Global Honey Powder Market Size, Share, And Business Benefits By Type (Organic, Conventional), By Category (Polarized, Non-polarized), By Application (Food and Beverages, Beauty and Personal Care, Nutraceutical, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 158716

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

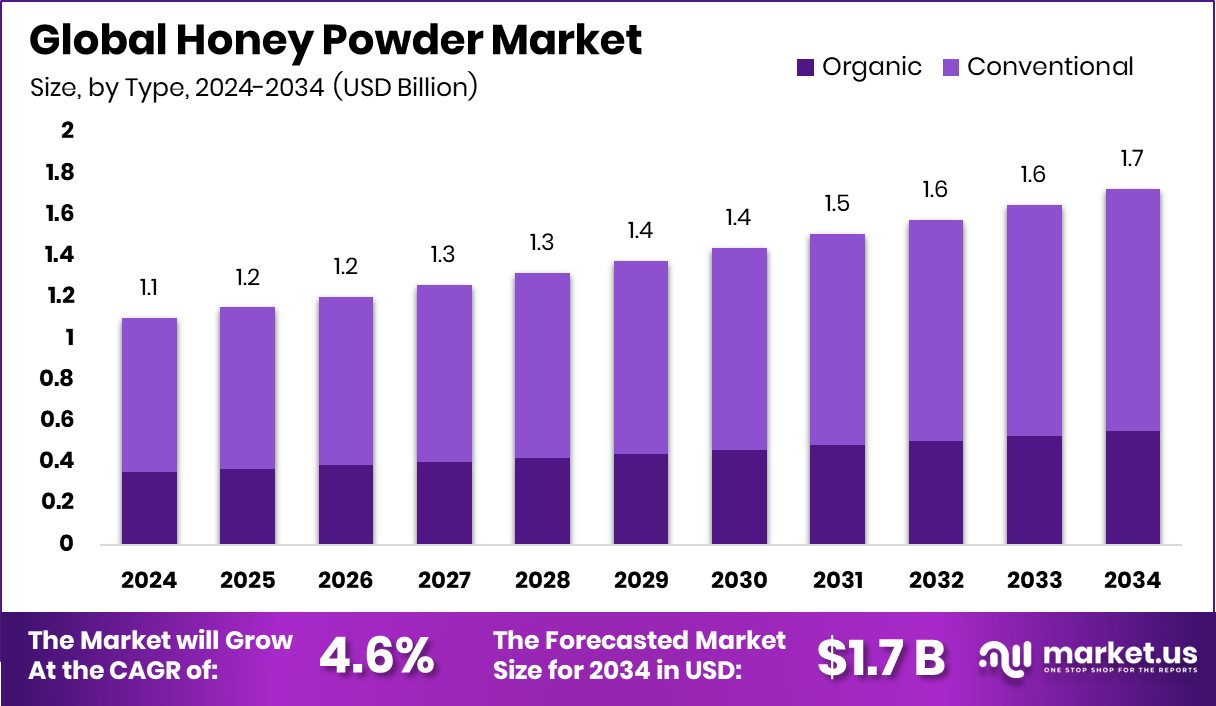

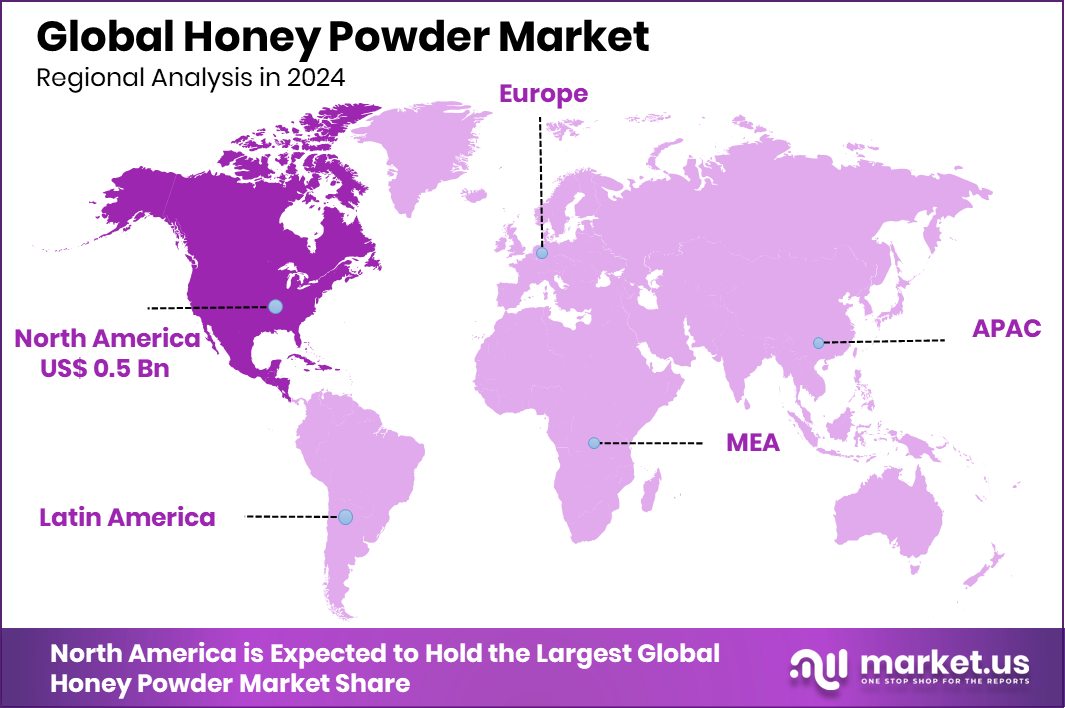

The Global Honey Powder Market is expected to be worth around USD 1.7 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 4.6% from 2025 to 2034. With a 49.30% share, North America’s Honey Powder Market achieved USD 0.5 Bn in strong revenue.

Honey powder is simply dehydrated honey—usually spray-dried onto a carrier—so it keeps honey’s flavor but becomes a free-flowing, non-sticky sweetener that’s easy to blend, dose, and store. It rehydrates quickly in liquids and helps control moisture in dry mixes.

The honey powder market covers these dry honey ingredients sold to food, beverage, bakery, confectionery, nutraceutical, and personal-care makers who want natural sweetness and label-friendly flavor without handling liquid honey. It trades as powders or granules with specified honey-solids content.

Clean-label reformulation (swapping refined sugar), formulation ease in dry mixes, and extended shelf life. Global honey supply underpins this—FAO notes ~1.87 million tonnes of honey produced worldwide (Asia ~44%, Europe ~24%). Stable supply plus processing tech advances support adoption.

Food makers use honey powder for consistent dosing in cereals, snack bars, instant beverages, bakery premixes, and rubs; supplement brands use it for taste masking and flow. The pollination value chain also keeps honey visible—the USDA estimates pollinators add ~$18 billion to U.S. crop revenue annually.

Key Takeaways

- The Global Honey Powder Market is expected to be worth around USD 1.7 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 4.6% from 2025 to 2034.

- In the Honey Powder Market, the conventional type dominates with a 67.9% share, showing strong consumer preference.

- Polarized category holds 58.3% share, reflecting growing awareness of specialized honey powder applications worldwide.

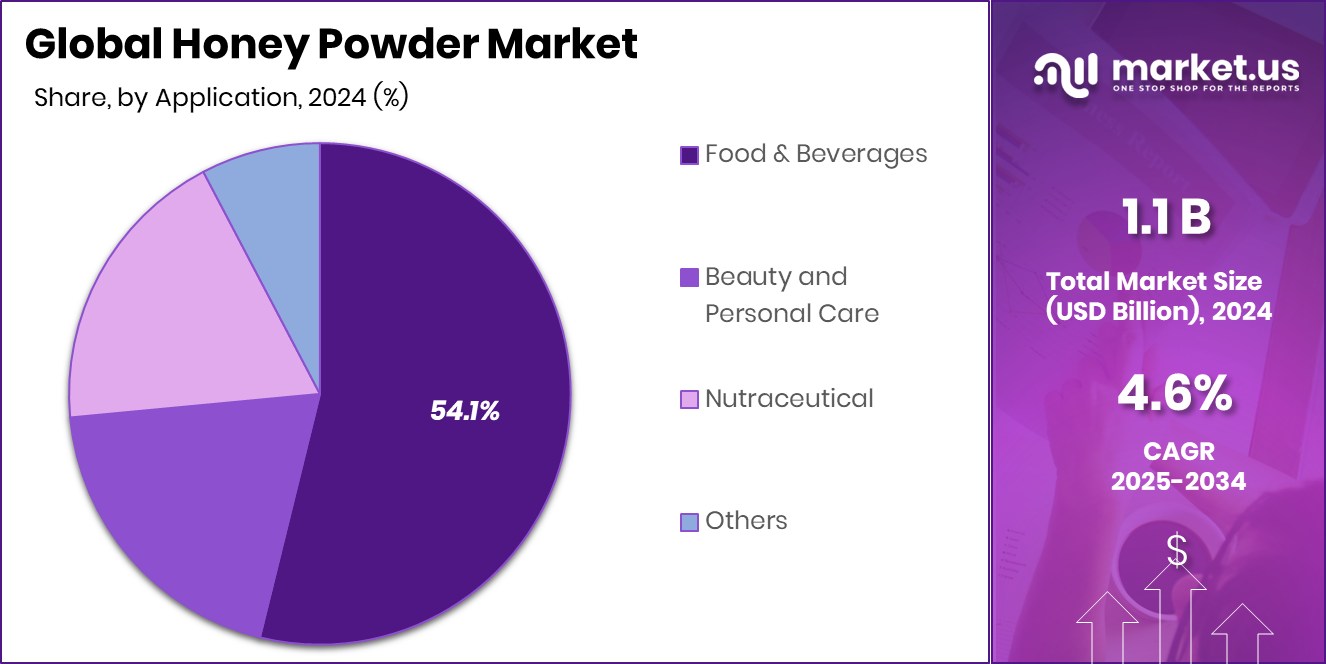

- Food & beverages lead applications, accounting for 54.1% market share, highlighting honey powder’s nutritional versatility.

- Offline distribution remains dominant at 78.2%, showing consumer reliance on traditional retail channels for honey powder.

- The Honey Powder Market in North America is valued at USD 0.5 Bn, representing 49.30% share.

By Type Analysis

The honey powder market remains dominated by the conventional type, capturing 67.9%.

In 2024, Conventional held a dominant market position in the By Type segment of the Honey Powder Market, capturing 67.9% of the share. This leadership reflects strong consumer preference for traditional honey sources that are widely available and cost-effective compared to organic options. Conventional honey powder continues to be favored in food and beverage formulations, bakery items, and nutritional supplements due to its stable pricing and consistent supply. The segment’s dominance is also supported by large-scale production capabilities, enabling manufacturers to meet rising demand efficiently while maintaining competitive market prices.

By Category Analysis

Polarized category products hold a strong preference, making up 58.3% of the market share.

In 2024, Polarized held a dominant market position in the By Category segment of the Honey Powder Market, with a 58.3% share. This leadership highlights its strong acceptance among end users who value its consistent quality, extended shelf life, and functional versatility in food applications. Polarized honey powder is widely utilized in confectionery, bakery, beverages, and health products, where stability and uniformity are critical.

The segment’s growth is also driven by its ability to maintain the natural sweetness and nutritional benefits of honey while offering easy storage and handling. Its broad industrial usage and reliable availability have reinforced its significant share, making it the preferred category across diverse application areas.

By Application Analysis

The food and beverage segment drives demand, representing 54.1% of total usage.

In 2024, Food and Beverages held a dominant market position in the By Application segment of the Honey Powder Market, with a 54.1% share. This dominance is attributed to the extensive use of honey powder as a natural sweetener and flavor enhancer in bakery products, confectionery, beverages, and ready-to-eat meals. Its ease of blending, longer shelf life, and ability to retain honey’s nutritional properties make it a preferred choice for manufacturers.

Growing consumer demand for clean-label and natural ingredients further supports its widespread adoption in the food and beverage industry. The segment’s strong performance underscores its central role in driving overall market growth and meeting evolving consumer taste and health preferences.

By Distribution Channel Analysis

Offline distribution channels dominate sales, covering 78.2% of the honey powder market.

In 2024, Offline held a dominant market position in the By Distribution Channel segment of the Honey Powder Market, with a 78.2% share. This dominance is driven by the strong presence of supermarkets, hypermarkets, specialty stores, and retail outlets that provide consumers with direct access to a wide variety of honey powder products.

The offline channel benefits from consumer trust in physical product inspection, immediate availability, and established distribution networks that ensure a steady supply. Additionally, attractive in-store promotions and bulk purchasing options further strengthen its appeal. The segment’s high share reflects its continued relevance in catering to diverse consumer groups who prefer traditional retail formats for purchasing food and nutritional products.

Key Market Segments

By Type

- Organic

- Conventional

By Category

- Polarized

- Non-polarized

By Application

- Food and Beverages

- Beauty and Personal Care

- Nutraceutical

- Others

By Distribution Channel

- Offline

- Online

Driving Factors

Rising Demand for Natural Sweeteners in Foods

One of the top driving factors for the Honey Powder Market is the growing demand for natural sweeteners in everyday foods and beverages. Consumers are moving away from artificial sugar and chemical-based sweeteners, choosing honey powder for its health benefits, easy use, and natural taste. Food and beverage makers are adding it to bakery items, cereals, drinks, and snacks to meet the rising preference for clean-label and natural ingredients.

Honey powder’s long shelf life and easy storage also make it attractive for large-scale production. Supporting this trend, Honey Mama’s closed a $4.5 million Series A funding round led by Amberstone Ventures, highlighting growing investor confidence in natural and health-focused sweetener solutions.

Restraining Factors

High Production Costs Limit Wider Market Growth

A key restraining factor for the Honey Powder Market is the high cost of production. Converting liquid honey into powder requires advanced processing technologies such as spray drying or freeze drying, which involve significant energy use and expensive equipment. This makes the final product more costly compared to traditional sweeteners like sugar or corn syrup.

For many price-sensitive consumers and small food manufacturers, these higher costs limit adoption despite honey powder’s health and functional benefits. Additionally, fluctuations in raw honey availability and prices add further pressure to production expenses. As a result, while demand is rising, high production costs remain a major hurdle to achieving broader penetration in both developed and emerging markets.

Growth Opportunity

Expanding Use in Health and Nutritional Products

A major growth opportunity for the Honey Powder Market lies in its expanding use in health and nutritional products. With more people focusing on wellness and natural diets, honey powder is gaining importance as a natural energy source, immune booster, and clean-label ingredient. It is being increasingly added to protein bars, dietary supplements, herbal teas, and functional beverages because it retains the essential nutrients and antioxidants of natural honey in a more stable form.

Its convenience in storage and easy blending into powders and capsules make it attractive for health product makers. As consumer spending on nutrition and wellness continues to rise, this segment opens strong opportunities for sustained market growth worldwide.

Latest Trends

Growing Popularity of Clean-Label and Organic Products

One of the latest trends in the Honey Powder Market is the growing popularity of clean-label and organic products. Consumers today want transparency in what they eat and prefer ingredients that are natural, chemical-free, and sustainably sourced. Honey powder made from organic honey fits this demand well, as it assures quality and health benefits without artificial additives.

Food and beverage companies are launching more organic honey powder-based items to meet this shift, especially in snacks, beverages, and baby food. This trend is also supported by rising awareness about sustainable farming and eco-friendly practices. As buyers associate organic products with safety and trust, the demand for organic honey powder continues to rise steadily.

Regional Analysis

In 2024, North America held a 49.30% share of the Honey Powder Market, reaching USD 0.5 Bn.

In 2024, North America emerged as the leading region in the global Honey Powder Market, holding a dominant share of 49.30% and generating USD 0.5 billion in revenue. The region’s leadership is driven by strong consumer awareness of natural and clean-label ingredients, which has significantly boosted the demand for honey powder in food, beverages, and nutritional products.

Major players in the region are actively leveraging honey powder as a healthier alternative to refined sugar, especially in bakery, confectionery, and dietary supplements. The convenience of powdered honey, with its longer shelf life and easy blending properties, further supports its adoption across industrial and retail applications.

Meanwhile, Europe continues to expand steadily with rising demand for functional and organic food products, while the Asia Pacific shows promising growth due to changing dietary habits and an expanding food processing sector.

The Middle East & Africa and Latin America are also witnessing a gradual uptake, supported by urbanization and an increasing shift toward natural sweeteners. However, North America’s established market infrastructure, advanced food processing industry, and high consumer preference for natural wellness products firmly position it as the dominant region, accounting for nearly half of the global Honey Powder Market share.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ADM continues to leverage its strong global supply chain and ingredient expertise to expand honey powder offerings, particularly for food and beverage applications. Its focus on innovation and large-scale production capabilities gives it a clear edge in meeting industrial demand.

Norevo, recognized for its specialization in natural sweeteners and confectionery ingredients, positions honey powder as a versatile solution across bakery, snacks, and beverage segments. The company’s expertise in maintaining product purity and functional properties ensures it remains a reliable partner for manufacturers seeking clean-label solutions. Its market standing is further enhanced by tailored formulations addressing specific industry needs.

AmTech Ingredients, meanwhile, emphasizes its strength in producing value-added dehydrated ingredients, including honey powder, that meet quality and safety standards demanded by global markets. Its ability to cater to diverse food processors through stable supply and functional product performance highlights its strategic importance.

Top Key Players in the Market

- ADM

- Norevo

- AmTech Ingredients

- Cargill, Incorporated

- Ingredion

- Great American Spice Company

- VedaOils

- Deli Foods

Recent Developments

- In December 2024, ADM released a technical paper on SweetRight® Stevia Edge-M, underscoring continued investment in its SweetRight® portfolio—the same platform that includes SweetRight® Honey Powder sold via channel partners—signaling ongoing support for honey-powder adjacencies in clean-label sweetening.

- In September 2024, Cargill introduced its Specialized Nutrition category at Vitafoods Asia in September 2024. This focuses on science-backed nutrition solutions. But no specific honey powder product was announced in that context.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Billion Forecast Revenue (2034) USD 1.7 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Organic, Conventional), By Category (Polarized, Non-polarized), By Application (Food and Beverages, Beauty and Personal Care, Nutraceutical, Others), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADM, Norevo, AmTech Ingredients, Cargill, Incorporated, Ingredion, Great American Spice Company, VedaOils, Deli Foods Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ADM

- Norevo

- AmTech Ingredients

- Cargill, Incorporated

- Ingredion

- Great American Spice Company

- VedaOils

- Deli Foods