Global Bauxite Market By Product Type (Metallurgical Grade and Refractory Grade), By Application (Alumina Production, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 38384

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

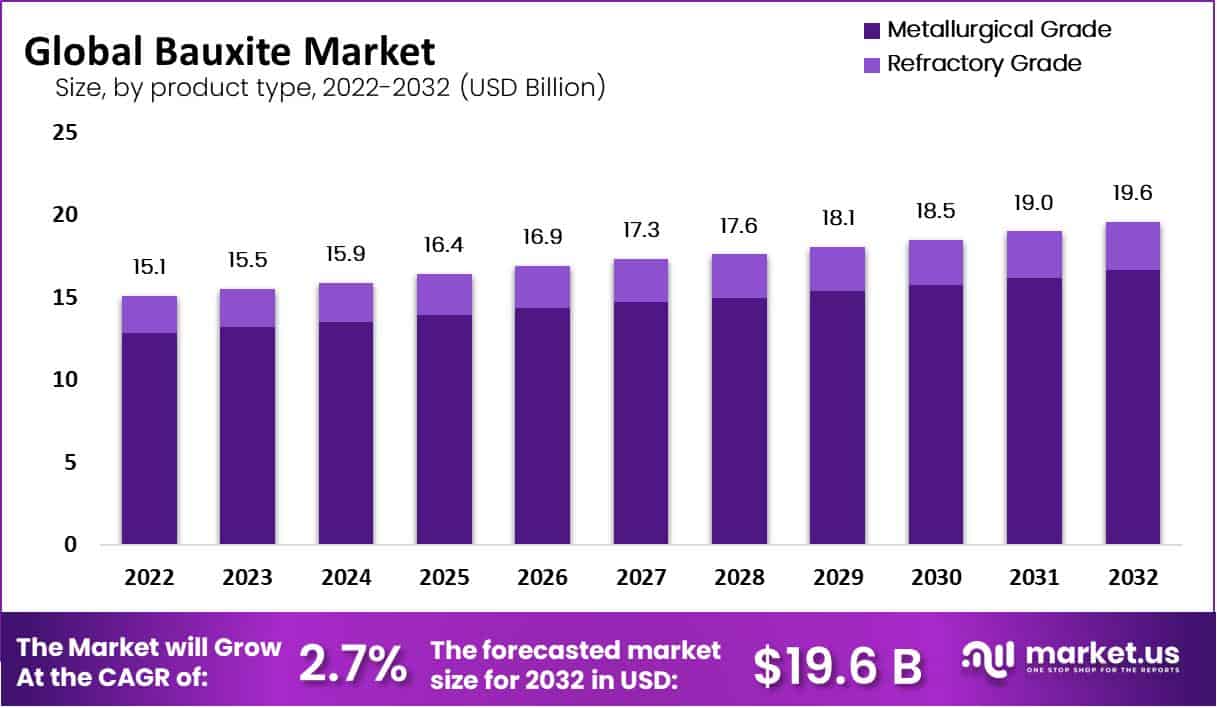

In 2022, the global bauxite market was valued at USD 15.1 billion and is expected to reach USD 19.6 billion in 2032. This market is estimated to register the highest CAGR of 2.7% between 2023 and 2032.

Bauxite is generally a naturally occurring, heterogeneous material that is composed primarily of one or more aluminum hydroxide minerals, mixtures of silica, titania, iron oxide, and other impurities in minor amounts.

Bauxite is used to produce alumina, which is then used in the production of aluminum. It is the most common ore of aluminum. The extraction of aluminum generally takes place in three steps, i.e., mining of bauxite ore, refining the ore, and smelting alumina to produce aluminum.

The demand for aluminum is increasing from end-use industries such as the automotive industries. Thus, the demand for bauxite is expected to increase during the forecast period for aluminum manufacturing.

Key Takeaways

- Market Value and Growth: The global bauxite market was valued at USD 15.1 billion in 2022 and is projected to reach USD 19.6 billion by 2032, showing a compound annual growth rate (CAGR) of 2.7% from 2023 to 2032.

- Bauxite Overview: Bauxite is a naturally occurring material composed primarily of aluminum hydroxide minerals, silica, titania, iron oxide, and other minor impurities. It is a crucial raw material for aluminum production.

- Aluminum Demand: The demand for aluminum is on the rise, particularly in industries like automotive, where aluminum is used for manufacturing various components, including transmission bodies, engine radiators, wheels, bumpers, and doors.

- Government Regulations: Governmental regulations in various countries are increasingly focusing on mining activities. Bauxite mining can have negative environmental impacts, including vegetation loss, forest fragmentation, and air pollution.

- Product Segmentation: The bauxite market is segmented into two product types: metallurgical grade and refractory grade. Metallurgical-grade bauxite is dominant and is crucial for aluminum production.

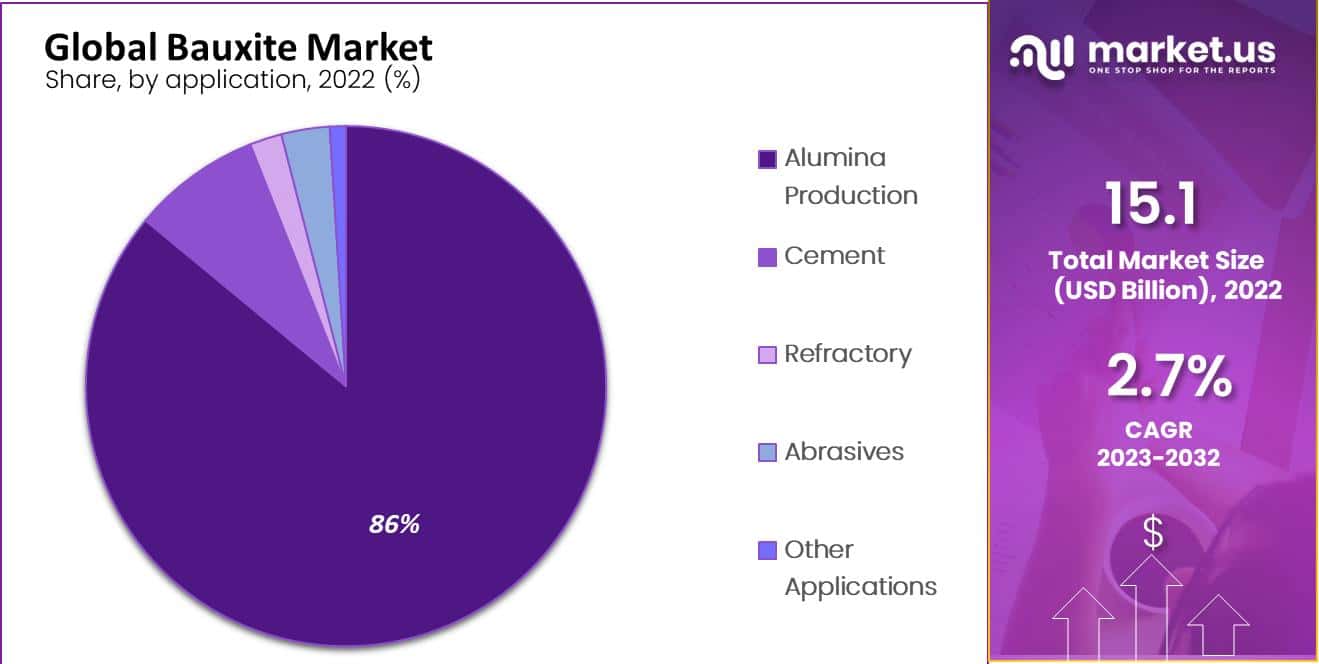

- Application Segmentation: Bauxite is used in various applications, with alumina production being the dominant segment, accounting for 86% of the market share in 2022. Alumina is a key ingredient in aluminum production.

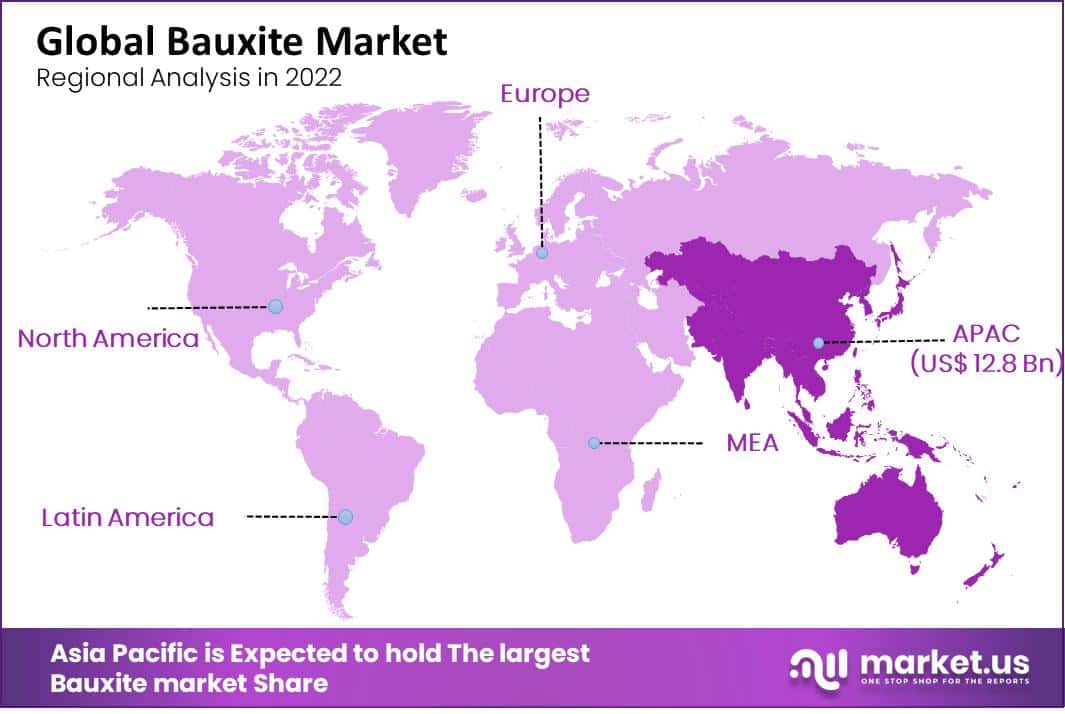

- Regional Dominance: Asia Pacific led the market in 2022 with the largest revenue share of 80%, followed by Australia as a significant bauxite producer. Europe is expected to grow at the fastest CAGR due to the demand for aluminum in lightweight vehicle manufacturing.

- Key Market Players: Major companies in the bauxite market include Alcoa Corporation, Rio Tinto, Aluminum Corporation of China Limited (CHALCO), and more. These players are adopting various strategies to maintain a competitive edge.

Driving Factors

Increasing Demand for Aluminum from End-Use Industries to Propel the Market Expansion

Bauxite has great demand in refractory products due to its high melting point. The lateritic grade bauxite is often used as building material when no material is available. In steel industries, bauxite is used to control the desulphurizing power fluidity of the slag and provide material for blast furnaces of cement during iron making.

Bauxite is the most important industrial mineral, and it is significantly used as an aluminum ore. It is the principal raw material for the production of alumina. The increasing governmental regulations on the emission of hazardous gases drive the need for lightweight and electrical vehicles (EVs), driving the demand for aluminum in automotive manufacturing industries.

The demand for aluminum is increasing in the manufacturing of car parts such as transmission bodies, engine radiators, wheels, bumpers, and doors, propelling the growth of the market. Aluminum is used as a standard alternative for steel parts of cars.

It is easier to form aluminum parts which reduces labor costs. Most car manufacturers, such as Bugatti, Ferrari, BMW, Porsche, and Mercedes, use aluminum parts in their cars. Aluminum is highly corrosion resistant and has high tensile strength; thus, manufacturers in automotive industries are adopting aluminum parts in vehicle manufacturing.

Restraining Factors

Governmental Regulations on Mining Activities

Bauxite mining is one of the major open-cast mining activities which have a significant negative impact on the local environment. Bauxite mining causes vegetation loss, forest fragmentation, biodiversity loss, and air pollution, which have a negative impact on water resources and the environment.

The increasing government regulation on mining activities in several countries is expected to hinder market growth during the forecast period.

By Product Analysis

The Metallurgical Grade Segment is Dominant in the Market, with Largest Market Revenue Share

Based on product type, the bauxite market is segmented into metallurgical grade and refractory grade. The metallurgical grade segment was dominant in the market with the largest market revenue share of 85% in 2022 in is expected to remain dominant in the market during the forecast period. Bauxite is the primary source of metallurgical grade alumina used in forming aluminum metal.

The demand for A-grade metallurgical bauxite is more in the market because it contains about 44% of aluminum oxide (Al2O3). Over 90% of the world’s bauxite production is consumed in the aluminum industry. The increasing demand for aluminum in different end-use industries such as packaging, automotive, transportation, and building & construction industries is driving the demand for aluminum.

The refractory grade bauxite segment is expected to grow at the fastest CAGR during the forecast period. Refractory grade bauxite (RGBs) are high-alumina used in aluminum production. Refractory grade bauxite is used to resist physical and chemical reactions, cracking, and spalling. This grade of bauxite is ideal in the manufacturing of furnace parts, regenerator walls and checkers, and combustion lining for boilers.

By Application Analysis

Alumina Production Segment is Dominant in the Market, with Largest Market Revenue Share

By application, the bauxite market is segmented into alumina production, refractory, cement, abrasives, and other applications. The alumina production segment was dominant in the market, with the largest market revenue share of 86% in 2022. Bauxite is the main component in the production of aluminum. The increasing demand for aluminum in building materials, aircraft construction, air conditioners, refrigerators, electrical conductors, and food processing equipment is driving the growth of this segment.

The aluminum production industries are evolving worldwide due to increasing demand from end-use industries. Thus, the demand for bauxite in the production of aluminum is increasing. The cement segment is expected to grow at the fastest CAGR during the forecast period. The residue of bauxite has high demand in cement production industries due to its composition, availability, volume, properties, and cost-effectiveness. The bauxite residue is used as a pozzolanic material in the cement industry, which helps in reducing CO2 emissions.

Key Market Segments

By Product Type

- Metallurgical Grade

- Refractory Grade

By Application

- Alumina Production

- Refractory

- Cement

- Abrasives

- Other Applications

Growing Opportunities

Increasing Demand in the Automotive Industry Expected to Create Growth Opportunities in Market

The increasing demand for electric vehicles due to strict governmental regulations on the emission of hazardous gases is expected to drive the demand for metal aluminum in the manufacturing of lightweight electric vehicles.

Aluminum has superior properties such as corrosion resistance, high density, strength, and high ductility; hence the demand for aluminum is increasing in the manufacturing of automotive parts, expected to propel the bauxite market during the forecast period.

The increasing demand for bauxite in alumina production, refractory, cement, and abrasives is expected to create lucrative growth opportunities in the global bauxite market during the forecast period.

Latest Trends

The Demand for Aluminum is Increasing in Packaging Industries

The aluminum foil acts as a total barrier to light and oxygen, increasing the demand for pharmaceutical packaging. The food & beverage industries are shifting towards aluminum packaging for drinks and dairy goods.

The major key players in the bauxite market are focusing on different business strategies such as merging, acquisition, and collaboration to obtain a competitive edge in the market and expand their businesses. The demand for bauxite is driven by aluminum production and increasing demand for aluminum from the construction, automotive, aerospace, and food packaging industries.

Regional Analysis

Asia Pacific Region is Dominant in the Market with Largest Market Revenue Share

Asia Pacific region was dominant in the market, with the largest market revenue share of 80% in 2022. The growth of the region is propelled by increasing demand for aluminum in the manufacturing and food packaging industries.

In 2021, Australia produced the highest volume of bauxite across the Asia Pacific region, with approximately 103 million tons of bauxite produced. Vietnam produced approximately 3.54 million tons of bauxite in 2020.

The large blanket deposits are found in Australia and India as flat layers near the surface. Increasing mining activities in China, Australia, and India are propelling market growth in the Asia-Pacific region. In 2021, China’s bauxite production volume amounted to 69.6 million tons. China is the largest producer and consumer of aluminum and is also dominant in importing bauxite.

Also, the presence of top key players in the mining industry, such as Mitsubishi Materials Corporation, Jiangxi Copper Co Ltd., and Aluminum Corporation of China Ltd., are playing a major role in the market’s development.

Europe is expected to grow at the fastest CAGR during the forecast period due to increasing demand for aluminum in the manufacturing of lightweight vehicles. Europe is the home of major key players in automotive manufacturers such as Volkswagen AG, Stellantis NV, and Mercedes-Benz Group AG, driving the demand for aluminum.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The major players in the metal magnesium market are focusing on expanding their business in foreign countries. Several key players are focusing on competitive pricing, merging, and acquisition strategies to stay competitive in the market. Several key players are adopting the latest technologies and machinery in bauxite mining to increase production yield.

The major key players in the bauxite market include Alcoa Corporation, Rio Tinto, Aluminum Corporation of China Limited (CHALCO), National Aluminum Company Limited (NALCO), Norsk Hydro ASA, China Hongqiao Group Limited, Emirates Global Aluminum PJSC, Metro Mining Limited, Hindalco Industries Ltd., Emirates Global Aluminium PJSC, and Other Key Players.

Market Key Players

- Alcoa Corporation

- Rio Tinto

- Aluminum Corporation of China Limited (CHALCO)

- National Aluminum Company Limited (NALCO)

- Norsk Hydro ASA

- China Hongqiao Group Limited

- Emirates Global Aluminum PJSC

- Metro Mining Limited

- Hindalco Industries Ltd.

- Emirates Global Aluminium PJSC

- Other Key Players

Recent Developments

In April 2023, Rio Tinto said it will produce 50% more bauxite by 2025. They expect this increase due to the higher demand for aluminum.

In May 2023, Alcoa announced a $1 billion investment in a new bauxite mine in Guinea. This will create 10,000 jobs and raise Alcoa’s bauxite production by 10%.

In June 2023, the International Aluminium Institute (IAI) released a report predicting a 2% yearly growth in global bauxite demand from 2023 to 2028. This growth is because of the increased need for aluminum in the construction, automotive, and packaging industries.

Report Scope

Report Features Description Market Value (2022) USD 15.1 Bn Forecast Revenue (2032) USD 19.6 Bn CAGR (2023-2032) 2.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product Type- Metallurgical Grade and Refractory Grade; By Application- Alumina Production, Refractory, Cement, Abrasives, and Other Applications Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Alcoa Corporation, Rio Tinto, Aluminum Corporation of China Limited (CHALCO), National Aluminum Company Limited (NALCO), Norsk Hydro ASA, China Hongqiao Group Limited, Emirates Global Aluminum PJSC, Metro Mining Limited, Hindalco Industries Ltd., Emirates Global Aluminium PJSC, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What will be the market size for Bauxite Market in 2032?In 2032, the Bauxite Market will reach USD 19.6 billion.

What CAGR is projected for the Bauxite Market?The Bauxite Market is expected to grow at 2.7% CAGR (2023-2032).

Name the major industry players in the Bauxite Market.Alcoa Corporation, Rio Tinto, Aluminum Corporation of China Limited (CHALCO), National Aluminum Company Limited (NALCO), Norsk Hydro ASA, China Hongqiao Group Limited, Emirates Global Aluminum PJSC and Other Key Players are the main vendors in this market.

List the segments encompassed in this report on the Bauxite Market?Market.US has segmented the Bauxite Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Product Type, market has been segmented into Metallurgical Grade and Refractory Grade. By Application, the market has been further divided into, Alumina Production, Refractory, Cement, Abrasives and Other Applications.

Name the key business areas for the Bauxite Market.The US, Canada, China, India, Brazil, South Africa, Malaysia, Australia & New Zealand, Argentina etc., are leading key areas of operation for the Bauxite Market.

-

-

- Alcoa Corporation

- Rio Tinto

- Aluminum Corporation of China Limited (CHALCO)

- National Aluminum Company Limited (NALCO)

- Norsk Hydro ASA

- China Hongqiao Group Limited

- Emirates Global Aluminum PJSC

- Metro Mining Limited

- Hindalco Industries Ltd.

- Emirates Global Aluminium PJSC

- Other Key Players