Global Biohazard Bags Market By Product Material (LDPE, HDPE, Cellophane, Polypropylene, and Others), By Application (Highly Infectious Waste, Sharps Waste, Chemical & Pharmaceutical Waste, General Healthcare Waste, and Others), By End-use (Hospitals/Clinics, Diagnostic Laboratories, Pharmaceutical/Research Laboratories, and Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2024

- Report ID: 139433

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

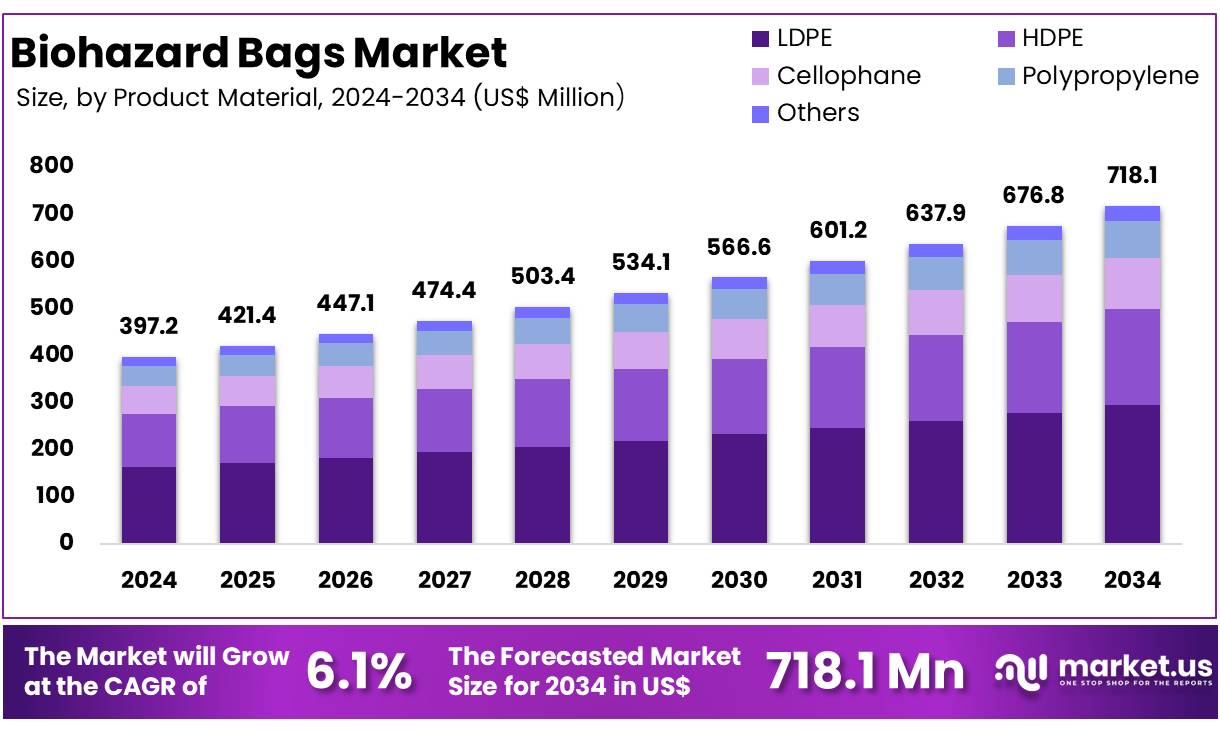

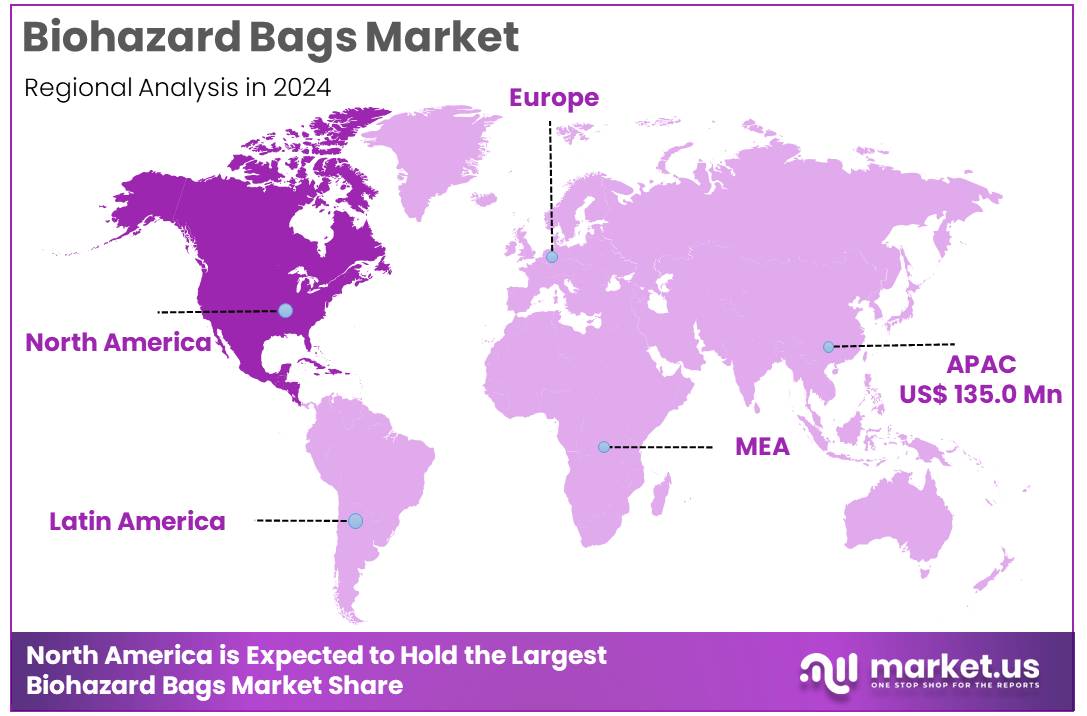

Global Biohazard Bags Market size is expected to be worth around US$ 718.1 Million by 2033 from US$ 397.2 Million in 2023, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033. In 2023, Asia Pacific led the market, achieving over 34% share with a revenue of US$ 135.0 Million.

The biohazard bags market is driven by the increasing need for safe and effective medical waste disposal, particularly in hospitals, laboratories, and research facilities. The rising prevalence of infectious diseases and stringent regulations regarding medical waste management are key factors propelling market growth. Innovations in materials, such as biodegradable and high-strength polymers, have further enhanced the efficiency and environmental sustainability of biohazard bags, fuelling their adoption.

However, the market faces challenges such as high costs associated with advanced biohazard bag materials and limited awareness in developing regions, which restrain growth. Furthermore, growing investments in healthcare infrastructure and the rising demand for personal protective equipment (PPE) waste management post-pandemic present significant opportunities.

Key Takeaways

- The global Biohazard Bags market was valued at USD 397.2 million in 2024 and is anticipated to register substantial growth of USD 718.1 million by 2034, with 6.1% CAGR.

- In 2024, the LDPE segment took the lead in the global market, securing 41% of the total revenue share.

- The veterinary hospitals/clinics segment took the lead in the global market, securing 40% of the total revenue share.

- Asia Pacific maintained its leading position in the global market with a share of over 34% of the total revenue.

By Product Material Analysis

Based on product material the market is fragmented into LDPE, HDPE, cellophane, polypropylene, and others. Amongst these, LDPE dominated the global biohazard bags market capturing a significant market share of 41% in 2024. Its widespread adoption is attributed to its excellent durability, flexibility, and chemical resistance, making it ideal for safely containing hazardous and infectious waste.

LDPE’s lightweight nature and cost-effectiveness further enhance its appeal, particularly in high-demand sectors like hospitals, laboratories, and pharmaceutical industries. The material’s ability to withstand punctures and tears ensures safe handling and transportation of biohazardous waste, meeting stringent regulatory requirements. Additionally, advancements in LDPE formulations, including biodegradable variants, align with the growing emphasis on sustainability, further driving demand.

By Application Analysis

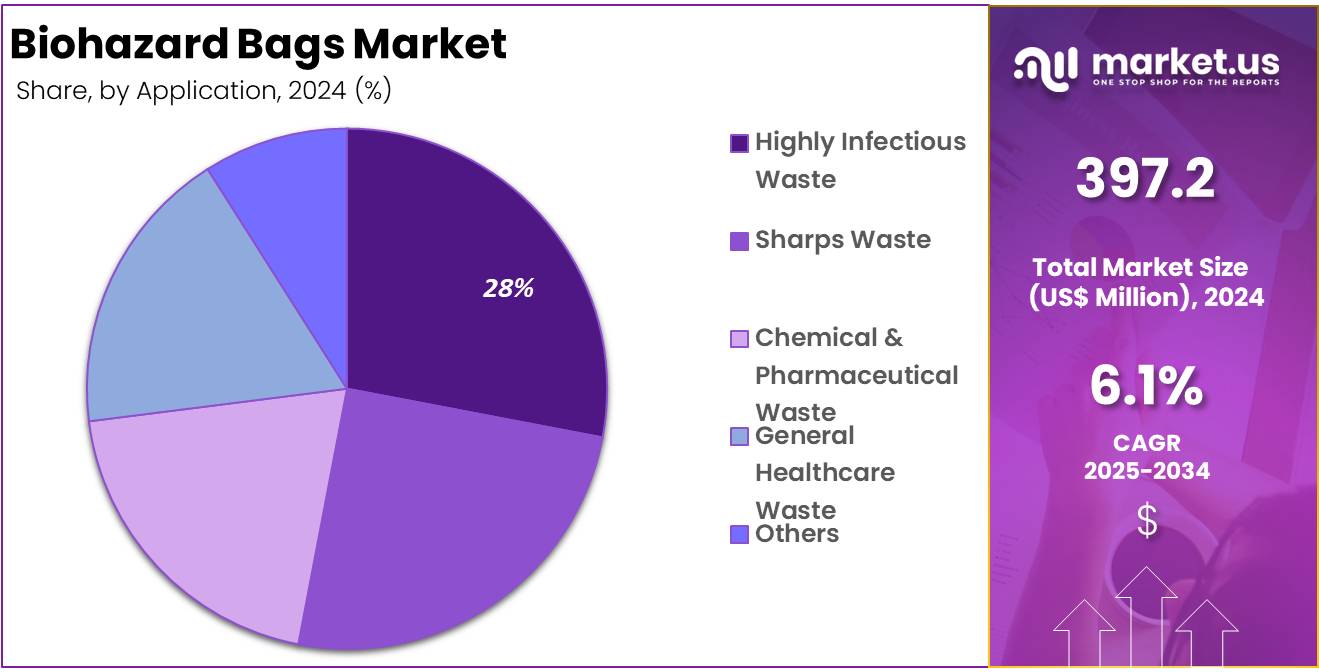

Based on application material the market is fragmented into highly infectious waste, sharps waste, chemical & pharmaceutical waste, general healthcare waste, and others. Amongst these, highly infectious waste dominated the global biohazard bags market capturing a significant market share of 28% in 2024 driven by the increasing prevalence of infectious diseases and heightened awareness regarding healthcare-associated infections (HAIs).

This segment’s dominance stems from the stringent regulations mandating the safe containment and disposal of waste generated from hospitals, diagnostic labs, and research facilities dealing with highly contagious pathogens.

The COVID-19 pandemic significantly amplified the demand for biohazard bags, particularly for managing waste from personal protective equipment (PPE), testing kits, and vaccination programs. The focus on infection control measures and the risk of cross-contamination have further bolstered the use of specialized biohazard bags for highly infectious waste.

By End Use Analysis

The market is fragmented by end use into hospitals/clinics, diagnostic laboratories, pharmaceutical/research laboratories, and others. Hospitals/clinics dominated the global biohazard bags market capturing a significant market share of 40% in 2024 due to their high volumes of hazardous medical waste.

These facilities generate substantial amounts of infectious waste daily, including sharps, surgical materials, and contaminated personal protective equipment (PPE), necessitating efficient waste segregation and disposal. The strict enforcement of healthcare waste management regulations worldwide has driven hospitals and clinics to adopt advanced biohazard bags to ensure compliance and minimize environmental impact. The increasing number of healthcare facilities, particularly in developing regions, further fuels this segment’s dominance.

Key Segments Analysis

Product Material

- LDPE

- HDPE

- Cellophane

- Polypropylene

- Others

Application

- Highly Infectious Waste

- Sharps Waste

- Chemical & Pharmaceutical Waste

- General Healthcare Waste

- Others

End-use

- Hospitals/Clinics

- Diagnostic Laboratories

- Pharmaceutical/Research Laboratories

- Others

Increasing Number of Hospital Beds

The increasing number of hospital beds worldwide is a key factor driving the growth of the biohazard bags market. As healthcare infrastructure expands to accommodate rising patient volumes, particularly in developing regions, the need for effective medical waste management systems grows proportionately. Each hospital bed generates significant quantities of infectious and hazardous waste daily, including disposable medical supplies, surgical materials, and contaminated PPE, necessitating the use of reliable biohazard bags.

- In 2023, India recorded over 1.5 million hospital beds, leading to a significant rise in medical waste volumes and highlighting the need for effective management solutions. Likewise, hospitals in Lebanon produce approximately 7,255 tons of infectious waste annually, emphasizing the critical healthcare waste challenge that requires immediate attention.

Market Restraints

High Cost

The high cost associated with advanced biohazard bags is a significant restraint for the market. These bags, often made with premium materials like biodegradable polymers or multi-layered structures for enhanced safety and durability, come at a higher price point compared to conventional alternatives. This cost factor poses a challenge, particularly in developing and under-resourced regions, where healthcare facilities operate on limited budgets and may prioritize cost over compliance with stringent waste management standards.

Additionally, small-scale healthcare providers and clinics often face financial constraints, limiting their ability to adopt high-quality biohazard bags. The reliance on cheaper, less effective options compromises waste handling safety and environmental compliance.

Market Opportunities

Increasing Government initiatives

Government initiatives to enhance healthcare access and capacity, coupled with a rising incidence of chronic and infectious diseases, have fuelled the establishment of new hospitals and the expansion of existing ones. This trend has directly translated into a higher demand for biohazard bags to ensure the safe segregation, transportation, and disposal of medical waste in compliance with stringent waste management regulations. The focus on infection prevention and sustainability further supports the adoption of advanced biohazard bag solutions in the expanding hospital sector.

- In August 2022, the Government of Japan, in partnership with the United Nations Development Programme (UNDP), launched a two-year project valued at USD 11 million. The initiative aims to support national health agencies and key stakeholders in Bangladesh, Bhutan, and the Maldives in managing the increased volume of infectious healthcare waste caused by the COVID-19 pandemic. This surge in waste had overwhelmed existing waste treatment facilities. The project’s focus on improving infectious waste management is expected to contribute to market growth in the coming years.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic and geopolitical factors significantly influence the biohazard bags market. Economic downturns or inflation can constrain healthcare budgets, particularly in developing countries, affecting investments in advanced waste management solutions like high-quality biohazard bags. Conversely, economic growth in emerging markets boosts healthcare infrastructure, increasing the demand for effective medical waste disposal products.

Geopolitical factors such as conflicts and instability can disrupt supply chains, causing shortages of raw materials like polymers used in biohazard bags. For example, trade restrictions or sanctions can limit the availability of critical materials, increasing production costs. Additionally, pandemics, such as COVID-19, have highlighted the role of global cooperation and the need for efficient waste management systems, spurring demand for biohazard bags.

Latest Trends

The biohazard bags market is evolving with key trends focused on sustainability, technology, and customization. The increasing demand for eco-friendly solutions has driven the adoption of biodegradable and compostable biohazard bags, aligning with global sustainability goals and stricter environmental regulations. Healthcare facilities are progressively shifting toward these alternatives to minimize their ecological footprint.

Technological advancements, such as the integration of RFID tags, are gaining momentum, enabling efficient tracking and management of biohazardous waste. These smart features improve compliance and streamline waste handling processes in hospitals and laboratories.

Regional Analysis

Asia Pacific held a significant 34% share of the biohazard bags market. Asia Pacific holds a substantial share in the biohazard bags market, driven by the region’s expanding healthcare sector and increasing awareness about medical waste management. Rapid population growth, urbanization, and rising healthcare expenditure in countries like China, India, and Japan have led to a surge in hospital and clinical establishments, significantly boosting the demand for biohazard bags.

The region’s vulnerability to infectious diseases and the subsequent focus on infection control have further accelerated the adoption of effective waste disposal systems. Government initiatives and regulatory frameworks aimed at improving healthcare waste management practices have played a pivotal role in driving market growth.

Key Regions and Countries

Asia Pacific

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The biohazard bags market is highly competitive, characterized by the presence of numerous regional and global players. Key companies are focusing on product innovation, sustainability, and strategic partnerships to strengthen their market positions. The development of biodegradable and eco-friendly biohazard bags is a major area of competition, driven by increasing environmental concerns and regulatory pressures.

Acquisitions and collaborations are common strategies, as seen with Spartech’s acquisition of Tufpak to expand its medical and biohazard packaging capabilities. Regional players also play a significant role by offering cost-effective solutions tailored to local needs, particularly in emerging markets. With growing healthcare infrastructure and waste management challenges, competition is expected to intensify, prompting continuous innovation and market expansion.

Top Key Players

- Thermo Fisher Scientific Inc.

- Bel-Art Products

- International Plastics Inc.

- Bioscience International

- Cole-Parmer Instrument Company, LLC

- TUFPAK, INC.

- BWS Incorporated

- Daniels Sharpsmart Inc.

- Stericycle Inc.

- Abdos Labtech Private Limited

- Transcendia

- DESCO Medica

- Minigrip

- TUFPAK, INC.

- Dynalab Corp.

Recent Developments

- In February 2021, Justrite Safety Group, a global leader in industrial safety products, introduced a line of poly waste container bags specifically designed to facilitate the efficient identification and proper handling of biohazard and infectious linen waste.

- In December 2020, Spartech announced its acquisition of Tufpak, Inc., a manufacturer specializing in custom and stock-engineered plastic films for biohazard bags, medical devices, and biopharma packaging. This acquisition aims to enhance Spartech’s product portfolio by including medical and biohazard plastic film solutions with cutting-edge packaging tailored for biological, chemical, pharmaceutical, and laboratory research applications.

Report Scope

Report Features Description Market Value (2024) US$ 397.2 million Forecast Revenue (2034) US$ 718.1 million CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Biohazard Bags Market By Product Material (LDPE, HDPE, Cellophane, Polypropylene, and Others), By Application (Highly Infectious Waste, Sharps Waste, Chemical & Pharmaceutical Waste, General Healthcare Waste, and Others), By End-use (Hospitals/Clinics, Diagnostic Laboratories, Pharmaceutical/Research Laboratories, and Others). Regional Analysis Asia Pacific – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Bel-Art Products, International Plastics Inc., Bioscience International, Cole-Parmer Instrument Company, LLC, TUFPAK, INC., BWS Incorporated, Daniels Sharpsmart Inc., Stericycle Inc., Abdos Labtech Private Limited, Transcendia, DESCO Medica, Minigrip, TUFPAK, INC., and Dynalab Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific Inc.

- Bel-Art Products

- International Plastics Inc.

- Bioscience International

- Cole-Parmer Instrument Company, LLC

- TUFPAK, INC.

- BWS Incorporated

- Daniels Sharpsmart Inc.

- Stericycle Inc.

- Abdos Labtech Private Limited

- Transcendia

- DESCO Medica

- Minigrip

- TUFPAK, INC.

- Dynalab Corp.