Global Sternal Closure Systems Market By Product Type (Closure Devices and Bone Cement), By Material (Stainless Steel, Polyether Ether Ketone (PEEK), Titanium, and Others), By Application (Median Sternotomy, Hemisternotomy, Bilateral Thoracosternotomy, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145542

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

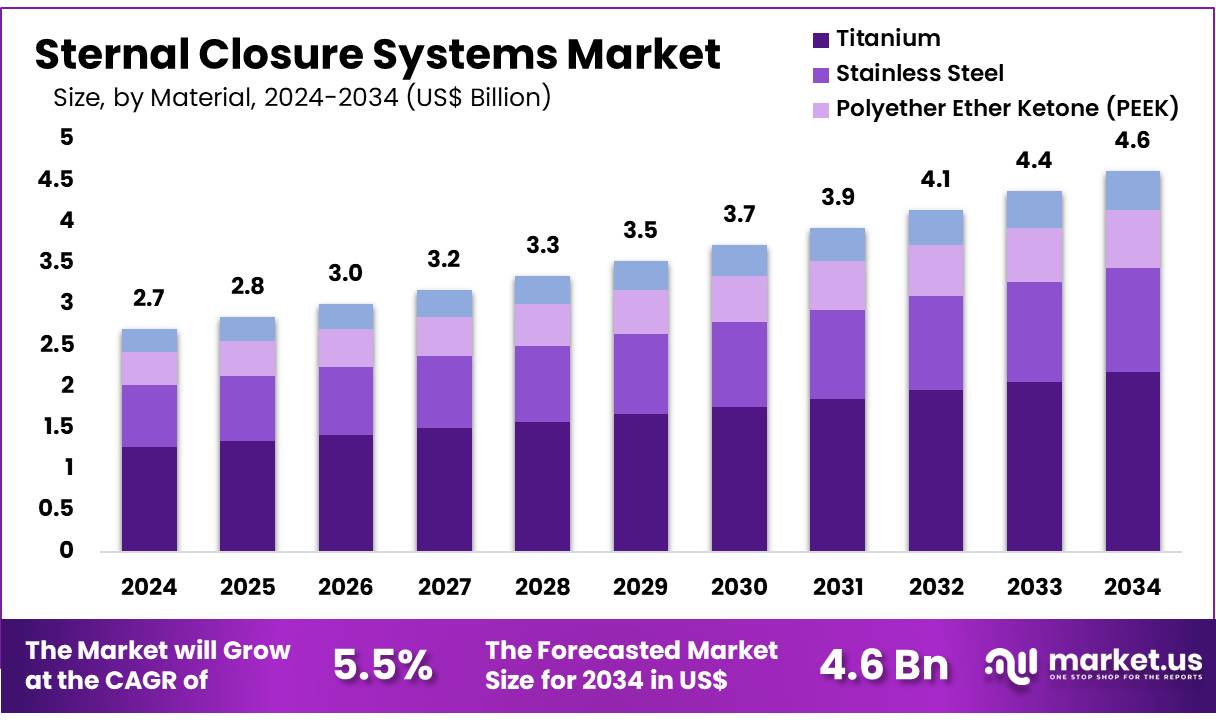

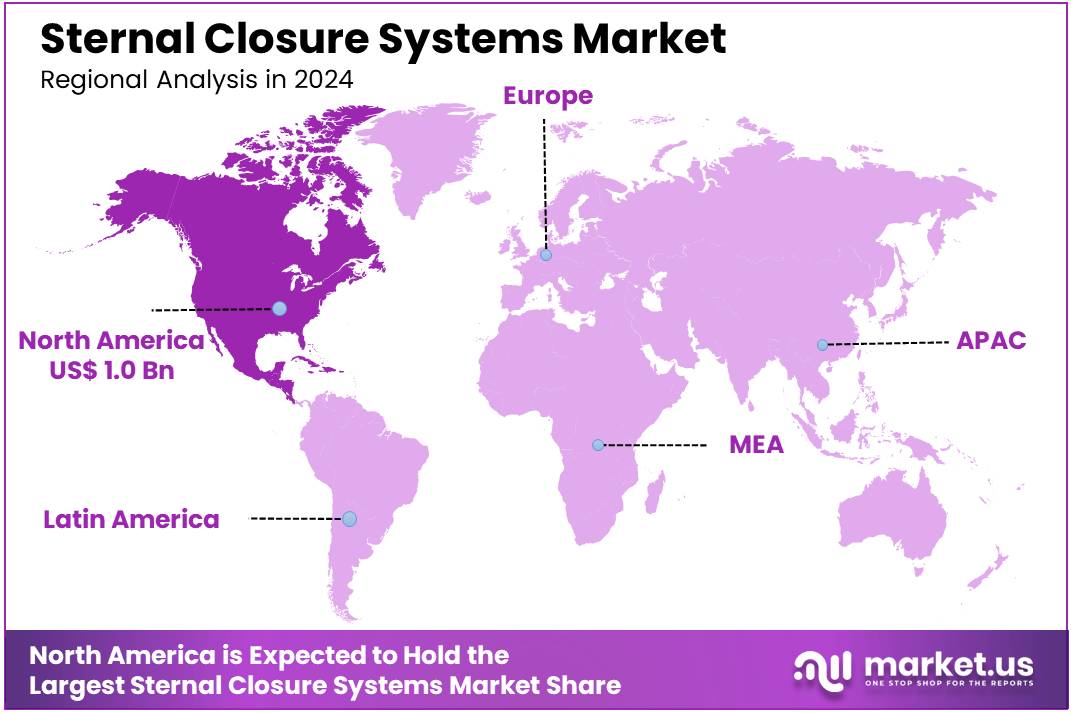

Global Sternal Closure Systems Market size is expected to be worth around US$ 4.6 billion by 2034 from US$ 2.7 billion in 2024, growing at a CAGR of 5.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.9% share with a revenue of US$ 1.0 Billion.

Increasing awareness of the importance of effective sternal closure following cardiac surgeries is driving growth in the sternal closure systems market. Surgeons and healthcare providers prioritize these systems for their ability to enhance recovery times, reduce complications, and improve patient outcomes. As the number of cardiac surgeries, particularly coronary artery bypass grafting (CABG), rises globally, the demand for reliable and innovative sternal closure solutions continues to expand.

Additionally, advancements in materials and technologies, such as the development of bioabsorbable devices and robotic-assisted surgery, offer opportunities to improve the precision and safety of sternal closure procedures. In line with these advancements, market players are focusing on enhancing the efficacy and ease of use of their products.

According to the India Ageing Report 2030, the elderly population in India is projected to reach 347 million by 2050. This growth is expected to drive increased demand for healthcare innovations tailored to the aging population, particularly for age-related conditions and long-term care solutions, including those addressing the need for cardiac surgery and recovery systems.

Key Takeaways

- In 2024, the market for sternal closure systems generated a revenue of US$ 2.7 billion, with a CAGR of 5.5%, and is expected to reach US$ 4.6 billion by the year 2033.

- The product type segment is divided into closure devices and bone cement, with closure devices taking the lead in 2024 with a market share of 58.5%.

- Considering material, the market is divided into stainless steel, polyether ether ketone (PEEK), titanium, and others. Among these, titanium held a significant share of 47.2%.

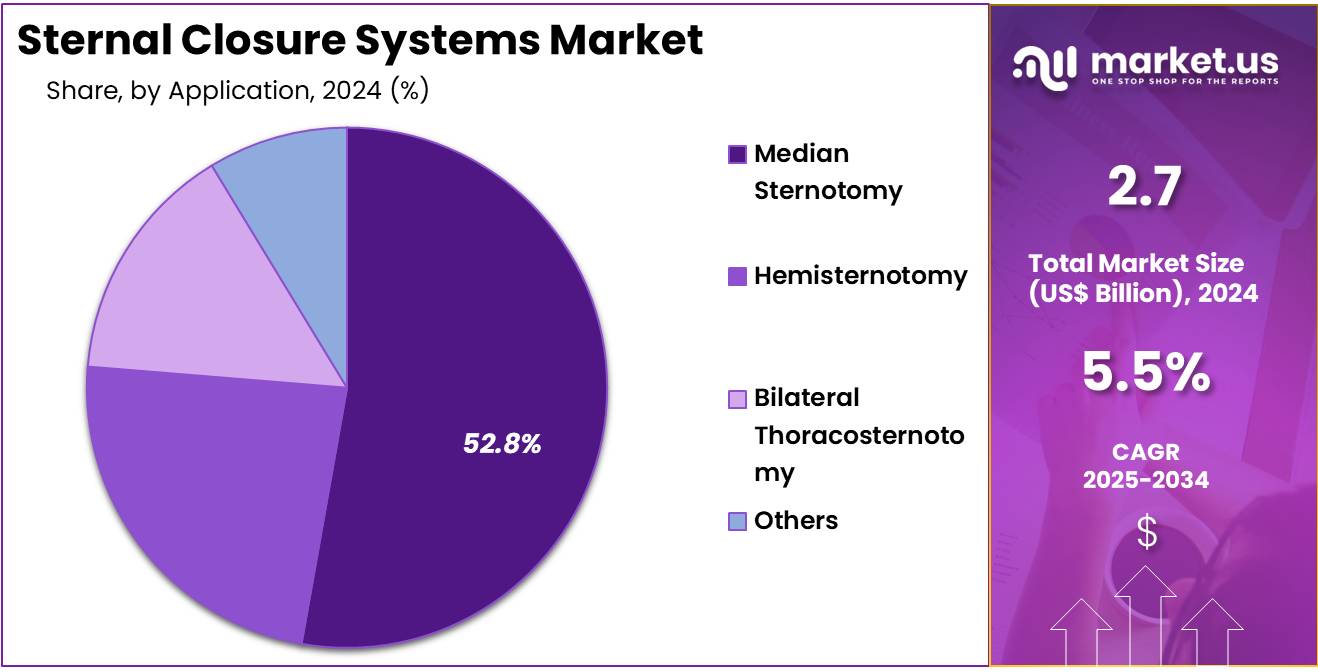

- Furthermore, concerning the application segment, the market is segregated into median sternotomy, hemisternotomy, bilateral thoracosternotomy, and others. The median sternotomy sector stands out as the dominant player, holding the largest revenue share of 52.8% in the sternal closure systems market.

- North America led the market by securing a market share of 37.9% in 2024.

Product Type Analysis

The closure devices segment led in 2024, claiming a market share of 58.5% as the demand for safer and more reliable sternal closure methods increases. The use of closure devices, such as sternal wires and plates, is projected to rise due to their ability to provide enhanced stability, prevent complications, and accelerate patient recovery following cardiac surgery.

Innovations in closure technology, such as improved material strength and ease of use, are likely to drive further adoption. As surgical techniques advance, healthcare providers are anticipated to prefer closure devices over traditional methods, fostering growth in this segment.

Material Analysis

The titanium held a significant share of 47.2% due to its unique properties, including strength, biocompatibility, and corrosion resistance. Titanium’s use in sternal closure systems, particularly in implants and fixation devices, is likely to increase as hospitals and healthcare providers seek durable materials that minimize complications and enhance healing post-surgery.

The growing preference for titanium in orthopedic and cardiac surgeries, along with its ability to withstand the harsh conditions of the human body, is expected to drive demand for titanium-based sternal closure systems, supporting growth in this material segment.

Application Analysis

The median sternotomy segment had a tremendous growth rate, with a revenue share of 52.8% as it remains the most common procedure for accessing the heart during cardiac surgeries. The increase in cardiac surgeries, including coronary artery bypass grafting (CABG) and heart valve replacement, is expected to drive the demand for sternal closure systems used in median sternotomy.

As surgical techniques improve and patient outcomes continue to be a priority, the effectiveness and efficiency of median sternotomy closure methods are likely to propel growth in this segment. Additionally, the rising prevalence of cardiovascular diseases and the aging population are expected to further contribute to the segment’s expansion.

Key Market Segments

Product Type

- Closure Devices

- Bone Cement

Material

- Stainless Steel

- Polyether Ether Ketone (PEEK)

- Titanium

- Others

Application

- Median Sternotomy

- Hemisternotomy

- Bilateral Thoracosternotomy

- Others

Drivers

Growing Number of Cardiac Surgeries is Driving the Market

The growing number of cardiac surgeries worldwide is significantly driving the market for sternal closure products and other related solutions. According to the American Heart Association, more than 2.4 million open-heart surgeries were performed globally in 2022, with the annual growth rate exceeding 5%.

The demand for reliable closure systems, particularly after cardiac surgeries like Coronary Artery Bypass Grafting (CABG), is increasing as the global population ages. Zimmer Biomet’s 2023 financial statements show a 14% increase in sales of their sternal closure products, reflecting the rising demand for efficient and effective surgical closure systems.

Data from the US CDC also indicates an 8% rise in CABG procedures between 2021 and 2023, further driving the need for advanced closure solutions. Additionally, clinical studies have demonstrated that rigid fixation systems reduce post-operative infections by 30% compared to traditional wiring techniques, emphasizing the growing reliance on superior closure systems for better patient outcomes.

With the WHO projecting that 20% of the global population will be over 60 by 2025, the demand for reliable surgical closure solutions is expected to continue rising.

Restraints

High Cost of Advanced Closure Systems is Restraining the Market

The high cost of advanced sternal closure systems remains a significant restraint on market growth, particularly in price-sensitive regions. Johnson & Johnson’s 2023 product pricing reveals that titanium plating systems, which offer superior fixation compared to traditional methods, cost between US$1,500 and US$3,000 per unit.

In contrast, basic wire cerclage systems are much more affordable, ranging from US$200 to US$500. Despite the higher efficiency and better clinical outcomes associated with advanced closure methods, 35% of hospitals in developing regions still rely on basic wiring due to cost constraints, according to FDA Medical Device Reports.

Additionally, Medicare’s 2023 fee schedule only covers 60-70% of advanced closure procedure costs, further limiting access to these superior solutions. Furthermore, the US Bureau of Labor Statistics documents a 12% increase in medical metal alloy prices since 2022, adding to the overall cost of advanced surgical systems.

These financial barriers restrict widespread adoption, particularly in emerging markets where the budget for healthcare infrastructure is constrained, and limit the overall market potential.

Opportunities

Development of Bioabsorbable Materials is Creating Growth Opportunities

The development of bioabsorbable materials presents significant growth opportunities in the sternal closure market. Bioabsorbable materials are increasingly being adopted for their potential to reduce long-term complications, such as chronic pain and the need for additional surgeries. Stryker’s 2023 Annual Report highlights a 22% revenue growth in their bioabsorbable medical devices segment, reflecting the rising demand for these innovative materials.

Peer-reviewed studies have shown that bioabsorbable systems reduce the risk of chronic pain by 40% compared to traditional metal plates, making them an attractive option for patients requiring sternal closure. In 2023, the European Medicines Agency (EMA) approved three new bioabsorbable sternal devices, signaling regulatory support for this emerging technology.

The FDA’s 2024 guidance has also prioritized biodegradable materials for use in pediatric and high-risk patients, further expanding the market opportunities for bioabsorbable systems. Industry analysts project that bioabsorbable systems could capture up to 25% of the market share by 2025, based on current adoption trends and growing interest in more sustainable and patient-friendly closure solutions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the sternal closure market, shaping both production costs and market demand. Global inflation has led to a 10-15% increase in medical device production costs since 2021, putting pressure on manufacturers’ profit margins. Geopolitical disruptions, such as the Russia-Ukraine conflict, have caused a 20% spike in titanium prices in 2022, further inflating the cost of essential materials used in sternal closure systems.

However, government initiatives, like the US CHIPS Act, are supporting advanced manufacturing and helping to mitigate the impact of rising production costs. In emerging markets, such as India, medical device imports grew by 18% in 2023, driven by increased healthcare investments and a growing demand for advanced medical solutions.

At the same time, geopolitical conflicts have highlighted the need for greater self-sufficiency in medical manufacturing, encouraging domestic production. Despite these challenges, the ongoing trend of technological innovation in surgical devices and strong demographic growth, particularly in aging populations, ensures continued demand for advanced sternal closure solutions. The market remains resilient, with strong long-term growth prospects, driven by technological advancements and evolving healthcare needs.

Latest Trends

Adoption of Patient-Specific 3D-Printed Implants is a Recent Trend

The adoption of patient-specific 3D-printed implants represents a significant recent trend in the sternal closure market. Advances in 3D printing technology have enabled the creation of highly personalized implants that improve the fit and effectiveness of closure systems, which are especially important in complex cardiac surgeries.

Medtronic’s 2023 financial disclosures show a 30% increase in sales of 3D-printed implants, highlighting the growing adoption of this technology. The FDA cleared five new patient-specific closure devices in 2023, further validating the demand for tailored solutions. Medical centers using 3D-printed implants report a 50% reduction in revision surgeries, underscoring the benefits of personalized surgical solutions.

However, the high cost of these advanced implants, which is typically 2-3 times higher than traditional devices, continues to limit widespread adoption. Despite this, the growing demand for personalized surgical solutions and the increasing recognition of the benefits of 3D printing suggest that this trend will continue to gain momentum across healthcare systems.

Regional Analysis

North America is leading the Sternal Closure Systems Market

North America dominated the market with the highest revenue share of 37.9% owing to three key factors. First, the rising volume of cardiovascular surgeries created sustained demand, with the American Heart Association reporting over 500,000 annual coronary artery bypass procedures in the US. Second, reimbursement policies evolved favorably, as Centers for Medicare & Medicaid Services data showed a 7% increase in approved claims for sternal closure procedures during 2023.

Third, technological advancements gained traction, with FDA records indicating clearance of 8 new closure devices between 2022 and 2024, including innovative titanium plating systems. Major manufacturers responded to this growing market, with corporate financial reports revealing 12-15% production capacity expansions in 2023.

Healthcare facilities demonstrated increased adoption, with American Hospital Association statistics documenting a 10% rise in specialized system purchases during 2023 compared to the previous year. These factors collectively contributed to the robust growth of the sternal closure systems market in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to several measurable developments. China’s National Health Commission recorded a 15% year-over-year increase in cardiac surgeries during 2023, creating immediate demand for reliable closure solutions. India’s healthcare modernization efforts included a US$200 million allocation for cardiac care upgrades in 2023, as reported by the Ministry of Health and Family Welfare.

Japan’s Ministry of Health, Labour and Welfare observed a 9% rise in complex sternal procedures during 2024, particularly among elderly patients. Regional manufacturers responded to this growing need, with corporate disclosures showing 18-20% production expansions in 2023.

The Asia Pacific Society of Cardiology noted a consistent 12% annual increase in specialized surgical training programs since 2022, suggesting continued market expansion. These indicators collectively point toward sustained growth across the region’s healthcare systems, highlighting the increasing demand for advanced sternal closure solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the sternal closure systems market focus on technological innovation, strategic partnerships, and expanding their global presence to drive growth. They invest in developing advanced closure devices and bone cements that enhance patient outcomes and simplify surgical procedures.

Collaborations with healthcare providers and research institutions facilitate the integration of new technologies and expand market reach. Additionally, targeting emerging markets with increasing cardiovascular disease prevalence presents significant growth opportunities.

DePuy Synthes, a subsidiary of Johnson & Johnson, offers a comprehensive range of sternal closure systems, including innovative closure devices and bone cements. The company emphasizes research and development to improve surgical outcomes and patient safety. Through strategic partnerships and a global distribution network, DePuy Synthes continues to expand its presence in the sternal closure systems market.

Top Key Players

- Zimmer Biomet

- KPOWER

- KLS Martin Group

- Kinamed Incorporated

- Johnson & Johnson

- Acumed LLC

- Abyrx

- ABLE MEDICAL DEVICES

Recent Developments

- In September 2023, Abyrx secured additional FDA clearance for its MONTAGE moldable bone putty, now approved for use in cardiothoracic procedures following sternotomy. This approval allows for improved sternal repair, providing surgeons with an advanced solution to enhance recovery outcomes in heart surgery patients.

- In May 2022, KPOWER, a subsidiary of Granulab, launched Prosteomax in Malaysia—a synthetic bone cement that holds halal certification. This product, suitable for a wide range of applications including orthopedics and dental procedures, offers a reliable solution for medical professionals requiring a high-quality material for surgical uses.

Report Scope

Report Features Description Market Value (2024) US$ 2.7 billion Forecast Revenue (2034) US$ 4.6 billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Closure Devices and Bone Cement), By Material (Stainless Steel, Polyether Ether Ketone (PEEK), Titanium, and Others), By Application (Median Sternotomy, Hemisternotomy, Bilateral Thoracosternotomy, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zimmer Biomet, KPOWER, KLS Martin Group, Kinamed Incorporated, Johnson & Johnson, Acumed LLC, Abyrx, and ABLE MEDICAL DEVICES. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sternal Closure Systems MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Sternal Closure Systems MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zimmer Biomet

- KPOWER

- KLS Martin Group

- Kinamed Incorporated

- Johnson & Johnson

- Acumed LLC

- Abyrx

- ABLE MEDICAL DEVICES