Global Abrasives Market By Material Type (Natural, Synthetic), By Type (Bonded Abrasive, Coated Abrasive, Super Abrasive), By Application (Automotive, Machinery, Metal Fabrication, Electrical and Electronics Equipment, Aerospace, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 18490

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

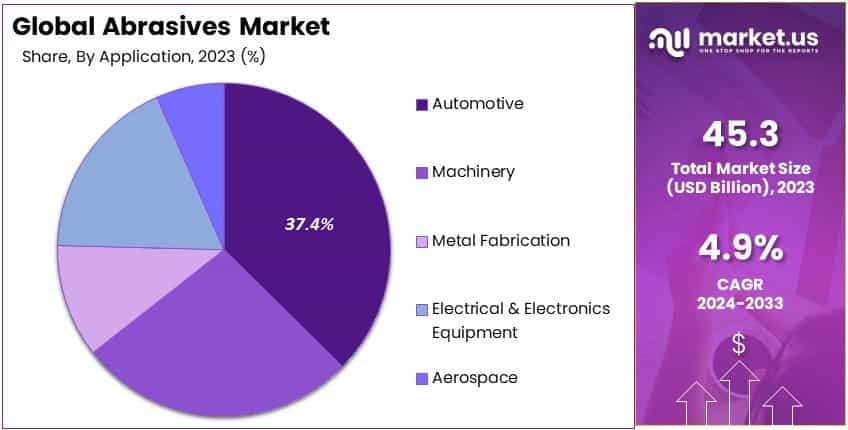

The Global Abrasives Market size is expected to be worth around USD 73.1 Billion by 2033, from USD 45.3 Billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2024 to 2033.

Abrasives are materials used to wear down, polish, or shape other surfaces through friction. Common abrasives include sandpaper, grinding wheels, and polishing compounds. They are essential in manufacturing and construction for surface finishing, cleaning, and cutting, serving diverse industries from automotive to electronics.

The abrasives market encompasses the production, distribution, and sale of abrasive materials and products. This market serves industries such as automotive, construction, and metalworking. It includes various types of abrasives, including bonded, coated, and loose abrasives, catering to diverse industrial needs for precision and efficiency in material finishing.

The abrasives market shows strong growth potential, driven by rising demand from industrial sectors like automotive and metalworking. Abrasives are essential for applications in grinding, polishing, and surface finishing, supporting both manufacturing and maintenance processes.

The global automotive sector, with 93.55 million vehicles produced in 2023, relies heavily on abrasives for tasks such as component shaping and finishing, emphasizing the material’s role in achieving precision.

In metalworking, abrasives are equally critical. For instance, 1,660,000 net tons of raw steel were produced in the U.S. alone in the week ending October 26, 2024, with a 74.7% capability utilization rate as per American Iron and Steel Institute. This underscores the significant demand for abrasives in shaping and refining metal products.

The competitive landscape of the abrasives market is dynamic, with numerous players vying for market share through technological advancements and diversified product offerings. Market leaders are investing in high-performance abrasive materials that cater to specific industrial needs, from automotive manufacturing to aerospace and metal fabrication.

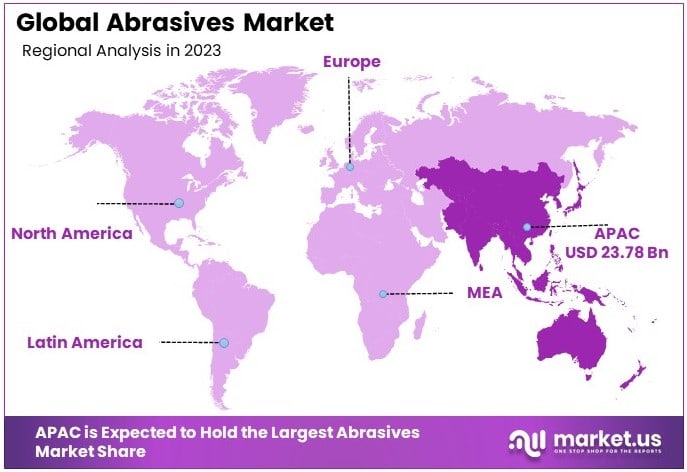

While some mature markets show signs of saturation, especially in North America and Western Europe, emerging markets in Asia-Pacific present notable opportunities for expansion. The abrasives market remains highly competitive, driven by the innovation of durable, efficient products tailored to industry-specific needs.

Locally, the sector supports manufacturing jobs and contributes to the broader industrial supply chain, while globally, abrasives play a crucial role in improving productivity and quality standards across industries. Government standards and environmental regulations encourage the development of more sustainable abrasive products, reinforcing the market’s alignment with industry growth and sustainability trends.

Key Takeaways

- The Abrasives Market was valued at USD 45.3 Billion in 2023 and is expected to reach USD 73.1 Billion by 2033, with a CAGR of 4.9%.

- In 2023, Bonded Abrasives dominate the type segment with 42.3%, driven by their extensive applications in grinding and polishing.

- In 2023, Automotive leads the application segment with 37.4%, reflecting high demand in vehicle manufacturing and maintenance.

- In 2023, the Asia Pacific region dominates with 52.5% of the market, supported by the region’s strong manufacturing base.

Material Type Analysis

Synthetic abrasives dominate due to their consistency and superior properties.

The Abrasives Market segmented by material type includes Natural and Synthetic. Synthetic abrasives dominate the market because they can be engineered to possess specific qualities required for various industrial applications. These abrasives are manufactured through controlled processes that ensure consistency, quality, and performance, which are often preferable to the variable nature of natural abrasives.

Synthetic abrasives include materials like aluminum oxide, silicon carbide, and ceramic, each chosen for specific applications based on their hardness and durability. These materials are used to produce both bonded and coated abrasives, offering versatility across a range of applications, from heavy material removal to fine polishing.

Natural abrasives, such as garnet, diamond, and emery, are still used where a softer or more varied abrasive action is needed. These materials play a crucial role in applications where synthetic alternatives may be too harsh or where natural materials offer a cost advantage.

Despite the dominance of synthetic materials, natural abrasives remain integral to certain traditional or specialized tasks, supporting niche markets within the broader Abrasives Industry.

Type Analysis

Bonded Abrasives dominate with 42.3% due to their durability and versatility.

The Abrasives Market segmented by type includes Bonded Abrasives, Coated Abrasives, and Super Abrasives. Bonded Abrasives hold the largest market share at 42.3%. This dominance is largely attributed to their robustness and versatility in various machining processes.

Bonded Abrasives are preferred for their ability to handle heavy-duty grinding and precision cutting, making them suitable for automotive, aerospace, and metal fabrication industries.

Bonded Abrasives are composed of an abrasive material bound within a matrix, which may be made from clay, resin, or rubber. This composition allows them to maintain structural integrity under harsh conditions. The ongoing technological advancements in abrasive materials and bonding agents further enhance their efficiency and lifespan, solidifying their position in the market.

Coated Abrasives, which are made by fixing abrasive grains to a backing material like paper or cloth using an adhesive, are essential for detailed surface finishing tasks. They are versatile and widely used in automotive and furniture industries for fine finishing and polishing.

Super Abrasives, made from materials like diamond and cubic boron nitride, are used for highly specialized tasks that require precision and a high degree of finish. These are crucial in sectors that demand ultra-precision, such as semiconductor manufacturing and intricate metalwork.

Application Analysis

Automotive dominates with 37.4% due to increasing demand for high-performance materials.

The Abrasives Market segmented by application includes Automotive, Machinery, Metal Fabrication, Electrical & Electronics Equipment, Aerospace, and Others. The Automotive sector leads with a 37.4% market share. This significant presence is driven by the constant demand for abrasives in the manufacturing, maintenance, and repair of automotive components.

Abrasives are extensively used in the automotive industry for tasks such as surface finishing, grinding, and polishing, critical for achieving the precise specifications required in modern automotive manufacturing.

The surge in automotive production and the rising standards for material quality and finish are key factors boosting the use of abrasives in this sector. The development of lightweight materials and more durable abrasive solutions has enabled manufacturers to enhance production efficiency and component quality, further driving growth in this segment.

Machinery and Metal Fabrication are also significant application areas for abrasives. In machinery, abrasives are utilized for shaping and finishing parts and tools. Metal Fabrication relies on abrasives for cutting, grinding, and polishing metal parts, essential for constructing high-quality metal structures and components.

Electrical & Electronics Equipment and Aerospace similarly depend on abrasives for precision manufacturing and maintenance, reflecting the broad utility of abrasives across different sectors.

Key Market Segments

By Material Type

- Natural

- Synthetic

By Type

- Bonded Abrasive

- Coated Abrasive

- Super Abrasive

By Application

- Automotive

- Machinery

- Metal Fabrication

- Electrical & Electronics Equipment

- Aerospace

- Others

Drivers

Growth in Metalworking and Machinery Industries Drives Market Growth

The growth of the metalworking industry directly contributes to the demand for abrasives. Abrasives are essential in metal fabrication processes such as grinding, cutting, and polishing.

Additionally, the increasing demand from the automotive sector drives market growth. Abrasives are used extensively in vehicle production, from shaping body parts to finishing components.

Advancements in manufacturing technologies have led to more efficient abrasive products. These innovations enhance precision and speed, boosting overall productivity in various industries.

Furthermore, rising construction activities across residential and commercial sectors require abrasives for surface preparation. As construction and infrastructure projects expand globally, the demand for abrasives is set to grow further.

Restraints

High Cost of Raw Materials Restraints Market Growth

The high cost of raw materials, such as aluminum oxide and silicon carbide, affects the Abrasives Market. These costs increase the production expenses, impacting profit margins for manufacturers.

Additionally, health and environmental concerns related to abrasive dust exposure create challenges. Strict safety and environmental regulations impose additional costs for compliance, which can limit market growth.

Limited availability of skilled labor further restrains the market. The production of high-quality abrasives requires expertise, and a shortage of trained workers can slow down manufacturing processes.

Government regulations on emissions and waste disposal also restrict market growth. Compliance with these regulations can increase operational costs, affecting the overall profitability of abrasive manufacturing companies.

Opportunity

Expansion in Emerging Economies Provides Opportunities

Emerging economies offer significant growth opportunities for the Abrasives Market. Rapid industrialization in regions like Asia-Pacific and Latin America boosts the demand for abrasives across various industries.

Development of eco-friendly abrasive solutions presents another opportunity. Growing environmental awareness drives the demand for sustainable products, leading to the creation of biodegradable and water-based abrasives.

Integration with automated machinery offers potential for market growth. Automated systems require precision tools, and abrasives play a critical role in ensuring high-quality outputs.

The rising demand for precision manufacturing also opens new avenues. Industries such as aerospace and medical devices need advanced abrasive tools for accurate component fabrication.

Challenges

Fluctuating Raw Material Prices Challenges Market Growth

Fluctuating prices of raw materials pose a major challenge for the Abrasives Market. Inconsistent pricing affects production costs and profitability, making it difficult for manufacturers to plan budgets.

Intense market competition adds to the challenge. Numerous players compete for market share, leading to aggressive pricing and reduced margins.

The risk of technological obsolescence also affects the market. Rapid advancements in manufacturing technologies can make existing abrasive products outdated, requiring constant innovation.

Economic instability in key markets further complicates growth. Uncertain economic conditions can reduce demand for abrasives in industries like construction and automotive, affecting overall market performance.

Growth Factors

Government Investments in Infrastructure Are Growth Factors

Government investments in infrastructure development significantly boost the Abrasives Market. Construction projects require abrasives for various applications, increasing market demand.

Innovations in abrasive materials also contribute to growth. Development of new materials like ceramic and diamond abrasives enhances performance, supporting market expansion.

Rising automotive production drives demand for abrasives. Vehicles require abrasives for tasks like body shaping, engine production, and finishing, supporting market growth.

Global industrialization further fuels demand for abrasives. As more industries adopt automated and precision manufacturing, the need for advanced abrasives increases, driving market growth.

Emerging Trends

Adoption of Smart Manufacturing Practices Is Latest Trending Factor

Smart manufacturing is gaining traction in the Abrasives Market. Integration of IoT and AI technologies in production enhances efficiency and precision, leading to higher quality abrasive products.

Growing focus on sustainable products is another trend. Manufacturers are developing eco-friendly abrasives that meet environmental standards, catering to consumer demand for green solutions.

Nano-abrasive technologies are also on the rise. These advanced abrasives provide superior performance in precision manufacturing, making them popular in industries like electronics and healthcare.

The demand for customized abrasive solutions is increasing. Industries seek tailored abrasives to meet specific requirements, driving innovation and product development in the market.

Regional Analysis

Asia Pacific Dominates with 52.5% Market Share

Asia Pacific (APAC) leads the Abrasives Market with a 52.5% share, totaling USD 23.78 billion. This dominance is driven by rapid industrialization, increased manufacturing activities, and high demand from automotive, electronics, and construction sectors. Major contributors include China, India, and Japan, where infrastructure development and industrial growth are significant.

The region’s market benefits from cost-effective production, extensive raw material availability, and favorable government policies for manufacturing. Strong demand for abrasives in metalworking and machinery further supports market performance. The growing automotive and electronics sectors also drive demand, particularly for precision abrasives.

Asia Pacific’s influence in the global abrasives market is projected to grow. Continuous advancements in manufacturing and the rising focus on sustainable abrasives will strengthen the region’s leading position.

Regional Mentions:

- North America: North America maintains a significant market presence with strong demand from aerospace, construction, and metal fabrication sectors. The region’s focus on advanced manufacturing technologies supports growth.

- Europe: Europe’s market is fueled by automotive and aerospace industries, alongside strict regulatory norms for quality and environmental standards. The region is focusing on sustainable and high-performance abrasives.

- Middle East & Africa: The region sees steady growth, driven by the construction and oil & gas sectors. Infrastructure development projects are increasing the demand for abrasives, especially in metal finishing and stone processing.

- Latin America: Latin America shows potential for growth with rising industrial activities in automotive and construction. Increased investments in infrastructure projects further support the demand for abrasives.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The abrasives market is competitive, driven by technological advancements and broad industrial applications. The top four companies in this sector are Robert Bosch GmbH, Saint-Gobain, NIPPON RESIBON CORPORATION, and The 3M Company. They maintain strong positions due to innovation, wide product ranges, and global presence.

Saint-Gobain focuses on advanced abrasives that cater to diverse sectors, including automotive and construction. Its strong R&D efforts enhance its position as a leader in precision grinding and surface finishing solutions.

NIPPON RESIBON CORPORATION is known for high-quality products, especially in Asia. It emphasizes durable and efficient abrasives, catering to industrial and commercial users.

The 3M Company leverages innovation to offer a wide range of abrasive solutions across industries. It continuously develops advanced products, focusing on efficiency and safety in manufacturing processes.

These companies dominate the market by continuously upgrading their technologies and expanding their global operations, reinforcing their leading positions.

Top Key Players in the Market

- Robert Bosch GmbH (Germany)

- NIPPON RESIBON CORPORATION (Japan)

- Saint-Gobain (U.S.)

- Asahi Diamond Industrial Co., Ltd. (Japan)

- Fujimi Incorporated (Japan)

- Carborundum Universal Limited (India)

- The 3M Company (U.S.)

- Henkel AG & Co. KGaA (Germany)

- Krebs & Riedel (Germany)

- KWH Mirka (Finland)

- NORITAKE CO., LIMITED (Japan)

- Others

Recent Developments

- Tyrolit Group and Acme Abrasives: In October 2023, the Tyrolit Group, a leader in abrasive solutions, acquired Michigan-based Acme Abrasives, known for hot-pressed grinding wheels for steel industries. This acquisition, Tyrolit’s seventh U.S. manufacturing plant, aims to expand its product range in the steel, foundry, and rail sectors.

- SAK Abrasives and Jowitt & Rodgers Co.: In May 2023, SAK Abrasives of India acquired Jowitt & Rodgers Co., a U.S.-based custom abrasive product manufacturer. This acquisition will allow SAK Abrasives to manufacture complementary products across facilities in India and the U.S., enhancing its market presence and product offerings.

- Saint-Gobain: In August 2023, Saint-Gobain, the parent company of Norton Abrasives, reported a record recurring net income of $1.9 billion USD for the first half of 2023, marking a 0.4% increase over the same period in 2022.

Report Scope

Report Features Description Market Value (2023) USD 45.3 Billion Forecast Revenue (2033) USD 73.1 Billion CAGR (2024-2033) 4.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Natural, Synthetic), By Type (Bonded Abrasive, Coated Abrasive, Super Abrasive), By Application (Automotive, Machinery, Metal Fabrication, Electrical and Electronics Equipment, Aerospace, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Robert Bosch GmbH (Germany), NIPPON RESIBON CORPORATION (Japan), Saint-Gobain (U.S.), Asahi Diamond Industrial Co., Ltd. (Japan), Fujimi Incorporated (Japan), Carborundum Universal Limited (India), The 3M Company (U.S.), Henkel AG & Co. KGaA (Germany), Krebs & Riedel (Germany), KWH Mirka (Finland), NORITAKE CO., LIMITED (Japan), Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Robert Bosch GmbH (Germany)

- NIPPON RESIBON CORPORATION (Japan)

- Saint-Gobain (U.S.)

- Asahi Diamond Industrial Co., Ltd. (Japan)

- Fujimi Incorporated (Japan)

- Carborundum Universal Limited (India)

- The 3M Company (U.S.)

- Henkel AG & Co. KGaA (Germany)

- Krebs & Riedel (Germany)

- KWH Mirka (Finland)

- NORITAKE CO., LIMITED (Japan)

- Others