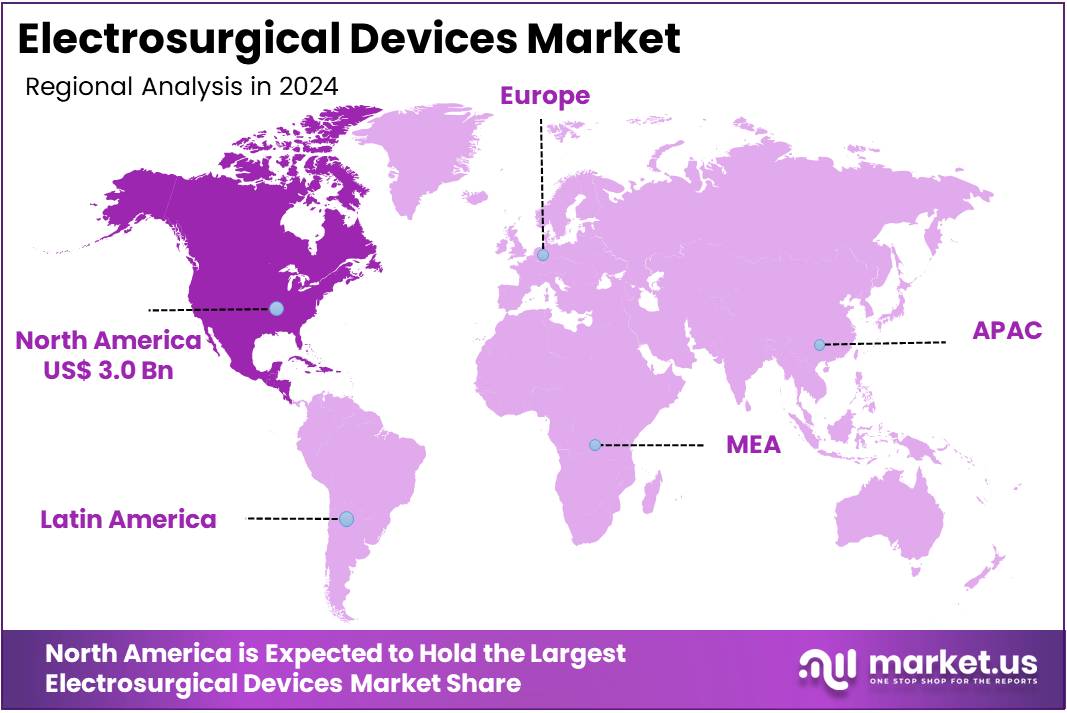

- North America led the market by securing a market share of 43.9% in 2023.

Method Analysis

The bipolar segment led in 2023, claiming a market share of 64.5% as the demand for precision in surgical procedures increases. Bipolar electrosurgical devices, which offer enhanced control over tissue coagulation and minimize the risk of thermal damage to surrounding tissues, are anticipated to see higher adoption rates in various surgical specialties, including cardiovascular, neurosurgery, and gynecology. The growing preference for minimally invasive procedures that ensure reduced complication rates and faster recovery times is likely to drive the demand for bipolar methods.

Additionally, advancements in bipolar technology, such as improved energy delivery systems and the development of more specialized instruments, are projected to further contribute to the segment’s growth. As surgeons continue to prioritize precision and patient safety, the bipolar electrosurgical method is anticipated to remain a key focus area within the market.

Product Analysis

The active electrodes held a significant share of 59.6% due to their critical role in ensuring effective energy delivery during electrosurgical procedures. Active electrodes are expected to see increased demand as surgical procedures become more complex and require greater precision. The growing prevalence of surgeries that require tissue coagulation, excision, and dissection is projected to drive the adoption of advanced active electrodes. Additionally, the development of electrodes with enhanced biocompatibility, durability, and energy efficiency is likely to spur further growth in this segment.

As hospitals and surgical centers prioritize optimal surgical outcomes and patient safety, the use of high-quality active electrodes is expected to expand. The increasing number of minimally invasive surgeries, which rely on precise electrosurgical tools, is also projected to contribute to the growth of the active electrodes segment in the electrosurgical market.

Key Market Segments

By Method

- Monopolar

- Bipolar

By Product

- Electrosurgical Generators

- Active Electrodes

- Others

Drivers

Technological Advancements are Driving the Market

Technological advancements in electrosurgical devices, such as the integration of robotics and AI, are significantly driving the market. Companies like Medtronic and Johnson & Johnson are investing heavily in developing advanced electrosurgical tools that offer greater precision, reduced surgical times, and minimized patient recovery periods. For instance, Medtronic’s Hugo RAS system, launched in 2022, incorporates electrosurgical capabilities with robotic assistance, enhancing surgical outcomes. Medtronic invested approximately US$6.5 billion in 2022, and the market is projected to grow at a CAGR of 6.8% through 2024, driven by these technological breakthroughs.

Restraints

High Costs are Restraining the Market

The high cost of electrosurgical devices and procedures is a major restraint for market growth. Advanced electrosurgical systems, particularly those integrated with robotics, can cost upwards of US$1 million, making them inaccessible for smaller healthcare facilities. Additionally, the maintenance and training costs associated with these devices further burden healthcare providers. Nearly 40% of low- and middle-income countries face budget constraints in adopting advanced surgical technologies. This financial barrier limits the widespread adoption of electrosurgical devices, particularly in developing regions, thereby restraining market expansion.

Opportunities

Minimally Invasive Surgeries are Creating Growth Opportunities

The increasing preference for minimally invasive surgeries (MIS) is creating significant growth opportunities for the electrosurgical market. MIS procedures, which rely heavily on electrosurgical tools, offer benefits such as reduced scarring, shorter hospital stays, and faster recovery times. MIS procedures accounted for over 60% of all surgeries in the US in 2022, with this number expected to rise by 8% annually through 2024. Companies like Stryker and Boston Scientific are capitalizing on this trend by developing specialized electrosurgical instruments tailored for MIS. This shift in surgical preferences is driving demand for advanced electrosurgical devices, particularly in developed markets.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors are significantly influencing the electrosurgical market. Rising healthcare expenditures, particularly in developed economies, are driving demand for advanced surgical tools, including electrosurgical devices. For instance, the US healthcare spending reached US$10.6 billion in 2023, up 12% from the previous year. This positive trend, coupled with technological advancements, ensures a resilient and expanding market for electrosurgical devices.

Trends

Sustainability is a Recent Trend in the Market

Sustainability has emerged as a recent trend in the electrosurgical market, with manufacturers focusing on eco-friendly designs and reusable components. For example, Olympus Corporation introduced a line of reusable electrosurgical instruments in 2023, reducing medical waste by 30% compared to traditional single-use devices. The healthcare sector generates over 5 million tons of waste annually, prompting regulatory bodies to push for sustainable medical devices. This trend aligns with global environmental goals and is gaining traction among healthcare providers, particularly in Europe and North America, where sustainability regulations are stringent.

Regional Analysis

North America is leading the Electrosurgical Devices Market

North America dominated the market with the highest revenue share of 43.9% owing to the increasing prevalence of chronic diseases and the rising demand for minimally invasive surgical procedures. The American Hospital Association reported that, as of 2022, there were approximately 6,093 hospitals in the United States, performing an estimated 36.2 million surgical procedures annually. This high volume of surgeries has escalated the demand for advanced electrosurgical devices.

Additionally, the U.S. Census Bureau noted that in 2023, individuals aged 65 and older comprised about 16.9% of the U.S. population, a demographic more susceptible to conditions necessitating surgical interventions. Technological advancements, such as the development of ultrasonic electrosurgical devices, have further propelled market expansion. For instance, Medtronic, a key industry player, reported a 5% increase in their surgical innovations segment in fiscal year 2023, reflecting heightened adoption of electrosurgical technologies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the rising prevalence of chronic disorders and an aging population in countries such as Japan and China. The World Health Organization reported that in 2022, noncommunicable diseases accounted for approximately 87% of all deaths in Japan, indicating a substantial need for surgical interventions.

Similarly, China’s National Bureau of Statistics noted that individuals aged 65 and above constituted about 14.2% of the population in 2022. The increasing volume of surgical procedures, along with improvements in healthcare infrastructure, is expected to further drive the demand for electrosurgical devices. Moreover, the growing adoption of minimally invasive surgeries and technological advancements in electrosurgical equipment are likely to propel market growth in the Asia-Pacific region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading companies in the electrosurgical industry focus on technological innovation, strategic acquisitions, and expanding their global footprint to drive growth. They invest in research and development to enhance energy-based surgical devices, improve patient safety, and optimize procedural efficiency. Collaborations with hospitals and surgical centers help accelerate product adoption and strengthen market presence.

Expanding into emerging economies and integrating robotic-assisted surgical technologies further boost revenue and competitive advantage. Regulatory approvals and continuous advancements in minimally invasive procedures support long-term market leadership. CONMED Corporation is a global medical technology company specializing in surgical devices and equipment.

Headquartered in Largo, Florida, the company offers a broad range of energy-based surgical instruments designed for precision and efficiency. Its portfolio includes advanced electrosurgery systems, smoke evacuation devices, and laparoscopic tools that enhance surgical outcomes. CONMED collaborates with healthcare professionals worldwide to develop cutting-edge solutions for various medical specialties. Through continuous innovation and strategic acquisitions, the company strengthens its position as a key player in the surgical technology market.

Top Key Players in the Electrosurgical Devices Market

- Smith & Nephew Plc

- Olympus Corporation

- Medtronic

- Johnson & Johnson

- Innoblative Designs

- Erbe Elektromedizin GmbH

- CONMED Corporation

Recent Developments

- In June 2023, Olympus Corporation introduced the ESG-410, an advanced electrosurgical generator designed to enhance procedural efficiency in treating benign prostatic hyperplasia (BPH) and non-muscle-invasive bladder cancer (NMIBC). The system features innovative electrode designs, including vaporization buttons, needles, band electrodes, and resection loops, to optimize surgical outcomes.

- In April 2023, Innoblative Designs secured Breakthrough Device Designation from the US FDA for its SIRA RFA Electrosurgical Device. This technology is developed to support breast cancer patients undergoing breast-conserving surgery by improving precision in tumor removal while preserving healthy tissue.

Report Scope

Report Features Description Market Value (2024) US$ 6.9 billion Forecast Revenue (2034) US$ 9.8 billion CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Method (Monopolar and Bipolar), By Product (Electrosurgical Generators, Active Electrodes, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Smith & Nephew Plc, Olympus Corporation, Medtronic, Johnson & Johnson, Innoblative Designs, Erbe Elektromedizin GmbH, and CONMED Corporation. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electrosurgical Devices MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Electrosurgical Devices MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Smith & Nephew Plc

- Olympus Corporation

- Medtronic

- Johnson & Johnson

- Innoblative Designs

- Erbe Elektromedizin GmbH

- CONMED Corporation