Global Endotracheal Tube Market By Product Type (Regular, Double-Lumen, Preformed, and Reinforced), By Route of Administration (Orotracheal and Nasotracheal), By Application (Emergency Treatment, Therapy, and Others), By End-user (Hospitals & Clinics, Ambulatory Surgical Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date:

- Report ID: 142858

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

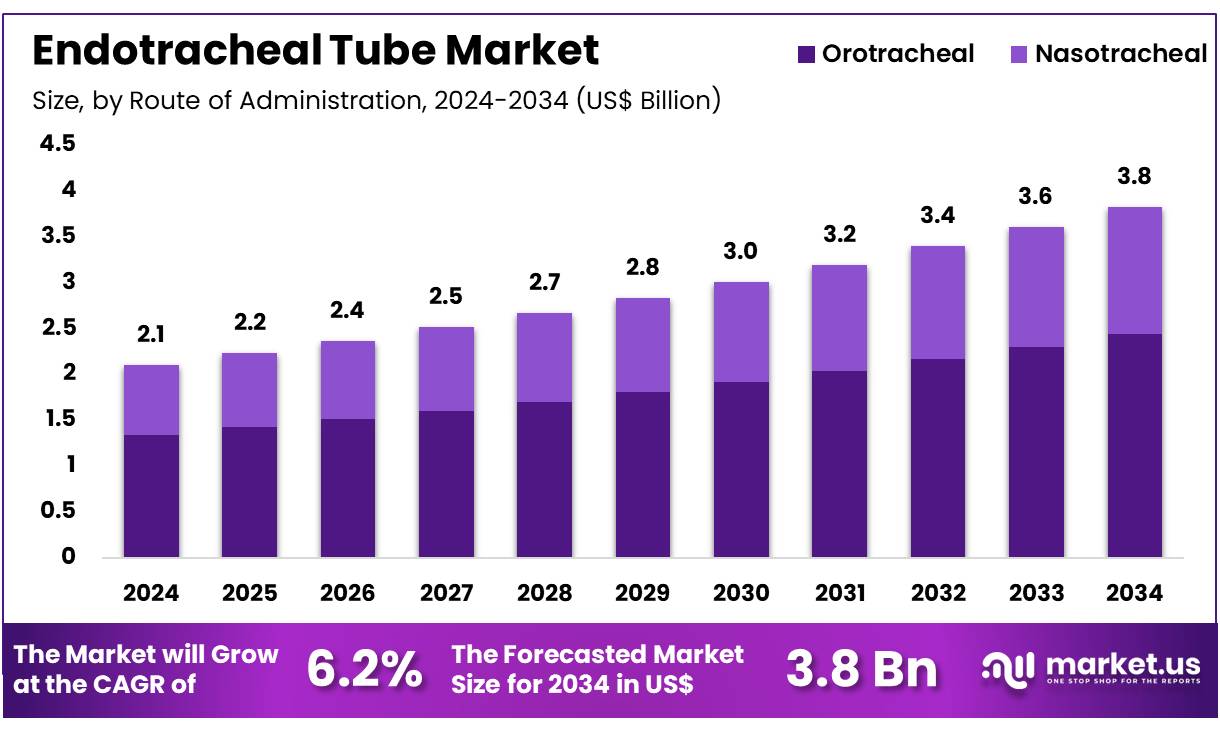

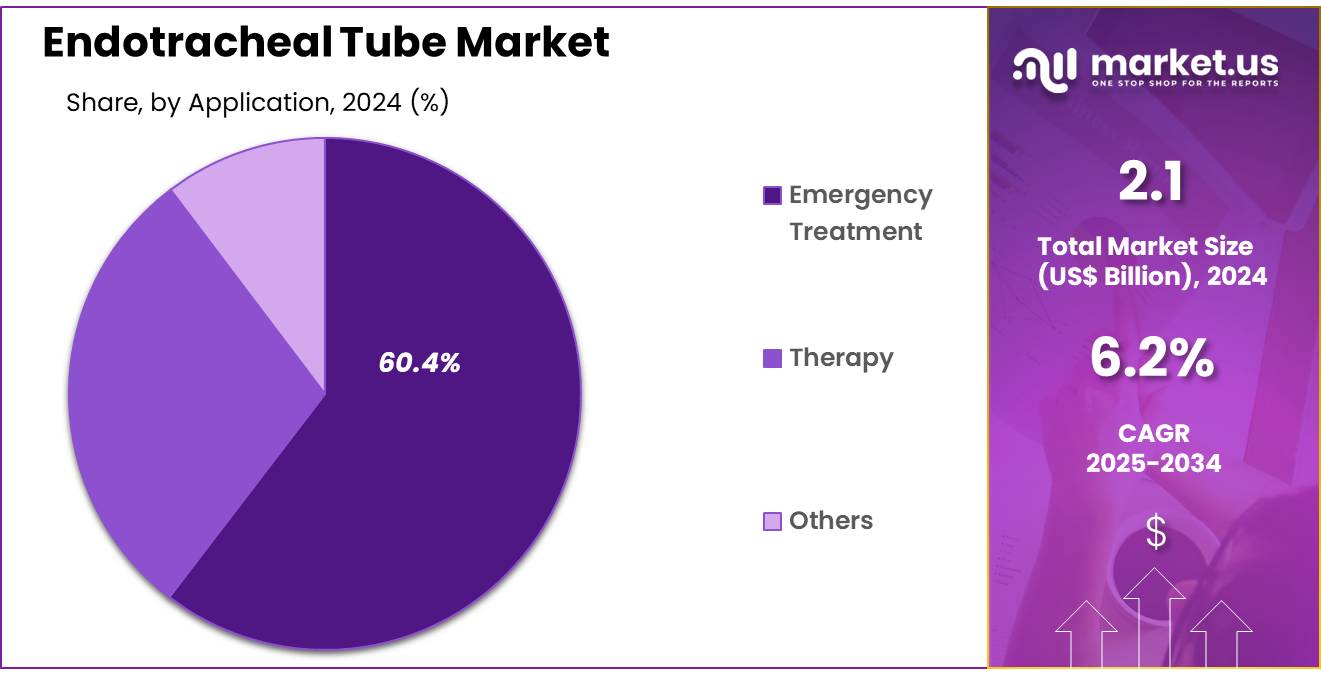

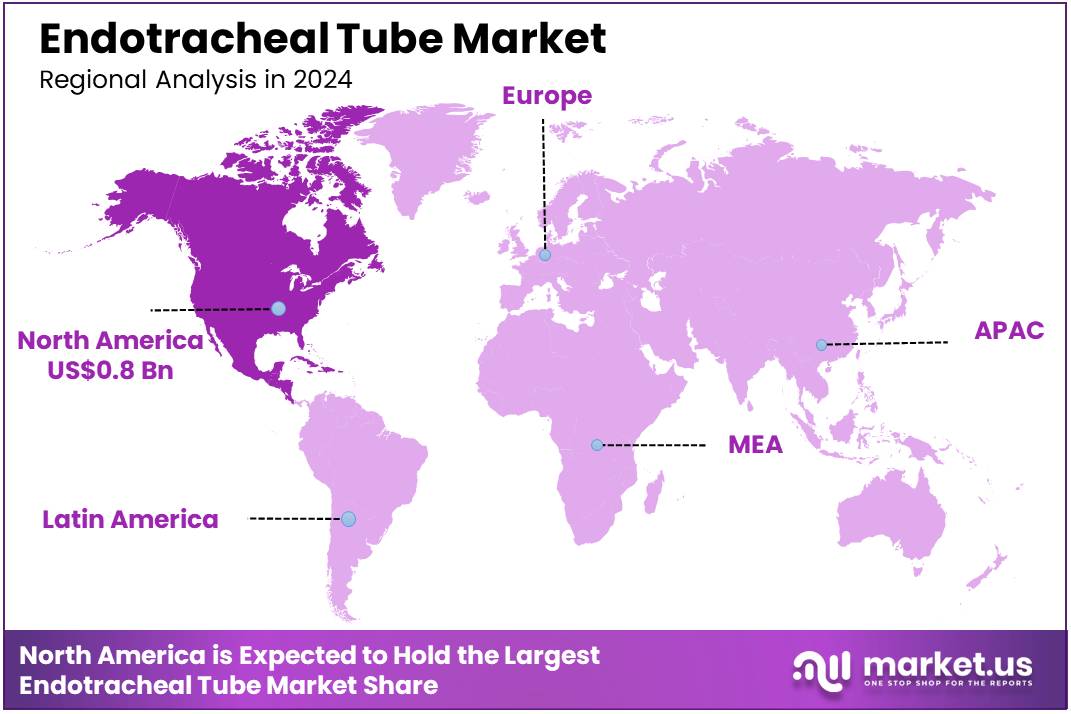

Global Endotracheal Tube Market size is expected to be worth around US$ 3.8 Billion by 2034 from US$ 2.1 Billion in 2024, growing at a CAGR of 6.2% during the forecast period 2025 to 2034. In 2023, North America led the market, achieving over 38.7% share with a revenue of US$ 0.8 Billion.

Increasing demand for enhanced patient care and advanced airway management technologies is driving the growth of the endotracheal tube market. Endotracheal tubes, essential for securing the airway during surgeries and critical care procedures, are undergoing significant advancements, fueled by the rise in chronic respiratory diseases and the growing number of surgical interventions.

The market benefits from innovations like antimicrobial-coated tubes and sensors integrated into the tubes, which improve patient safety and optimize outcomes. In November 2023, researchers at the University of Nottingham secured funding from the Medical Research Council (MRC) to initiate clinical trials for iTraXS, an endotracheal tube integrated with optical fiber sensors. This technology aims to enhance real-time monitoring of intubated patients, further improving airway management.

In August 2021, scientists at the Children’s Hospital of Philadelphia (CHOP) developed an antimicrobial-coated endotracheal tube to combat bacterial infections, reducing airway inflammation and minimizing the risks associated with prolonged intubation. These innovations, alongside the rising adoption of advanced healthcare technologies, are opening up new opportunities in the market, particularly in the critical care and surgery sectors.

Key Takeaways

- In 2024, the market for Endotracheal Tube generated a revenue of US$ 2.1 billion, with a CAGR of 6.2%, and is expected to reach US$ 3.8 billion by the year 2033.

- The product type segment is divided into regular, double-lumen, preformed, and reinforced, with regular taking the lead in 2023 with a market share of 52.3%.

- Considering route of administration, the market is divided into orotracheal and nasotracheal. Among these, orotracheal held a significant share of 63.8%.

- Furthermore, concerning the application segment, the market is segregated into emergency treatment, therapy, and others. The emergency treatment sector stands out as the dominant player, holding the largest revenue share of 60.4% in the Endotracheal Tube market.

- The end-user segment is segregated into hospitals & clinics, ambulatory surgical centers, and others, with the hospitals & clinics segment leading the market, holding a revenue share of 58.6%.

- North America led the market by securing a market share of 38.7% in 2024.

Product Type Analysis

The regular segment led in 2024, claiming a market share of 52.3% owing to its widespread use in general anesthesia and respiratory management during surgeries. Regular endotracheal tubes are anticipated to remain the preferred choice for routine airway management because of their simplicity, ease of use, and cost-effectiveness. As the number of elective and emergency surgeries increases globally, the demand for these standard tubes is likely to rise.

Additionally, the growing prevalence of respiratory diseases and the need for effective airway management during both routine and complex procedures are projected to drive the continued adoption of regular endotracheal tubes. As hospitals and surgical centers focus on improving patient safety and outcomes, the demand for reliable and affordable airway management devices, like regular tubes, is expected to expand.

Route of Administration Analysis

The orotracheal held a significant share of 63.8% due to its common use in airway management during surgeries and emergency procedures. Orotracheal intubation, where the tube is inserted through the mouth into the trachea, is anticipated to remain the preferred method for airway access in many clinical settings because it offers quicker and easier access compared to nasotracheal intubation. The rising number of surgeries, trauma cases, and emergency treatments is likely to contribute to the growth of this segment.

Additionally, the increasing focus on providing faster and more efficient care during critical situations, such as cardiac arrest or severe respiratory distress, is projected to drive the demand for orotracheal tubes. As healthcare providers prioritize ease of use and quick intervention, the orotracheal segment is expected to continue its expansion.

Application Analysis

The emergency treatment segment had a tremendous growth rate, with a revenue share of 60.4% owing to the increasing prevalence of respiratory emergencies and trauma cases that require immediate airway management. Endotracheal tubes are essential for securing the airway during emergencies, such as cardiac arrest, acute respiratory failure, and trauma situations, where rapid intervention is critical. The rise in road accidents, cardiovascular diseases, and respiratory disorders, along with an aging population, is likely to drive the demand for endotracheal tubes used in emergency care.

Furthermore, advancements in airway management techniques and the growing need for pre-hospital care are anticipated to further contribute to the growth of this segment. As healthcare systems continue to focus on improving outcomes in critical care, the emergency treatment segment is expected to expand in the coming years.

End-user Analysis

The hospitals & clinics segment grew at a substantial rate, generating a revenue portion of 58.6% as hospitals remain the primary location for surgeries, critical care, and emergency treatments. Hospitals and clinics are likely to continue being the largest consumers of endotracheal tubes due to their role in managing a wide variety of respiratory conditions and surgical procedures. The increasing number of surgeries, particularly elective surgeries, along with the growing prevalence of respiratory diseases, is likely to drive the demand for endotracheal tubes in hospitals and clinics.

Additionally, hospitals’ focus on improving patient safety, reducing complications, and enhancing recovery times is projected to boost the adoption of advanced airway management systems. As healthcare systems invest in better medical infrastructure and prioritize efficient care delivery, the hospitals and clinics segment is expected to grow steadily.

Key Market Segments

Product Type

- Regular

- Double-Lumen

- Preformed

- Reinforced

Route of Administration

- Orotracheal

- Nasotracheal

Application

- Emergency Treatment

- Therapy

- Others

End-user

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Others

Drivers

Increasing Prevalence of Respiratory Diseases is Driving the Market

The rising incidence of respiratory diseases, such as chronic obstructive pulmonary disease (COPD), asthma, and COVID-19-related complications, is a significant driver for the endotracheal tube market. COPD is the third leading cause of death globally, accounting for over 3 million deaths annually as of 2022. Additionally, the COVID-19 pandemic has heightened the demand for advanced respiratory care devices, including endotracheal tubes, as severe cases often require mechanical ventilation.

Key players like Medtronic and Teleflex have reported increased sales in their respiratory care divisions, with Medtronic’s 2023 annual report indicating a 12% year-on-year growth in this segment. The growing aging population, which is more susceptible to respiratory conditions, further amplifies this demand.

Governments and healthcare organizations are also investing heavily in improving critical care infrastructure, which directly benefits the market. For instance, the US Department of Health and Human Services allocated US$350 million in 2023 to enhance emergency medical services, including ventilator support systems. This combination of factors ensures sustained growth in the market.

Restraints

High Cost of Advanced Endotracheal Tubes is Restraining the Market

The high cost of advanced endotracheal tubes, particularly those with specialized features like subglottic suctioning or antimicrobial coatings, is a major restraint in the market. These tubes can cost up to 5-10 times more than standard versions, making them less accessible in low- and middle-income countries.

Healthcare expenditure in developing nations remains limited, with many countries spending less than US$100 per capita annually on medical devices. Additionally, stringent regulatory requirements for product approval, such as those imposed by the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA), increase development costs for manufacturers. This, in turn, raises the final price of the product.

For example, Teleflex’s 2022 financial report highlighted a 15% increase in R&D expenses due to compliance with new regulatory standards. While these advanced tubes offer significant clinical benefits, their high cost limits widespread adoption, particularly in resource-constrained settings, thereby restraining market growth.

Opportunities

Technological Advancements are Creating Growth Opportunities

Technological advancements in endotracheal tube design and materials are creating significant growth opportunities in the market. Innovations such as laser-resistant tubes, which are safer for patients undergoing laser surgery, and tubes with integrated cameras for real-time visualization are gaining traction.

Companies like Smiths Medical and Medtronic are leading the way, with Smiths Medical launching a new line of antimicrobial-coated tubes in 2023, reducing the risk of ventilator-associated pneumonia (VAP). Additionally, the integration of artificial intelligence (AI) and IoT in respiratory care devices is opening new avenues for growth.

For instance, AI-powered monitoring systems can predict tube displacement or blockage, enhancing patient safety. These innovations not only improve clinical outcomes but also create lucrative opportunities for manufacturers to differentiate their products and capture a larger market share.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the endotracheal tube market, shaping its growth trajectory. Economic stability and increased healthcare spending in developed regions, such as North America and Europe, drive market expansion.

For instance, US healthcare expenditure reached US$7 billion in 2023 to enhance critical care facilities. Trade policies and tariffs also play a role, with some countries imposing restrictions on medical device imports to promote local manufacturing. Despite these challenges, the market remains resilient, supported by technological innovation and the global focus on improving respiratory care, ensuring a promising future.

Latest Trends

Rising Adoption of Disposable Endotracheal Tubes is a Recent Trend

The increasing adoption of disposable endotracheal tubes is a notable trend in the market, driven by the need to reduce the risk of hospital-acquired infections (HAIs). HAIs affect approximately 1 in 31 hospital patients in the US annually, with respiratory devices being a common source of contamination.

Disposable tubes eliminate the need for sterilization, thereby minimizing infection risks. Key players like ICU Medical and Medline Industries have expanded their disposable product lines to meet this demand. For example, ICU Medical reported a 20% increase in sales of disposable respiratory products in 2023. This trend is further supported by regulatory guidelines promoting single-use devices to enhance patient safety, making disposable tubes a preferred choice in healthcare settings.

Regional Analysis

North America is leading the Endotracheal Tube Market

North America dominated the market with the highest revenue share of 38.7% owing to advancements in medical technology, increasing prevalence of respiratory diseases, and rising demand for critical care solutions. The introduction of innovative products, such as Medtronic’s SonarMed airway monitoring system in May 2021, has played a pivotal role in this expansion.

This system, which utilizes acoustic technology for real-time detection of blockages and placement verification, has enhanced the safety and efficacy of airway management, encouraging broader adoption of advanced endotracheal devices. Additionally, the aging population in North America, coupled with a higher incidence of chronic respiratory conditions like COPD and asthma, has fueled the need for reliable intubation tools.

Hospitals and healthcare facilities are increasingly investing in state-of-the-art equipment to improve patient outcomes, further propelling market growth. The COVID-19 pandemic also underscored the importance of robust respiratory care infrastructure, leading to sustained demand for these devices.

Moreover, regulatory approvals and favorable reimbursement policies have facilitated the integration of advanced endotracheal solutions into clinical practice. As a result, the market has seen a steady rise in revenue, with manufacturers focusing on product innovation and strategic collaborations to meet the growing demand.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rapid urbanization, improving healthcare infrastructure, and increasing awareness of advanced medical technologies. Countries such as China, India, and Japan are anticipated to lead this growth, owing to their large patient populations and expanding healthcare expenditure.

The rising prevalence of respiratory disorders, exacerbated by air pollution and lifestyle changes, is projected to boost the demand for effective airway management solutions. Governments in the region are likely to invest heavily in modernizing healthcare facilities, further accelerating market expansion.

Additionally, the growing adoption of minimally invasive surgical procedures and the increasing number of emergency care cases are estimated to drive the need for reliable intubation devices. Manufacturers are expected to focus on developing cost-effective and technologically advanced products tailored to the region’s diverse healthcare needs.

The establishment of local production facilities and partnerships with regional distributors is anticipated to enhance market penetration. Furthermore, rising medical tourism and the influence of Western medical practices are likely to contribute to the market’s upward trajectory. As a result, the Asia Pacific region is poised to become a key contributor to the global endotracheal tube market, with significant opportunities for innovation and growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the endotracheal tube market employ strategies such as product innovation, strategic partnerships, mergers and acquisitions, and geographic expansion to drive growth. They focus on developing advanced materials and designs to enhance patient safety and comfort, while also investing in research and development to meet evolving medical standards.

Companies often collaborate with healthcare providers and distributors to strengthen their market presence and expand their customer base. Additionally, they prioritize regulatory compliance and certifications to ensure product reliability and gain a competitive edge. Marketing efforts emphasize educating healthcare professionals about the benefits of their products, further boosting adoption rates.

One of the key players, Medtronic, is a global leader in medical technology, services, and solutions. The company offers a wide range of products, including advanced airway management devices, and is known for its commitment to innovation and improving patient outcomes. Medtronic’s extensive portfolio and strong distribution network enable it to maintain a significant share in the global market.

Top Key Players

- Teleflex Incorporated

- Sterimed Group

- Mercury Medical

- Medtronic

- ICU Medical

- Hollister Incorporated

- Fuji Systems Corp

- Advin Health Care

Recent Developments

- In January 2022, ICU Medical completed the acquisition of Smiths Medical, significantly strengthening its global footprint in the medical technology sector. This acquisition expanded ICU Medical’s product offerings, enhancing its capabilities in infusion therapy and critical care solutions.

- In January 2022, Medtronic finalized an agreement to acquire Affera, Inc., a medical technology company specializing in innovative cardiac treatment solutions. This acquisition broadened Medtronic’s portfolio in cardiac ablation, further reinforcing its position in the electrophysiology market.

Report Scope

Report Features Description Market Value (2024) US$ 2.1 billion Forecast Revenue (2034) US$ 3.8 billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Regular, Double-Lumen, Preformed, and Reinforced), By Route of Administration (Orotracheal and Nasotracheal), By Application (Emergency Treatment, Therapy, and Others), By End-user (Hospitals & Clinics, Ambulatory Surgical Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Teleflex Incorporated, Sterimed Group, Mercury Medical, Medtronic, ICU Medical, Hollister Incorporated, Fuji Systems Corp, and Advin Health Care. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Teleflex Incorporated

- Sterimed Group

- Mercury Medical

- Medtronic

- ICU Medical

- Hollister Incorporated

- Fuji Systems Corp

- Advin Health Care