Global Industrial Enzymes Market Size, Share, And Growth Analysis Report By Source (Microorganisms, Plants, Animals), By Product Type (Carbohydrases, Proteases, Lipases, Polymerases and Nucleases), By Formulation (Liquid, Powder), By Production Method (Submerged Fermentation, Solid-state Fermentation), By Application (Food and Beverages, Animal Feed, Cleaning Product, Biofuel, Pulp and Paper, Textiles, Leather Processing), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148218

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

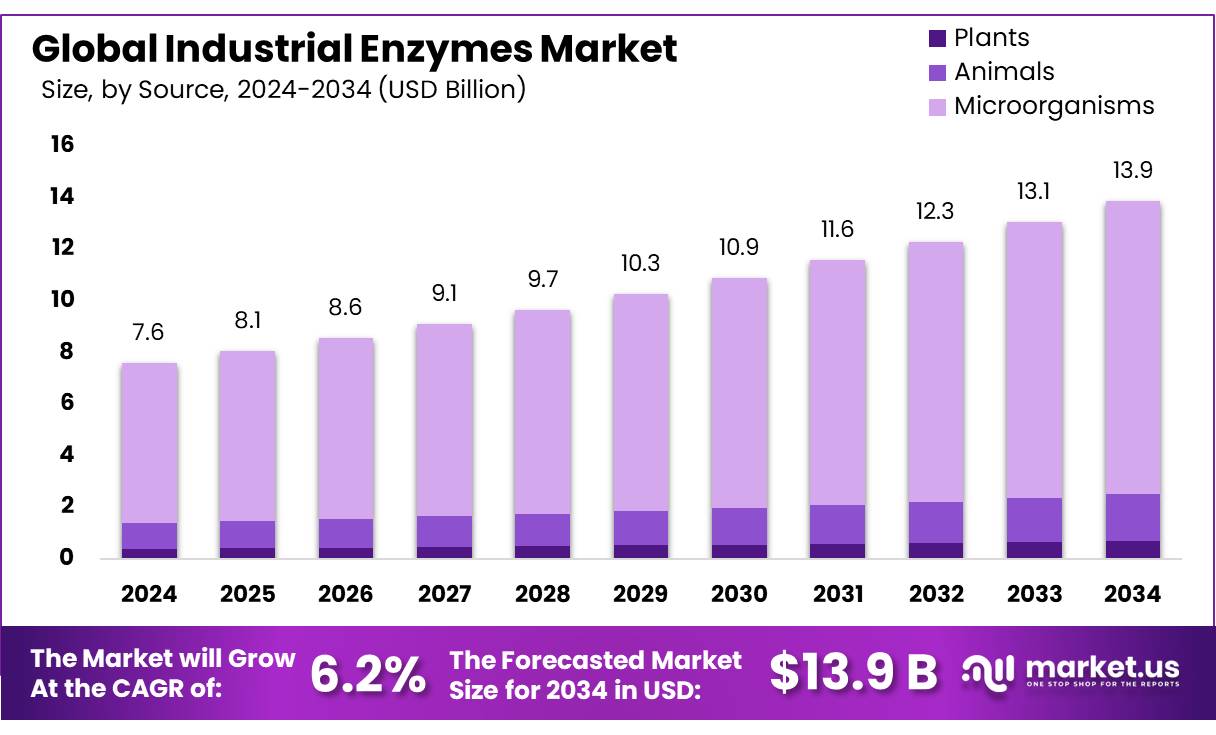

The Global Industrial Enzymes Market size is expected to be worth around USD 13.9 billion by 2034, from USD 7.6 billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

Industrial enzymes are proteins that are produced by living organisms and are used in various industrial processes to improve the efficiency and effectiveness of these processes. Industrial enzymes are commonly used in industries such as food and beverage, pharmaceuticals, chemical production, consumer products, and biofuels.

The Industrial Enzyme companies currently sell enzymes for a wide variety of applications. The estimated value of the world enzyme market is presently about USD 1.3 billion and is predicted to grow to almost USD 2 billion. Detergents (37%), textiles (12%), starch (11%), baking (8%), and animal feed (6%) are the main industries, and use about 75% of industrially-produced enzymes. Enzymes are also indirectly used in biocatalytic processes involving living or dead and permeabilized microorganisms.

This review concentrates on the use of isolated enzyme preparations in large-scale and specialty applications and chemical manufacturing. The use of microorganisms as biocatalysts in chemical production is, however, an interesting and growing field. The techniques of genetic, protein, and pathway engineering are making chemical production by living cells an interesting green alternative to traditional chemical processes.

Only a limited number of all the known enzymes are commercially available, and even fewer are used in large quantities. More than 75% of industrial enzymes are hydrolases. Protein-degrading enzymes constitute about 40% of all enzyme sales. Proteinases have found new applications, but their use in detergents is the major market. More than fifty commercial industrial enzymes are available, and they are increasing steadily in number.

Key Takeaways

- The Global Industrial Enzymes Market is projected to grow from USD 7.6 billion in 2024 to USD 13.9 billion by 2034, with a CAGR of 6.2%.

- Microorganisms dominate with an 82.2% share, driven by cost-effective and efficient enzyme production.

- Carbohydrases lead with a 46.3% share, widely used in food and beverages for texture and taste enhancement.

- Liquid formulations hold a 67.2% share, favored for solubility and ease of application in industrial processes.

- Submerged fermentation captures a 73.2% share, excelling in high-yield enzyme production.

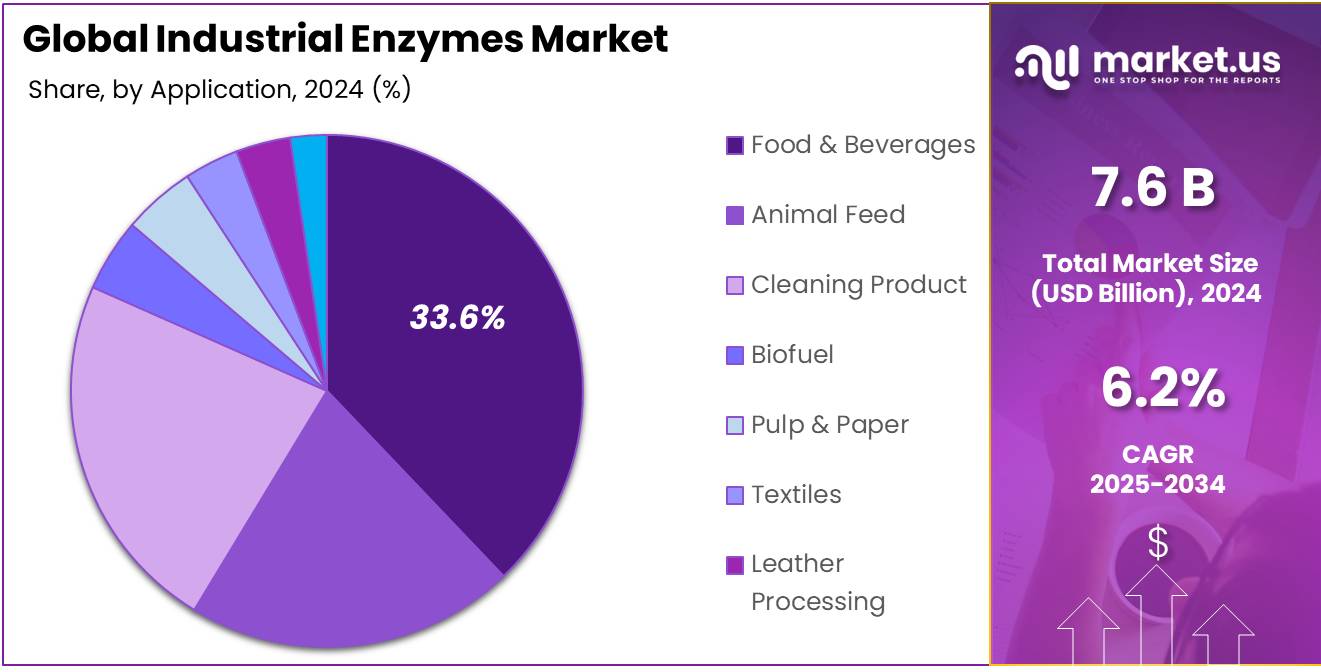

- Food and beverages account for a 33.6% share, leveraging enzymes for improved quality and shelf life.

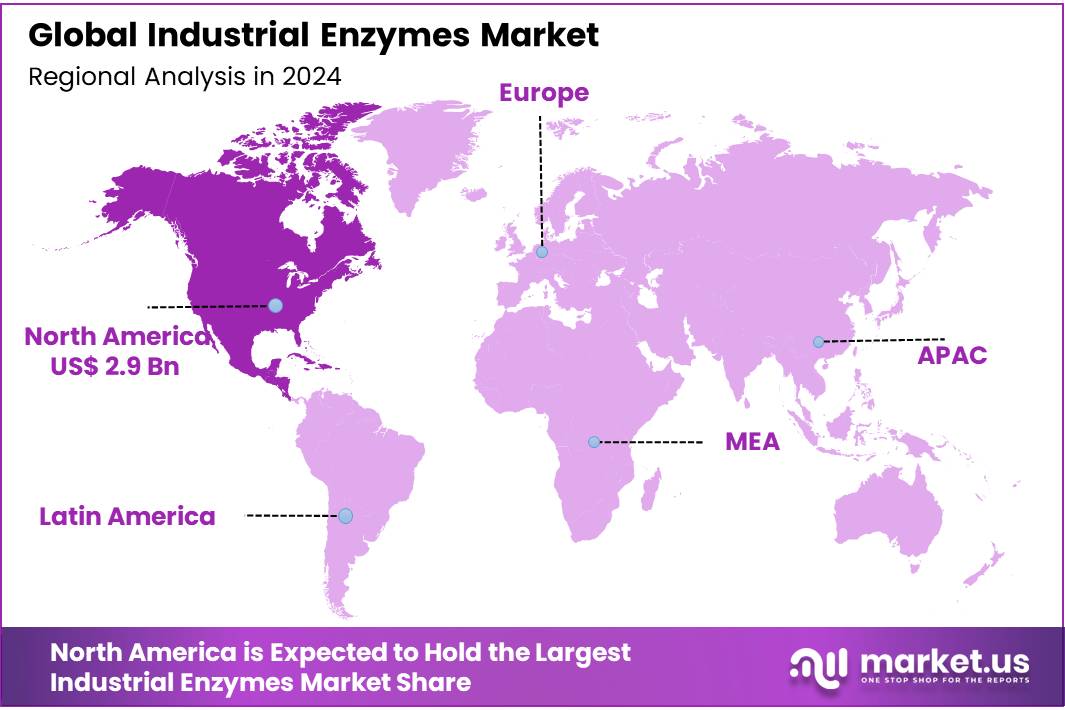

- North America leads with a 39.2% share (USD 2.9 billion), fueled by strong biotech R&D and enzyme adoption.

Analyst Viewpoint

The Industrial Enzymes Market is buzzing with potential for investors, driven by a global push for sustainability and efficiency across industries like food, biofuels, and textiles. Enzymes, acting as natural catalysts, are revolutionizing processes by reducing energy use and waste, aligning perfectly with consumer demand for eco-friendly products.

Investment opportunities shine in sectors like food processing, where enzymes enhance product quality, and in biofuels, where they break down biomass into fermentable sugars. Smaller companies focusing on niche applications, like plant-based enzyme solutions for vegan products, are also catching attention, offering high-growth potential for early investors.

Consumer insights reveal a growing preference for clean-label and natural products, pushing companies to innovate with non-GMO and plant-derived enzymes, but this shift demands significant investment in technology. Advances like enzyme engineering and machine learning are game-changers, enabling tailored enzymes that perform under extreme conditions, yet these innovations require hefty upfront capital.

By Source

Microorganisms Dominate Industrial Enzymes Market with 82.2% Share in 2024

In 2024, Microorganisms held a dominant market position, capturing more than an 82.2% share in the Industrial Enzymes Market. This substantial share is attributed to their widespread use in the production of enzymes due to their high efficiency, cost-effectiveness, and ability to thrive under controlled conditions.

The year witnessed significant advancements in microbial enzyme technologies, particularly in the food and beverage sector, where they played a crucial role in enhancing product quality and extending shelf life. Furthermore, the pharmaceutical and biotechnology industries leveraged microbial enzymes for drug manufacturing and biocatalysis processes, driving their increased adoption.

As the industrial enzyme sector continues to expand, microorganisms are expected to maintain their leading position, supported by ongoing research and development efforts aimed at optimizing enzyme yields and performance. The dominance of microorganisms in the Industrial Enzymes Market is further reinforced by their ability to be genetically modified for enhanced enzyme production.

By Product Type

Carbohydrases Secure 46.3% Share in Industrial Enzymes Market in 2024

In 2024, Carbohydrases held a dominant market position, capturing more than a 46.3% share in the Industrial Enzymes Market. This significant share is largely driven by their extensive use in the food and beverage sector, where they play a crucial role in converting complex carbohydrates into simpler sugars, enhancing product texture and taste.

The demand for carbohydrases surged notably in the baking and brewing industries, driven by the increasing preference for enzyme-based processing methods to improve efficiency and product consistency. Additionally, the pharmaceutical sector leveraged carbohydrases for the production of bioactive compounds, further bolstering their market presence.

As industries focus on sustainable and cost-effective solutions, carbohydrases are expected to maintain their market position, supported by advancements in enzyme engineering and increased adoption in emerging markets. Furthermore, ongoing research and development efforts aimed at optimizing enzyme performance are likely to open new avenues for carbohydrases in industrial applications.

By Formulation

Liquid Formulation Commands 67.2% Share in Industrial Enzymes Market in 2024

In 2024, Liquid formulations held a dominant market position, capturing more than a 67.2% share in the Industrial Enzymes Market. The extensive adoption of liquid enzyme formulations is primarily driven by their superior solubility, ease of application, and effectiveness in diverse industrial processes.

The food and beverage industry remains the largest consumer, utilizing liquid enzymes for processes like juice clarification, starch conversion, and dairy processing. The textile and detergent sectors have increasingly embraced liquid enzymes due to their ability to enhance cleaning efficiency and fabric care without compromising environmental standards.

Liquid formulations are projected to sustain their market dominance, bolstered by ongoing advancements in enzyme stability and storage. The pharmaceutical sector is also witnessing increased utilization of liquid enzymes in biocatalysis and drug manufacturing, further amplifying market penetration.

By Production Method

Submerged Fermentation Captures 73.2% Share in Industrial Enzymes Market in 2024

In 2024, Submerged Fermentation held a dominant market position, capturing more than a 73.2% share in the Industrial Enzymes Market. The extensive use of submerged fermentation is attributed to its efficiency in producing high yields of enzymes through controlled microbial growth in nutrient-rich liquid media.

The process is widely adopted across industries, including food and beverage, textiles, and pharmaceuticals, due to its ability to produce enzymes with consistent quality and purity. In 2025, the demand for submerged fermentation is expected to remain robust as manufacturers increasingly adopt advanced fermentation technologies to optimize enzyme production and reduce costs.

Furthermore, ongoing research into genetically engineered microorganisms is likely to enhance the efficiency of submerged fermentation, reinforcing its market leadership. The pharmaceutical sector, in particular, is projected to drive substantial demand for enzyme production through submerged fermentation, as it offers scalable solutions for large-volume enzyme manufacturing.

By Application

Food and Beverages Hold 33.6% Share in Industrial Enzymes Market in 2024

In 2024, Food and Beverages held a dominant market position, capturing more than a 33.6% share in the Industrial Enzymes Market. This substantial share is driven by the increasing utilization of enzymes in food processing to enhance product quality, shelf life, and texture.

Enzymes like amylases, proteases, and lipases are extensively employed in baking, brewing, dairy, and meat processing to optimize production efficiency and reduce costs. Additionally, the growing consumer demand for natural and clean-label products has further propelled the adoption of enzyme-based solutions in the food and beverage sector.

The sector is expected to witness continued growth, fueled by advancements in enzyme formulations designed to cater to specific food processing needs. Furthermore, with manufacturers focusing on sustainable production methods, enzyme applications in food processing are anticipated to expand, reinforcing the segment’s market dominance.

Key Market Segments

By Source

- Microorganisms

- Plants

- Animals

By Product Type

- Carbohydrases

- Amylases

- Cellulases

- Others

- Proteases

- Lipases

- Polymerases and Nucleases

- Others

By Formulation

- Liquid

- Powder

By Production Method

- Submerged Fermentation

- Solid-state Fermentation

By Application

- Food and Beverages

- Dairy and Dairy Products

- Bakery and Confectionery

- Meat Processing

- Nutraceuticals

- Beverages

- Others

- Animal Feed

- Poultry

- Ruminant

- Swine

- Others

- Cleaning Product

- Biofuel

- Pulp and Paper

- Textiles

- Leather Processing

- Others

Drivers

Rising Demand for Natural and Clean-Label Foods Drives Industrial Enzymes Market

One of the significant driving factors for the industrial enzymes market is the increasing consumer preference for natural and clean-label food products. As health consciousness grows, consumers are seeking foods with fewer synthetic additives and more natural ingredients. Enzymes, being natural proteins that catalyze biochemical reactions, align perfectly with this trend.

Government initiatives and regulatory bodies have also played a role in promoting the use of enzymes in food processing. The Food and Agriculture Organization (FAO) and the World Health Organization (WHO) have provided guidelines and safety assessments for enzyme preparations used in foods, ensuring their safe application in the industry.

Furthermore, advancements in biotechnology have enabled the development of more efficient and specific enzymes, catering to the diverse needs of the food industry. These innovations have facilitated the production of lactose-free dairy products, gluten-free baked goods, and other specialized foods that meet the dietary requirements of various consumer groups.

Restraints

Regulatory Complexities Pose Challenges for the Industrial Enzymes Market

A significant restraint in the industrial enzymes market is the intricate and evolving regulatory landscape governing enzyme use in food processing. While enzymes are indispensable in enhancing food quality and production efficiency, their approval and oversight vary considerably across regions, leading to compliance challenges for manufacturers.

In the United States, the Food and Drug Administration (FDA) classifies many enzymes under the Generally Recognized as Safe (GRAS) category. However, the GRAS system has faced criticism for its self-affirmation pathway, allowing companies to determine an ingredient’s safety without mandatory FDA notification.

The Joint FAO/WHO Expert Committee on Food Additives (JECFA) provides international guidelines for enzyme safety assessments. These assessments encompass evaluations of the production organism, potential allergenicity, and the presence of toxic metabolites. However, adherence to JECFA guidelines varies among countries, leading to inconsistencies in enzyme approval processes.

Opportunity

Government Support and Regulatory Frameworks Fuel Growth in Industrial Enzymes Market

One of the major growth factors propelling the industrial enzymes market is the increasing support from governments and the establishment of comprehensive regulatory frameworks that ensure the safe and effective use of enzymes in food processing. Organizations like the Joint FAO/WHO Expert Committee on Food Additives (JECFA) have been instrumental in setting international standards for enzyme safety.

In the European Union, the Regulation (EC) No 1332/2008 on food enzymes establishes rules for the safety assessment and authorization of enzymes used in food processing. This regulation ensures that only enzymes that are safe, technologically justified, and do not mislead consumers are approved for use.

These regulatory frameworks not only ensure the safety of enzyme applications but also provide clarity and confidence to manufacturers and consumers alike. As a result, there is a growing adoption of enzymes in various food processing applications, ranging from improving bread quality to enhancing juice extraction.

Trends

Biotechnological Innovations in Enzyme Production

A significant emerging factor propelling the growth of the industrial enzymes market is the rapid advancement in biotechnological methods, particularly in enzyme engineering and fermentation technologies.

These innovations are enabling the development of more efficient, specific, and stable enzymes tailored for diverse industrial applications. The use of genetically engineered microorganisms has become a cornerstone in enzyme production.

Organisms like Aspergillus oryzae and Trichoderma reesei are extensively utilized due to their ability to produce large quantities of enzymes such as amylases and cellulases, which are essential in food processing and biofuel production. These microorganisms can be genetically modified to enhance enzyme yield and specificity, thereby improving process efficiency and reducing costs.

Regional Analysis

North America Leads Industrial Enzymes Market with 39.2% Share in 2024

In 2024, North America held a dominant position in the global industrial enzymes market, capturing 39.2% of the total market share, equivalent to approximately USD 2.9 billion. This leadership is primarily attributed to the region’s robust biotechnology sector, significant investments in research and development, and the widespread adoption of enzyme technologies across various industries.

The United States, in particular, has been at the forefront, with a strong presence of key players and advanced technological infrastructure. The food and beverage industry remains a major consumer of industrial enzymes, utilizing them to enhance product quality, shelf life, and production efficiency.

Canada and Mexico have also contributed to the region’s market dominance. In Canada, the emphasis on sustainable practices and clean energy has led to increased enzyme applications in biofuel production and wastewater treatment. Mexico’s expanding food processing industry has adopted enzyme technologies to meet the rising demand for processed and packaged foods.

North America’s industrial enzymes market is poised for continued growth. The ongoing advancements in enzyme engineering, coupled with the increasing demand for sustainable industrial processes, are expected to drive the market forward. With its strong industrial base and commitment to innovation, North America is set to maintain its leading position in the global industrial enzymes market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- Novozymes A/S is a global leader in enzyme production, accounting for a substantial share of the industrial enzymes market. The company specializes in bioinnovation, offering enzyme solutions for sectors such as food and beverages, bioenergy, and agriculture. The company continues to invest in enzyme research to optimize industrial processes and reduce environmental impact.

- DSM leverages its expertise in biotechnology to provide enzyme solutions across diverse industries, including food processing, pharmaceuticals, and biofuels. DSM’s focus on sustainable enzyme production aligns with its mission to address global challenges such as food security and climate change through bio-based innovations.

- DuPont is a key player in the industrial enzymes market, offering enzyme solutions that enhance manufacturing efficiency and reduce environmental impact. DuPont’s enzyme portfolio includes innovative products for applications such as baking, brewing, and biofuel production, positioning it as a leader in enzyme-driven industrial processes.

Top Key Players in the Market

- Novozymes A/S

- DSM

- Dupont

- Associated British Foods Plc

- BASF SE

- Chr. Hansen A/S

- Kerry Group

- Soufflet Biotechnologies

- Ajinomoto Co. Inc.

- Amano Enzyme Inc.

- NAGASE Group

- Advanced Enzyme Technologies Ltd.

- Lesaffre

- Adisseo

- Novus International, Inc.

Recent Developments

In 2024, Novozymes merged with Chr. Hansen to form Novonesis, a global leader in biosolutions, approved by the European Commission after agreeing to divest part of their lactase enzyme business to address competition concerns.

In 2024, DSM merged with Firmenich to create DSM-Firmenich, combining expertise in enzymes, flavors, and fragrances. This merger bolsters their industrial enzyme offerings, particularly in food and nutrition. DSM also acquired S-Biomedic NV, a skin microbiome company, expanding enzyme applications in cosmetics.

Report Scope

Report Features Description Market Value (2024) USD 7.6 Billion Forecast Revenue (2034) USD 13.9 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Microorganisms, Plants, Animals), By Product Type (Carbohydrases, Proteases, Lipases, Polymerases and Nucleases), By Formulation (Liquid, Powder), By Production Method (Submerged Fermentation, Solid-state Fermentation), By Application (Food and Beverages, Animal Feed, Cleaning Product, Biofuel, Pulp and Paper, Textiles, Leather Processing) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Novozymes A/S, DSM, DuPont, Associated British Foods Plc, BASF SE, Chr. Hansen A/S, Kerry Group, Soufflet Biotechnologies, Ajinomoto Co. Inc., Amano Enzyme Inc., NAGASE Group, Advanced Enzyme Technologies Ltd., Lesaffre, Adisseo, Novus International, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Novozymes A/S

- DSM

- Dupont

- Associated British Foods Plc

- BASF SE

- Chr. Hansen A/S

- Kerry Group

- Soufflet Biotechnologies

- Ajinomoto Co. Inc.

- Amano Enzyme Inc.

- NAGASE Group

- Advanced Enzyme Technologies Ltd.

- Lesaffre

- Adisseo

- Novus International, Inc.