Global Hospital Linen Supply and Management Services Market Analysis By Product (Bed Sheet & Pillow Covers, Blanket, Bed Covers, Bathing & Cleaning Accessories, Patient Repositioner), By Material (Woven, Non-woven), By End Use (Hospitals, Diagnostic Centers, Specialty Clinics), By Service Provider (In-house, Contractual), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2025

- Report ID: 16277

- Number of Pages: 282

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

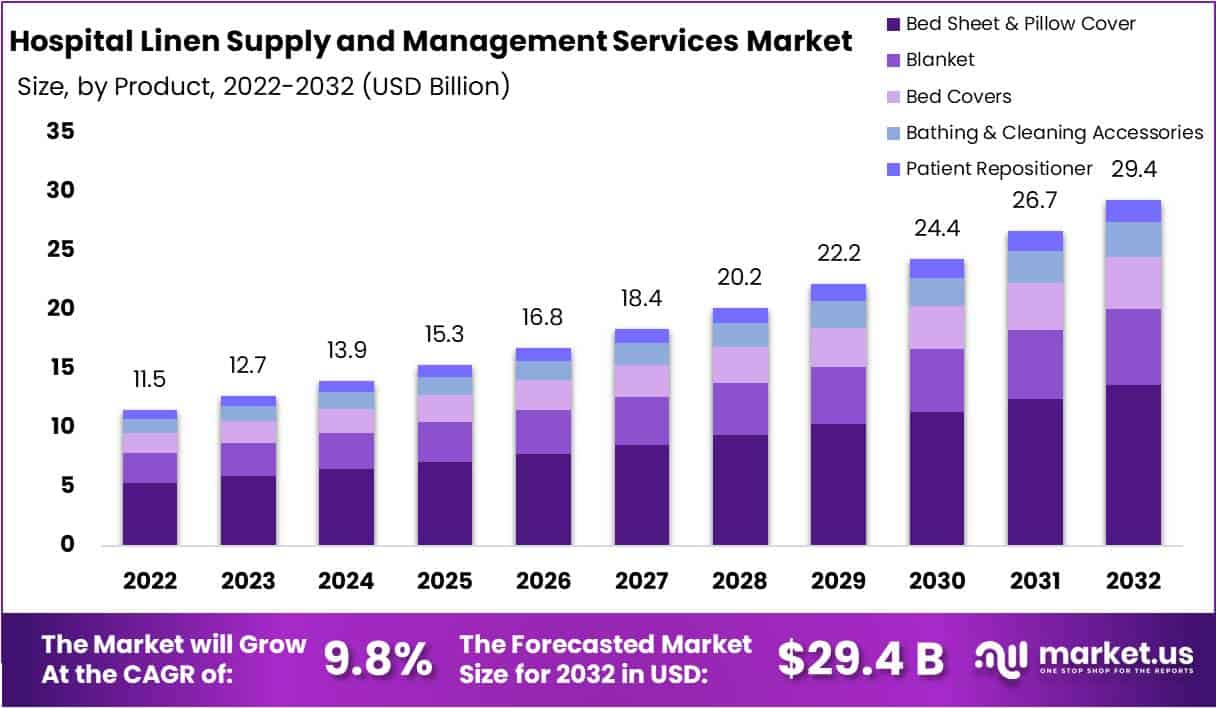

The hospital linen supply and management services market size is projected to witness significant growth in the coming years. By 2033, it is anticipated to reach a substantial value of approximately USD 29.4 billion, marking a substantial increase from the 2023 figure of USD 11.5 billion. This growth is expected to occur at a Compound Annual Growth Rate (CAGR) of 9.8% throughout the forecast period spanning from 2024 to 2033.

Hospital Linen Supply and Management Services play an essential role in healthcare environments, particularly hospitals. These services involve the provision, laundering, and management of various types of linen such as beddings and patient gowns. An integral component of effective hygiene and infection control practices lies in upholding stringent hygiene and infection control standards.

This process encompasses taking an integrative approach that ensures linens are supplied efficiently while simultaneously meeting industry-grade cleanliness levels. These services ensure an uninterrupted supply of clean linens within hospital environments. Their purpose includes robust laundry services, careful inventory control, stringent quality assurance measures and efficient logistics to manage linen distribution and collection processes. These are key elements in maintaining an uncontaminated linen supply.

Hospitals find outsourcing linen management more cost-effective than maintaining in-house laundry facilities, according to research conducted by the American Hospital Association. Outsourcing can lead to 20-30% cost reduction related to linen management costs and allows healthcare facilities to focus more on primary operations than on administrative duties related to linen management. Compliance with regulatory hygiene standards is of the utmost importance within healthcare, so specialty linen service providers must adhere strictly to regulations so as to meet necessary health and safety standards at hospitals.

Hospital Linen Supply and Management Services market is highly varied, featuring both multinational corporations and regional service providers. One notable trend within this sector is an increasing emphasis on sustainability: providers are adopting eco-friendly practices into their operations to keep up with global efforts towards environmental responsibility; according to Global Healthcare Market Report a portion of providers specifically devote resources towards sustainable practices; additionally the ever-evolving healthcare industry suggests demand will remain steady with an expected annual market growth projection of around 5-6% over five years.

Key Takeaways

- Market Growth: The hospital linen supply market is set to grow from USD 11.5 billion (2023) to an estimated USD 29.4 billion by 2033, with a projected 9.8% CAGR.

- Product Dominance: In 2023, Bed Sheet & Pillow Covers led with a 46.4% market share, emphasizing their crucial role in patient comfort and hygiene.

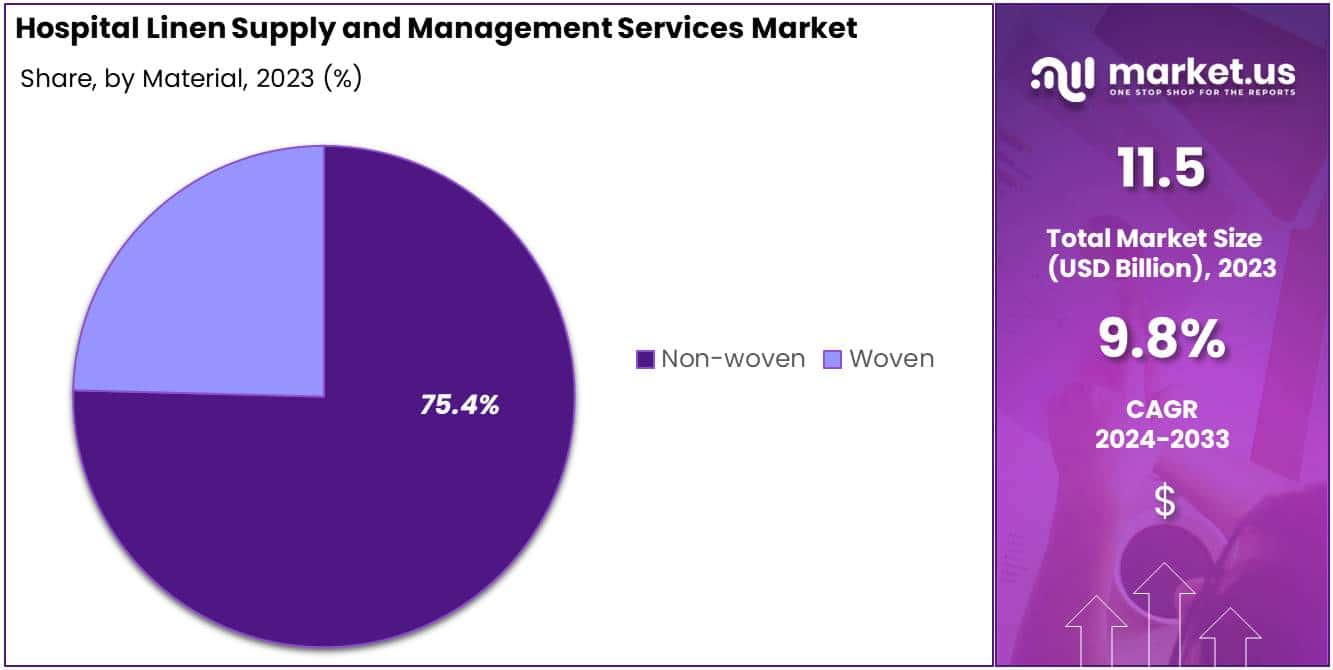

- Material Preference: Non-woven materials dominated with a remarkable 75.4% share in 2023, driven by their cost efficiency and disposal convenience.

- End-Use Leadership: Hospitals claimed over 50.5% market share in 2023, underscoring their critical role in healthcare delivery and linen demand.

- Service Provider Preference: In-House services led with over 50% market share in 2023, reflecting hospitals’ preference for direct control over linen management.

- Market Drivers: Rising hospital-acquired infections and demographic factors, like an aging population, propel demand for linen supply services globally.

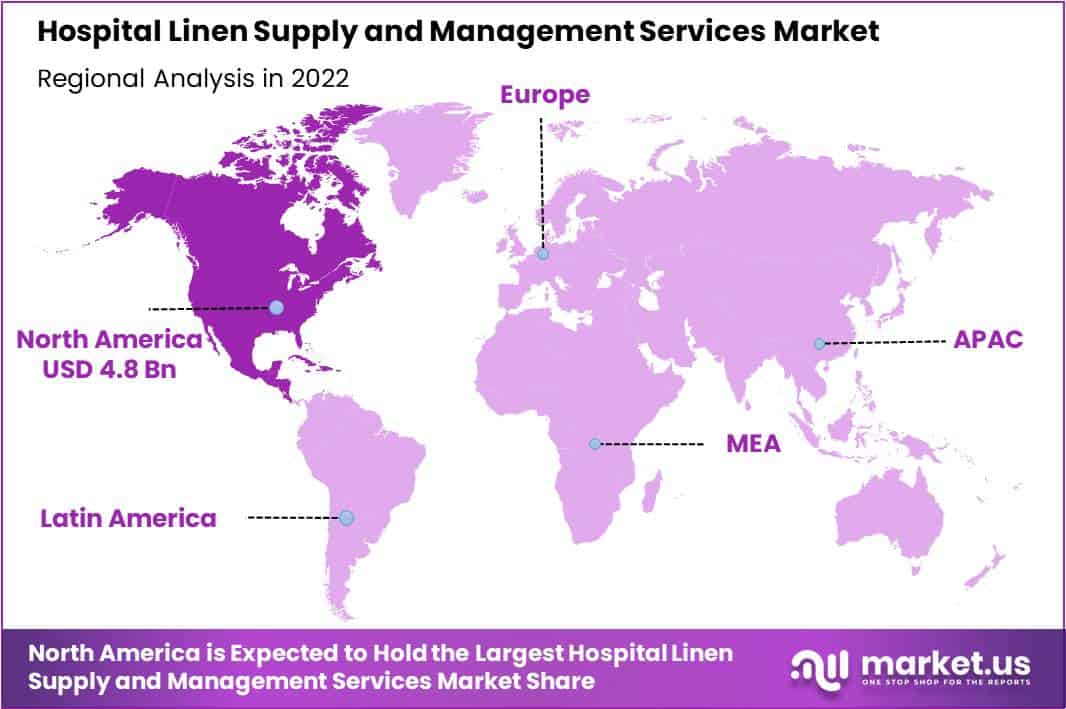

- Regional Market Dominance: In 2023, North America commanded a substantial 41.8% market share, driven by advanced healthcare infrastructure and technological adoption.

- Challenges: High operational costs pose challenges, making the industry capital-intensive, and budget limitations impact the adoption of external linen management services.

- Opportunities: Smart textile innovation, outsourcing partnerships, and healthcare digitization present opportunities for efficiency, cost reduction, and innovation in the market.

- Sustainability Trend: The industry is witnessing a growing trend towards sustainability, with a focus on eco-friendly practices, reduced water consumption, and recycling initiatives.

Product Analysis

In 2023, the Hospital Linen Supply and Management Services Market showcased a prominent trend with the Bed Sheet & Pillow Covers segment, securing a leading market position by capturing an impressive 46.4% share. This segment’s dominance can be attributed to its essential role in maintaining patient comfort and hygiene within healthcare facilities.

Bed Sheet & Pillow Covers form the cornerstone of creating a healthy patient environment. Hospitals understand this critical role played by bed linens in providing quality patient care; accordingly they prioritize purchasing quality bed linens from quality manufacturers in order to uphold stringent hygiene standards while creating a relaxing experience for patients. Their considerable market share speaks volumes of their importance.

Blankets also made an important impactful statement by commanding an impressive market share. Blankets play an essential role in maintaining patient comfort by helping regulate temperature regulation and providing warmth – features recognized by hospitals and healthcare facilities that contribute significantly to an excellent patient experience. Hospitals and healthcare facilities increasingly acknowledge their significance in improving comfort levels which has contributed to its market standing.

Bed Covers, another key product category within the Hospital Linen Supply and Management Services Market, has demonstrated impressive growth. These covers play a crucial role in maintaining a sanitary hospital environment by shielding beds from contamination while simultaneously aiding effective infection control measures.

Bathing & Cleaning Accessories enjoyed a substantial market presence, reflecting healthcare facilities’ increased focus on patient hygiene standards. To prevent infections and remain compliant, patients require high-quality bathing and cleaning accessories; driving this segment’s market presence and increase in its share.

Patient Repositioners have experienced steady market expansion over time, reflecting their importance in improving mobility and avoiding pressure ulcers. Hospitals increasingly prioritize improving patient care outcomes and the significance of Patient Repositioners as preventive tools is being recognized; consequently impacting its market position positively.

Material Analysis

In 2023, the Hospital Linen Supply and Management Services market experienced a remarkable dominance of the Non-woven segment, capturing a commanding market position with an impressive share exceeding 75.4%.

This significant preference for non-woven materials within the healthcare industry’s linen supply and management landscape can be attributed to the escalating number of COVID-19-related patient admissions into hospitals. A study conducted by the University of California San Francisco revealed that operating rooms were generating approximately 2000 tons of waste per day, with a substantial portion stemming from disposable medical equipment. The heightened reliance on medical disposables in hospitals is anticipated to contribute to the continued growth of the Non-woven segment throughout the forecast period.

Non-woven materials, with their seamless fabric-like structure and low cost-per-use are becoming the go-to material for hospital linen services. Their popularity can be attributed to superior characteristics like durability, cost-efficiency and disposal convenience, features valued by hospitals and healthcare facilities that emphasize hygiene standards as they work towards patient care excellence.

Conversely, Woven Materials still remain relevant; however their market share has become significantly smaller in comparison with non-woven alternatives. Woven fabrics, known for their traditional yet robust weave structure are competing with non-woven alternatives for market share; however certain niche applications in hospital linen remain strong supporters for this material type.

End Use Analysis

In 2023, the Hospital Linen Supply and Management Services market displayed an eye-catching landscape, with Hospitals dominating with over 50.5% market share. This can be attributed to their critical role in healthcare delivery requiring consistent access to high-quality linen supplies for patient care, surgery, and overall hygiene maintenance.

Hospitals, as the primary end-users, value efficient and reliable linen management to uphold rigorous hygiene standards. Hospitals’ leadership position demonstrates their significant demand for linen supply services within their ecosystem due to an ever-evolving need for clean and sanitized fabrics in various medical environments.

Diagnostic Centers, another significant end-use segment, followed closely, securing a notable market presence. With a focus on accurate diagnosis and patient comfort, these centers rely on specialized linen services to maintain cleanliness and create a positive environment for medical testing and consultations.

Specialty Clinics carved out a distinctive niche within the market, contributing to the overall growth but holding a comparatively smaller share. Despite their smaller market presence, specialty clinics, with their specific healthcare focus, displayed a growing awareness of the importance of dedicated linen management services for maintaining a sterile and patient-friendly environment.

As the market evolves, these distinct segments showcase varied dynamics, reflecting the unique requirements and preferences of different healthcare facilities. The dominance of the Hospitals segment highlights the central role of these institutions in shaping the trajectory of the Hospital Linen Supply and Management Services market, emphasizing the ongoing need for tailored solutions to meet the diverse demands of the healthcare industry.

Service Provider Analysis

In 2023, the In-House segment took the lead in Hospital Linen Supply and Management Services Market with over 50% market share. Hospitals choosing In-House Linen Management as their preferred method reflected their preference for having direct control and oversight over their linen services.

Contrarily, Contractual segment dipped slightly behind with 49.5% market share despite still representing an effective offering to hospitals looking for external assistance with streamlining their linen supply and management operations. This segment saw strong momentum as hospital staff increasingly looked outside for assistance to optimize these processes.

Healthcare facilities looking for an in-house approach to quality control and cost management found great satisfaction with opting for linen services operated directly by them, ensuring stringent compliance with hygiene standards as well as being quickly responsive to any operational challenges that arose.

Contractual services were particularly appealing to hospitals looking to outsource the intricate processes associated with linen management to external experts. This outsourcing strategy offered operational efficiency, cost effectiveness and the flexibility necessary to meet changing healthcare institutions needs.

Key Market Segments

Product

- Bed Sheet & Pillow Covers

- Blanket

- Bed Covers

- Bathing & Cleaning Accessories

- Patient Repositioner

Material

- Woven

- Non-woven

End Use

- Hospitals

- Diagnostic Centers

- Specialty Clinics

Service Provider

- In-house

- Contractual

Drivers

Hospital-acquired infections have increased demand for linen supply and management services, according to World Health Organization figures. Hospital acquired infections are estimated to affect 7-10% of patients annually across high income countries; hospital administrators are increasingly turning to outsourcing linen services in order to maintain consistent, clean supplies that reduce infection transmission risk.

Factors such as an aging population and increased chronic illness rates have caused more hospital admissions and surgeries, fueling an increase in hospital linen supply and laundering services. The United Nations predicts that by 2050 one out of every six people globally will be over 65 years old and require healthcare services; this demand for hospital bed linens and surgical drapes has only compounded it further.

Investments in healthcare infrastructure and hospital expansion in developing regions, particularly sub-Saharan Africa, are helping drive market expansion. According to the International Finance Corporation, sub-Saharan African healthcare is projected to experience annual compounded compound annual growth between now and 2030; with increased investments being made into large hospitals as well as community healthcare facilities creating increased demands for linen supply services.

Restraints

The high costs associated with running large-scale laundry operations, including expenses for industrial equipment, water, electricity, and labor, create challenges for service providers in the hospital linen supply industry. These costs make it a capital-intensive sector, making it difficult for smaller regional players to enter and grow in the market.

Moreover, efforts by hospitals to contain costs due to budget limitations can have a negative impact on the global hospital linen supply and management market. Some facilities opt to manage their linen in-house instead of outsourcing to industrial laundries as a cost-saving measure.

Additionally, the environmental consequences of water usage and effluent discharges from industrial laundries are becoming a growing concern. Increased regulatory control, such as the UK health services discharging over 2 billion liters of effluent annually, puts pressure on commercial laundries to comply with strict regulations, leading to higher compliance costs.

Opportunities

Exploring the realm of smart textiles with moisture-absorbing and antimicrobial features opens doors for innovative products, revolutionizing infection control and patient comfort in hospitals. Textile manufacturers and companies collaborate closely, integrating these smart fabrics seamlessly into everyday hospital essentials like bedsheets, blankets, and patient apparel.

Capitalizing on outsourcing partnerships with healthcare networks proves economically advantageous, streamlining costs in contrast to individual contracts with service providers. The centralization of linen supply logistics networks amplifies efficiency. In Asia’s emerging economies, the surge in private investments within expansive hospital networks offers promising collaboration prospects.

Embracing healthcare digitization and cutting-edge technologies, such as RFID tags for inventory tracking, empowers providers to enhance supply chain efficiencies and simultaneously reduce labor costs. Further innovations like sensors, blockchain integration, and similar advancements open up new avenues for refining and revolutionizing hospital product offerings.

Trends

The trend of consolidation among industrial laundry service providers is on the rise, driven by a pursuit of economies of scale and the desire to offer comprehensive linen solutions nationally, particularly to large hospital networks. Notably, companies like Elis SA are expanding in Europe through strategic acquisitions of various regional and specialty laundry services.

There is a growing adoption of hybrid business models that involve outsourcing certain aspects, such as linen purchases and specialty item processing, while retaining core laundry functions in-house. This approach enables hospitals to strike a balance between cost efficiency, productivity, and maintaining high-quality standards.

A heightened focus on sustainability is evident in the industry, with a shift towards laundry equipment that consumes less water, the use of biodegradable textiles and chemicals, and the recycling of linen into derivatives. Healthcare institutions with green initiatives are increasingly drawn to laundry process improvements that aim to reduce environmental impact.

Regional Analysis

In 2023, North America asserted its dominant position in the Hospital Linen Supply and Management Services Market, capturing a substantial market share of over 41.8%. This regional stronghold was accompanied by a robust market value, reaching USD 4.8 Billion for the year.

North America holds an advantageous place in this market due to several reasons. First and foremost, its healthcare infrastructure is highly advanced with numerous hospitals and healthcare facilities across its regions, plus stringent infection control regulations driving demand for effective linen supply and management services.

North American markets are distinguished by a high level of awareness and adoption of advanced technologies, contributing to an increasing demand for technologically sophisticated hospital linen management solutions. Key market players with innovative product offerings and strategic alliances all played an essential role in reinforcing North America’s position on the world stage.

Moving beyond North America, Europe emerged as another significant player in the Hospital Linen Supply and Management Services Market. The region accounted for a considerable market share, driven by a well-established healthcare system and an increasing emphasis on patient safety and hygiene. The adoption of sustainable and eco-friendly practices in linen management further contributed to the region’s market growth.

Asia-Pacific region displayed significant potential and experienced rapid market expansion during the review period. Factors like its growing population, increasing healthcare expenditure and greater awareness regarding infection control measures led to an increased need for efficient linen supply and management services – China and India played key roles in driving market expansion in this region.

Middle East and African hospitals experienced gradual yet steady growth for Hospital Linen Supply and Management Services over time. Healthcare infrastructure across countries varied, while economic challenges slowed market development to some extent.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Hospital Linen Supply and Management Services Market is witnessing continuous evolution among key players. From improved tracking systems to sustainability initiatives and hygiene certifications, these developments reflect the industry’s commitment to delivering high-quality services to healthcare institutions. As the market continues to grow, staying updated with these key players’ innovations will be crucial for informed decision-making in the healthcare linen sector.

Unitex Textile Rental Services Inc. has made strides in improving their linen supply chain efficiency, recently announcing they had implemented advanced tracking systems to enhance inventory management and decrease costs, while guaranteeing timely deliveries to hospitals.

Emes Textiles Pvt Ltd has expanded their operations in response to an ever-increasing demand for hospital linen services, reporting steady increases in clientele through quality service delivery and dedication to customer satisfaction. They credit this success with expanding operations.

Angelica has also invested in eco-friendly linen solutions. Their recent announcement showed their efforts to lower environmental impact through sustainable materials for linen products – reflecting natural products trend and showing commitment towards sustainability.

Elizabethtown Laundry Company has been recognized for its exceptional hygiene standards. Their recent achievement includes receiving certification for meeting stringent industry hygiene regulations. This accomplishment reinforces their position as a reliable provider of hospital linen services.

Among other key players, there has been a noticeable trend of technological integration. Many companies are adopting data analytics and automation to streamline their operations. This shift aims to improve service quality, reduce errors, and enhance overall efficiency.

Market Key Players

- Unitex Textile Rental Services Inc.

- Emes Textiles Pvt. Ltd

- Angelica

- Elizabethtown Laundry Company

- Healthcare Services Group Inc.

- ImageFIRST

- Tetsudo Linen Service Co. Ltd

- Celtic Linen

- Swisslog Holding Ltd.

Recent Developments

- In September 2023, Unitex has recently announced its strategic alliance with HealthLine Systems, an established healthcare technology provider. This collaboration seeks to integrate Unitex’s linen management services seamlessly with HealthLine’s patient tracking and billing system with an end goal to increase operational efficiencies, reduce costs for hospitals, ultimately benefitting patient care.

- In August 2023, Angelica unveiled its antimicrobial fabric-crafted surgical gowns as an innovative solution to mitigate hospital-acquired infections (HAIs). This initiative coincides with an increasing need for infection-control solutions within healthcare facilities and further underlines Angelica’s commitment to patient safety.

- In July 2023, Elizabethtown Laundry Company expanded their market presence by acquiring Central Valley Linen Services, a smaller competitor. This strategic acquisition solidified Elizabethtown’s foothold in the Mid-Atlantic region of the US while widening their clientele within healthcare organizations as a key player within this industry.

- In June 2023, Tetsudo Linen Service Co. Ltd and a Japanese research institute signed an agreement in June 2023 to jointly advance laundry technologies using nanomaterials. Their initiative involves creating textiles with superior stain-resistance and odor control properties; their innovative textiles should help increase hygiene standards as well as patient comfort in hospital environments.

Report Scope

Report Features Description Market Value (2023) USD 11.5 Bn Forecast Revenue (2033) USD 29.4 Bn CAGR (2024-2033) 9.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Bed Sheet & Pillow Covers, Blanket, Bed Covers, Bathing & Cleaning Accessories, Patient Repositioner), By Material (Woven, Non-woven), By End Use (Hospitals, Diagnostic Centers, Specialty Clinics), By Service Provider (In-house, Contractual) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Unitex Textile Rental Services Inc., Emes Textiles Pvt. Ltd, Angelica, Elizabethtown Laundry Company, Healthcare Services Group Inc., ImageFIRST, Tetsudo Linen Service Co. Ltd, Celtic Linen, Swisslog Holding Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hospital Linen Supply and Management Services MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Hospital Linen Supply and Management Services MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Unitex Textile Rental Services Inc.

- Emes Textiles Pvt. Ltd

- Angelica

- Elizabethtown Laundry Company

- Healthcare Services Group Inc.

- ImageFIRST

- Tetsudo Linen Service Co. Ltd

- Celtic Linen

- Swisslog Holding Ltd.