Vet Ultrasound System Market By Product Type (Device (Cart-based and Portable) and Software), By Technology (Analog Imaging Technology, Digital Imaging Technology, and Contrast Imaging Technology), By Application (Orthopedics & Traumatology, Cardiology, Oncology and Neurology), By Animal Type (Large Animals and Small Companion Animals), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135613

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

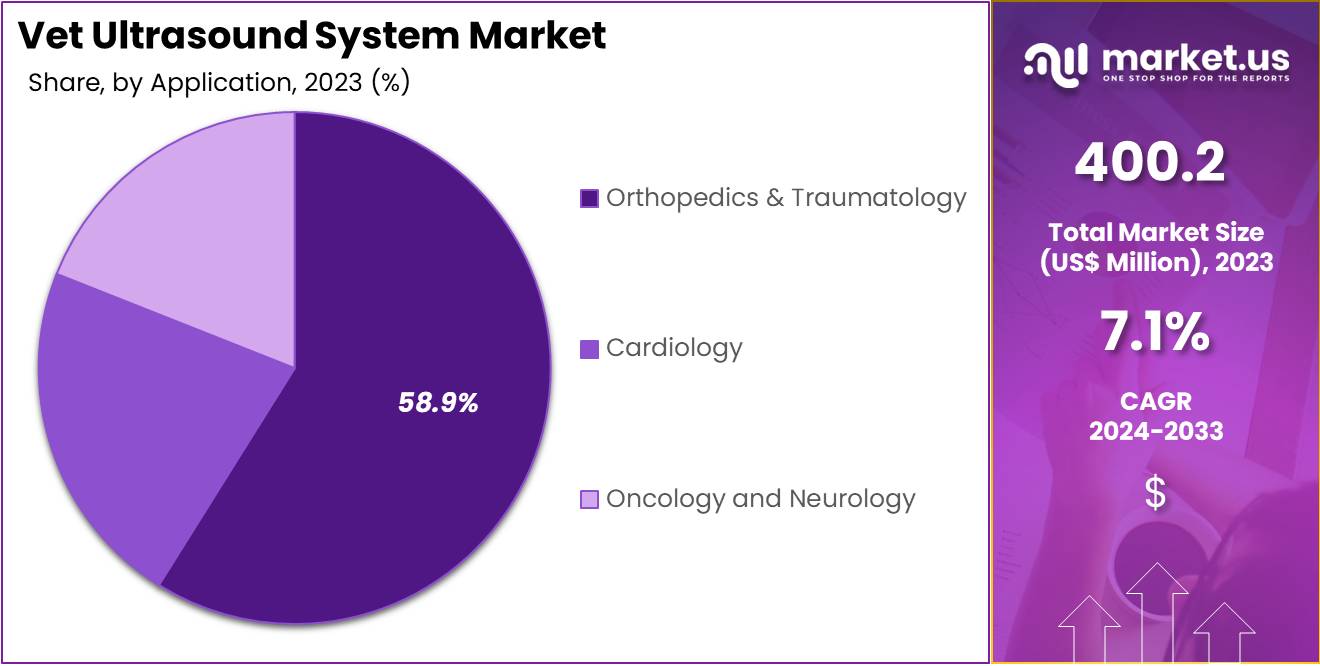

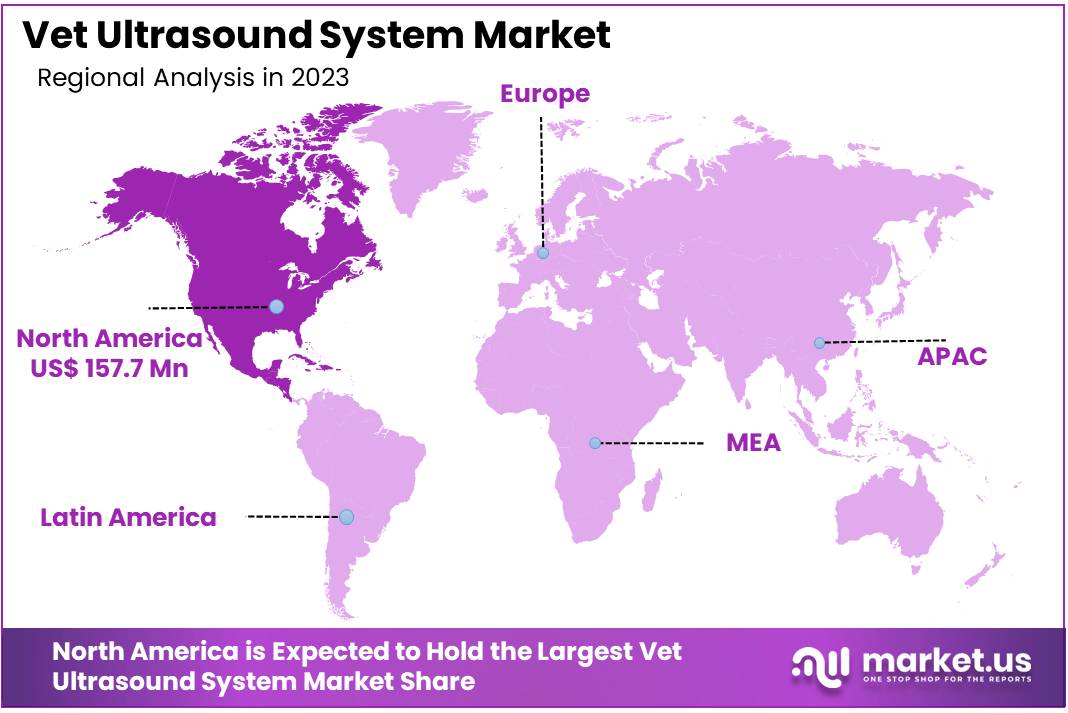

The Global Vet Ultrasound System Market size is expected to be worth around US$ 794.6 Million by 2033, from US$ 400.2 Million in 2023, growing at a CAGR of 7.1 % during the forecast period from 2024 to 2033. North America held a dominant market position, capturing more than a 39.4% share and holds US$ 157.7 Million market value for the year.

Rising demand for advanced diagnostic tools in veterinary care has fueled the growth of the veterinary ultrasound system market. These systems play a critical role in diagnosing and monitoring a variety of conditions in both domestic and non-domestic animals, such as pregnancy, organ abnormalities, and cardiovascular issues.

The ability to perform real-time, non-invasive imaging provides veterinarians with valuable insights, enabling more accurate and efficient diagnoses. Increasing awareness of animal health, coupled with the rising pet ownership trend, drives the market for veterinary ultrasound systems. Additionally, advancements in portable and high-resolution ultrasound technologies create new opportunities for veterinarians in remote or underserved areas.

Ultrasound systems also find applications in emergency and critical care settings, aiding in quick decision-making during acute conditions. In September 2024, a collaboration between zoos and aquariums across the US led to the creation of the Zoo and Aquarium Radiology Database (ZARD). This initiative aims to provide a vast archive of diagnostic images for non-domestic species, which often lack adequate reference material, further highlighting the growing demand for sophisticated diagnostic tools in veterinary practice.

As these technologies continue to evolve, the veterinary ultrasound system market is poised for significant expansion, offering more precise, accessible, and diverse applications in animal healthcare.

How Does Artificial Intelligence Help to Improve the Vet Ultrasound System Market?

Artificial intelligence (AI) significantly enhances veterinary ultrasound systems, markedly improving diagnostic accuracy and efficiency. AI algorithms automate image analysis, swiftly identifying patterns and abnormalities that might escape traditional methods. This technology reduces diagnostic errors, ensuring quicker and more accurate treatment responses. Automated analysis streamlines procedures, allowing veterinarians to focus on critical care aspects.

AI’s integration elevates diagnostic precision by aiding in the early detection of diseases. Machine learning models assist in pinpointing subtle signs that are crucial for early intervention, particularly beneficial in complex cases. This advanced detection capability fosters more effective treatment plans, enhancing animal healthcare outcomes.

Efficiency is further amplified through AI by automating routine tasks such as organ measurements and index calculations. This optimization frees veterinary professionals to concentrate more on patient care rather than administrative tasks. Moreover, AI-powered systems offer real-time feedback and guidance, which is invaluable for training less experienced practitioners, thus raising the overall care standard.

AI also plays a pivotal role in developing portable ultrasound devices that deliver high-quality imaging on-the-go. Such innovations make veterinary care more accessible, especially in remote areas, and promote the integration of ultrasound systems with other health technologies. This creates a cohesive and efficient veterinary healthcare environment, fostering broader adoption of advanced ultrasound capabilities.

Key Takeaways

- In 2023, the market for Vet Ultrasound System generated a revenue of US$ 400.2 million, with a CAGR of 7.1%, and is expected to reach US$ 794.6 million by the year 2033.

- The product type segment is divided into device and software, with device taking the lead in 2023 with a market share of 67.5%.

- Considering technology, the market is divided into analog imaging technology, digital imaging technology, and contrast imaging technology. Among these, digital imaging technology held a significant share of 72.4%.

- Furthermore, concerning the application segment, the market is segregated into orthopedics & traumatology, cardiology, oncology and neurology. The orthopedics & traumatology sector stands out as the dominant player, holding the largest revenue share of 58.9% in the Vet Ultrasound System market.

- The animal type segment is segregated into large animals and small companion animals, with the large animals segment leading the market, holding a revenue share of 68.7%.

- North America led the market by securing a market share of 39.4% in 2023.

Product Type Analysis

The device segment led in 2023, claiming a market share of 67.5% owing to the increasing demand for accurate and efficient diagnostic tools in veterinary medicine. Advancements in ultrasound technology, particularly portable and user-friendly devices, are likely to drive the growth of this segment. Veterinarians increasingly rely on ultrasound devices for non-invasive diagnosis of a wide range of conditions in animals, from abdominal issues to cardiac assessments.

The growing adoption of point-of-care diagnostics in veterinary clinics and mobile veterinary services is anticipated to boost the demand for portable ultrasound devices. Furthermore, the focus on improving animal welfare and the growing number of pet owners seeking better healthcare solutions are expected to contribute to the increased market demand for these devices.

Technology Analysis

The digital imaging technology held a significant share of 72.4% as veterinary professionals seek enhanced imaging quality and precision. Digital imaging technology provides clearer, more detailed images compared to analog alternatives, improving diagnostic accuracy in animals. The growing trend of adopting advanced diagnostic tools in veterinary practices, especially for monitoring and diagnosing complex conditions like tumors and heart disease, is likely to drive the growth of this segment.

Additionally, the ability to store, share, and analyze digital images easily has made digital imaging technology highly popular in veterinary clinics. The integration of digital ultrasound technology with other veterinary equipment and the increasing demand for non-invasive diagnostic techniques are expected to further fuel this segment’s expansion.

Application Analysis

The orthopedics & traumatology segment had a tremendous growth rate, with a revenue share of 58.9% owing to the increasing demand for advanced diagnostic techniques in veterinary orthopedics. Ultrasound systems are widely used for imaging musculoskeletal conditions, joint injuries, fractures, and soft tissue abnormalities in animals. The ability of ultrasound to provide real-time, non-invasive imaging makes it highly effective for diagnosing and monitoring orthopedic and traumatology conditions.

The growing prevalence of traumatic injuries in both pets and working animals is likely to drive this market segment. Moreover, advancements in ultrasound technology, such as higher resolution imaging and portability, have increased their adoption in veterinary clinics and mobile veterinary services, further boosting this segment’s growth. As veterinary professionals increasingly rely on ultrasound for orthopedic diagnosis, this segment is projected to continue expanding.

Animal Type Analysis

The large animals segment grew at a substantial rate, generating a revenue portion of 68.7% as the demand for veterinary care in livestock and large animals continues to rise. Ultrasound systems play a crucial role in monitoring the health of large animals such as cattle, horses, and other livestock, particularly for pregnancy detection, reproductive health, and musculoskeletal issues.

The growing focus on improving animal welfare and maximizing productivity in agriculture has driven the increased adoption of advanced veterinary diagnostic tools for large animals. Additionally, veterinary clinics are investing in portable ultrasound systems for on-site diagnostics at farms, which is likely to contribute to the segment’s growth. As the demand for precise and timely veterinary care in large animals grows, the large animals segment is expected to expand significantly.

Key Market Segments

By Product Type

- Device

- Cart-based

- Portable

- Software

By Technology

- Analog Imaging Technology

- Digital Imaging Technology

- Contrast Imaging Technology

By Application

- Orthopedics & Traumatology

- Cardiology

- Oncology

- Neurology

By Animal Type

- Large Animals

- Small Companion Animals

Drivers

Rising Innovation Driving the Vet Ultrasound System Market

Rising innovation in veterinary diagnostic tools is significantly driving growth in the vet ultrasound system market. With advancements in technology, systems are becoming more efficient, compact, and capable of delivering high-quality imaging, which improves diagnosis and treatment outcomes for animals.

For example, in May 2024, Esaote North America Inc. introduced the MyLab FOX, a cutting-edge veterinary ultrasound system. This versatile scanning platform is designed to meet the needs of modern veterinary practices, offering enhanced imaging capabilities and ease of use.

The MyLab FOX, inspired by the fox’s agility, speed, and intelligence, raises the standard for veterinary ultrasound technology. As veterinary practices adopt these new systems, the market for advanced ultrasound equipment is expected to expand rapidly. With increased innovation, manufacturers are likely to focus on improving portability, image clarity, and diagnostic accuracy, further boosting demand for high-performance ultrasound systems in veterinary care.

Restraints

Rising Lack of Skilled Professionals Restraining the Vet Ultrasound System Market

Rising demand for advanced veterinary ultrasound systems is expected to be restrained by the shortage of skilled professionals capable of operating such sophisticated equipment. The increasing complexity of modern ultrasound systems could impede their widespread adoption, especially in regions with limited access to qualified veterinary technicians and specialists.

The high level of expertise required to operate these systems efficiently often acts as a significant barrier, particularly in smaller clinics or developing markets. Training and certification programs for veterinary ultrasound professionals are anticipated to take time to scale, and the current lack of such programs could hamper market growth. Additionally, the need for ongoing education and support to keep up with rapid technological advancements is expected to add further challenges. As a result, the lack of skilled professionals in the field may limit the adoption and effective use of veterinary ultrasound systems, restraining overall market expansion.

Opportunities

Increasing Financial Aid and Investments Present Opportunity for the Market

Increasing financial aid and investments are creating significant opportunities for growth in the vet ultrasound system market. The surge in venture capital funding is expected to accelerate innovation in veterinary diagnostic technologies, including ultrasound systems. In October 2023, Mars, Incorporated, along with Digitalis Ventures, launched Companion Fund II, a US$300 million venture capital fund. This initiative aims to support startups that leverage advanced science, technology, and design to improve veterinary care.

Such investments are likely to drive the development of more sophisticated and affordable ultrasound systems, making them accessible to a wider range of veterinary practices. The availability of financial resources is expected to foster collaboration between tech developers and veterinary professionals, leading to innovations that enhance the accuracy, portability, and ease of use of ultrasound devices. With increased funding, manufacturers are anticipated to introduce breakthrough solutions, expanding market potential and improving the standard of care for animals globally.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors can significantly impact the vet ultrasound system market. Economic challenges, such as inflation and healthcare budget cuts, may reduce veterinary clinic investments in advanced imaging technology. Trade barriers and tariffs could raise the cost of importing key components for ultrasound devices, leading to higher prices for end users.

However, a growing focus on animal healthcare and the increasing demand for non-invasive diagnostic tools for pets and livestock offer significant market growth opportunities. The rising disposable income in emerging markets and the expansion of veterinary practices worldwide also support the adoption of high-quality ultrasound systems. While these markets face challenges due to geopolitical tensions and fluctuating currencies, continued technological advancements in veterinary care will sustain long-term growth in the sector.

Trends

Rising Partnerships and Collaborations Driving the Vet Ultrasound System Market

Rising partnerships and collaborations have become a key driver for the vet ultrasound system market. High demand for affordable and portable ultrasound solutions has led to significant industry alliances. For instance, in July 2023, Konica Minolta Healthcare partnered with Healcerion to introduce the PocketPro H2, a portable ultrasound machine, in the U.S.

This device is designed for use in both human and animal applications, expanding the reach of ultrasound technology in veterinary care. Such collaborations are expected to enhance product accessibility, boost innovation, and improve the affordability of veterinary diagnostics, leading to a wider adoption of advanced ultrasound systems across veterinary clinics.

Regional Analysis

North America is leading the Vet Ultrasound System Market

North America dominated the market with the highest revenue share of 39.4% owing to increasing investment in animal healthcare and diagnostic technologies. The region’s growing pet population and rising demand for advanced diagnostic tools in veterinary clinics have led to greater adoption of ultrasound systems. The market saw further expansion with the backing of initiatives such as the Sustainable Canadian Agricultural Partnership’s Agri Assurance Program, which allocated substantial funding for animal health projects.

Veterinary professionals have increasingly relied on ultrasound systems for non-invasive, real-time imaging that aids in diagnosing various conditions in animals, including reproductive health issues, cardiac conditions, and abdominal disorders. Technological advancements in ultrasound technology, including portable and more affordable models, have also contributed to this market’s growth by expanding accessibility to both rural and urban veterinary practices.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to expanding veterinary care and increasing awareness of advanced diagnostic methods. Countries like India and China are investing heavily in improving animal healthcare infrastructure, with initiatives like the launch of specialized diagnostic units, such as the one at Guru Angad Dev Veterinary and Animal Sciences University.

This region is anticipated to see increased demand for ultrasound imaging devices due to the rising number of veterinary clinics and animal hospitals, particularly in urban areas. Growing concerns over animal welfare and the increasing commercialization of livestock farming are also projected to drive demand for accurate, early-stage diagnostic technologies across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the Vet Ultrasound System market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the vet ultrasound system market drive growth through product innovation, expanding product lines, and increasing accessibility to advanced diagnostic tools.

Companies focus on developing portable, user-friendly ultrasound systems with enhanced imaging capabilities, such as 3D and Doppler imaging, to support veterinarians in diagnosing a range of animal health conditions. Strategic partnerships with veterinary hospitals and clinics help expand the reach of these systems, particularly in emerging markets.

Players also invest in educating veterinary professionals on the benefits of ultrasound technology, while offering affordable solutions for small and large practices. Additionally, players emphasize improving device integration with veterinary practice management systems to streamline operations. One of the leading companies in the market is GE Healthcare, which offers a range of ultrasound systems tailored for veterinary applications. GE Healthcare’s growth strategy focuses on enhancing its product offerings, including the LOGIQ e series, which provides high-quality imaging in a portable format ideal for veterinary clinics.

The company also emphasizes innovation by integrating advanced imaging technologies with user-friendly interfaces to improve diagnostic accuracy. By forming strategic partnerships with veterinary care providers and expanding into international markets, GE Healthcare continues to strengthen its position in the veterinary ultrasound space.

Top Key Players in the Vet Ultrasound System Market

- Vinno Technology

- SonoScape Medical Corp.

- Siemens Healthineers

- Samsung Electronics

- Reproscan

- Interson Corporation

- GE Healthcare

- I. Medical Imaging

- CVS Group

Industrial Advantages and Opportunities For Market Players

The veterinary ultrasound system market presents several business benefits that enhance veterinary practices significantly. Improved diagnostic capabilities allow for more accurate and detailed examinations, leading to better animal healthcare outcomes. Efficiency in diagnostic processes is increased, reducing the time required for each patient and allowing veterinarians to handle more cases effectively. Additionally, the ability to expand services attracts a wider clientele, improving business growth and profitability.

In terms of industrial advantages, continuous advancements in ultrasound technology give manufacturers a competitive edge. As veterinary medicine becomes increasingly specialized, there is a growing demand for advanced diagnostic tools. This specialization opens up opportunities for ultrasound system manufacturers to collaborate with veterinary colleges and research institutions, thus enhancing product development and brand reputation.

The market also presents numerous opportunities for growth and expansion. Manufacturers can innovate by customizing ultrasound systems to cater to different animal sizes and types, from small pets to large livestock. There is also significant potential for integrating these systems with digital record-keeping solutions, enhancing operational efficiency for veterinary practices. Such integrations make veterinary care more streamlined and data-driven, appealing to modern veterinary operations.

Finally, the expansion into mobile veterinary services and preventive care represents a lucrative opportunity. Portable ultrasound systems that are easy to transport can serve an expanding market of mobile vet services. Furthermore, tapping into preventive care markets through regular health screenings using ultrasound technology opens new revenue streams. These strategic moves can significantly broaden market reach and deepen penetration in both established and emerging markets, catering to a more diverse client base.

Recent Developments

- In September 2024: CVS Group, operating in the UK, initiated a nationwide clinical improvement program aimed at enhancing the use of ultrasound technology for initial diagnoses in small animals. This initiative resulted in the performance of an additional 3,675 ultrasound scans within a year across its small animal practices. Recognized for its significant impact, the initiative received a ‘highly commended’ accolade from RCVS Knowledge and is slated to enter its second phase, concentrating on echocardiography.

- In August 2024: Vinno’s advanced ultrasound technology for small animals was implemented at the Cangzhou Hospital of Integrated Traditional Chinese and Western Medicine. This technology deployment has bolstered the hospital’s diagnostic capabilities, providing stable and precise imaging for both researchers and clinicians engaged in animal health care and research.

Report Scope

Report Features Description Market Value (2023) US$ 400.2 million Forecast Revenue (2033) US$ 794.6 million CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Device (Cart-based and Portable) and Software), By Technology (Analog Imaging Technology, Digital Imaging Technology, and Contrast Imaging Technology), By Application (Orthopedics & Traumatology, Cardiology, Oncology and Neurology), By Animal Type (Large Animals and Small Companion Animals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Vinno Technology, SonoScape Medical Corp., Siemens Healthineers, Samsung Electronics, Reproscan, Interson Corporation, GE Healthcare, E.I. Medical Imaging, and CVS Group. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vet Ultrasound System MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Vet Ultrasound System MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Vinno Technology

- SonoScape Medical Corp.

- Siemens Healthineers

- Samsung Electronics

- Reproscan

- Interson Corporation

- GE Healthcare

- I. Medical Imaging

- CVS Group