Global Spectroscopy Market Analysis By Type [Atomic Spectroscopy (Atomic Absorption Spectroscopy (AAS), Atomic Emission Spectroscopy (AES), X-ray Fluorescence (XRF)), Molecular Spectroscopy (Infrared Spectroscopy (IR), Ultraviolet-Visible Spectroscopy (UV-Vis), Nuclear Magnetic Resonance Spectroscopy (NMR), Others), Mass Spectroscopy (Matrix-Assisted Laser Desorption/Ionization (MALDI-MS), Gas Chromatography-Mass Spectrometry (GC-MS), Liquid Chromatography-Mass Spectrometry (LC-MS), Others)], By Application (Pharmaceutical & Biopharmaceutical, Food & Beverage Testing, Environment testing, Academic research, Other applications) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135243

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

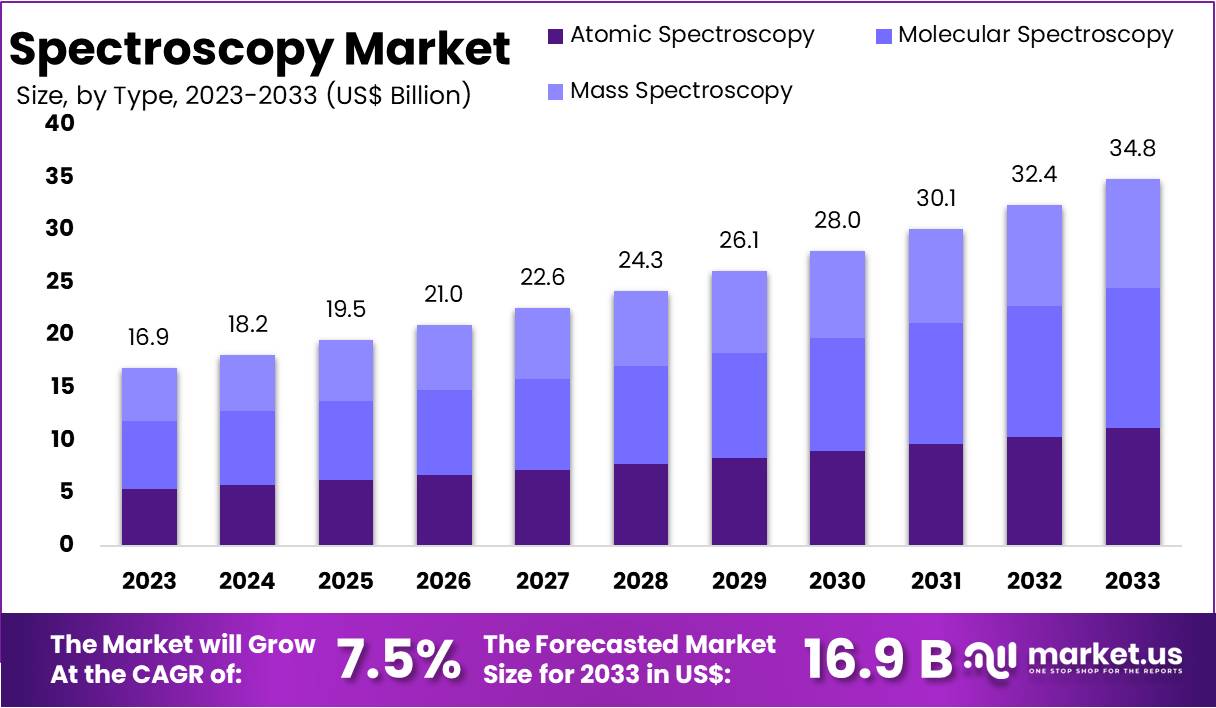

The Global Spectroscopy Market size is expected to be worth around US$ 34.8 Billion by 2033, from US$ 16.9 Billion in 2023, growing at a CAGR of 7.5% during the forecast period from 2024 to 2033.

Spectroscopy is a pivotal analytical method that explores the interaction between matter and electromagnetic radiation, widely applied in industries like pharmaceuticals, biotechnology, and environmental science. This technique, which encompasses mass, molecular, and atomic spectroscopy, is essential for analyzing complex materials and biological compounds.

The North American region dominates the global spectroscopy market due to its advanced technological infrastructure and high adoption rates across various sectors. This region’s lead is bolstered by substantial investments in research and development from both government and private entities, focusing on applications in life sciences, environmental monitoring, and industrial processes. The strategic push towards innovation in spectroscopy technologies enhances market growth and operational efficiencies in these critical areas.

Recent developments in the spectroscopy market underscore the rapid pace of innovation within the field. For instance, new launches of sophisticated spectrometers are enhancing capabilities in proteomics research and broadening the applications in food safety, forensic analysis, and environmental testing. These advancements are not only improving the analytical performance but are also making spectroscopy more accessible and cost-effective for a broader range of users.

Government regulations and initiatives significantly influence the spectroscopy market, with policies often designed to ensure accuracy and safety in pharmaceutical manufacturing and environmental compliance. These regulations encourage the adoption of advanced spectroscopic techniques to meet stringent quality standards. Moreover, funding for technological research and development in spectroscopy helps drive the creation of new applications and improvements in existing methods.

The competitive landscape of the spectroscopy market is shaped by various strategic movements such as mergers, acquisitions, and collaborations. These strategies are crucial as companies strive to enhance their technological capabilities and expand their market presence. By combining resources and expertise, companies can more effectively innovate and meet the evolving needs of their customers, setting the stage for continued growth and expansion in the spectroscopy sector.

Key Takeaways

- The Spectroscopy Market is projected to reach approximately US$ 34.8 billion by 2033, growing from US$ 16.9 billion in 2023 with a 7.5% CAGR.

- Molecular Spectroscopy dominated the Type Segment in 2023, holding over 38.4% of the Spectroscopy Market.

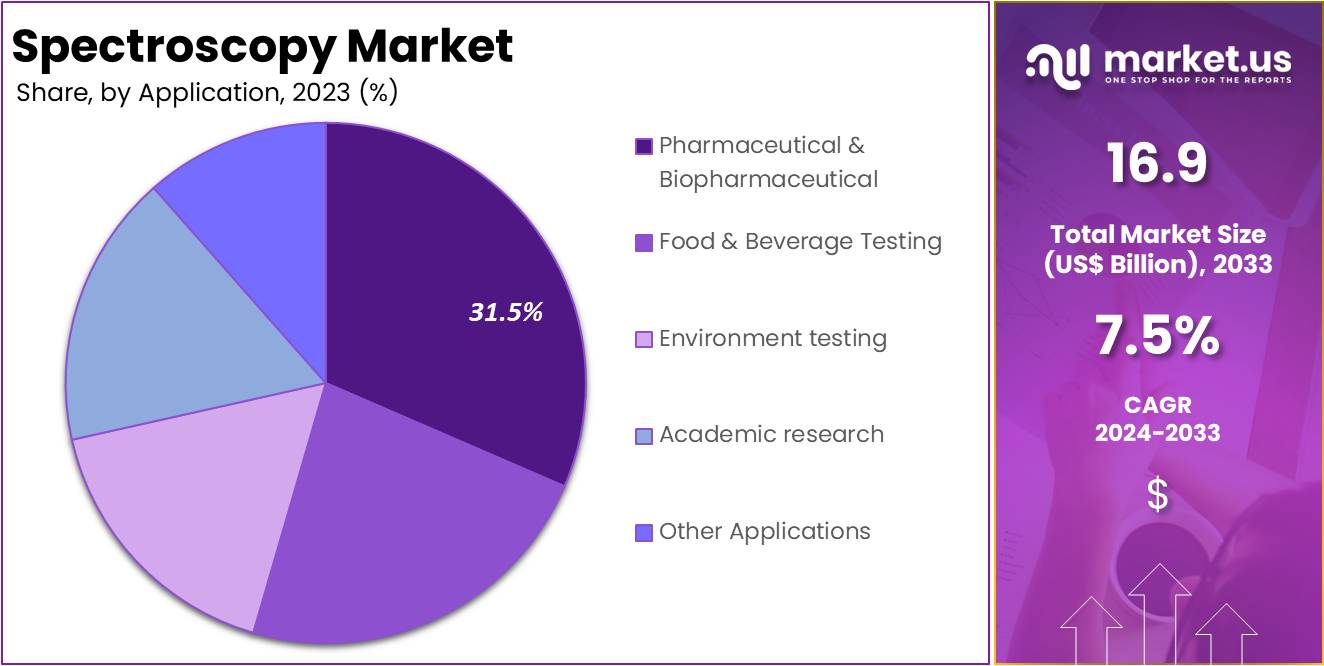

- The Pharmaceutical and Biopharmaceutical segment led in applications, capturing over 31.5% of the market share in 2023.

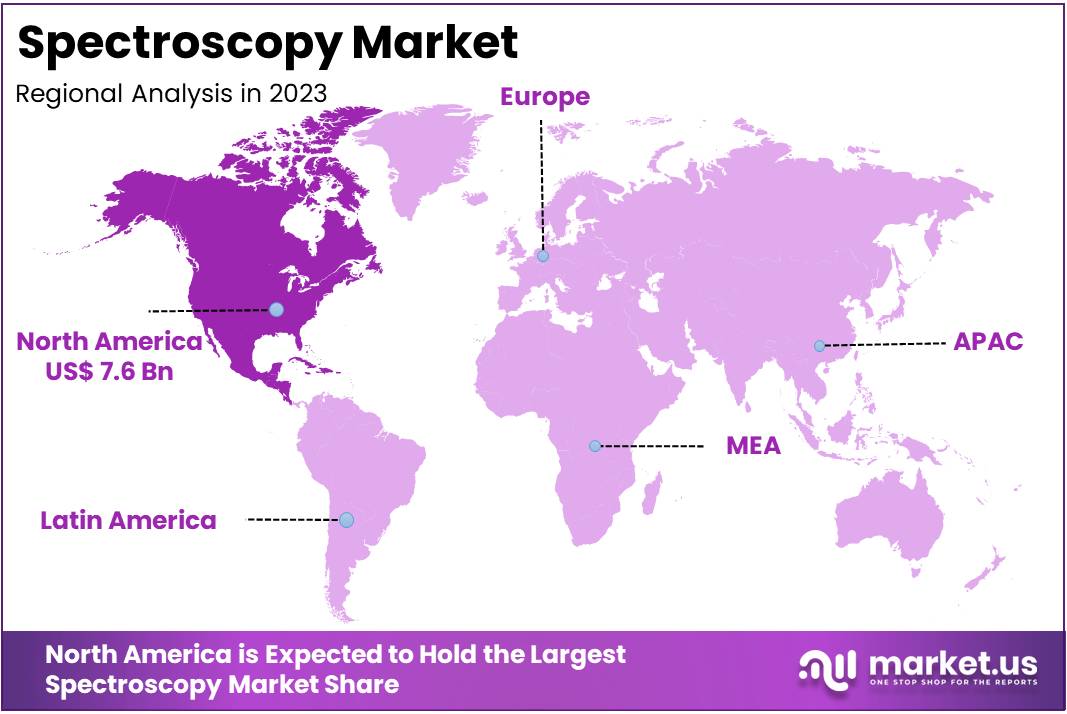

- North America was the leading region in 2023, securing over 45.2% of the market, valued at US$ 7.6 billion.

Type Analysis

In 2023, the Molecular Spectroscopy segment held a dominant market position in the Type Segment of the Spectroscopy Market, capturing more than a 38.4% share. This segment’s strength comes from its wide range of applications. Industries such as pharmaceuticals, food and beverage, and environmental testing rely heavily on molecular spectroscopy. Techniques like Infrared Spectroscopy (IR) and Ultraviolet-Visible Spectroscopy (UV-Vis) are particularly valued for their accuracy and efficiency in analysis.

Following closely is the Atomic Spectroscopy segment. This includes methods such as Atomic Absorption Spectroscopy (AAS) and X-ray Fluorescence (XRF). These techniques are essential for elemental analysis across various sectors. Environmental monitoring and food safety are two key areas where atomic spectroscopy plays a crucial role. The segment is expected to grow steadily, driven by technological advancements and increasing regulatory demands.

The Mass Spectroscopy segment is also gaining traction in the market. It features methodologies like Gas Chromatography-Mass Spectrometry (GC-MS) and Liquid Chromatography-Mass Spectrometry (LC-MS). These techniques are known for their high sensitivity and precision in identifying chemical compounds. They are especially important in clinical diagnostics and research settings. As the need for accurate analytical methods rises, mass spectroscopy will likely see continued growth.

Application Analysis

In 2023, the Pharmaceutical and Biopharmaceutical segment held a dominant market position in the Application Segment of the Spectroscopy Market, capturing more than a 31.5% share. This segment’s growth is largely attributed to the increasing use of spectroscopy in drug development and quality control. Companies rely on these techniques for accurate analysis and compliance with regulatory standards. As a result, this application remains crucial for ensuring the safety and efficacy of pharmaceutical products.

The Food and Beverage Testing segment is also significant in the spectroscopy market. It focuses on ensuring product safety and quality through rigorous testing. Spectroscopy helps detect contaminants and verify ingredient authenticity. With consumers demanding higher safety standards, the need for effective testing methods has surged. This trend drives growth in the food and beverage sector, making spectroscopy an essential tool for manufacturers.

Environmental Testing is another key area where spectroscopy is applied. Growing concerns about pollution and environmental health have increased demand in this sector. Techniques like mass spectrometry are used to monitor pollutants in air, water, and soil. These methods are vital for regulatory compliance and environmental protection efforts. As environmental issues gain more attention, the role of spectroscopy in this field becomes increasingly important.

Lastly, Academic Research contributes significantly to the spectroscopy market. Educational institutions use these techniques for various scientific investigations. Spectroscopy aids researchers in exploring complex chemical reactions and biological processes. Increased funding for research initiatives further supports this application segment. Additionally, other applications, such as petrochemicals and forensic analysis, showcase the versatility of spectroscopy across multiple industries, enhancing its overall market growth potential.

Key Market Segments

By Type

- Atomic Spectroscopy

- Atomic Absorption Spectroscopy (AAS)

- Atomic Emission Spectroscopy (AES)

- X-ray Fluorescence (XRF)

- Molecular Spectroscopy

- Infrared Spectroscopy (IR)

- Ultraviolet-Visible Spectroscopy (UV-Vis)

- Nuclear Magnetic Resonance Spectroscopy (NMR)

- Others

- Mass Spectroscopy

- Matrix-Assisted Laser Desorption/Ionization (MALDI-MS)

- Gas Chromatography-Mass Spectrometry (GC-MS)

- Liquid Chromatography-Mass Spectrometry (LC-MS)

- Others

By Application

- Pharmaceutical & Biopharmaceutical

- Food & Beverage Testing

- Environment testing

- Academic research

- Other applications

Drivers

Increasing Demand in Pharmaceutical and Biotechnology Industries

The pharmaceutical and biotechnology sectors are major users of spectroscopy technologies. These industries rely heavily on spectroscopy for drug discovery, formulation, and ensuring quality control. The technology’s ability to analyze and confirm the composition and quality of substances makes it indispensable. With increasing demand for effective therapies, the importance of precise and accurate spectral analysis continues to rise.

Spectroscopy techniques such as mass spectroscopy and nuclear magnetic resonance (NMR) are essential in structural analysis and biomarker identification. These techniques are crucial in the development of new drugs, providing detailed insights into chemical structures and biological markers. This helps pharmaceutical companies meet stringent regulatory standards and ensure the safety and efficacy of their products.

The expanding use of spectroscopy in the pharmaceutical and biotechnology industries is driving significant market growth. As regulatory standards for drug development become stricter, the role of spectroscopy in maintaining high-quality standards in product development is more critical than ever. This trend indicates a growing reliance on advanced spectroscopic techniques to meet global health needs effectively.

Restraints

High Costs of Spectroscopy Equipment

Advanced spectroscopy instruments, like Fourier Transform Infrared (FTIR) and Raman spectroscopy systems, represent a high upfront investment. These systems are not only expensive to purchase but also to maintain. This cost factor can be a substantial financial burden, particularly for smaller entities such as academic institutions and research centers. These groups often operate with tighter budgets, making such advanced equipment less accessible.

The ongoing expenses related to these sophisticated instruments extend beyond initial purchase costs. Maintenance and repair, essential for optimal functionality and accuracy, further inflate the total cost of ownership. For many organizations, these ongoing costs are a critical consideration, influencing their ability to invest in such technology.

Moreover, operating advanced spectroscopy equipment requires specialized skills. The need for trained personnel who can accurately handle these systems and interpret complex data adds another layer of expense. This necessity can limit market penetration, especially in regions where cost sensitivity is paramount and access to trained professionals is limited. As a result, the high cost of both acquisition and operation restricts broader adoption of advanced spectroscopy tools.

Opportunities

Rising Applications in Environmental Analysis

With increasing awareness of environmental degradation, the adoption of spectroscopy technologies is on the rise for monitoring environmental pollutants. This technology is crucial in detecting contaminants in air, water, and soil, supporting global sustainability efforts. The use of spectroscopy aids in identifying hazardous substances like heavy metals in water sources, which is vital for maintaining public health and environmental safety.

Governments and various organizations are integrating spectroscopy into their regulatory practices to comply with stringent environmental laws. This integration ensures accurate monitoring and enforcement of regulations aimed at reducing pollution. As a result, spectroscopy is becoming an indispensable tool in environmental governance, enhancing its market growth potential.

The expanding application of spectroscopy in environmental analysis presents significant opportunities for growth within this sector. Particularly, its role in measuring greenhouse gas emissions is critical in the fight against climate change. This capability not only supports global sustainability goals but also opens up new markets for advanced spectroscopy solutions, making it a lucrative area for future investments and technological innovations.

Trends

Integration of AI and Machine Learning with Spectroscopy

The integration of artificial intelligence (AI) and machine learning (ML) into spectroscopy is revolutionizing the industry. These advanced technologies facilitate automated data analysis, which significantly reduces human errors and enhances accuracy. By automating these processes, spectroscopy systems equipped with AI can deliver more reliable and precise results, which is essential in high-stakes research environments.

AI-powered spectroscopy systems excel in identifying complex patterns within large datasets quickly. This capability is crucial in accelerating research and decision-making processes. In fields that handle extensive data, such as proteomics and genomics, this speed is particularly valuable, enabling scientists to achieve insights faster than ever before.

The application of AI in spectroscopy is increasingly evident in areas like food safety, where rapid and accurate analysis is paramount. The ability to process and analyze vast amounts of data efficiently makes AI-enhanced spectroscopy tools indispensable in these sectors. This trend underscores a growing reliance on technological advancements to improve standard practices and push the boundaries of what’s possible in scientific research and safety assurance.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 45.2% share and holding a US$ 7.6 billion market value for the year. This strong performance can be attributed to several factors that enhance the growth of the spectroscopy market in the region. Technological advancements play a crucial role. Major companies in North America invest heavily in research and development, leading to innovative spectroscopic techniques that improve efficiency and accuracy.

Another significant factor is the region’s robust industrial base. Key sectors such as pharmaceuticals, chemicals, and food and beverage rely on spectroscopy for quality control and compliance with regulations. The stringent standards set by organizations like the FDA drive the demand for reliable analytical methods. This reliance on spectroscopy ensures continued market growth in North America.

Investment in research and development is also noteworthy. Both private companies and public institutions are committed to advancing spectroscopic technologies. This commitment fosters better product development and enhances analytical capabilities. As a result, North America remains a leader in the global spectroscopy market, attracting further investments.

While North America leads, other regions are showing growth potential. The Asia Pacific region is expected to be the fastest-growing market due to rapid industrialization and increased research investments. Europe continues to invest significantly in spectroscopy technologies, driven by strong pharmaceutical and environmental sectors. Overall, North America’s dominance is supported by its innovation, industrial strength, and commitment to research.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The spectroscopy market features several key players, each contributing to its growth and innovation. Thermo Fisher Scientific leads the way with a broad range of advanced analytical instruments. The company focuses on research and development to enhance its product offerings. Their commitment to innovation allows them to meet the diverse needs of industries such as pharmaceuticals and environmental testing. This strong focus on technology positions Thermo Fisher as a dominant force in the spectroscopy market.

Joel Ltd is another important player in this sector. They specialize in high-quality analytical instruments, particularly in electron microscopy and spectroscopy. Joel Ltd has been expanding its product range to cater to various applications. Their focus on precision and reliability helps them build a loyal customer base. By continually improving their technologies, Joel Ltd remains competitive in a rapidly evolving market. Their dedication to quality ensures they meet the rigorous demands of their clients.

Jasco International Co., Ltd offers a diverse array of spectroscopy solutions. Their portfolio includes UV-Visible, IR, and fluorescence spectroscopy instruments. Jasco is known for its user-friendly designs and high-performance products. The company invests heavily in research to develop new technologies that enhance analytical accuracy. This focus is crucial for industries like pharmaceuticals and food safety. Jasco’s global presence also strengthens its position in the market, allowing them to serve clients effectively across different regions.

PerkinElmer, Inc and Danaher Corporation are also significant players in the spectroscopy landscape. PerkinElmer is known for its innovative molecular spectroscopy solutions, focusing on health sciences and sustainability. Meanwhile, Danaher leverages its technological expertise across multiple sectors, including life sciences and diagnostics. Both companies actively pursue mergers and acquisitions to enhance their capabilities. Their ongoing investments in research and development will shape the future of the spectroscopy market, addressing emerging opportunities and challenges effectively.

Market Key Players

- Joel Ltd

- Danaher Corporation

- Jasco International Co.Ltd

- Perkin ElmerInc

- Thermo Fisher Scientific

- himadzu Corporation

- Agilent Technologies

- Leco Corporation

- Kore Technology

- Water

- Endress+hauser group

- Horiba Ltd

- Merck KGaA

- Kaiser optical system

- Kett electric laboratory

- Sartorius AG

- Yokogawa electric corporation

Industrial Advantages and Opportunities For Market Players

Spectroscopy offers significant business benefits across various industries. It provides accurate composition analysis, which is crucial for sectors like pharmaceuticals. This precision ensures that products meet their labeled specifications. Accurate ingredient identification is vital for patient safety. Companies can rely on spectroscopy to guarantee the quality of their products. This builds consumer trust and enhances brand reputation. By leveraging these advantages, businesses can improve their market position and attract more customers.

Another key benefit of spectroscopy is streamlined quality control. Real-time monitoring of production processes enhances quality assurance. Spectroscopy helps detect contaminants early, ensuring compliance with safety standards. This proactive approach reduces the risk of product recalls. Companies can maintain high-quality standards consistently. As a result, they can focus on innovation and growth. Effective quality control also leads to increased customer satisfaction and loyalty.

In addition to business benefits, spectroscopy provides industrial advantages. Enhanced process monitoring allows companies to optimize operations effectively. Real-time analysis helps identify defects early in the manufacturing process. This capability is particularly valuable in industries like food and pharmaceuticals. Moreover, spectroscopy’s versatility enables its application across various sectors. Different spectrometers can be tailored for specific tasks, increasing operational efficiency and effectiveness.

Finally, increased consumer awareness about product quality creates further opportunities. Consumers are more discerning about the safety and quality of the products they purchase. Companies utilizing spectroscopy can better meet these demands by ensuring high standards. This focus on quality not only helps in regulatory compliance but also supports sustainability initiatives. By embracing spectroscopy, businesses can position themselves favorably in the market while contributing to environmental goals and enhancing their brand image.

Recent Developments

- October 2023: JEOL Ltd launched two new Scanning Electron Microscopes (SEM) models, featuring advanced intelligent technology for easier operation and faster, high-resolution imaging and analysis. These new models aim to enhance data acquisition capabilities for various specimen types, addressing the growing demand for sophisticated imaging solutions in scientific research and industrial applications.

- June 2023: Thermo Fisher Scientific launched the Orbitrap Astral mass spectrometer, a significant advancement in mass spectrometry technology. This device is designed to revolutionize biological discovery by combining high resolution and speed, which accelerates the discovery of new proteins and advances precision medicine. The Orbitrap Astral offers up to two times deeper proteome coverage and up to four times more throughput compared to existing mass spectrometers, significantly enhancing the ability to identify new clinical biomarkers and develop new therapeutic interventions.

Report Scope

Report Features Description Market Value (2023) US$ 16.9 Billion Forecast Revenue (2033) US$ 34.8 Billion CAGR (2024-2033) 7.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type [Atomic Spectroscopy (Atomic Absorption Spectroscopy (AAS), Atomic Emission Spectroscopy (AES), X-ray Fluorescence (XRF)), Molecular Spectroscopy (Infrared Spectroscopy (IR), Ultraviolet-Visible Spectroscopy (UV-Vis), Nuclear Magnetic Resonance Spectroscopy (NMR), Others), Mass Spectroscopy (Matrix-Assisted Laser Desorption/Ionization (MALDI-MS), Gas Chromatography-Mass Spectrometry (GC-MS), Liquid Chromatography-Mass Spectrometry (LC-MS), Others)], By Application (Pharmaceutical & Biopharmaceutical, Food & Beverage Testing, Environment testing, Academic research, Other applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Joel Ltd, Danaher Corporation, Jasco International Co.Ltd, Perkin ElmerInc, Thermo Fisher Scientific, himadzu Corporation, Agilent Technologies, Leco Corporation, Kore Technology, Water, Endress+hauser group, Horiba Ltd, Merck KGaA, Kaiser optical system, Kett electric laboratory, Sartorius AG, Yokogawa electric corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Joel Ltd

- Danaher Corporation

- Jasco International Co.Ltd

- Perkin ElmerInc

- Thermo Fisher Scientific

- himadzu Corporation

- Agilent Technologies

- Leco Corporation

- Kore Technology

- Water

- Endress+hauser group

- Horiba Ltd

- Merck KGaA

- Kaiser optical system

- Kett electric laboratory

- Sartorius AG

- Yokogawa electric corporation