Global Hydrogen Cooled Generators Market Size, Share, And Industry Analysis Report By Cooling Method (Direct Cooling Systems, Indirect Cooling Systems), By Power Rating (Below 500 MVA, 500 to 800 MVA, Above 800 MVA), By End-Use (Thermal Power Plants, Coal Power Plants, Gas Power Plants, Nuclear Power Plants), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 176258

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

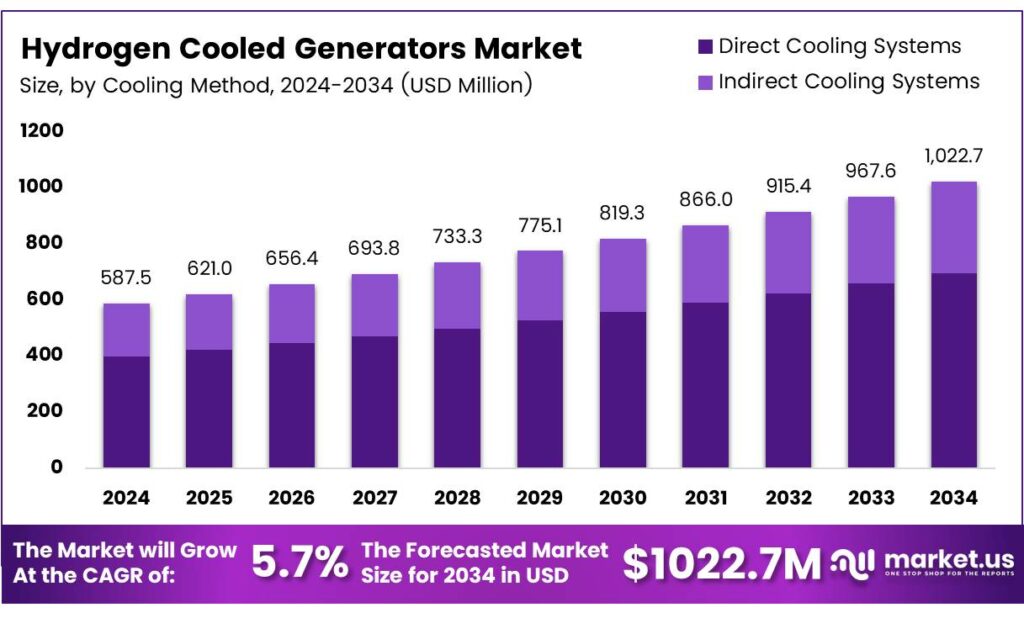

The Global Hydrogen Cooled Generators Market size is expected to be worth around USD 1022.7 million by 2034, from USD 587.5 million in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

The Hydrogen Cooled Generators Market represents a high-efficiency power generation segment where hydrogen gas ensures better thermal conductivity than air-cooled systems. These generators are widely used in large thermal, nuclear, and combined-cycle plants requiring high-capacity output. As global power demand rises, hydrogen-cooled systems gain traction for reliability, performance, and operational safety.

Moreover, governments increasingly invest in grid modernization and utility-scale generation assets, boosting demand for hydrogen-cooled generators. Transitioning toward low-emission energy infrastructure encourages utilities to adopt advanced cooling technologies, improving efficiency and lifecycle economics. With supportive regulations promoting clean energy integration, the market experiences sustained interest across developed and emerging economies.

- GVPI stators paired with water-cooling ensure uniform temperatures and low stress, achieving over 99.9% reliability across 1,700+ units operating at 10–22 kV and up to 1,300 MVA. A leading unit has exceeded 150,000 hours and 3,320 cycles without failure, confirming long-term durability. The SGen-3000W series applies these proven designs with CFD-optimized cooling, delivering 900 MVA-class output, around 25 kV terminal voltage, 99.0% efficiency, and operating speeds of 3,000–3,600 min⁻¹ for 50/60 Hz grids.

Industry innovation strengthens market expansion as manufacturers adopt new cooling geometries, digital monitoring, and CFD-optimized airflow systems. These developments reduce thermal stress, extend operational life, and enhance uptime, key value drivers for utilities. The market benefits from rising retrofitting activities, especially in regions upgrading aging power generation fleets.

Furthermore, opportunities emerge as nations push for higher efficiency turbine-generator units to meet growing industrial electricity loads. Hydrogen cooling helps achieve superior power density, enabling generators to operate at higher MVA ratings without overheating. As demand for reliable baseload power persists, hydrogen-cooled generators remain vital for long-term generation planning.

Key Takeaways

- The Global Hydrogen Cooled Generators Market is projected to reach USD 1022.7 million by 2034, up from USD 587.5 million in 2024, at a steady 5.7% CAGR from 2025–2034.

- Direct Cooling Systems lead the cooling segment with a dominant 67.2% market share in 2025.

- The 500 to 800 MVA power rating segment dominates with a 53.1% share in 2025.

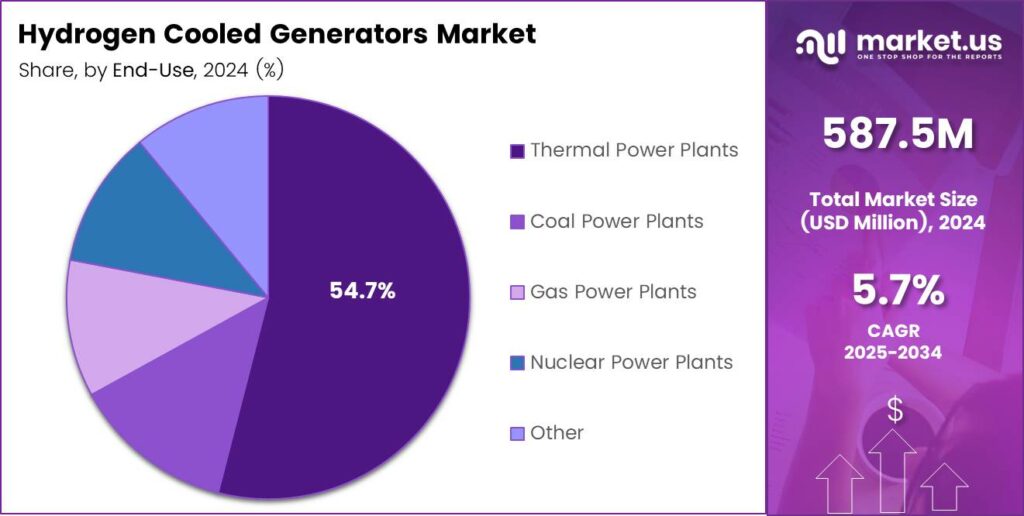

- Thermal Power Plants remain the largest end-use segment, holding 54.7% share in 2025.

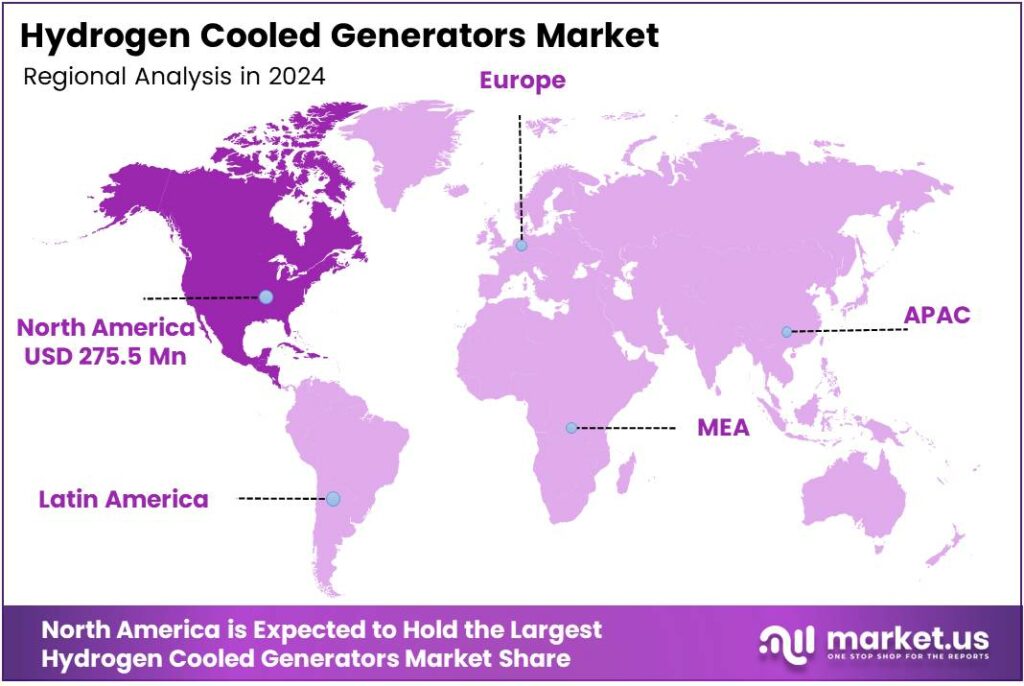

- North America is the leading region with 46.9% market share valued at USD 275.5 million.

Cooling Method Analysis

Direct Cooling Systems dominate with 67.2% due to efficient heat transfer and stable generator performance.

In 2025, Direct Cooling Systems held a dominant market position in the By Cooling Method Analysis segment of the Hydrogen Cooled Generators Market, with a 67.2% share. This method improves thermal stability, enhances generator lifespan, and supports large-capacity units. Its efficiency and reliability continue to drive wide global adoption.

Indirect Cooling Systems remained relevant in the By Cooling Method segment, appealing to users seeking simpler maintenance. Though it holds a smaller share than direct systems, its design ensures safer handling and lower installation complexities. Industries adopt it where operational conditions demand moderate efficiency requirements.

Power Rating Analysis

500 to 800 MVA dominates with 53.1% due to higher suitability for large utility grids.

In 2025, the 500 to 800 MVA segment held a dominant market position in the By Power Rating Analysis segment of the Hydrogen Cooled Generators Market, with a 53.1% share. This range matches global demand for high-output generators, enabling utilities to manage rising grid loads efficiently.

The Below 500 MVA segment continued serving industries requiring smaller-scale energy generation. Its compact design and cost-friendly installation make it suitable for mid-sized plants. As distributed power systems grow, this segment sees sustained adoption across various industrial environments.

The above 800 MVA segment supported ultra-large power stations where maximum output is essential. Although used less widely, this category ensures a robust electricity supply for heavy-demand regions. Its advanced engineering enables stable performance in long-duration, high-load operations.

End-Use Analysis

Thermal Power Plants dominate with 54.7%, driven by extensive global electricity requirements.

In 2025, Thermal Power Plants held a dominant market position in the By End-Use Analysis segment of the Hydrogen Cooled Generators Market, with a 54.7% share. These plants rely heavily on hydrogen cooling due to superior efficiency and high-capacity generation needs across expanding industrial regions.

Coal Power Plants continued using hydrogen-cooled generators to maintain operational reliability. Despite the shift toward cleaner fuels, coal facilities in many emerging markets still depend on these systems to ensure stable performance and better thermal management during peak power cycles.

Gas Power Plants adopted hydrogen-cooled generators for flexible and faster load response. As gas-based energy expands worldwide, these generators support improved fuel efficiency and help operators meet fluctuating power demand scenarios more effectively.

Nuclear Power Plants used hydrogen-cooled generators to ensure continuous, safe, and high-capacity power production. Their reliability and ability to manage high heat loads make them essential in nuclear environments requiring uninterrupted operations.

The Other end-use segment included mixed industrial facilities and specialized energy systems. These users deploy hydrogen-cooled generators to achieve balanced output, maintain operational efficiency, and meet diverse energy requirements across niche power applications.

Key Market Segments

By Cooling Method

- Direct Cooling Systems

- Indirect Cooling Systems

By Power Rating

- Below 500 MVA

- 500 to 800 MVA

- Above 800 MVA

By End-Use

- Thermal Power Plants

- Coal Power Plants

- Gas Power Plants

- Nuclear Power Plants

- Other

Emerging Trends

Growing Adoption of Advanced Cooling Technologies Shapes Market Trends

One key trend is the rising use of digital monitoring in hydrogen-cooled generators. Power plants increasingly rely on smart sensors and automated detection systems to maintain hydrogen purity, reduce leak risks, and optimize generator performance.

- The North American Electric Reliability Corporation projects winter peak demand growth of 245 GW over the next ten years, with shrinking reserve margins in several regions. The report highlights PJM’s reserve margin potentially falling from 30% to 14%, while MISO’s could drop from 11% to 4%, a direction that makes unplanned outages more costly than ever.

Another trend is the shift toward hybrid cooling solutions. Many utilities are integrating hydrogen cooling with advanced ventilation systems to achieve higher load capacity while reducing thermal stress. This helps generators operate more efficiently in demanding environments.

Drivers

Rising Power Demand from Heavy Industries Drives Market Growth

Growing electricity demand from manufacturing, oil & gas, and steel industries is one of the major drivers for hydrogen-cooled generators. These sectors require large-capacity turbines where hydrogen cooling provides high efficiency and stable performance. As developing countries expand industrial output, power producers invest in advanced generator technologies.

- The IEA reports that electricity consumption in buildings increased by more than 600 TWh in 2024, accounting for nearly 60% of total growth in electricity consumption. That kind of broad-based demand from cooling, heating, and digital infrastructure encourages utilities to keep large generator blocks reliable, upgrade auxiliaries, and avoid extended outages that could tighten supply during peaks.

Additionally, the rapid modernization of aging power infrastructure supports adoption. Many regions are replacing decades-old steam turbine systems with modern hydrogen-cooled generators to improve reliability. These upgrades help utilities meet increasing grid stability requirements while maintaining cost-effective operations.

Restraints

High Installation and Maintenance Requirements Restrict Market Adoption

A major restraint in this market is the high installation cost associated with hydrogen-cooled generators. Large power producers must invest heavily in hydrogen handling systems, safety equipment, and specialized monitoring devices. These expenses make adoption difficult for small and medium-scale plants.

- Hydrogen systems require continuous leak detection, purity checks, and skilled technicians trained in gas-handling protocols. In the U.S., OSHA explains that the Process Safety Management (PSM) standard can apply to processes containing hydrogen in quantities of 10,000 pounds or more, because hydrogen is treated as a flammable gas under the rule.

Safety concerns also act as a barrier. Hydrogen is highly flammable, and utilities must follow strict protocols for transportation, storage, and cooling operations. Meeting these requirements increases operational costs and discourages some power producers from upgrading to hydrogen-based cooling systems.

Growth Factors

Growing Shift Toward High-Efficiency Power Plants Creates New Opportunities

The global push to upgrade thermal power plants offers significant growth opportunities for hydrogen-cooled generators. Countries focused on improving grid stability are investing in high-capacity turbines, where hydrogen cooling supports better efficiency than air-cooled or water-cooled systems.

- Another major opportunity comes from emerging economies expanding their power generation capabilities. The U.S. Department of Energy notes hydrogen’s wide flammability range of 4–74% in air, and that the ignition energy can be as low as 0.02 mJ.

Technological innovations also open new pathways. Modern systems now feature improved gas-management controls, predictive maintenance tools, and automated safety mechanisms. These innovations reduce operational challenges and make hydrogen cooling more accessible to mid-scale plants, creating room for wider adoption.

Regional Analysis

North America Dominates the Hydrogen Cooled Generators Market with a Market Share of 46.9%, Valued at USD 275.5 Million

North America leads the Hydrogen Cooled Generators Market, holding a dominant 46.9% share valued at USD 275.5 million. The region benefits from strong industrial power demand, widespread deployment of large-capacity turbines, and ongoing modernization of thermal power assets. Increased investments in grid stability and the growing shift toward high-efficiency generator cooling technologies continue to support market expansion across the U.S. and Canada.

Europe shows steady growth driven by industrial electrification, combined-cycle power plant upgrades, and decarbonization policies. The region’s mature power infrastructure encourages the adoption of advanced cooling systems to boost generator efficiency and reduce operational losses. Rising integration of renewable energy assets also increases the need for stable conventional generation backup, supporting market demand.

Asia Pacific experiences strong momentum due to expanding thermal power capacity across China, India, and Southeast Asia. Rapid industrialization and growing electricity consumption are pushing utilities to invest in efficient generator technologies. Government-backed power reforms and infrastructure funding further contribute to higher adoption of hydrogen-cooled systems across emerging economies.

The Middle East & Africa region is gradually adopting hydrogen-cooled generators, supported by large-scale power projects and heavy industrial activities. Investment in gas-fired generation, driven by oil and gas sector growth, strengthens market uptake. Infrastructure development initiatives and long-term national energy programs contribute to progressive market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Siemens Energy enters 2025 with a clear advantage in the installed-base cycle, where uprates, rewinds, and life-extension programs often move faster than new-build orders. From an analyst lens, its positioning is strongest when hydrogen-cooled generators are packaged with broader turbine modernization and long-term service contracts, helping customers stabilize availability and forced-outage risk.

GE Vernova is well placed for 2025 demand tied to reliability upgrades at combined-cycle and large thermal plants that must run harder to balance renewables. Its opportunity is to convert fleet insights into repeatable retrofit scopes—cooling performance, insulation upgrades, and monitoring improvements—so plant operators can defend output and thermal efficiency.

Mitsubishi Hitachi Power Systems benefits from a reputation for robust heavy-duty power equipment, which matters as utilities prioritize long run-hours and cyclic operation. In 2025, its hydrogen-cooled generator narrative can be sharpened around higher duty cycles, better thermal margins, and planned-outage predictability for aging assets. The constraint is that procurement cycles remain cautious, so winning tends to rely on technical clarity—scope definition, site readiness planning, and strong commissioning support.

Toshiba Energy Systems & Solutions can gain share where customers seek conservative engineering choices and stable long-term support for critical rotating equipment. For 2025, its strongest plays are selective new installations and targeted refurbishments that de-risk operations through improved diagnostics and more disciplined maintenance planning. The differentiator will be responsiveness in parts availability and field-service depth, since generator downtime directly translates into lost dispatch and contractual exposure.

Top Key Players in the Market

- Siemens Energy

- GE Vernova

- Mitsubishi Hitachi Power Systems

- Toshiba Energy Systems & Solutions

- ABB Ltd.

- Hitachi Energy

- Bharat Heavy Electricals Ltd.– BHEL

- Dongfang Electric Corporation

- Harbin Electric Corporation

- Hyundai Electric

Recent Developments

- In 2025, Siemens Energy continues to offer its SGen-3000W series of water-/hydrogen-cooled generators, designed for high-power applications in gas and steam power plants. These generators feature advanced cooling technology with Global Vacuum Pressure Impregnation (GVPI) wound stator cores, enabling efficient operation across various regimes with outputs up to significant capacities.

- In 2025, ABB offers the AK100 H2 purity and purge gas monitor, specifically designed for monitoring hydrogen purity in hydrogen-cooled generators to ensure safe and efficient operation. Historical comparisons highlight ABB’s air-cooled turbogenerators as simpler alternatives to hydrogen-cooled designs, reducing complexity and maintenance.

Report Scope

Report Features Description Market Value (2024) USD 587.5 Million Forecast Revenue (2034) USD 1022.7 Million CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Cooling Method (Direct Cooling Systems, Indirect Cooling Systems), By Power Rating (Below 500 MVA, 500 to 800 MVA, Above 800 MVA), By End-Use (Thermal Power Plants, Coal Power Plants, Gas Power Plants, Nuclear Power Plants, Other) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Siemens Energy, GE Vernova, Mitsubishi Hitachi Power Systems, Toshiba Energy Systems & Solutions, ABB Ltd., Hitachi Energy, Bharat Heavy Electricals Ltd.– BHEL, Dongfang Electric Corporation, Harbin Electric Corporation, Hyundai Electric Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Hydrogen Cooled Generators MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Hydrogen Cooled Generators MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Energy

- GE Vernova

- Mitsubishi Hitachi Power Systems

- Toshiba Energy Systems & Solutions

- ABB Ltd.

- Hitachi Energy

- Bharat Heavy Electricals Ltd.– BHEL

- Dongfang Electric Corporation

- Harbin Electric Corporation

- Hyundai Electric