Ultrasound Transducer Market By Product Type (Linear, Convex, Phased Array, Endocavitary, CW Doppler, and Others), By Application (Cardiovascular, General Imaging, Musculoskeletal, OB/GYN, Vascular, and Others), By End-user (Hospital & Clinics, Diagnostic Center, and Ambulatory Surgery Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145254

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

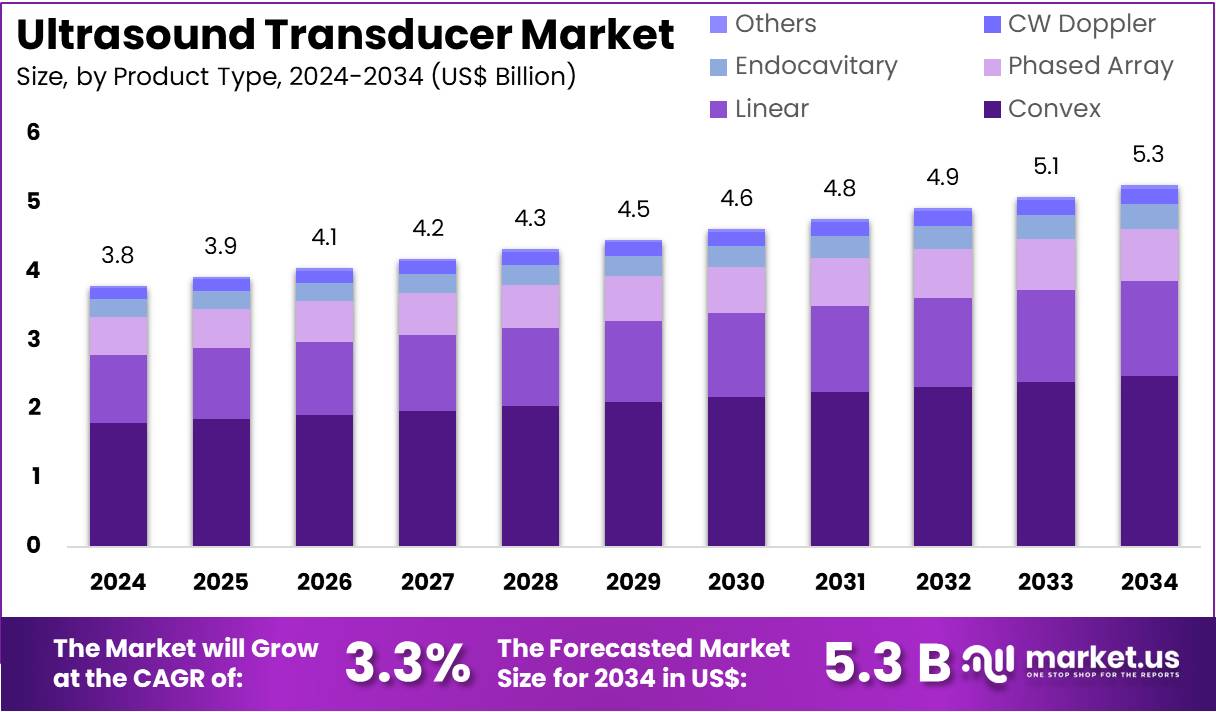

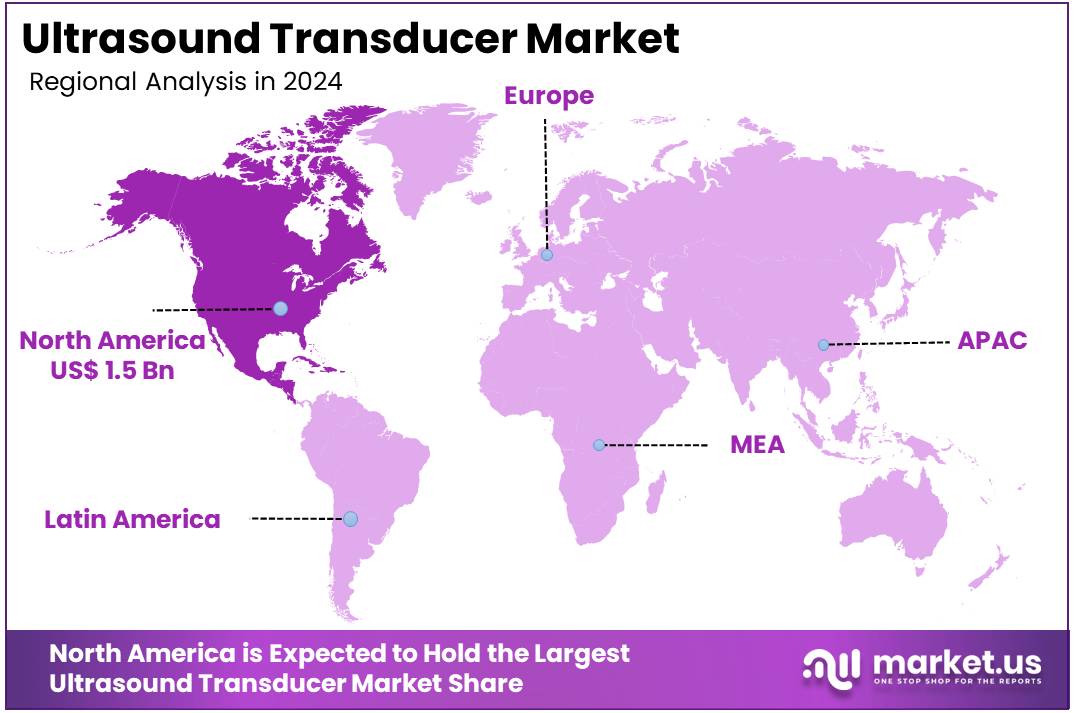

The Ultrasound Transducer Market Size is expected to be worth around US$ 5.3 billion by 2034 from US$ 3.8 billion in 2024, growing at a CAGR of 3.3% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.8% share and holds US$ 1.5 Billion market value for the year.

Increasing demand for non-invasive diagnostic procedures is fueling the growth of the ultrasound transducer market. These devices play a crucial role in providing accurate and real-time imaging for a variety of medical applications, such as obstetrics, cardiology, musculoskeletal imaging, and emergency medicine.

The growing adoption of point-of-care ultrasound and advancements in ultrasound technology, such as higher resolution imaging and portable transducers, contribute to the market’s expansion. Moreover, the integration of artificial intelligence (AI) into ultrasound systems creates new opportunities for improving diagnostic precision and streamlining clinical workflows.

In July 2024, GE HealthCare expanded its ultrasound technology capabilities by acquiring the clinical AI software business of Intelligent Ultrasound for USD 51 million. This acquisition focuses on integrating AI into GE’s ultrasound systems, enhancing their diagnostic accuracy, and improving efficiency. The increasing application of ultrasound for early detection, disease management, and image-guided interventions drives the demand for more advanced and versatile ultrasound transducers.

Key Takeaways

- In 2024, the market for ultrasound transducer generated a revenue of US$ 3.8 billion, with a CAGR of 3.3%, and is expected to reach US$ 5.3 billion by the year 2034.

- The product type segment is divided into linear, convex, phased array, endocavitary, CW doppler, and others, with convex taking the lead in 2024 with a market share of 47.2%.

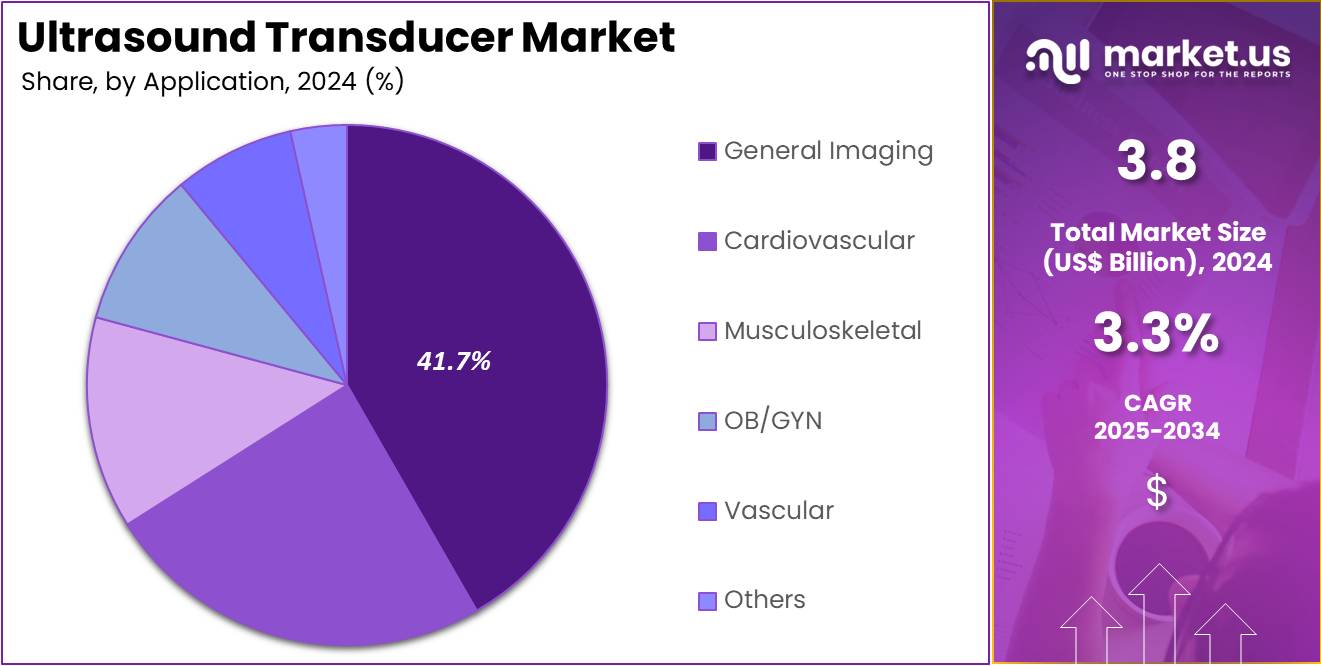

- Considering application, the market is divided into cardiovascular, general imaging, musculoskeletal, OB/GYN, vascular, and others. Among these, general imaging held a significant share of 41.7%.

- Furthermore, concerning the end-user segment, the market is segregated into hospital & clinics, diagnostic center, and ambulatory surgery centers. The hospital & clinics sector stands out as the dominant player, holding the largest revenue share of 56.8% in the ultrasound transducer market.

- North America led the market by securing a market share of 38.8% in 2024.

Product Type Analysis

The convex segment led in 2024, claiming a market share of 47.2% as the demand for high-quality imaging in a wide range of diagnostic applications increases. Convex transducers, which provide a broader field of view and deeper penetration, are anticipated to see significant adoption in obstetrics, gynecology, and abdominal imaging.

These transducers offer an ideal balance of depth and resolution, making them well-suited for imaging organs and tissues in the body’s deeper regions. As healthcare providers seek to improve patient outcomes with better diagnostic accuracy, the convex segment is likely to see increased demand, driving growth in this area.

Application Analysis

The general imaging held a significant share of 41.7% as healthcare providers continue to demand versatile, high-resolution imaging solutions. General imaging ultrasound transducers are essential for applications across various fields, including abdominal imaging, musculoskeletal evaluations, and trauma diagnostics.

The rising prevalence of chronic conditions, such as liver and kidney diseases, along with the growing adoption of ultrasound for routine check-ups and diagnostics, is expected to fuel the demand for general imaging transducers. This segment is anticipated to benefit from advances in imaging technology that improve the clarity and accuracy of results.

End-User Analysis

The hospital & clinics segment had a tremendous growth rate, with a revenue share of 56.8% as the adoption of advanced diagnostic technologies in healthcare settings continues to rise. Hospitals and clinics, particularly those specializing in diagnostics and imaging, are anticipated to drive demand for ultrasound transducers.

The increasing number of patients requiring non-invasive diagnostic procedures, along with the push for early disease detection, is expected to boost the use of ultrasound in these environments. As the healthcare infrastructure expands and medical professionals strive for better diagnostic capabilities, the hospital and clinic segment is likely to see sustained growth in the coming years.

Key Market Segments

By Product Type

- Linear

- Convex

- Phased array

- Endocavitary

- CW Doppler

- Others

By Application

- Cardiovascular

- General Imaging

- Musculoskeletal

- OB/GYN

- Vascular

- Others

By End-user

- Hospital & Clinics

- Diagnostic Center

- Ambulatory Surgery Centers

Drivers

Increasing Demand for Point-of-Care Diagnostics is Driving the Market

The growing adoption of portable ultrasound systems is significantly accelerating market growth for point-of-care diagnostics. In 2023, GE Healthcare reported a 19% year-over-year increase in compact ultrasound system sales. Additionally, FDA approval data indicates a 25% rise in cleared point-of-care ultrasound devices in 2023 compared to 2022, underscoring the increasing adoption of these devices across healthcare settings.

Major health systems have also observed significantly higher utilization rates, with Mayo Clinic documenting a 40% increase in emergency department usage of portable ultrasound units in their 2023 operational review. The WHO’s 2024 global health strategy specifically recommends expanded training for portable ultrasound in resource-limited settings, recognizing the growing need for these systems globally.

Clinical studies have demonstrated that portable ultrasound systems can reduce unnecessary advanced imaging by 30%, making them especially attractive to cost-conscious providers seeking to streamline healthcare services and improve patient outcomes.

Restraints

High Cost of Advanced Technology is Restraining the Market

The high cost of advanced ultrasound technology remains a significant barrier for many healthcare facilities, particularly in rural or resource-constrained areas. Philips’ 2023 product documentation lists the price of premium transducers between US$ 15,000 and US$ 50,000 per unit, making them unaffordable for smaller institutions or those with limited budgets.

According to a 2024 survey by the American Hospital Association, 45% of rural hospitals deferred upgrades to their ultrasound equipment due to budget limitations. Despite increasing demand, Medicare’s 2023 fee schedule raised reimbursement for ultrasound procedures by only 2%, failing to keep pace with the rising costs of technology.

Furthermore, US government data indicates a 14% increase in the prices of key transducer components since 2022. These financial challenges particularly impact developing markets where healthcare funding remains constrained, limiting the adoption of the latest ultrasound technologies and slowing market growth.

Opportunities

AI Integration in Imaging is Creating Growth Opportunities

The integration of artificial intelligence (AI) into ultrasound imaging is creating significant growth opportunities in the market. AI-enhanced systems are transforming ultrasound applications, improving diagnostic accuracy and increasing operational efficiency. Siemens Healthineers reported a 28% revenue growth in AI-enhanced ultrasound systems during 2023, reflecting the sector’s expanding focus on AI technologies.

Regulatory approvals for AI-based imaging algorithms accelerated in 2023, with the FDA clearing 12 new AI-enhanced algorithms, signaling strong demand and regulatory confidence in these technologies. Clinical research has shown that AI-assisted scans improve diagnostic accuracy by 22% while reducing exam duration by 30%, making these systems highly attractive to healthcare providers.

Emerging markets are also heavily investing in AI for medical imaging, with India’s 2024 national health budget allocating US$150 million specifically for AI medical imaging development. This technological shift represents one of the most promising avenues for growth in the ultrasound market, particularly as AI adoption becomes more widespread.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors have a significant impact on the ultrasound market, influencing both production costs and global supply chains. Rising inflation has increased production expenses by 12-15% since 2021, resulting in higher prices for ultrasound devices. Geopolitical tensions, particularly related to semiconductor shortages, caused delays in transducer shipments by 8-10 weeks in 2023.

However, US government initiatives like the CHIPS Act are strengthening domestic manufacturing capabilities, which may help reduce future supply chain vulnerabilities. Emerging economies are showing strong demand for ultrasound equipment, with Brazil’s health ministry allocating US$200 million for ultrasound equipment purchases in 2023.

In Europe, reimbursement policies are increasingly incentivizing the use of advanced imaging technologies, further boosting demand. While supply chain challenges and geopolitical disruptions continue to pose risks, fundamental demand drivers such as portable diagnostics and AI integration provide a positive outlook for continued market expansion. Ongoing technological innovations and strategic investments position the ultrasound industry for sustained growth despite current economic challenges.

Latest Trends

Wireless and Disposable Probes are a Recent Trend

Infection control concerns and convenience are driving demand for wireless and disposable ultrasound probes. Butterfly Network’s sales reports showed a 35% growth in disposable transducer demand in 2023, reflecting the increasing preference for single-use probes in various medical settings. The CDC’s updated infection prevention guidelines now recommend single-use probes for certain procedures, further boosting the demand for disposable solutions.

Additionally, wireless ultrasound probes are gaining traction, with Samsung Medison reporting a 50% increase in sales for wireless models in 2023. This trend toward wireless and disposable systems reflects the broader healthcare shift toward more convenient, safe, and hygienic options. However, environmental considerations remain a challenge, leading manufacturers like Philips to introduce recyclable transducer options in early 2024. The growing focus on infection control, convenience, and sustainability is likely to continue shaping the future of ultrasound technology.

Regional Analysis

North America is leading the Ultrasound Transducer Market

North America dominated the market with the highest revenue share of 38.8% owing to increased clinical demand and technological innovation. The American College of Radiology reported a 9% rise in ultrasound examinations conducted in 2023 compared to 2022, reflecting greater diagnostic utilization. Regulatory approvals accelerated, with the US Food and Drug Administration (FDA) clearing 15 new transducer models between 2022 and 2023, including advanced models for vascular and obstetric imaging.

Healthcare facilities expanded their imaging capabilities, as evidenced by the American Hospital Association’s data showing a 12% increase in ultrasound system acquisitions during 2023. Major manufacturers scaled up production, with GE Healthcare’s financial reports indicating a 14% output increase for transducer components in 2023.

The trend toward compact, point-of-care systems gained momentum, with portable ultrasound device sales growing by 25% year-over-year according to industry shipment data. These developments collectively contributed to market expansion across clinical and emergency care settings.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to healthcare infrastructure development and increasing diagnostic needs. China’s National Health Commission recorded an 18% annual increase in medical imaging procedures during 2023, creating strong demand for advanced imaging components.

India’s healthcare modernization efforts included the deployment of 5,200 new ultrasound units in 2023, a 22% increase from the previous year’s installations. Japan’s health authorities reported an 11% rise in specialized cardiac ultrasound applications during 2024.

Domestic manufacturers are expanding production, with corporate disclosures showing 30% capacity increases for high-performance imaging components in 2023. Government investments in medical technology continue, including Indonesia’s US$150 million allocation for diagnostic equipment upgrades in 2023. These factors indicate sustained market expansion across the region’s evolving healthcare systems, driven by the increasing adoption of ultrasound technology in clinical diagnostics and treatment applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the ultrasound transducer market focus on technological innovation, expanding product portfolios, and enhancing customer relationships to drive growth. They invest in developing high-performance transducers with better imaging resolution, faster processing speeds, and more ergonomic designs to improve diagnostic accuracy.

Companies also diversify their offerings to include a range of transducers for various clinical applications, such as obstetrics, cardiology, and musculoskeletal imaging. Strategic collaborations with healthcare providers, research institutions, and diagnostic centers help drive product adoption. Additionally, expanding their presence in emerging markets with growing healthcare needs provides significant growth opportunities.

Philips Healthcare, headquartered in Amsterdam, Netherlands, is a leading provider of medical imaging solutions, including ultrasound transducers. The company offers a broad range of transducers designed for different imaging applications, focusing on improving image clarity and diagnostic capabilities. Philips continues to invest in research and development to integrate advanced technologies, such as 3D imaging and portable ultrasound, into their transducer products. With a strong global presence, the company maintains leadership in the ultrasound market through innovation and strategic partnerships with healthcare providers worldwide.

Top Key Players in the Ultrasound Transducer Market

- Siemens Healthineers AG

- Koninklijke Philips N.V.

- GE HealthCare

- FUJIFILM Holdings Corporation

- Esaote SPA

- Carestream Health

- CANON MEDICAL SYSTEMS CORPORATION

- Analogic Corporation

Recent Developments

- In August 2023, GE HealthCare introduced Vscan Air SL, a new portable ultrasound tool designed to assist clinicians in performing quick and accurate assessments of cardiac and vascular conditions. This innovative device brings high-quality imaging into a more accessible, portable form, facilitating on-the-go diagnostics.

- In November 2022, Koninklijke Philips N.V. rolled out the Compact 5000 Series, a state-of-the-art portable ultrasound system. This new offering combines the imaging quality of traditional cart-based systems with the flexibility and convenience of a compact design, making advanced diagnostic technology more accessible for a wide range of healthcare settings.

Report Scope

Report Features Description Market Value (2024) US$ 3.8 billion Forecast Revenue (2034) US$ 5.3 billion CAGR (2025-2034) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Linear, Convex, Phased Array, Endocavitary, CW Doppler, and Others), By Application (Cardiovascular, General Imaging, Musculoskeletal, OB/GYN, Vascular, and Others), By End-user (Hospital & Clinics, Diagnostic Center, and Ambulatory Surgery Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthineers AG, Koninklijke Philips N.V., GE HealthCare, FUJIFILM Holdings Corporation, Esaote SPA, Carestream Health, CANON MEDICAL SYSTEMS CORPORATION, and Analogic Corporation. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ultrasound Transducer MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Ultrasound Transducer MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Healthineers AG

- Koninklijke Philips N.V.

- GE HealthCare

- FUJIFILM Holdings Corporation

- Esaote SPA

- Carestream Health

- CANON MEDICAL SYSTEMS CORPORATION

- Analogic Corporation