Global Infusion Pump Market By Product Type (Devices, and Accessories & Consumables), By Mode of Administration (Intravenous, Subcutaneous, Intrathecal, Epidural, and Enteral), By Application (Chemotherapy/Oncology, Hematology, Gastroenterology, Diabetes Management, Analgesia/Pain Management, and Others), By End-User (Hospitals, Oncology Centers, Home Care Settings, Ambulatory Care Settings, Academic & Research Institutes, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 32730

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

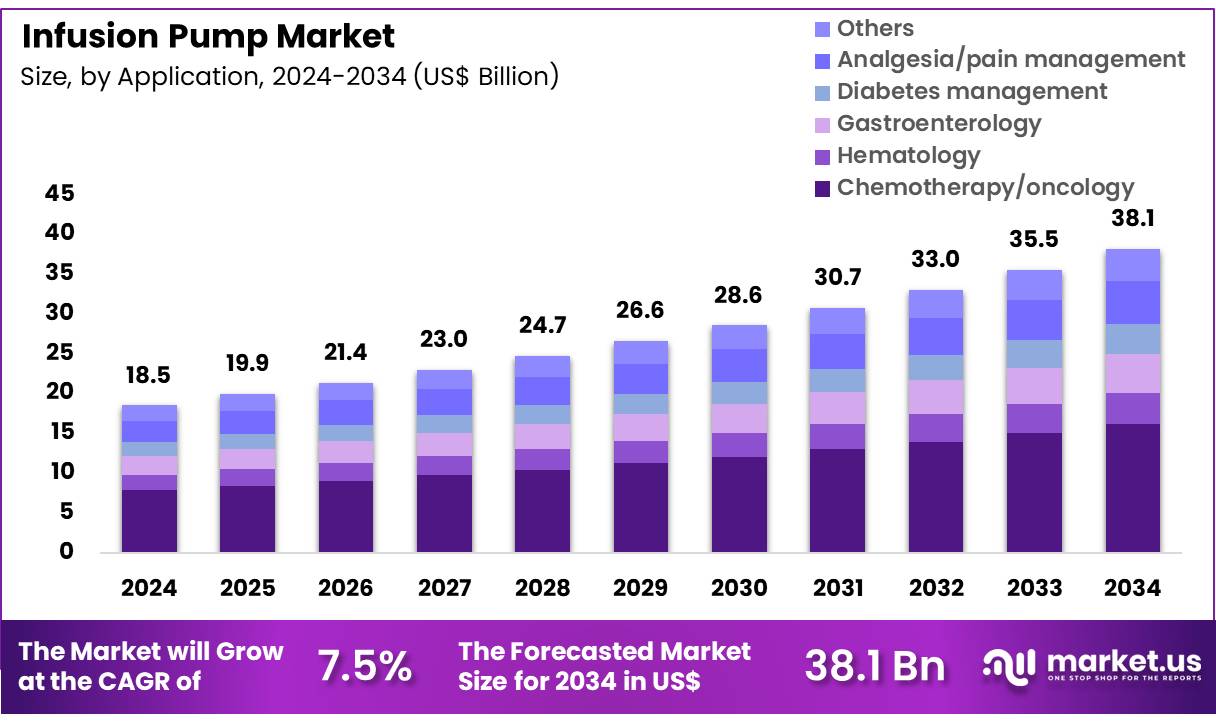

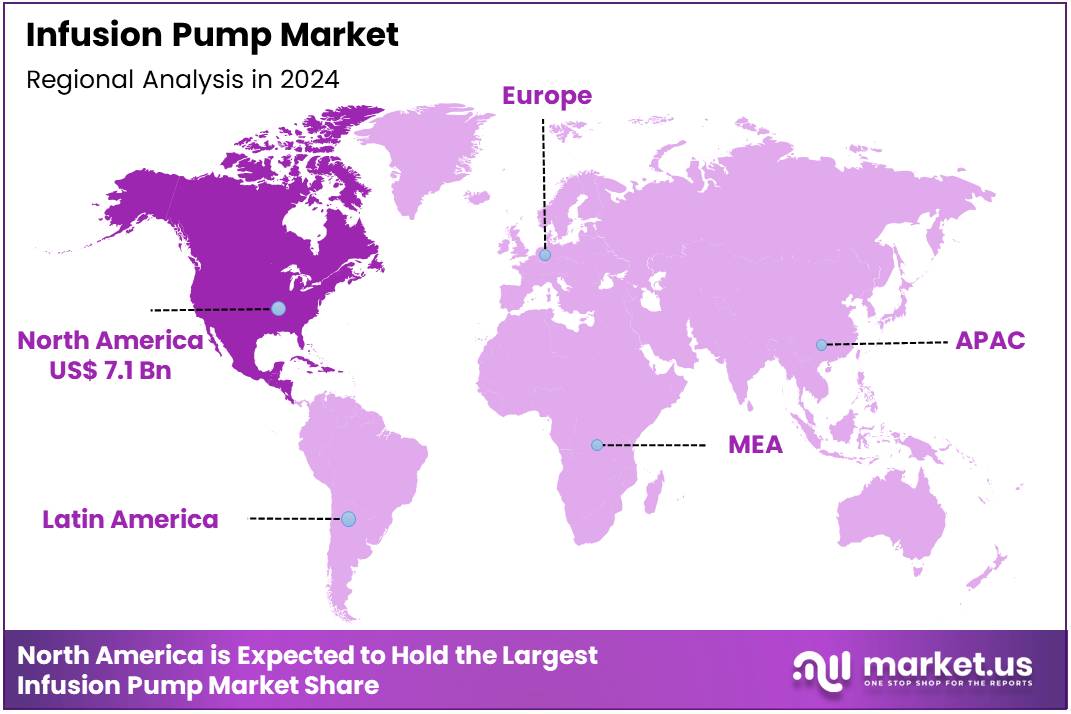

Global Infusion Pump Market size is expected to be worth around US$ 38.1 Billion by 2034 from US$ 18.5 Billion in 2024, growing at a CAGR of 7.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.5% share with a revenue of US$ 7.1 Billion.

Rising prevalence of chronic diseases propels the infusion pump market as healthcare providers demand precise drug delivery systems to manage complex patient needs effectively. Clinicians increasingly deploy infusion pumps for diabetes care, administering insulin boluses with programmable rates to stabilize glucose levels in ambulatory settings. This driver escalates with oncology protocols, where pumps deliver continuous chemotherapy infusions to minimize toxicity while maximizing therapeutic efficacy.

Hospitals utilize these devices in pain management, titrating opioids for post-surgical recovery to enhance comfort without oversedation. In February 2025, ICU Medical’s Plum 360 smart infusion system earned the ‘Best in KLAS’ distinction for eight consecutive years, reinforcing its reliability in EMR-integrated workflows. According to the CDC, 6 in 10 adults have at least one chronic disease, highlighting the essential demand for advanced infusion technologies across therapeutic applications.

Growing integration of artificial intelligence unlocks substantial opportunities in the infusion pump market. Innovators develop AI-enabled pumps that adjust flow rates dynamically, supporting neonatal applications by preventing extravasation during parenteral nutrition. Health systems explore these solutions for antimicrobial stewardship, automating antibiotic dosing in sepsis treatment to combat resistance.

Opportunities also emerge in home care, where wearable pumps facilitate enteral feeding for dysphagia patients, promoting independence. In September 2024, BD completed its $4.2 billion acquisition of Edwards Lifesciences’ Critical Care business, integrating AI-driven monitoring into the BD Alaris system for enhanced precision. The FDA cleared 124 new medical devices in 2023, including several infusion innovations, underscoring the potential for smart pumps to revolutionize patient safety and efficiency.

Recent trends in the infusion pump market emphasize safety software and regulatory advancements to optimize clinical performance. Manufacturers incorporate wireless connectivity for real-time dose error reduction, aiding critical care by alerting staff to potential occlusions in vasopressor infusions.

Trends also include modular designs for ambulatory oncology, allowing seamless transitions from hospital to outpatient settings. In August 2023, ICU Medical obtained clearance from FDA for its Plum Duo infusion pump with LifeShield safety software, advancing secure drug delivery protocols.

The CDC reports that 1 in 31 hospital patients has a healthcare-associated infection on any given day, emphasizing the role of intelligent pumps in mitigating risks. These evolutions signal a strategic progression toward interoperable, clinician-empowered infusion ecosystems.

Key Takeaways

- In 2024, the market generated a revenue of US$ 18.5 Billion, with a CAGR of 7.5%, and is expected to reach US$ 38.1 Billion by the year 2034.

- The product type segment is divided into devices and accessories & consumables, with devices taking the lead in 2023 with a market share of 73.5%.

- Considering mode of administration, the market is divided into intravenous, subcutaneous, intrathecal, epidural, and enteral. Among these, intravenous held a significant share of 56.7%.

- Furthermore, concerning the application segment, the market is segregated into chemotherapy/oncology, hematology, gastroenterology, diabetes management, analgesia/pain management, and others. The chemotherapy/oncology sector stands out as the dominant player, holding the largest revenue share of 42.3% in the market.

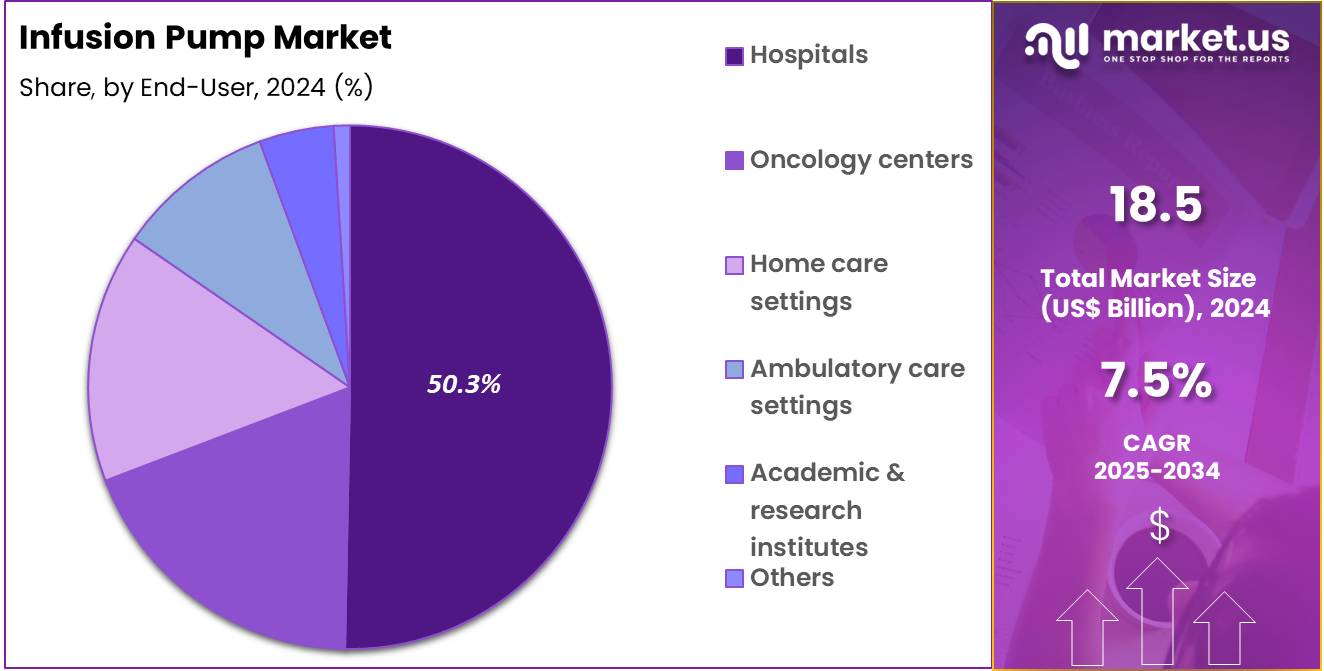

- The end-user segment is segregated into hospitals, oncology centers, home care settings, ambulatory care settings, academic & research institutes, and others, with the hospitals segment leading the market, holding a revenue share of 50.3%.

- North America led the market by securing a market share of 38.5% in 2023.

Product Type Analysis

Devices account for the largest share in the infusion pump market, with 73.5% of the market share, and are expected to maintain strong growth due to their essential role in the safe and accurate administration of fluids and medications. The rising prevalence of chronic diseases, such as diabetes, cancer, and cardiovascular conditions, is anticipated to increase the demand for infusion pumps. With advancements in pump technology, including smart pumps that provide real-time feedback and automated safety checks, healthcare providers are increasingly adopting devices for precise medication delivery.

The growing demand for homecare solutions also strengthens the market for devices, as patients with chronic conditions or undergoing long-term treatments increasingly prefer to manage their care at home. Innovations such as mobile connectivity and integration with electronic health records (EHR) systems are expected to enhance the appeal of infusion pumps, driving further adoption in both hospitals and homecare settings. Additionally, regulatory advancements and improved reimbursement policies are likely to foster market growth for infusion devices.

Mode of Administration Analysis

Intravenous (IV) administration holds 56.7% of the market share and is projected to continue leading the mode of administration segment due to its widespread use in hospitals for administering fluids, nutrients, and medications. IV infusion is essential for the immediate delivery of drugs, especially in emergency and critical care situations. The increasing prevalence of conditions such as cancer, diabetes, and dehydration, which require intravenous medication, is expected to drive demand.

Additionally, advances in IV pump technology, including more precise control, automated infusion rates, and patient monitoring, are likely to expand their usage. Hospitals, particularly those focusing on intensive care units (ICUs) and emergency departments, are expected to increase their adoption of advanced intravenous infusion pumps for better patient outcomes.

Furthermore, IV therapy is projected to continue playing a significant role in the increasing trend of outpatient care, where patients receive intravenous medications in non-hospital settings. The ease of use and rapid action of intravenous administration makes it the preferred method in both acute and long-term treatments.

Application Analysis

Chemotherapy/oncology represents 42.3% of the application segment in the infusion pump market and is expected to experience substantial growth as the global incidence of cancer continues to rise. Infusion pumps are essential in oncology for the precise administration of chemotherapy drugs, allowing for controlled dosing and minimizing adverse side effects.

The growing demand for personalized cancer treatments, including targeted therapies and immunotherapies, is anticipated to increase the adoption of infusion pumps in oncology settings. Moreover, advancements in infusion pump technology, such as the integration of real-time monitoring and the ability to administer multiple drugs simultaneously, are likely to improve treatment outcomes and patient safety.

As the treatment landscape in oncology becomes more complex, the demand for reliable, accurate, and efficient infusion systems is expected to rise, further strengthening the market for chemotherapy applications. In addition, the increasing number of outpatient oncology clinics and homecare settings offering infusion therapies is expected to contribute to growth in this segment.

End-User Analysis

Hospitals account for 50.3% of the end-user segment in the infusion pump market and are expected to remain the dominant consumers due to their critical role in patient care and high-volume medical treatments. Hospitals use infusion pumps extensively in various departments, including oncology, cardiology, emergency, and critical care, where the need for accurate and continuous medication delivery is paramount.

The increasing prevalence of chronic diseases, such as diabetes and cardiovascular diseases, alongside the rising elderly population requiring infusion therapies, is expected to drive demand in hospitals. As healthcare systems transition toward value-based care and improved patient safety, hospitals are expected to invest in more advanced, smart infusion pumps that offer automated features, real-time monitoring, and data integration with electronic health systems.

Additionally, hospitals’ efforts to reduce medication errors and improve patient outcomes through precise dosing will continue to propel the adoption of advanced infusion pumps. As the healthcare landscape evolves with a growing focus on outpatient care and home healthcare, hospitals will continue to play a pivotal role in driving the demand for infusion pump technology.

Key Market Segments

By Product Type

- Devices

- Accessories & Consumables

By Mode of Administration

- Intravenous

- Subcutaneous

- Intrathecal

- Epidural

- Enteral

By Application

- Chemotherapy/Oncology

- Hematology

- Gastroenterology

- Diabetes Management

- Analgesia/Pain Management

- Others

By End-User

- Hospitals

- Oncology Centers

- Home Care Settings

- Ambulatory Care Settings

- Academic & Research Institutes

- Others

Drivers

Increasing Prevalence of Diabetes is Driving the Market

The rising number of individuals diagnosed with diabetes has significantly propelled demand for infusion pumps, particularly those designed for precise insulin delivery to manage blood glucose levels effectively. This chronic condition necessitates continuous and accurate medication administration, making advanced infusion systems indispensable for patient care. As diabetes affects a substantial portion of the population, healthcare providers increasingly rely on these devices to prevent complications such as hypoglycemia or hyperglycemia.

The integration of infusion pumps with continuous glucose monitoring systems further enhances their utility, allowing for automated adjustments in insulin dosing. This driver is amplified by the need for reliable, portable solutions that support daily living without constant medical supervision. Government health agencies have documented a steady uptick in diabetes cases, underscoring the urgency for scalable infusion technologies.

For instance, the Centers for Disease Control and Prevention reported that 38.4 million people (all age groups), or 11.6 percent of the US population, had diabetes as of the latest available data. This figure highlights the scale of the challenge and the corresponding market expansion for infusion equipment.

Key manufacturers have responded by innovating user-friendly models that align with diabetes management guidelines. The economic burden of unmanaged diabetes further incentivizes adoption, as pumps reduce hospitalization rates through proactive therapy. Overall, this demographic shift ensures sustained investment in infusion pump development to meet evolving clinical needs.

Restraints

Frequent Regulatory Recalls Due to Safety Concerns is Restraining the Market

Regulatory recalls stemming from safety vulnerabilities in infusion pumps pose a substantial barrier to widespread adoption and market confidence. These events often arise from software glitches, mechanical failures, or compatibility issues that could lead to over- or under-dosing of critical medications. Such incidents trigger mandatory corrections or removals, disrupting supply chains and eroding trust among healthcare providers.

Manufacturers face heightened scrutiny from oversight bodies, resulting in delayed product launches and increased compliance costs. This restraint is particularly acute in hospital settings, where reliability is paramount for patient safety. The financial implications include potential litigation and reputational damage, deterring innovation investments.

A notable example occurred when B. Braun Medical Inc. initiated a recall of 10,655 Infusomat Space Large Volume Pumps due to a software anomaly that could cause delivery inaccuracies. This action, classified by the Food and Drug Administration, affected devices distributed between October 2022 and July 2023.

Healthcare facilities must then invest in retraining and alternative equipment, straining operational budgets. Moreover, these recalls amplify calls for stricter pre-market testing, slowing overall market penetration. Consequently, stakeholders prioritize risk mitigation over expansion, limiting growth potential in the sector.

Opportunities

Expansion of Home-Based Infusion Therapy is Creating Growth Opportunities

The shift toward home-based care presents a pivotal opportunity for infusion pump manufacturers to capture emerging demand in non-hospital environments. This transition is fueled by patient preferences for comfort and independence, coupled with cost efficiencies for healthcare systems. Infusion pumps tailored for ambulatory use enable seamless therapy continuation outside clinical walls, reducing readmission risks.

Technological enhancements, such as wireless connectivity and user interfaces, facilitate remote monitoring by caregivers. Government initiatives promoting value-based care further bolster this avenue, encouraging device portability and ease of integration. Key players are leveraging their portfolios to penetrate this space, driving revenue diversification.

Baxter International Inc., for example, reported $ 1.1 billion in revenue from its Infusion Therapies and Technologies segment in 2024, reflecting expansion into home settings as part of its Medical Products and Therapies offerings. This segment’s performance underscores the viability of home infusion solutions amid broader care continuum evolution.

Opportunities also arise in partnerships with telehealth providers for enhanced support services. As aging populations seek domiciliary options, customized pumps could address specific therapeutic needs like chemotherapy or nutrition. Ultimately, this domain fosters innovation in compact, durable designs, positioning the market for accelerated uptake.

Impact of Macroeconomic / Geopolitical Factors

Rising energy costs and tight budgets are pressuring manufacturers in the infusion pump market, forcing them to focus on core tubing improvements rather than wireless interoperability upgrades. Trade barriers between the U.S. and China, along with Red Sea shipping delays, are slowing imports of precision actuators, increasing compliance and freight costs for wide-scale deployments.

To address this, some companies are partnering with actuator suppliers in Ohio, adding tamper-proof protocols to speed CMS approvals and attract precision therapy investors. Growing chronic illness caseloads are driving CMS grants toward ambulatory dosage controllers, boosting adoption in hospice networks.

U.S. investigations into medical equipment imports are raising concerns over tariffs on Asian-made consoles, increasing assembly costs and limiting inventory for rural clinics. In response, manufacturers are leveraging federal incentives to establish molding and assembly hubs in Indiana, introducing haptic dose verification and improving leak-proof seals, strengthening the reliability and safety of infusion pumps.

Latest Trends

Introduction of Precision IV Pumps with Enhanced Accuracy is a Recent Trend

The emergence of precision IV pumps represents a transformative trend in infusion therapy, emphasizing superior dosing reliability in clinical practice. These devices incorporate advanced sensors and algorithms to minimize variability, ensuring consistent fluid delivery irrespective of environmental factors. This development aligns with heightened emphasis on data-driven patient outcomes and error reduction. Full-color interfaces and interoperability with electronic health records streamline clinician workflows, promoting efficiency.

The trend gained momentum in 2025 with regulatory endorsements for next-generation models. ICU Medical Inc. secured Food and Drug Administration clearance for its Plum Solo and Plum Duo pumps, achieving ±3 percent accuracy under real-world conditions, including compatibility with blood products. Such precision addresses longstanding inconsistencies in traditional systems, enhancing safety protocols.

Integration with broader platforms anticipates future expansions, like synchronized syringe and ambulatory pumps. Healthcare leaders view this as a benchmark for future-proofing infusion infrastructure. Adoption is projected to rise with demonstrated reductions in adverse events. This evolution not only refines therapeutic precision but also supports scalable deployment across diverse care venues.

Regional Analysis

North America is leading the Infusion Pump Market

In 2024, North America secured a 39.9% share of the global creatine kinase reagent market, bolstered by heightened clinical adoption for cardiac biomarker assessment amid persistent high rates of myocardial infarction and muscular disorders in an aging population. Diagnostic labs expanded utilization of high-sensitivity reagents to improve assay precision, enabling earlier detection of tissue damage in emergency settings and supporting adjusted therapeutic protocols for patients with comorbidities.

Regulatory emphasis on quality control standards enhanced reagent formulation stability, reducing variability in results for point-of-care applications in ambulatory care centers. Academic collaborations with reagent suppliers refined enzyme-linked compositions, optimizing compatibility with automated analyzers for high-throughput processing in hospital networks.

Demographic trends, including increased obesity rates, amplified testing demands for rhabdomyolysis monitoring in sports medicine. These factors illustrated the region’s focus on diagnostic efficiency for cardiovascular outcomes. The Centers for Disease Control and Prevention reported approximately 805,000 heart attacks annually in the United States, with 605,000 being first-time events, underscoring the ongoing need for CK testing from 2022 onward.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Health ministries in Asia Pacific anticipate the creatine kinase reagent sector to surge during the forecast period, as escalating cardiovascular burdens in urbanizing nations necessitate expanded biomarker screening infrastructures. Authorities in India and China allocate funds to subsidize reagent kits for public hospitals, equipping them to handle large-scale assays for acute coronary syndromes in high-density populations.

Diagnostic firms partner with regional research institutes to customize formulations for local enzyme variants, projecting improved accuracy in detecting myopathy in tropical climates. Innovation hubs in South Korea and Japan pioneer freeze-dried reagents, positioning remote clinics to conduct reliable tests without cold-chain dependencies.

Governments estimate incorporating the reagent into national health surveys, addressing gaps in muscular dystrophy diagnostics for pediatric cohorts. Local innovators integrate pH-stabilized components, synchronizing with mobile labs to monitor rhabdomyolysis in labor-intensive sectors.

These initiatives build a foundation for equitable renal and cardiac risk evaluation. The World Health Organization documented 19.8 million cardiovascular disease deaths globally in 2022, with a significant proportion in Asia Pacific, highlighting the imperative for enhanced testing capabilities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the infusion therapy sector drive growth by launching compact, wireless devices with real-time dose monitoring, enhancing patient mobility and safety. They form alliances with hospitals to integrate smart pumps with EHR systems, streamlining medication delivery workflows. Companies invest in user-friendly interfaces and remote calibration to reduce errors and boost clinician adoption.

Executives acquire niche sensor developers to embed predictive maintenance, cutting downtime costs. They expand into Africa and Southeast Asia, aligning with local health policies to tap growing demand. Additionally, they offer subscription-based analytics to optimize usage and secure steady revenue.

Becton, Dickinson and Company (BD), founded in 1897 and based in Franklin Lakes, New Jersey, develops advanced medical devices, including infusion systems for precise drug administration. Its BD Alaris platform enhances safety with automated dose checks and connectivity features.

BD focuses on R&D to improve pump portability and interoperability for global healthcare settings. CEO Tom Polen leads operations across 50 countries, emphasizing innovation and reliability. The firm partners with clinics to support seamless care delivery. BD strengthens its market leadership through technology-driven solutions and strategic global outreach..

Top Key Players

- ICU Medical Inc

- Fresenius SE and Co. KGaA

- Flowonix Medical Inc

- Eitan Medical Ltd

- Digicare Biomedical Technology Inc

- CODAN ARGUS AG

- Beijing KellyMed Co. Ltd

- Becton Dickinson and Co

- Baxter International Inc

- Braun SE

- Arcomed AG

- ADOX SA

Recent Developments

- In April 2025, Medtronic received FDA approval for the Simplera Sync sensor to be used with its MiniMed 780G insulin delivery system. By enabling Meal Detection technology with both Guardian 4 and Simplera Sync sensors, this approval enhances system versatility and personalization, driving demand for advanced, integrated infusion pumps in diabetes care.

- In March 2025, Terumo Corporation inaugurated its “D-TECT” R&D facility in Aliso Viejo, California. The center fosters collaboration with medical institutions, academia, and startups, supporting innovation in infusion and vascular technologies. This strategic investment accelerates development of next-generation infusion pump solutions, enhancing Terumo’s competitiveness in the global market.

Report Scope

Report Features Description Market Value (2024) US$ 18.5 Billion Forecast Revenue (2034) US$ 38.1 Billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Devices, and Accessories & Consumables), By Mode of Administration (Intravenous, Subcutaneous, Intrathecal, Epidural, and Enteral), By Application (Chemotherapy/Oncology, Hematology, Gastroenterology, Diabetes Management, Analgesia/Pain Management, and Others), By End-User (Hospitals, Oncology Centers, Home Care Settings, Ambulatory Care Settings, Academic & Research Institutes, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ICU Medical Inc, Fresenius SE and Co. KGaA, Flowonix Medical Inc, Eitan Medical Ltd, Digicare Biomedical Technology Inc, CODAN ARGUS AG, Beijing KellyMed Co. Ltd, Becton Dickinson and Co, Baxter International Inc, B.Braun SE, Arcomed AG, ADOX SA. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ICU Medical Inc

- Fresenius SE and Co. KGaA

- Flowonix Medical Inc

- Eitan Medical Ltd

- Digicare Biomedical Technology Inc

- CODAN ARGUS AG

- Beijing KellyMed Co. Ltd

- Becton Dickinson and Co

- Baxter International Inc

- Braun SE

- Arcomed AG

- ADOX SA