Global Artificial Pancreas Device Systems Market By Device Type(Threshold Suspend Device Systems, Control-to-Range (CTR) Systems, Control-to-Target (CTT) Systems) By End-Use(Hospitals, Clinics, Other) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jun 2024

- Report ID: 56270

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

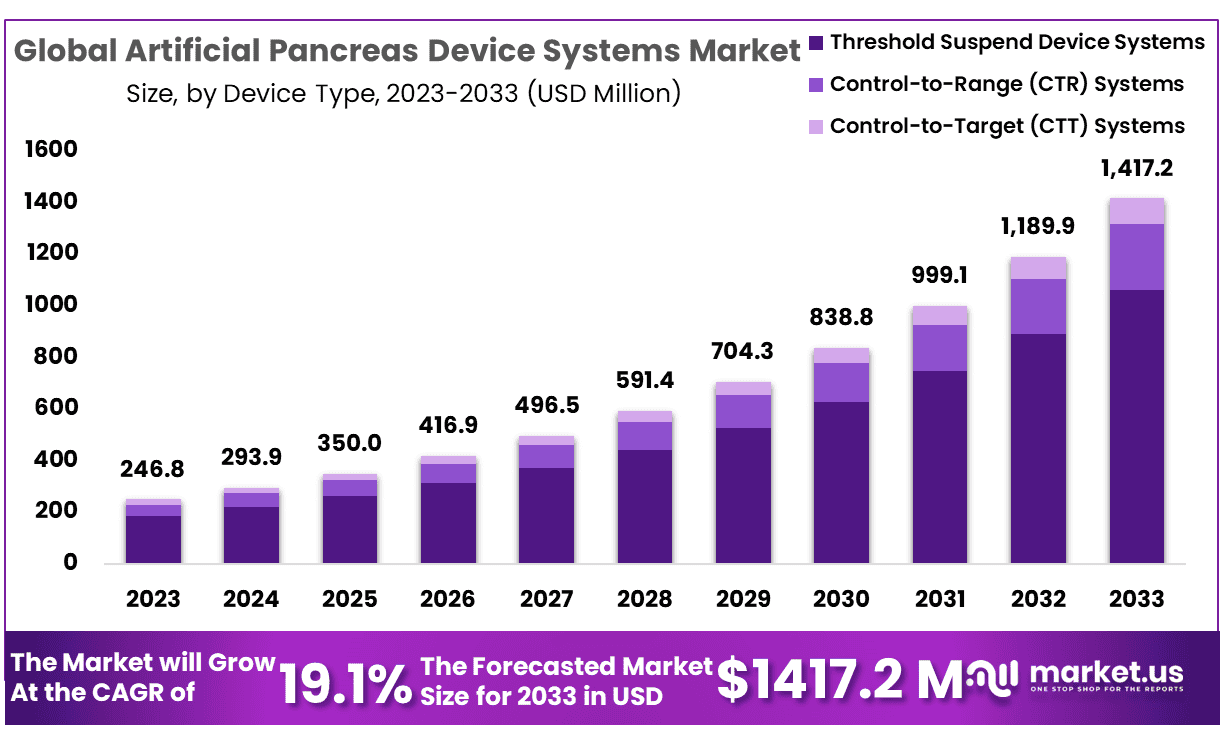

The Global Artificial Pancreas Device Systems Market size is expected to be worth around USD 1417.2 Million by 2033 from USD 246.8 Million in 2023, growing at a CAGR of 19.1% during the forecast period from 2024 to 2033.

Artificial pancreas device systems closely replicate the functions of a healthy pancreas in terms of glucose regulation. These artificial devices not only monitor body glucose levels but can also autonomously fine-tune insulin distribution, mitigating high levels while simultaneously decreasing low ones – according to FDA, using artificial pancreases leads to more effective blood sugar level management among individuals living with type 1 diabetes than using conventional treatments alone.

This report tracks market development through current trends, historical growth analysis and revenue projections up to 2023. Furthermore, this report spotlights Control to Range (CTR) Systems and Control to Target (CTT) Systems within the market; furthermore placing special attention on end user segments such as hospitals and medical centers while offering in-depth analyses for each one of them. Furthermore, market dynamics such as pricing feasibility analyses as well as macroeconomic and feasibility indicators are thoroughly explored in order to provide a complete forecast for artificial pancreas device system sales market.

Industry growth is driven by the rising prevalence of diabetes and intensive R&D efforts made by industry players. Artificial pancreas devices (APDS), which control blood glucose levels in diabetic patients, are being researched extensively by industry players. These devices are much more accessible and are widely accepted by patients. Major factors driving the growth of this market include the growing geriatric population and the rising incidence of diabetes.

Key Takeaways

- Market Size: Artificial Pancreas Device Systems Market size is expected to be worth around USD 1417.2 Million by 2033 from USD 246.8 Million in 2023.

- Market Growth: The market rowing at a CAGR of 19.1% during the forecast period from 2024 to 2033.

- Device Type Analysis: The market segment Threshold suspended system was the largest and contributed 74.9% of global revenue in 2023.

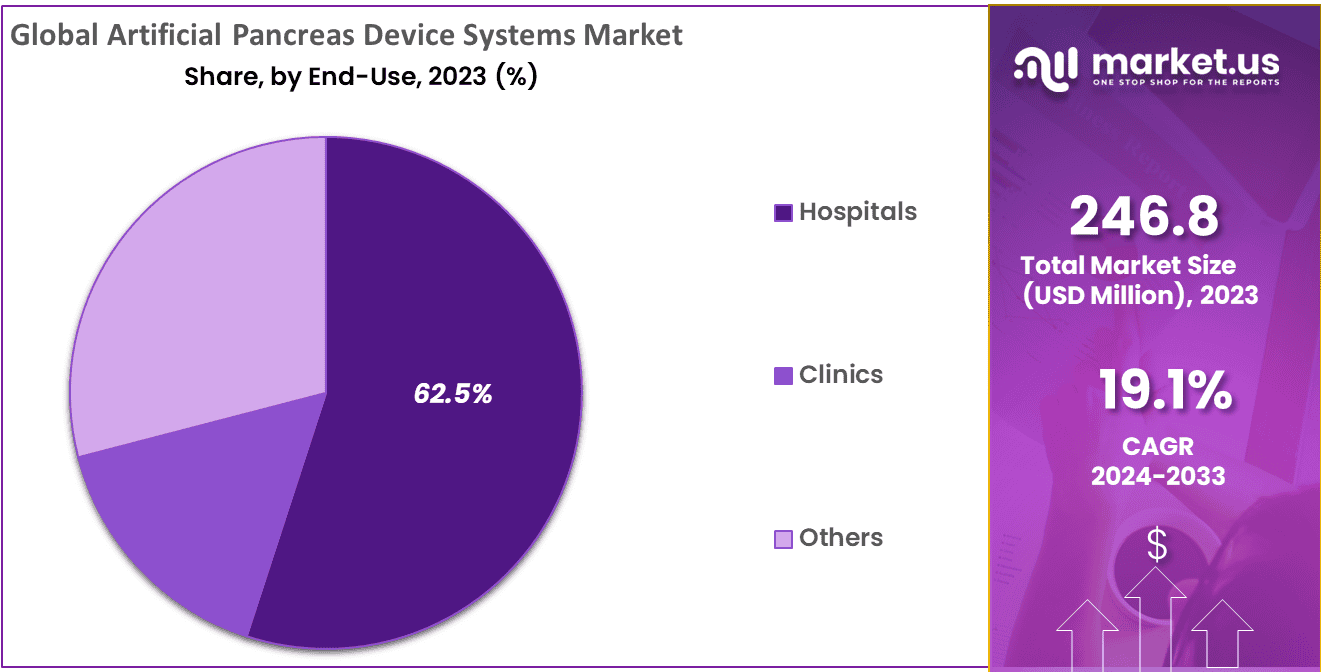

- End-Use Analysis: Hospitals represent an essential end user in the Artificial Pancreas Device Systems Market, accounting for 62.54%.

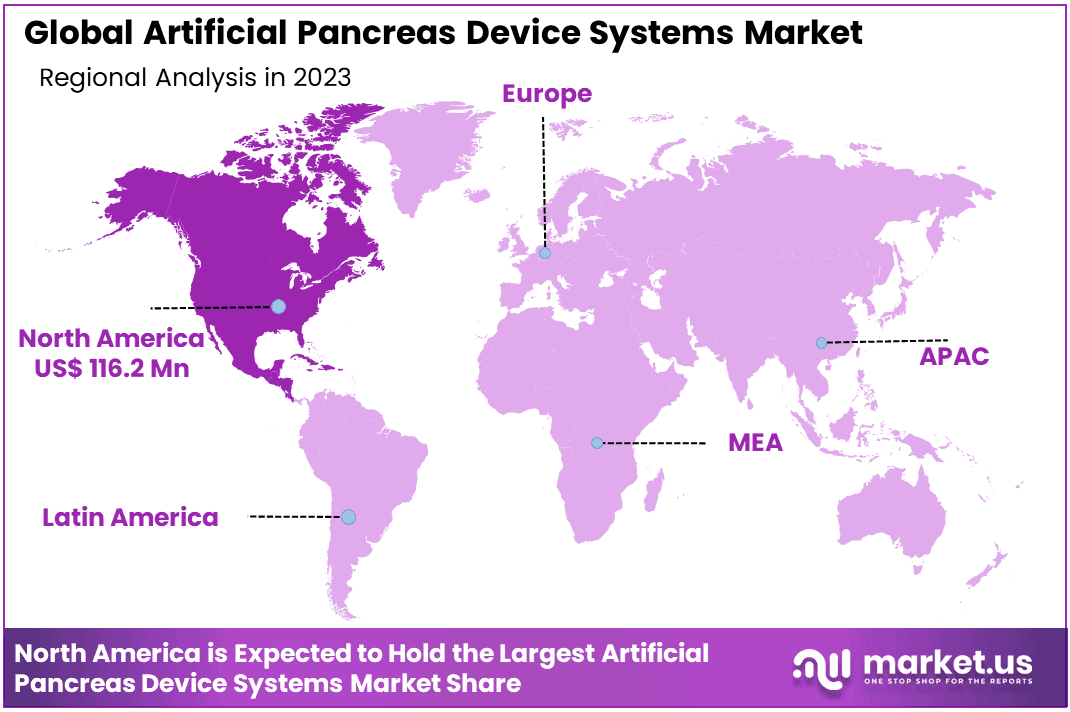

- Regional Analysis: North America was the dominate 47.1% share and holding USD 116.2 Million of the total revenue in 2023.

- Cost as a Barrier: Artificial pancreas systems’ high costs present an impediment to wider adoption, emphasizing the need to strike a balance between innovation and cost-effectiveness.

- Regulatory Challenges: Stringent approval processes and regulatory hurdles slow market entry, necessitating significant investments of time and resources to launch into new markets quickly.

- Research Opportunities: Current research and development activities offer ample opportunity for revolutionary innovations that could address current limitations while increasing affordability.

- Education Initiatives: Increased awareness and educational initiatives have resulted in greater acceptance and adoption of artificial pancreas systems among healthcare providers and patients alike.

Device Type Analysis

The market can be divided into three segments based on type: CTR system, threshold suspended device system, and CTT system. In the artificial pancreas devices, the market segment Threshold suspended system was the largest and contributed 74.9% of global revenue in 2023.

The device stops insulin delivery if the sensor glucose level reaches a certain threshold and automatically responds to a threshold suspension alarm. This device is attractive because of its potential to treat hypoglycemic disorders such as type 1 diabetes. The threshold suspended device system, also known as the low glucose suspend the system, is also called this. This is used when severe hypoglycemia is present. Insulin is administered to raise glucose levels.

The Control-to-Target systems segment will experience exponential growth over the forecast period. CTT systems can be fully automated and do not require patient intervention for the administration of insulin or monitoring glucose levels. The CTT system will gain more momentum over the forecast period.

According to the International Diabetes Federation, 538 million people will be living with diabetes in 2021. This number is expected to increase to 650 million in 2032, and 783 million in 2045. Around 7 million people died from diabetes in 2021. CTT systems will likely see a rise in demand due to increasing diabetes prevalence and the large diabetic population.

End-Use Analysis

Hospitals represent an essential end user in the Artificial Pancreas Device Systems Market, accounting for 62.54%. Their presence exemplifies their pivotal role in managing diabetes. Hospitals rely on comprehensive healthcare infrastructures for efficient insulin administration and improved diabetes treatment outcomes, and use these systems to enhance patient care, streamline insulin distribution, and optimize overall treatment results for individuals living with the condition. Integrating Artificial Pancreas Device Systems in hospital settings aligns with patient-centric approaches, providing real-time monitoring and responsive insulin adjustments.

Clinics also play an essential part in shaping the market landscape by spreading these advanced systems further afield. Hospitals and clinics alike recognize the growing significance of Artificial Pancreas Device Systems in modern diabetes management, reinforcing their market’s direction toward greater accessibility and improved patient outcomes.

Kеу Маrkеt Ѕеgmеntѕ

Device Type

- Threshold Suspend Device Systems

- Control-to-Range (CTR) Systems

- Control-to-Target (CTT) Systems

End-Use

- Hospitals

- Clinics

- Others

Driving Factors

Driving Innovation in Diabetes Management Technology

Artificial Pancreas Device Systems market growth is driven primarily by advances in diabetes management technology. Algorithms, machine learning and real-time data analysis has resulted in more efficient artificial pancreas systems which automate insulin delivery for improved glucose control among those living with diabetes. Convergence between sensor technologies and closed loop systems have advanced glucose management significantly as well.

Bionic Pancreas technology, and technological advances, such as in-home Bionic Pancreas use, are expected to provide significant growth opportunities in near future. Market growth has been driven by both developing and developed countries increasing their awareness of APDS and their usage.

A diabetic patient in the United States can expect to spend nearly US$ 16,750 annually on medical expenses. The industry is also growing due to the widespread adoption of smart devices, and technological advances such as AI and data analytics. One in eight people suffers from impaired glucose tolerance, according to the International Diabetes Federation. The forecast period will see this ratio increase.

Rise in Diabetes Prevalence

Diabetes’ increasing global prevalence is driving growth of Artificial Pancreas Device Systems market growth. Patients need innovative solutions that improve quality of life; artificial pancreas systems offer one such innovative solution by automating insulin delivery thereby relieving individuals of having to constantly adjust and monitor glucose levels themselves – type 1 and 2 diabetes prevalence rates continue to increase, prompting more individuals to turn toward these proactive and personalized methods of treating and managing the condition.

One of the main factors driving the market growth for artificial pancreas device systems is the rising incidence of diabetes as a result of aging, obesity, and unhealthy lifestyles. Diabetes is on the rise due to obesity and overweight. WHO estimates that in 2016, more than 1.9 billion people were overweight. Of those, approximately 650 million were obese. These factors will increase diabetes prevalence, thereby increasing the demand for APDS.

Trending Factors

Integrating Continuous Glucose Monitoring (CGM) Technology

Artificial Pancreas Device Systems market trends include an increasing focus on Continuous Glucose Monitoring (CGM). CGM serves an invaluable function within artificial pancreas systems by providing timely insulin dosage adjustments based on real-time CGM sensor readings integrated into closed loop insulin pumps; further improving performance and reliability and reflecting industry commitment to providing comprehensive diabetes solutions.

Focus on Tailored Solutions

One notable trend in the artificial pancreas device industry is a shift towards tailored, patient-specific solutions. Artificial pancreas device manufacturers have prioritized user experience, comfort and customization over cost when developing personalized systems to address individual patient requirements, preferences and lifestyle factors – increasing patient compliance while meeting diverse diabetes population requirements and making artificial pancreas devices more desirable across broader demographics.

Restraint

Artificial Pancreas Systems Can Be Expensive

One of the primary obstacles to artificial pancreas system adoption is cost. Due to advanced technologies, continuous glucose monitoring sensors, and closed-loop algorithms adding up over time; affordability remains an obstacle for some diabetic patients; though industry attempts to balance innovation with cost effectiveness in order to provide greater accessibility.

Regulatory Challenges and Stringent Approval Processes

The regulatory landscape can pose considerable barriers to rapid introduction of artificial pancreas devices onto the market, especially as regulatory approval processes can often prove burdensome and time consuming; spending valuable resources trying to navigate a complicated regulatory framework further compounds efforts at speedy innovation delivery for patients who urgently require pancreatic solutions faster.

Opportunity

Research and Development Activities

An exciting aspect of the Artificial Pancreas Device Systems market is its growing emphasis on research and development activities. Companies are investing heavily in novel technologies, clinical trials, and collaborative efforts with experts from various fields to expand the capabilities of artificial pancreas systems; potentially leading to breakthrough innovations that address current limitations while expanding affordability or market reach of artificial pancreas systems.

Rising Awareness and Education Initiatives

An opportunity for market expansion lies in raising awareness and education initiatives about diabetes management technologies such as artificial pancreas systems. If awareness increases among healthcare providers and patients alike, adoption rates could rise considerably – educational campaigns that outline benefits such as safety features can create an informed market that accepts artificial pancreas systems better.

Regional Analysis

North America was the dominant market for artificial pancreas device systems in 2023. It accounted for 47.1% share and holding USD 116.2 Million of the total revenue. The region is expected to be driven by the rising prevalence of obesity and the availability of effective reimbursement policies. There is also growing awareness about advanced technologies for diabetes management.

The market will be driven by major players, high treatment costs, technological advancements,s, and product launches. Globally, there has been a rise in diabetes incidences that have attracted both private and public investments to help manage the disease. These factors are expected to increase the adoption rate of APDS within the region.

The Asia Pacific artificial-pancreas devices market is forecast to experience lucrative growth over the forecast period. This region is seeing significant growth due to increased healthcare funding and government initiatives to raise awareness about diabetes. According to the International Diabetes Federation (IDF), India and China have the highest number of diabetes patients worldwide.

The majority of these countries are developing nations. This has led to an increase in type I and II diabetes. Despite diabetes’s increasing prevalence, the cost of treating the disease was much lower. The market will also be boosted by the adoption of new technology within developing countries.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

To strengthen their market position, key market players participate in strategies like mergers and acquisitions, partnerships, and the launch and promotion of new technology-advanced products and services.

They invest heavily in R&D to produce technologically advanced products. Medtronic, for example, received CE-Mark in 2020 for its MiniMed780G. This device adjusts basal insulin rate automatically after five minutes. It is suitable for patients with diabetes between 7 and 80 years old. The U.S. FDA approved in September 2020 a next-generation closed-loop hybrid insulin delivery system for type 1 diabetic children aged 2-6 years.

Маrkеt Кеу Рlауеrѕ

- Medtronic Plc

- Bigfoot Biomedical

- Johnson & Johnson Services Inc.

- Tandem Diabetes Care, Inc.

- Pancreum, Inc.

- TypeZero Technologies, LLC

- Beta Bionics

Recent Developments

- Medtronic Plc (May 2024): Medtronic Plc launched its latest artificial pancreas device system, the MiniMed 780G, which features advanced glucose sensor technology. This innovation aims to provide enhanced accuracy and improved user experience, contributing to better diabetes management.

- Bigfoot Biomedical (April 2024): Bigfoot Biomedical acquired a strategic partner specializing in glucose monitoring technology. This acquisition is expected to enhance Bigfoot’s capabilities in developing integrated diabetes management solutions, including advanced artificial pancreas systems.

- Johnson & Johnson Services Inc. (March 2024): Johnson & Johnson Services Inc. introduced a new version of their artificial pancreas device, featuring an updated algorithm that significantly improves insulin delivery precision. This launch aims to optimize glycemic control for patients with diabetes.

- Tandem Diabetes Care, Inc. (February 2024): Tandem Diabetes Care, Inc. merged with a leading insulin pump manufacturer. This merger is anticipated to expand Tandem’s product portfolio and strengthen its position in the artificial pancreas device systems market.

- Pancreum, Inc. (January 2024): Pancreum, Inc. unveiled its latest artificial pancreas device, the Beta-Pump X1, which integrates advanced machine learning algorithms to provide personalized insulin dosing. This product aims to enhance the quality of life for individuals with diabetes.

- Beta Bionics (May 2024): Beta Bionics merged with a biotechnology firm to advance the development of their iLet bionic pancreas system. This merger is expected to accelerate innovation and bring more advanced diabetes management solutions to the market.

Report Scope

Report Features Description Market Value (2023) USD 246.8 Million Forecast Revenue (2033) USD 1417.2 Million CAGR (2024-2033) 19.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Device Type-(Threshold Suspend Device Systems, Control-to-Range (CTR) Systems, Control-to-Target (CTT) Systems) By End-Use-(Hospitals, Clinics, Other) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Medtronic Plc, Bigfoot Biomedical, Johnson & Johnson Services Inc., Tandem Diabetes Care, Inc., Pancreum, Inc., TypeZero Technologies, LLC, Beta Bionics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Why is there a demand for artificial pancreas systems?The increasing global prevalence of diabetes, encompassing both type 1 and type 2, is fueling demand for innovative solutions, making artificial pancreas systems a proactive approach to diabetes management.

How big is the Artificial Pancreas Device Systems Market?The global Artificial Pancreas Device Systems Market size was estimated at USD 246.8 Million in 2023 and is expected to reach USD 1417.2 Million in 2033.

What is the Artificial Pancreas Device Systems Market growth?The global Artificial Pancreas Device Systems Market is expected to grow at a compound annual growth rate of 19.1%. From 2024 To 2033

Who are the key companies/players in the Artificial Pancreas Device Systems Market?Some of the key players in the Artificial Pancreas Device Systems Markets are Medtronic Plc, Bigfoot Biomedical, Johnson & Johnson Services Inc., Tandem Diabetes Care, Inc., Pancreum, Inc., TypeZero Technologies, LLC, Beta Bionics

What role does Continuous Glucose Monitoring (CGM) play in artificial pancreas devices?Integration of CGM technology enhances the performance of artificial pancreas devices by providing accurate real-time data for insulin dose adjustments.

What is the current industry trend in artificial pancreas development?The industry trend is shifting towards personalized and patient-centric solutions, emphasizing user experience, comfort, and customization to improve patient compliance.

What is a significant barrier to the widespread adoption of artificial pancreas systems?The high costs associated with artificial pancreas systems act as a significant barrier to widespread adoption, necessitating a balance between innovation and cost-effectiveness.

Artificial Pancreas Device Systems MarketPublished date: Jun 2024add_shopping_cartBuy Now get_appDownload Sample

Artificial Pancreas Device Systems MarketPublished date: Jun 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic Plc

- Bigfoot Biomedical

- Johnson & Johnson Services Inc.

- Tandem Diabetes Care, Inc.

- Pancreum, Inc.

- TypeZero Technologies, LLC

- Beta Bionics