Global Industrial Gases Market Size, Share, And Growth Analysis Report By Product Type (Atmospheric Gases, Hydrocarbon Gases, Noble Gases, Specialty Gases), By Distribution (Merchant, On-site, Packaged), By End-use (Healthcare, Metallurgy and Glass, Food and Beverages, Retail, Chemicals and Petrochemicals, Electronics, Energy and Power, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 18522

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

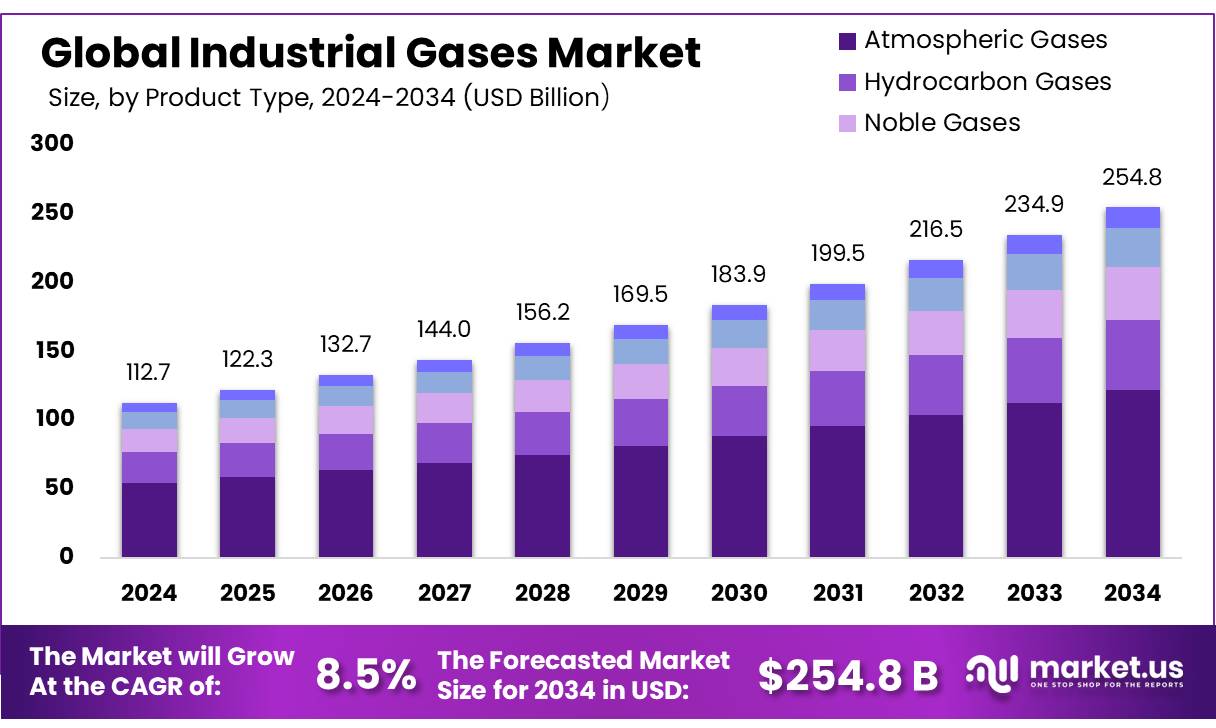

The Global Industrial Gases Market size is expected to be worth around USD 254.8 billion by 2034, from USD 112.7 billion in 2024, growing at a CAGR of 8.5% during the forecast period from 2025 to 2034.

Industrial gases are different types of gaseous chemicals that are manufactured for use in a wide range of industrial processes. These gases include such as oxygen, nitrogen, hydrogen, and carbon dioxide, and noble gases such as argon and xenon are typically gaseous at room temperature but may be stored as liquids or solids depending on usage and storage requirements.

Their unique properties make them important in numerous sectors including steel, oil and gas, chemicals, petrochemicals, biotechnology, healthcare, environmental protection, and energy production. In the oil and gas sector, gases such as hydrogen and nitrogen are essential for refining, enhanced oil recovery, and ensuring operational safety through inserting and blanketing. In the chemical industry, these gases play key roles in synthesis reactions and process optimization.

Global market of industrial gases driven by rapid infrastructure development, and industrialization in developing Economies such as India and other emerging markets are experiencing rising demand for these gases across all major industries.

Further supportive government initiatives and policies that accelerate industrial development, including tax incentives and various regulatory law processes, are driving investment and innovation in the industrial gases sector. As industrial growth and technological advancements accelerate, industrial gases remain a functional component of global economic manufacturing sectors.

Key Takeaways

- The global industrial gases market was valued at US$ 112.7 billion in 2024.

- The global industrial gas market is projected to grow at a CAGR of 8.5% and is estimated to reach US$ 254.8 billion by 2034.

- Among product types, atmospheric gases accounted for the largest market share of 48.4%.

- Among distribution, merchants accounted for the majority of the market share at 44.4%.

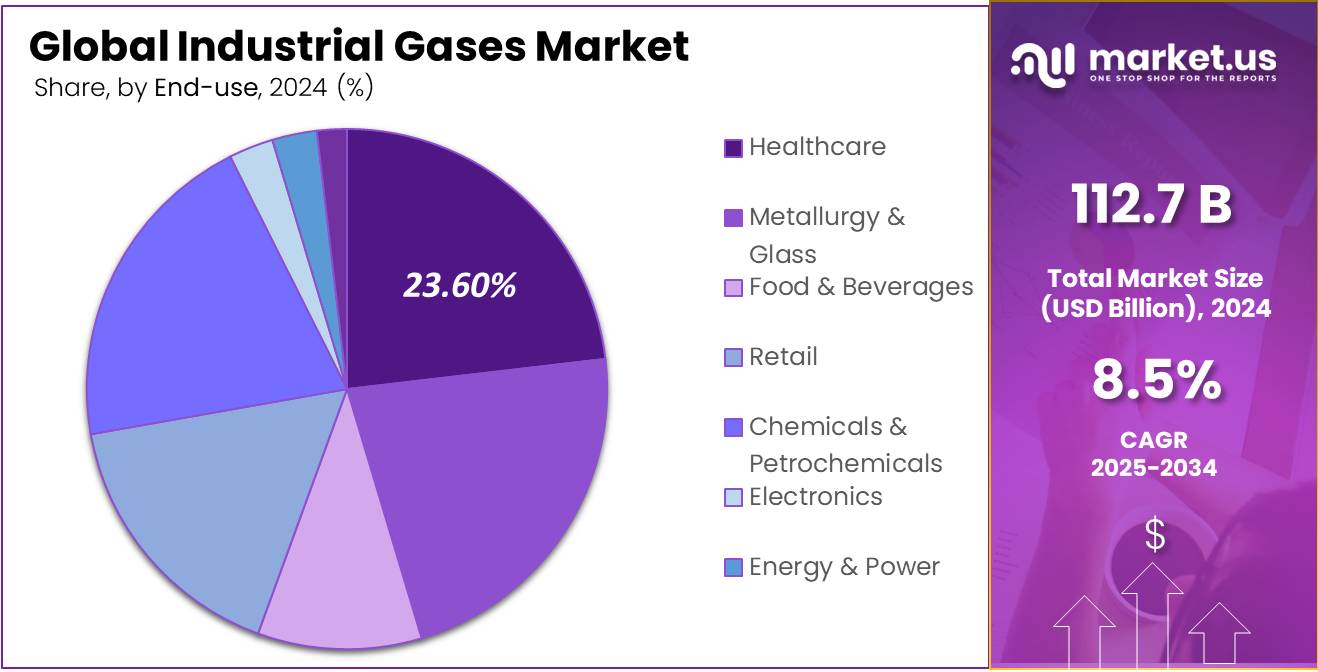

- By end-use, healthcare accounted for the largest market share of 23.6%.

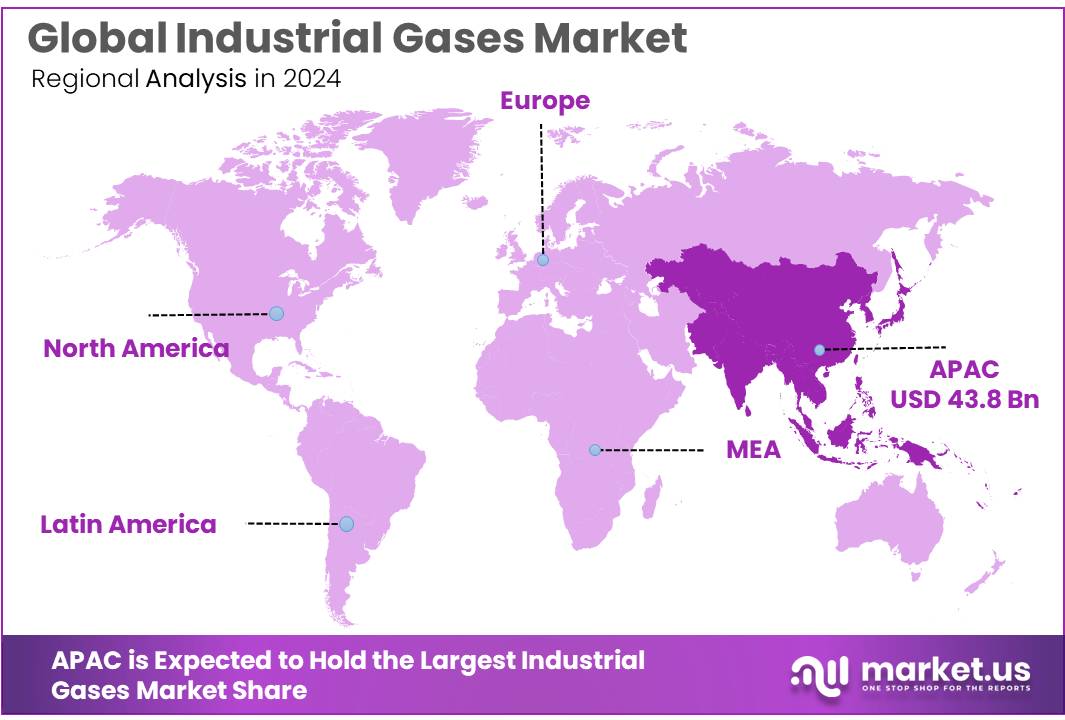

- Asia Pacific is estimated as the largest market for industrial gases with a share of 38.9% of the market share.

By Product Type

Atmospheric Gases Dominate Industrial Gases Market

The industrial gases market is segmented based on product type into atmospheric gases, hydrocarbon gases, noble gases, specialty gases, and others. In 2024, the atmospheric gases segment held a significant revenue share of 48.4%. This dominance is primarily driven by the widespread use of oxygen, nitrogen, and argon across key industries such as healthcare, metallurgy, electronics, and food processing. Oxygen is critical for medical applications and steel manufacturing, while nitrogen is extensively used for inserting, blanketing, and refrigeration. The cost-effectiveness, abundant availability, and broad industrial applicability of atmospheric gases continue to reinforce their market leadership.

By Distribution Type

Merchant Segment Leads Industrial Gases Distribution

Based on distribution, the market is further divided into on-site, merchant, and packaged. The predominance of the merchant, commanding a substantial 44.4% market share in 2024. Driven by its flexibility, cost-efficiency, and ability to serve a broad customer base across various industries. This mode, which involves transporting gases in liquid or gaseous form via tankers or cylinders to customer sites, is ideal for medium-scale users who do not require on-site production. Its scalability and convenience make it the preferred choice for sectors such as healthcare, food and beverage, and manufacturing, where consistent supply and manageable volumes are critical.

By End-Use Type

Healthcare Sector Prominent Driver In Industrial Gases

By end-use, the market is categorized into healthcare, metallurgy & glass, food & beverages, chemicals & petrochemicals, electronics, energy & power, and others. The healthcare segment emerging as the dominant channel, holding 23.6% of the total market share in 2024. This dominance is attributed to the critical role of medical gases such as oxygen, nitrous oxide, and carbon dioxide in patient care, anesthesia, respiratory therapy, and diagnostics.

The rising global burden of chronic and respiratory diseases, growing investments in healthcare infrastructure, and increased demand for emergency and critical care services—further amplified by lessons from the pandemic—have significantly boosted the consumption of medical-grade gases in hospitals and clinics worldwide.

Key Market Segments

By Product Type

- Atmospheric Gases

- Nitrogen

- Oxygen

- Argon

- Others

- Hydrocarbon Gases

- Methane

- Ethane

- Propane

- Butane

- Acetylene

- Others

- Noble Gases

- Helium

- Neon

- Krypton

- Xenon

- Others

- Specialty Gases

- Carbon dioxide

- Hydrogen

- Ammonia

- Others

By Distribution

- Merchant

- On-site

- Packaged

By End-use

- Healthcare

- Metallurgy and Glass

- Food and Beverages

- Retail

- Chemicals and Petrochemicals

- Electronics

- Energy and Power

- Others

Drivers

Increased Global Healthcare Infrastructure Investments

The growth of global healthcare infrastructure is emerging as a pivotal driver fueling the expansion of the industrial gas market. With rapid urbanization and sustained economic development in emerging and developing regions, there is a growing emphasis on strengthening healthcare systems to address the rising prevalence of chronic, respiratory, and infectious diseases. This has led to significant public and private investments in healthcare infrastructure, including the modernization of hospitals, the adoption of advanced medical technologies, and the expansion of critical care facilities—all of which are increasing the demand for medical gases.

Governments across the globe are actively launching incentive programs and policy initiatives to establish resilient and well-equipped healthcare infrastructure. These efforts have accelerated the critical need for robust medical oxygen systems, especially in low-resource settings where access remains insufficient despite high clinical demand. Medical gases such as oxygen and nitrous oxide are vital not only for treating respiratory conditions such as pneumonia and chronic obstructive pulmonary disease (COPD) expected to be the third leading cause of death worldwide by 2030 but also for supporting maternal and child health, surgical procedures, and the treatment of infectious diseases like tuberculosis and malaria.

- According to Clinton health access initiative reports in 2024 approximately US$500 million in global investmentsto address oxygen-related health system challenges.

- The Global Alliance for Oxygen estimates that a US$4 billion investment by 2030 is needed to increase oxygen access in low- and middle-income countries by 25 percent, potentially saving up to 860,000 lives.

Additionally, there is a growing use of calibration and specialty gas mixtures in healthcare facilities to ensure the accuracy and reliability of diagnostic and monitoring equipment. With a global focus on achieving universal health coverage and strengthening pandemic preparedness, industrial gases are emerging as foundational elements in health system resilience.

Investments in the production, storage, and distribution of medical gases are now aligned with broader health-related Sustainable Development Goals (SDGs), including reducing mortality rates and enhancing maternal and neonatal outcomes. As medical technology continues to advance, the demand for such high-purity gases is rising, making them a key component of modern healthcare delivery systems.

Restraints

Fluctuation In Gas Price

The fluctuating prices of industrial gases, driven by the volatile crude oil market, present a major restraining factor to global industrial gas market growth. Factors such as geopolitical tensions, supply chain disruptions, and broader economic conditions can cause significant price fluctuations. Industrial gases, essential for both commercial and industrial use, have seen price increases due to their dependence on crude oil refining.

Any rise in crude oil prices directly impacts the cost of gas production and these high prices adversely affect various industrial sectors along with health, electronics, metallurgy & glass, and chemical and petrochemical industries heavily depend on industrial gas for their manufacturing theses affect the production as well electronic goods supply chain.

As sourcing raw materials becomes more challenging for companies, higher demand can lead to price increases, while lower demand may result in reduced prices. If production is disrupted and supply decreases, prices can rise sharply. The volatility in industrial gas prices is largely driven by supply and demand dynamics, which directly influence production costs.

Opportunity

Growing Demand For Electric Vehicles

The global shift toward electric vehicles (EVs) is creating significant growth opportunities for the industrial gases market. As the EV market scales globally, so too does the demand for consistent, high-quality lithium-ion battery production. Industrial gases such as nitrogen are increasingly used in the mixing of active materials to prevent degradation and preserve purity. With EV manufacturers prioritizing efficiency, quality, and environmental responsibility, the role of industrial gases is becoming more prominent. This rising demand positions the industrial gases sector as a key contributor to the growth of electric vehicles.

- For instance, according us transportation sector reports U.S., accounting for 13–15% of global emissions, aims to cut emissions by 50–52% by 2030 and reach net zero by 2050; widespread EV adoption by 2025 could reduce global CO₂ emissions by 1.5 billion metric tons annually thereby driving increased demand for industrial gases used in battery and clean energy manufacturing.

Furthermore, Industrial gases are utilized extensively across various stages of battery production, from raw material processing to final assembly and recycling. During battery component manufacturing, gases such as nitrogen and oxygen are strategically deployed to maintain product integrity and improve process reliability. For instance, nitrogen is used during the calcination heat treatment of anodes to create inert conditions that prevent oxidation.

In cathode synthesis, oxygen supports the development of layered oxide structures, particularly for high-nickel cathode active materials (CAM), while nitrogen plays a vital role in forming olivine-structured cathodes such as lithium iron phosphate (LFP). These gases are also critical during material mixing, jet milling, and spray drying processes that demand precision and contamination control. Industrial gases play a critical role throughout the lithium-ion battery value chain, making them essential elements of advanced battery manufacturing processes.

- According to the International Energy Agency (IEA), global lithium-ion battery manufacturing capacity is expected to increase dramatically between 2022 and 2030. Projects that global demand for lithium-ion batteries will rise nearly seven-fold, reaching 4.7 terawatt-hours (TWh) by 2030. This surge directly drives the demand for industrial gases in the adoption of electric vehicles (EVs) worldwide.

Trends

Rise of Modular Skid Based Gas Systems

The global industrial gas market is witnessing a growing trend toward modular skid-based gas systems, driven by the need for efficient, scalable, and cost-effective gas processing solutions. These pre-assembled units, built off-site in controlled environments, enable faster deployment, minimize on-site construction risks, and reduce downtime.

Their compact footprint, improved safety standards, and consistent quality control make them highly attractive across sectors like oil & gas, chemicals, healthcare, and electronics. Additionally, their adaptability to different gas types and production scales supports greater operational flexibility, aligning with the industry’s push toward modular, sustainable infrastructure.

Geopolitical Impact Analysis

Geopolitical Trade-Tariff War Between Major Regions Impacting Supply Change Price of Global Industrial Gases Market.

Geopolitical developments have become increasingly influential in shaping the dynamics of the global industrial gas market. Key factors such as transit agreements through Ukraine, adverse weather events, and the escalation of geopolitical tensions are impacting supply chain reliability, transportation routes, and energy availability elements critical to the production and distribution of industrial gases. Disruptions in these areas can lead to fluctuations in gas supply, increased operational costs, and delays in delivery, particularly for gases dependent on energy-intensive production methods such as oxygen, nitrogen, and hydrogen.

Additionally, global trade tensions, including the ongoing US-China-European trade conflicts, have significantly affected the industrial gases sector. Tariffs on chemical and gas-related products have increased the cost of raw materials and intermediate goods, companies have begun diversifying their supply chains and exploring alternative regional markets to mitigate exposure to tariff-related cost pressures.

- For instance, In April 2025, the Bangladesh Energy Regulatory Commission (BERC) approved a 33% increase in gas tariffs for new industrial units. The revised rate for industrial gas is now set at Tk 40 per cubic meter, up from Tk 30, while new captive power users will pay Tk 42 per cubic meter, an increase from Tk 31.5.

- In another regulatory development, the President of the Energy Regulatory Office approved Tariff No. 10 for LNG regasification services, which took effect on January 1, 2025, and will remain valid through January 1, 2026. This tariff introduces updated rates for LNG regasification, directly influencing industrial gas prices for users reliant on LNG terminals.

- In addition, in the Netherlands, gas transmission tariffs are set to rise significantly in 2025, with an average increase of over 50%. This steep hike is expected to impact industrial gas costs across various sectors, adding to broader pricing pressures within the European industrial gas market.

Tariff hikes and geopolitical shifts are having a significant impact on the global industrial gas market, leading to tighter supply conditions and increased price volatility. In Europe, sharp rises in transmission tariffs—such as the 50% jump in the Netherlands—are driving up costs for industrial users and contributing to broader inflationary trends, especially as reliance on LNG imports grows amid constrained pipeline supplies.

Meanwhile, escalating trade tensions between major economies such as the U.S. and China, along with targeted duties in Asia-Pacific, are raising manufacturing costs and potentially reducing industrial gas demand. These pressures, coupled with macroeconomic uncertainty and ongoing challenges in gas storage and supply flexibility, are expected to impact global demand growth in 2025, reshaping market dynamics across the industrial gas value chain.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Industrial Gases Market

In 2024, Asia Pacific dominated the global Industrial Gases market, accounting for 38.9% of the total market share, Driven by rapid urbanization and sustained economic development, regions with well-established industrial sectors particularly in healthcare, pharmaceuticals, and electronics are witnessing a significant rise in demand for industrial gases.

In the Asia-Pacific region, rapid population growth, urbanization, and rising healthcare investments are fueling strong demand for medical-grade industrial gases. The expansion of hospital networks, modernization of medical equipment, and focus on critical care services have led to increased consumption of essential gases such as oxygen, nitrous oxide, and other medical-grade mixtures used in respiratory therapies, surgical procedures, and diagnostics. Furthermore, rapid expansion of electric vehicle (EV) manufacturing and lithium-ion battery production.

As countries such as China, Japan, South Korea, and India ramp up efforts to transition to clean energy transportation, the demand for high-performance lithium-ion batteries is accelerating. This drives significant demand for industrial gases, which are essential to battery manufacturing processes. With Asia-Pacific positioned as a global manufacturing hub for EVs and batteries—led by China’s dominant battery supply chain and supported by strong government incentives across the region—the demand for industrial gases is set to grow steadily. The region’s investment in large-scale battery plants, coupled with expanding EV adoption and supportive clean energy policies, makes them one of the most dominating markets for industrial gas suppliers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players In the Global Industrial Gas Market Maintain Their Market Competition Through Advanced Technologies and Adopting Green Manufacturing Practices.

Key players in the global industrial gases market include Linde plc, Air Liquide S.A, Messer Group, Yingde Gases Group Company Limited, Buzwair Industrial Gases Factory, BASF SE, INOX Air Products, Iwatani Corporation, Taiyo Nippon Sanso Corporation, Hangyang, SOL Group, Strandmøllen A/S, Bhuruka Gases Limited, Matheson Tri-Gas, Inc., Other Key Players these players fostering innovation to strengthen their competitive edge and meet evolving industry needs.

These companies are investing in advanced gas technologies, expanding into green hydrogen, carbon capture, and energy-efficient gas production, while also developing modular and automated distribution systems. Strategic collaborations, sustainable product development, and digitization of gas supply chains are further reinforcing their positions as innovation leaders in the industrial gas sector.

Top Key Players

- Linde plc

- Air Liquide S.A

- Messer Group

- Yingde Gases Group Company Limited

- Buzwair Industrial Gases Factory

- BASF SE

- INOX Air Products

- Iwatani Corporation

- Taiyo Nippon Sanso Corporation

- Hangyang

- SOL Group

- Strandmøllen A / S

- Bhuruka Gases Limited

- Matheson Tri-Gas, Inc.

- Other Key Players

Recent Developments

- In January 2025- Air Liquide Healthcare has signed contracts with 20 hospitals, including its first in Brazil, to supply certified low-carbon medical gases through its ECO ORIGIN™ offer. Launched in early 2024, the solution helps healthcare facilities cut CO₂ emissions by over 70% on average. This development supports Air Liquide’s ADVANCE strategy for sustainable innovation.

- In June 2025- Linde announced plans to double its CO₂ production capacity at its Freeport, Texas facility by 2027 with a second liquefaction plant, aiming to meet rising demand across sectors like food, beverage, and low-carbon fuels. The facility, which captures CO₂ from MEGlobal’s ethylene glycol plant, is the first of its kind in the U.S. to receive ISCC PLUS certification, underscoring Linde’s commitment to sustainability and carbon reuse.

- In January 2025- Messer announced a $70 million investment to build a new air separation unit in Berryville, Arkansas, to meet rising demand for industrial gases across key sectors. The facility will enhance regional supply capabilities and create new jobs, reinforcing Messer’s growth in the southern U.S.

- In January 2023- Iwatani Corporation of America acquired Aspen Air US, a leading producer and distributor of bulk liquid industrial gases in Montana, marking its strategic entry into the U.S. industrial gases market. The acquisition expands Iwatani’s presence in underserved regions and strengthens its portfolio across hydrogen, helium, specialty, and now industrial gases.

Report Scope

Report Features Description Market Value (2024) USD 112.7 Billion Forecast Revenue (2034) USD 254.8 Billion CAGR (2025-2034) 8.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Product Type (Atmospheric Gases, Hydrocarbon Gases, Noble Gases, Specialty Gases), By Distribution (Merchant, On-site, Packaged), By End-use (Healthcare, Metallurgy and Glass, Food and Beverages, Retail, Chemicals and Petrochemicals, Electronics, Energy and Power, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Linde plc, Air Liquide S.A., Messer Group, Yingde Gases Group Company Limited, Buzwair Industrial Gases Factory, BASF SE, INOX Air Products, Iwatani Corporation, Taiyo Nippon Sanso Corporation, Hangyang, SOL Group, Strandmøllen A / S, Bhuruka Gases Limited, Matheson Tri-Gas, Inc., Other Key Players Customization Scope Customization for segments at, region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Linde plc

- Air Liquide S.A

- Messer Group

- Yingde Gases Group Company Limited

- Buzwair Industrial Gases Factory

- BASF SE

- INOX Air Products

- Iwatani Corporation

- Taiyo Nippon Sanso Corporation

- Hangyang

- SOL Group

- Strandmøllen A / S

- Bhuruka Gases Limited

- Matheson Tri-Gas, Inc.

- Other Key Players