Global Apheresis Equipment Market By Product Type (Disposable Kits and Machines), By Technology (Centrifugation and Membrane Filtration), By Application (Neurological Disorders, Renal Disorders, Hematological Disorders, and Others), By Procedure (Plasmapheresis, Photopheresis, LDL Apheresis, Leukapheresis, and Others), By End-user (Hospitals & Clinics, Blood Donation Centers, Ambulatory Surgical Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143371

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

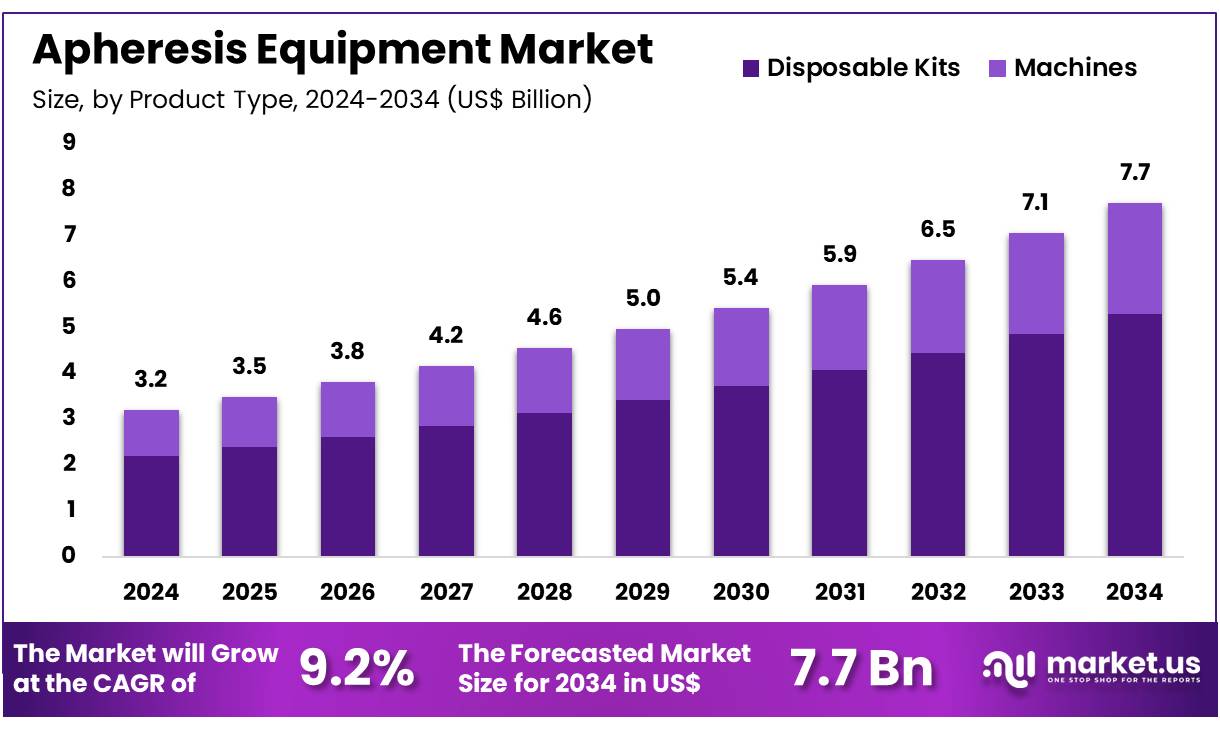

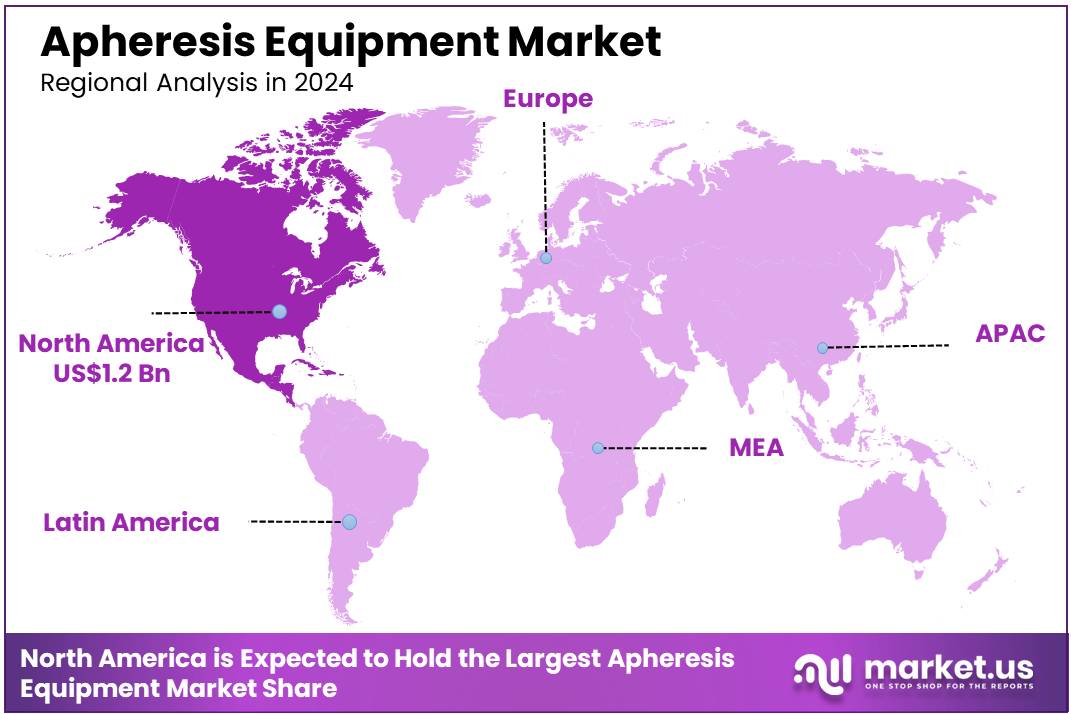

Global Apheresis Equipment Market size is expected to be worth around US$ 7.7 Billion by 2034 from US$ 3.2 Billion in 2024, growing at a CAGR of 9.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.7% share with a revenue of US$ 1.2 Billion.

Increasing demand for advanced therapeutic treatments and rising awareness of the benefits of apheresis drive the growth of the apheresis equipment market. Apheresis procedures are crucial in treating a variety of conditions such as autoimmune diseases, cancer, and blood disorders, which require the removal or separation of specific blood components. Technological advancements, such as improved filtration techniques and more efficient blood separation processes, have enhanced the precision and effectiveness of apheresis procedures.

Additionally, the rise in organ transplantation, personalized medicine, and the increasing prevalence of chronic diseases further fuel market expansion. In December 2023, TERUMO BCT, INC. engaged in the second edition of the “Connecting the Dots” film series, a collaborative initiative aimed at highlighting innovations from European MedTech companies. This initiative underscores the growing emphasis on innovation in apheresis technologies, creating opportunities for better patient outcomes and operational efficiency in healthcare settings.

Key Takeaways

- In 2024, the market for Apheresis Equipment generated a revenue of US$ 3.2 billion, with a CAGR of 9.2%, and is expected to reach US$ 7.7 billion by the year 2033.

- The product type segment is divided into disposable kits and machines, with disposable kits taking the lead in 2024 with a market share of 68.7%.

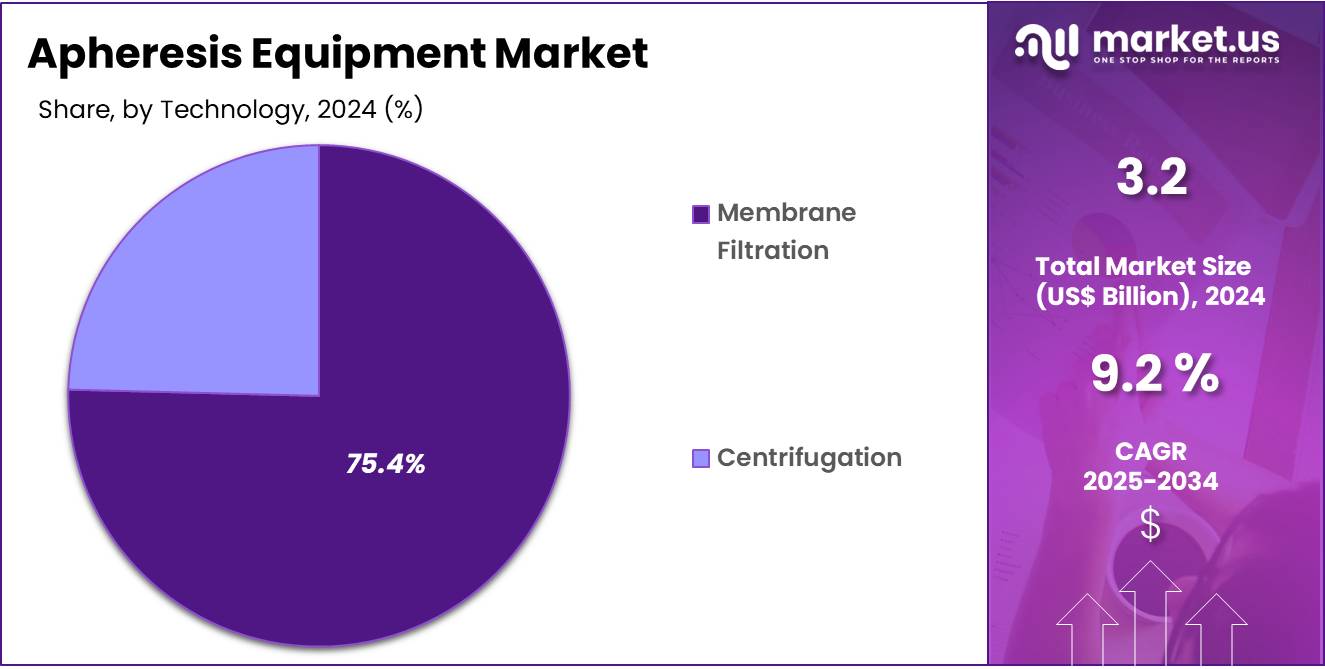

- Considering technology, the market is divided into centrifugation and membrane filtration. Among these, membrane filtration held a significant share of 75.4%.

- Furthermore, concerning the application segment, the market is segregated into neurological disorders, renal disorders, hematological disorders, and others. The neurological disorders sector stands out as the dominant player, holding the largest revenue share of 56.5% in the Apheresis Equipment market.

- The procedure segment is segregated into plasmapheresis, photopheresis, ldl apheresis, leukapheresis, and others, with the plasmapheresis segment leading the market, holding a revenue share of 66.3%.

- Considering end-user, the market is divided into hospitals & clinics, blood donation centers, ambulatory surgical centers, and others. Among these, hospitals & clinics held a significant share of 72.1%.

- North America led the market by securing a market share of 38.7% in 2024.

Product Type Analysis

The disposable kits segment led in 2024, claiming a market share of 68.7% owing to the increasing demand for cost-effective, single-use solutions in medical procedures. Disposable kits are anticipated to become the preferred option as they offer convenience, reduce the risk of cross-contamination, and eliminate the need for complex cleaning and sterilization procedures.

The rising frequency of apheresis treatments, especially in hospitals and clinics, is likely to drive demand for disposable kits. Additionally, the growing focus on patient safety, the rise of outpatient treatments, and advancements in disposable kit technology are projected to further fuel the growth of this segment. The cost-effectiveness and ease of use make disposable kits an attractive choice for healthcare providers.

Technology Analysis

The membrane filtration held a significant share of 75.4% due to its ability to efficiently separate components in blood products. Membrane filtration technology is increasingly preferred for its precision, ability to handle large volumes, and improved recovery rates. The growing need for advanced filtration methods to treat various medical conditions, including renal failure and neurological disorders, is likely to drive the demand for membrane filtration-based apheresis systems.

Additionally, as healthcare providers focus on improving patient outcomes and increasing the efficiency of treatments, membrane filtration technology is expected to become a critical component in apheresis equipment, contributing to the growth of this segment.

Application Analysis

The neurological disorders segment had a tremendous growth rate, with a revenue share of 56.5% as apheresis techniques become more commonly used to treat neurological conditions. Apheresis treatments, such as plasmapheresis, are increasingly being recognized for their effectiveness in managing neurological disorders like multiple sclerosis, myasthenia gravis, and Guillain-Barré syndrome.

The growing incidence of autoimmune neurological diseases and the increasing acceptance of apheresis as a therapeutic option are anticipated to drive demand for apheresis equipment in this segment. As the medical community continues to explore new treatment options for neurological disorders, the application of apheresis equipment is expected to expand, further fueling growth in this area.

Procedure Analysis

The plasmapheresis segment grew at a substantial rate, generating a revenue portion of 66.3% due to its widespread application in treating various conditions, including autoimmune diseases, neurological disorders, and hematological disorders. Plasmapheresis is increasingly used to remove harmful antibodies or other substances from the blood, offering relief to patients with conditions such as myasthenia gravis and lupus.

The growing recognition of plasmapheresis as an effective treatment option is expected to drive the demand for apheresis equipment. Additionally, advancements in plasmapheresis technology, such as enhanced filtration methods and improved equipment designs, are likely to further contribute to the growth of this segment, making it an essential part of modern therapeutic practices.

End-user Analysis

The hospitals & clinics held a significant share of 72.1% as these facilities continue to be the primary locations for apheresis treatments. Hospitals and clinics are projected to remain the largest consumers of apheresis equipment due to their capacity to handle a wide range of medical conditions requiring specialized treatments such as plasmapheresis and leukapheresis.

The rising prevalence of chronic conditions, including renal failure, hematological disorders, and autoimmune diseases, is likely to drive the demand for apheresis treatments in these settings. Additionally, as hospitals focus on improving patient care and enhancing operational efficiency, the need for advanced, efficient apheresis equipment in clinical settings is expected to grow, further expanding this segment.

Key Market Segments

Product Type

- Disposable Kits

- Machines

Technology

- Centrifugation

- Membrane Filtration

Application

- Neurological Disorders

- Renal Disorders

- Hematological Disorders

- Others

Procedure

- Plasmapheresis

- Photopheresis

- LDL Apheresis

- Leukapheresis

- Others

End-user

- Hospitals & Clinics

- Blood Donation Centers

- Ambulatory Surgical Centers

- Others

Drivers

Increasing Demand for Blood Components is Driving the Market

The rising demand for blood components, essential in treating various medical conditions, significantly drives the apheresis equipment market. Blood components, including plasma, platelets, and red blood cells, are crucial for treating conditions like autoimmune diseases, hematological disorders, and chronic illnesses. The increasing number of patients with conditions requiring therapeutic apheresis has led to the expanded use of these devices in hospitals and blood banks.

According to the Centers for Disease Control and Prevention (CDC), approximately 4.5 million people in the US annually require blood transfusions, highlighting the growing need for efficient blood component separation. This growing demand for plasma and blood components for both therapeutic and biopharmaceutical purposes has spurred the adoption of apheresis technology in hospitals and specialized centers.

The integration of advanced equipment in healthcare facilities worldwide allows for more effective and timely treatment of patients, thus expanding the market further. Additionally, increased focus on enhancing the efficiency and accuracy of apheresis devices also contributes to market growth.

Restraints

High Operational Costs are Restraining the Market

Despite advancements in apheresis equipment, high operational costs continue to hinder the market’s growth. The significant investment required for the purchase, maintenance, and operational usage of apheresis devices can be prohibitive, especially for smaller hospitals and healthcare centers in low-resource settings. The cost of specialized consumables, such as separation filters and disposables, further adds to the overall expense of apheresis procedures.

Moreover, the need for skilled professionals to operate these complex machines increases the financial burden on healthcare facilities. The high costs of training staff and ensuring patient safety during these procedures also deter smaller clinics and hospitals from adopting these technologies.

This financial barrier can limit the accessibility and frequency of apheresis treatments, particularly in regions with budget constraints. Overcoming these challenges requires strategic pricing, government intervention, and cost-reduction innovations to ensure that apheresis treatments remain widely accessible without compromising patient care.

Opportunities

Technological Advancements in Apheresis Equipment are Creating Growth Opportunities

Advancements in apheresis technology present significant growth opportunities by enhancing the efficiency, safety, and therapeutic applications of these devices. Recent developments in automated systems and improved separation technologies have made apheresis treatments quicker, more effective, and less intrusive. Innovations such as enhanced blood component recovery systems and systems that reduce patient discomfort during treatments are increasing the appeal of apheresis procedures.

The integration of better user interfaces and automated monitoring systems further contributes to patient and operator safety, improving the overall treatment process. These technological innovations also expand the clinical applications of apheresis, making it an effective treatment for a wider range of conditions, such as neurological disorders, cardiovascular diseases, and autoimmune diseases.

Moreover, the growing recognition of the benefits of apheresis in biopharmaceutical production, particularly in plasma collection for drug development, offers significant opportunities for the market. As these technologies continue to evolve, healthcare providers are increasingly adopting them, fueling the growth of the apheresis equipment market.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the apheresis equipment market. Economic downturns can lead to reduced healthcare budgets, limiting the funds available for purchasing advanced medical devices such as apheresis equipment. Conversely, during periods of economic growth, increased healthcare investments often result in expanded access to medical technologies, driving the adoption of apheresis devices.

Geopolitical stability plays a vital role in the global distribution of apheresis equipment, ensuring that regions with a high demand for these devices receive consistent supply. However, geopolitical tensions or trade restrictions can disrupt supply chains, delaying equipment shipments or inflating costs, which may negatively affect market growth.

Additionally, regulatory policies in different regions, such as the US Food and Drug Administration’s (FDA) approval processes for medical devices, can influence market dynamics by either accelerating or slowing down the introduction of new technologies.

Cultural factors also influence the adoption of apheresis equipment, with regions prioritizing healthcare advancements and technological integration showing faster growth in the sector. Despite these challenges, the overall global trend toward improving healthcare infrastructure and treatment options for chronic diseases presents a positive outlook for the apheresis equipment market.

Latest Trends

Increasing Prevalence of Chronic Diseases is a Recent Trend in the Market

A recent trend in the apheresis equipment market is the increasing prevalence of chronic diseases, which has heightened the demand for therapeutic apheresis procedures. Chronic diseases such as cardiovascular disorders, autoimmune diseases, and renal diseases often require continuous management and, in some cases, therapeutic apheresis as part of the treatment plan.

According to the Centers for Disease Control and Prevention (CDC), nearly half of all adults in the US have at least one chronic condition, and this number is steadily increasing. This growing patient population, along with the rise in the adoption of apheresis as an effective treatment method for various chronic conditions, has resulted in an expanding market for apheresis equipment.

As awareness about the benefits of apheresis increases, more healthcare providers are incorporating this treatment into their practice, which in turn contributes to the rising demand. The aging global population also plays a key role in driving this trend, as older adults are more likely to suffer from chronic diseases that may require apheresis treatment. The expansion of the apheresis market driven by this trend is expected to continue as the demand for such therapies grows.

Regional Analysis

North America is leading the Apheresis Equipment Market

North America dominated the market with the highest revenue share of 38.7% owing to several key factors. A major contributor was the increasing prevalence of chronic diseases, leading to a higher demand for therapeutic apheresis procedures. Technological advancements in apheresis equipment enhanced procedure efficiency and patient outcomes, encouraging wider adoption among healthcare facilities.

Additionally, the rising geriatric population in North America, who are more susceptible to conditions requiring apheresis, further fueled market expansion. Government initiatives, such as those from the Centers for Medicare & Medicaid Services (CMS) to improve healthcare access and support advanced medical technologies, also played a role in supporting the adoption of apheresis equipment.

Major industry players, such as Terumo BCT Inc., Fresenius SE & Co. KGaA, and Haemonetics Corporation, contributed to market growth by introducing innovative products and expanding their presence in the North American market. These factors collectively resulted in a robust growth trajectory for the apheresis equipment market in North America throughout 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing prevalence of hematological disorders and a rising demand for blood components. Technological advancements in apheresis equipment are expected to improve procedure efficiency, making treatments more accessible and effective. Government initiatives, such as the Indian government’s support for enhancing healthcare infrastructure and the promotion of advanced medical technologies, are likely to facilitate the adoption of advanced apheresis technologies.

Major companies, including Terumo BCT Inc., Fresenius SE & Co. KGaA, and Haemonetics Corporation, are actively participating in the Asia-Pacific market, introducing innovative products tailored to regional needs. These factors are expected to drive the significant growth of the apheresis equipment market in the Asia-Pacific region during the forecast period.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the apheresis equipment market focus on technological advancements, product diversification, and strategic partnerships to drive growth. They invest in improving the efficiency and safety of apheresis systems, including developing automated and portable devices to enhance patient experience.

Companies also expand their product portfolios to offer a range of blood separation and collection technologies for different therapeutic applications. Strategic collaborations with hospitals and healthcare providers help increase the adoption of apheresis solutions. Additionally, they target emerging markets with growing healthcare demands and invest in raising awareness about the benefits of apheresis therapies.

Fresenius Medical Care, based in Bad Homburg, Germany, is a global leader in healthcare, specializing in dialysis and apheresis equipment. The company provides a wide range of apheresis systems used in therapeutic blood separation for various diseases, including autoimmune disorders. Fresenius Medical Care emphasizes innovation and quality, continually improving its equipment and offering personalized care solutions.

The company maintains a strong global presence, focusing on expanding its offerings and improving healthcare accessibility, particularly in emerging markets. Through ongoing research and development, Fresenius Medical Care remains a key player in the apheresis equipment market.

Top Key Players

- Terumo BCT, Inc

- Nikkiso Europe GmbH

- Mallinckrodt Plc

- Haemonetics Corporation

- Fresenius Kabi AG

- Braun SE

- Asahi Kasei Medical

Recent Developments

- In August 2023, TERUMO BCT, INC received U.S. FDA clearance for a groundbreaking platelet device, which efficiently processes blood into platelets in a single centrifugation cycle, improving the speed and reliability of blood component preparation.

- In August 2023, Fresenius Kabi AG partnered with Lupagen Inc. under a new supply and development agreement. This collaboration focuses on advancing technologies designed to streamline the delivery of cell and gene therapies directly to patients in clinical settings.

Report Scope

Report Features Description Market Value (2024) US$ 3.2 billion Forecast Revenue (2034) US$ 7.7 billion CAGR (2025-2034) 9.2% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Disposable Kits and Machines), By Technology (Centrifugation and Membrane Filtration), By Application (Neurological Disorders, Renal Disorders, Hematological Disorders, and Others), By Procedure (Plasmapheresis, Photopheresis, LDL Apheresis, Leukapheresis, and Others), By End-user (Hospitals & Clinics, Blood Donation Centers, Ambulatory Surgical Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Terumo BCT, Inc, Nikkiso Europe GmbH, Mallinckrodt Plc, Haemonetics Corporation, Fresenius Kabi AG, B. Braun SE, and Asahi Kasei Medical. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Apheresis Equipment MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Apheresis Equipment MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Terumo BCT, Inc

- Nikkiso Europe GmbH

- Mallinckrodt Plc

- Haemonetics Corporation

- Fresenius Kabi AG

- Braun SE

- Asahi Kasei Medical