Global Remote Cardiac Monitoring Market By Type (Devices and Software and Services), By End-User (Hospitals and Clinics, Ambulatory Surgical Centers (ASCs), Home Healthcare, Diagnostic Centers, and Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138009

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

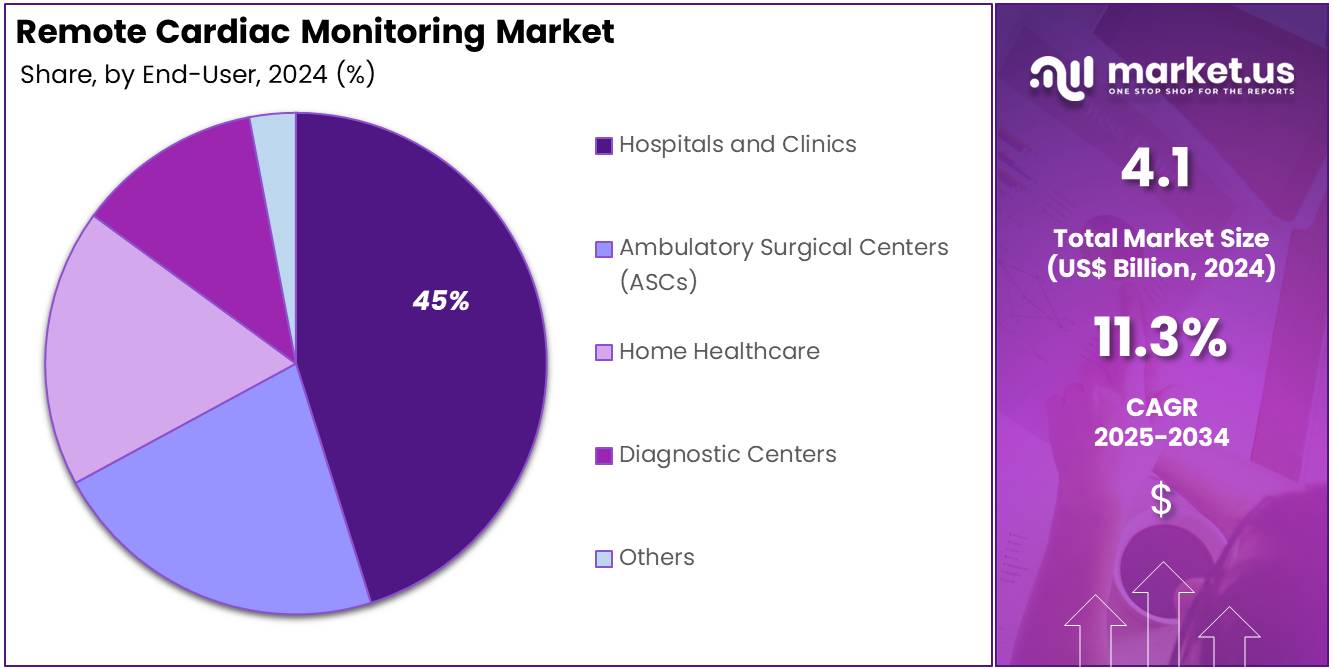

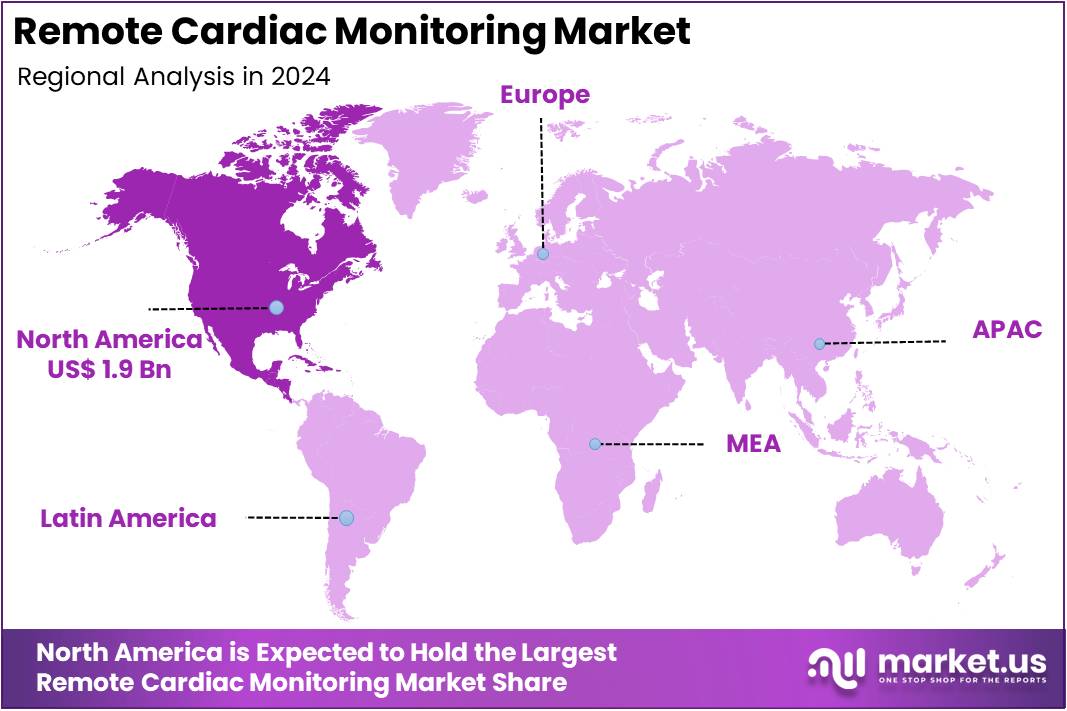

The Global Remote Cardiac Monitoring Market size is expected to be worth around US$ 12 Billion by 2034, from US$ 4.1 Billion in 2024, growing at a CAGR of 11.3% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 47% share and holds US$ 1.9 Billion market value for the year.

The global remote cardiac monitoring market is experiencing significant growth driven by advancements in imaging technology and the increasing prevalence of chronic diseases requiring minimally invasive procedures. The demand for mobile Remote Cardiac Monitoring is particularly rising due to their flexibility and wide application in orthopaedics, cardiology, and neurology.

Technological innovations, such as 3D imaging and AI-enabled systems, further enhance diagnostic accuracy and surgical precision, boosting market adoption. However, high equipment costs and stringent regulatory requirements pose challenges, particularly in developing regions with limited healthcare budgets.

Additionally, the long lifecycle of Remote Cardiac Monitoring reduces replacement frequency, slightly restraining market growth. Moreover, collaborations between medical device manufacturers and healthcare providers are expanding access to advanced imaging systems in underserved regions, further driving market expansion.

Key Takeaways

- The global remote cardiac monitoring market was valued at USD 4.1 billion in 2024 and is anticipated to register substantial growth of USD 12.0 billion by 2034, with 11.3% CAGR.

- In 2024, the devices segment took the lead in the global market, securing 49% of the total revenue share.

- The hospitals and clinics segment took the lead in the global market, securing 45% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 47% of the total revenue.

Product Type Analysis

Based on product type the market is fragmented into devices and software and services. Amongst these, devices dominated the global remote cardiac monitoring market capturing a significant market share of 49% in 2024. Devices are the dominant segment in the global remote cardiac monitoring market, accounting for the largest share due to their critical role in tracking and managing cardiovascular health.

Advanced devices such as ECG monitors, implantable loop recorders, mobile cardiac telemetry (MCT) systems, and smart wearables are increasingly adopted for their accuracy and reliability in detecting heart conditions. The growing prevalence of cardiovascular diseases, combined with the rising demand for continuous monitoring, has spurred the adoption of these devices. Technological innovations, including wireless connectivity and integration with mobile apps, have enhanced usability and patient compliance.

End-User Analysis

The market is fragmented by end-user into hospitals and clinics, ambulatory surgical centers (ASCs), home healthcare, diagnostic centers, and others. Hospitals and clinics dominated the global remote cardiac monitoring market capturing a significant market share of 45% in 2024. Hospitals and clinics hold the largest share in the global remote cardiac monitoring market, driven by their critical role in diagnosing and managing cardiovascular diseases.

These facilities are the primary points of care for patients requiring advanced monitoring and treatment, benefiting from access to state-of-the-art equipment and skilled healthcare professionals. The adoption of remote cardiac monitoring devices in hospitals and clinics is bolstered by their ability to deliver accurate, real-time data for timely medical intervention. Furthermore, the integration of advanced technologies, such as cloud-based monitoring and AI-driven analytics, has enhanced the efficiency of cardiac care in clinical settings.

Key Segments Analysis

By Product Type

- Devices

- ECG Monitoring Devices

- Event Monitors

- Implantable Loop Recorders

- Smart Wearables

- Software and Services

- Monitoring Services

- Data Analytics Software

By End-User

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Home Healthcare

- Diagnostic Centers

- Others

Drivers

Rising Prevalence of Cardiovascular Diseases

The rising prevalence of cardiovascular diseases (CVDs) is significantly driving the growth of the Remote Cardiac Monitoring Market. The increasing incidence of conditions such as arrhythmias, heart failure, and coronary artery diseases has heightened the need for continuous cardiac monitoring.

Remote cardiac monitoring offers real-time, non-invasive tracking of heart activity, enabling early detection of irregularities and timely medical intervention. Factors such as sedentary lifestyles, unhealthy dietary habits, and the growing aging population further exacerbate the prevalence of CVDs, creating a robust demand for remote solutions.

- According to the World Health Organization, CVDs are the leading cause of death globally, accounting for nearly 18 million deaths annually. In 2022, approximately six out of ten U.S. adults were affected by at least one chronic disease. Similarly, as per the U.K. Factsheet released in August 2022, 7.6 million people in the U.K. were living with heart or circulatory diseases.

Restraints

Refurbished Equipment may Limit Demand

The high costs associated with remote cardiac monitoring devices and services are restraining the growth of the market. Advanced monitoring devices, such as mobile cardiac telemetry systems and implantable loop recorders, involve significant initial investments. The average price of remote cardiac monitoring devices varies significantly based on their complexity and features.

Basic consumer-grade devices, such as certain smartwatches equipped with heart rate monitoring capabilities, can range from approximately US$90 to US$800. Additionally, ongoing costs related to data analytics software, subscription-based services, and maintenance further increase the financial burden on patients and healthcare providers. In regions with limited healthcare budgets or inadequate insurance coverage, the affordability of these solutions remains a challenge. Patients in developing economies, in particular, face difficulties accessing such advanced technologies due to their high costs, resulting in lower adoption rates.

Opportunities

Technological Advancement

Technological advancements are unlocking significant growth opportunities in the Remote Cardiac Monitoring Devices Market. Innovations in device connectivity, artificial intelligence, and data analytics are enabling more precise, real-time cardiac monitoring, improving patient outcomes.

- For example, in July 2023, PaceMate, a prominent provider of remote cardiac monitoring services, secured investment from Lead Edge Capital. This funding aims to enhance PaceMate’s cardiac solutions and expand its demographic reach, underscoring the rising focus on cutting-edge technologies and scalable healthcare solutions. Such investments highlight the increasing integration of advanced tools like AI-driven analytics and IoT-enabled devices to provide continuous and personalized cardiac care.

These developments not only expand market penetration but also improve healthcare accessibility, especially in remote areas. The combination of enhanced technology and strategic investments is expected to propel the adoption of remote cardiac monitoring systems, driving robust market growth during the forecast period.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic and geopolitical factors significantly impact the global remote cardiac monitoring market, shaping its growth dynamics and adoption trends. Economic conditions, such as inflation, fluctuating exchange rates, and healthcare budget constraints, directly influence the affordability and accessibility of remote monitoring devices, particularly in developing regions.

High costs of advanced technologies may deter adoption in low and middle-income countries, limiting market expansion. Geopolitical tensions, trade restrictions, and supply chain disruptions, such as those caused by the COVID-19 pandemic or conflicts, can hinder the production and distribution of cardiac monitoring devices. Additionally, regulatory changes and varied reimbursement policies across regions create challenges for market players in scaling their operations globally.

Trends

The global remote cardiac monitoring market is witnessing several key trends driven by technological advancements and shifting healthcare priorities. Wearable technology has emerged as a prominent trend, with smartwatches and fitness trackers integrating advanced cardiac monitoring features like ECG and heart rate variability analysis, increasing user engagement and accessibility.

AI and machine learning are transforming remote cardiac monitoring by enabling predictive analytics, real-time alerts, and personalized care, improving early detection and management of cardiovascular diseases. The adoption of cloud-based platforms for data storage and seamless integration with electronic health records (EHRs) is enhancing remote monitoring efficiency.

Regional Analysis

North America held a significant share in the remote cardiac monitoring market, driven by advanced healthcare infrastructure, high adoption of innovative technologies, and the increasing prevalence of cardiovascular diseases. The U.S., in particular, contributes significantly due to its aging population.

- According to the Rural Health Information Hub, the geriatric population in the U.S. is expected to grow by 18 million between 2020 and 2030, with 90% of adults over 65 likely to develop one or more chronic conditions, including cardiovascular diseases.

The region’s focus on preventive healthcare and early diagnosis further boosts the adoption of remote cardiac monitoring devices. Additionally, the integration of AI and IoT technologies in healthcare and strong reimbursement policies enhance market penetration. Strategic collaborations and investments by key players also reinforce North America’s dominance, making it a critical market for innovation and revenue generation in remote cardiac monitoring.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The remote cardiac monitoring market is characterized by intense competition, driven by the presence of established players and the entry of innovative startups. Key companies, including Medtronic, GE Healthcare, Philips Healthcare, Boston Scientific Corporation, and Biotronik, dominate the market with advanced technologies and extensive distribution networks.

These players focus on developing AI-powered solutions, cloud-based platforms, and wearable monitoring devices to cater to growing demand. Strategic initiatives such as mergers, acquisitions, and collaborations are common, with companies seeking to enhance their portfolios and expand their geographic presence.

Abbott Laboratories is a global healthcare leader headquartered in the United States, specializing in diagnostics, medical devices, nutritionals, and branded generic medicines. In the remote cardiac monitoring market, Abbott offers advanced solutions such as implantable cardiac devices and remote monitoring systems.

AMC Health is a leading provider of remote patient monitoring (RPM) and telehealth solutions, based in the United States. The company specializes in delivering end-to-end RPM services, leveraging real-time monitoring and analytics to improve chronic disease management, including cardiovascular conditions.

Top Key Players in the Remote Cardiac Monitoring Market

- Abbott Laboratories

- AMC Health

- Biotronik, Inc

- Boston Scientific Corporation

- GE Healthcare

- Honeywell International Inc.

- Koninklijke Philips N.V.

- Medtronic

- Nihon Kohden Corporation

- OSI Systems, Inc.

Recent Developments

- In January 2022, OMRON Healthcare introduced VitalSight, a solution specifically designed for individuals managing hypertension. The kit includes an OMRON-connected blood pressure monitor and a data hub, both pre-configured to securely transmit readings digitally to the patient’s doctor and care team. Delivered directly to the patient’s residence, this innovative product is expected to enhance the company’s growth and market presence.

- In May 2023, VivaLNK, Inc. introduced an upgraded multi-parameter wearable ECG patch. This new product offers continuous 14-day live streaming capabilities, enhancing patient comfort while significantly reducing administrative tasks for clinics.

Report Scope

Report Features Description Market Value (2024) US$ 4.1 billion Forecast Revenue (2034) US$ 12.0 billion CAGR (2025-2034) 11.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Devices and Software and Services), By End-User (Hospitals and Clinics, Ambulatory Surgical Centers (ASCs), Home Healthcare, Diagnostic Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, AMC Health, Biotronik, Inc., Boston Scientific Corporation, GE Healthcare, Honeywell International Inc., Koninklijke Philips N.V., Medtronic, Nihon Kohden Corporation, and OSI Systems, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Remote Cardiac Monitoring MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Remote Cardiac Monitoring MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- AMC Health

- Biotronik, Inc

- Boston Scientific Corporation

- GE Healthcare

- Honeywell International Inc.

- Koninklijke Philips N.V.

- Medtronic

- Nihon Kohden Corporation

- OSI Systems, Inc.