Global Radiation Therapy Market Analysis By Type [External Beam Radiation Therapy (Intensity-modulated radiation therapy (IMRT), Image-guided radiation therapy (IGRT), Proton therapy, Other external radiation therapies), Internal Radiation Therapy, Systemic Radiation Therapy], By Application (Lung Cancer, Prostate Cancer, Breast Cancer, Cervical Cancer, Head & Neck Cancer, Other Applications), By End-use (Hospitals, Radiotherapy Centres & Ambulatory Surgery Centers, Cancer Research Institutes) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136498

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

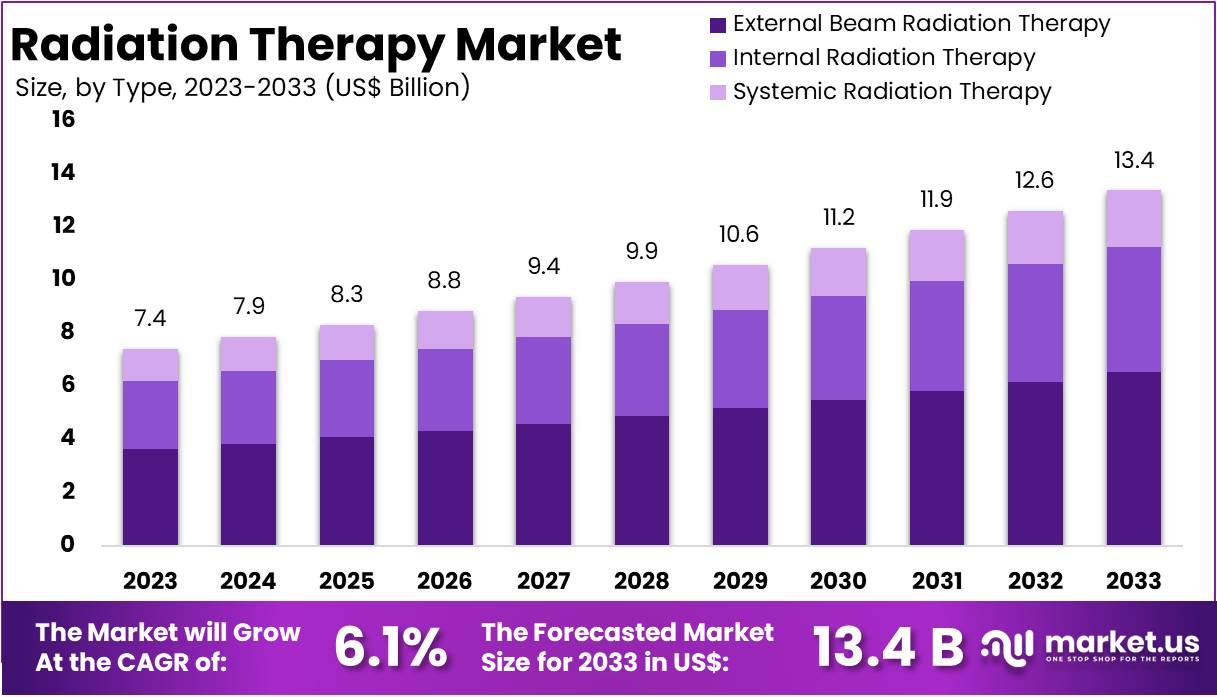

The Global Radiation Therapy Market size is expected to be worth around US$ 13.4 Billion by 2033, from US$ 7.4 Billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033.

Radiation therapy is a crucial medical treatment that uses high-energy radiation to destroy cancer cells by damaging their DNA. It is frequently used to treat various cancers, either as a standalone treatment or in combination with surgery and chemotherapy. There are two primary types: external beam radiation therapy, which directs radiation from a machine to the cancer site, and internal radiation therapy (brachytherapy), where radioactive materials are placed near the cancer. This approach minimizes damage to surrounding healthy tissues.

The global radiation therapy market is expanding rapidly due to the increasing incidence of cancer worldwide. According to recent reports, advancements in radiation technology and growing awareness of non-invasive treatments are driving this growth. Key technologies include linear accelerators, proton therapy, and stereotactic radiosurgery. The integration of AI-based treatment planning and imaging systems is further enhancing precision and efficiency in treatment.

A study by OAE Publish highlighted the benefits of radiation therapy beyond cancer treatment. For instance, in managing keloids, combining surgical excision with radiation therapy significantly reduces recurrence rates. While surgical excision alone has recurrence rates exceeding 45%, adding radiation therapy lowers this to approximately 20%. Such applications underscore the versatility of radiation therapy in addressing both malignant and non-malignant conditions.

Pain management is another critical area where radiation therapy demonstrates effectiveness. Conventional radiation therapy (cRT) provides pain relief for 60% to 85% of patients with bone metastases. A 2023 study reported by Red Journal, response rates of 72% to 75% for initial radiation therapy and about 68% for reirradiation. Advanced techniques like stereotactic body radiation therapy (SBRT) are emerging as alternatives to cRT, offering higher precision and potentially better outcomes.

Adjuvant radiation therapy also plays a vital role in reducing recurrence rates in early-stage breast cancer patients. For example, a Harvard Health study presented that the American Society of Clinical Oncology annual meeting in 2022 suggested that certain women over 65 with hormone receptor-positive breast cancer might safely omit radiation post-lumpectomy. However, current guidelines generally recommend radiation to minimize recurrence risks.

In addition to cancer treatment, the low risk of adverse effects makes radiation therapy a safe option for other conditions. A review of Oxford Academic, over 6,500 cases reported only five potential radiation-induced malignancies, emphasizing the treatment’s safety profile. This low risk is particularly crucial when considering the significant benefits radiation therapy provides.

The radiation therapy market’s growth is fueled by innovations and rising demand for precision treatments. As highlighted in Annals of Palliative Medicine studies, reirradiation can achieve success rates of up to 80%, making it a viable option for patients with recurrent pain after initial therapy. These advancements are ensuring better patient outcomes and driving the adoption of cutting-edge technologies across healthcare facilities globally.

The radiation therapy market is critical in improving cancer treatment outcomes and addressing non-malignant conditions. With continuous innovation, such as AI-driven technologies and advanced treatment modalities, the market is poised for sustained growth. As the global demand for effective and minimally invasive treatments rises, radiation therapy will remain a cornerstone of modern oncology and pain management.

Key Takeaways

- The global Radiation Therapy Market is projected to grow from US$ 7.4 billion in 2023 to US$ 13.4 billion by 2033, at a 6.1% CAGR.

- In 2023, External Beam Radiation Therapy dominated the Type Segment, holding over 49% of the market share.

- Breast Cancer was the leading application in the Radiation Therapy Market in 2023, with more than 28% market share.

- The Opioids segment was the largest in the Drug Class Segment of the Radiation Therapy Market in 2023, also capturing over 28%.

- North America led the global market in 2023, accounting for 44% of the market share, valued at US$ 3.2 billion.

Type Analysis

In 2023, External Beam Radiation Therapy held a dominant market position in the Type Segment of the Radiation Therapy Market. It captured more than a 49% share. This category includes advanced techniques like Intensity-modulated and Image-guided radiation therapy. These methods enhance the precision of tumor targeting. They minimize damage to healthy tissues nearby.

Proton therapy, a part of External Beam Radiation Therapy, stands out for its pinpoint accuracy. It uses protons instead of x-rays, ensuring the radiation affects only the tumor with minimal impact on surrounding healthy organs. This approach is crucial for reducing unwanted side effects.

Internal Radiation Therapy, or brachytherapy, involves placing radioactive sources inside or near the tumor. This method delivers a high dose directly to the target while sparing nearby healthy tissues. It is particularly effective for treating localized cancers such as those found in the prostate, breast, and cervix.

Systemic Radiation Therapy employs radioactive substances that circulate through the bloodstream to target cancer cells. This type is effective for treating specific cancers like thyroid cancer where the radioactive material can directly target malignant cells. This method helps limit the exposure of healthy cells to radiation.

Application Analysis

In 2023, Breast Cancer held a dominant market position in the Application Segment of the Radiation Therapy Market, capturing more than a 28% share. This significant portion underscores the prevalent use of radiation therapy as a critical component in breast cancer treatment protocols. The effectiveness of radiation therapy in managing and potentially curing breast cancer drives its adoption.

The market also sees substantial contributions from other applications such as lung cancer, prostate cancer, and colorectal cancer. Each area utilizes radiation therapy uniquely, tailored to the specific cancer type’s requirements. For lung cancer, radiation therapy often serves as a palliative treatment or in combination with surgery and chemotherapy to improve outcomes. In prostate cancer, it is a primary treatment, especially in early stages or as part of a comprehensive treatment plan in advanced stages.

Colorectal cancer applications of radiation therapy are increasing as well, particularly in managing localized tumors and reducing recurrence risks. This trend highlights the evolving landscape of radiation therapy applications, emphasizing its role in diverse oncological treatments. As technology advances, the precision and efficacy of radiation treatments improve, broadening their applicability across different cancer types and stages. This continuous innovation fuels growth in the Radiation Therapy Market, promoting sustained investment and research in this field.

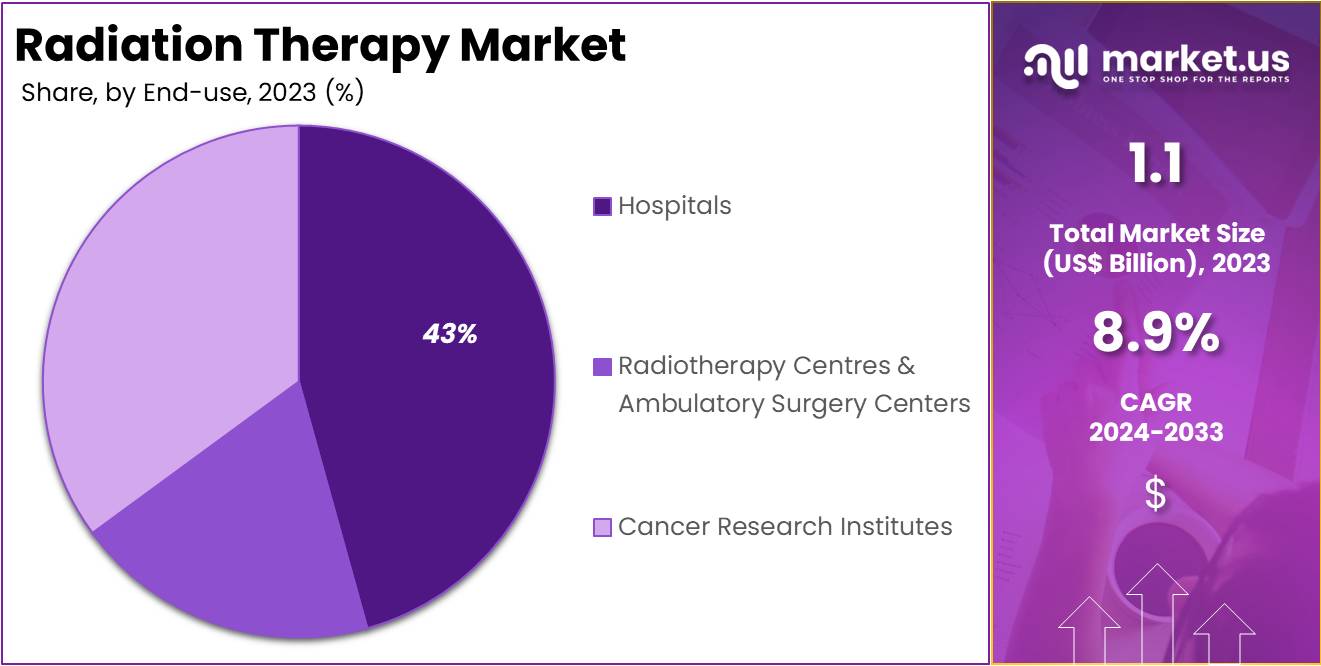

End-use Analysis

In 2023, the Opioids segment held a dominant market position in the Drug Class Segment of the Radiation Therapy Market, capturing more than a 28% share. Hospitals are the primary facilities where radiation therapy is administered. They are equipped with sophisticated machinery, such as linear accelerators, and offer integrated healthcare services that include coordinated treatment plans and follow-ups. This broad access to resources allows hospitals to deliver comprehensive cancer care, securing their lead in the market.

Specialized radiotherapy centers focus exclusively on cancer treatment using radiation, offering a higher level of specialized care. The staff’s expertise in radiation therapy techniques often results in greater precision in treatment delivery and improved patient management. These centers are essential for driving innovations and adapting practices in radiation therapy, enhancing overall treatment efficacy.

Ambulatory Surgery Centers (ASCs) are becoming more popular due to their cost-effective and efficient service model. They primarily cater to outpatient cases, allowing patients to receive therapy without hospital admission. This model is especially advantageous for patients needing routine radiation sessions, offering convenience and reduced treatment times.

Cancer research institutes are pivotal in advancing radiation therapy techniques and developing new treatment protocols. Their research contributes significantly to improvements in treatment outcomes and efficacy. These institutes frequently collaborate with hospitals and radiotherapy centers to implement new strategies and technologies, ensuring continuous advancements in radiation treatments and better patient care outcomes.

Key Market Segments

By Type

- External Beam Radiation Therapy

- Intensity-modulated radiation therapy (IMRT)

- Image-guided radiation therapy (IGRT)

- Proton therapy

- Other external radiation therapies

- Internal Radiation Therapy

- Systemic Radiation Therapy

By Application

- Lung Cancer

- Prostate Cancer

- Breast Cancer

- Cervical Cancer

- Head & Neck Cancer

- Other Applications

By End-use

- Hospitals

- Radiotherapy Centres & Ambulatory Surgery Centers

- Cancer Research Institutes

Drivers

Increase in Geriatric Population

The global increase in the geriatric population serves as a significant driver for the radiation therapy market. As people age, their susceptibility to chronic conditions, particularly cancer, escalates. This demographic trend has prompted a rising demand for effective treatment modalities. Radiation therapy, known for its precision and minimal invasiveness, stands out as a preferred option for cancer management among older adults.

Older individuals often require treatments that offer both efficacy and reduced side effects, making radiation therapy a favorable choice. Its ability to target cancerous cells while sparing surrounding healthy tissue makes it particularly suitable for the elderly, who may not tolerate more aggressive treatment forms well.

The expanding elderly population thus directly impacts the radiation therapy market’s growth. Healthcare providers are increasingly adopting radiation therapy to meet the needs of this growing patient segment. This trend is expected to continue, reflecting in the market’s expansion as the population ages, emphasizing the ongoing need for advanced, patient-friendly cancer treatment solutions.

Restraints

Regulatory and Reimbursement Issues

Regulatory Challenges in Radiation Therapy Regulatory hurdles present significant challenges in the radiation therapy market. Manufacturers of radiation therapy systems must navigate complex approval processes that vary widely between countries. This complexity can delay product launches and restrict market entry, particularly for new players. The stringent standards set by regulatory bodies ensure patient safety but often require extensive documentation and clinical trials, adding to the cost and time needed for new technologies to reach the market.

Impact of Regulatory Processes The rigorous regulatory processes, while crucial for ensuring safety and efficacy, can significantly slow down the adoption of innovative radiation therapy technologies. These delays can impede market growth as manufacturers struggle to get their products approved in a timely manner. Additionally, the uncertainty associated with regulatory approvals can deter investment in new technologies, potentially stifling innovation and technological advancement in this field.

Reimbursement Variabilities Reimbursement policies also play a crucial role in the adoption rates of advanced radiation therapy technologies. The variability of these policies across different countries can create disparities in technology adoption. In regions with favorable reimbursement scenarios, there is often a higher adoption rate of advanced therapies, which supports market growth. Conversely, in countries with less favorable or more complex reimbursement processes, healthcare providers may be hesitant to adopt newer, potentially costlier technologies.

Opportunities

Expansion in Emerging Economies

Emerging economies are increasingly becoming vital areas for growth in the radiation therapy market. As healthcare spending rises, these regions show substantial potential for the adoption of advanced cancer treatment technologies. This growth is driven by the commitment of these countries to enhance their healthcare capabilities and ensure better patient outcomes.

Furthermore, improvements in healthcare infrastructure support the expansion of radiation therapy services. Upgraded facilities can accommodate sophisticated radiation therapy systems, facilitating more effective treatments. This infrastructural development is crucial for integrating advanced medical technologies in routine care.

Rising awareness about the benefits of timely and effective cancer treatment also plays a significant role in the adoption of radiation therapy in emerging economies. Educational initiatives and government programs are increasing public knowledge about cancer therapies, thus driving demand for advanced treatment options like radiation therapy. This awareness is essential for early diagnosis and treatment, which are key to improving cancer survival rates.

Trends

Integration of Artificial Intelligence

Artificial intelligence (AI) is transforming radiation therapy by enhancing treatment planning. AI algorithms process medical images faster and with more accuracy than traditional techniques. This speed allows healthcare professionals to focus on critical decisions. AI improves precision in identifying tumor boundaries, which is crucial for targeting radiation effectively. By analyzing vast amounts of imaging data, AI ensures accurate assessments. This advancement minimizes errors in treatment planning. Such improvements are pivotal for patient safety and achieving better therapeutic outcomes in radiation therapy practices.

AI integration also optimizes operational efficiency in radiation therapy centers. Automated processes powered by AI reduce the time spent on manual tasks. For example, AI accelerates contouring, dose calculations, and scheduling. This streamlining benefits both clinicians and patients, resulting in reduced wait times. By efficiently allocating resources, clinics can treat more patients without compromising quality. The adoption of AI supports standardized practices, which improve overall consistency in treatment delivery. These operational gains enhance the quality of healthcare services.

AI-driven radiation therapy is reshaping patient outcomes by creating personalized treatment plans. Algorithms tailor radiation doses based on individual patient data. This customization reduces damage to healthy tissues and enhances recovery rates. Additionally, AI systems monitor patient responses in real-time, enabling timely adjustments to treatment. These innovations lead to improved survival rates and a better quality of life for patients. As AI technology evolves, its potential to revolutionize cancer care grows, making it an essential tool in modern radiation therapy.

Regional Analysis

In 2023, North America maintained a dominant position in the radiation therapy market, capturing over 44% market share and reaching a value of US$ 3.2 billion. This prominence is attributed to the region’s advanced healthcare infrastructure and significant investment in research and development. Technological advancements such as image-guided radiation therapy (IGRT) and proton therapy have enhanced treatment precision, increasing their demand among healthcare providers and patients.

The region benefits from substantial healthcare spending, which supports access to advanced treatment options. Extensive research and development activities, particularly in the U.S. and Canada, foster innovation in radiation therapy, enhancing safety and effectiveness. Additionally, supportive government policies and private sector investment contribute to market expansion, facilitating the acquisition of new technologies and the upgrading of existing facilities.

North America’s high cancer prevalence demands robust healthcare solutions, with radiation therapy playing a critical role. The market is further bolstered by swift regulatory approvals, which expedite the introduction of advanced therapies. Moreover, increased awareness and early detection initiatives lead to higher demand for radiation treatments, ensuring early and intensive care for cancer patients, thereby supporting the region’s strong market position.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Accuray Incorporated stands out in the radiation therapy market for its precision and safety-focused solutions. Their financial stability supports technology investments and market expansion. Brainlab AG, known for its software-driven technology, shows robust financial growth due to high demand for its radiation therapy software solutions. Both companies emphasize continuous innovation; Accuray with recent software upgrades, and Brainlab through AI integration, enhancing treatment precision.

Curium leads in nuclear medicine, providing essential radioactive tracers for both diagnostic and therapeutic purposes. Their financial strength is underpinned by a strong position in the radiopharmaceuticals market. Canon Medical Systems, a Canon Inc. subsidiary, contributes with extensive medical imaging solutions, including radiation therapy systems. Both companies are expanding their market reach through strategic partnerships and innovations in diagnostic and treatment technologies.

Elekta AB is at the forefront with its pioneering equipment and software for cancer treatment, driven by strong R&D capabilities. The company’s financial growth is bolstered by the global increase in cancer cases. Elekta’s commitment to precision in radiation therapy is evident in its continuous product enhancements and strategic market expansions, particularly in emerging regions.

The radiation therapy market also benefits from the contributions of other key players, enhancing the industry’s diversity and dynamism. These companies, ranging from equipment manufacturers to software developers, drive innovation and expand global access to radiation therapy. Their collective efforts are crucial in advancing technology adoption and improving oncological patient outcomes worldwide.

Market Key Players

- Accuray Incorporated

- Brainlab AG

- Curium

- Canon Medical Systems Corporation

- Elekta AB

- Hitachi High-Tech Corporation

- IBA Radiopharma Solutions

- Isoray Inc.

- Mevion Medical Systems

- Mitsubishi Electric Corporation

- Nordion Inc.

- NTP Radioisotopes SOC Ltd.

- RefleXion

- Toshiba Energy Systems & Solutions Corporation

- Varian Medical Systems Inc.

Recent Developments

- In October 2023: Canon Medical Systems USA, Inc. launched the Aquilion Exceed LB™ CT system, designed to enhance radiation therapy planning. This AI-powered, premium large bore CT scanner offers the industry’s largest bore and widest field-of-view, facilitating fast and efficient workflows without compromising on patient position, image quality, or reproducibility. This system leverages the latest in deep learning reconstruction technology to improve accuracy in complex simulations, which is critical for cancer treatment planning.

- In October 2023: Elekta acquired the Xoft brachytherapy business from iCAD, Inc. for approximately $5.5 million. This acquisition includes the Xoft Axxent Electronic Brachytherapy System, which offers innovative treatment options for a range of cancers. The technology allows for precise, targeted radiation in a minimally shielded setting, enhancing access to personalized cancer care worldwide.

- In June 2023: Brainlab expanded its collaboration with the AO Foundation, focusing on immersive medical education and training. This partnership will integrate Brainlab technology into AO courses to enhance surgical education through mixed reality technologies, improving knowledge acquisition, decision-making, and coordination of skills. This initiative is part of a broader strategy to utilize extended reality technologies to advance surgical practices and improve patient outcomes.

Report Scope

Report Features Description Market Value (2023) US$ 7.4 Billion Forecast Revenue (2033) US$ 13.4 Billion CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type [External Beam Radiation Therapy (Intensity-modulated radiation therapy (IMRT), Image-guided radiation therapy (IGRT), Proton therapy, Other external radiation therapies), Internal Radiation Therapy, Systemic Radiation Therapy], By Application (Lung Cancer, Prostate Cancer, Breast Cancer, Cervical Cancer, Head & Neck Cancer, Other Applications), By End-use (Hospitals, Radiotherapy Centres & Ambulatory Surgery Centers, Cancer Research Institutes) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Accuray Incorporated, Brainlab AG, Curium, Canon Medical Systems Corporation, Elekta AB, Hitachi High-Tech Corporation, IBA Radiopharma Solutions, Isoray Inc., Mevion Medical Systems, Mitsubishi Electric Corporation, Nordion Inc., NTP Radioisotopes SOC Ltd., RefleXion, Toshiba Energy Systems & Solutions Corporation, Varian Medical Systems Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Accuray Incorporated

- Brainlab AG

- Curium

- Canon Medical Systems Corporation

- Elekta AB

- Hitachi High-Tech Corporation

- IBA Radiopharma Solutions

- Isoray Inc.

- Mevion Medical Systems

- Mitsubishi Electric Corporation

- Nordion Inc.

- NTP Radioisotopes SOC Ltd.

- RefleXion

- Toshiba Energy Systems & Solutions Corporation

- Varian Medical Systems Inc.