Global Retractable Needle Safety Syringes Market By Product (Manual and Automatic), By Needle Length (1 inch, 1.5 inch, and Others), By End-User (Hospitals, Clinics, Ambulatory Surgery Centers, and Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138129

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

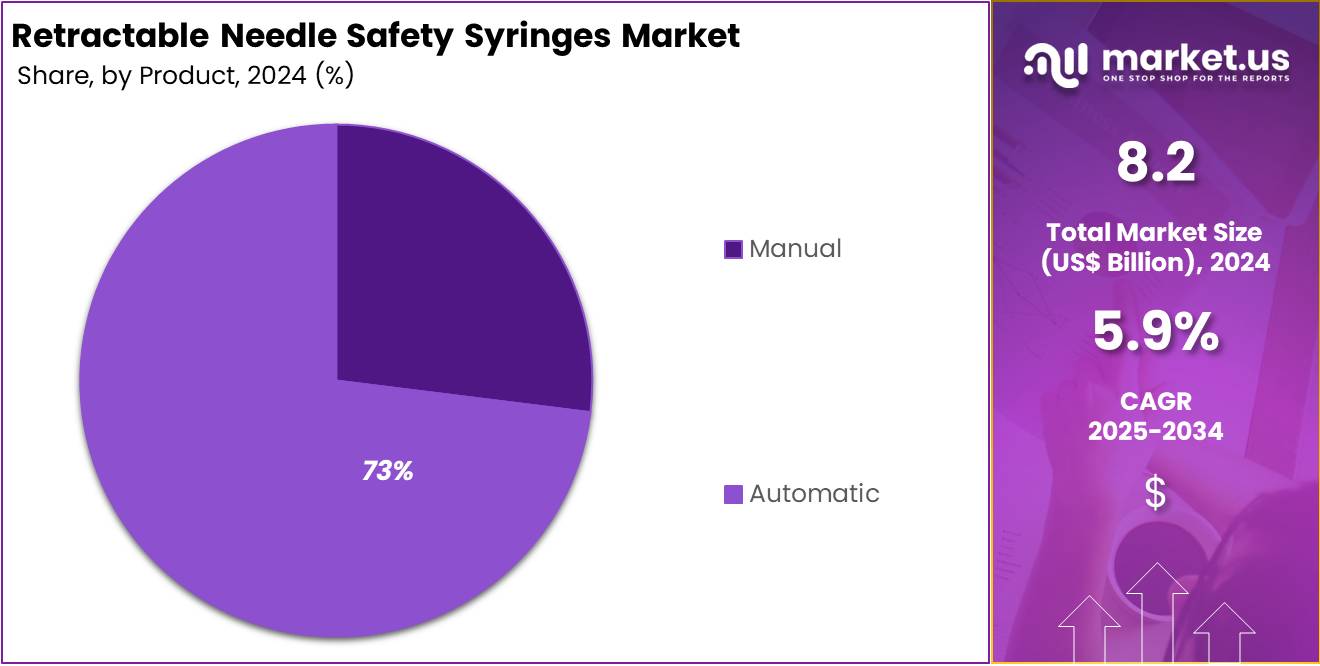

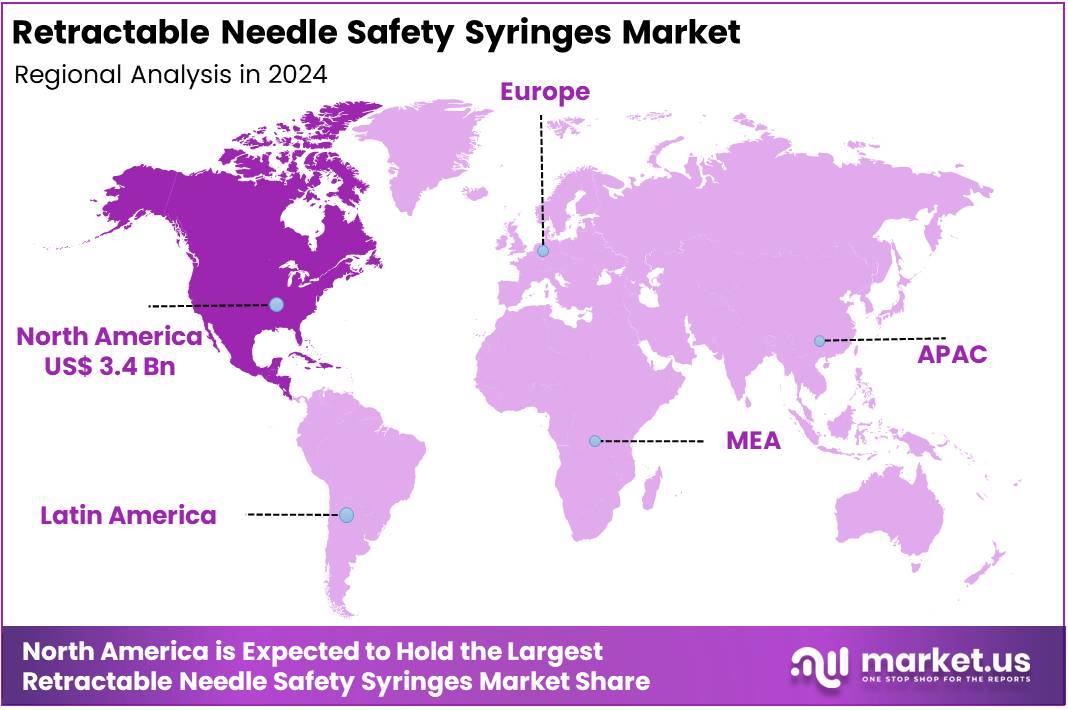

The Global Retractable Needle Safety Syringes Market size is expected to be worth around US$ 14.5 Billion by 2034, from US$ 8.2 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 42% share with a revenue of US$ 3.4 Billion.

The retractable needle safety syringes market is driven by several key dynamics, including increasing concerns over needle stick injuries and the growing emphasis on patient and healthcare worker safety. These safety syringes are designed to minimize the risk of accidental needle sticks, which can lead to the transmission of infectious diseases like HIV and Hepatitis, thereby enhancing their demand across hospitals, clinics, and other healthcare facilities.

Regulatory bodies like the FDA and OSHA have introduced stringent guidelines requiring the use of safety-engineered devices, further boosting market growth. Additionally, the rising adoption of vaccination programs, home healthcare, and self-injection therapies for conditions such as diabetes and multiple sclerosis is propelling the need for retractable needle safety syringes.

Technological innovations, such as automated safety systems and ergonomically designed syringes, are also driving product development. However, challenges such as high product costs and complexity in manufacturing can hinder market expansion.

Key Takeaways

- The global retractable needle safety syringes market was valued at USD 8.2 billion in 2024 and is anticipated to register substantial growth of USD 14.5 billion by 2034, with 5.9% CAGR.

- In 2024, the automatic segment took the lead in the global market, securing 73% of the total revenue share.

- The hospitals segment took the lead in the global market, securing 49% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 42% of the total revenue.

Product Analysis

Based on product the market is fragmented into manual and automatic. Amongst these, automatic dominated the global retractable needle safety syringes market capturing a significant market share of 73% in 2024 due to its superior safety features, convenience, and widespread adoption across healthcare settings.

Automatic retractable needles are designed to automatically retract the needle into the syringe barrel after use, preventing accidental needle stick injuries and minimizing the risk of infection transmission. This feature has made automatic syringes highly preferred by healthcare professionals, especially in high-risk environments like hospitals and clinics.

Additionally, ease of use, efficiency, and enhanced hygiene make automatic syringes an attractive option for both medical staff and patients. The growing adoption of these syringes in vaccination programs and chronic disease management further supports their dominance in the market. Despite being more expensive than manual alternatives, their added safety benefits outweigh the costs.

Needle Length Analysis

The market is fragmented by needle length into 1 inch, 1.5 inch, and others. 1 inch dominated the global retractable needle safety syringes market capturing a significant market share of 35% in 2024 due to its versatility and wide applicability across various medical procedures. A 1-inch needle is commonly used for intramuscular (IM) injections, which are among the most frequently administered injections in healthcare settings. It is the preferred choice for delivering vaccines, pain management injections, and treatments for chronic conditions such as diabetes and multiple sclerosis.

Additionally, the 1-inch needle strikes an optimal balance between comfort and efficiency, making it suitable for a broad range of patient populations, including both adults and children. The global vaccination initiatives and increasing self-injection therapies further drive the demand for retractable needles of this size, as they offer enhanced safety by reducing the risk of needle-stick injuries. Regulatory mandates for safety-engineered devices, along with a growing focus on healthcare worker and patient protection, have further contributed to the dominance of the 1-inch retractable needle segment in the market.

End-User Analysis

The global retractable needle safety syringes market is fragmented by end-users, including hospitals, clinics, ambulatory surgery centers, and others. Hospitals captured a significant market share of 49% in 2024. This dominance is attributed to the high volume of injections administered in these facilities.

Hospitals are primary settings for surgeries, emergency care, vaccinations, and managing chronic diseases. These procedures require frequent syringe use for medication delivery. The demand for retractable needle safety syringes is growing due to their role in enhancing safety and compliance with healthcare regulations.

Strict regulations play a vital role in boosting the adoption of retractable needle safety syringes in hospitals. These measures aim to reduce needle stick injuries and protect healthcare workers from bloodborne pathogens. Hospitals face the highest risk of such injuries due to their large patient volumes and frequent medical procedures. This has led to increased demand for safety-focused syringes in these settings, supporting their significant market share in the global retractable needle safety syringes market.

Key Segments Analysis

By Product

- Manual

- Automatic

By End-User

- Hospitals

- Clinics

- Ambulatory Surgery Centers

- Others

By Needle Length

- 1 inch

- 5 inch

- Others

Drivers

Rising Incidence of Needle Stick Injuries

The rising incidence of needlestick injuries is a significant driver of growth in the retractable needle safety syringes market. Needlestick injuries are a major safety concern for healthcare workers, as they can lead to the transmission of bloodborne pathogens such as HIV, Hepatitis B, and Hepatitis C.

These incidents not only endanger the health of medical professionals but also result in significant costs related to post-exposure treatment and lost productivity. As a response, regulatory bodies like the FDA and OSHA have introduced strict mandates for the use of safety-engineered devices, such as retractable needle safety syringes.

- According to the Centers for Disease Control and Prevention (CDC), in 2021, needlestick injuries pose a significant risk to healthcare workers. Each year, more than 385,000 needlestick and sharps-related injuries occur among healthcare workers in the United States alone.

Restraints

Availability of Alternative Products

There are several safety alternatives to retractable needle syringes, such as shielded needle syringes, manual safety syringes, and self-sheathing needles, which offer similar safety features to prevent needlestick injuries. These alternatives are often priced lower than retractable needle syringes and may be more cost-effective for healthcare providers, especially in budget-conscious regions. The presence of these alternatives gives healthcare facilities more options to choose from, potentially reducing the demand for retractable needle syringes.

Additionally, some hospitals and clinics may prefer to use less complex safety devices that are easier and cheaper to manufacture, further limiting the market’s growth. While retractable needle syringes offer advanced safety features, the competition from these cost-effective alternatives may slow their widespread adoption, particularly in cost-sensitive healthcare settings.

Opportunities

Growing Adoption of Self-Injection Therapies

The growing adoption of self-injection therapies for chronic conditions, such as diabetes, multiple sclerosis, and rheumatoid arthritis. As the prevalence of these conditions continues to rise globally, there is an increasing need for safe and convenient injection devices that can be used at home or in outpatient settings.

Retractable needle safety syringes are well-suited for these applications as they offer enhanced safety features, preventing needlestick injuries and reducing the risk of contamination. With more patients opting for self-injection treatments, the demand for these syringes is expected to grow, especially in the homecare and ambulatory care segments. Furthermore, innovations in syringe designs, such as integrated smart features for tracking injections or providing dosage reminders, can further expand the market.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic and geopolitical factors significantly influence the retractable needle safety syringes market. Economic downturns or recessions can lead to budget cuts in healthcare spending, reducing the adoption of advanced safety products like retractable needle syringes, particularly in public hospitals and low-income regions.

Additionally, rising raw material costs driven by inflation or supply chain disruptions can increase manufacturing costs, which may be passed on to consumers, limiting market growth. Geopolitical factors, such as trade restrictions, tariffs, or political instability, can also affect the global supply chain for medical devices. For instance, if key manufacturing hubs experience instability or face export restrictions, the availability and affordability of safety syringes can be compromised.

Trends

The Retractable Needle Safety Syringes Market is witnessing several key trends that are shaping its growth. First, there is a strong focus on smart syringes, which incorporate digital technologies such as RFID tags and sensors for better tracking of injections and medication dosages. These smart syringes not only improve patient safety but also enhance compliance, making them particularly popular in the self-injection and homecare segments.

Another emerging trend is the increasing adoption of safety-engineered syringes driven by stricter regulatory requirements from agencies like the FDA and OSHA, mandating the use of devices that reduce the risk of needlestick injuries in healthcare settings.

Regional Analysis

North America held a significant share of the global retractable needle safety syringes market, driven by a combination of factors such as stringent regulatory frameworks, high healthcare standards, and increasing demand for safety devices. Moreover, the high prevalence of chronic diseases like diabetes and multiple sclerosis in North America has led to greater demand for safe and efficient injection devices for homecare and self-injection therapies. Hospitals and healthcare facilities in North America are also quick to adopt innovative medical technologies, further fuelling the market growth.

- The Centers for Disease Control and Prevention (CDC) reports that more than 385,000 needlestick injuries occur among healthcare professionals annually in the United States. This high incidence is driving the demand for retractable needle safety syringes in the country, as these devices play a crucial role in reducing the risk of such injuries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Retractable Needle Safety Syringes market is characterized by intense competition, driven by the presence of both established healthcare technology companies and emerging players offering innovative solutions. Leading companies in the market include Becton, Dickinson and Company (BD), Medtronic, Cardinal Health, Smiths Medical, and Terumo Corporation, among others. These companies are focusing on product innovation, regulatory compliance, and strategic partnerships to strengthen their positions.

Product differentiation through features like smart syringes, ergonomic designs, and automated safety mechanisms is a key competitive strategy. Manufacturers are also increasingly investing in sustainability by introducing eco-friendly products. Mergers and acquisitions play a significant role in market consolidation, as companies seek to expand their product portfolios and geographic reach.

Becton, Dickinson and Company (BD) is a leading global medical technology company that focuses on improving healthcare outcomes by providing a broad range of medical devices, instruments, and reagents. Established in 1897 and headquartered in Franklin Lakes, New Jersey, BD operates in more than 190 countries. The company is renowned for its innovations in needle safety, syringe technologies, and diagnostic instruments.

In addition, Medtronic is a global leader in medical technology, offering a wide range of products and therapies aimed at improving patient outcomes. Headquartered in Dublin, Ireland, and founded in 1949, Medtronic operates in more than 150 countries. The company’s diverse portfolio spans across cardiac devices, diabetes management, surgical instruments, and advanced needle safety systems.

Top Key Players in the Retractable Needle Safety Syringes Market

- Becton, Dickinson and Company

- UltiMed

- Axel Bio

- Unilife

- Retractable Technologies

- Terumo Corporation

- Smiths Medical

- Revolutions Medical

- Covidien

- Medtronic

Recent Developments

- In February 2022: BD successfully acquired Cytognos, a company renowned for its expertise in blood cancer diagnostics, immune monitoring for blood diseases, and minimal residual disease (MRD) detection.

- In May 2021: Datwyler partnered with Roncadelle to create an innovative safety syringe incorporating a needle retraction mechanism aimed at eliminating needlestick injury risks.

Report Scope

Report Features Description Market Value (2024) US$ 8.2 Billion Forecast Revenue (2034) US$ 14.5 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Manual and Automatic), By Needle Length (1 inch, 1.5 inch, and Others), By End-User (Hospitals, Clinics, Ambulatory Surgery Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Becton, Dickinson and Company, UltiMed, Axel Bio, Unilife, Retractable Technologies, Terumo Corporation, Smiths Medical, Revolutions Medical, Covidien, and Medtronic. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Retractable Needle Safety Syringes MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Retractable Needle Safety Syringes MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Becton, Dickinson and Company

- UltiMed

- Axel Bio

- Unilife

- Retractable Technologies

- Terumo Corporation

- Smiths Medical

- Revolutions Medical

- Covidien

- Medtronic