Global Home Equity Lending Market By Type (Fixed-rate loans, Home Equity Line of Credit), By Service Provider (Banks, Online platforms, Credit Unions, Other financial institutions), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 131957

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

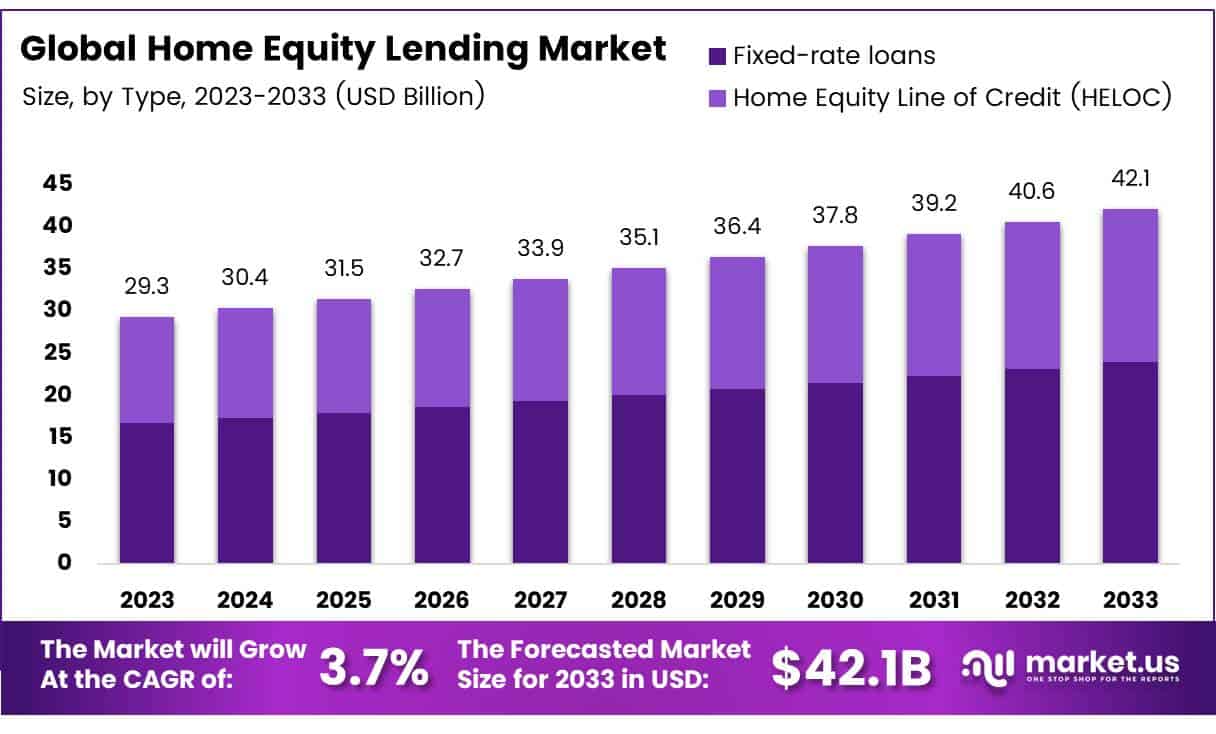

The Global Home Equity Lending Market size is expected to be worth around USD 42.7 Billion by 2033, from USD 29.3 Billion in 2023, growing at a CAGR of 3.7% during the forecast period from 2024 to 2033.

Home equity lending involves giving loans that use the homeowner’s equity as collateral. Equity is the part of the home that the owner fully owns, calculated as the home’s current market value minus any debts tied to the property.

People often take out these loans for big expenses like home improvements, education costs, or to pay off high-interest debts. To decide how much can be borrowed, lenders look at the homeowner’s credit history and the home’s value.

These loans typically have fixed interest rates, which means the payment amount doesn’t change, making it easier for homeowners to manage their budgets.

The home equity lending market includes the banks and institutions that provide these loans. It is affected by various economic factors like changes in interest rates, the state of the housing market, and how easy it is for consumers to get credit.

Banks and credit unions are key players in this market, offering loan options based on homeowners’ financial needs. The health of this market is linked to property values and the broader economy. The market has grown due to rising home prices and low interest rates, which have increased the amount of equity homeowners have, enabling them to borrow more.

According to the New York Times, American homeowners with mortgages currently have about $315,000 in home equity on average—almost $129,000 more than at the onset of the coronavirus pandemic in 2020.

This substantial increase in equity not only enhances the capacity for current homeowners to access financial resources but also attracts new participants into the market, fostering competition among lenders to offer favorable terms.

Government policies and regulations play a crucial role in shaping the home equity lending landscape. These regulations are designed to protect consumers from predatory lending practices and ensure fair lending standards across the board. In recent years, there has been an emphasis on transparency and fairness in lending practices, which has increased consumer confidence and contributed to market growth.

The interest rate environment has a direct impact on the home equity lending market. For instance, the data from Mojo Mortgages indicates that the average fixed mortgage rate in August was 4.8%, a reduction from 5.9% the previous year.

This decrease in mortgage rates generally makes home equity loans more attractive, as lower rates reduce the cost of borrowing. This trend supports market growth by increasing consumer interest in tapping into home equity for large purchases or debt consolidation.

When assessing the attractiveness of home equity loans, it is essential to consider their cost relative to other types of lending. For example, Bankrate reports that the average personal loan interest rate currently stands at 12.43%.

This comparison highlights the competitive advantage of home equity loans, which typically feature lower interest rates due to the secured nature of the lending. The favorable rates associated with home equity loans make them a preferred choice for homeowners over other higher-cost unsecured borrowing options, thus driving further growth in the home equity lending market.

Key Takeaways

- The global home equity lending market is projected to grow from USD 29.3 billion in 2023 to USD 42.7 billion by 2033, with a CAGR of 3.7%.

- Fixed-rate loans dominate the home equity lending market due to their stability and predictability, making them a preferred choice among homeowners.

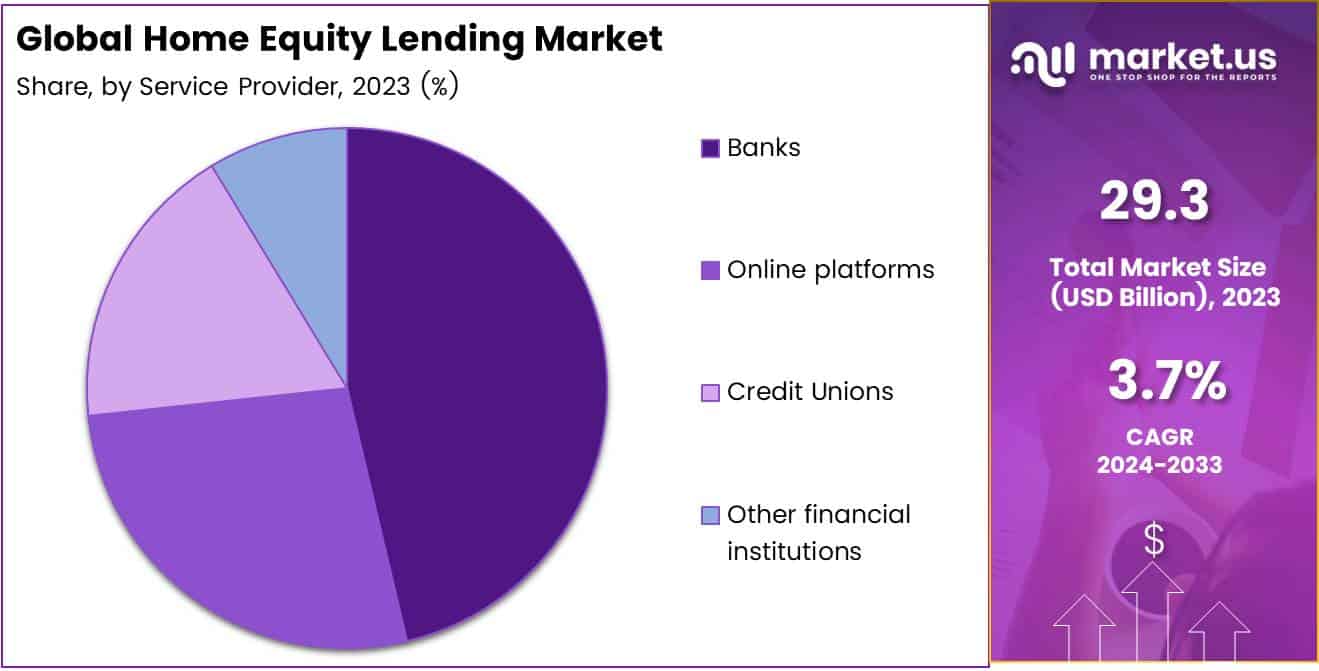

- Banks are the leading service providers in the home equity lending market, favored for their trustworthiness, competitive interest rates, and widespread branch networks.

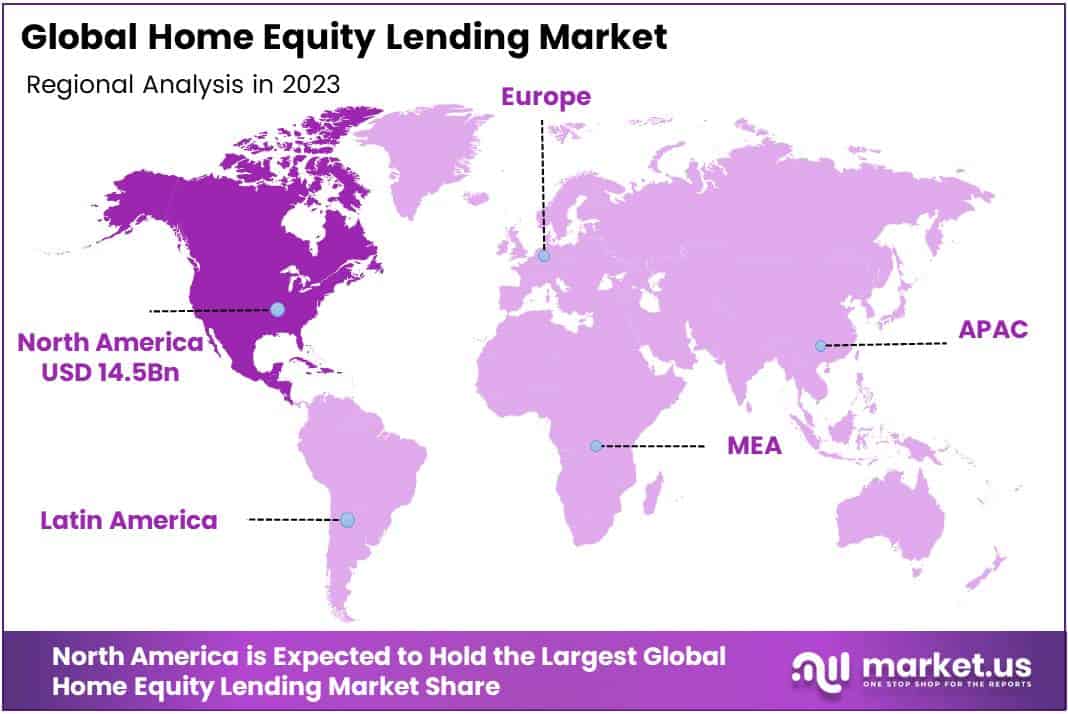

- North America holds a dominant 50% share of the home equity lending market, driven by strong financial systems and high homeownership rates.

- Rising property values and an increase in home renovations are key drivers expanding borrowing capacities and fueling market growth.

- There is a significant opportunity for market growth through the digitalization of loan processes, targeting a tech-savvy demographic and improving customer experience and loan processing efficiency.

Type Analysis

Fixed-Rate Loans Dominate Home Equity Lending

In 2023, Fixed-rate loans held a dominant market position in the By Type Analysis segment of the Home Equity Lending Market, capturing a significant share due to their stable interest rates and predictable repayment structures.

Fixed-rate loans attracted risk-averse borrowers seeking stability in their financial planning, particularly as market volatility and fluctuating interest rates became prevalent concerns. This preference was largely driven by homeowners aiming to leverage home equity for long-term investments or substantial expenses, ensuring a steady repayment plan amidst uncertain economic conditions.

Conversely, the Home Equity Line of Credit (HELOC) segment also retained a notable share in 2023, favored for its flexible borrowing structure. HELOCs provided homeowners with a revolving credit line, enabling them to borrow as needed against their home equity and pay interest only on the amount drawn.

This feature was particularly appealing to those seeking financing for ongoing or phased projects, such as home renovations. However, the demand for HELOCs was somewhat moderated by rising interest rates, as their variable rate structure introduced higher repayment uncertainties.

Overall, fixed-rate loans are expected to maintain their lead in the Home Equity Lending Market’s type segment, with HELOCs remaining attractive for specific, adaptable financing needs.

Service Provider Analysis

Home Equity Lending Market: Banks Lead with Dominant Market Share

In 2023, banks held a dominant market position in the By Service Provider Analysis segment of the Home Equity Lending Market. Banks, as traditional financial entities, possess well-established customer relationships, comprehensive regulatory insights, and a vast network of branches that facilitate personal interactions and complex transaction handling.

This foundational infrastructure enabled them to capture the largest market share, as consumers often prioritize trust and proven service effectiveness when opting for equity lending services.

Following banks, online platforms emerged as the second most influential service providers. Leveraging technology, these platforms offer a streamlined and convenient loan application process, appealing to the tech-savvy consumer base seeking quick and hassle-free lending solutions.

Meanwhile, credit unions, known for their member-centric approaches, also carved out a significant niche. These institutions offer competitive rates and personalized service, strengthening their market presence among members who value community-focused financial solutions.

Other financial institutions, including savings and loans associations, though smaller in scale, continue to serve specific segments of the market, focusing on localized service and specialized lending options. Their tailored strategies allow them to remain competitive and relevant, addressing the diverse needs of the home equity lending market.

Key Market Segments

By Type

- Fixed-rate loans

- Home Equity Line of Credit (HELOC)

By Service Provider

- Banks

- Online platforms

- Credit Unions

- Other financial institutions

Drivers

Rising Property Values Boost Home Equity Lending

In the home equity lending market, rising property values are a significant driver. As real estate prices increase, homeowners find themselves with enhanced equity, expanding their capacity to borrow against the value of their homes. This boost in borrowing potential is further propelled by a heightened demand for home renovations.

Many homeowners are choosing to invest in improvements and upgrades, which not only enhances their living space but also contributes to increasing the overall value of their properties. Additionally, home equity loans are becoming a favored option for debt consolidation.

Homeowners are attracted to these loans because they typically offer lower interest rates compared to alternatives like credit cards, making them an economically sensible choice for managing and reducing personal debt. This convergence of rising home values, renovation interests, and debt consolidation needs collectively fuels the growth and dynamism of the home equity lending market.

Restraints

Challenges in the Home Equity Lending Market

Rising interest rates and property value volatility present significant challenges in the home equity lending market. As interest rates climb, the cost associated with borrowing against home equity increases, potentially deterring homeowners from seeking such loans. This rise in borrowing costs can lead to a slowdown in the demand for home equity loans, impacting lenders’ profitability and the market’s overall growth.

Concurrently, fluctuations in property values play a crucial role. When property values decline, the equity that homeowners possess diminishes. This reduction in equity limits the amount homeowners can borrow, constraining their ability to leverage their properties for financial gains.

Such volatility not only affects individual homeowners but also introduces risks for lenders, as the collateral value backing the loans becomes less secure. These factors combined can tighten the availability of credit within the market, influencing both the accessibility of home equity loans for consumers and the strategic approaches lenders must adopt to manage risks associated with lending.

Growth Factors

Expansion of Digital and Mobile Platforms

The home equity lending market presents significant growth opportunities, primarily through the expansion of digital and mobile platforms. By digitizing the application and loan management process, lenders can appeal to a tech-savvy demographic that values convenience and efficiency. This shift not only streamlines operations but also reduces processing times, enhancing customer satisfaction and potentially increasing loan uptake.

Furthermore, innovation in product offerings, such as the introduction of flexible loan products including hybrid loans and Home Equity Lines of Credit (HELOCs), addresses the varied financial needs and preferences of borrowers. These innovations can expand market reach by providing tailored solutions that ensure broader consumer engagement and retention.

The combination of technological advancement and product diversification is poised to drive the home equity lending market forward, tapping into new customer segments and fostering sustained growth.

Emerging Trends

Shift Toward Fixed-Rate Loans Offers Stability in Home Equity Lending

In the evolving landscape of the home equity lending market, a notable shift toward fixed-rate loans is emerging as a prominent trend. This preference reflects borrowers’ increasing desire for stability amid fluctuating economic conditions, ensuring predictable monthly payments that safeguard against interest rate volatility.

Additionally, the market is witnessing a strategic integration with real estate apps, which enhances user engagement by providing streamlined access to loan information and services directly through digital platforms familiar to homeowners.

This integration not only boosts the convenience and visibility of home equity products but also aligns with the growing digitization of financial services.

Furthermore, financial institutions are ramping up their financial literacy campaigns, aiming to educate consumers about the nuances of home equity loans. These efforts are designed to enhance borrower understanding of both the benefits and potential risks, promoting more informed decision-making in the home equity borrowing process.

Collectively, these factors are reshaping the home equity lending landscape, making it more accessible and understandable for consumers.

Regional Analysis

North America Dominating with 50% Market Share, Valued at USD 14.5 Billion

The global home equity lending market exhibits substantial regional variations in growth dynamics and market penetration, influenced by economic factors, consumer behavior, and regulatory environments.

North America is the dominant region in the home equity lending market, commanding a 50% share valued at approximately USD 14.5 billion. This region’s market is bolstered by robust financial frameworks and a high prevalence of homeownership, which facilitates access to equity financing. The U.S. leads this region, with an increasing trend in home renovations and consumer spending contributing to the market’s expansion.

Regional Mentions:

In Europe, the market is characterized by moderate growth, driven by an aging housing stock requiring renovations and an increasing consumer interest in leveraging home equity for debt consolidation. Regulatory environments here are stringent, providing a structured framework for lenders and borrowers, which stabilizes the market.

Asia Pacific is witnessing rapid growth in the home equity lending market, propelled by rising real estate prices and an expanding middle class. Countries like China and India are experiencing a surge in consumer demand for housing-related expenditures, which in turn stimulates the home equity loans sector. However, the market is also fragmented due to diverse financial regulations across the region, affecting the scalability of lending solutions.

The market in the Middle East & Africa shows potential for growth, although it is currently nascent. Economic diversification and improving regulatory frameworks can attract more participants into the market. Homeownership rates are varied, with some countries showing higher potential for market development than others.

Latin America presents a mixed scenario, with certain economies displaying strong market potentials, such as Brazil and Mexico, driven by increasing urbanization and a gradual shift towards formal banking. However, economic volatility and lower homeownership rates compared to North America and Europe somewhat hinder the broader adoption of home equity lending in the region.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global home equity lending market has seen significant activity from major financial institutions, which have tailored their offerings to adapt to evolving consumer needs and economic conditions.

Among the key players, Bank of America Corp., Barclays PLC, and HSBC Holdings Plc have maintained a robust presence, leveraging their expansive networks and digital platforms to streamline lending processes and enhance customer experience.

The PNC Financial Services Group Inc. and Wells Fargo & Co. are notable for their strategic focus on integrating advanced data analytics to assess credit risk and personalize loan offerings. This approach has not only improved their market positioning but also catered to a more risk-aware clientele.

Emerging players such as LoanDepot LLC and Police and Nurses Ltd. have distinguished themselves through niche strategies, targeting underserved demographics with more flexible lending criteria and competitive rates. Their growth reflects a broader market trend towards inclusivity and accessibility in financial services.

Furthermore, institutions like JPMorgan Chase & Co. and The Goldman Sachs Group Inc. continue to excel by offering premium services that emphasize long-term customer relationships and wealth management, aligning home equity products with broader financial planning and investment strategies.

On the international front, Commonwealth Bank of Australia and Australia and New Zealand Banking Group Ltd. have capitalized on the stable Australian housing market to expand their home equity lending portfolios. Similarly, the State Bank of India has leveraged its vast domestic presence to cater to India’s growing middle class, who are increasingly looking to home equity loans as viable financial tools.

Top Key Players in the Market

- Bank of America Corp.

- Barclays PLC

- HSBC Holdings Plc

- THE PNC FINANCIAL SERVICES GROUP INC.

- Police and Nurses Ltd.

- Regions Financial Corp.

- State Bank of India

- The Goldman Sachs Group Inc.

- Discover Bank

- Member FDIC

- LoanDepot LLC

- Wells Fargo and Co.

- JPMorgan Chase and Co.

- Morgan Stanley

- City Holding Company

- Commonwealth Bank of Australia

- Navy Federal Credit Union

- nbkc bank

- Pentagon Federal Credit Union

- Australia and New Zealand Banking Group Ltd.

Recent Developments

- In October 2024, J.P. Morgan has solidified its leading position in the foreign currency trading market by winning five significant awards. This recognition comes as the firm excels in a market with daily turnovers surpassing $7.5 trillion, highlighting its robust strategies and market influence in facilitating global trade and finance.

- In June 2024, BankTech Ventures has reinforced its dedication to enhancing the prospects of community banks by investing $13.5 million across six fintech startups. This strategic move aims to integrate innovative technologies into community banking, thereby improving efficiency, customer service, and financial inclusivity.

- In September 2024, U.S. Bancorp has announced a substantial initiative to repurchase $5 billion of its common stock, paired with an increase in its quarterly dividend. This financial maneuver reflects the company’s strong capital position and commitment to delivering value to its shareholders, fostering investor confidence and

Report Scope

Report Features Description Market Value (2023) USD 29.3 Billion Forecast Revenue (2033) USD 42.7 Billion CAGR (2024-2033) 3.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Fixed-rate loans, Home Equity Line of Credit (HELOC)), By Service Provider (Banks, Online platforms, Credit Unions, Other financial institutions) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bank of America Corp., Barclays PLC, HSBC Holdings Plc, THE PNC FINANCIAL SERVICES GROUP INC., Police and Nurses Ltd., Regions Financial Corp., State Bank of India, The Goldman Sachs Group Inc., Discover Bank, Member FDIC, LoanDepot LLC, Wells Fargo and Co., JPMorgan Chase and Co., Morgan Stanley, City Holding Company, Commonwealth Bank of Australia, Navy Federal Credit Union, nbkc bank, Pentagon Federal Credit Union, Australia and New Zealand Banking Group Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bank of America Corp.

- Barclays PLC

- HSBC Holdings Plc

- THE PNC FINANCIAL SERVICES GROUP INC.

- Police and Nurses Ltd.

- Regions Financial Corp.

- State Bank of India

- The Goldman Sachs Group Inc.

- Discover Bank

- Member FDIC

- LoanDepot LLC

- Wells Fargo and Co.

- JPMorgan Chase and Co.

- Morgan Stanley

- City Holding Company

- Commonwealth Bank of Australia

- Navy Federal Credit Union

- nbkc bank

- Pentagon Federal Credit Union

- Australia and New Zealand Banking Group Ltd.