Global Image Guided Therapy System Market By Product (Endoscope, Computed Tomography (CT) Scanners, Ultrasound Systems, Magnetic Resonance Imaging (MRI), X-ray Fluoroscopy, Positron Emission Tomography (PET), and Single Photon Emission Computed Tomography (SPECT)), By Connectivity Technology (Cardiac Surgery, Neurosurgery, Orthopedic Surgery, Urology, Gastroenterology, Oncology Surgery, and Others), By End-use (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Research & Academic Institutes), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148088

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Analysis

- Connectivity Technology Analysis

- End-use Analysis

- Key Segments Analysis

- Market Dynamics

- Market Restraints

- Market Opportunities

- Impact of macroeconomic factors / Geopolitical factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

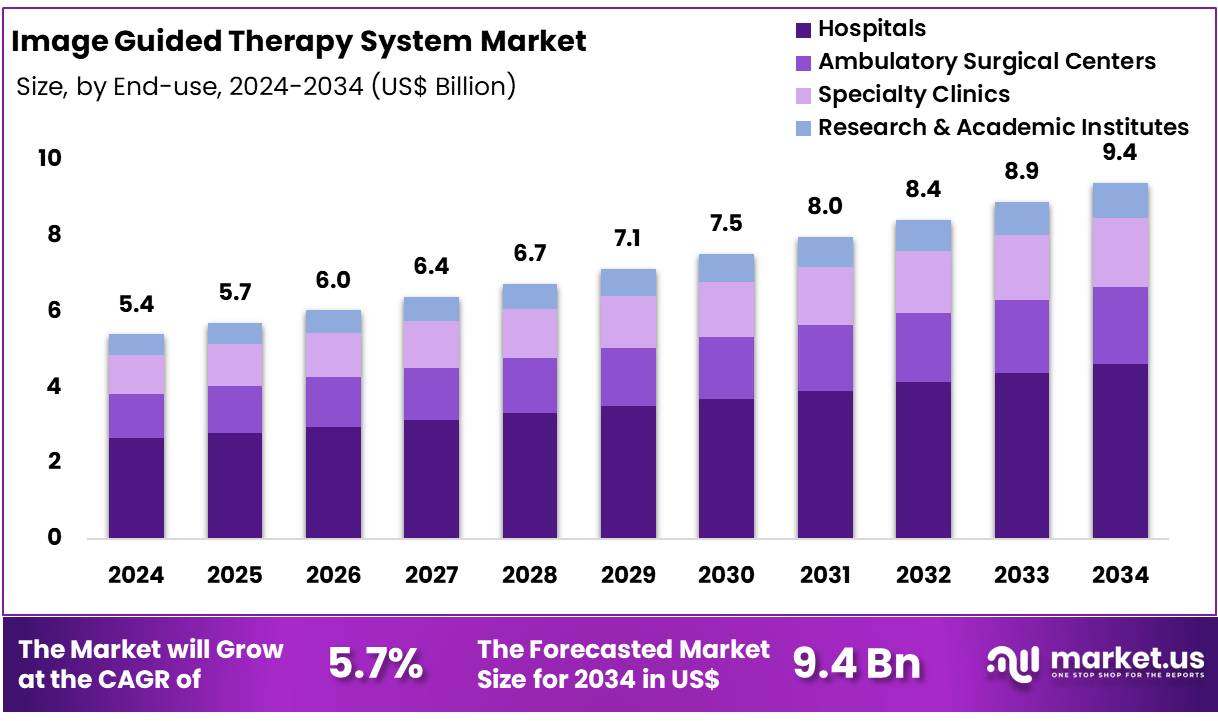

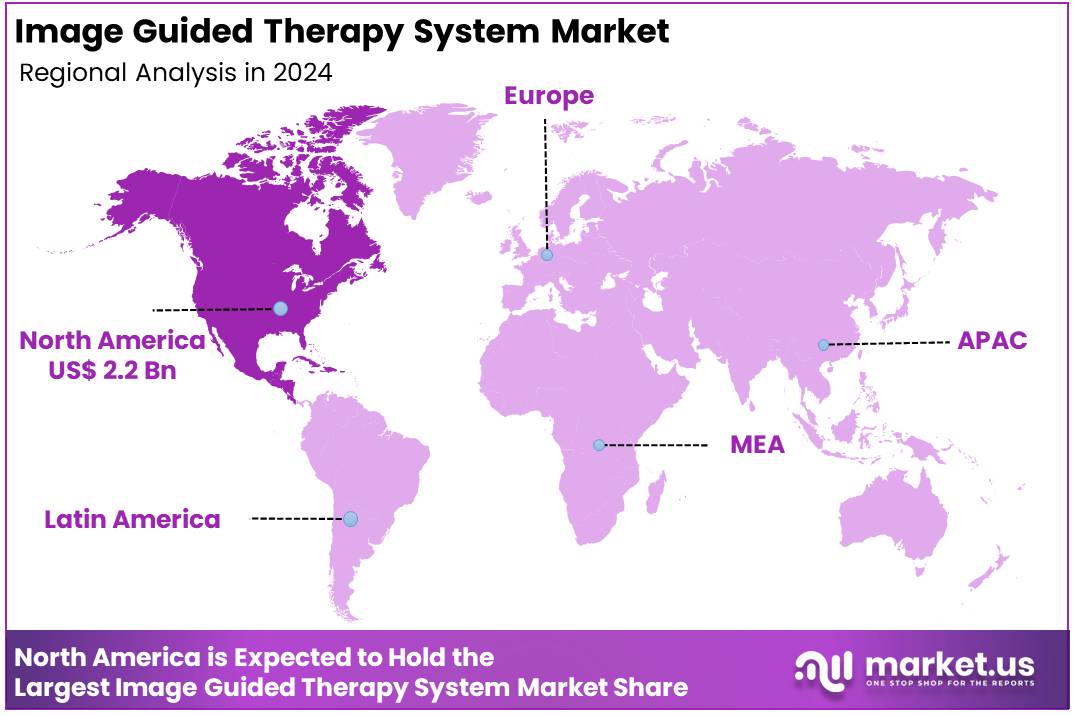

Global Image Guided Therapy System Market size is expected to be worth around US$ 9.4 Billion by 2034 from US$ 5.4 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 42.1% share with a revenue of US$ 2.2 Billion.

The global image-guided therapy systems market is experiencing robust growth, driven by several key factors. Technological advancements in imaging modalities such as MRI, CT, PET, and ultrasound have enhanced the precision of minimally invasive procedures, leading to reduced recovery times and improved patient outcomes. The increasing prevalence of chronic diseases, including cancer and cardiovascular conditions, is further propelling demand for these advanced therapeutic solutions.

Additionally, the aging global population is contributing to a higher incidence of age-related health issues, thereby expanding the need for effective treatment options. The integration of artificial intelligence, robotics, and augmented reality into image-guided therapies is revolutionizing surgical practices, offering real-time navigation and enhancing surgical accuracy. While North America currently leads the market due to its advanced healthcare infrastructure, the Asia-Pacific region is anticipated to exhibit the fastest growth, fuelled by improving healthcare access and increasing medical investments.

Key Takeaways

- The global image guided therapy system market was valued at US$ 5.4 billion in 2024 and is anticipated to register substantial growth of US$ 9.4 billion by 2034, with 5.7% CAGR.

- In 2024, the endoscope segment took the lead in the global market, securing 33.5% of the total revenue share.

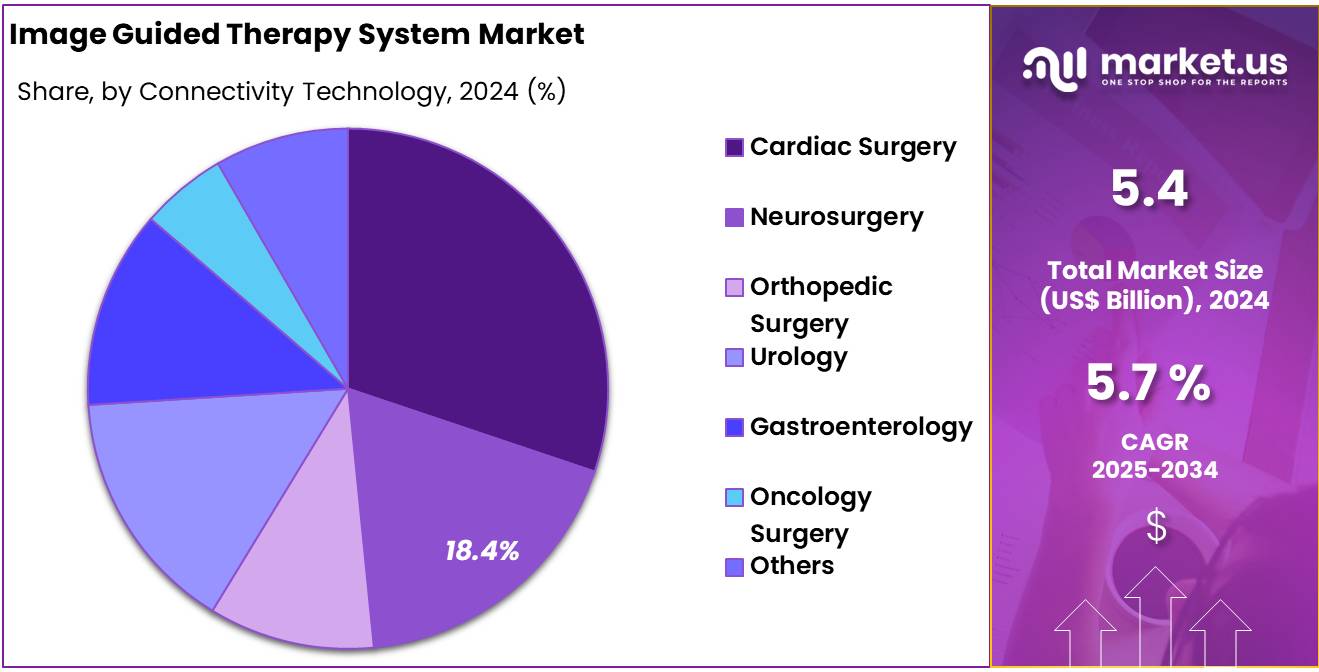

- The cardiac surgery segment took the lead in the global market, securing 30.4% of the total revenue share.

- The Hospitals segment took the lead in the global market, securing 36.8% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 42.1% of the total revenue.

Product Analysis

Based on product the market is fragmented into computed tomography (CT) scanners, ultrasound systems, magnetic resonance imaging (MRI), x-ray fluoroscopy, positron emission tomography (PET), and single photon emission computed tomography (SPECT). Amongst these, endoscope segment dominated the global image guided therapy system market capturing a significant market share of 33.5% in 2024. This prominence is attributed to the escalating preference for minimally invasive procedures, which endoscopy facilitates by allowing real-time visualization of internal structures.

Technological advancements, such as the integration of artificial intelligence and robotic assistance, have further enhanced the precision and efficiency of endoscopic procedures. Notably, platforms like Medtronic’s GI Genius and Olympus’s EVIS EXERA III exemplify the fusion of AI with endoscopy, improving diagnostic accuracy and therapeutic outcomes. The increasing prevalence of chronic conditions, including gastrointestinal disorders and cancers, has amplified the demand for endoscopic interventions.

Additionally, the high volume of endoscope-guided surgeries across various medical specialties underscores the segment’s expansive role. With continuous innovations and a growing inclination towards procedures that offer reduced recovery times and minimized patient trauma, the endoscope segment is poised to maintain its leadership in the image-guided therapy systems market.

Connectivity Technology Analysis

The market is fragmented by connectivity technology into cardiac surgery, neurosurgery, orthopedic surgery, urology, gastroenterology, oncology surgery, and others. Cardiac surgery dominated the global image guided therapy system market capturing a significant market share of 30.4% in 2024. The market is driven by the increasing prevalence of cardiovascular diseases and the growing demand for minimally invasive procedures.

Technologies such as fluoroscopy, intravascular ultrasound (IVUS), and magnetic resonance imaging (MRI) are pivotal in guiding complex cardiac interventions, including coronary artery bypass grafting (CABG), angioplasty, and valve repair surgeries. These imaging modalities enhance procedural precision, reduce risks, and facilitate real-time decision-making, leading to improved patient outcomes. The integration of advanced imaging systems into hybrid operating rooms further augments the capabilities of cardiac surgeons, enabling them to perform intricate procedures with greater accuracy.

For instance, platforms like Philips’ Azurion and GE Healthcare’s Allia IGS 7 offer advanced imaging solutions tailored for cardiac interventions, incorporating features like 3D visualization and robotic assistance. The adoption of these technologies is particularly pronounced in regions with advanced healthcare infrastructures, such as North America and Europe, where the demand for high-precision cardiac surgeries is escalating.

As the global burden of cardiovascular diseases continues to rise, the cardiac surgery segment is expected to maintain its leadership in the image-guided therapy systems market, driving innovations and setting new standards in surgical precision and patient care.

- In the United States, over 900,000 cardiac surgeries are performed annually, encompassing procedures such as coronary artery bypass grafting (CABG), valve replacements, and left atrial appendage (LAA) closures. The number of procedures is projected to exceed 1.3 million by 2029, indicating a steady increase in surgical interventions.

End-use Analysis

The market is fragmented by end-use into hospitals, ambulatory surgical centers, specialty clinics, and research & academic institutes. Hospitals dominated the global image guided therapy system market capturing a significant market share of 36.8% in 2024. This dominance is attributed to several factors, including the high volume of complex procedures performed in hospital settings, the availability of advanced imaging technologies, and the presence of multidisciplinary medical teams.

Hospitals are equipped with state-of-the-art facilities that integrate various imaging modalities such as MRI, CT, and fluoroscopy, enabling precise navigation during surgeries and interventions. The adoption of image-guided therapies in hospitals enhances surgical accuracy, reduces patient recovery times, and minimizes complications, aligning with the increasing demand for minimally invasive procedures.

Furthermore, hospitals benefit from favourable reimbursement structures and government support, facilitating the acquisition and implementation of advanced imaging systems. As the global healthcare landscape continues to evolve, hospitals remain at the forefront of adopting innovative technologies, ensuring optimal patient outcomes and maintaining their pivotal role in the image-guided therapy systems market.

Key Segments Analysis

By Product

- Endoscope

- Computed Tomography (CT) Scanners

- Ultrasound Systems

- Magnetic Resonance Imaging (MRI)

- X-ray Fluoroscopy

- Positron Emission Tomography (PET)

- Single Photon Emission Computed Tomography (SPECT)

By Connectivity Technology

- Cardiac Surgery

- Neurosurgery

- Orthopedic Surgery

- Urology

- Gastroenterology

- Oncology Surgery

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Research & Academic Institutes

Market Dynamics

Increased Prevalence of Chronic Disorders

The escalating prevalence of chronic diseases worldwide is a significant driver propelling the growth of the image-guided therapy (IGT) systems market. Chronic conditions such as cancer, cardiovascular diseases, and neurological disorders necessitate precise and effective treatment modalities. Image-guided therapy systems, which integrate advanced imaging technologies like MRI, CT scans, and ultrasound, enable clinicians to perform minimally invasive procedures with enhanced accuracy and reduced patient trauma. These systems facilitate real-time visualization, allowing for targeted interventions that improve patient outcomes and reduce recovery times.

For instance, in oncology, image-guided radiation therapy allows for the precise delivery of radiation to tumor sites, minimizing exposure to surrounding healthy tissues. In cardiology, image-guided interventions such as angioplasty and stenting benefit from the detailed imaging provided by IGT systems, leading to improved procedural success rates. The increasing burden of chronic diseases underscores the need for advanced therapeutic solutions, thereby driving the demand for image-guided therapy systems in healthcare settings globally.

- In 2023, approximately 76.4% of U.S. adults reported having at least one chronic condition, with 51.4% experiencing multiple chronic conditions, highlighting a substantial burden on healthcare systems.

Market Restraints

Lack of Skilled Professionals

The high cost of equipment presents a significant barrier to the growth of the global image-guided therapy (IGT) systems market. These substantial upfront investments are often coupled with ongoing expenses for maintenance, software upgrades, and specialized training for medical personnel. Such financial demands can be prohibitive for healthcare facilities, particularly in low- and middle-income countries, limiting their ability to adopt these advanced systems.

Even in developed regions, the allocation of budgets to other pressing healthcare needs can delay the acquisition of IGT technologies. The high cost of imaging equipment, particularly MRI and CT scanners, significantly impacts the adoption of image-guided therapy (IGT) systems, especially in resource-constrained settings. MRI machines, essential for precise imaging in various medical procedures, are among the most expensive medical devices.

- The cost of new MRI machines typically ranges from $500,000 to over $3 million, depending on factors such as magnetic field strength, features, and manufacturer. For instance, a 1.5T MRI machine may cost around $500,000, while a 3T MRI machine can exceed $3 million.

Market Opportunities

Integration of Artificial Intelligence (AI) and Robotics

The integration of Artificial Intelligence (AI) and robotics into image-guided therapy systems is revolutionizing the healthcare landscape, unlocking new growth opportunities in the market. AI enhances these systems by enabling real-time data analysis, predictive modeling, and personalized treatment planning, leading to improved surgical precision and patient outcomes. Robotic assistance further refines this by offering steady, minimally invasive interventions that reduce human error and variability.

For instance, AI-driven platforms like Medtronic’s GI Genius assist in detecting colorectal polyps during endoscopic procedures, while Philips’ ClarifEye system employs augmented reality to guide spine surgeries with enhanced accuracy. These innovations are particularly impactful in complex specialties such as neurosurgery, cardiology, and oncology, where precision is paramount.

The convergence of AI and robotics not only elevates procedural efficacy but also addresses challenges like clinician fatigue and workforce shortages, thereby expanding the accessibility and efficiency of advanced medical treatments. As healthcare systems increasingly prioritize minimally invasive procedures and personalized care, the adoption of AI and robotic technologies in image-guided therapy is poised to accelerate, driving substantial market growth and transforming patient care paradigms.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic and geopolitical factors significantly impact the global image-guided therapy (IGT) systems market by influencing both supply and demand. Economically, fluctuations in global financial conditions such as inflation, interest rates, and economic downturns can lead to reduced healthcare budgets, affecting the ability of hospitals and clinics to invest in expensive imaging equipment like MRI, CT, and ultrasound systems. When economic conditions are strained, healthcare providers may delay or scale down the purchase of advanced IGT systems, which are crucial for minimally invasive procedures.

Additionally, the rising cost of medical technologies can be amplified by currency exchange rate fluctuations, especially when importing these devices. On the geopolitical front, trade policies, tariffs, and international relations play a significant role in the market dynamics. For example, trade tensions between major economies, such as the U.S. and China, have led to the imposition of tariffs on medical device components, increasing production costs.

Political instability and conflicts in certain regions may also hinder the development of healthcare infrastructure, thus limiting the adoption of advanced medical technologies, including IGT systems. These macroeconomic and geopolitical factors create a complex environment for manufacturers and healthcare providers, influencing purchasing decisions and market expansion opportunities in different regions.

Latest Trends

The global image-guided therapy (IGT) systems market is experiencing significant advancements, driven by technological innovations and evolving healthcare needs. A notable trend is the integration of artificial intelligence (AI) and robotics into IGT systems, enhancing surgical precision and reducing human error. For instance, platforms like Philips’ ClarifEye and Medtronic’s GI Genius employ AI to assist in complex procedures such as spine surgeries and colorectal cancer detection, respectively.

Additionally, the adoption of augmented reality (AR) technologies is improving real-time visualization during surgeries, allowing clinicians to overlay critical imaging data onto the patient’s anatomy, thereby increasing accuracy and efficiency. The demand for minimally invasive procedures continues to rise, fueled by benefits like shorter recovery times and reduced complications. This shift is prompting healthcare facilities to invest in advanced IGT systems to meet patient expectations and improve clinical outcomes.

Furthermore, the growing prevalence of chronic diseases, including cardiovascular conditions and cancer, is escalating the need for precise diagnostic and therapeutic interventions, further propelling the market. These trends indicate a transformative phase for the IGT systems market, characterized by technological convergence and a patient-centric approach to care.

Regional Analysis

The North America dominated the global image-guided therapy systems market, driven by significant advancements in healthcare infrastructure, research and development (R&D) activities, and the presence of key competitors in the medical device sector. The region benefits from high investment in innovative technologies, including artificial intelligence (AI), robotics, and augmented reality, which have greatly enhanced the precision and effectiveness of IGT systems.

These technologies improve surgical outcomes, reduce recovery times, and enable minimally invasive procedures, which are in increasing demand across various specialties, including cardiology, oncology, and neurology. Additionally, the U.S. is home to world-class medical research institutions and hospitals that are early adopters of cutting-edge medical devices.

- For instance, in June 2023, the U.S. FDA approved Daiichi Sankyo’s INJECTAFER for treating iron deficiency in adult heart failure patients, further highlighting the region’s strong focus on advancing medical treatments.

Moreover, the competitive landscape in North America, with companies like Medtronic, Philips, and Siemens Healthineers, fosters a continual cycle of innovation. These factors collectively create a dynamic environment for IGT system adoption in hospitals, enabling improved patient care and supporting the region’s dominance in the global market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global image-guided therapy (IGT) systems market is characterized by a competitive landscape dominated by several key players who are driving innovation and adoption across various medical specialties. Leading companies include Koninklijke Philips N.V., Siemens Healthineers, GE Healthcare, Medtronic, Brainlab AG, Analogic Corporation, Olympus Corporation, Stryker Corporation, and Varian Medical Systems, among others.

These industry leaders employ a range of strategies to maintain and enhance their market positions. Product innovation is a primary focus, with companies developing advanced imaging technologies and integrating artificial intelligence (AI) and robotics to improve surgical precision and patient outcomes.

For instance, Philips launched the ClarifEye Augmented Reality Surgical Navigation System to assist in spine procedures, while Medtronic introduced the GI Genius, an AI-driven endoscopy module for colorectal cancer detection. Strategic partnerships and collaborations are also prevalent, enabling companies to expand their technological capabilities and market reach. An example is Philips’ agreement with NICO.LAB to enhance stroke care capabilities within its Azurion platform.

Top Key Players

- Koninklijke Philips N.V.

- Medtronic

- Siemens Healthineers

- Analogic Corporation

- GE Healthcare

- Varian Medical Systems, Inc.

- Brainlab AG

- Olympus Corporation

- Stryker

Recent Developments

- In June 2023, GSK received a positive opinion from the Committee for Medicinal Products for Human Use (CHMP), recommending the approval of daprodustat for treating symptomatic anemia associated with chronic kidney disease (CKD) in adults undergoing chronic maintenance dialysis.

- In March 2024, the U.S. FDA approved Vafseo for the treatment of anemia related to chronic kidney disease in dialysis-dependent adult patients. CSL Vifor expressed satisfaction with its partner Akebia Therapeutics, Inc. following the FDA’s approval of Vafseo (vadadustat) tablets for treating anemia due to CKD in adults who have been undergoing dialysis for at least three months.

- In February 2024, Lupin launched its Cyanocobalamin Nasal Spray (500 mcg/spray, one spray per device), after receiving approval from the U.S. FDA.

Report Scope

Report Features Description Market Value (2024) US$ 5.4 billion Forecast Revenue (2034) US$ 9.4 billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Endoscope, Computed Tomography (CT) Scanners, Ultrasound Systems, Magnetic Resonance Imaging (MRI), X-ray Fluoroscopy, Positron Emission Tomography (PET), and Single Photon Emission Computed Tomography (SPECT)), By Connectivity Technology (Cardiac Surgery, Neurosurgery, Orthopedic Surgery, Urology, Gastroenterology, Oncology Surgery, and Others), By End-use (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Research & Academic Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Koninklijke Philips N.V., Medtronic, Siemens Healthineers, Analogic Corporation, GE Healthcare, Varian Medical Systems, Inc., Brainlab AG, Olympus Corporation, and Stryker Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Image Guided Therapy System MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Image Guided Therapy System MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Koninklijke Philips N.V.

- Medtronic

- Siemens Healthineers

- Analogic Corporation

- GE Healthcare

- Varian Medical Systems, Inc.

- Brainlab AG

- Olympus Corporation

- Stryker