Enteral Feeding Tubes Market By Product Type (Nasogastric Tubes, Orogastric Tubes, Gastrostomy Tubes, and Others), By Material (Polyurethane Feeding Tubes, Silicone Feeding Tubes, and Polyvinyl Chloride Feeding Tubes), By Application (Oncology, Neurological Disorders, Gastrointestinal Disorders, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2025

- Report ID: 143687

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

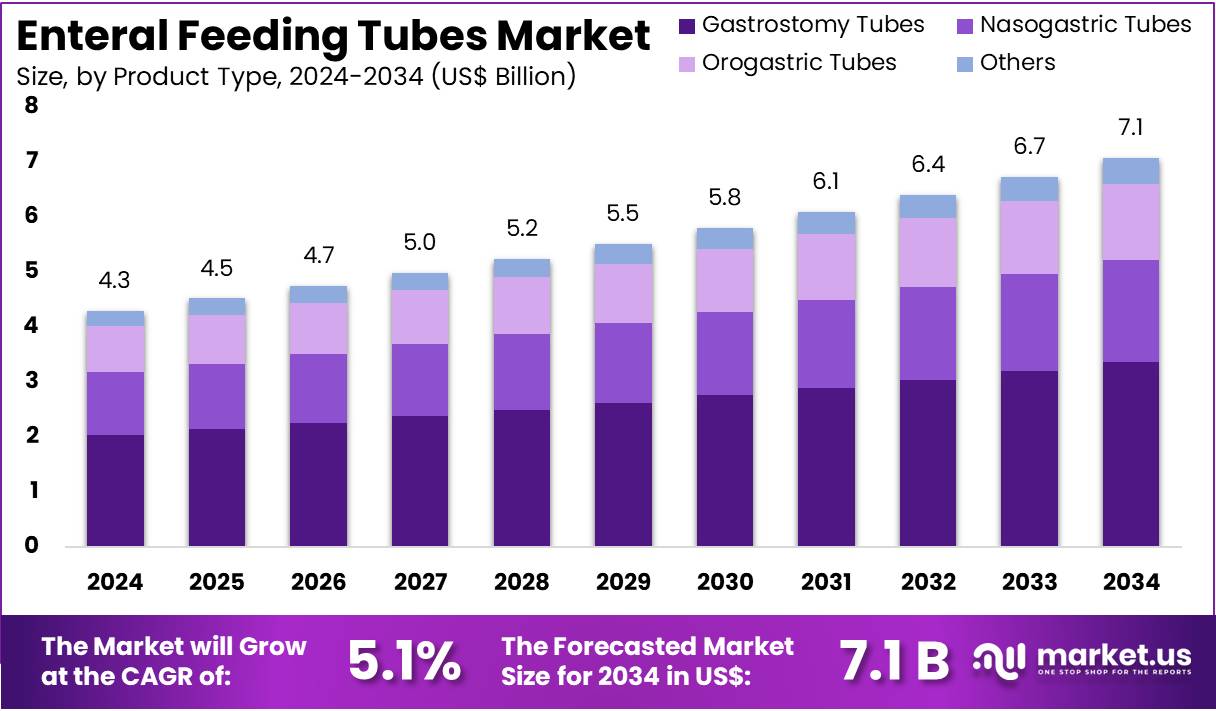

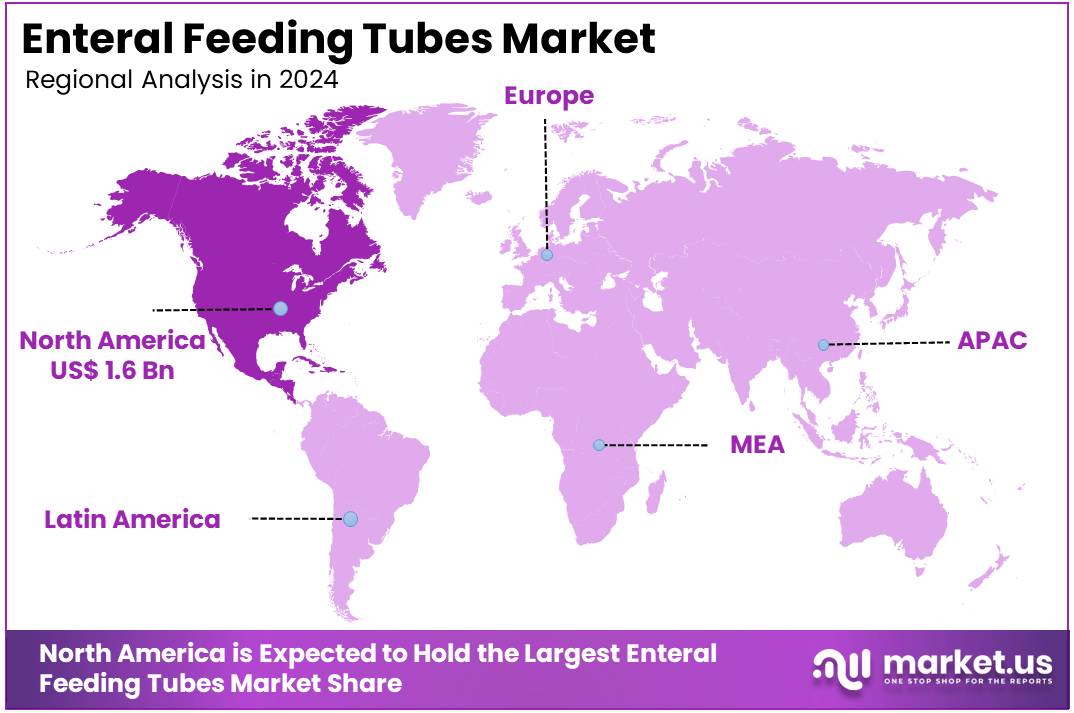

The Global Enteral Feeding Tubes Market Size is expected to be worth around US$ 7.1 Billion by 2034, from US$ 4.3 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 38.3% share and holds US$ 1.6 Billion market value for the year.

Increasing awareness of the importance of adequate nutrition for patients with specific medical conditions is driving the growth of the enteral feeding tubes market. As healthcare continues to evolve, enteral feeding tubes have become essential for patients who are unable to consume food orally due to medical conditions such as gastrointestinal, neurological, and metabolic disorders. These feeding tubes allow for the direct delivery of nutrition, ensuring patients receive the nutrients they need for recovery and long-term health.

The rising prevalence of chronic conditions, including cancer and gastrointestinal diseases, as well as the aging population, has led to a surge in the demand for enteral feeding solutions. According to the CDC, about 1 in 10 babies were born prematurely in the U.S. in 2021, further contributing to the demand for enteral feeding tubes, as premature infants often require specialized nutritional support.

Additionally, innovations in tube design, including more comfortable, less invasive options, are creating new opportunities within the market. As the healthcare industry prioritizes patient-centered care and improving the quality of life for individuals with chronic conditions, the enteral feeding tubes market is expected to expand significantly.

Key Takeaways

- In 2023, the market for enteral feeding tubes generated a revenue of US$ 4.3 billion, with a CAGR of 5.1%, and is expected to reach US$ 7.1 billion by the year 2033.

- The product type segment is divided into nasogastric tubes, orogastric tubes, gastrostomy tubes, and others, with gastrostomy tubes taking the lead in 2023 with a market share of 47.5%.

- Considering material, the market is divided into polyurethane feeding tubes, silicone feeding tubes, and polyvinyl chloride feeding tubes. Among these, polyurethane feeding tubes held a significant share of 55.2%.

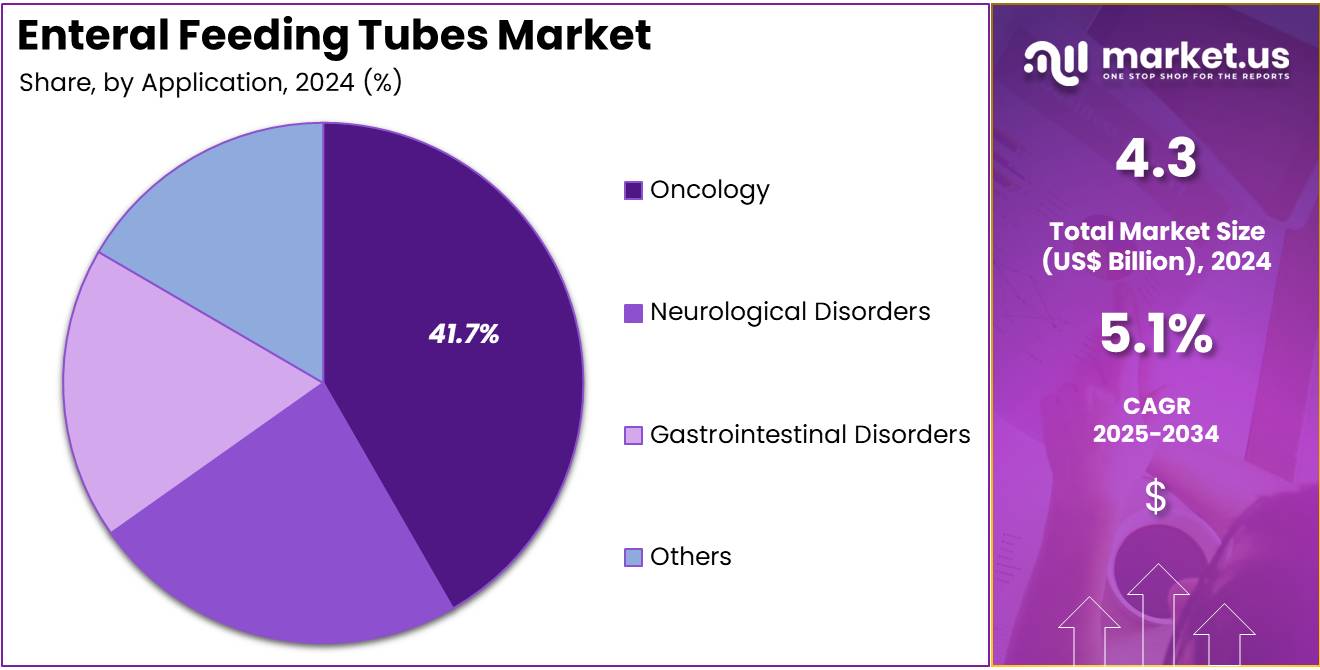

- Furthermore, concerning the application segment, the market is segregated into oncology, neurological disorders, gastrointestinal disorders, and others. The oncology sector stands out as the dominant player, holding the largest revenue share of 41.7% in the enteral feeding tubes market.

- North America led the market by securing a market share of 38.3% in 2023.

Product Type Analysis

The gastrostomy tubes segment led in 2023, claiming a market share of 47.5% owing to the increasing demand for long-term feeding solutions in patients who cannot consume food orally. Gastrostomy tubes are anticipated to become the preferred option for patients with chronic conditions such as neurological disorders, cancer, and critical illnesses requiring prolonged nutritional support.

The rise in conditions that impair swallowing, such as stroke, head and neck cancers, and dementia, is likely to drive the demand for gastrostomy tubes. Additionally, advancements in the design and safety of gastrostomy tubes, including reduced risk of infection and improved comfort, are projected to contribute to the segment’s growth.

Material Analysis

The polyurethane feeding tubes held a significant share of 55.2% due to the increasing adoption of polyurethane-based feeding tubes in clinical settings. Polyurethane tubes offer several advantages, including greater durability, flexibility, and resistance to kinking compared to other materials. These features make polyurethane tubes a preferred choice for long-term feeding in patients with complex medical conditions.

The growing demand for high-performance feeding tubes that reduce complications such as tube blockage and dislodgement is likely to contribute to the expansion of the polyurethane feeding tubes segment. As healthcare providers prioritize patient comfort and safety, the adoption of polyurethane-based tubes is expected to continue rising.

Application Analysis

The oncology segment had a tremendous growth rate, with a revenue share of 41.7% owing to the increasing prevalence of cancer and the associated rise in patients requiring enteral nutrition. Cancer patients, particularly those undergoing chemotherapy or radiation therapy, often experience difficulties in eating and maintaining proper nutrition, which increases the demand for enteral feeding tubes.

The growing emphasis on providing comprehensive nutritional support to cancer patients to improve their treatment outcomes and quality of life is likely to drive the growth of this segment. Additionally, as the global cancer burden continues to rise, the need for enteral feeding solutions for oncology patients is projected to increase, further contributing to the expansion of the oncology segment in the enteral feeding tubes market.

Key Market Segments

By Product Type

- Nasogastric Tubes

- Orogastric Tubes

- Gastrostomy Tubes

- Others

By Material

- Polyurethane Feeding Tubes

- Silicone Feeding Tubes

- Polyvinyl Chloride Feeding Tubes

By Application

- Oncology

- Neurological Disorders

- Gastrointestinal Disorders

- Others

Drivers

Rising Prevalence of Chronic Diseases is Driving the Market

The increasing prevalence of chronic diseases such as cancer, gastrointestinal disorders, and neurological conditions is a major driver of the enteral feeding tubes market. These conditions often impair a patient’s ability to consume food orally, necessitating the use of enteral nutrition. According to the World Health Organization, chronic diseases accounted for 74% of global deaths in 2022, with cancer cases rising by 10% compared to 2020.

This has led to a higher demand for enteral feeding solutions, particularly in aging populations. Key players like Fresenius Kabi and Nestlé Health Science have reported a 15% increase in sales of enteral feeding products in 2023, driven by the growing need for clinical nutrition. Hospitals and home care settings are increasingly adopting these devices, further propelling market growth.

Restraints

High Cost of Enteral Feeding Devices is Restraining the Market

The high cost of enteral feeding devices and associated procedures is a significant restraint in the market. Advanced feeding tubes, such as those with anti-clogging or antimicrobial features, are expensive, making them less accessible in low- and middle-income countries. In 2023, the average cost of a single enteral feeding tube in the US ranged from US$ 50 to US$ 200, depending on the type and features.

Additionally, the need for trained healthcare professionals to administer and manage these devices adds to the overall cost. According to a 2022 report by the American Society for Parenteral and Enteral Nutrition, 30% of hospitals in developing countries cited cost as a barrier to adopting advanced enteral feeding solutions. This financial burden limits market expansion, particularly in resource-constrained regions.

Opportunities

Growing Demand for Home-Based Enteral Nutrition is Creating Growth Opportunities

The growing preference for home-based enteral nutrition is creating significant growth opportunities in the market. Patients and caregivers are increasingly opting for home care settings due to the comfort, convenience, and cost-effectiveness they offer. In 2023, the global home healthcare market was valued at over US$300 billion, with enteral nutrition products accounting for a significant share.

Companies like Abbott and Danone are capitalizing on this trend by developing user-friendly and portable enteral feeding solutions. For instance, Abbott reported a 20% increase in sales of home-use enteral feeding products in 2023. This shift toward home-based care is expected to continue, driven by advancements in device design and increasing awareness about enteral nutrition.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors are shaping the enteral feeding tubes market in both positive and negative ways. Rising healthcare expenditures and increased government funding for chronic disease management are boosting market growth. For example, in 2023, the US government allocated US$ 5 billion to improve access to clinical nutrition for patients with chronic illnesses.

However, inflation and supply chain disruptions have increased the cost of raw materials, impacting the production and pricing of enteral feeding devices. Geopolitical tensions, such as the Russia-Ukraine conflict, have disrupted the supply of medical-grade polymers, a key component in manufacturing these tubes. Despite these challenges, the market is witnessing innovation, with companies developing cost-effective and sustainable solutions.

The growing focus on home-based care and technological advancements in device design are expected to drive long-term growth, ensuring a positive outlook for the market.

Trends

Adoption of Antimicrobial-Coated Tubes is a Recent Trend

The adoption of antimicrobial-coated enteral feeding tubes is a prominent recent trend in the market. These tubes are designed to reduce the risk of infections, which are a common complication associated with enteral feeding. In 2023, the FDA approved several antimicrobial-coated tubes, citing a 25% reduction in infection rates compared to traditional tubes.

Companies like Avanos Medical and Cardinal Health have introduced innovative products in this segment, with Avanos reporting a 30% increase in sales of antimicrobial-coated tubes in 2023. This trend is gaining traction in hospitals and long-term care facilities, where infection control is a top priority. The development of such advanced products is expected to drive market growth and improve patient outcomes.

Regional Analysis

North America is leading the Enteral feeding tubes Market

North America dominated the market with the highest revenue share of 38.3% owing to the rising prevalence of chronic diseases, an aging population, and advancements in medical technology. According to the Centers for Disease Control and Prevention (CDC), the number of adults aged 65 and older in the US increased by 12% between 2022 and 2024, leading to higher demand for nutritional support solutions.

The American Society for Parenteral and Enteral Nutrition (ASPEN) reported a 15% rise in the use of enteral nutrition in hospitals and home care settings during the same period, reflecting its effectiveness in managing conditions like cancer, gastrointestinal disorders, and neurological impairments. Additionally, the US Food and Drug Administration (FDA) approved 10% more enteral feeding devices in 2023 compared to the previous year, ensuring safer and more innovative options for patients.

The National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) highlighted a 20% increase in funding for research on malnutrition and its treatment in 2024, further boosting the adoption of these devices. These factors, combined with improved reimbursement policies and heightened awareness of enteral nutrition, have contributed to the market’s robust growth in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing healthcare investments, rising awareness of clinical nutrition, and a growing burden of chronic diseases. The World Health Organization (WHO) reported a 25% increase in the prevalence of malnutrition-related conditions in the region between 2022 and 2024, underscoring the need for effective nutritional interventions.

The Chinese National Health Commission (NHC) noted a 30% rise in hospital admissions requiring enteral nutrition support in 2023, particularly for patients with cancer and stroke. India’s Ministry of Health and Family Welfare (MoHFW) announced a 20% increase in funding for critical care infrastructure in 2024, which is anticipated to enhance access to advanced medical devices.

The Japanese Ministry of Health, Labour, and Welfare (MHLW) highlighted a 15% growth in the adoption of home-based enteral nutrition solutions in 2023, driven by the country’s aging population. These developments, along with expanding healthcare access and improving regulatory frameworks, are projected to fuel the market’s expansion in the Asia Pacific region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the enteral feeding tubes market focus on product innovation, strategic partnerships, and expanding their geographical reach to drive growth. They invest in the development of advanced feeding tube systems that are safer, more comfortable, and easier to use for patients. Companies also enhance their product offerings by incorporating features like antimicrobial coatings and improved flow regulation to meet the diverse needs of healthcare providers.

Collaborating with hospitals, healthcare institutions, and home healthcare services helps increase adoption rates. Additionally, targeting emerging markets with growing healthcare access provides new opportunities for expansion. Fresenius Kabi, headquartered in Bad Homburg, Germany, is a global healthcare company specializing in intravenous generics, clinical nutrition, and medical devices.

The company offers a range of enteral feeding tubes designed to improve patient care and nutritional delivery, including products that cater to both acute and long-term care settings. Fresenius Kabi focuses on continuous innovation, developing products that meet the evolving needs of healthcare providers. With a strong global presence and strategic partnerships, the company remains a key player in the enteral feeding tubes market, serving a broad range of healthcare applications.

Recent Developments

- In September 2023, Cardinal Health introduced the Kangaroo OMNI enteral feeding pump, offering patients a more personalized approach to enteral feeding with customizable options for their unique care needs throughout their feeding journey.

- In August 2023, Cardinal Health also launched the NTrainer™System 2.0, an advanced medical device designed to help premature and newborn infants develop oral coordination skills. This system aims to reduce the time spent in neonatal intensive care units (NICUs) by facilitating faster transitions to independent feeding.

Top Key Players in the Enteral feeding tubes Market

- Kimberly-Clark

- Fresenius Kabi AG

- Danone Medical Nutrition

- Cook Medical

- Conmed Corporation

- Cardinal Health

- Boston Scientific Corporation

- Abbott Nutrition

Report Scope

Report Features Description Market Value (2024) US$ 4.3 billion Forecast Revenue (2034) US$ 7.1 billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Nasogastric Tubes, Orogastric Tubes, Gastrostomy Tubes, and Others), By Material (Polyurethane Feeding Tubes, Silicone Feeding Tubes, and Polyvinyl Chloride Feeding Tubes), By Application (Oncology, Neurological Disorders, Gastrointestinal Disorders, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kimberly-Clark, Fresenius Kabi AG, Danone Medical Nutrition, Cook Medical, Conmed Corporation, Cardinal Health, Boston Scientific Corporation, and Abbott Nutrition. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Enteral Feeding Tubes MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Enteral Feeding Tubes MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kimberly-Clark

- Fresenius Kabi AG

- Danone Medical Nutrition

- Cook Medical

- Conmed Corporation

- Cardinal Health

- Boston Scientific Corporation

- Abbott Nutrition