Global Hospital Bedsheet & Pillow Cover Market By Type (Bedsheet and Pillow Cover), By Product (Reusable and Disposable), By End-User (Hospitals & Clinics, Outpatient care centers, Rehabilitation centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170640

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

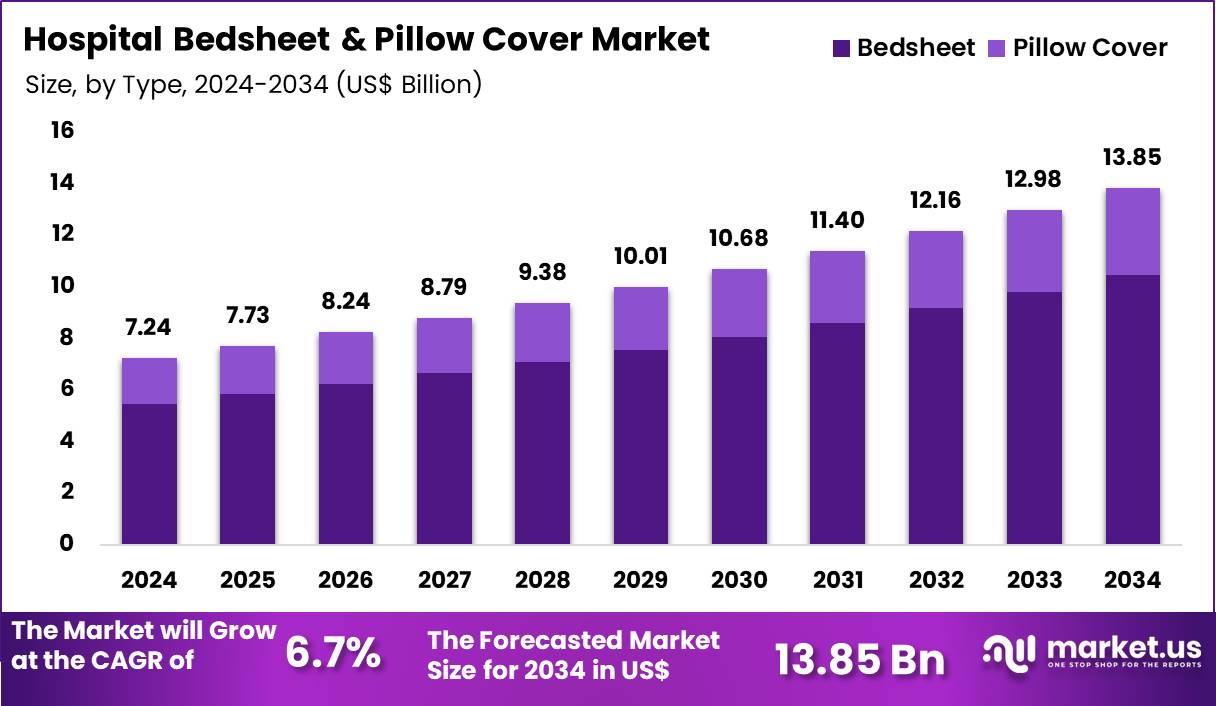

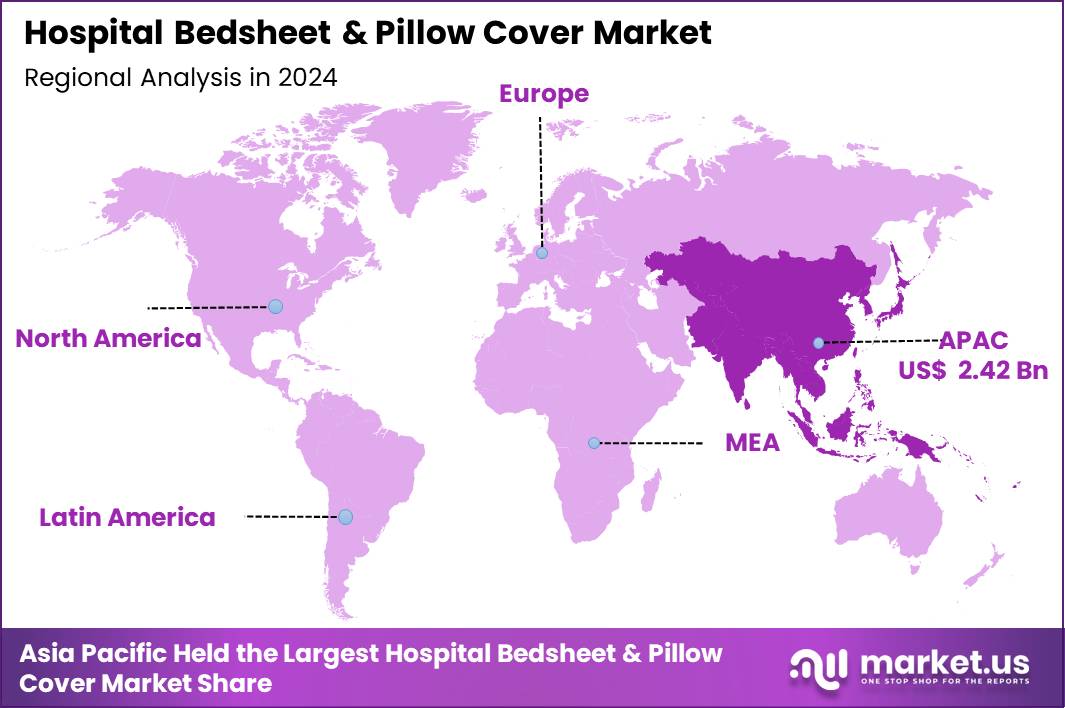

The Global Hospital Bedsheet & Pillow Cover Market size is expected to be worth around US$ 13.85 Billion by 2034 from US$ 7.24 Billion in 2024, growing at a CAGR of 6.7% during the forecast period 2025 to 2034. In 2024, Asia Pacific led the market, achieving over 33.4% share with a revenue of US$ 2.42 Billion.

The Hospital Bedsheet & Pillow Cover Market represents an essential component of hospital linen management and patient-care hygiene systems. Demand for high-quality, durable, and hygienic linen continues to increase as global healthcare facilities expand bed capacity, adopt stricter sanitation protocols, and implement standardized textile-handling procedures.

According to the University of Michigan, adult patient wait times for available beds at University Hospital and the Frankel Cardiovascular Center decreased by 33%. This improvement included a 37% reduction in the time required to assign beds to adults arriving through the emergency department who were approved for inpatient admission.

At the U-M C.S. Mott Children’s Hospital, children experienced a 13% decrease in the time needed to assign a bed. U-M Health also improved its patient transfer acceptance rate, rising from 70% to 80%, supported by new data-driven prioritization processes that enable more patients to access advanced quaternary care.

Additionally, patients ready for discharge saw notable reductions in the time from discharge order to actual departure, with adults experiencing a 12% decrease and children seeing a 9% decrease due to more efficient, streamlined procedures.

Bedsheets and pillow covers support infection-prevention workflows by maintaining clean patient-contact surfaces across inpatient wards, intensive care units, maternity departments, postoperative recovery rooms, and isolation units. Rising surgical volumes, higher hospital occupancy rates, greater turnover in outpatient recovery beds, and heightened awareness toward patient comfort are further accelerating the consumption of hospital linen.

Reusable and disposable textile formats remain central to operational planning in healthcare settings. Many hospitals continue to rely on reusable cotton or blended-fabric sheets for cost-efficiency, durability, and comfort. However, increasing emphasis on controlling healthcare-associated infections has encouraged selective adoption of disposable non-woven pillow covers and bedsheets, particularly in high-risk departments.

Government initiatives promoting improved hospital hygiene practices, including WHO’s patient safety campaigns and national sanitation audits, reinforce the importance of regular linen replacement cycles. Linen service providers and textile manufacturers are investing in antimicrobial coatings, stain-resistant finishes, fluid-repellent technologies, and higher thread-count materials to enhance performance and extend service life, aligning the market with evolving clinical standards.

Key Takeaways

- In 2024, the market generated a revenue of US$ 7.24 Billion, with a CAGR of 6.7%, and is expected to reach US$ 13.85 Billion by the year 2034.

- The Type segment is divided into Bedsheet and Pillow Cover, with Bedsheet taking the lead in 2024 with a market share of 75.6%

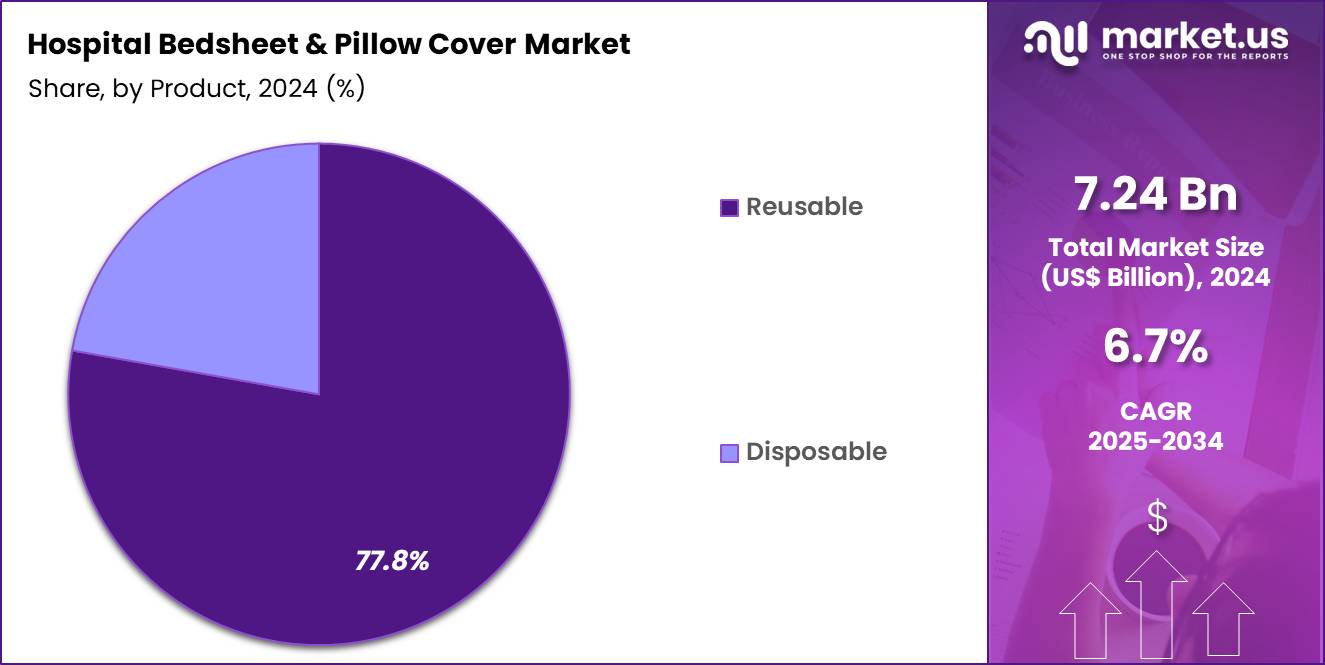

- The Product segment is divided into Reusable, and Disposable, with Reusable linen dominated current product usage owing to lower cost per cycle and widespread compatibility with commercial hospital laundry systems in 2024 with a market share of 77.8%

- The End-User segment is divided into Hospitals & Clinics, Outpatient care centers, Rehabilitation centers, and Others, with Hospitals & Clinics taking the lead in 2024 with a market share of 68.3%

- Asia Pacific led the market by securing a market share of 33.4% in 2024.

Type Analysis

Bedsheets form the dominant type segment accounting for over 75.6% because every hospital bed requires routine linen replacement to maintain hygiene standards. A single occupied inpatient bed may require multiple sheet changes per day depending on patient mobility, infection risk, and cleanliness protocols. ICUs, operating theaters, burn units, pediatric departments, and maternity wards maintain strict linen-change intervals, driving high consumption volumes.

During seasonal surges of respiratory infections or gastrointestinal illnesses, bed occupancy rises significantly, increasing linen turnover even further. Hospital bedsheets are increasingly manufactured using cotton-rich or poly-cotton blends that withstand repeated laundering cycles at high temperatures. Providers are also adopting antimicrobial-treated sheets to reduce microbial contamination, especially in long-stay wards. Many regions have strengthened textile safety standards, encouraging hospitals to procure higher-grade sheets with improved tensile strength and fluid-repellent finishing.

Pillow covers hold a smaller but steadily growing share in the market, driven by higher adoption of disposable pillow protectors in outpatient and diagnostic settings. Pillow covers frequently require replacement when handling patients with infectious diseases, excessive sweating, wound drainage, or post-operative requirements.

Product Analysis

Reusable bedsheets and pillow covers dominated this segment which held 77.8% market share in 2024 because healthcare facilities traditionally rely on commercial laundry systems that make reusable linen cost-efficient over multiple wash cycles. Cotton and blended-fabric sheets can withstand hundreds of hot-water sterilization cycles, making them suitable for long-term use in public and private hospitals.

Reusable linen supports sustainability efforts, especially in regions where hospitals aim to reduce medical textile waste. Large facilities employ automated laundry tunnels, high-capacity dryers, and RFID-tagged tracking systems to manage linen circulation efficiently. Rehabilitation centers favor reusable linen due to longer patient stays and consistent comfort requirements.

Disposable products represent an important and expanding niche, particularly in infection-control zones that require rapid linen turnover without the risk of cross-contamination. Non-woven disposable sheets and pillow covers have gained traction in emergency departments, isolation wards, COVID-care units, oncology infusion rooms, and outpatient surgical centers.

End-User Analysis

Hospitals & Clinics account for the largest share of the market of 68.3% due to high inpatient admissions, intensive care operations, and continuous bed occupancy across multiple departments. A general hospital may manage thousands of linen items per day, with requirements spanning emergency rooms, ICUs, operating theaters, delivery suites, and long-stay wards.

Strict bed-change protocols are enforced after every discharge, diagnostic procedure, or contamination event. The rise in chronic disease management, neonatal care, trauma cases, and elderly patient admissions further increases linen usage. High-volume tertiary hospitals often partner with large textile suppliers and outsourced linen-service providers to maintain uninterrupted supply.

Outpatient care centers including day-care surgery units, diagnostic imaging facilities, dialysis centers, and infusion clinics use bedsheets and pillow covers during short patient stays and rapid check-ins. Increased adoption of same-day surgical procedures and minimally invasive treatments has boosted linen turnover in outpatient environments. Rehabilitation centers, physiotherapy units, and long-term recovery facilities depend on reusable sheets and pillow covers to support extended patient stays.

Key Market Segments

By Type

- Bedsheet

- Pillow Cover

By Product

- Reusable

- Disposable

By End-User

- Hospitals & Clinics

- Outpatient care centers

- Rehabilitation centers

- Others

Drivers

Strong emphasis on hospital hygiene and infection prevention

Strong emphasis on hospital hygiene and infection prevention continues to drive demand for hospital bedsheets and pillow covers across inpatient, outpatient, and emergency-care environments. Healthcare-associated infections affect 7–15% of patients globally according to WHO guidelines, prompting hospitals to tighten linen-change cycles and adopt standardized textile handling protocols. High bed occupancy amplifies linen turnover; for example, India records over 65 million annual hospitalizations, while the US exceeds 34 million inpatient stays each year, resulting in millions of linen replacements daily.

Surgical procedures also contribute significantly global surgical volumes surpass 330 million operations annually, and every postoperative recovery bed requires fresh sheets and pillow covers after each case. Growing chronic disease management, such as dialysis, oncology infusions, and long-term respiratory care, increases bed usage in day-care units and specialty clinics. Rapid expansion of healthcare infrastructure in Asia and Africa—over 1,500 new hospitals built in Asia-Pacific in the last decade—further boosts textile consumption.

Heightened regulatory compliance, including CDC and national health-quality audits, requires hospitals to maintain linen inventories aligned with strict cleanliness benchmarks. In May 2025, Derila Ergo introduced its latest ergonomic pillow, engineered with comfort-focused features to support healthier sleep positions. The pillow’s distinctive butterfly-shaped, contoured design gently supports the head and neck, helping users achieve more restful nights and enhanced overall sleep comfort.

Restraints

Rising environmental concerns and waste-generation challenges

Rising environmental concerns and waste-generation challenges remain significant restraints for hospitals adopting disposable linens. Healthcare systems generate over 5 million tons of medical waste annually, and disposable pillow covers and bedsheets contribute noticeably due to stringent single-use mandates in infectious-disease units. Incineration limitations in densely populated regions worsen waste-management burdens.

Cost pressures also remain a concern, as reusable linens require substantial investment in industrial washers, dryers, detergents, and energy-intensive sterilization systems. Hospitals managing thousands of beds incur heavy operational expenditure to sustain hygiene cycles large tertiary hospitals may process over 25,000 linen pieces per day. Damage, staining, and fabric deterioration from high-temperature washing reduce textile longevity, increasing replacement frequency.

Supply-chain volatility also affects costs; fluctuations in cotton prices driven by weather disruptions in India, Pakistan, and the US directly impact linen procurement budgets. Smaller clinics often struggle to maintain adequate inventory, leading to inconsistent linen availability. Labor shortages in laundry departments, especially during peak infection seasons, create operational bottlenecks.

Opportunities

Growing innovation in textile engineering

Growing innovation in textile engineering presents major opportunities for manufacturers and healthcare facilities. Antimicrobial fabrics capable of reducing bacterial load by 99% offer significant infection-control benefits, especially in ICUs, burn units, and post-surgical wards. Fluid-repellent finishes and stain-resistant coatings are being integrated into high-performance bedsheets to improve durability and reduce laundry loads.

Eco-friendly materials, including biodegradable non-wovens and recycled polyester blends, are emerging as alternatives to traditional cotton and polypropylene-based disposables, addressing sustainability targets. Increasing investments in hospital infrastructure China alone has added over 12,000 new healthcare facilities since 2015 boosts linen procurement at scale.

Expanding outpatient surgery volumes, which now account for 60–70% of all procedures in developed nations, create opportunities for compact disposable pillow covers that support rapid patient turnover. Digitization of linen management using RFID tags allows real-time tracking, reducing losses and improving efficiency in facilities that handle hundreds of thousands of textiles each week.

Medical tourism hotspots such as Thailand, India, and Malaysia increasingly adopt premium linens to elevate patient experience, supporting demand for higher thread-count and comfort-enhanced products. In January 2025, Assam Chief Minister Himanta Biswa Sarma announced that Guwahati Medical College and Hospital (GMCH) in India introduced color-coded bedsheets assigned to specific weekdays. The initiative aims to improve hygiene standards and ensure that hospital linen is changed on a regular, systematic schedule.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical forces significantly influence the Hospital Bedsheet & Pillow Cover Market through disruptions in raw material supply, labor availability, energy prices, and global trade flows. Cotton production central to reusable linens remains highly sensitive to climate volatility and geopolitical instability in major producing nations such as India, China, Pakistan, and the US. Severe droughts, flooding, and pest outbreaks can reduce cotton yield by 10–30%, raising textile costs and straining hospital procurement budgets.

Geopolitical tensions affecting maritime routes or port operations often delay shipments of textile chemicals, dyes, and non-woven materials used in disposable linens. Inflationary pressure increases the cost of detergents, utility bills, and laundry operations, impacting hospitals that process tens of thousands of linens daily.

During health emergencies, governments may prioritize domestic PPE and medical textile production, resulting in export restrictions that limit global availability. The COVID-19 period demonstrated how sharp spikes in hospital occupancy can triple linen consumption in isolation wards, overwhelming supply chains. Labor shortages in textile mills and hospital laundry departments further tighten operational capacity.

Additionally, currency fluctuations affect import-dependent regions, influencing cost competitiveness of both reusable and disposable products. As healthcare systems expand and geopolitical uncertainties persist, maintaining stable linen supply becomes increasingly complex and strategically significant.

Latest Trends

Shift toward advanced, high-performance fabrics

A major trend in the Hospital Bedsheet & Pillow Cover Market is the shift toward advanced, high-performance fabrics designed for both durability and hygiene. Hospitals increasingly prefer polycotton blends that withstand 200–300 industrial wash cycles without significant degradation.

Antimicrobial and odor-control technologies are rapidly gaining acceptance in long-stay wards, with treated linens helping reduce microbial growth on surfaces frequently exposed to perspiration and wound fluids. The adoption of disposable pillow covers in outpatient and imaging centers is rising due to shorter patient stays and quicker turnover centers performing MRI/CT scans may accommodate 50–100 patients daily, each requiring a fresh pillow cover.

Global sustainability goals are encouraging the transition toward reusable linens produced through energy-efficient dyeing and finishing processes. Automated laundry operations equipped with water-recycling systems and AI-enabled sorting are being implemented to improve hygiene compliance while reducing operational costs.

Hotels and hospitals increasingly share linen supply networks in some regions, optimizing laundering infrastructure. Aesthetic improvements such as color-coded linens for departments (ICU, maternity, emergency) support workflow efficiency and reduce cross-departmental mixing.

Regional Analysis

Asia Pacific is leading the Hospital Bedsheet & Pillow Cover Market

Asia Pacific represents the largest market accounting for over 33.4% due to rapid healthcare expansion, rising hospitalization rates, and extensive government investment in medical infrastructure. Countries such as China, India, Indonesia, and Vietnam collectively add millions of new inpatient admissions annually, requiring high linen turnover across emergency units, ICUs, and surgical wards. India alone operates more than 1.9 million hospital beds, while China exceeds 6 million, generating massive daily demand for bedsheets and pillow covers.

The region also conducts high procedure volumes China performs over 60 million surgeries annually driving consistent linen replacement in pre- and post-operative rooms. Public hospital modernization programs, such as Ayushman Bharat in India and Healthy China 2030, emphasize improved sanitation standards, further boosting linen consumption. Growing private hospital chains, medical tourism hubs, and rehabilitation centers in Thailand, Malaysia, and Singapore support rising demand for premium comfort textiles and reusable high-durability sheets.

North America region is expected to experience the highest CAGR during the forecast period

North America is the fastest-growing region due to strong infection-control regulations, high adoption of premium textile technologies, and well-established hospital laundry infrastructure. The United States records over 34 million annual inpatient stays and 860 million outpatient visits, each contributing to large-scale linen turnover across hospitals, ambulatory surgery centers, dialysis units, and infusion clinics.

Strict CDC and OSHA guidelines require frequent linen changes in high-risk departments such as ICUs, oncology, and emergency care. The region performs more than 40 million surgical procedures annually, accelerating usage of sterile and clean linens in pre-surgical and recovery units. Nursing homes and long-term care facilities serving over 1.3 million residents in the US drive demand for comfort-focused, skin-friendly sheets and pillow covers.

Innovation adoption is also rapid, with hospitals integrating RFID-based linen tracking and antimicrobial-coated fabrics to enhance operational efficiency and hygiene compliance. Canada’s growing long-term-care investments further support market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Unitex Textile Rental Services, ImageFIRST Healthcare Laundry Specialists, Healthcare Services Group, Inc., Angelica Corporation, Elizabethtown Laundry Company, Tetsudo Linen Service Co., Ltd., Celtic Linen, Emerald Textiles, Raenco Mills, Emes Textiles Pvt. Ltd., IndoSurgicals Pvt. Ltd., Jindal Texofab Ltd., Medmech Healthcare Pvt. Ltd., Oscar Overseas, Oscar Overseas, and Others.

These firms focus on outsourced linen-rental and laundry services for hospitals and large healthcare institutions, offering scale, logistics, consistent hygiene standards, and recurring contracts. On the manufacturing and supply side, textile producers and exporters such as IndoSurgicals Pvt. Ltd., Jindal Texofab Ltd., Medmech Healthcare Pvt. Ltd., Oscar Overseas, along with firms like Celtic Linen, Emerald Textiles, Raenco Mills, and Emes Textiles Pvt. Ltd., supply bedsheets and pillow covers directly — addressing both institutional buyers and smaller clinics, domestically and via exports.

Large service-providers dominate in scale, consistent quality, and long-term contracts; whereas manufacturers compete on cost, fabric quality, customization, and flexibility. The result is a bifurcated market where rental-service leaders cater to high-volume hospitals, and textile suppliers serve emerging markets, smaller clinics or those preferring outright purchase.

Top Key Players

- Unitex Textile Rental Services

- ImageFIRST Healthcare Laundry Specialists

- Healthcare Services Group, Inc.

- Angelica Corporation

- Elizabethtown Laundry Company

- Tetsudo Linen Service Co., Ltd.

- Celtic Linen

- Emerald Textiles

- Raenco Mills

- Emes Textiles Pvt. Ltd.

- IndoSurgicals Pvt. Ltd.

- Jindal Texofab Ltd.

- Medmech Healthcare Pvt. Ltd.

- Oscar Overseas

- Others

Recent Developments

- In March 2023, Toyota Tsusho, the global trading arm of the Toyota Group, partnered with Tokai Corp, a Japanese specialist in hospital linen and medical support services, to establish Valabhi Hospital Services in India. The venture aims to deliver comprehensive end-to-end linen management solutions to hospitals, enhancing overall hygiene standards and transforming linen operations across healthcare facilities in the country.

- In March 2022, ImageFIRST announced a “record-breaking year” for its medical-linen business: the company added more than 10 facilities across the U.S. during 2021 (from Maine to Seattle) and expanded its “National Account” division to support more multiregional clients, increasing processing capacity in locations including Lakeland (FL), San Diego (CA), Elmsford (NY), and Seattle (WA).

- In November 2021, Unicamp’s Hospital de Clínicas (HC) received a donation of 938 blankets and 100 pillows, valued at more than R$53 thousand. The initiative was led by hospital physicians, the Medical Residency Committee (Coreme), and faculty members and alumni from Unicamp’s Faculty of Medical Sciences (FCM).

Report Scope

Report Features Description Market Value (2024) US$ 7.24 Billion Forecast Revenue (2034) US$ 13.85 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Bedsheet and Pillow Cover), By Product (Reusable and Disposable), By End-User (Hospitals & Clinics, Outpatient care centers, Rehabilitation centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Unitex Textile Rental Services, ImageFIRST Healthcare Laundry Specialists, Healthcare Services Group, Inc., Angelica Corporation, Elizabethtown Laundry Company, Tetsudo Linen Service Co., Ltd., Celtic Linen, Emerald Textiles, Raenco Mills, Emes Textiles Pvt. Ltd., IndoSurgicals Pvt. Ltd., Jindal Texofab Ltd., Medmech Healthcare Pvt. Ltd., Oscar Overseas, Oscar Overseas, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hospital Bedsheet & Pillow Cover MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Hospital Bedsheet & Pillow Cover MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Unitex Textile Rental Services

- ImageFIRST Healthcare Laundry Specialists

- Healthcare Services Group, Inc.

- Angelica Corporation

- Elizabethtown Laundry Company

- Tetsudo Linen Service Co., Ltd.

- Celtic Linen

- Emerald Textiles

- Raenco Mills

- Emes Textiles Pvt. Ltd.

- IndoSurgicals Pvt. Ltd.

- Jindal Texofab Ltd.

- Medmech Healthcare Pvt. Ltd.

- Oscar Overseas

- Others