Global Ultrasound Probe Disinfection Market Analysis By Product Type [Instruments (Automated Reprocessors, UV-C Disinfectors, Manual Reprocessors/Soaking Stations, Ultrasound Probe Storage Cabinets), Consumables (Formulations (Disinfectant Wipes, Disinfectant Liquids, Disinfectant Sprays), Detergents (Enzymatic Detergents, Non-enzymatic Detergents)), Services], By Disinfection Process (Intermediate/Low-Level Disinfection, High-Level Disinfection), By End-Use (Hospitals and Clinics, Diagnostic Imaging Centers, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136527

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

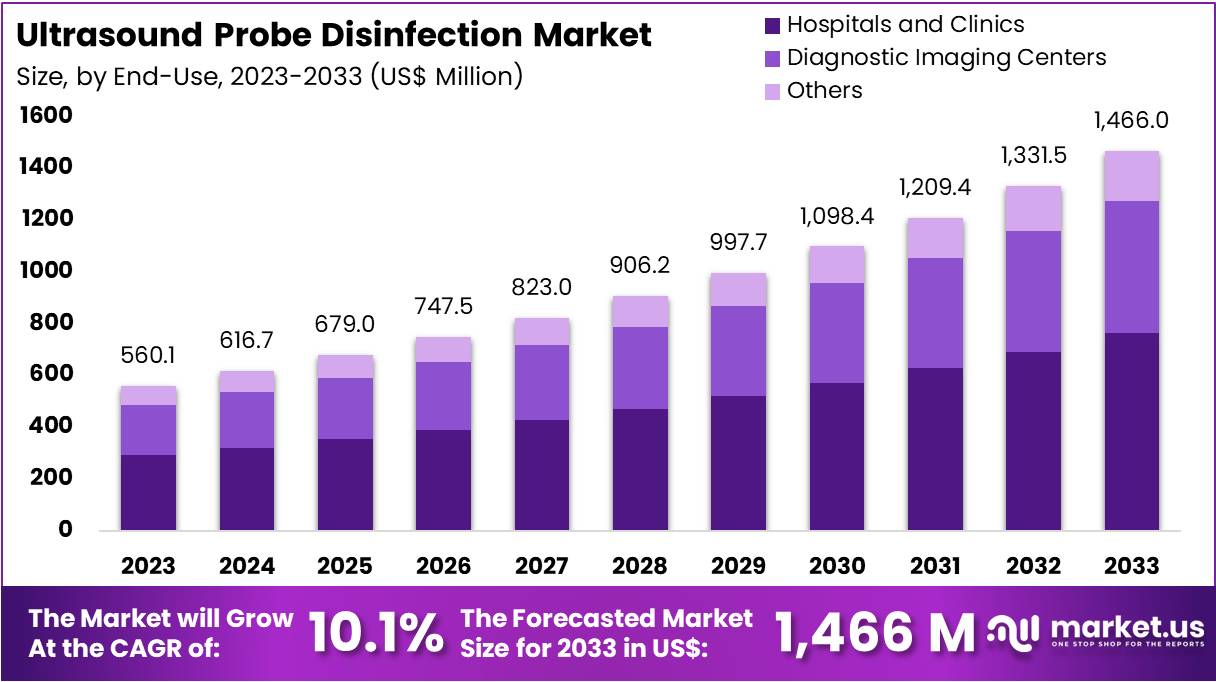

The Global Ultrasound Probe Disinfection Market Size is expected to be worth around US$ 1466 Million by 2033, from US$ 560.1 Million in 2023, growing at a CAGR of 10.1% during the forecast period from 2024 to 2033.

The ultrasound probe disinfection market is growing rapidly, fueled by the increasing need to prevent hospital-acquired infections (HAIs) and the expanding use of ultrasound imaging. Probes used in ultrasonography require effective cleaning to prevent cross-contamination. Depending on their use, disinfection levels range from low-level for non-invasive procedures to high-level disinfection (HLD) for semi-invasive applications. This market includes a variety of solutions such as disinfectants, automated systems, and UV-C disinfection devices.

Growing awareness about infection control standards drives the demand for advanced probe disinfection technologies. According to a study by the Department of Obstetrics and Gynecology, University Hospital Muenster, Germany, automated high-level disinfection systems, like the Trophon EPR®, showed a 91.4% disinfection success rate compared to 78.8% with manual methods using Mikrozid Sensitive® wipes. The research highlighted that manual methods have a 2.9-fold increased contamination risk.

Emergency departments (EDs) and intensive care units (ICUs) face significant challenges in maintaining probe hygiene. A 2023 multicenter study By Research Square revealed that 18.2% of ED ultrasound probes were contaminated with resistant bacteria, including methicillin-resistant Staphylococcus epidermidis and Staphylococcus aureus. Blood contamination was reported across all facilities. Similarly, over 50% of probes in ICUs showed blood contamination, with bacterial contamination exceeding 45%.

Transvaginal probes, commonly used in gynecological examinations, are particularly susceptible to contamination. A study by Clinical Services Journal found that more than 90% of these probes remained contaminated after cleaning with a paper towel. Additionally, over 50% tested positive for methicillin-resistant Staphylococcus aureus (MRSA) and other harmful bacteria. A separate meta-analysis reported a 12.9% prevalence of bacterial contamination and 1% for viruses on transvaginal and transrectal probes after low-level disinfection with wipes or sprays.

Automated disinfection methods are gaining traction due to their efficiency and reliability. For example, a study in the American Journal of Infection Control showed that a new UV-C probe disinfector achieved a median microbial kill rate of 93.67% on probe tips and 97.50% on the sides of external-use probes. These results significantly outperformed traditional methods like disinfectant wipes. Such innovations are transforming disinfection practices and addressing gaps in manual cleaning.

The market’s growth is also supported by advancements in eco-friendly and safer disinfection products. Key industry players are focusing on regulatory compliance while developing sustainable solutions to enhance patient safety. The demand for automated high-level disinfection systems is expected to grow as healthcare providers prioritize efficiency and standardization to reduce contamination risks.

The ultrasound probe disinfection market is poised for robust growth. Increasing awareness, stringent infection control regulations, and technological advancements are driving demand for innovative disinfection solutions. With ultrasound applications expanding across specialties like obstetrics, cardiology, and radiology, the need for effective probe disinfection methods will continue to rise, ensuring better patient outcomes and safer healthcare environments.

Key Takeaways

- The Global Ultrasound Probe Disinfection Market is projected to reach approximately US$ 1466 Million by 2033, expanding from US$ 560.1 Million in 2023.

- With a growth rate of 10.1% from 2024 to 2033, the market demonstrates robust expansion prospects.

- Instruments led the Product Type Segment in 2023, achieving over 40% of the market share.

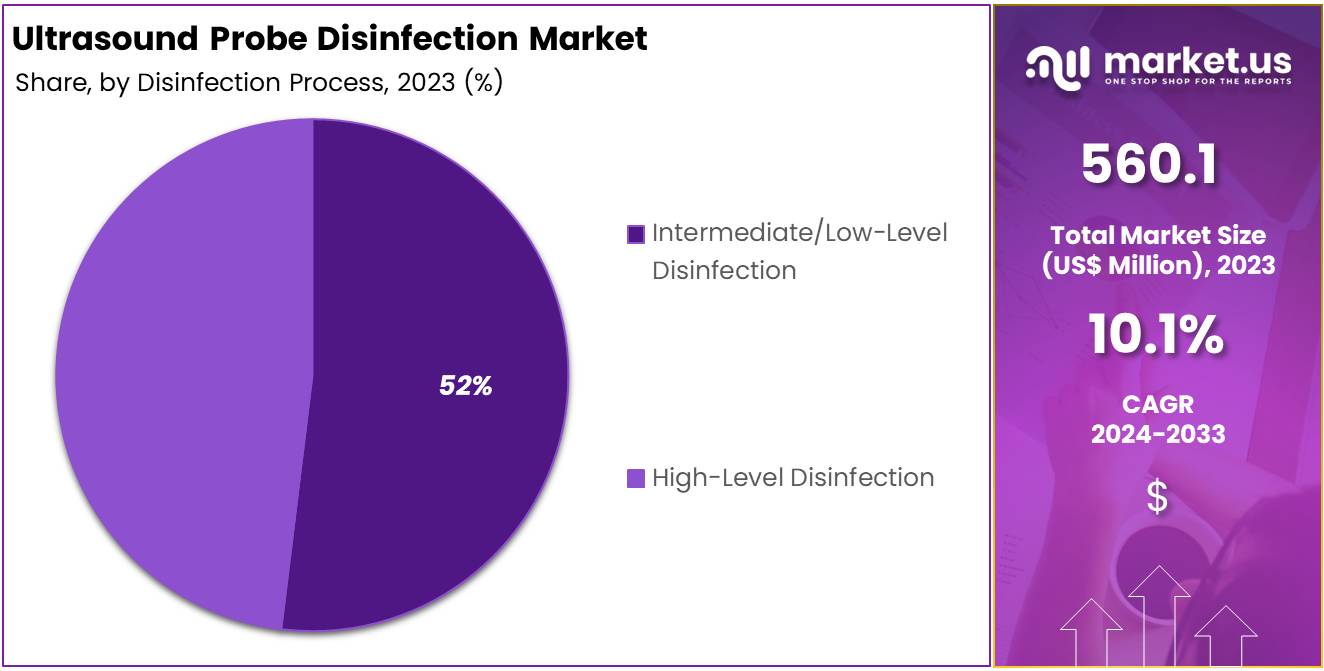

- The Intermediate/Low-Level Disinfection process dominated its segment in 2023, holding more than 52% of the market.

- Hospitals and clinics were the leading end-users in 2023, accounting for more than 46% of the market share.

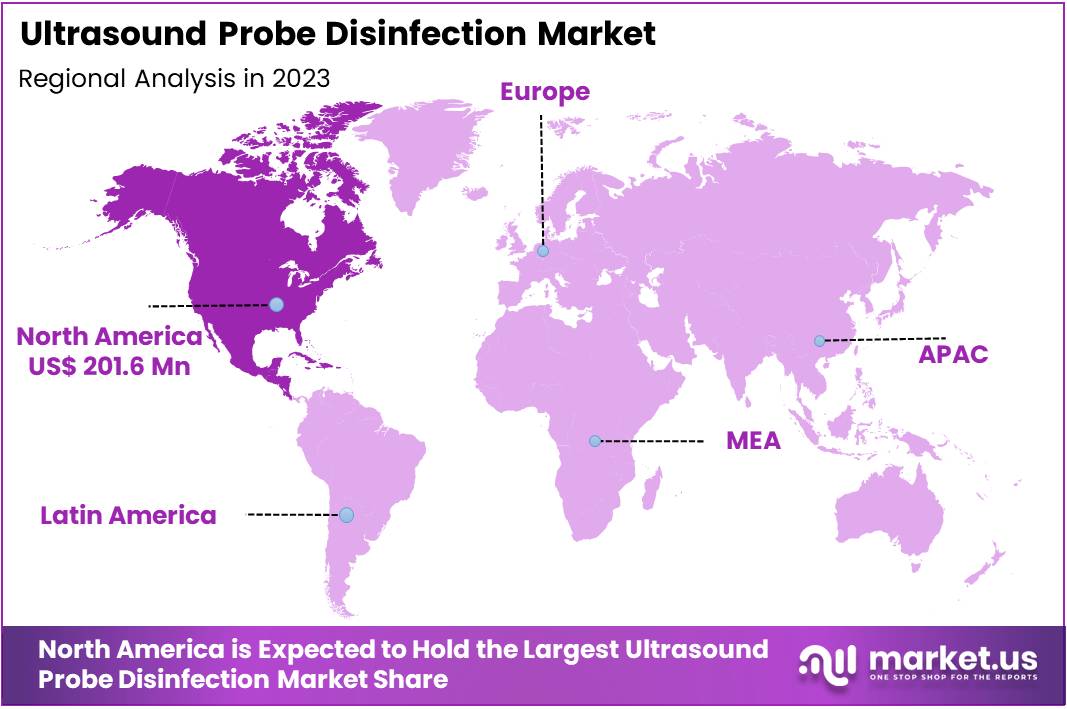

- North America was the leading region in 2023, with a substantial 36% market share valued at US$ 201.6 million.

Product Type Analysis

In 2023, Instruments held a dominant market position in the Product Type Segment of the Ultrasound Probe Disinfection Market, capturing more than a 40% share. This category includes Automated Reprocessors, UV-C Disinfectors, Manual Reprocessors/Soaking Stations, and Ultrasound Probe Storage Cabinets. Automated Reprocessors are especially noteworthy for their ability to provide efficient and consistent disinfection, significantly contributing to the segment’s prominence.

UV-C Disinfectors are another key component. They are appreciated for their quick and chemical-free pathogen neutralization capabilities. This method of disinfection is gaining traction in healthcare settings, further solidifying the Instruments segment’s market leadership.

The Consumables segment is vital too. It encompasses Disinfectant Formulations such as Wipes, Liquids, and Sprays, along with Detergents like Enzymatic and Non-enzymatic Detergents. Disinfectant Wipes and Liquids are favored for their convenience and rapid action, which are essential for effective routine disinfection.

Services form the smallest segment but are crucial for maintaining high hygiene standards in healthcare facilities. They include training, optimization of disinfection protocols, and maintenance services. This segment ensures compliance with regulatory guidelines, underlining the critical role of safety and effectiveness in ultrasound probe disinfection.

Disinfection Process Analysis

In 2023, Intermediate/Low-Level Disinfection held a dominant market position in the Disinfection Process Segment of the Ultrasound Probe Disinfection Market, capturing more than a 52% share. This method is favored due to its efficiency and cost-effectiveness. Hospitals and clinics primarily use this process for general probes that require rapid reprocessing. Its popularity stems from shorter disinfection cycles and lower chemical usage, reducing operational costs.

On the other hand, High-Level Disinfection (HLD) is critical for probes used in sterile or semi-sterile environments. HLD employs stronger chemicals to eliminate all microorganisms, ensuring patient safety during invasive procedures. Although HLD ensures a higher level of disinfection, its higher costs and longer cycle times make it less prevalent compared to intermediate/low-level disinfection.

The market’s dynamics are influenced by regulatory standards and the increasing emphasis on patient safety. Technological advancements in disinfection processes and a growing awareness of hygiene practices in medical settings further drive the segment’s development. Hospitals are continuously updating their disinfection protocols to align with the latest guidelines, bolstering the growth of both disinfection types.

End-Use Analysis

In 2023, hospitals and clinics held a dominant market position in the End-Use Segment of the Ultrasound Probe Disinfection Market, capturing more than a 46% share. This sector’s lead stems from its high volume of ultrasound procedures, necessitating rigorous standards for disinfection to prevent infections. Hospitals and clinics are equipped with the infrastructure and protocols essential for the effective use of advanced disinfection technologies. This ensures patient safety and compliance with health regulations, driving demand for reliable disinfection solutions.

Diagnostic imaging centers also play a crucial role in this market. These centers specialize in imaging services and prioritize the maintenance of equipment hygiene to ensure accurate diagnostics and patient safety. Their focused nature allows for efficient implementation of disinfection protocols, making them a significant segment within the market.

Other end-users, including small clinics and research facilities, contribute to market diversity. These segments are adopting ultrasound probe disinfection systems at a growing rate, driven by increasing awareness of the importance of infection control in all healthcare settings.

Each of these segments reflects the ongoing evolution in health standards and technology adoption, emphasizing the critical role of effective disinfection in ultrasound diagnostics across various healthcare environments.

Key Market Segments

By Product Type

- Instruments

- Automated Reprocessors

- UV-C Disinfectors

- Manual Reprocessors/Soaking Stations

- Ultrasound Probe Storage Cabinets

- Consumables

- Formulations

- Disinfectant Wipes

- Disinfectant Liquids

- Disinfectant Sprays

- Detergents

- Enzymatic Detergents

- Non-enzymatic Detergents

- Formulations

- Services

By Disinfection Process

- Intermediate/Low-Level Disinfection

- High-Level Disinfection

By End-Use

- Hospitals and Clinics

- Diagnostic Imaging Centers

- Others

Drivers

Increasing Regulatory Requirements

The ultrasound probe disinfection market is experiencing significant growth due to increasingly stringent regulatory standards. These regulations are implemented to ensure the prevention of cross-contamination and the transmission of infections within medical settings. Authorities worldwide are mandating that healthcare facilities adopt comprehensive disinfection protocols. This is essential for maintaining patient safety and meeting compliance requirements, which in turn propels the demand for effective disinfection solutions.

These heightened regulatory demands necessitate advanced disinfection technologies and practices. As healthcare providers strive to adhere to these rigorous standards, there is a marked increase in the adoption of specialized disinfection equipment and supplies. This trend is particularly noticeable in environments where ultrasound probes are used frequently, highlighting the critical role of stringent disinfection in safeguarding patient health while ensuring medical device longevity and reliability.

Restraints

High Cost of Automated Probe Disinfection Systems

The high cost of automated ultrasound probe disinfection systems poses a significant barrier to market growth. These systems, crucial for ensuring sterile conditions in medical imaging, come with substantial upfront costs. This expense can be prohibitive for many healthcare providers, especially in cost-sensitive areas. The initial investment, combined with maintenance and operational expenses, often makes these systems less accessible, particularly in settings with limited financial resources.

Developing regions feel this impact most acutely, where budget constraints are common. The economic challenge restricts the adoption of advanced disinfection technologies, thus limiting market expansion in these areas. Healthcare facilities in such regions may opt for manual disinfection methods, which, while less expensive, are also less effective and more time-consuming. This trade-off between cost and quality highlights the need for more affordable disinfection solutions in the global market.

Opportunities

Technological Advancements in Disinfection Methods

Technological advancements in disinfection methods present a significant opportunity in the market. Innovations that focus on increasing the speed and efficiency of disinfection processes can meet the growing demand for more effective hygiene practices. These developments are especially relevant in healthcare, hospitality, and public service sectors where safety and compliance with stringent health standards are paramount. Improved technologies can facilitate easier user interaction, enhancing the adoption rate across various industries.

Moreover, the integration of user-friendly features in disinfection equipment can expand market penetration. As businesses and facilities aim to maintain high cleanliness standards, the availability of advanced, easy-to-use disinfectants plays a crucial role. This trend is driven by the need for environments that safeguard against infections, particularly in the wake of global health crises. Thus, companies investing in these technologies are likely to see increased interest and growth, as consumer priorities continue to lean towards enhanced safety solutions.

Trends

Rising Use of High-Level Disinfection (HLD) Techniques

The healthcare sector is witnessing a notable shift towards the adoption of high-level disinfection (HLD) techniques. This trend is primarily driven by the need to ensure the safety of critical probes used in invasive procedures. As medical facilities increasingly prioritize patient safety, the use of advanced disinfection methods is becoming a standard practice. This shift reflects a broader awareness among healthcare professionals about the importance of rigorous infection control protocols to prevent the transmission of pathogens during medical interventions.

The growing implementation of HLD techniques is also a response to heightened regulatory standards and healthcare guidelines that demand stringent disinfection processes. This ensures that all medical instruments, particularly those involved in invasive procedures, meet the highest levels of sterility. By integrating more sophisticated disinfection technologies, healthcare providers are able to enhance patient outcomes and minimize the risk of infection, thereby aligning with global efforts to improve overall healthcare safety.

Regional Analysis

In 2023, North America maintained a dominant position in the ultrasound probe disinfection market, securing over a 36% share with a market value of US$ 201.6 million. This dominance is bolstered by the region’s robust healthcare infrastructure, which extensively utilizes advanced ultrasound technology. These factors necessitate high-standard disinfection solutions to ensure patient safety and equipment hygiene.

The region benefits from the presence of leading healthcare technology firms. These companies continuously innovate, developing state-of-the-art disinfection products. Such innovations cater specifically to the stringent healthcare standards in North America, thereby driving market growth.

Heightened awareness among healthcare providers about the risks of cross-contamination also contributes significantly to market dominance. This awareness is supported by comprehensive training programs and strict guidelines from health authorities. The focus on stringent disinfection protocols is critical in preventing infections transmitted through improperly disinfected ultrasound probes.

Government initiatives aimed at improving healthcare outcomes also play a crucial role. Policies focusing on controlling hospital-acquired infections encourage healthcare facilities to invest in effective disinfection technologies. This regulatory push further supports the market growth in North America, ensuring it remains a leader in adopting advanced disinfection solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The ultrasound probe disinfection market is led by several key players, each bringing unique technological advancements and innovations. Nanosonics is recognized for its ultrasonic technology solutions, particularly its flagship product, Trophon, which ensures high-level disinfection standards. Another notable company, CIVCO Medical Solutions, focuses on ultrasound probe covers and disinfection systems, known for their reliability and ease of use. These companies enhance clinical hygiene and ensure patient safety through their cutting-edge products.

Tristel Solutions Ltd. differentiates itself with a proprietary chlorine dioxide disinfection formula, offering effective protection against a broad range of pathogens. This is crucial for preventing cross-contamination in ultrasound procedures. Similarly, Ecolab Inc. provides a comprehensive suite of infection prevention solutions that prioritize both efficacy and environmental safety, making them a trusted name in healthcare settings globally.

Germitec stands out by employing UV-C technology to disinfect ultrasound probes without chemicals, presenting an eco-friendly option that effectively kills harmful microorganisms. Alongside Germitec, other key players in the market continuously innovate and enhance disinfection technologies. These companies collectively contribute to safer diagnostic practices by pushing the boundaries of ultrasound probe hygiene, underscoring their pivotal role in the healthcare industry.

Market Key Players

- Nanosonics

- CIVCO Medical Solutions

- Tristel Solutions Ltd.

- Ecolab Inc.

- Germitec

- CS Medical LLC

- Advanced Sterilization Products Services Inc.

- Metrex Research LLC

- The Clorox Company

- Medline Industries Inc.

- Schülke & Mayr GmbH

Recent Developments

- In November 2024: Nanosonics introduced the trophon Wireless Ultrasound Probe Holder, marking a significant advancement in the disinfection of wireless ultrasound probes. This new accessory, compatible with trophon EPR and trophon2 devices, emphasizes enhanced infection control in healthcare settings, integrating seamlessly into existing workflows. It also supports the AcuTrace Medical Instrument Tags for better traceability and compliance within medical facilities.

- In March 2023: CIVCO Medical Solutions introduced the ASTRA series of automated ultrasound probe reprocessors. These systems use barcode technology to automate the entire disinfection log process, tracking data such as probe information, operator ID, and disinfection outcomes. The ASTRA systems can disinfect up to two probes simultaneously using hydrogen peroxide or OPA, and are not limited to proprietary disinfectants, significantly reducing operational costs.

- In September 2024: Germitec received FDA de novo clearance for its Chronos ultrasound probe disinfection device. This approval classifies the device under the de novo Class II category, which uses ultraviolet-C light to disinfect ultrasound probes, offering a quick and chemical-free disinfection solution in approximately 90 seconds. This clearance marks Chronos as the first UV-C chamber approved for market distribution in the US, setting a significant milestone for Germitec in the healthcare market.

Report Scope

Report Features Description Market Value (2023) US$ 1466 Million Forecast Revenue (2033) US$ 560.1 Million CAGR (2024-2033) 10.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type [Instruments (Automated Reprocessors, UV-C Disinfectors, Manual Reprocessors/Soaking Stations, Ultrasound Probe Storage Cabinets), Consumables (Formulations (Disinfectant Wipes, Disinfectant Liquids, Disinfectant Sprays), Detergents (Enzymatic Detergents, Non-enzymatic Detergents)), Services], By Disinfection Process (Intermediate/Low-Level Disinfection, High-Level Disinfection), By End-Use (Hospitals and Clinics, Diagnostic Imaging Centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Nanosonics, CIVCO Medical Solutions, Tristel Solutions Ltd., Ecolab Inc., Germitec, CS Medical LLC, Advanced Sterilization Products Services Inc., Metrex Research LLC, The Clorox Company, Medline Industries Inc., Schülke & Mayr GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ultrasound Probe Disinfection MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Ultrasound Probe Disinfection MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Nanosonics

- CIVCO Medical Solutions

- Tristel Solutions Ltd.

- Ecolab Inc.

- Germitec

- CS Medical LLC

- Advanced Sterilization Products Services Inc.

- Metrex Research LLC

- The Clorox Company

- Medline Industries Inc.

- Schülke & Mayr GmbH