Global Antibody Therapy Market Analysis By Type (Monoclonal Antibodies (Oncology, Autoimmune Disease, Infectious Disease, Other), Antibody Drug Conjugates), By End User (Hospitals, Specialty Centers, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136660

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

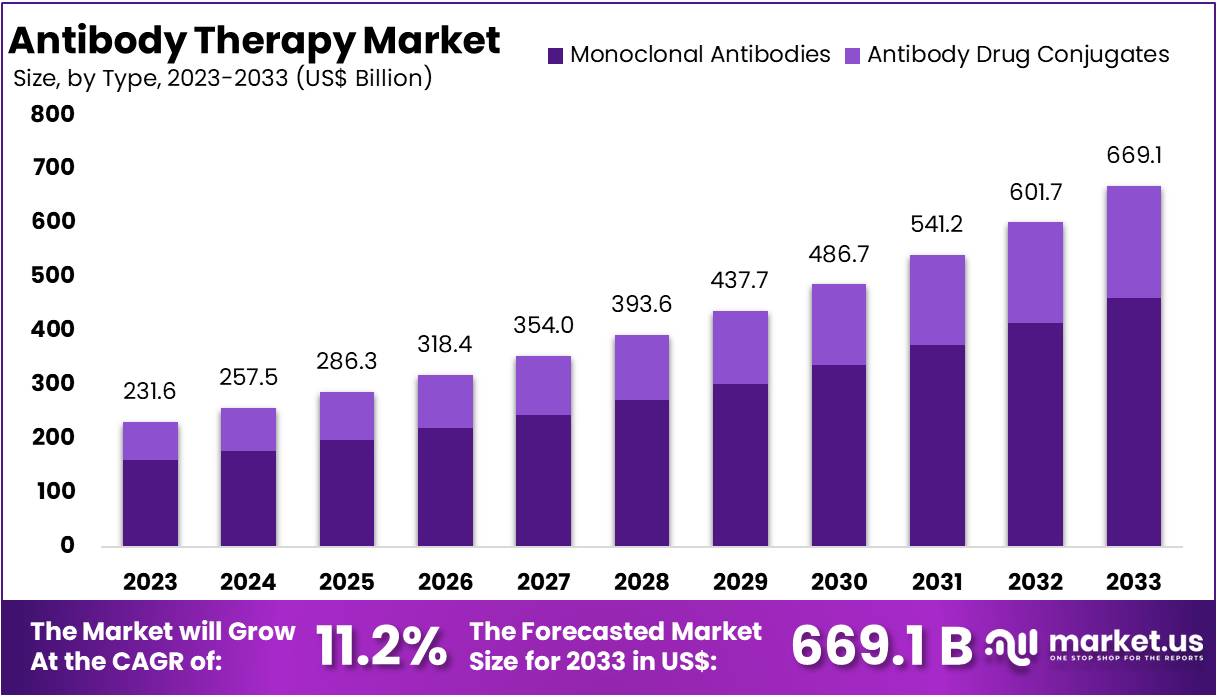

The Global Antibody Therapy Market Size is expected to be worth around US$ 669.1 Billion by 2033, from US$ 231.6 Billion in 2023, growing at a CAGR of 11.2% during the forecast period from 2024 to 2033.

Antibody therapy, also known as monoclonal antibody therapy, involves the use of monoclonal antibodies (mAbs) to specifically target and neutralize pathogens, such as viruses and bacteria, or to interfere with specific biological processes that contribute to diseases like cancer. These antibodies are engineered to mimic the body’s natural immune defenses, offering a highly specific approach to treatment. They can block antigens on cancer cells, neutralize toxins produced by pathogens, or modulate immune system responses, making them versatile tools in treating a variety of conditions, including autoimmune diseases, infectious diseases, and cancers.

The antibody therapy market has been experiencing significant growth, driven by its success in treating diseases with previously limited options. By 2024, this market includes numerous approved therapies and many more in advanced development stages. Technological advancements in genetic engineering and biotechnology have improved the precision and efficacy of these treatments. Additionally, the global rise in chronic diseases and the demand for innovative therapeutics have fueled market expansion. Major pharmaceutical companies are heavily investing in research and development, signaling robust future growth.

Regulatory approvals have played a key role in the market’s advancement. According to Wikipedia, in 2022, the U.S. Food and Drug Administration (FDA) approved several monoclonal antibodies, including Teplizumab (Tzield), which delays the onset of stage 3 type 1 diabetes in individuals with stage 2 of the disease. By mid-2023, five more antibody therapeutics had received FDA approval. Notably, Donanemab (Kisunla), approved in July 2023, demonstrated a 39% reduction in the progression of Alzheimer’s disease. These milestones underscore the growing importance of antibody therapies in modern medicine.

Innovative clinical developments are further driving market growth. Bispecific antibodies, which can target two antigens simultaneously, have shown great promise, particularly in oncology. For example, Blinatumomab, a bispecific T-cell engager, has been effective in treating certain types of leukemia. Furthermore, a study by QXMD Read highlighted that, as of November 2022, approximately 140 investigational antibody therapies were in late-stage clinical trials, reflecting a 20% increase from the previous year. This growing pipeline showcases the expanding role of antibody therapies in addressing diverse medical conditions.

Economic indicators demonstrate the market’s significant expansion. According to La Merie, global sales of branded originator biologics, including antibody therapies, increased by 7.3% in 2022, reaching USD 291 billion. Additionally, investments in antibody-focused deals reached a record USD 57.3 billion across 156 agreements in the same year, representing nearly a 40% growth compared to 2021. These figures highlight the sector’s economic vitality and potential for sustained growth.

Emerging research offers new opportunities for antibody applications. A 2024 study published by Wired revealed that targeting the IL-11 protein with antibodies reduced inflammation and extended mouse lifespans by 25%. This finding suggests that antibody therapies could play a role in anti-aging and regenerative medicine, opening new avenues for their use beyond conventional treatments.

The antibody therapy market continues to grow rapidly, supported by technological innovations, regulatory milestones, and expanding applications. Increasing investment and clinical breakthroughs further strengthen its outlook, solidifying its position as a vital segment in the biopharmaceutical industry.

Key Takeaways

- The Antibody Therapy Market is projected to grow from US$ 231.6 billion in 2023 to US$ 669.1 billion by 2033, with an 11.2% CAGR.

- Monoclonal Antibodies led the Type Segment in 2023, securing over 69.1% of the market share in the Antibody Therapy Market.

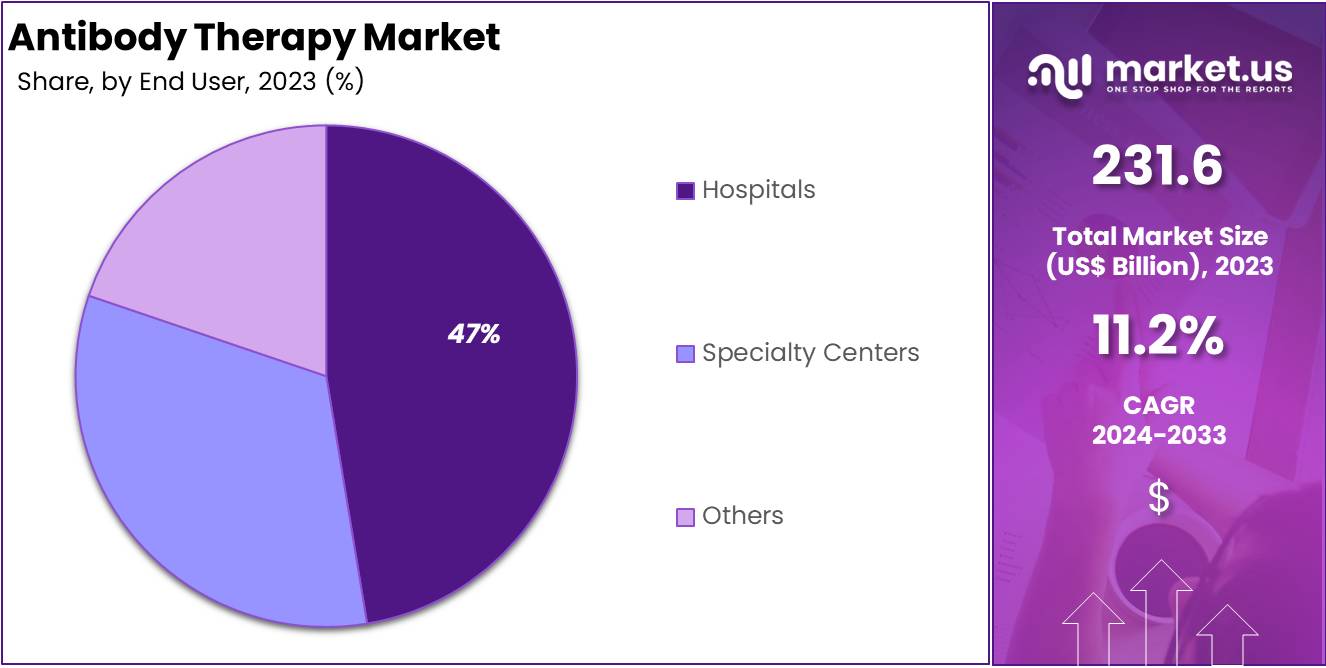

- Hospitals were the leading end users in the Antibody Therapy Market in 2023, holding over 47.4% of the market share.

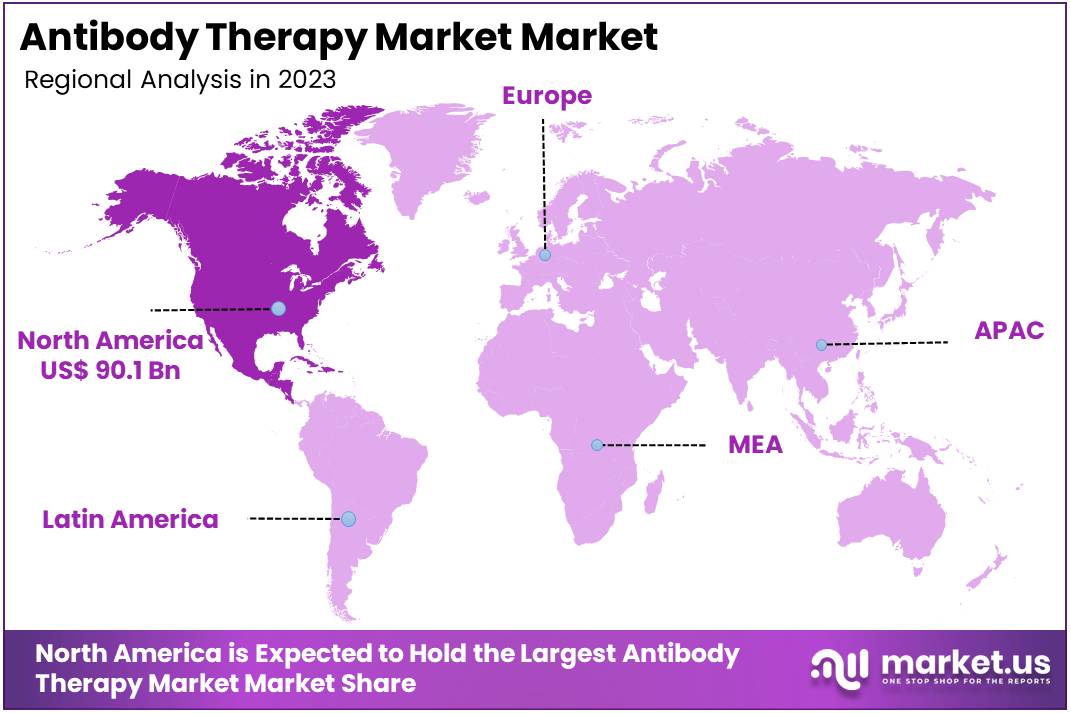

- In 2023, North America was the largest market for antibody therapy, accounting for 38.9% of the global market and valued at US$ 90.1 million.

Type Analysis

In 2023, Monoclonal Antibodies held a dominant market position in the Type Segment of the Antibody Therapy Market, capturing more than a 69.1% share. This segment excels due to its broad use across various medical conditions. Primarily, it targets and neutralizes cancer cells in oncology treatments. This precision significantly enhances its effectiveness in managing complex diseases.

Monoclonal Antibodies are also essential in treating autoimmune disorders. They function by selectively targeting components of the immune system that are not working correctly. This targeted approach helps in managing the disease more effectively, offering patients better management options for their conditions.

In the realm of infectious diseases, Monoclonal Antibodies play a critical role. They are designed to attack pathogens with high specificity, which makes them effective in targeting and neutralizing infectious agents. This method provides a targeted therapeutic approach, which is crucial in treating infectious diseases effectively.

Antibody Drug Conjugates (ADCs) are emerging as a significant advancement in the market. These drugs combine the specificity of monoclonal antibodies with the potent effect of cytotoxic drugs. They are particularly valuable in oncology, targeting tumor cells while minimizing the impact on healthy tissue. This approach not only improves the efficacy of treatments but also enhances patient outcomes by reducing side effects associated with traditional chemotherapy.

End User Analysis

In 2023, hospitals held a dominant market position in the End User Segment of the Antibody Therapy Market, capturing more than a 47.4% share. Hospitals are key for delivering complex antibody therapies. They have the necessary equipment and skilled staff, making them ideal for such specialized treatments.

Specialty centers are also crucial in the antibody therapy landscape. They focus on precise, targeted treatments for conditions like cancer and autoimmune diseases. These centers are pivotal in personalized care, which is vital for effective therapy.

Other contributors to this market include clinics and research facilities. These institutions are integral to clinical trials and the development of new treatment protocols. Their work helps to push the boundaries of antibody therapy, enhancing outcomes for various diseases.

The future of the antibody therapy market is set to evolve. Hospitals will likely continue to lead due to their extensive medical resources. However, specialty centers will also see growth, driven by the increasing demand for tailored treatment approaches.

Key Market Segments

By Type

- Monoclonal Antibodies

- Oncology, Autoimmune Disease

- Infectious Disease

- Other

- Antibody Drug Conjugates

By End User

- Hospitals

- Specialty Centers

- Others

Drivers

Rising Prevalence of Chronic Diseases

The antibody therapy market is experiencing significant growth due to the rising prevalence of chronic diseases, such as cancer and autoimmune disorders. These conditions require highly specialized and effective treatments, making antibody therapies increasingly important. Such therapies offer targeted action, which is crucial in managing complex diseases that affect millions worldwide.

As healthcare systems and technologies advance, the capabilities to diagnose and treat chronic illnesses have improved. This advancement leads to a higher detection rate of conditions that can be effectively managed or treated using antibody therapies. Consequently, the demand for these treatments is escalating, further stimulating market expansion.

The global health landscape is seeing a shift towards personalized medicine, where treatments are tailored to individual genetic profiles and disease characteristics. Antibody therapies fit well into this paradigm because of their ability to target specific disease mechanisms. This specificity not only enhances treatment efficacy but also minimizes side effects, making these therapies more appealing to both healthcare providers and patients.

Restraints

High Cost of Antibody Therapies

The production of antibody therapies involves intricate and costly processes. These high expenses stem from the need for specialized equipment and skilled personnel to handle the complex biotechnological methods required. As a result, the initial investment and ongoing operational costs are substantial. This aspect of production significantly influences the overall cost of the final therapeutic products, making them less accessible in markets with limited financial resources.

In regions with lower incomes, the high cost of antibody therapies poses a significant barrier. This financial challenge restricts the availability of advanced treatments, leading to a disparity in healthcare access between affluent and economically disadvantaged areas. Consequently, patients in poorer regions often have limited access to these cutting-edge therapies, which can be crucial for treating severe and chronic conditions.

The economic implications of the high cost of antibody therapies also impact market expansion globally. Potential markets in developing countries remain underexploited because the therapies are unaffordable for a large segment of the population. This limitation not only affects public health outcomes but also stifles the growth opportunities for pharmaceutical companies looking to expand their reach in global markets. Reducing costs and enhancing affordability could open up new avenues for both market growth and improved health access.

Opportunities

Advances in Personalized Medicine

The focus on personalized medicine is creating new opportunities for the antibody therapy market. Personalized medicine tailors treatments to the genetic profiles of individual patients. This approach ensures targeted action against specific diseases. Antibody therapies are well-suited for this trend, as they can precisely target disease-causing proteins. The result is improved treatment efficacy and fewer side effects. This makes antibody therapies an essential part of personalized medicine, meeting the demand for more effective and patient-centric treatments.

Tailoring antibody therapies to genetic profiles is becoming increasingly feasible with advancements in genomics and bioinformatics. These technologies allow researchers to identify unique biomarkers linked to various diseases. By targeting these biomarkers, antibody therapies can deliver highly specific treatments. This approach boosts treatment outcomes and minimizes risks. It aligns with the broader healthcare shift toward precision medicine. Such developments enhance the appeal of antibody therapies for pharmaceutical companies and healthcare providers.

The integration of personalized medicine into healthcare systems supports the growth of the antibody therapy market. Patients now expect treatments that work best for their individual needs. Healthcare providers see this as a way to improve patient satisfaction and outcomes. Pharmaceutical companies are investing heavily in developing personalized antibody therapies. These innovations align with the demand for more precise, effective, and safe treatment options. The growing acceptance of personalized medicine ensures a robust future for antibody therapy advancements.

Trends

Development of Bispecific Antibodies

The development of bispecific antibodies is a significant trend in the pharmaceutical and biotechnology sectors. These antibodies are engineered to target two different antigens at the same time. This dual-targeting ability provides enhanced precision in addressing complex diseases. The technology is particularly beneficial for conditions like cancer, where multiple pathways contribute to disease progression. By binding to two targets, bispecific antibodies can block multiple signaling pathways or recruit immune cells more effectively. This unique mechanism sets them apart from traditional monoclonal antibodies.

Bispecific antibodies are gaining attention for their potential to improve outcomes in oncology treatments. They offer a novel approach to combat tumors by simultaneously engaging tumor cells and immune cells. This dual action enables immune cells to attack cancer cells more efficiently. In clinical trials, bispecific antibodies have shown promise in treating solid tumors and hematologic malignancies. These advancements represent a breakthrough in cancer therapy, offering hope for more effective treatments. Their versatility makes them a key focus for researchers and developers.

The growing adoption of bispecific antibodies aligns with the demand for innovative therapies in healthcare. Pharmaceutical companies are investing heavily in this technology to expand their oncology pipelines. Additionally, regulatory approvals for bispecific antibody treatments are increasing, indicating strong market potential. Their ability to address unmet medical needs, especially in challenging conditions, drives their rapid development. As the field advances, bispecific antibodies are expected to play a pivotal role in the future of precision medicine and immunotherapy. This trend highlights their transformative impact on healthcare innovation.

Regional Analysis

In 2023, North America held a dominant market position in the antibody therapy market, capturing more than a 38.9% share. The region’s market value reached US$ 90.1 million. This dominance is underpinned by its advanced healthcare infrastructure and a strong focus on research and development. The robust regulatory framework in this region facilitates the rapid approval of new therapies, enhancing market growth.

The U.S. is a key contributor to North America’s leadership in the market. It boasts significant advancements in biotechnology, which play a crucial role in driving innovation within the antibody therapy field. Moreover, the increasing prevalence of chronic diseases such as cancer and autoimmune disorders heightens the demand for targeted therapeutic solutions.

Canada also plays a vital role in the regional market’s strength. Its government policies are favorable towards healthcare innovation, which promotes a thriving environment for biopharmaceutical research and development. Additionally, the country sees numerous research collaborations between its academic institutions and the biotechnology industry, fostering innovation and development.

Overall, North America’s market dominance in antibody therapy is sustained by a combination of technological prowess, a focus on personalized healthcare, and a supportive regulatory environment. These factors collectively ensure the region not only maintains but also enhances its market position, paving the way for future growth and innovation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The antibody therapy market is competitive, led by established players with strong global networks and innovative R&D. Companies like F. Hoffmann-La Roche Ltd. and AbbVie Inc. dominate due to their leading products, Rituxan and Humira. Emerging players focus on niche therapies and personalized medicine. Amgen Inc. and Bristol-Myers Squibb are expanding shares through oncology and autoimmune therapies. Johnson & Johnson excels with a broad healthcare portfolio, driven by Darzalex and Stelara. Smaller firms and regional players also contribute with cost-effective offerings and local expertise.

Key strategies include mergers, acquisitions, and collaborations to expand portfolios and enter new markets. Companies invest in advanced manufacturing technologies to improve efficiency in antibody production. Partnerships with academic institutions and technology firms drive innovation in oncology and autoimmune therapies. Biosimilars are gaining traction, mitigating the impact of patent expirations and enhancing affordability. Focus areas include rare diseases, immune-oncology, and bi-specific antibodies, propelling the market’s growth.

Established companies hold strong market positions, while new entrants explore innovative delivery systems and niche applications. Financial performance is robust for leaders like AbbVie and Roche, supported by blockbuster drugs. SWOT analysis highlights strengths like global reach and innovation but also exposes risks like patent cliffs and pricing pressures. The future market outlook remains promising, with ongoing R&D, strategic expansions, and increasing demand for effective antibody therapies in oncology, autoimmune diseases, and infectious diseases.

Market Key Players

- F. Hoffmann-La Roche Ltd.

- AbbVie Inc.

- Amgen Inc.

- Bristol-Myers Squibb Company

- Johnson & Johnson Services Inc.

- Seagen

- Merck & Co. Inc.

- Regeneron Pharmaceuticals Inc.

- Novartis AG

- AstraZeneca

- Eli Lilly and Company

- GlaxoSmithKline plc.

- Takeda Pharmaceutical Company Ltd.

Recent Developments

- In February 2024: AbbVie completed its acquisition of ImmunoGen, a deal valued at $31.26 per share of ImmunoGen’s common stock. This acquisition notably includes ImmunoGen’s antibody-drug conjugate ELAHERE® (mirvetuximab soravtansine-gynx), which is targeted at treating folate receptor-alpha positive platinum-resistant ovarian cancer. The financial impact of this acquisition on AbbVie’s diluted EPS is expected to be accretive from 2027 onwards.

- In January 2024: Roche announced a collaboration and license agreement with Medilink Therapeutics for the development of YL-211, a next-generation antibody-drug conjugate (ADC) targeting the proto-oncogene c-Met for solid tumors. This collaboration aims to advance Roche’s capabilities in developing innovative cancer treatments.

- In September 2023: Bristol-Myers Squibb entered into a strategic license and collaboration agreement with Zenas BioPharma to develop and commercialize the novel bi-functional antibody, obexelimab, in several Asia-Pacific regions including Japan, South Korea, Taiwan, Singapore, Hong Kong, and Australia. This agreement aims to address autoimmune diseases within these markets.

Report Scope

Report Features Description Market Value (2023) US$ 231.6 Billion Forecast Revenue (2033) US$ 669.1 Billion CAGR (2024-2033) 11.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Monoclonal Antibodies (Oncology, Autoimmune Disease, Infectious Disease, Other), Antibody Drug Conjugates), By End User (Hospitals, Specialty Centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape F. Hoffmann-La Roche Ltd., AbbVie Inc., Amgen Inc., Bristol-Myers Squibb Company, Johnson & Johnson Services Inc., Seagen, Merck & Co. Inc., Regeneron Pharmaceuticals Inc., Novartis AG, AstraZeneca, Eli Lilly and Company, GlaxoSmithKline plc., Takeda Pharmaceutical Company Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- F. Hoffmann-La Roche Ltd.

- AbbVie Inc.

- Amgen Inc.

- Bristol-Myers Squibb Company

- Johnson & Johnson Services Inc.

- Seagen

- Merck & Co. Inc.

- Regeneron Pharmaceuticals Inc.

- Novartis AG

- AstraZeneca

- Eli Lilly and Company

- GlaxoSmithKline plc.

- Takeda Pharmaceutical Company Ltd.